Timing the market is tough but recognizing foundational assets when they're undervalued is how fortunes are made. The best time to buy was yesterday; the next best time is now.

In a cycle driven by real adoption and infrastructure development, the spotlight is shifting to tokens building the bedrock of crypto: monetary sovereignty, scalable DeFi layers, and modular blockchain design. As retail looks for hype, institutions are quietly accumulating infrastructure coins.

Today, we’re diving into three of the strongest contenders: Bitcoin (BTC), the original digital reserve; Sui (SUI), the DeFi engine with record TVL growth; and Celestia (TIA), the modular base layer powering the rollup revolution.

Why do these tokens deserve attention right now? Let’s find out.

Bitcoin: The Digital Apex Asset Reclaims the Throne

They say the best time to plant a tree was yesterday — and the same logic applies to Bitcoin. Every dip is a second chance. With nation-states, billionaires, and institutions now treating BTC as the digital equivalent of gold, Bitcoin isn’t just surviving — it's institutionalizing.

Backed by sovereign treasuries, ETF approvals, and geopolitical alignment, BTC’s current trajectory is less about speculation and more about global financial architecture. Here's why Bitcoin is still the ultimate conviction play.

The Meteoric Rise

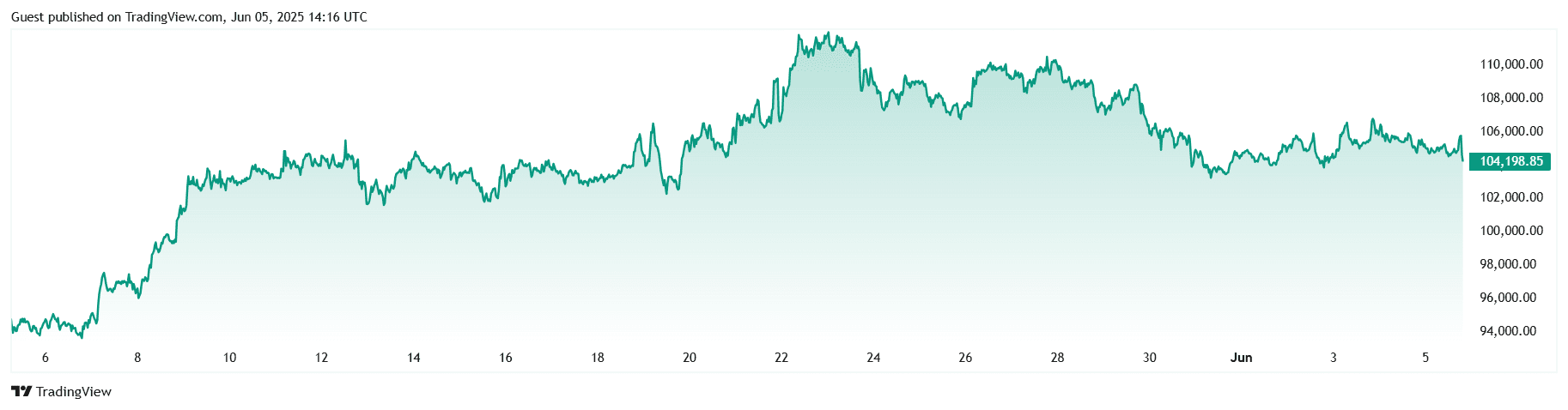

In the last month, BTC climbed from $94.3K to above $112K before stabilizing around $104K. The rise wasn’t fueled by retail FOMO — it was driven by billion-dollar on-chain positions, sovereign fund announcements, and landmark institutional integration.

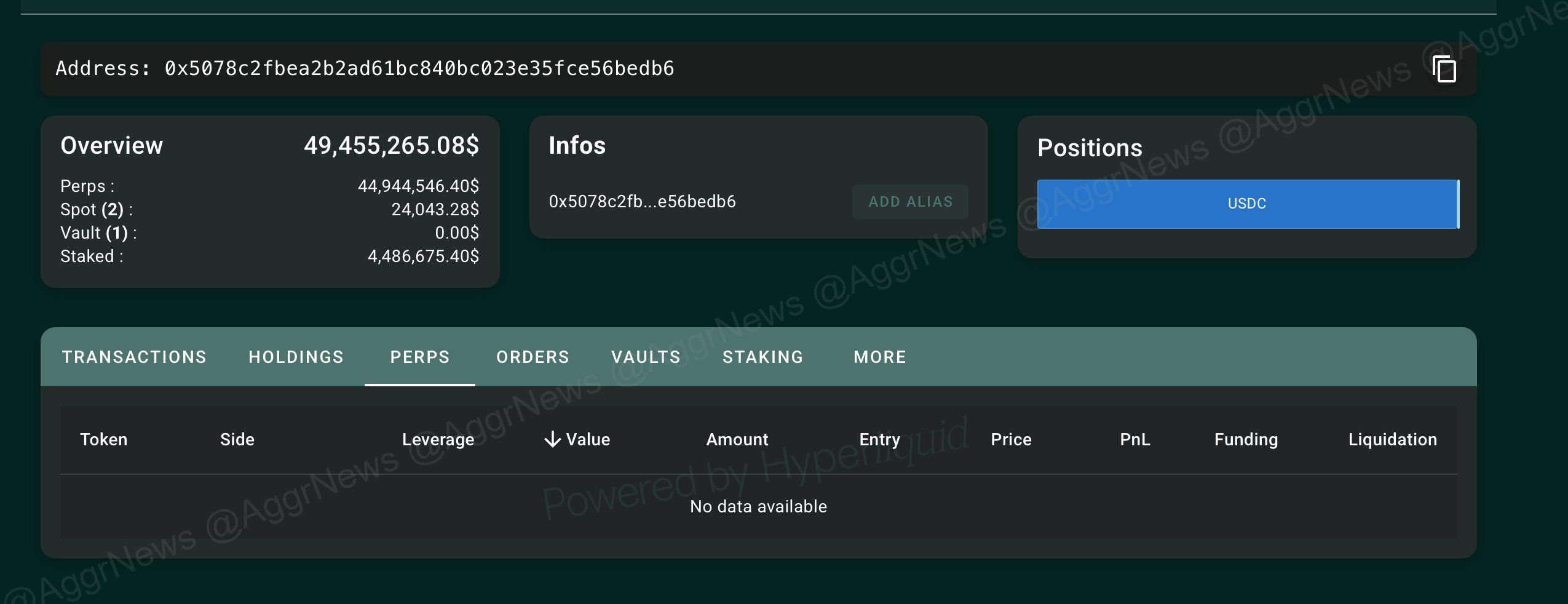

Notably, James Wynn's $1.2B position was closed on Hyperliquid on May 24, triggering widespread attention. Days later, Trump Media unveiled a $2.5 billion Bitcoin treasury plan. The momentum was only strengthened by PSG, K Wave, and the U.S. Government itself announcing BTC as a strategic reserve.

What Makes BTC Special?

Bitcoin as a Strategic Reserve Asset

In March 2025, the White House signed an executive order declaring BTC a strategic reserve, signaling the end of seizure-and-auction practices. This isn't just symbolic, it imposes long-term supply constraints by locking up state-held BTC from circulation.

Simultaneously, Pakistan, Texas, and California joined the BTC movement using mined reserves for national holdings and authorizing crypto as a payment method.

Treasury-Backed Demand Surge

From Trump Media’s treasury deal to K Wave’s $500M equity raise for BTC purchases, corporations are locking in BTC not as an investment, but as protection, a digital moat against traditional finance volatility.

Institutional Collateral Integration

JPMorgan now accepts BTC ETFs as loan collateral. This signals a systemic shift. Bitcoin has entered traditional wealth calculations, treated on par with real estate, stocks, and bonds. The “digital gold” tag is no longer metaphorical, it's financial infrastructure.

Strong Tokenomics

-

BTC’s supply remains capped at 21 million — with over 19.7 million already mined. But now, a new phenomenon is underway:

-

$63B worth of BTC accumulated by new whale wallets in just three months

-

Whale holdings grew from 2.5% to 5.6% of circulating supply

-

Increased long-term holdings caused sharp declines in exchange reserves

The result? A liquidity crunch. With fewer coins on exchanges and more in long-term treasuries, price sensitivity to new demand is higher than ever.

Global Policy Catalysts

-

South Korea’s new president vows to legalize BTC ETFs and launch a KRW-backed national stablecoin

-

Trump Media files for a Truth Social Bitcoin ETF with the SEC, targeting retail access via NYSE Arca

-

GENIUS Act in the U.S. Senate seeks to legitimize stablecoins, bolstering BTC adoption

-

Labor Department rollback now allows crypto in retirement plans

-

Banks can custody Bitcoin, and regulatory agencies are reversing anti-crypto guidance

In essence, BTC is not just policy-compliant, it is policy-favored.

Strategic Partnerships and Infrastructure

-

BlackRock’s IBIT ETF leads U.S. market with over $70B AUM

-

Crypto.com and Anchorage Digital provide custody for corporate BTC

-

K Wave Media plans to operate Lightning Network nodes, accelerating micropayment use cases

-

Michael Saylor’s new STRD IPO aims to raise $250M solely to buy more BTC

The Growth Opportunity

Bitcoin is no longer just a hedge, it’s a growth asset. The convergence of institutional demand, government endorsement, and deep liquidity now allows Bitcoin to play multiple roles:

✅ Reserve asset

✅ Infrastructure layer

✅ Collateral backbone

✅ Payment medium

✅ Political instrument

From ETF inclusion to national strategies, BTC is becoming the monetary backbone of a decentralized financial world.

Why Now?

The past month has seen an unprecedented institutional wave. Billion-dollar treasuries, ETF filings, state adoption, and infrastructure expansion are not signs of a speculative bubble — they’re foundations of a new financial order.

BTC isn’t just bullish, it’s becoming systemic.

If you’re waiting for a "perfect entry," you’re looking in the wrong direction. Bitcoin is being priced as a sovereign-grade digital commodity, and every dip is a last chance before the next leg up.

Buy the Dip. HODL the Future.

Sui: The Sleeping Giant of Layer 1 DeFi Rises Again

At a glance, SUI’s chart may look like a recovery story stalled, but take a deeper look, and it’s clear: Sui is rebuilding stronger, faster, and more diversified than most Layer 1s in the space. It’s a rare moment where price lag is not a red flag, but an invitation, a discounted entry into a protocol that’s quietly becoming a DeFi heavyweight.

If you missed Solana or Avalanche early on, this might be your second shot.

The Meteoric Rise

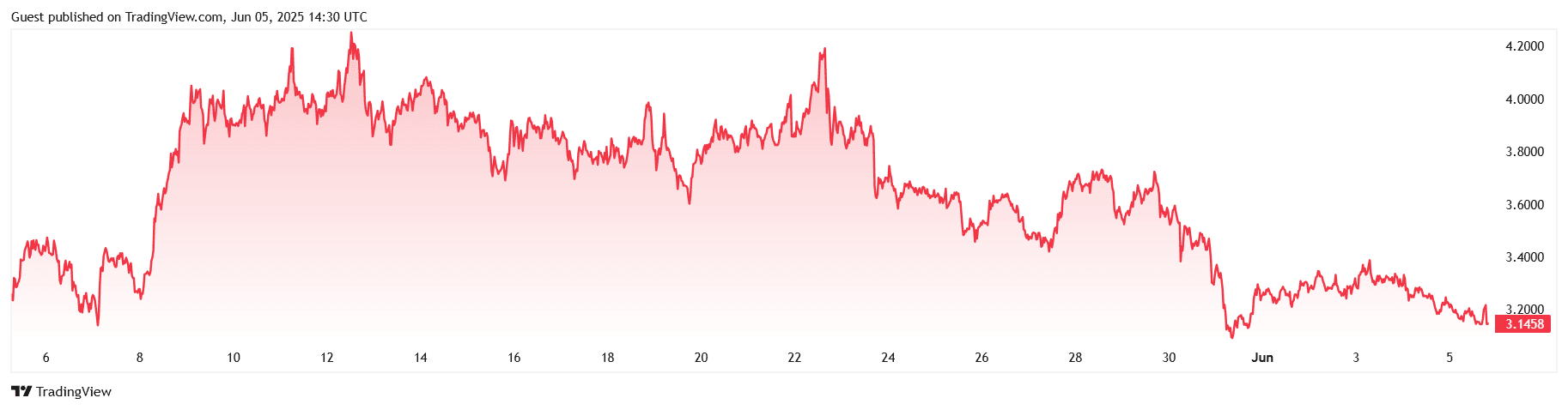

After spiking above $4.20 in early May, SUI’s price dropped to $3.10 by early June, a 26% retracement largely triggered by the $220M Cetus exploit. But unlike typical hacks that crater ecosystems, Sui’s rapid and transparent response, freezing $162M, initiating a validator-led vote, issuing a secured loan, restored confidence. As of June 4, TVL hit $1.76 billion, and trading volumes are climbing once again.

The market hasn’t priced in the resilience. That’s the opportunity.

What Makes Sui Special?

Zero-to-One Layer 1 Innovation

Sui’s technical architecture is designed for real-world scalability: parallel execution, dynamic on-chain objects, native support for zkLogins, all tailored for DeFi, gaming, and identity.

Microsoft Fabric + OMG Assembly integration: Enables real-time on-chain data for RWAs like commodities and private credit.

Soulbound Token minting: Institutional-grade applications now possible.

BitVM Bridge: Bringing Bitcoin into DeFi for the first time on Sui.

Rising Institutional Interest

21Shares’ SUI Spot ETF accepted by the SEC on June 5, with Nasdaq as the listing exchange and Coinbase as custodian.

Fireblocks integration makes institutional custody and staking seamless.

Dubai VARA partnership aims to grow Web3 ecosystems with local support and regulation.

TVL & Liquidity Momentum

✅ Stablecoin supply surpassed $1B

✅ TVL surged to $2.18B in May before the hack, and continues rebounding

✅ New BTC-SUI bridges and vaults are attracting sticky liquidity

Strong Tokenomics

With a circulating supply of 3.39B SUI and a max cap of 10B, SUI isn’t scarce yet — but the real yield from DeFi vaults, combined with developer incentives and massive transaction volumes (10B+ total transactions), is tightening token velocity.

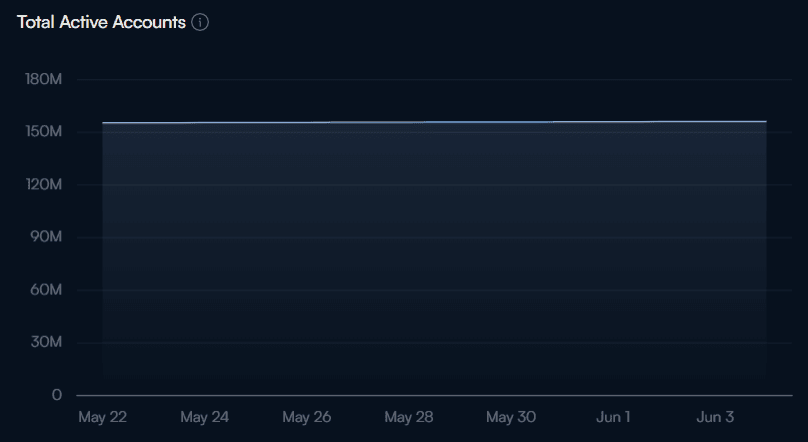

On-chain data shows:

-

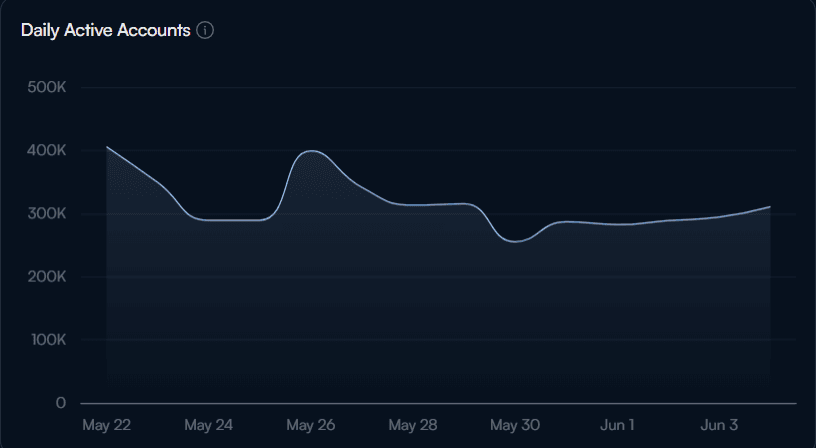

Daily active wallets up 42% MoM

-

70% surge in stablecoin inflow in the past 3 weeks

-

Over 190M accounts created

These are fundamentals, not hype.

Strategic Partnerships & Ecosystem

Sui’s footprint now includes:

-

SEGA, Playtron, Adidas, and Claynosaurz in gaming and NFTs

-

DeFi apps like Cetus, Bluemove, and new Bitcoin lending protocols

-

Backpack, offering $200K rewards for cross-chain bridging and liquidity

And despite the largest DEX on Sui (Cetus) being hacked, it resumed full trading just 2 weeks later, after initiating compensation contracts and a multisig governance structure, no chain rollback, no central override. A strong signal for both decentralization and professionalism.

The Growth Opportunity

SUI is still undervalued. The recent price pullback from $4.20 to ~$3.10 gives this protocol a new floor, not a red flag. Its DeFi ecosystem is maturing. The institutional railroads are being laid. Regulatory acceptance is underway.

This is not just another alt-L1 riding sentiment. This is a network building critical infrastructure and onboarding users who aren’t just speculating — they’re using.

Why Now?

SUI is trading at $3.10, just above its support band and forming a bullish continuation pattern. If the ETF approval pushes through, or if BTC’s integration goes live with full DeFi flow, SUI could easily hit $8–$10 over the next cycle.

The best projects are the ones that survive setbacks — and grow stronger from them.

Buy the dip. Stake the future.

Celestia: The Modular Backbone Powering the Rollup Renaissance

When blockchains hit the ceiling of scalability, Celestia redefined the ceiling entirely. It’s not just another Layer 1, it’s the invisible scaffolding for the future of decentralized applications. And right now, as it retraces to just above $2, TIA offers one of the cleanest setups in crypto for high-conviction long-term accumulation.

Why? Because every new rollup that launches, every appchain that deploys, and every modular upgrade that becomes standard, Celestia gets more essential.

The Meteoric Rise

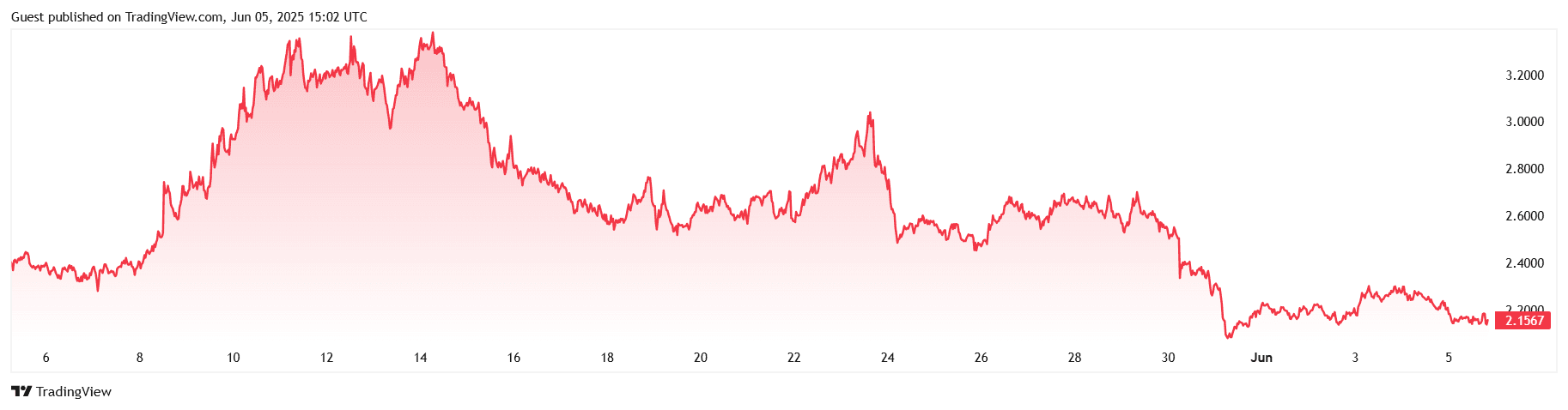

After touching above $3.20 in mid-May, TIA has cooled down to around $2.15, down 33% from local highs. But price is only half the picture.

Since launching in late 2023, TIA soared over 360% in its debut cycle before this healthy pullback. With listings on Upbit (KRW pair) and renewed institutional attention, the seasonal dip we’re seeing now may mirror its 2023 summer lull, which preceded a massive Q4 rally.

The base is forming. The builder activity is accelerating. And the ETF-driven narrative hasn’t even started yet.

What Makes Celestia Special?

Modular Blockchain Architecture

Celestia isn’t your standard monolithic blockchain. It introduced Data Availability Sampling, letting rollups and appchains inherit consensus and security without carrying the weight of execution.

In simpler terms? It lets any project launch their own blockchain in minutes, with full validator-backed security, no permission, no bottlenecks.

Execution is sovereign, not dictated by a shared VM.

Rollups get freedom and security without compromise.

Builders own their stack, not just deploy dApps.

Seamless Interoperability

Through the Hyperlane integration (Lotus upgrade), TIA is now natively interoperable with Ethereum, Base, Arbitrum, and Cosmos chains. New rollups can interact with non-Celestia ecosystems instantly with IBC-like functionality.

On top of that, the Lemongrass upgrade is set to unlock one-click rollup deployment, interchain accounts, and major UX upgrades.

Massive Testnet Scaling

Celestia’s mamo-1 testnet is pushing 128MB blocks every 6 seconds, a key milestone in the path toward 1GB block throughput. The innovation isn’t theoretical, it’s live, tested, and scaling.

Strong Tokenomics + Builder Traction

✅ Circulating Supply: 661.58M TIA

✅ TVL across Celestia-connected rollups is rising

✅ 20+ modular chains (like Eclipse, Movement, Dymension) already deployed

✅ Over $155M raised from top-tier investors

TIA is used for:

-

Staking and validator incentives

-

Governance of protocol upgrades

-

Core to DA layer integration with emerging rollups

In a modular future, DA tokens are gold. And TIA is the most battle-tested, accessible, and integrated DA token in the market.

The Growth Opportunity

Celestia is now the go-to solution for data availability. It stands at the center of the Modular Boom, supported by Ethereum rollups, Cosmos appchains, and hybrid builders all seeking scalable foundations.

With rising institutional attention, builder migration, and tech superiority in real testnet environments, TIA is one strong ETF announcement or staking boom away from entering a new valuation band.

This is not a memecoin pump. This is an ecosystem quietly locking itself into the long-term architecture of crypto.

Why Now?

TIA is down 55% YTD, not because it’s failing, but because the market hasn’t priced in what’s coming. With Upbit listings, mamo-1 testnet, Lotus integration, and Lemongrass beta live, the chain is progressing faster than most competitors.

As more rollups move off Ethereum and into modular environments, Celestia is the first call they make. And when modular becomes default, TIA becomes the toll asset for the next wave of blockchain deployment.

If you believe in sovereignty, scalability, and innovation, Celestia isn’t just a good buy—it’s the foundation.

Buy the Dip. Build with the best.

Closing Thoughts

Infrastructure is once again king but this time, the narrative isn't built on speculation. It’s built on protocol-level adoption, sovereign integrations, and architectural shifts that make crypto usable, scalable, and sustainable.

BTC is maturing into a reserve asset with sovereign and institutional backing. SUI is capturing DeFi TVL with real user growth, and TIA is laying the modular rails for tomorrow’s rollup-powered world.

Together, these tokens represent:

✅ Fundamentals backed by ecosystem traction and long-term use cases

✅ Technical setups signaling clean accumulation zones

✅ Catalysts including ETFs, governance upgrades, and developer onboarding waves

The bottom line? These aren’t just dips, they’re entry points into the next layer of crypto’s future.

Buy the dip — before the infrastructure boom leaves the station.