Even in a choppy market, the deepest gains usually hide in the rails everyone ends up using once the hype returns. Snagging quality infrastructure names while they’re unloved is a classic way to multiply upside when the next risk-on wave hits.

This cycle’s spotlight is swinging toward plumbing-level projects that unlock new activity: Bitcoin-settled DeFi, cheap GPU compute, and bulletproof validator stacks. Those sectors are surging in real-world usage even as their native tokens still trade at hefty discounts.

Enter Stacks (STX), Akash Network (AKT), and ssv.network (SSV). One anchors Bitcoin-native smart contracts, one rents out hard-to-find H100 GPUs at half the cloud price, and one secures the entire Ethereum restaking boom. Each has major rollouts or grants landing in July, setting the stage for fresh TVL, fee burn, and renewed headline flow.

Why do these tokens deserve attention right now? Let’s find out.

Stacks: The Bitcoin DeFi Toll-Booth You Can Still Buy on Clearance

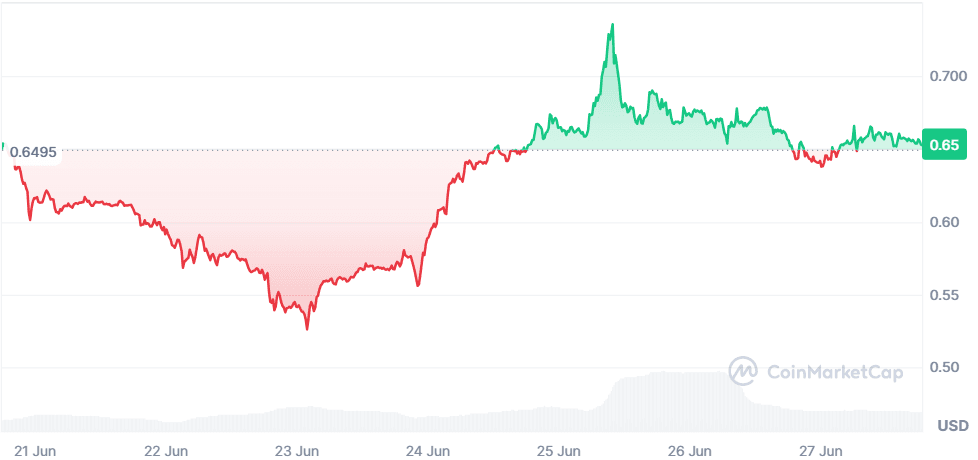

In a cycle where “Bitcoin L2” is the buzziest phrase on CT, Stacks (STX) has quietly become the infrastructure most likely to capture that flow. The network already settles back to Bitcoin, its new sBTC bridge finally lets users withdraw to native BTC, and the Nakamoto upgrade slashes block times to single-digit seconds—all before the real liquidity shows up. Yet STX trades at $0.65, miles below its 2024 peak, making this a textbook dip for anyone who missed the first wave.

The Meteoric Rise (…and Dip)

Stacks ripped from $1.06 in January 2024 to an all-time high of $3.84 that December, riding the initial Bitcoin-layer narrative. After Bitcoin cooled and macro jitters hit alt-L1s, STX retraced -83 % to a March-2025 low of $0.50 before grinding back to the mid-$0.60s today.

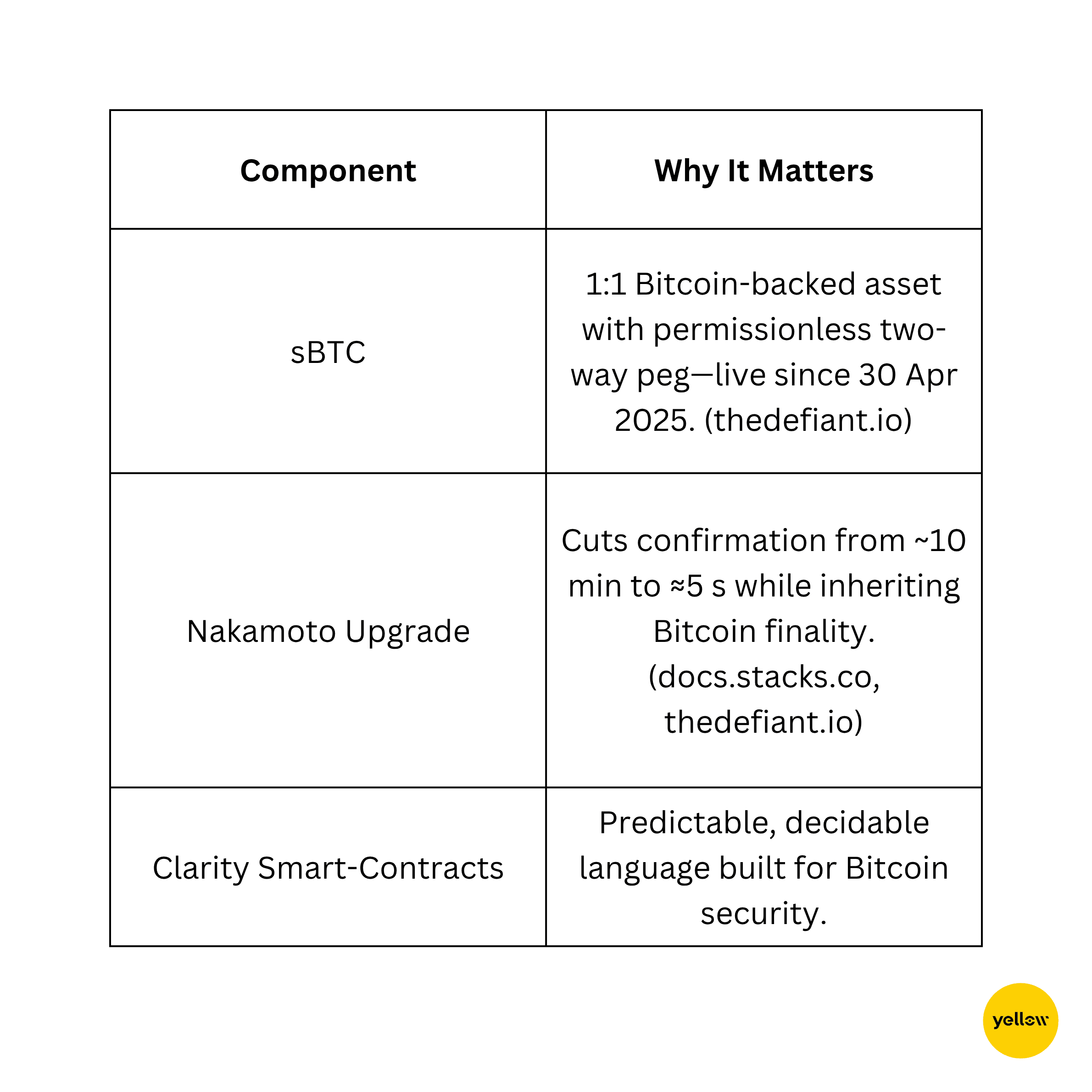

What Makes Stacks Special?

Backed by Industry Titans

-

Stacks Foundation steers core dev funding, grants, and a Signer-delegation program that already counts Figment, Blockdaemon and Copper among its operators.

-

BitGo & Fireblocks added institutional sBTC custody ahead of the April-30 withdrawal go-live, dropping the final barrier for big-ticket capital.

Innovative Product Suite

Strong Tokenomics

-

Proof-of-Transfer (PoX): STX stakers earn native BTC yield every 2,100 Bitcoin blocks, unique among L2s.

-

Hard-capped 1.818 B supply; ~1.53 B circulating.

Strategic Partnerships

-

Axelar Mobius Stack: Stacks slated for first-wave chain integration, unlocking friction-free ERC-20 and stablecoin liquidity in Q3.

-

Hack-Weeks & Grants: July “Satoshi Upgrades” hackathon seeds new vault, lending, and RW-asset apps with dedicated TVL incentives.

The Growth Opportunity

Bitcoin’s market cap now dwarfs Ethereum’s by 2X, but its on-chain TVL is a rounding error. Stacks is positioned as the toll-booth every swap, stablecoin and lending market must pay to tap that liquidity, exactly the dynamic that turned L2 gas tokens on Ethereum into multibillion-dollar assets last cycle. With sBTC withdrawals live and cross-chain plugs arriving, the addressable market expands from hobbyist DeFi to institutional strategies chasing Bitcoin native yield.

Why Now?

✅ Valuation Reset: STX still sits 80 % below its ATH despite delivering every roadmap milestone.

✅ Near-Term Catalysts: Axelar bridge vote, July hack-week liquidity mining, and sBTC integrations all land inside the next 90 days.

✅ Narrative Tailwind: Bitcoin ETF inflows keep mainstream eyes on BTC; Stacks is the easiest “picks-and-shovels” play.

If Bitcoin-secured DeFi is the trade of 2025, Stacks is the shovel seller, and it’s on the discount rack right now. Size positions responsibly, keep risk tight, and remember: information, not financial advice.

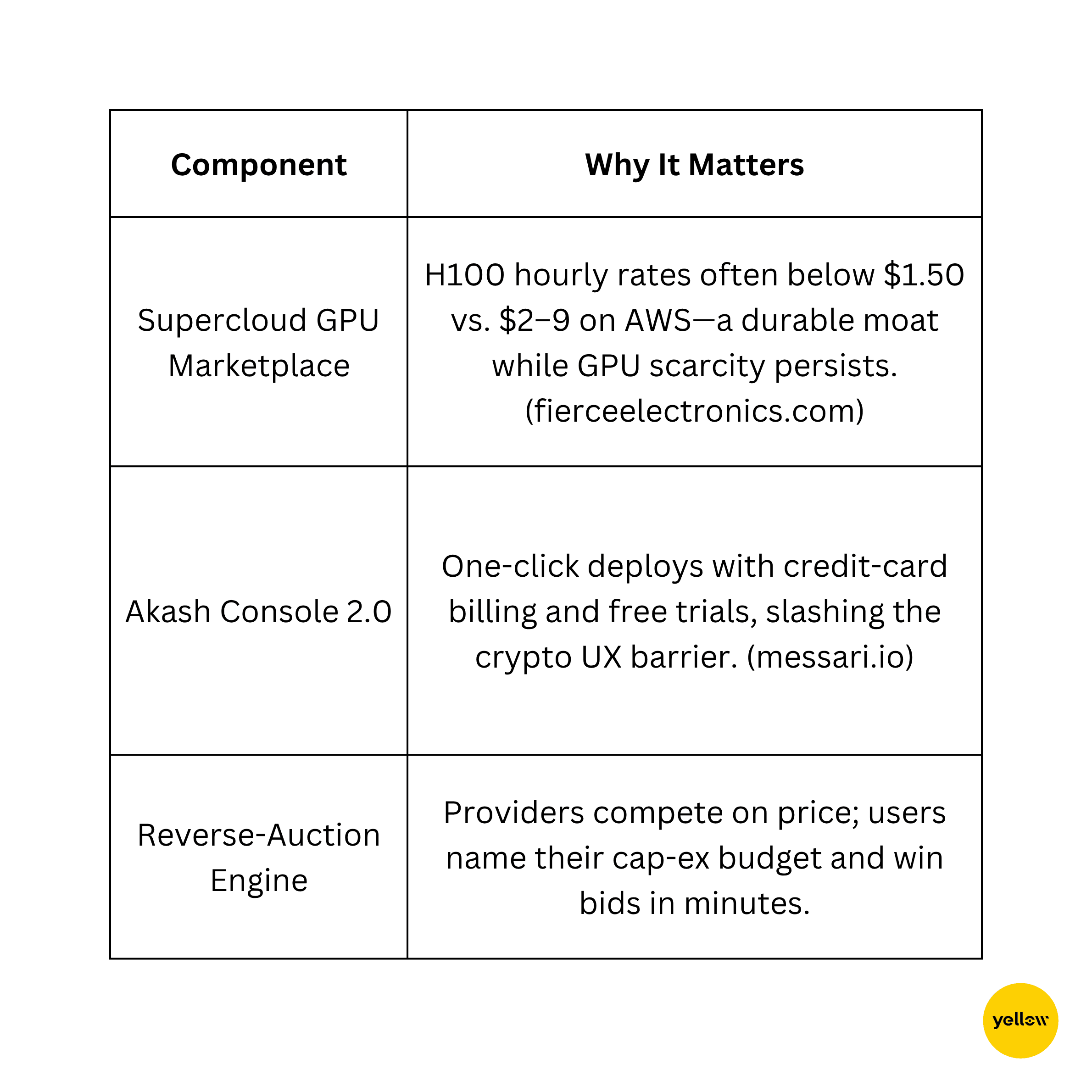

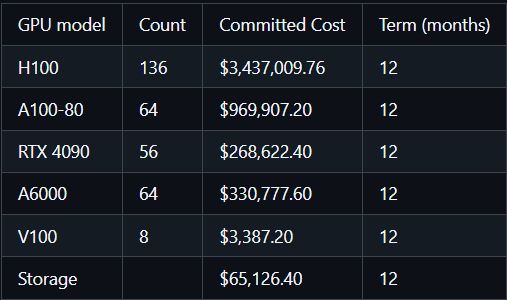

Akash Network: The Decentralized GPU Supercloud That’s Still on Clearance

In the post-ChatGPT world every AI start-up, quant desk, and indie dev wants H100 horsepower, but AWS spot queues are weeks long and $2-plus an hour. Akash Network (AKT) solves that crunch with a permissionless “Airbnb for GPUs,” renting the same chips for roughly half the cost while routing fees through its native token. Usage fees, GPU capacity, and revenue have all exploded this cycle, yet the token sits near a dollar. That’s a dip worth studying.

The Meteoric Rise (…and Dip)

AKT bottomed at $0.18 in late-2022 before ripping to $3.90 in January 2025 on the first AI mania. Macro unwind plus “bridge-hack” PTSD then cratered most DePIN names; AKT retraced -73 % to $1.05 today. Meanwhile daily lease revenue and GPU usage keep printing new highs.

What Makes Akash Special?

Backed by Industry Titans

-

NVIDIA ties: Brev.dev (acquired by NVIDIA) pipes H100 inventory straight into Akash.

-

Enterprise adopters: AI platforms like Prime Intellect and NodeShift now default to Akash GPUs for training workflows.

Innovative Product Suite

Strong Tokenomics

-

Hard-capped 1 B supply; ~889 M circulating. Stakers secure the chain and earn both inflation and 100 % of network fees.

-

AKT 2.0 draft (in community review) shifts inflation to an incentive pool and adds a fee-burn, tightening float as usage grows.

Strategic Partnerships

-

Venice.ai, Sentinel Scout, Passage and other AI & gaming workloads drive triple-digit GPU demand.

-

Provider Incentives Pilot 2: $10 M in grants paying operators to onboard more GPUs, capacity already +37 % QoQ.

The Growth Opportunity

Global GPU demand is a one-way bet, forecast to top $460 B by 2032. Every inference job or diffusion render pushed through Akash burns AKT fees and locks tokens in validator stakes. Revenue already grew 1,731% YoY in 2024, before credit-card on-ramps and enterprise SLAs even went live. If DePIN becomes the next mega-narrative, Akash is the only network showing real, paid throughput today.

Why Now?

✅ Deep Discount: AKT trades ~80 % below its January highs while GPU leases, fee revenue, and capacity sit at record levels.

✅ Q3 Catalysts:

-

Supercloud Phase II adds off-chain inventory & secret-store (security must-have for enterprises).

-

Credit-card ramp + fiat trials target the non-crypto DevOps crowd, new demand without new token emissions.

✅ Macro Tailwind: As AI models outgrow on-prem GPUs, cost-sensitive builders need alternative clouds; Akash’s reverse-auction is the cheapest liquidity in town.

If decentralized compute is Web3’s next trillion-dollar vertical, Akash is the router for that flow and it’s on sale at a buck. Manage size, expect volatility, and remember this write-up is information, not financial advice.

ssv.network (SSV): The Validator-Powered Restaking Engine Trading at Pennies on the Dollar

Ethereum’s “restaking meta” is exploding, and ssv.network is the infrastructure most AVS (Actively Validated Services) rely on to keep their validator sets safe. The protocol already secures ≈ 883 k ETH (~$3 B TVL) with its Distributed Validator Technology (DVT) cluster, yet the token sits near $7, 89 % below its March-2024 peak. With SSV 2.0 rolling out and the 1 July Based Rollup Summit ready to broadcast new integrations, this is one of the deepest discounts in the infra trade.

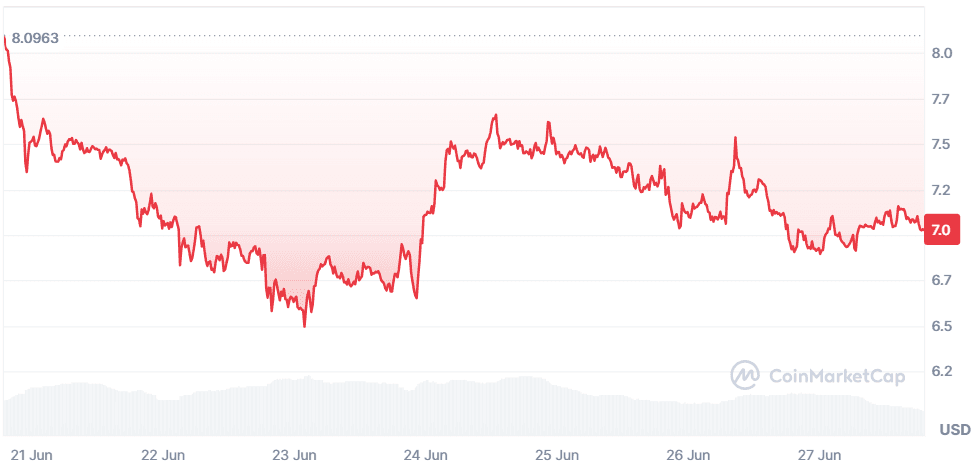

The Meteoric Rise (…and Dip)

SSV ripped from $8 in late-2023 to an all-time high of $62.32 in March 2024 on the first restaking hype cycle, then bled out with the broader alt slump, bottoming at $6.50 in May 2025. Price has barely bounced, even as TVL and validator count hit fresh records—classic narrative-fundamentals divergence.

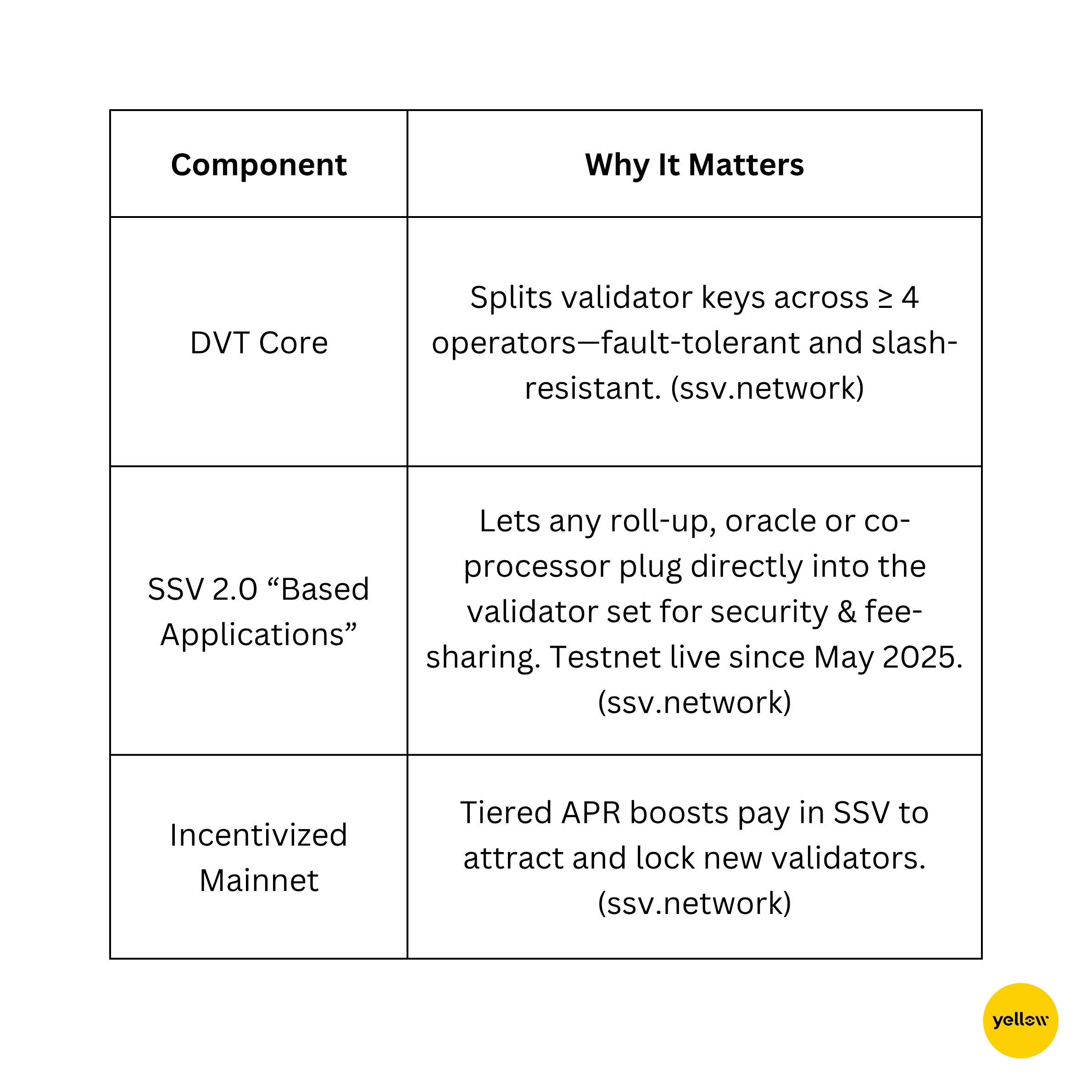

What Makes SSV Special?

Backed by Industry Titans

-

ether.fi, EigenLayer& Lido Simple-DVT all rely on SSV clusters to harden their validator sets. ether.fi alone pushed SSV TVL past $2 B within a month of integration.

-

Institutional nodes from P2P.org, Figment, Blockdaemon and Copper are already registered operators, giving the network a blue-chip backbone.

Innovative Product Suite

Strong Tokenomics

-

Hard-cap 11 M supply (≈ 12.7 M circulating after DAO releases).

-

Validators stake SSV for security bonds and earn 100 % of protocol fees, no rent extraction by a foundation.

-

SSV 2.0 proposal adds a burn on bApp fees, turning usage directly into deflation.

Strategic Partnerships

-

EigenLayer native restaking guide is live, one-click EigenPod + SSV setup for institutions.

-

Ether.fi Learn-&-Earn and P2P.org enterprise restaking funnels keep onboarding new whales.

The Growth Opportunity

Restaking TVL has already crossed $15 B across EigenLayer, ether.fi and friends, yet every new AVS still needs hardened validator clusters. SSV is the shovel seller: each validator spun up by an AVS locks SSV, pays SSV fees and deepens moats against copy-cats. With SSV 2.0 turning validators into yield-stacking “based apps,” the addressable fee pool jumps from staking to any on-chain service that wants Ethereum-grade economic security.

Why Now?

✅ Event-Driven Catalyst: SSV headlines the Based Rollup Summit on 1 July, where core devs will demo the first bApp deployments; conference alpha traditionally front-runs price.

✅ Valuation Reset: Price is -89 % from ATH while TVL is up 50 % YoY; risk-reward skews heavily positive.

✅ Restaking Flywheel: Every EigenLayer AVS launch (oracle networks, coprocessors, based rollups) must provision DVT; SSV is the default vendor and gets paid in locked SSV each time.

If the next cycle’s winners are the infra layers that everyone builds on, SSV is the router for validator security and right now it’s trading like the market forgot the schematic. As always, size positions for volatility, set stops, and remember this is information, not financial advice.

Closing Thoughts

Infrastructure may not grab the meme-coin headlines, but it’s the backbone every other narrative relies on. When capital rotates back into crypto risk assets, rails that already generate fees tend to rerate fastest and furthest.

In a single sweep, STX, AKT, and SSV offer:

✅ Rock-solid fundamentals: live mainnets, real users, and tangible revenue streams.

✅ Technical readiness: sBTC withdrawals, Supercloud GPU inventory, and SSV 2.0 are all shipping or expanding this quarter.

✅ Crowd-catching catalysts: July hack-weeks, enterprise GPU pilots, and the Based Rollup Summit put them directly in the news flow.

Prices still sit 70–90 % below their 2024 highs, yet on-chain metrics keep climbing. That mismatch is precisely the kind of “buy the dip” window seasoned investors hunt before a bull-run narrative snaps back into place.