Smart money is made in the lull, not the launch. When the crowd steps back, disciplined buyers scoop up quality tokens at clearance prices and ride them into the next leg higher.

Today’s most compelling bargains sit at the intersection of three unstoppable trends, omnichain connectivity, on-chain yield trading, and decentralized GPU power. Cross-chain pioneer ZetaChain (ZETA), yield-derivatives hub Pendle (PENDLE), and AI compute marketplace io.net (IO) have all endured deep pullbacks even as their products, revenues, and ecosystems keep expanding.

Together they form a trio that could lead the “real-infrastructure” rotation many analysts expect once Q3 liquidity returns. Why do these tokens deserve attention right now? Let’s find out.

ZetaChain (ZETA): The Universal Bridge Worth Catching on the Dip

In a market racing toward chain abstraction, ZetaChain’s “universal L1” vision, one network that can plug into any blockchain, even Bitcoin, has quietly become reality. The project already runs omnichain smart contracts in production, enabling developers to build DEXs, social apps, and lending pools that move assets natively across Ethereum, Cosmos, Solana, and more. That connective tissue is exactly what institutions and retail users will need when the next liquidity wave hits in Q3 2025. Here’s why ZETA looks oversold today and primed for a rebound.

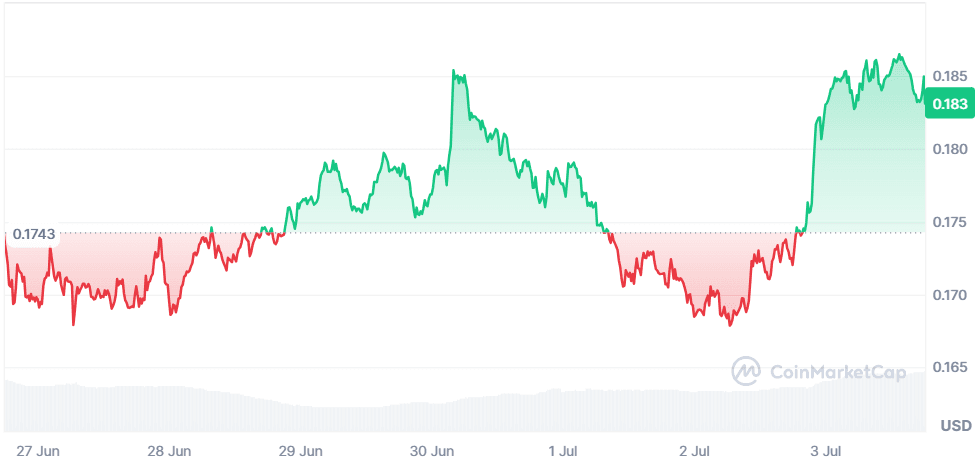

The Roller-Coaster Ride

-

All-time high: $2.86 on 15 Feb 2024

-

Today: ~$0.18 (-94 % from ATH)

-

Recent pressure: A 46 M ZETA unlock scheduled for the first week of July has traders front-running supply expansion.

The unlock is a textbook “sell-the-rumor” event; once supply overhang is absorbed, catalysts below can flip sentiment.

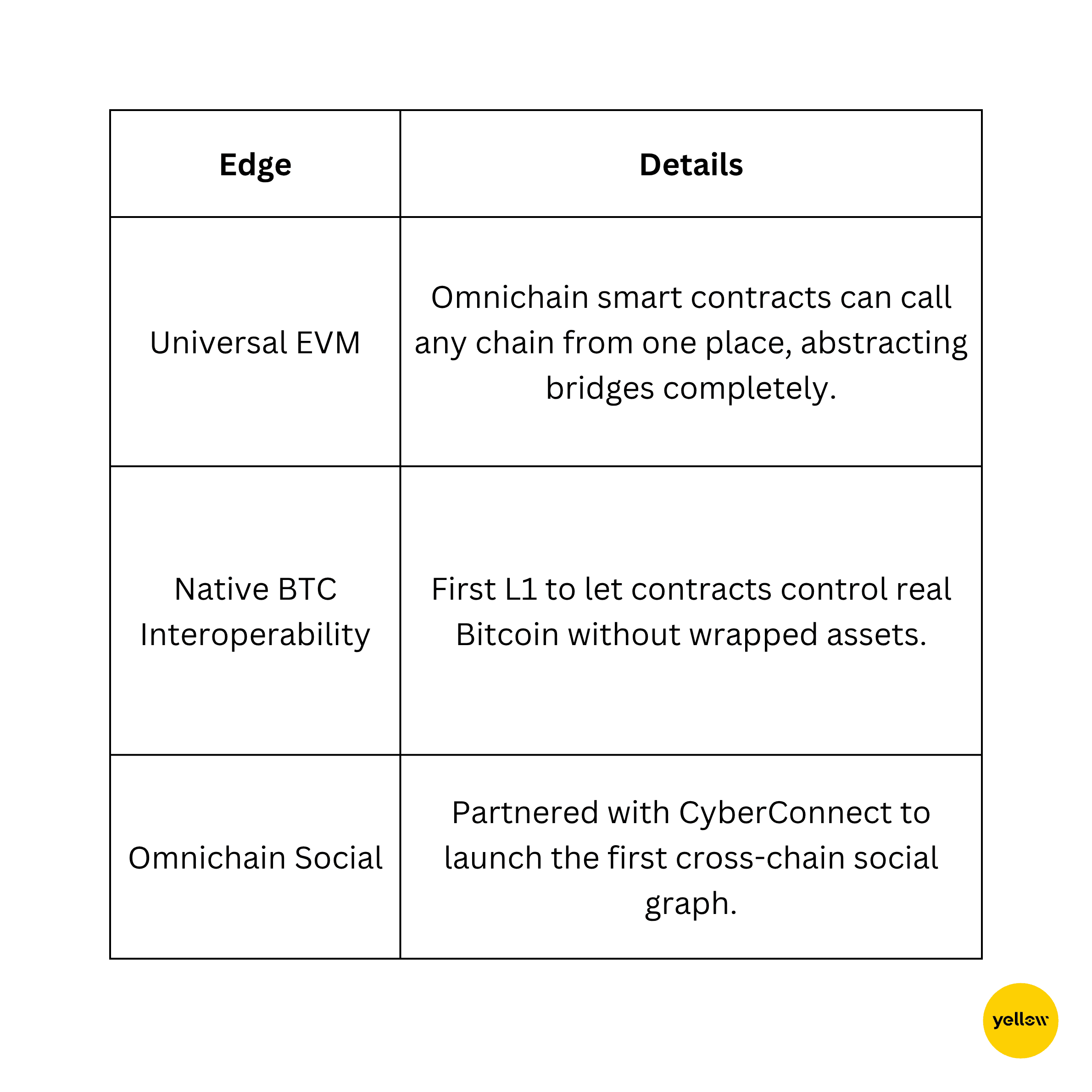

What Makes ZetaChain Special?

Strong Tokenomics

-

Utility: Gas for omnichain contracts, staking to secure light-client validators, and governance on protocol upgrades.

-

Supply: 2.1 B max; 926 M circulating. Circulating cap ≈ $170 M—small for cross-chain infra that already handles nine-figure TVL.

-

Unlock Schedule: Majority of new supply vests linearly over four years; Q3 2025 is the single largest cliff, meaning dilution risk falls after this summer.

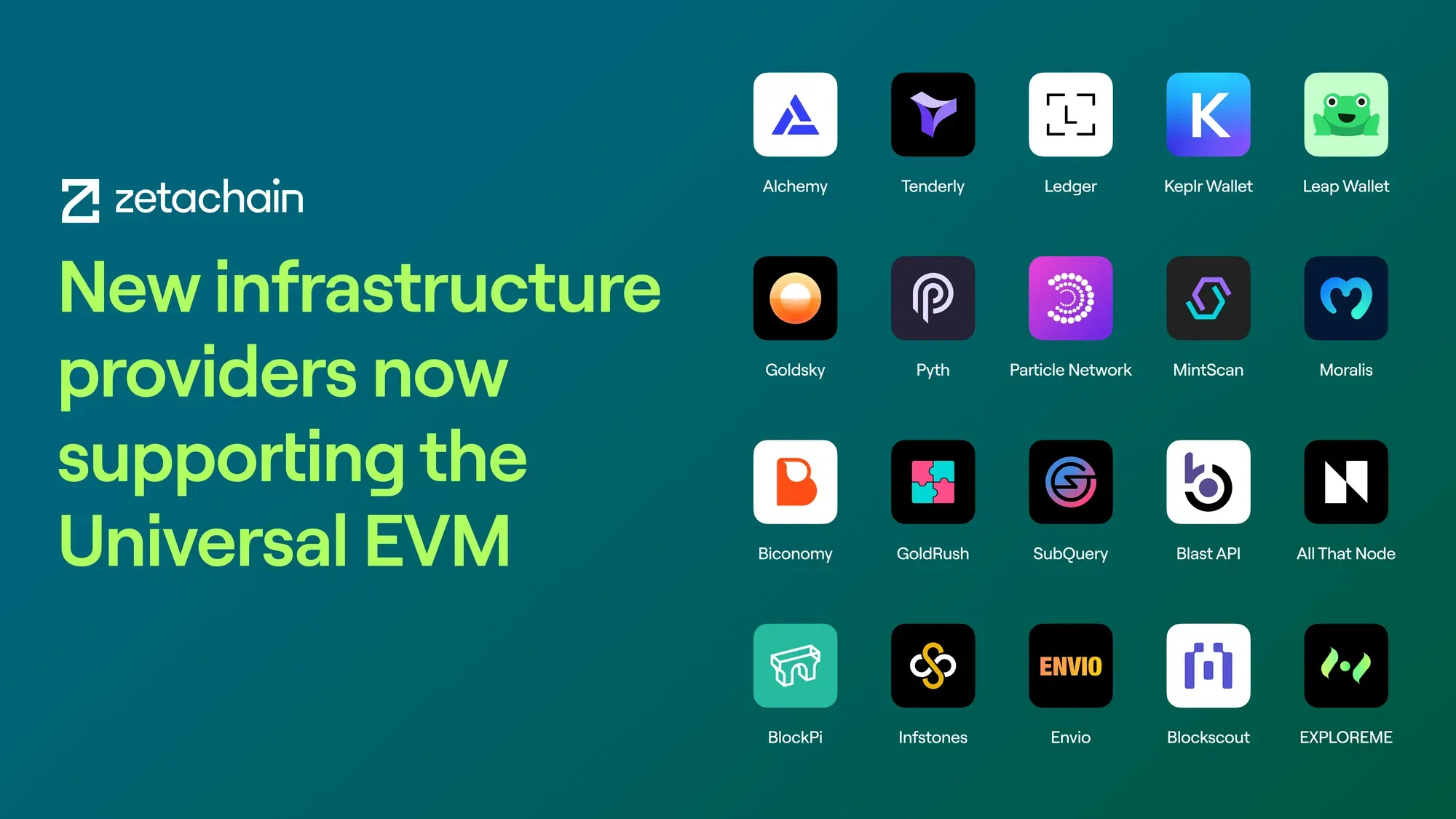

Strategic Partnerships & Ecosystem Traction

- Infra giants: Alchemy, Tenderly, Ledger & Ankr provide RPC, debugging and wallet support.

-

dApps live today: Cross-Chain DEX, OmniLend, Link3 Social, and several GameFi ports leveraging native USDC transfers across chains.

-

Exchange coverage: Listed on Binance, Coinbase, OKX, Bybit—ample liquidity for both retail and funds.

The Growth Opportunity

Cross-chain volume has doubled YoY, but 70 % of that still relies on risky wrapped assets. ZetaChain’s native route slashes bridge attacks and UX friction, exactly the bottlenecks regulators and TradFi entrants cite. As MiCA licensing pushes European platforms to safer infrastructure, a universal L1 with built-in compliance hooks stands to capture outsized flow.

Why Now?

-

Capitulation levels: 94 % drawdown against fundamentals that are stronger than at launch.

-

Post-unlock float clarity: Supply shock priced in; inflation curve flattens sharply after July.

-

Q3 narrative tailwinds: ETH restaking wars and BTC L2 hype both need secure cross-chain rails—ZETA is the neutral hub.

If you’re hunting mid-cap infrastructure plays before the Q3 2025 rotation, ZetaChain offers asymmetric upside with real product-market fit. Accumulating below $0.20 could look prescient once omnichain volume becomes the market’s default setting.

Pendle (PENDLE): Yield-Trading Powerhouse Sleeping at the Bottom

In a market obsessed with future restaking points, Pendle is already letting traders price, hedge, and lever every major yield stream, yet the token trades at mid-2024 levels despite a 20× TVL explosion. That disconnect makes PENDLE a rare “buy-the-dip” candidate before Q3 liquidity kicks back into DeFi.

The Roller-Coaster Ride

-

All-time high: $7.12 on 9 Apr 2024

-

Today: ~$3.61 (-49 % from ATH)

-

Sentiment drag: Profit-taking after March airdrop farming spree plus macro risk-off crushed price, even as protocol revenue hit record highs.

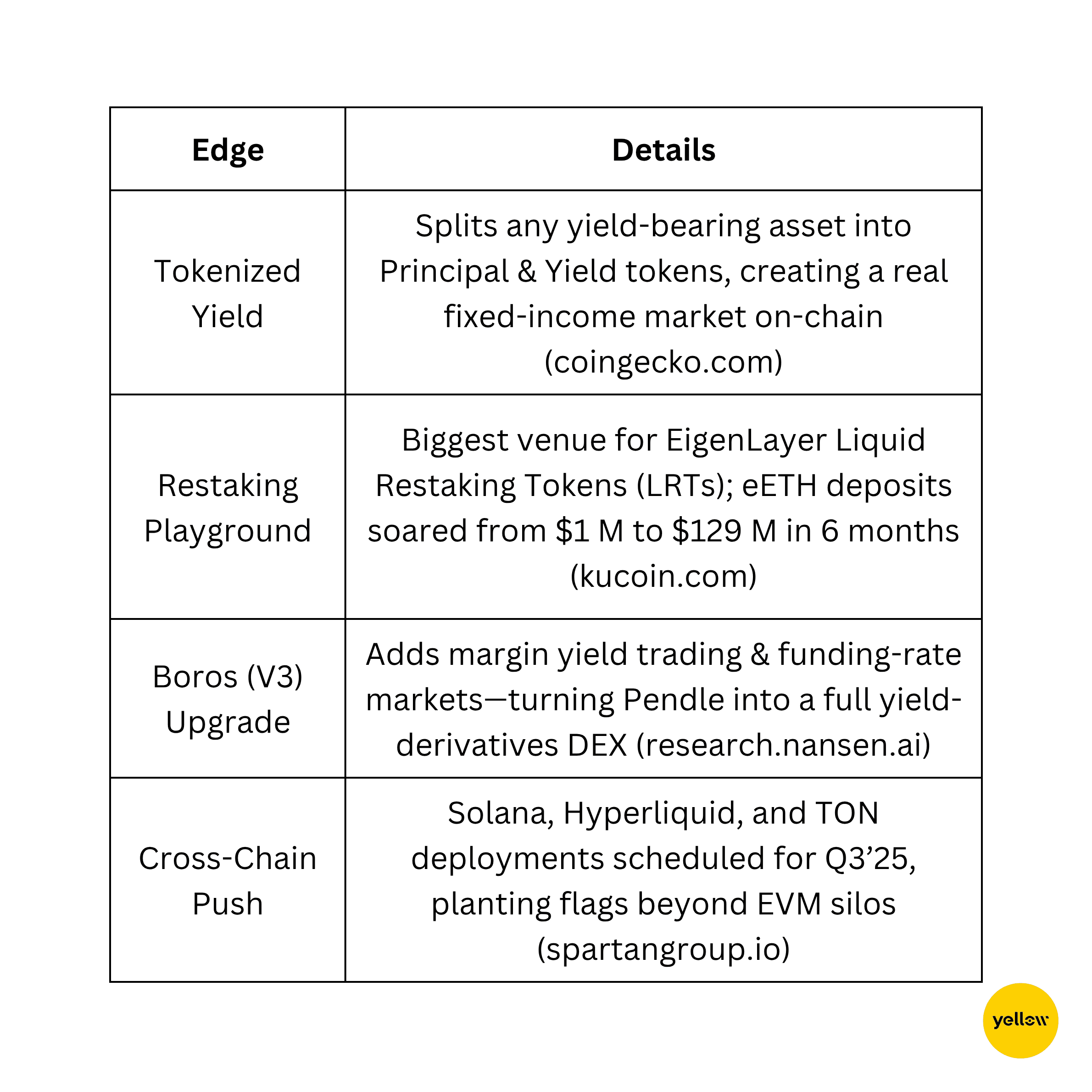

What Makes Pendle Special?

Strong Tokenomics

-

Total supply: 281.5 M; circulating: 164.6 M (≈ 58 %)

-

Locking flywheel: >66 % of circulating PENDLE is ve-locked, throttling liquid supply and boosting voting power over fee flows.

-

Emissions glide path: Largest liquidity-incentive tranche already live; remaining unlocks bleed out linearly into 2026, no giant cliffs ahead.

Strategic Partnerships & Ecosystem Traction

-

Restaking Titans: Ether.fi, KelpDAO & Swell all route LRT yields through Pendle pools.

-

DePIN Meets DeFi: Aethir’s GPU-restaking token eATH integrated last week, proof Pendle can tap totally new yield verticals.

-

Institutional Eye-catcher: Spartan, Jump and Wintermute LP across Pendle pools; Messari tags it “highest real revenue per $ of TVL” in DeFi.

The Growth Opportunity

DeFi’s next leg hinges on real yield and compliant fixed-income products. Pendle already clears > $150 M daily notional in yield swaps while charging a 3 bps fee, revenue that accrues 100 % to vePENDLE lockers. Add Solana’s firehose of staked SOL and Hyperliquid perpetual funding streams, and fee potential could 3× by year-end.

Why Now?

-

Half-off from ATH with double the TVL, valuation lagging fundamentals.

-

Emission overhang fading; >two-thirds of float already in sticky ve-locks.

-

Macro fit: If rates stay high, on-chain fixed yield becomes hot property, and Pendle is the venue.

For investors craving a dip buy with actual cashflow, Pendle offers asymmetric upside as the yield layer every restaking protocol plugs into. Accumulating sub-$4 PENDLE before the Q3 cross-chain roll-out could feel like buying Uniswap under a dollar.

io.net (IO): The Internet of GPUs Trading for Pocket Change

In an AI-hungry world where cloud giants are booked months out, io.net’s “Internet of GPUs” already rents out hundreds of thousands of graphics cards at Web2-beating prices—yet the token has bled ≈ 88 % since launch and now hovers under a dollar. That mismatch between real revenue and rock-bottom valuation makes IO an unusually juicy dip candidate ahead of Q3’s AI and DePIN rotation.

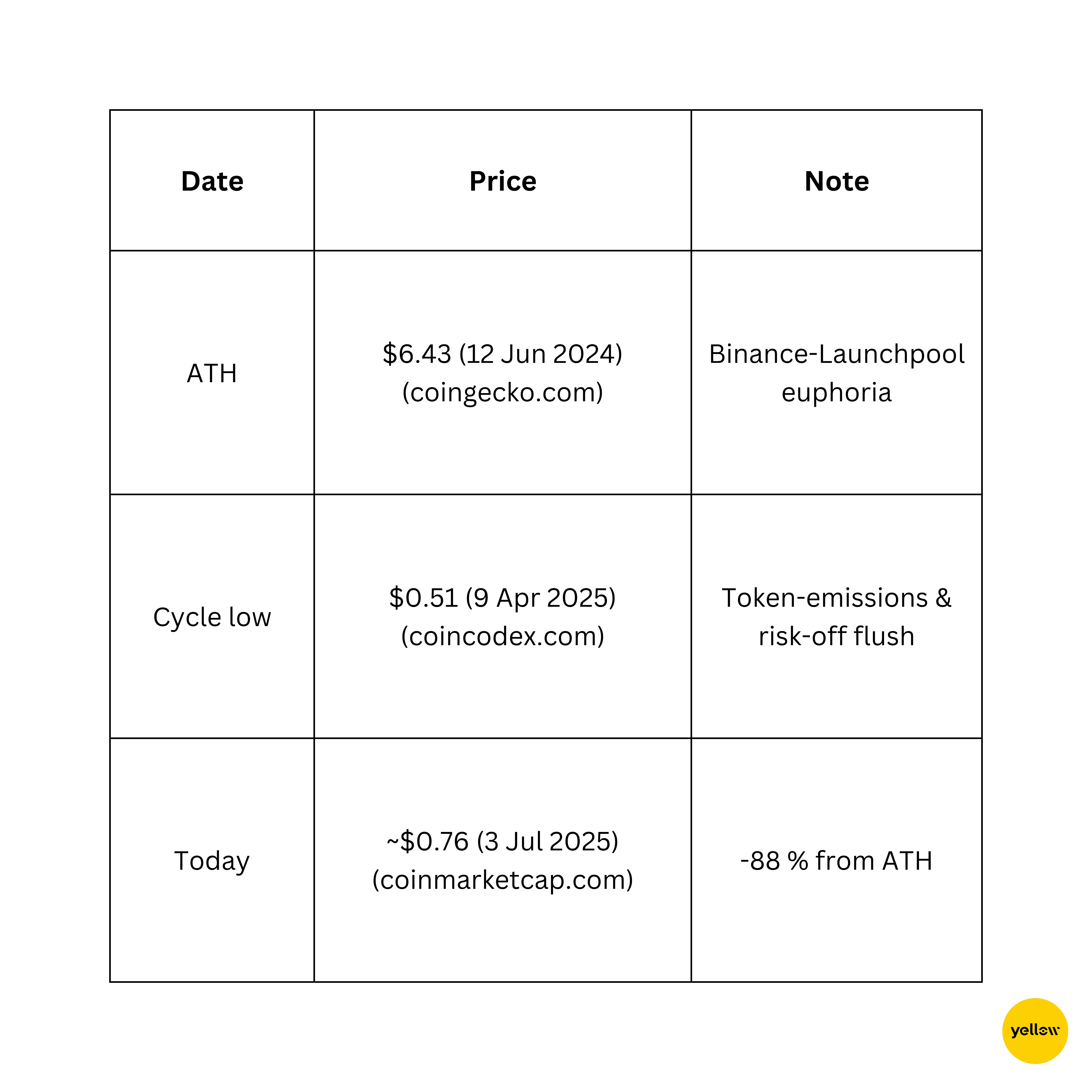

The Roller-Coaster Ride

Unlock drip and macro jitters crushed price, but the fundamentals below keep marching forward.

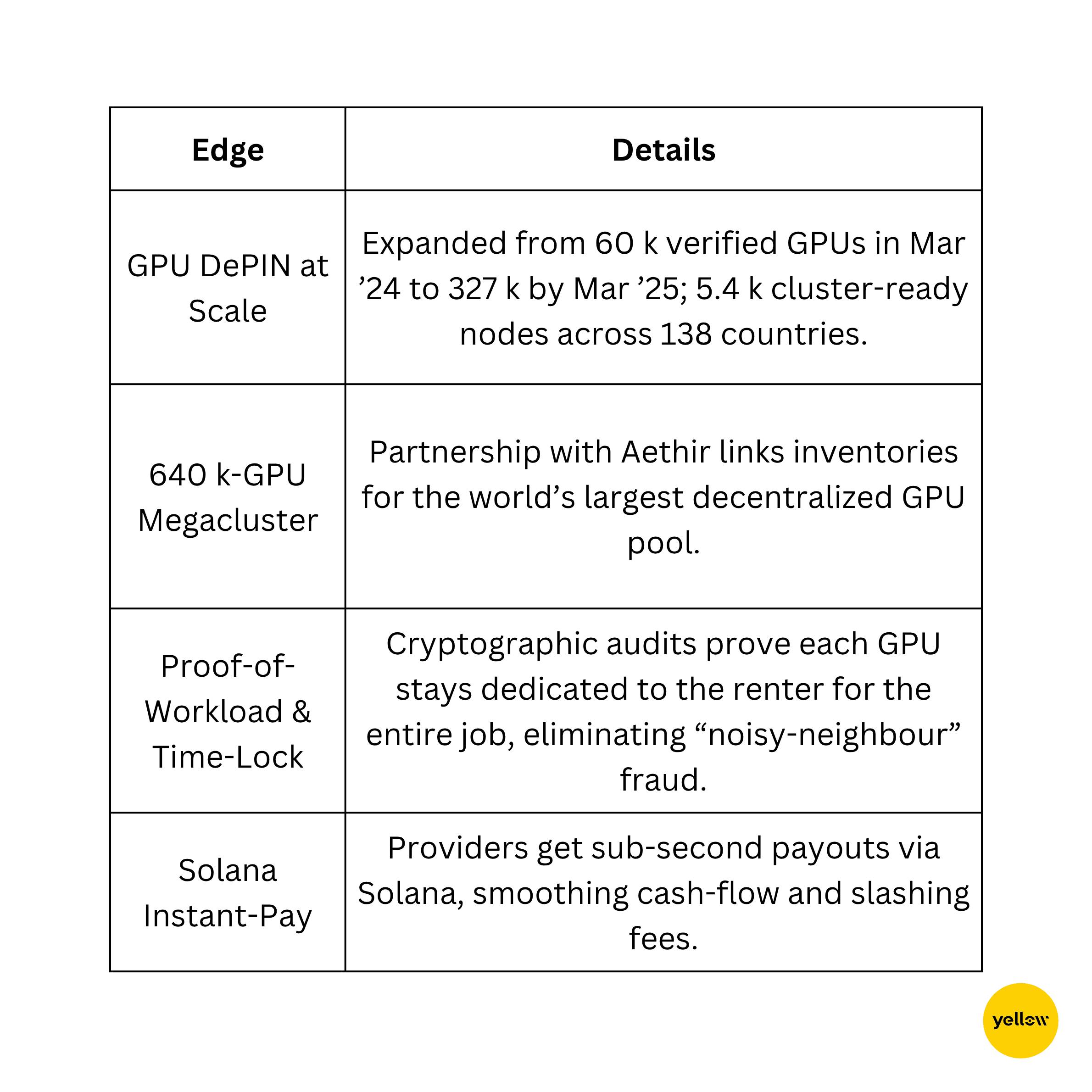

What Makes io.net Special?

Strong Tokenomics

-

Max supply: 800 M IO; circulating: 168.8 M (21%).

-

Emission curve: Remaining 300M tokens vest linearly over 20 years, no monster cliffs ahead.

-

Utility: Gas for workload proofs, staking for slashing insurance, and governance over fee parameters.

-

Staking flywheel: GPU operators must bond IO; delegators co-stake, sharing 70 % of protocol fees.

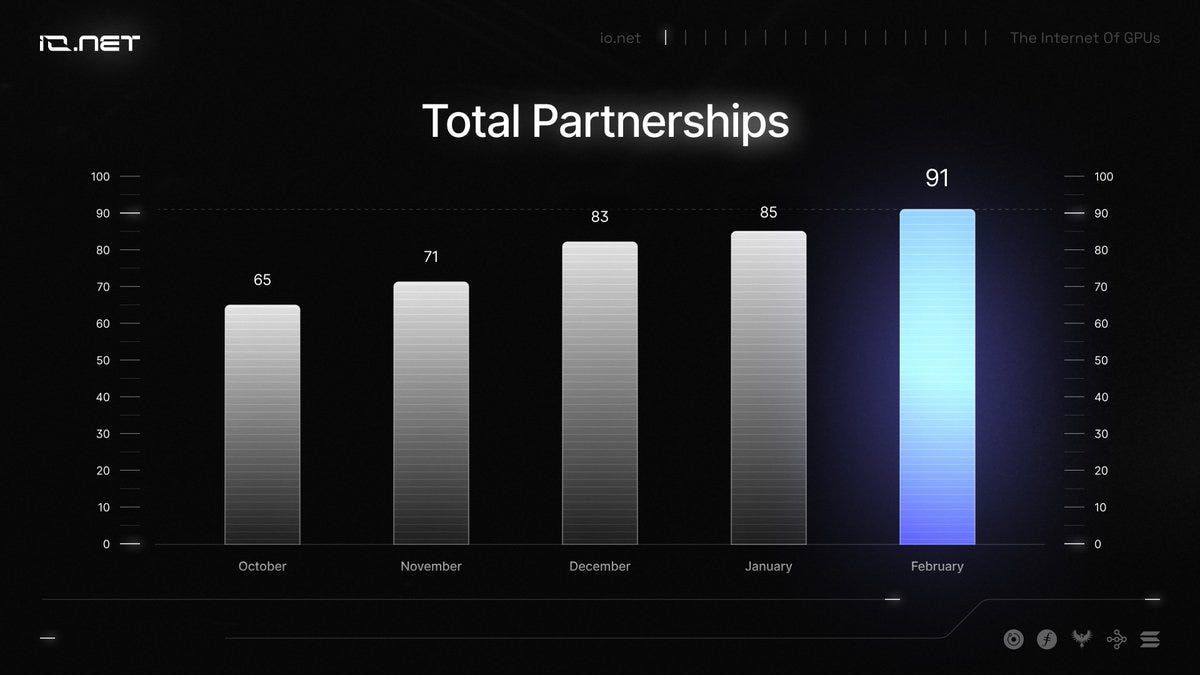

Strategic Partnerships & Ecosystem Traction

-

$30 M Series A led by Hack VC, Solana Labs & OKX, valuing parent IO Research at a nine-figure clip.

-

91 production partners, from privacy L2s to Agentic-AI startups, onboarded by Feb 2025.

- 20M IO Builder Grants just launched by the IOG Foundation to bankroll GPU-hungry AI projects, seeding fresh demand for compute and tokens.

The Growth Opportunity

DePIN analysts peg decentralized compute TAM at $30 B by 2028. io.net’s average GPU hour already prices ≈ 30 % below AWS A10 instances, carving a moat on cost while wrapped in cryptographic guarantees. As AI startups scramble for budget GPUs and regulators push data-sovereign infra, a cross-chain marketplace that can spin up 300 k+ cards on demand sits in the sweet spot.

Why Now?

-

Capitulation valuation: Market cap < $130 M despite real, growing fee income.

-

Seller exhaustion: Biggest post-launch unlocks are behind; emissions now a slow drip.

-

Q3 catalysts: Builder-grant inflows, HyperGPU clusters, and Solana-native USDC billing could 2-3× revenue just as AI narratives re-ignite.

-

Mean-reversion math: Even a 25 % retrace of the ATH prices IO at ~$1.60—double today’s quote with no new highs required.

For dip-hunters seeking tangible cash-flow and a front-row seat to the AI compute land-grab, io.net offers one of the cleanest asymmetry plays heading into Q3 2025. Sub-$1 IO might look like buying AWS in the garage-server era.

Closing Thoughts

Cross-chain rails, yield marketplaces, and AI compute form the backbone of the next crypto build-out, and that’s exactly what ZetaChain, Pendle, and io.net already deliver. ZETA is unlocking native Bitcoin-to-EVM transfers, PENDLE is turning every restaking and staking stream into a tradable fixed-income market, and IO is renting out hundreds of thousands of GPUs at prices AWS can’t touch. Each network is live, revenue-generating, and partnered with blue-chip players, so the tech is battle-tested even as their tokens still trade 50–90 % below prior highs. With this summer’s unlock overhangs nearly behind them, fresh cross-chain deployments, Solana integrations, and AI demand spikes on the horizon, fundamentals, technical readiness, and catalysts are finally pointing the same way. Add an improving macro backdrop and you have a rare setup where buying the dip in real-infrastructure tokens could capture the early innings of Q3’s next leg higher.