As the market consolidates, narratives are shifting fast, from infrastructure to identity to gaming. But one thing’s clear: the tokens worth watching in June aren’t just riding hype. They’re building ecosystems, launching products, and onboarding real users.

This month, three tokens stand out across very different verticals. Zebec Network (ZBCN) is building a real-world crypto payment rail spanning payroll to prepaid cards. Floki (FLOKI), once dismissed as a meme, is now pushing into AI robotics, Web3 identity, and GameFi with a 3-month U.S. media blitz. And Avalanche (AVAX) continues to dominate the modular blockchain narrative with subnets that are onboarding AAA game studios and global fintech brands.

Each of these projects is moving past its early perception and for smart investors, that’s often where the upside begins.

Avalanche: From Ethereum Rival to Real-World Blockchain Backbone

In a market where Bitcoin dominance often overshadows other narratives, Avalanche (AVAX) is carving its own lane—not just as an Ethereum competitor, but as a foundational layer for mainstream blockchain adoption. With FIFA, BlackRock, and municipal governments on board, AVAX is no longer just a crypto token—it’s becoming critical infrastructure.

Here’s how Avalanche is reshaping what Web3 looks like in the real world.

Avalanche’s Real-World Traction: Institutions, Governments, and Games

Avalanche is steadily climbing the ranks as one of the most utilized Layer 1 platforms, underpinned by its unique architecture and institutional focus. From powering FIFA’s proprietary blockchain to enabling $240 billion in real estate deed tokenization across New Jersey, the network’s use cases are becoming as real as they get.

-

FIFA Blockchain: The world’s most iconic sports federation chose Avalanche to power its L1 for digital collectibles and fan engagement. FIFA Collect is now migrating fully to Avalanche, ensuring seamless fan experiences at global scale.

-

$240B Real Estate Tokenization: Balcony’s landmark partnership with Bergen County and AvaCloud is bringing centuries-old property records on-chain, cutting settlement times from 90 days to 1. Over $290B in total value across multiple municipalities is set to be digitized on Avalanche.

-

Pixelmon and MapleStory: Two Web3 gaming giants are bringing their mobile-first monster franchises to Avalanche. Pixelmon’s “Warden’s Ascent” and Nexon’s “MapleStory N” show Avalanche’s dominance in the Asian mobile gaming market, with over 3 million monthly active users and 10.8M daily transactions recorded in May 2025.

-

Filecoin Partnership: Avalanche now supports a native cross-chain data bridge with Filecoin, enabling secure, verifiable storage for institutions, compliance-grade audit trails, and decentralized data infrastructure.

What Sets Avalanche Apart?

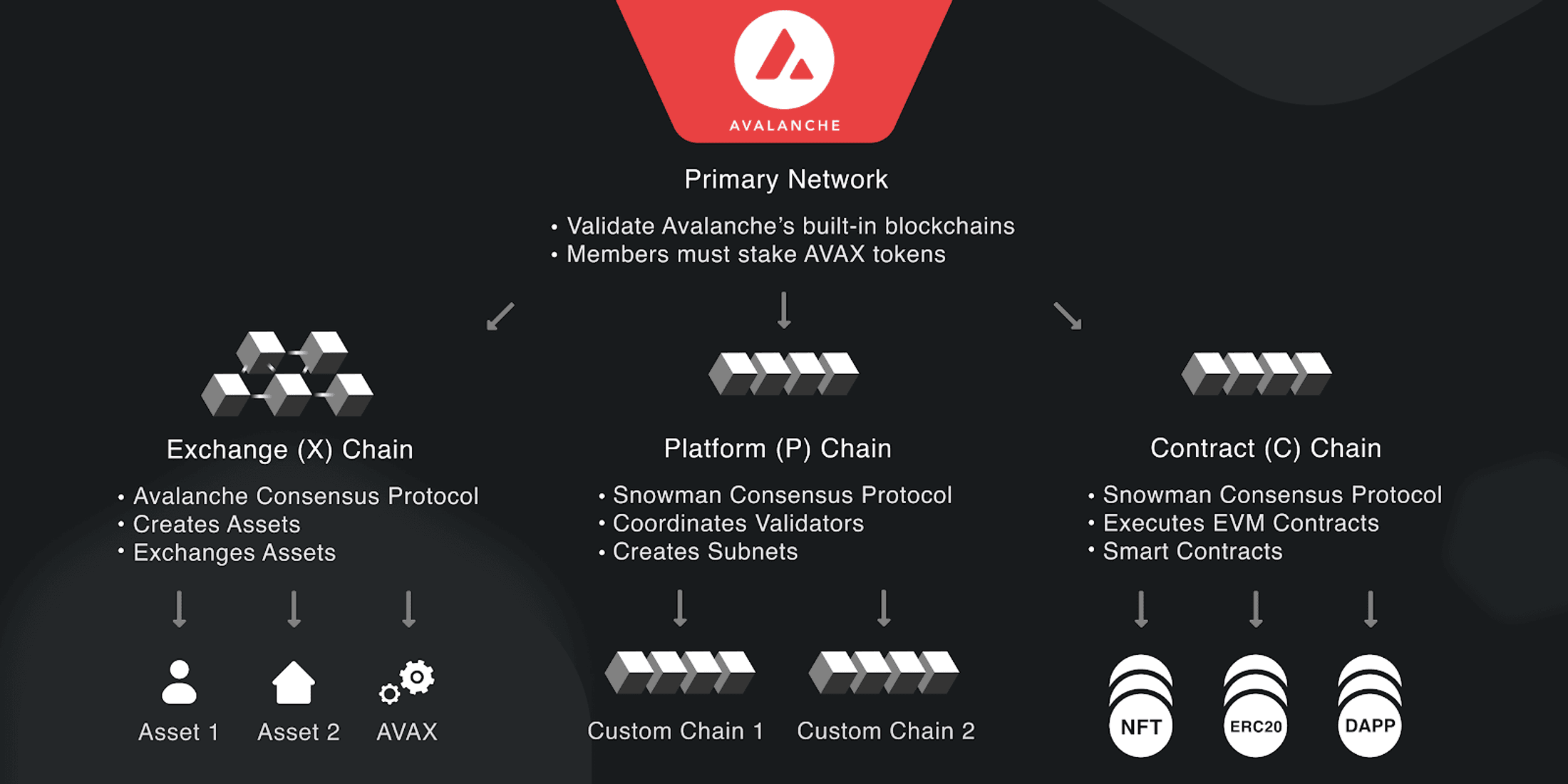

- Three-Pronged Architecture: Unlike other monolithic chains, Avalanche is built around three interoperable chains, X-Chain, C-Chain, and P-Chain, each optimized for its role (assets, smart contracts, and validators, respectively). This modularity enables scale without compromising decentralization.

-

Subnets and AvaCloud: Avalanche’s subnet model allows enterprises to spin up custom blockchains (Layer 1s) tailored to their needs, whether it’s for gaming, DeFi, or public infrastructure. AvaCloud makes this deployment as easy as spinning up a cloud server, and the results are showing: Avalanche is now the L1 of choice for FIFA, Balcony, and game studios alike.

-

Speed + Finality: With sub-second finality and up to 6,500 transactions per second, Avalanche is a natural fit for high-frequency use cases—from mobile games to financial infrastructure.

Tokenomics, Price Action & What Comes Next

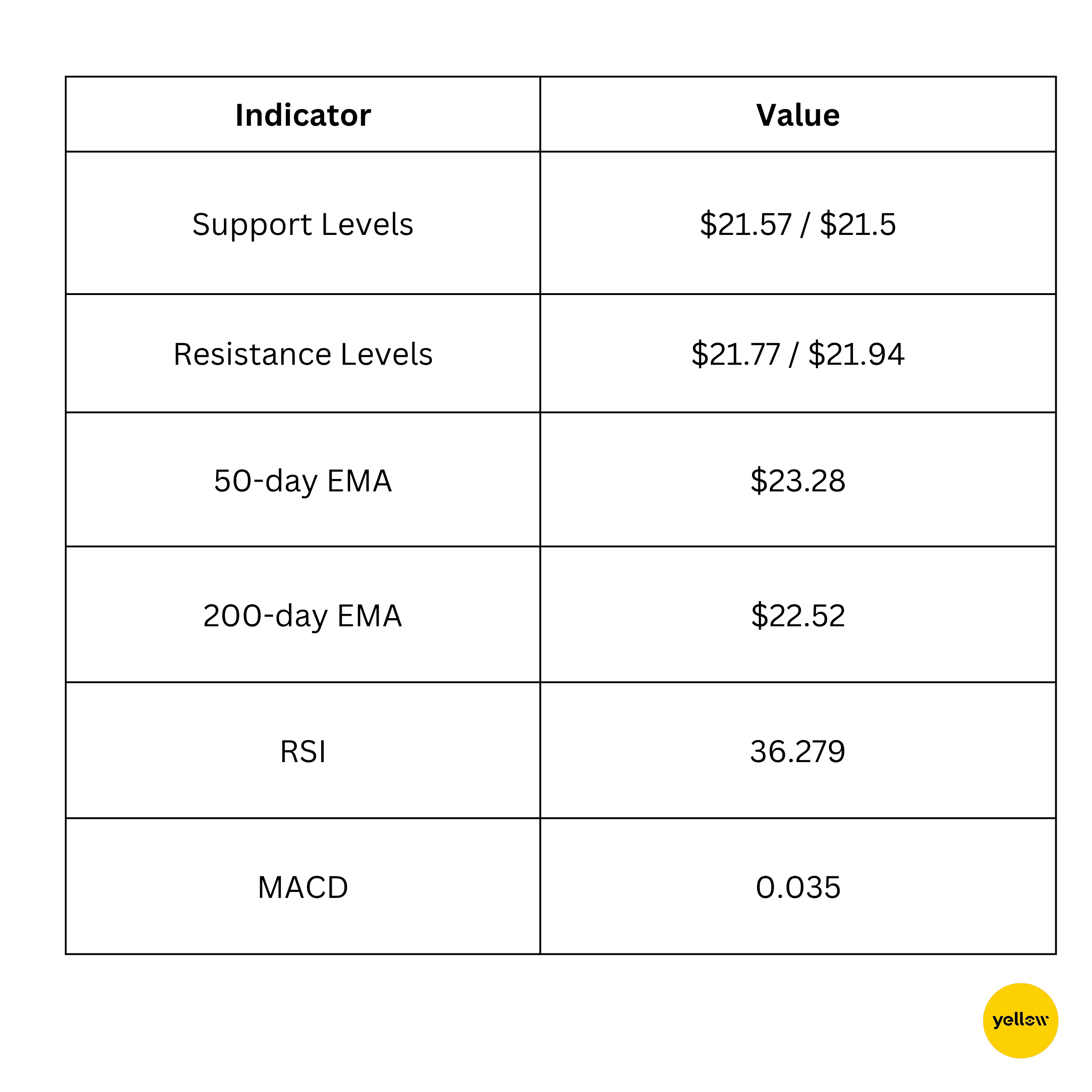

AVAX is currently priced at $22.91, showing a mild 3.37% increase over the past month. However, the price remains in a tight range below its key resistance at $25. Technical indicators like the MACD and EMAs suggest weakening bullish momentum in the short term.

Still, the volume-to-market cap ratio (5.27%) and growing on-chain metrics indicate steady accumulation. The price pattern resembles a pivot setup, holding above $23.50 may open a run to $26+, while a breakdown below $20 could test $18 support.

Why Avalanche’s Moment Might Just Be Starting

Avalanche’s growth isn’t driven by hype, it’s being built on institutional adoption, regulatory relevance, and real-world utility. That’s a massive shift from the speculative cycles of the past. Unlike meme coins or even hype-heavy Layer 1s, AVAX is securing government contracts, partnering with global giants like BlackRock and FIFA, and onboarding tens of millions of users through gaming.

While crypto Twitter debates memecoins and ETF approvals, Avalanche is quietly onboarding the next billion users. And that, more than any chart pattern, is what positions $AVAX as a long-term blue-chip asset in the making.

If you're looking for a token with substance, scalability, and mainstream integration—Avalanche isn’t just promising the future of Web3. It’s delivering it.

Zebec Network: The Payroll Powerhouse Bridging TradFi and Web3

While most crypto projects chase trends, Zebec Network (ZBCN) is quietly reshaping one of the largest real-world use cases in finance—payroll and payments. With roots in Solana and adoption across Ethereum, Base, and BNB Chain, Zebec is proving that blockchain’s killer app might just be boring… and that’s exactly why it works.

As the world moves toward digital value flows, Zebec is not just building on-chain infrastructure—it’s becoming the rails.

Zebec’s Rise: Real Volume, Real Clients, Real Value

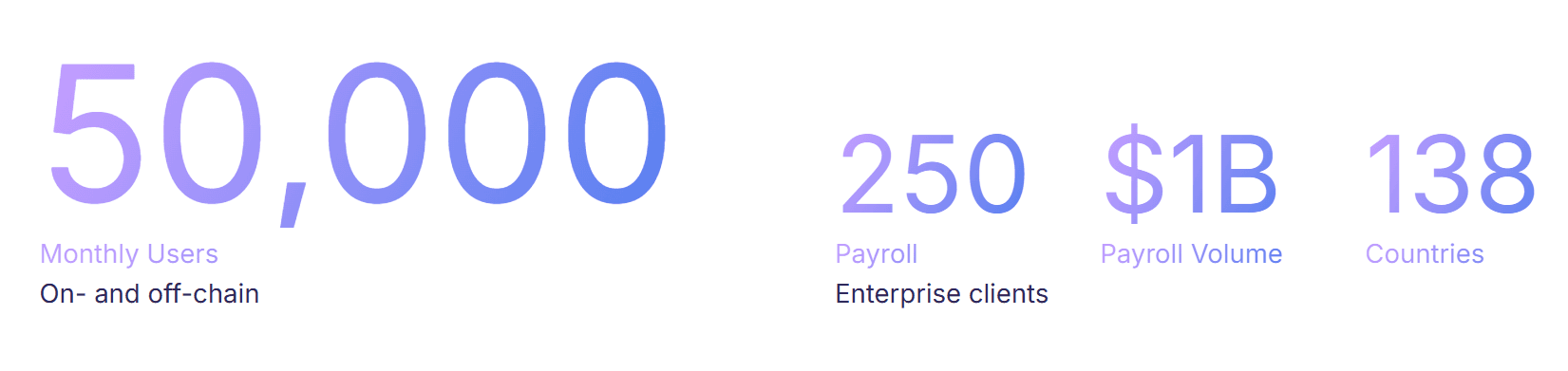

From programmable payroll to Mastercard-backed debit cards and tokenized university finances, Zebec Network has scaled rapidly to touch both traditional and Web3 economies. Its reach spans 50,000+ monthly users, 250 enterprise payroll clients, and $1 billion in processed payroll volume across 138 countries.

Here’s what’s fueling ZBCN’s momentum:

-

Mastercard Partnership & Zebec Carbon Card: Zebec’s crypto debit cards allow users to spend stablecoins as fiat with no fees, Apple Pay and Google Pay integration, and up to $10,000/day spend limits no KYC required for U.S. users.

-

Payroll Growth Partners (PGP): Zebec’s investment arm has acquired major U.S. payroll firms like PayBridge and School Payroll Services, bringing blockchain into public schools and traditional HR systems.

-

Web3-Native Payroll Tools: Wagelink, Zebec’s compliant payroll app, features USDC payments, early wage access, and automated budgeting with backend integration for Solana, Stellar, and Circle.

-

Science Card Acquisition: This UK-based EdTech platform brings Zebec into universities like Cambridge and Aston, enabling research grant disbursals and student payments on-chain via prepaid cards.

-

Backed by Giants: Zebec has secured funding from Coinbase Ventures, Circle, Solana Ventures, OKX, and Breyer Capital, while Uphold currently holds $100M+ in ZBCN and is launching a major airdrop campaign.

What Makes Zebec Different?

-

Multi-Chain Infrastructure with Real Product Adoption: Zebec isn’t just EVM-compatible, it’s deployed across Solana, Ethereum, Base, BNB Chain, and NEAR, offering a suite of fintech tools designed for mass adoption. From Solana’s speed to Ethereum’s network effect, Zebec thrives on interoperability.

-

DePIN + Real-World Assets: Zebec has developed physical Point-of-Sale systems and treasury tools for enterprises, making blockchain not just digital but tangible. With over 355,000 unique users and nearly 600 paying clients, this isn’t a testnet experiment.

-

Streaming Money, Not Just Payments: Zebec pioneered the concept of continuous settlement—where wages are streamed in real-time. This radically alters how salaries, remittances, and DAO disbursements work, offering constant liquidity without manual payroll cycles.

-

Active Community & Staking Growth: With over 2 billion ZBCN staked and 60,000+ holders, the ecosystem is growing rapidly. Yield rates up to 15% APY are attracting serious on-chain participation.

Tokenomics, Price Action & What Comes Next

ZBCN is currently trading at $0.00588, marking a 378.46% gain in the past month. After breaking above key resistance at $0.0022, the rally has accelerated sharply. However, RSI readings near 77 suggest near-term overheating.

Still, the 41.27% volume-to-market cap ratio signals strong conviction. If consolidation holds, ZBCN could eye a sustained breakout towards $0.008–$0.01.

Why Zebec Might Be One of the Most Undervalued Infrastructure Tokens

Unlike the hype cycles surrounding memecoins and DeFi fads, Zebec is building actual financial infrastructure and gaining traction. It is one of the rare crypto projects merging Web2 and Web3 in a way that makes blockchain invisible, yet indispensable.

With real cash flows, compliance-ready payroll products, partnerships with Visa, Mastercard, Circle, and Ripple in the pipeline, ZBCN isn’t just “going mainstream.” It’s already there.

Zebec is on track to become the Stripe of Web3 payroll, and ZBCN may very well be its operating token for the next generation of programmable money.

Floki: The Meme Giant Turning Mainstream with Utility, AI, and a Metaverse Push

Once dismissed as just another meme token, FLOKI is steadily morphing into a multifaceted digital brand. With an expanding ecosystem featuring a metaverse game, decentralized identity protocol, and even an AI-powered companion robot, Floki is pulling off what few meme coins have done—evolve.

And just in time, too. With a 3-month U.S. media blitz, growing adoption, and strategic partnerships ahead of Valhalla’s mainnet launch on June 30, FLOKI is now vying for real market share in GameFi, DePIN, and Web3 identity.

Why FLOKI Is Gaining Momentum

Despite its meme origins, Floki is embracing utility like never before. This month, it surged over 20%, supported by institutional-grade campaigns, tech innovation, and expanding global interest. Here's what’s making FLOKI hard to ignore:

-

Valhalla Mainnet Launch (June 30): FLOKI's flagship NFT-based MMORPG will go live this summer. Inspired by Pokémon and Skyrim, the game enables players to battle, farm, and trade in-game assets with real-world value.

-

3-Month U.S. Media Blitz: FLOKI is hitting national TV via Bloomberg, Fox Business, and CNBC. With digital billboards in Times Square and hundreds of ad slots secured, the exposure could reach over 219 million U.S. households.

-

FlokiHub Launch: A new Web3 identity system powered by the Floki Name Service. Users can showcase wallets, NFTs, social links, and create decentralized resumes, all built on .floki domains.

-

AI + Robotics Integration: Partnering with Rice Robotics, Floki will launch the FLOKI Minibot M1, a daily companion robot powered by AI and the $RICE token. Users will earn tokens through interactions, forming a human-AI engagement layer powered by the FLOKI ecosystem.

-

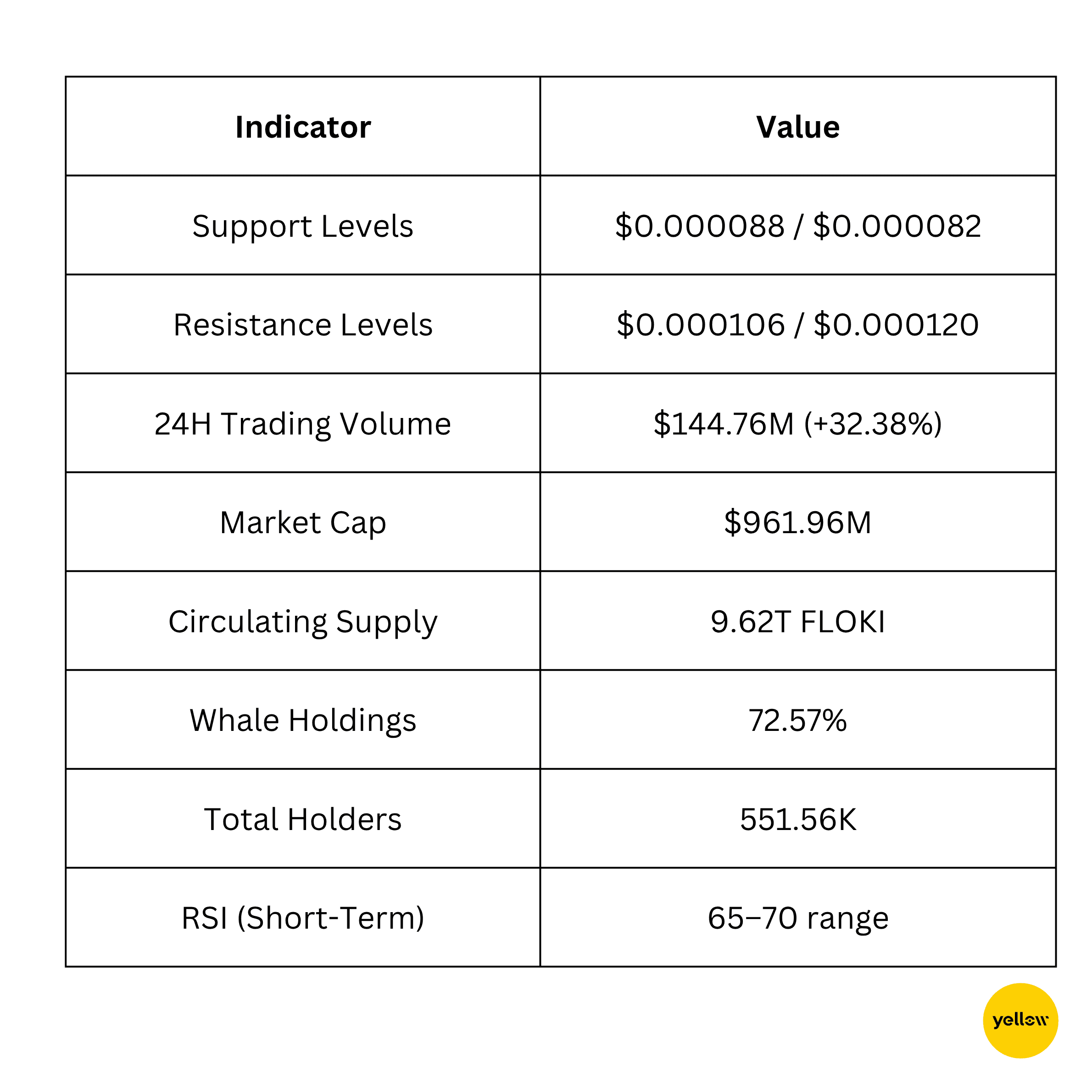

DAO-Driven & Globally Held: With over 454K holders, a majority of whom are long-term, Floki’s ecosystem is governed by its community. Over 47% of the supply is held by the top 10 wallets, with 72.57% controlled by whales.

Meme-to-Mainstream: How Floki Is Redefining Its Identity

-

Mass Adoption Meets Cultural Branding: FLOKI is more than just a name tied to Elon Musk’s Shiba Inu. It's one of the few tokens to bridge meme culture with major product rollouts. FlokiFi Locker, FlokiPlaces marketplace, and Floki University are all live or in advanced development.

-

Massive Community and Holder Base: With over 9.6 trillion tokens circulating and more than half a million wallets holding FLOKI, the token has one of the most distributed and engaged communities in the space.

-

Token Utility in Action: Whether staking, gaming, buying .floki domains, or earning $RICE via the robot assistant, FLOKI is weaving utility into its ecosystem at every level. It even integrates with the SpaceID protocol, bridging it into the broader naming service landscape.

Tokenomics, Price Action & Key Metrics

FLOKI is trading at $0.0000994, up over 20.28% in the last month, with renewed interest from both retail and whales. On-chain analytics reveal strong holder accumulation and a healthy 15.01% volume-to-market cap ratio, reflecting active interest.

FLOKI's Future: From Valhalla to Real-World Integration

Floki’s strategy is clear: dominate through brand, utility, and community. With Valhalla set to bring immersive play-to-earn gaming, FlokiHub pushing Web3 identity adoption, and FLOKI Minibot M1 bridging AI and DePIN into the meme token space, Floki’s ecosystem now appeals to investors far beyond the meme hype.

It’s building in every major vertical: GameFi, DeFi, Identity, AI, and Retail Payments while staying true to its roots as a community-led brand.

For a token born from meme culture, FLOKI is doing something rare: turning its brand equity into lasting infrastructure. The Viking meme is becoming a decentralized empire.

Closing Thoughts

The current market phase appears to be shifting from speculative surges to sustained ecosystem growth. Projects like Avalanche, Zebec Network, and Floki are not just gaining price momentum but are expanding their real world presence through partnerships, user adoption, and infrastructure development. This shift indicates a broader market appetite for utility, scalability, and mainstream relevance rather than quick returns.

As blockchain adoption continues to mature, tokens that deliver functional value are increasingly being viewed as long-term plays. These three projects reflect different segments of this evolution, be it enterprise-grade scalability, financial infrastructure, or consumer-facing engagement, and their growing traction suggests they may play a more significant role in the months ahead.