When markets cool off, smart investors don’t retreat — they reposition. And some of the most undervalued opportunities right now aren’t in hype-driven memecoins, but in the infrastructure quietly powering the next wave of blockchain growth.

From AI compute networks to cross-chain liquidity routers and customizable L1 gaming subnets, the spotlight is shifting to tokens building real-world solutions. With the bull run knocking, infrastructure plays like Axelar (AXL), Avalanche (AVAX), and Render (RENDER) are emerging as the blue-chip bets of this cycle.

Why do these tokens deserve attention right now? Let’s find out.

Avalanche (AVAX): The Ethereum Challenger Poised for a Breakout

Avalanche isn’t trying to be Ethereum 2.0. It’s building something far more adaptable. With subnets, ultra-fast consensus, and a rising tide of institutional and GameFi adoption, AVAX is finally stepping out of the shadow of layer-1 rivals. As macro sentiment improves and retail flows return, Avalanche is positioned to make one of the strongest comebacks in crypto.

From Innovation to Adoption

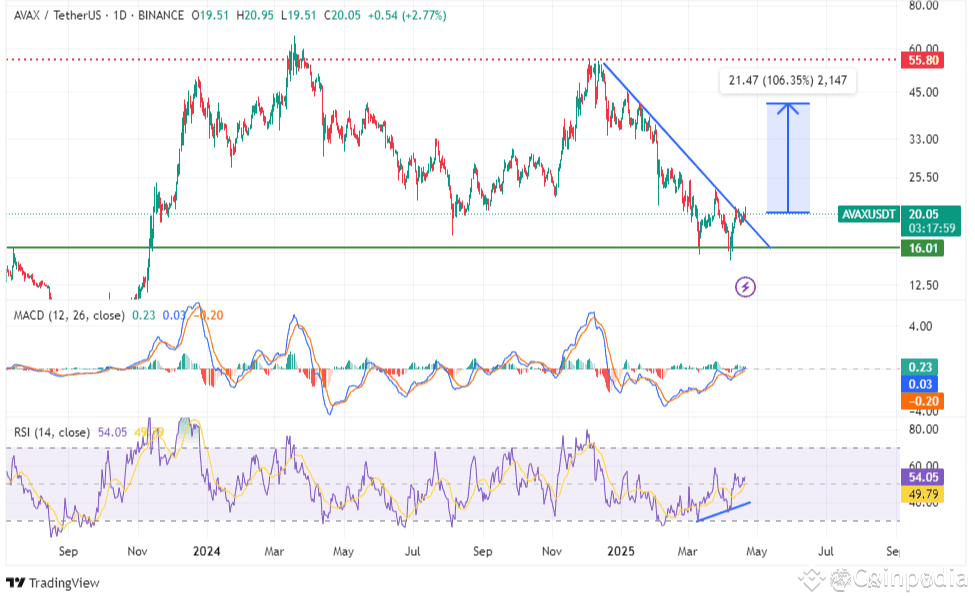

After a brutal year of price consolidation, AVAX has rebounded sharply from $16 lows to hover around $21.24, marking a 30%+ surge in the last few weeks. With volume accelerating to $335M+ daily, and new technical support holding at $19.50, Avalanche is sending clear signals of bullish momentum.

But this isn’t just a dead-cat bounce. It's being powered by ecosystem catalysts, strategic integrations, and a game-changing shift in subnet economics.

What Makes AVAX a Market Standout?

The Trilemma Killer: Subnet-Powered Modularity**

Three-Chain Architecture1

-

X-Chain handles transfers using DAG consensus.

-

C-Chain runs smart contracts (EVM-compatible).

-

P-Chain manages validators and subnets.

Subnets = Custom Blockchains: Projects like MapleStory N can spin up dedicated networks optimized for their needs — while still settling value in AVAX. That means demand for AVAX rises with ecosystem growth.

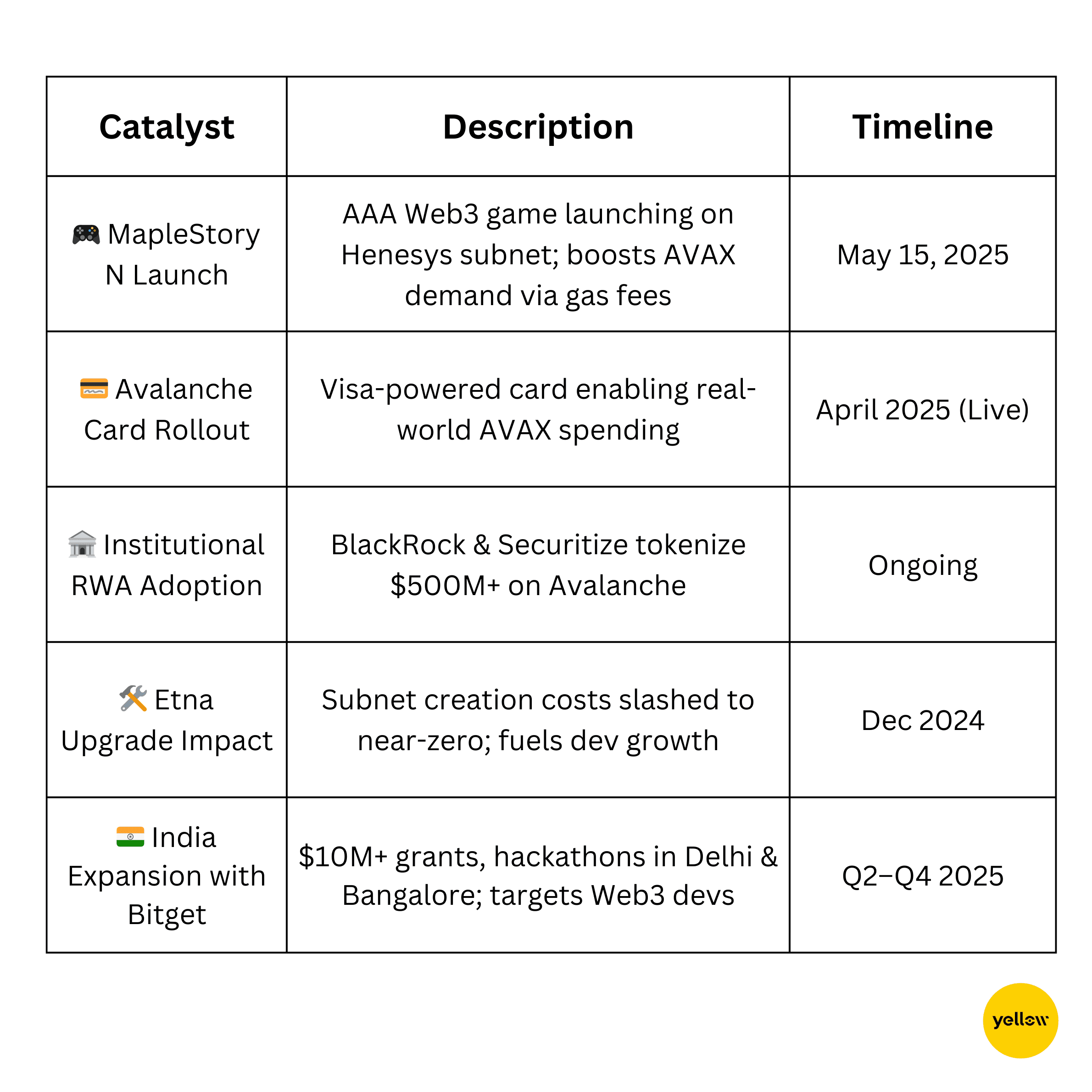

Etna Upgrade Impact: In Dec 2024, Avalanche slashed the cost of launching a subnet to near-zero, unlocking a wave of developer activity that Ethereum L2s are struggling to contain.

GameFi with Real Users, Not Just Hype

MapleStory N is launching May 15 is not a speculative cash-grab. With 31M+ test transactions and nearly 1M wallets, it could be the most successful Web3 game to date. The game runs on Avalanche’s Henesys subnet, meaning all transaction fees feed directly into AVAX economics. Nexon, the creator, migrated from Polygon — a strong vote of confidence in Avalanche’s performance and scale.

Institutional Real-World Asset (RWA) Momentum

-

BlackRock & Securitize tokenized $500M+ worth of RWAs via Avalanche’s infrastructure.

-

Citibank has been actively exploring tokenized finance pilots on Avalanche.

-

Avalanche Card (launched with Visa & Rain): Enables seamless global AVAX payments with zero conversion fees.

This isn't theory. This is live infrastructure being used by the biggest names in TradFi.

On-Chain & Ecosystem Strength

-

Circulating Supply: 417M AVAX

-

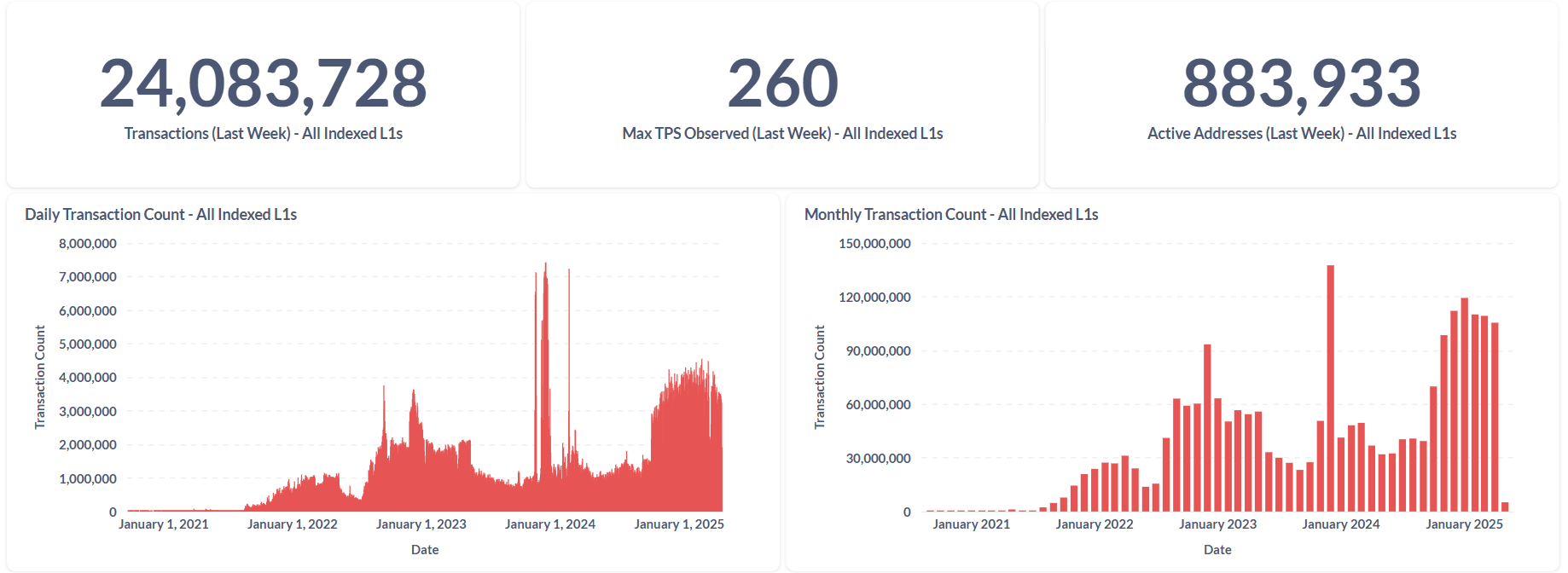

Total Transactions (All L1s): 2.1B+

-

Monthly Active Addresses: 3.2M+

-

Transaction Count Last Week: 24M

-

Gas Fees (30D avg): $0.0302 — low and stable

-

Holders (Time Held > 1Y): 67.3%

-

Holdings: 72.6% — Strong long-term conviction

Avalanche is growing, and it’s not just contracts — we’re seeing new wallets, gas consumption, and subnet validators all on the rise since January.

Technically Speaking

-

bottom formation confirmed at $16 with bullish RSI divergence.

-

Immediate resistance lies at $25, with breakout targets between $30–$33.

-

Longer term, Standard Chartered forecasts AVAX at $55 by end of 2025, $250 by 2029 — a potential 10x from current levels.

Key Catalysts to Watch

The Verdict

AVAX has been quietly building the infrastructure that makes narratives possible. From high-performance GameFi to scalable RWA tokenization and a thriving modular ecosystem, Avalanche is building real-world utility with a deflationary economic model to match. And with AVAX still trading 88% below its 2021 ATH of $145, this breakout could be just the beginning.

RENDER: The AI Compute Backbone That’s Quietly Leading the Next Crypto Boom

In a world obsessed with AI and digital creation, Render Network isn’t riding the hype — it’s building the infrastructure. With decentralized GPU compute power, real enterprise integrations, and a recent breakout backed by fundamentals, $RENDER is proving it’s more than just another altcoin.

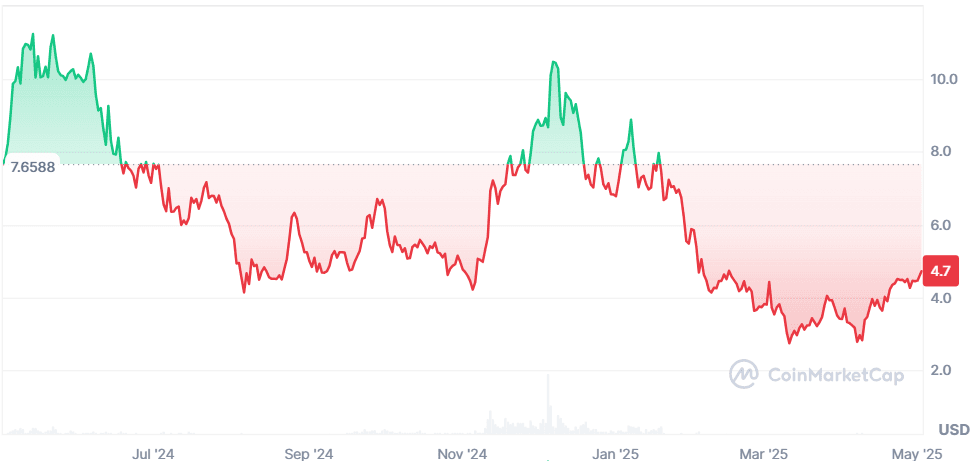

From powering indie creators to enabling AI labs and 3D studios, Render is creating the backbone of the future digital economy. And after a 38% drawdown this year, the token is showing serious signs of reversal.

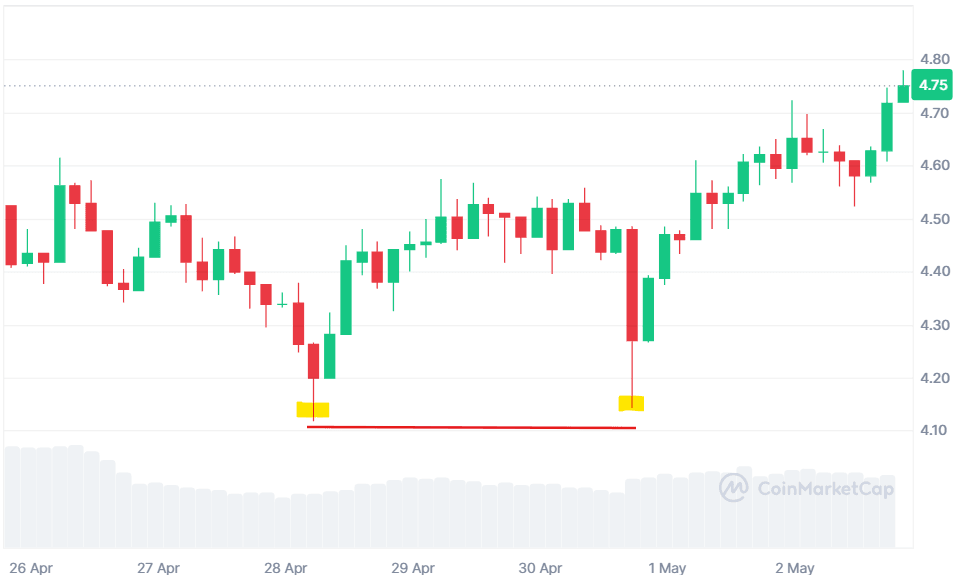

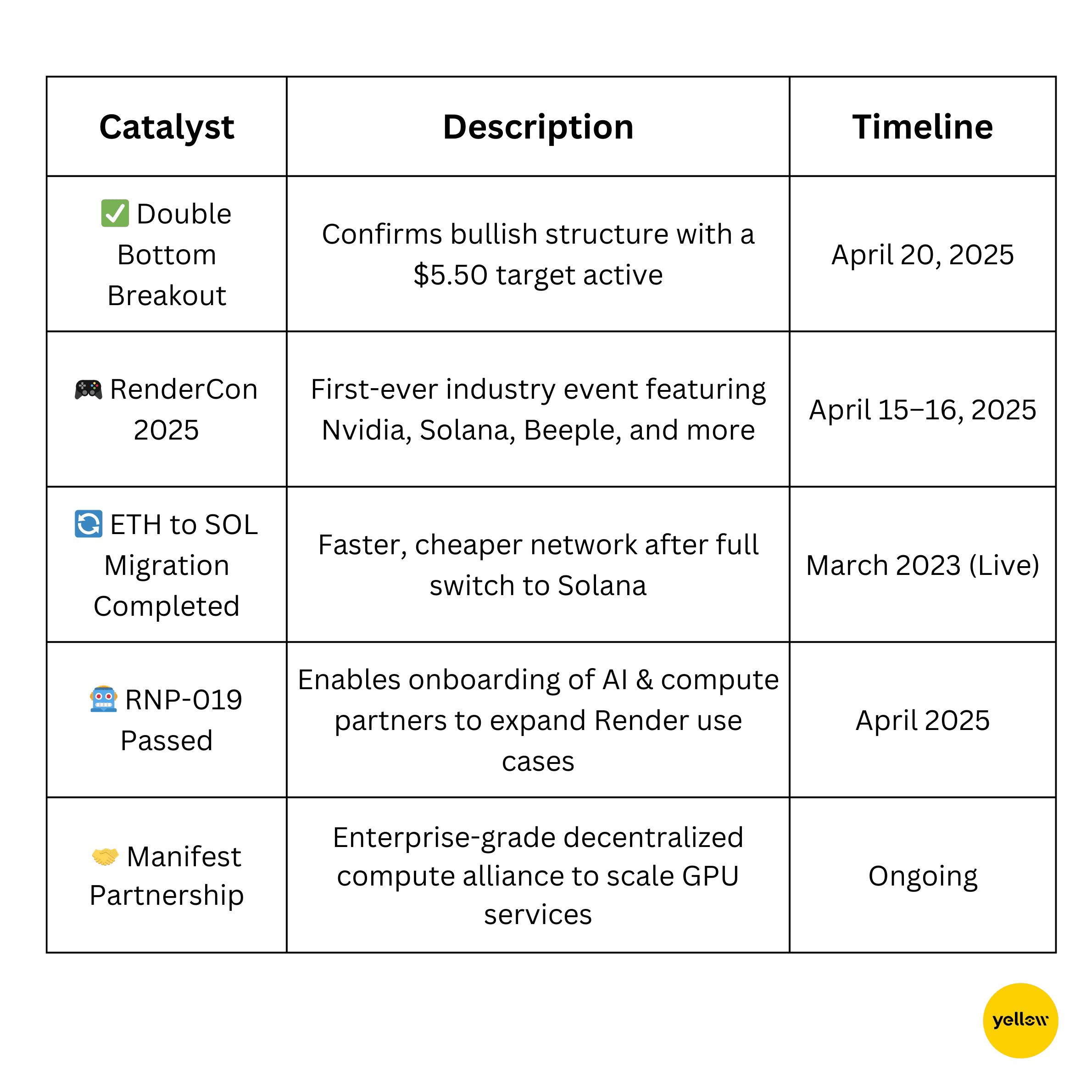

The Breakout Begins

RENDER is currently trading at $4.72, recovering sharply from the March lows of ~$2.80. The token recently completed a double bottom breakout above the $4.00 neckline — a classic bullish reversal pattern — with a measured target of $5.50, and further upside toward $7–$8 if momentum holds.

Backed by 78.57% whale holdings, and 57.83% of addresses identified as long-term holders, this isn’t just short-term speculation. It’s conviction.

What Makes Render a Standout in the AI + Web3 Space?

Decentralized GPU Power, Built for Real-World Utility

Render connects GPU providers with creators, enabling powerful 3D rendering, AI training, and VR development without expensive infrastructure. Artists, studios, and developers can rent computing power from a global decentralized pool — reducing cost, accelerating workflows. Built on OTOY's OctaneRender, used by professionals across film and gaming industries.

Enterprise-Grade Architecture

-

After its migration from Ethereum to Solana in 2023, Render now processes high-speed, low-cost transactions.

-

Its Burn-and-Mint Equilibrium model reduces circulating supply over time — incentivizing both node providers and token holders.

-

Built-in smart contract mechanisms handle payments, job verifications, and rendering outputs — fully trustless.

Hollywood Meets Crypto

Render's advisory board includes:

🛸Jules Urbach (Founder, Star Trek Enthusiast )

🎬 JJ Abrams (CEO, Bad Robot)

🧑🎨 Beeple (NFT & digital art icon)

💼 Ari Emanuel (WME Co-CEO)

🧠 Emad Mostaque (Founder, Stability AI)

🦁 Brendan Eich (Founder, Brave)

These aren’t just symbolic affiliations. Render is being shaped as a Web3-native infrastructure layer for entertainment, AI, and the open metaverse.

AI Compute

With generative AI exploding, demand for GPU rendering is at an all-time high. Render is the first decentralized network ready to meet that need, efficiently and affordably.Render even passed RNP -019, a community vote for adding its next feature which was passed with 2.9M yes. It added an additional Render Compute Network to onboard general compute and AI partners.

Technically Speaking

-

Double bottom pattern confirmed in April with a breakout above $4.00.

-

Price has reclaimed $4.28, and as long as it stays above $4.00, the $5.50 target remains active.

-

Next major resistance: $5.50 → $7.00 → $8.88 (January 2025 high).

-

Volume-to-market-cap ratio at 3.38% suggests strong liquidity.

-

RSI neutral (~55) — room for more upside before becoming overbought.

Key Catalysts to Watch

The Verdict

Render isn’t just another AI coin — it’s the decentralized backbone for the next wave of compute innovation. With its recent breakout structure, proven token economics, and rising institutional credibility, RENDER is emerging as a quiet leader in the AI + Web3 crossover narrative. If AI truly reshapes the digital world, Render is the power grid. And at just under $5, it's still early.

AXL: Cross-Chain Infrastructure That’s Quietly Powering Web3’s Interoperable Future

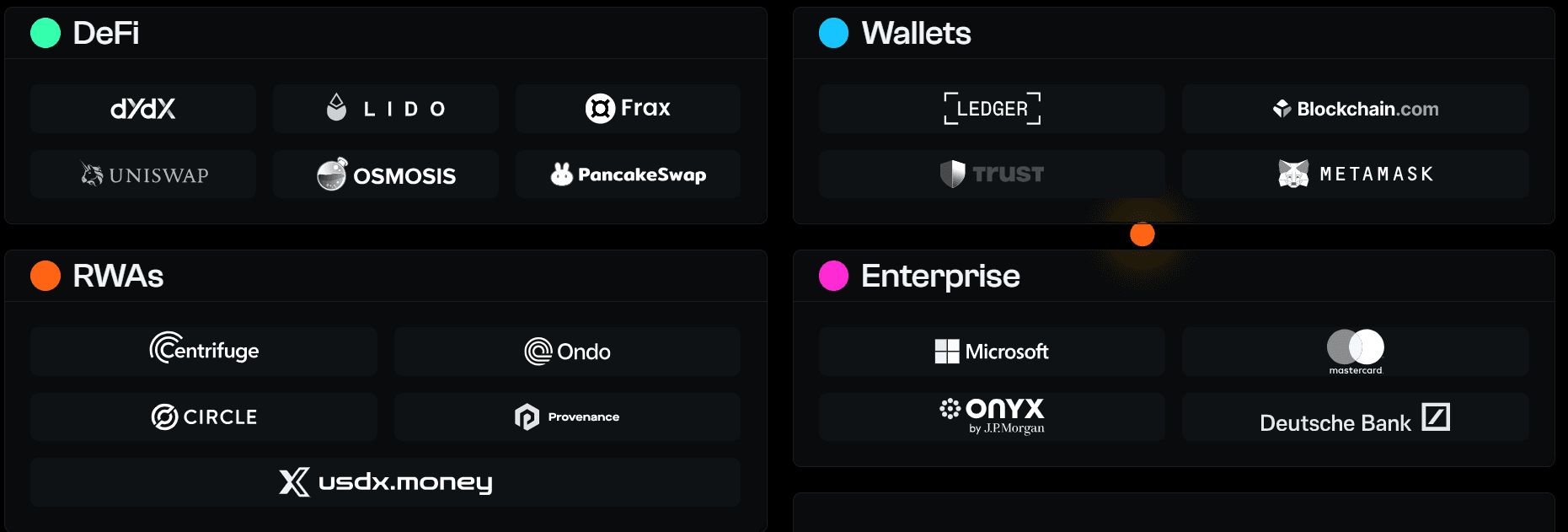

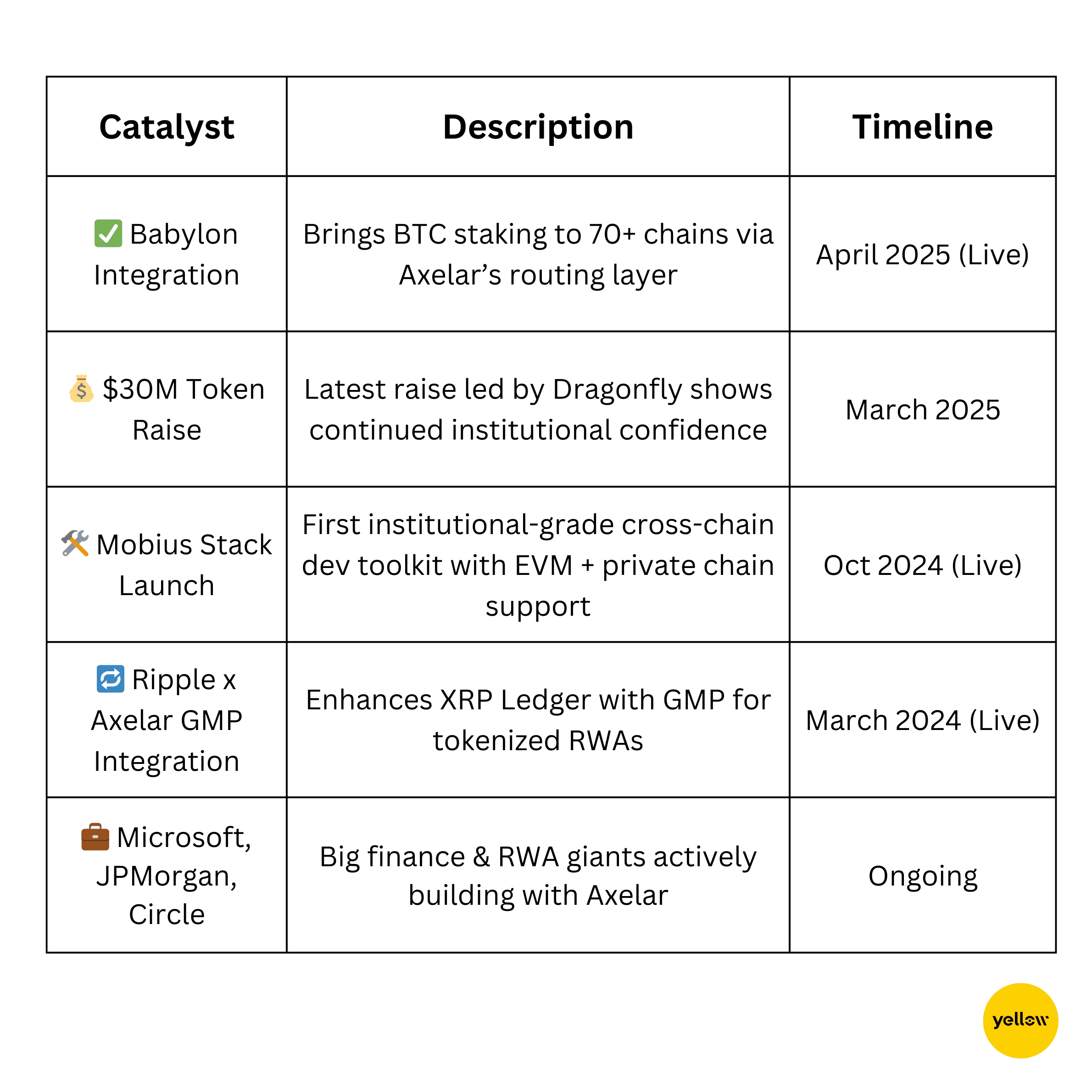

While Layer 1s battle it out for ecosystem dominance, Axelar (AXL) is building what everyone needs but few understand — the underlying pipes that connect everything. As chain abstraction gains momentum and traditional finance eyes real-world asset (RWA) tokenization, Axelar stands tall as the most integrated and undervalued interoperability protocol in crypto. From Microsoft to JPMorgan, Avalanche to Moonbeam, 75 chains already run on Axelar. And with key partnerships, new institutional traction, and a long-overdue breakout from all-time lows, the market is starting to notice.

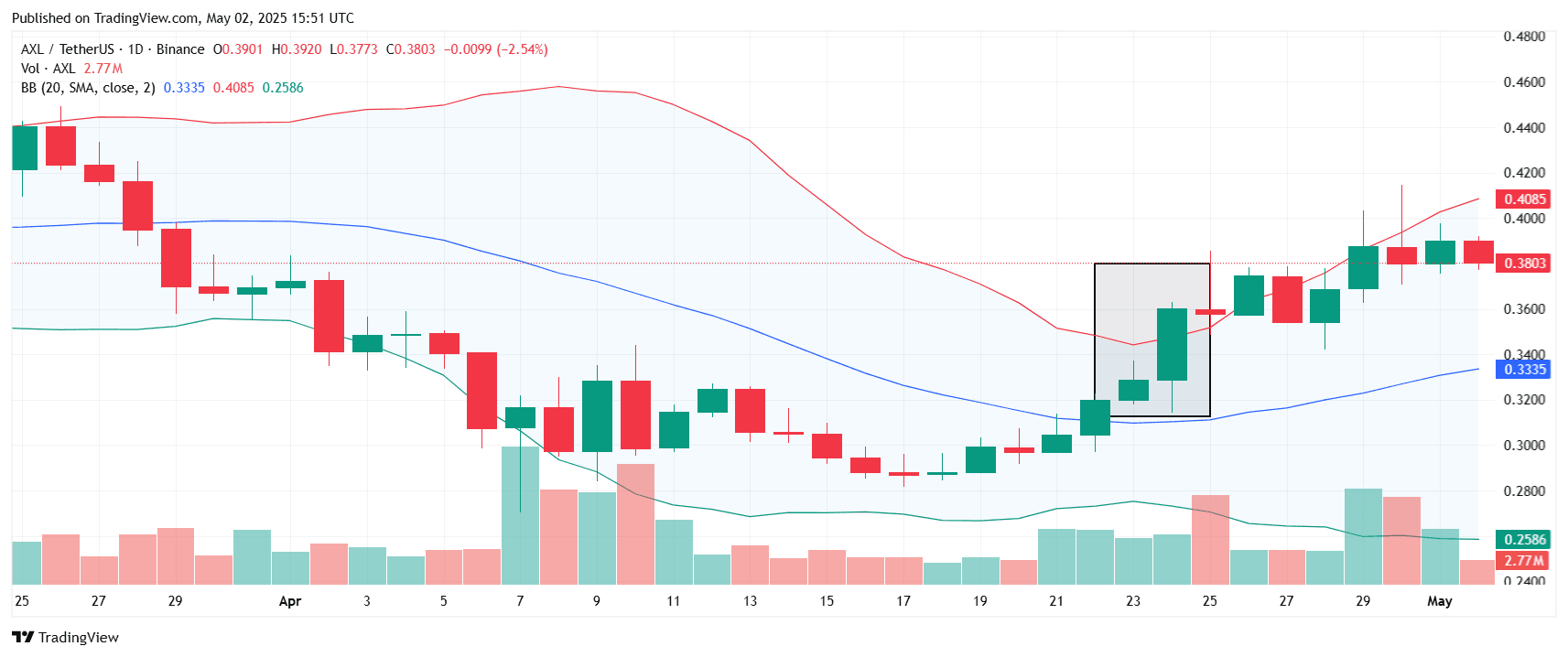

The Recovery Begins

Trading at $0.3785, Axelar has just bounced 37% off its all-time low of $0.2745 (April 7), confirming a bullish engulfing pattern on the weekly chart. While still 70% down on the year, technicals suggest the downtrend has bottomed. The next resistance is around $1.04, followed by a larger target zone at $2.20 — levels last seen during the 2022–2023 expansion phase. Backed by $11.3B in cross-chain volume, 3.3M transactions, and integrations with over 75 chains, this isn’t just a speculative bounce — it's fundamental strength re-entering price action.

Why Axelar Matters Now More Than Ever

The Backbone of Chain Abstraction

-

Axelar isn’t just a bridge — it’s a universal interoperability layer. Its General Message Passing (GMP) lets devs deploy once, run across chains, and skip complex backend work.

-

Developers can build cross-chain dApps without learning multiple protocols — Axelar handles routing, gas abstraction, and message verification.

Enterprise + RWA Integration

Axelar isn’t just Web3-native. It’s plugged into traditional finance:

-

Partners include Microsoft, Deutsche Bank, Mastercard, and JPMorgan's Onyx.

-

Through partnerships with Circle, Centrifuge, and Ondo, Axelar supports real-world asset tokenization, giving institutions the rails to onboard into DeFi securely.

The Bitcoin Liquidity Onramp

In 2025, Axelar integrated with Babylon to bring self-custodial BTC staking to over 70 chains. This could become a major unlock for Bitcoin capital trapped in a non-EVM ecosystem — Axelar now powers the movement of BTC collateral across DeFi in a secure, decentralized way.

Technically Speaking

-

Bullish engulfing weekly candle formed at $0.3178 support.

-

Price broke out of a year-long descending channel in early May.

-

Next resistance at $1.0421, followed by a psychological push to $2.20+ if volume sustains.

-

Volume has increased over 246% in the last 48 hours — a sign that whales are accumulating at suppressed valuations.

Tokenomics Snapshot

-

Market Cap: $287.4M

-

Circulating Supply: 759.42M AXL

-

FDV: $454.32M

-

TVL: $201.54M

-

Connected Chains: 75

-

Backers: Binance Labs, Coinbase Ventures, Dragonfly Capital

AXL powers every transaction on the Axelar Network — from token transfers to GMP calls. It is also staked by validators securing the chain’s PoS infrastructure. With ongoing token burns and usage-based demand, AXL’s value is directly tied to network utility.

Key Catalysts to watch

The Verdict

Axelar is not another bridge — it’s the infrastructure powering multichain finance. With deep integrations across DeFi, TradFi, and RWAs, Axelar is positioned as the Layer 0 of the chain abstraction era. Its price action is just starting to reflect what insiders already know: this is foundational tech. With Bitcoin capital coming online, institutional rails solidifying, and the Web3 user experience finally being abstracted — $AXL looks heavily undervalued below $0.50. If chain abstraction is the future of crypto, Axelar is already there and for long-term investors, this may be one of the best asymmetric plays in 2025.

Closing Thoughts

As investor focus shifts from speculative momentum to utility-driven assets, infrastructure tokens like Axelar, Avalanche, and Render stand out for their foundational roles in blockchain scalability and interoperability. Axelar is leading the chain abstraction thesis, enabling seamless cross-chain communication across 75+ blockchains — a capability now crucial for dApps integrating across ecosystems. Avalanche’s modular subnet architecture is attracting major IPs like MapleStory, proving its model for scalable, application-specific blockchains. Meanwhile, Render is capitalizing on surging demand for decentralized GPU compute, with adoption in AI, VR, and digital art pipelines — backed by real usage and strong governance momentum.

Technically, all three tokens are showing early signs of reversal — from Axelar’s breakout after its 85% drawdown, to Avalanche reclaiming key support on GameFi expectations, and Render breaking out of a double bottom with renewed AI interest. Each has a differentiated value proposition and clear catalysts ahead. For investors seeking exposure to the next stage of Web3 infrastructure, this is a rare opportunity to buy fundamentally strong assets while they remain undervalued.