In a week where Bitcoin largely held steady, the spotlight shifted to altcoins riding sector-specific waves. From AI-powered infrastructure tokens like AERGO and FHE, to Layer-1 stalwarts like AVAX, and DeFi veterans CRV and ORCA, the market witnessed high-volume rallies fueled by fresh narratives.

Investor attention gravitated toward tokens delivering either deep protocol utility, real-world adoption, or strong community incentives. Meanwhile, memecoins and low-cap pumps took a back seat as participants leaned into tokens with clear fundamentals and roadmap momentum.

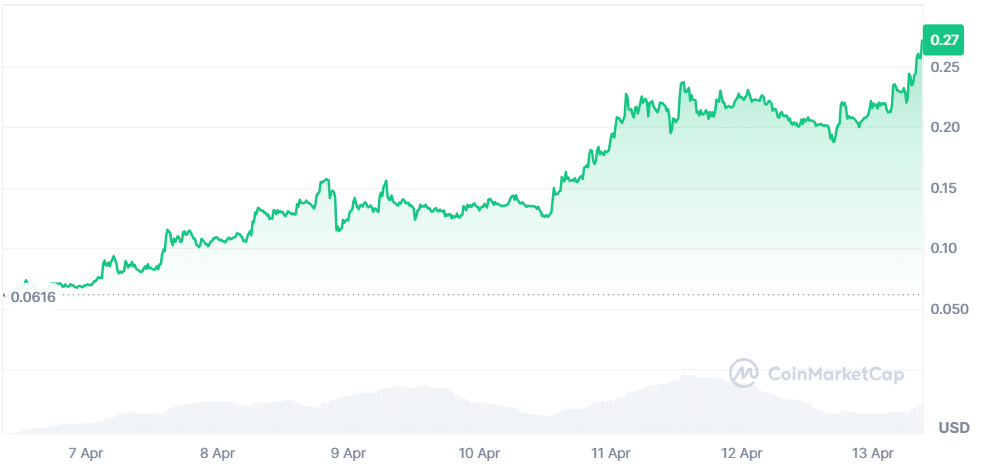

AERGO (AERGO)

Price Change (7D): +336.47% Current Price: $0.2712

News

Aergo has officially approved a groundbreaking governance proposal to form the House Party Protocol (HPP), a strategic merger with Alpha Quark, Booost, and W3DB (VaaSBlock). This initiative aims to create a versatile DeFi ecosystem by integrating tools for digital ownership, decentralized social networking, and secure data infrastructure. With AIP-21 passed, the Aergo team is focusing on Layer2 infrastructure and token integration, promising real-world DeFi utility and ecosystem synergy.

Forecast

AERGO’s 7D RSI is nearing overbought territory (currently estimated above 75), signaling bullish momentum. Key resistance lies at $0.29, while strong support rests at $0.20. If momentum continues and the Layer2 roadmap milestones (Q2–Q4 2025) remain on track, price could reach $0.32–$0.35 in the coming weeks. However, a failure to hold above $0.24 may initiate a consolidation phase.

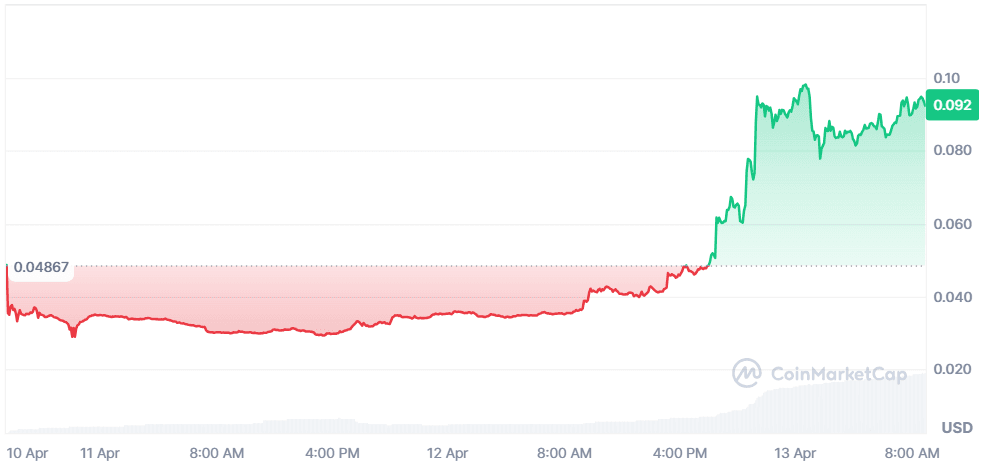

Mind Network (FHE)

Price Change (7D): +161.49% Current Price: $0.0926

News

Mind Network gained major attention following its exclusive Binance Wallet Token Generation Event (TGE) on April 10, distributing FHE tokens via PancakeSwap. The token is built on Fully Homomorphic Encryption (FHE), a quantum-resistant privacy tech, and supports the HTTPZ protocol. In parallel, the project initiated its airdrop challenge for key early adopters. Backed by Binance and Animoca, Mind is positioning itself as a cornerstone for encrypted Web3 and AI infrastructure.

Forecast

FHE has broken out strongly above $0.06 with an RSI hovering near 78, indicating sustained bullish momentum. If buying pressure holds, the next key resistance is at $0.11, with potential to test $0.125. Caution is advised as overbought conditions may lead to a brief pullback to $0.075 support before another leg up.

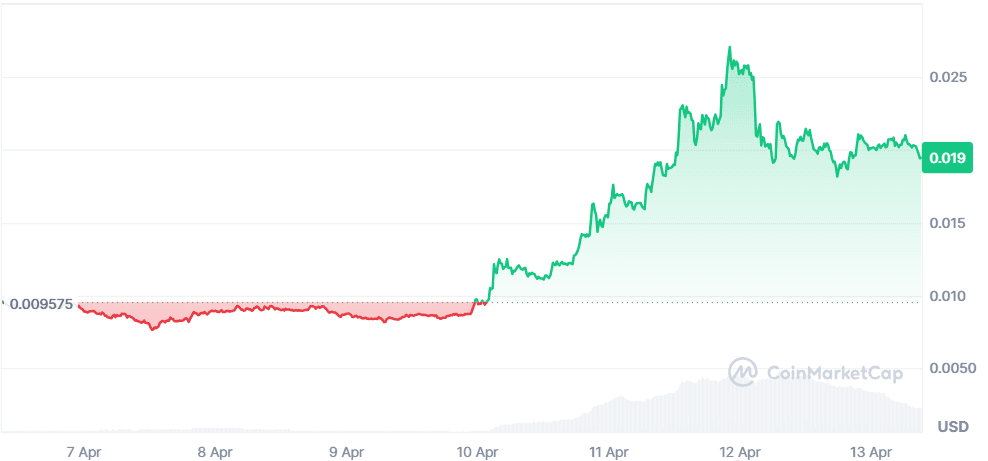

Onyxcoin (XCN)

Price Change (7D): +103.40% Current Price: $0.0195

News

Onyxcoin surged after Binance announced XCN futures listing on April 11. While the listing didn’t result in further upside due to “sell the news” behavior, daily volume spiked from $25M to $600M. As the native token for the Onyxchain modular blockchain, XCN is used for governance and node payments. Despite past controversy over price manipulation, the renewed institutional attention is fueling speculation once more.

Forecast

XCN hit near-term resistance at $0.025 before retracing. RSI sits around 70, suggesting strength with mild overheating. A break above $0.021 could lead to retesting $0.03, while failure to hold above $0.017 may send it back to $0.014. Market structure supports continued upside, barring negative press.

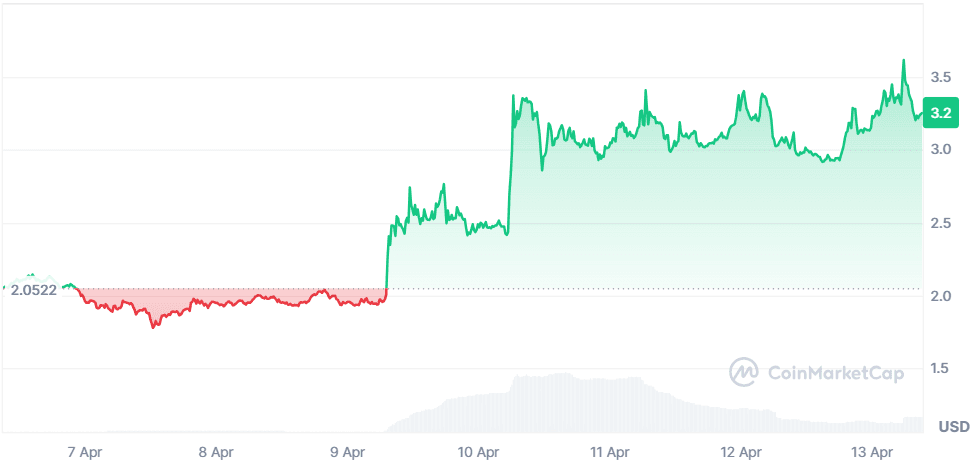

GAS (GAS)

Price Change (7D): +58.23% Current Price: $3.24

News

GAS rallied alongside NEO due to a 50% APY incentive program under the Neo Bond market-stabilization initiative. This initiative, backed by a $5 price guarantee, drove massive Korean volume—GAS/KRW making up 70% of total volume. As the fuel token for the Neo blockchain, GAS benefited from increased smart contract activity and investor participation in yield-based staking.

Forecast

GAS is holding above $3.20 with an RSI around 65, suggesting healthy uptrend continuation. With strong correlation to NEO and growing yield farming interest, it could reach $3.60–$3.80 short-term. Watch for consolidation near $3.00 if volume dips or the KRW pair momentum weakens.

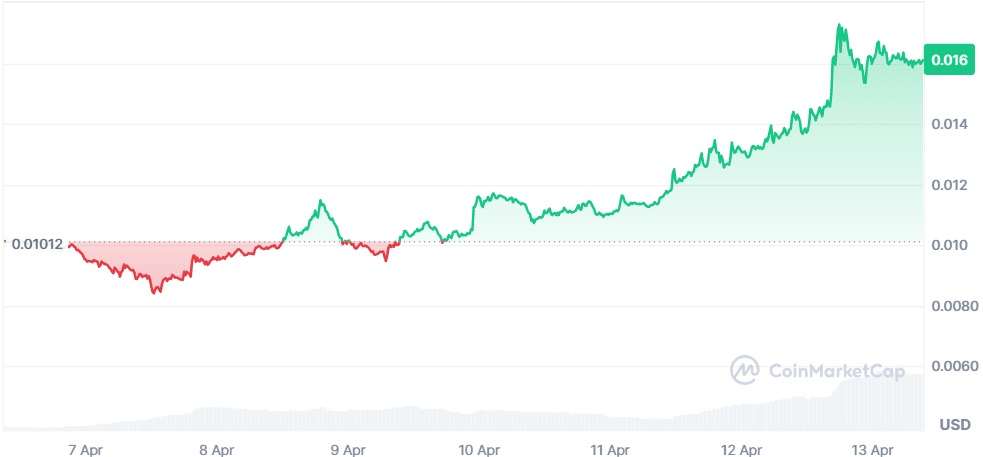

JasmyCoin (JASMY)

Price Change (7D): +59.33% Current Price: $0.0161

News

Jasmy advanced its roadmap with cross-chain integration via Chainlink’s CCIP, allowing Ethereum-Base transfers. It also launched a blockchain-based carbon credit tracking system in Nagano and a Secure PC solution for remote work. The Cicada Market Making partnership is improving JASMY liquidity, while the upcoming Sagan Tosu fan token match is expected to boost community engagement. Jasmy is steadily pushing real-world applications across IoT and sustainability.

Forecast

JASMY has risen steadily, with RSI near 70 and rising whale accumulation (48.18%). Key resistance is at $0.0178 with room for growth up to $0.02. Support sits at $0.014. If user metrics continue rising, short-term bullish continuation is likely. Watch out for sell pressure if ecosystem news slows down.

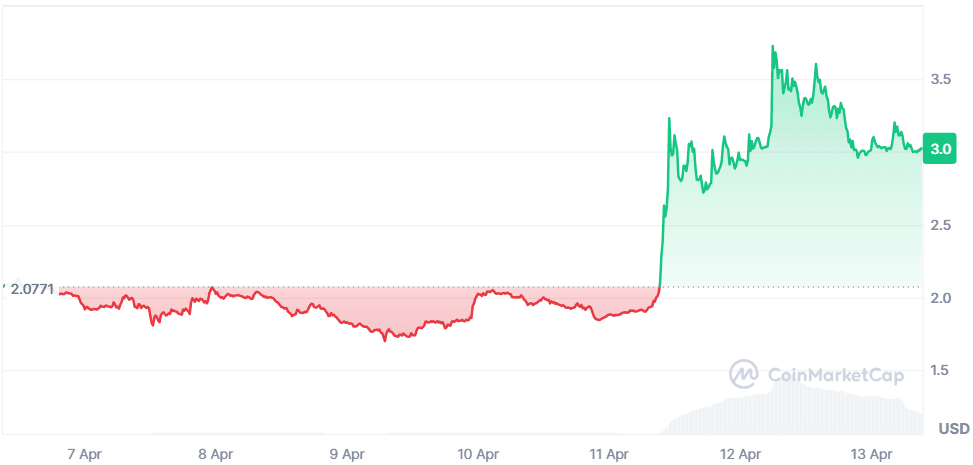

Orca (ORCA)

Price Change (7D): +45.59% Current Price: $3.02

News

Orca, a leading Solana DEX, surged by over 50% following a sharp volume spike (+910%) and a successful breakout above the $2.15 resistance level. The bullish momentum is driven by a major governance proposal that includes a 25% token burn, plus feature rollouts like the Liquidity Terminal, tx sender library, and KAST Solana debit card benefits. These developments are significantly strengthening investor sentiment, especially amid a flat broader crypto market.

Forecast

ORCA has entered a bullish price discovery zone, now consolidating near $3.00. RSI sits near 68—still in bullish territory without overextension. If it holds above $2.90, price may attempt a breakout to $3.40–$3.60. Failure to maintain volume support could lead to a retest at $2.55. Overall sentiment is strongly bullish if the burn proposal is passed.

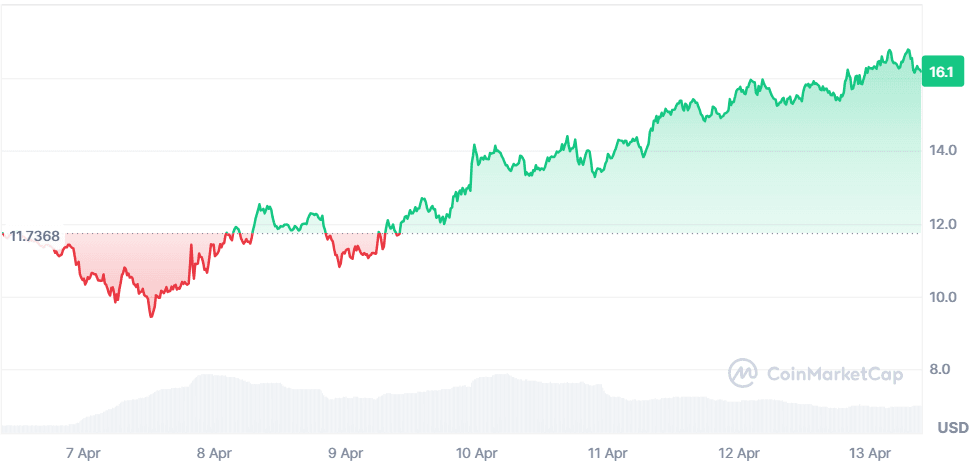

Hyperliquid (HYPE)

Price Change (7D): +37.92% Current Price: $16.18

News

Hyperliquid, despite a $6.2 million exploit due to manipulation of liquidation parameters involving the JELLY token, continues to dominate DEX volumes. Ranking 8th globally among perpetual futures exchanges, it has outpaced major CEXs like Kraken and BitMEX. The platform shows resilience and growth amid scrutiny, with technical analysts observing a bullish reversal structure, targeting a breakout toward $18.50. The team’s rapid containment of the exploit reassured many investors.

Forecast

HYPE reclaimed its $9.34 range low and confirmed a bullish retest aligned with the 0.618 Fibonacci level. RSI sits near 64, showing room for upward momentum. As long as price holds above $15.20, continuation toward $18.50 is likely. Breakdown below $14.00 could invalidate the setup and prompt a corrective phase to $12.80. Volume and pattern structure suggest a breakout setup forming.

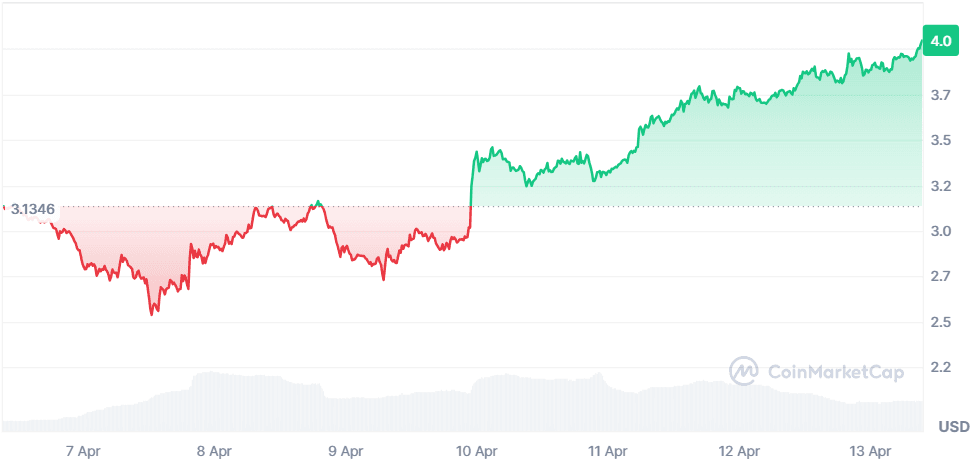

Render (RNDR)

Price Change (7D): +29.10% Current Price: $4.04

News

Render Network is gaining attention this week, particularly with its prominent role in powering content at Coachella 2025 through a partnership with FCG Studio. The project is gearing up for RenderCon 2025, drawing major figures such as Solana co-founder Raj Gokal. With creative grants, active community support, and high-profile showcases of its decentralized GPU rendering capabilities, Render is carving out a niche at the intersection of AI, art, and blockchain infrastructure.

Forecast

RNDR continues a strong upward trajectory, trading above $4 with a 7D RSI around 66. Key resistance lies at $4.20 and support at $3.75. If momentum from RenderCon sustains, RNDR could challenge $4.50 in the coming week. The consistent uptrend and strong market interest suggest buyers remain in control, barring any sudden drop in volume.

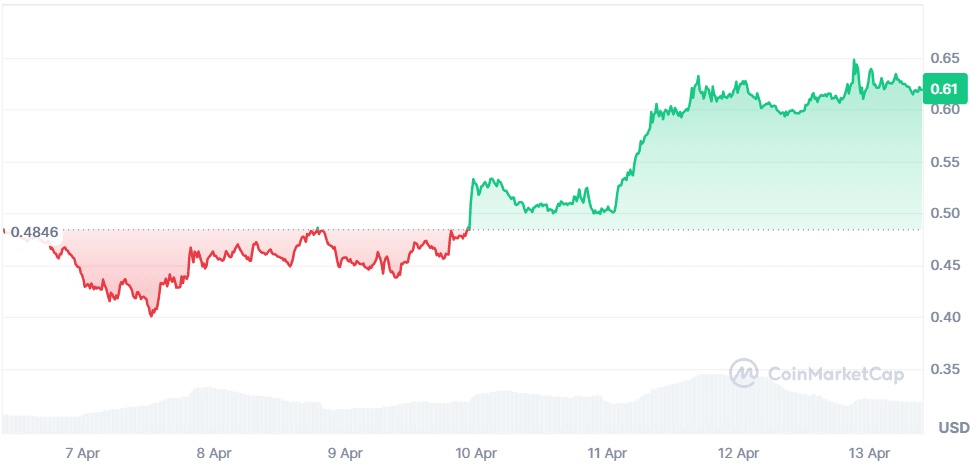

Curve DAO (CRV)

Price Change (7D): +27.75% Current Price: $0.619

News

Curve is making waves as MEGA DeFi incentives from KelpDAO prepare to flow across top protocols including Curve, Uniswap, and Balancer. On-chain fee data reveals Curve has paid out over $155M in real yield to veCRV holders, with multiple weekly distributions above $300K in early 2025. Curve’s continued payout leadership and high protocol incentives signal a strong DeFi comeback narrative.

Forecast

CRV is testing the $0.62 resistance with RSI at approximately 68. A clear break above $0.63 could see a surge toward $0.70. Support is found at $0.58. Yield metrics and incentive buzz are drawing traders back in, and if market-wide DeFi momentum continues, CRV may outperform other governance tokens.

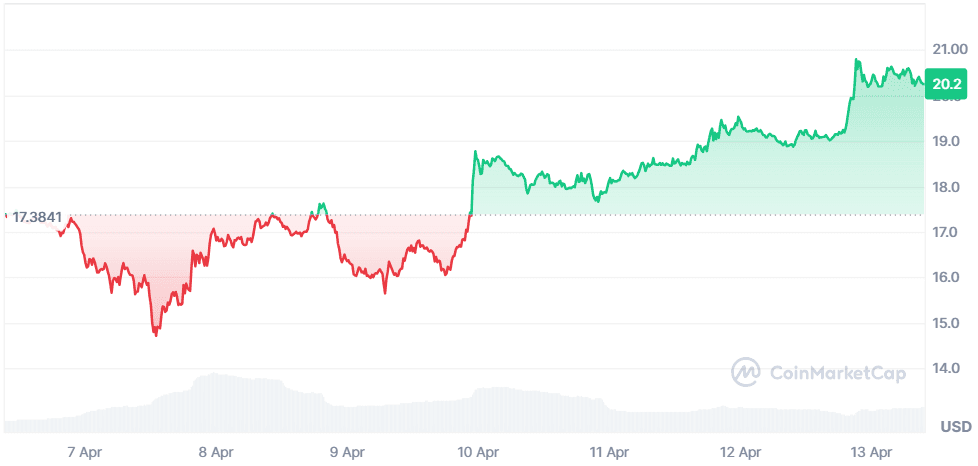

Avalanche (AVAX)

Price Change (7D): +16.53% Current Price: $20.25

News

Avalanche had a news-packed week, with Nasdaq proposing an ETF tracking AVAX’s spot price and Interactive Brokers enabling AVAX trading. On-chain, its Octane update introduced dynamic fee structures for C-Chain, and AvaCloud’s encrypted token system boosted blockchain privacy. Balancer v3’s launch on Avalanche also enhances its DeFi depth, while institutional tools and Layer 1 customization continue to attract developers.

Forecast

AVAX is forming higher lows, with RSI hovering near 65, suggesting continued strength. Immediate resistance lies at $21.30, and support is near $19. With ETF and broker integration news boosting sentiment, a breakout toward $22.50 remains on the table if macro conditions remain stable.

Closing Thoughts

This week's market action signals a shift in trader focus—from speculative hype to functionality and infrastructure-driven growth. Coins like AERGO and FHE attracted attention due to their integrations in DeFi and AI privacy ecosystems, reflecting a broader appetite for scalable tech stacks and security-enhancing protocols. At the same time, ORCA, CRV, and GAS showed that incentives and liquidity-driven DeFi still command substantial volume when paired with tokenomics upgrades or staking rewards.

On the Layer-1 front, AVAX drew institutional interest with ETF rumors and new tooling like AvaCloud and Octane upgrades, reinforcing its standing in the smart contract platform race. Meanwhile, RNDR carved out a unique niche at the intersection of blockchain and creative media, signaling early momentum in decentralized rendering.

In terms of sectors, AI infrastructure, cross-chain DeFi, and Layer-1 scalability saw the most engagement, with tokens reacting positively to product updates and partnership news. This suggests investors are recalibrating toward long-term utility over short-term noise—particularly in a market still recovering from macro uncertainty. With major conferences like RenderCon and incentive programs like MEGA DeFi on the horizon, we may be entering a phase of steady, theme-driven rallies across the altcoin space.