Timing the market may be tricky, but recognizing strong fundamentals paired with bullish technical setups is how smart investors win big. Buying the dip isn’t just about low prices—it’s about spotting projects ready to explode when momentum returns.

In a market shifting towards scalability, real-world utility, and institutional adoption, high-performance blockchain tokens like SUI, LAYER, and SOLAYER are taking center stage. These aren’t speculative plays—they’re infrastructure tokens powering the next wave of DeFi, payments, and enterprise blockchain solutions.

From Sui’s blazing-fast hybrid Web3 innovations to Layer’s staking-driven growth, and Solayer’s hardware-accelerated blockchain disrupting payment systems, these projects are building real value while flying under the radar of many retail investors.

Why do these tokens deserve attention right now? Let's find out.

ONDO: The Institutional DeFi Powerhouse Ready for Its Next Leg Up

ONDO isn’t just another DeFi token, it’s fast becoming the backbone of institutional-grade finance on-chain. As global markets pivot towards tokenizing real-world assets (RWAs), Ondo Finance is leading the charge with partnerships spanning BlackRock, Coinbase, and Morgan Stanley. Fresh off regulatory talks with the SEC, ONDO is positioning itself as the gateway between TradFi and DeFi. Here's why ONDO could be one of the smartest plays in RWA-focused crypto this year.

The Bounce Back After Consolidation

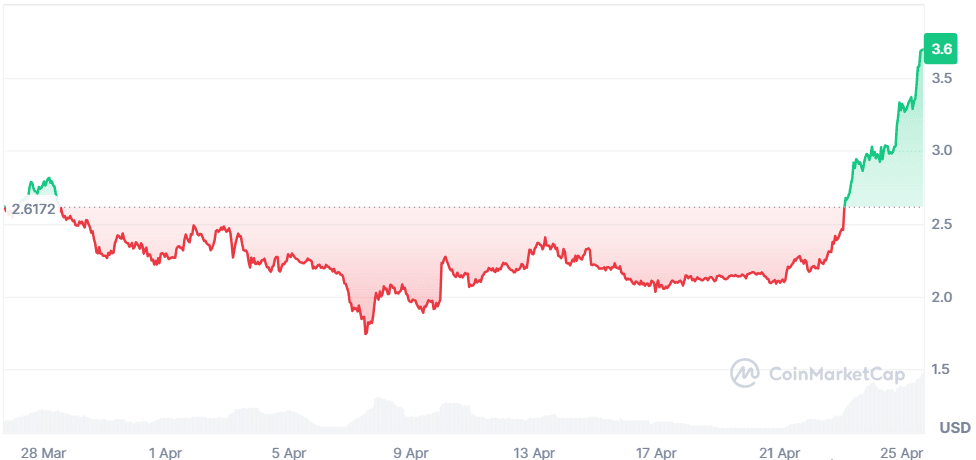

After peaking at $2.14 in December 2024, ONDO faced heavy sell-offs, typical of early-stage RWA projects navigating regulatory uncertainties. But April 2025 marked a turning point. Following high-profile discussions with the SEC on compliant tokenized securities, ONDO surged over 10%, reclaiming the crucial $1 level.

Now trading at $1.01 with a $3.2B market cap, ONDO has broken above its 50-day SMA ($0.85) and is testing resistance near the 100-day SMA ($1.05). With bullish momentum building, the next target sits at $1.20, with eyes on a potential retest of the $1.50 zone if macro conditions align.

What Makes ONDO Stand Out?

The Leader in Tokenized Real-World Assets (RWAs)

-

Institutional Integration: Ondo isn’t theorizing RWA tokenization, it’s executing it. Products like USDY (a yield-bearing token backed by U.S. Treasuries) and OUSG (a tokenized BlackRock ETF) are already live and gaining traction.

-

Flux Finance Protocol: The first lending platform supporting tokenized securities as collateral, governed by the Ondo DAO.

** Backed by Financial Giants**

-

Strategic Partnerships: Collaborations with BlackRock, Coinbase, Morgan Stanley, and DeFi protocols like Injective, Pendle, and Polygon.

-

Cross-Chain Presence: Ondo Bridge enables seamless asset movement across Ethereum, Solana, Mantle, and Cosmos ecosystems.

Regulatory Engagement = First-Mover Advantage

-

SEC Talks: Ondo is actively shaping how tokenized securities will be regulated in the U.S.

-

Sandbox Proposals: Advocating for compliant innovation, giving Ondo a head start while competitors wait on the sidelines.

Why Now?

ONDO is No Longer Just a DeFi Token — It’s a Compliance-Ready RWA Infrastructure

-

Technical Breakout: ONDO has cleared key resistance at $1.00, with RSI around 58—suggesting more upside before hitting overbought territory.

-

Volume Surge: 24h trading volume spiked 157% to $535M, indicating renewed investor interest post-SEC meeting.

-

Market Cap/TVL Ratio: Sitting at 3.15, showing ONDO is still undervalued compared to its total value locked ($1.01B).

-

Macro Tailwinds: As global institutions look to tokenize assets, Ondo’s head start in regulatory dialogue positions it as a go-to platform.

Technically Speaking

-

Next Resistance: $1.08 (200-day SMA). A clean break could open the path to $1.20 and beyond.

-

Support Levels: Strong buy zone near $0.90 if price pulls back.

-

Circulating Supply: 3.15B ONDO out of 10B total - leaving room for growth but watch for future unlocks.

-

On-Chain Strength: Growing adoption of USDY across Solana, Injective, and Pendle ecosystems enhances ONDO’s utility and demand.

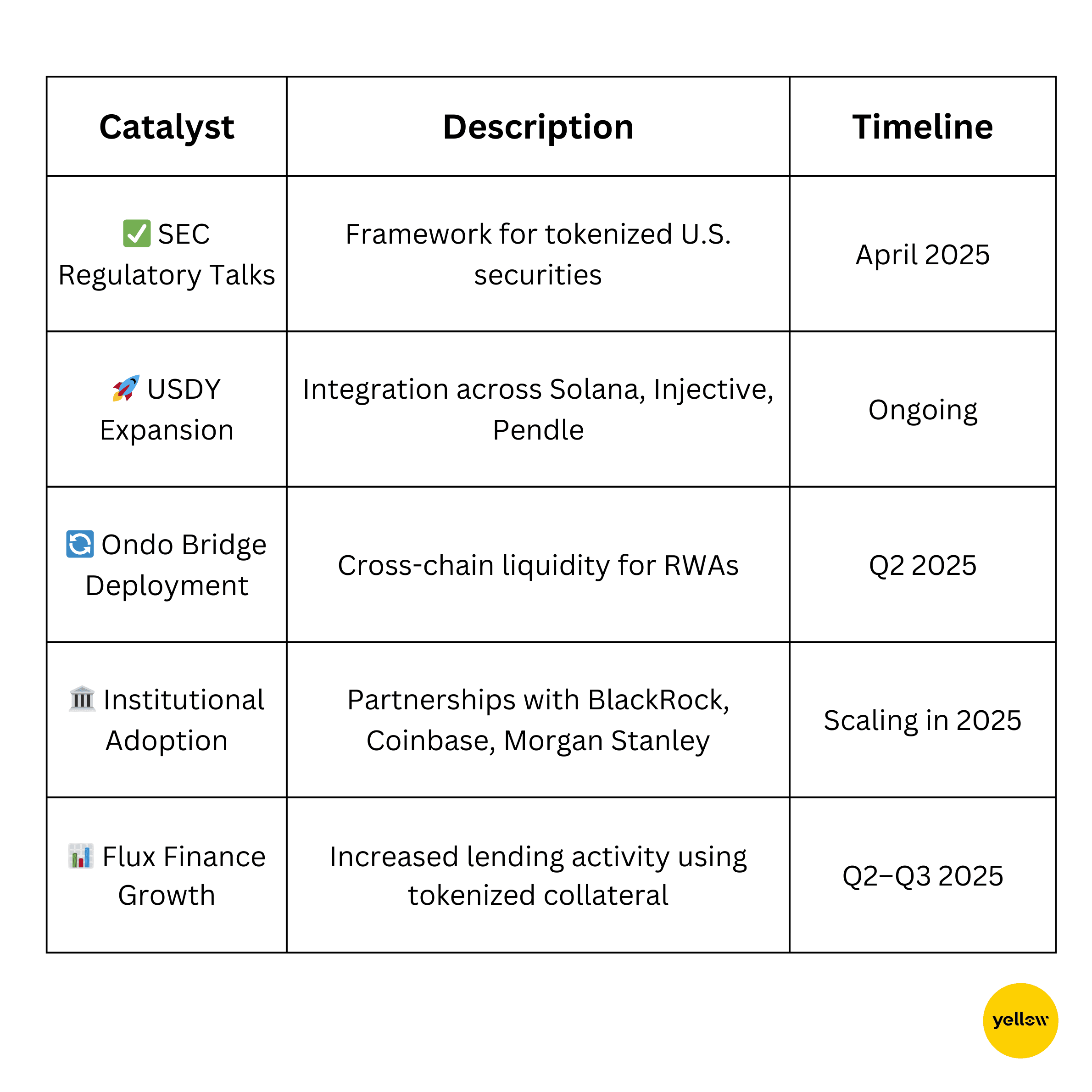

Key Catalysts to Watch

The Verdict

ONDO is building the regulatory-compliant infrastructure for the next wave of DeFi and RWA convergence.

With real products live, blue-chip partnerships, and regulatory doors opening, ONDO stands out as one of the few projects truly bridging TradFi and DeFi. Trading significantly below its ATH, ONDO offers a prime opportunity for investors looking to buy into a fundamentally strong project before mainstream adoption kicks in. This breakout could be just the start of ONDO’s long-term ascent in the tokenized finance revolution.

SUI: High-Performance Blockchain Powering Real-World Adoption and Institutional Interest

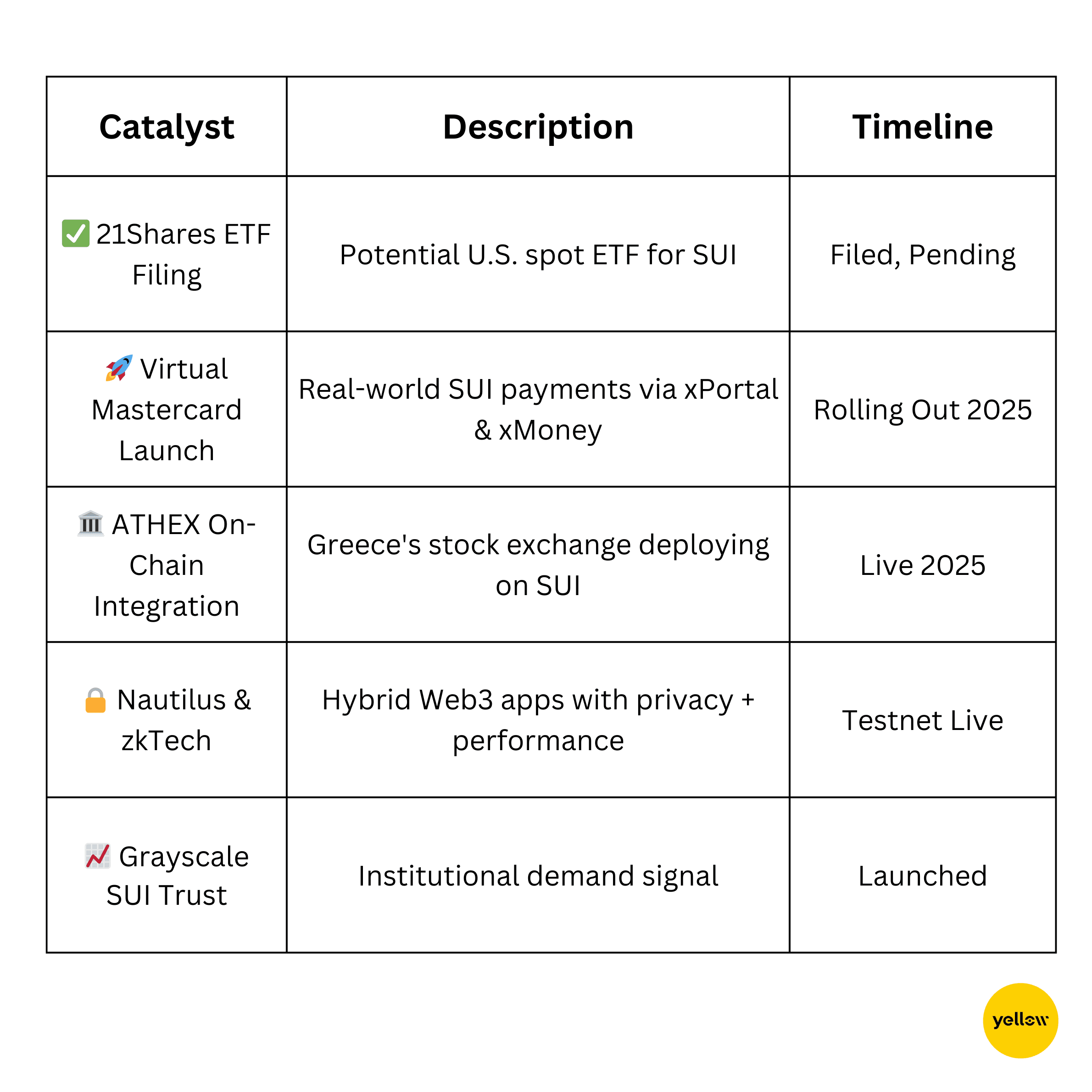

SUI, a layer-1 blockchain, is redefining speed, scalability, and real-world integration. With groundbreaking partnerships like Greece’s national stock exchange going on-chain, a virtual Mastercard launch, and a potential ETF filing in the U.S., SUI is transitioning from a high-potential blockchain to a cornerstone of next-gen finance and Web3 infrastructure. Here's why SUI’s recent breakout could be the start of a much larger move.

The Breakout from Multi-Month Downtrend

After retracing over 68% from its January ATH of $5.35, SUI found strong support near $2.00. The token has surged 56% in the past week, breaking decisively above key resistance at $3.20. Now trading at $3.69 with a $12B market cap, SUI is flashing bullish signals across both technical and fundamental fronts.

The breakout from its falling wedge pattern mirrors previous rallies that led to new ATHs. With institutional catalysts stacking up, SUI is now eyeing the critical $4.00 resistance, with potential to revisit—and surpass—its previous highs.

What Makes SUI Stand Out?

Blazing Fast, Scalable Infrastructure

-

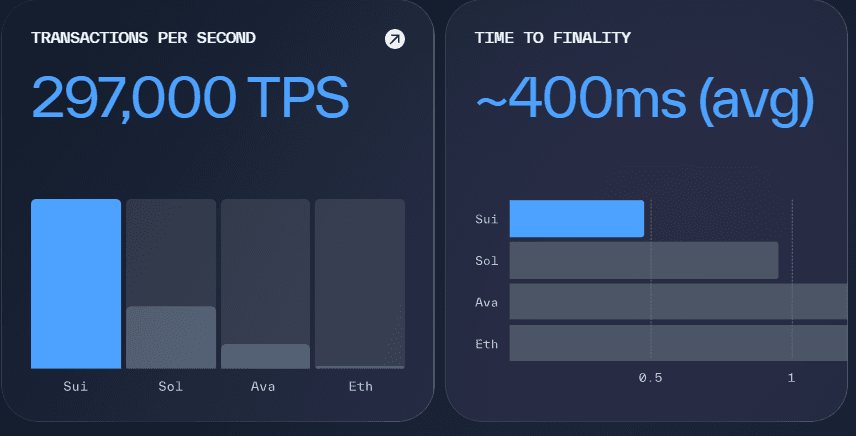

297,000 TPS with ~400ms finality — outperforming Solana, Avalanche, and Ethereum.

-

$0.0009 avg. transaction cost, enabling high-frequency dApps and real-world use cases.

-

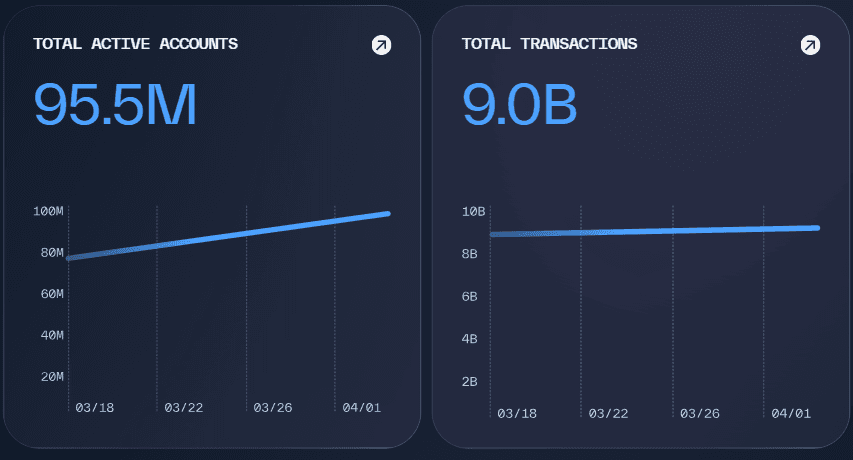

Over 95.5M active accounts and 9B transactions processed, showing explosive ecosystem growth.

Institutional & Real-World Integration

-

ATHEX Partnership: Greece’s national stock exchange building a ZK-powered fundraising platform on SUI.

-

Virtual Mastercard Launch: Spend SUI tokens globally via xPortal and xMoney, integrated with Apple Pay & Google Pay.

-

21Shares SUI ETF Filing: A gateway for traditional investors to gain exposure through regulated markets.

Cutting-Edge Tech Stack

-

Nautilus: Verifiable off-chain computation via Trusted Execution Environments (TEEs).

-

zkLogin & Seal: Privacy-centric features combining Web2 usability with Web3 security.

-

Dynamic Wallet Integration: Simplifying dApp onboarding for over 20M users.

Why Now?

SUI is not just a High-Speed Chain — It’s Becoming Institutional Infrastructure

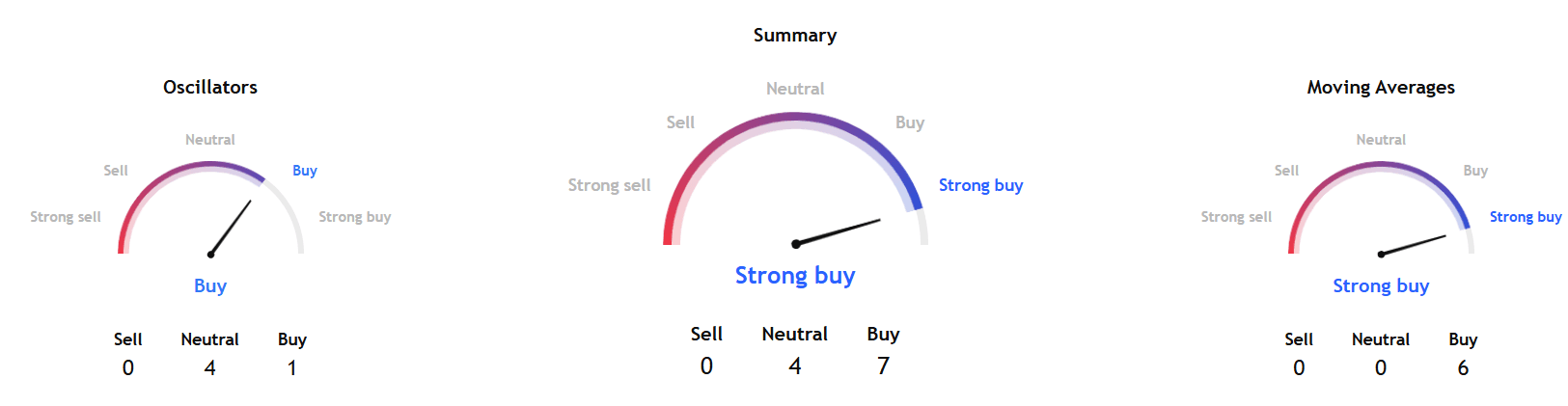

Technical Indicators:

- Summary: Strong Buy

- Moving Averages: 6 Buy, 0 Sell

- Oscillators: Momentum favoring continuation.

- Volume Surge: $3.68B in 24h trading volume (+36%), reflecting strong market conviction.

- TVL Growth: Locked value at $1.28B, indicating rising DeFi activity on SUI.

- ETF Momentum: With Bitcoin and Ethereum ETFs paving the way, SUI’s ETF registration positions it for massive inflows if approved.

Technically Speaking

-

Key Resistance: $3.70–$3.72 zone. A daily close above this could trigger a push toward $4.00 and set up for a new ATH run.

-

Support Levels: Watch $3.20 as immediate support; failure to hold could see a retest of $2.80.

-

RSI: Hovering near 64—bullish but not yet overbought, suggesting room for further upside.

-

Market Cap Rank: #11, recently flipping AVAX and LINK, signaling growing dominance among altcoins.

Key Catalysts to Watch

The Verdict

SUI is evolving from a high-speed blockchain into a serious contender for institutional-grade Web3 infrastructure.

With unmatched technical performance, real-world financial integrations, and regulatory-friendly developments like the ETF filing, SUI is positioning itself at the forefront of blockchain adoption. Its ability to merge DeFi, TradFi, and consumer usability sets it apart in a crowded layer-1 landscape. Trading well below its ATH, with bullish technicals and growing on-chain activity, SUI offers a prime opportunity for those looking to buy into a fundamentally sound, high-utility project before the next leg up. If you're eyeing a dip buy with strong upside potential and real-world relevance - SUI deserves a spot on your watchlist.

Solayer (LAYER): The Hardware-Accelerated Blockchain Entering Price Discovery with Real-World Utility

Solayer is the first hardware-accelerated Layer-1 pushing blockchain scalability beyond software limits. With its InfiniSVM architecture, a cutting-edge crypto debit card, and strong institutional backing, Solayer is positioning itself at the intersection of DeFi innovation and real-world payments. Now trading near its all-time high, LAYER has entered a new phase of price discovery—here’s why this could just be the beginning.

LAYER Surges 68% This Month, Enters Bullish Price Discovery

Since its listing on major exchanges like OKX and Binance, LAYER has maintained a strong bullish trend, rallying 68% in the past month to hit a new ATH at $2.34. With a market cap of $492M and a high 32.4% volume-to-market-cap ratio, Solayer shows robust liquidity and investor interest.

Supported by positive technicals and continuous ecosystem expansion, LAYER is well-positioned for further upside as it rides momentum from product launches and institutional adoption.

What Makes Solayer a Standout?

Hardware-Driven Scalability Like No Other

-

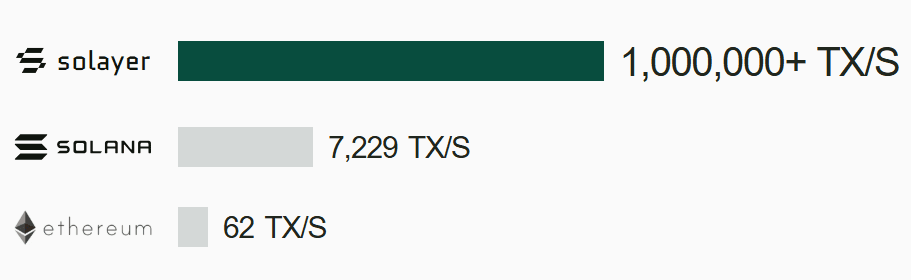

1,000,000+ TPS — outperforming Solana (7,229 TPS) and Ethereum (62 TPS) by a massive margin.

-

100+ Gbps Network Bandwidth leveraging InfiniBand & RDMA tech for near-zero latency.

-

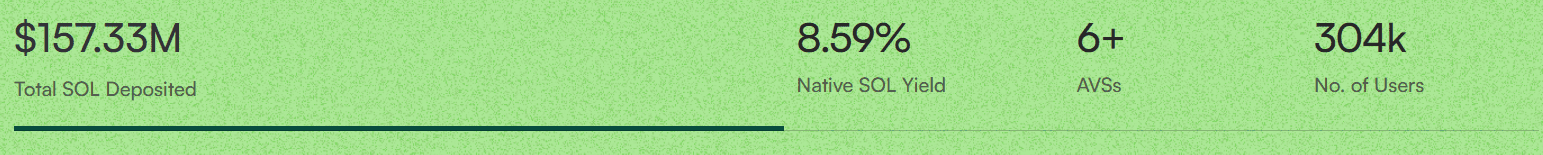

304K+ Users and $157M SOL Deposited, indicating rapid ecosystem adoption.

Real-World Integration: The Emerald Card

-

Direct crypto spending via Visa network in over 100 countries.

-

Supports USDC deposits, fiat conversions, ATM withdrawals, and integrates with Apple Pay & Google Pay.

-

Earn passive yield via synthetic assets like sUSD linked to a 4% T-bill rate.

Seamless DeFi + TradFi Experience

-

Solana Compatibility: Instantly integrates Solana dApps without manual bridging.

-

SolanaID Integration: Unified digital identity across blockchains for personalized rewards and streamlined UX.

-

Chain Abstraction: Users interact with apps without worrying about backend complexities.

Why Now?

Solayer is Redefining Blockchain Throughput and Usability

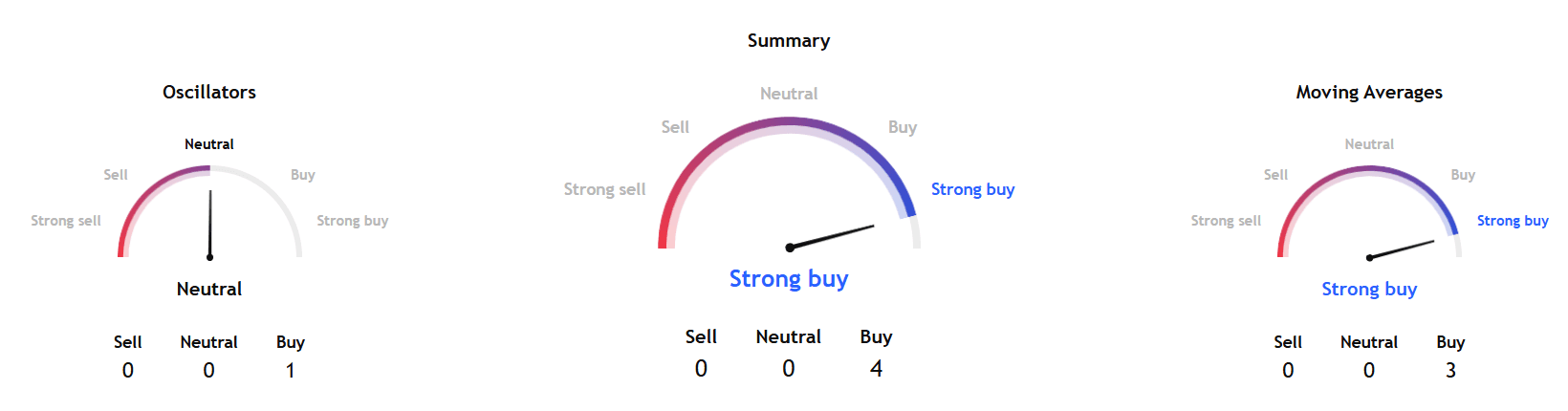

Technical Indicators

- Summary: Strong Buy

- Moving Averages: All bullish

- Oscillators remain neutral, indicating room for growth without immediate overbought pressure.

- Bullish Price Action: Consistently holding above key EMAs (50, 100, 200 on 8H charts).

- RSI at ~64: Suggesting healthy momentum with potential for further upside before overbought conditions.

- High Liquidity: A 0.74 volume-to-market cap ratio—well above average for mid-cap altcoins.

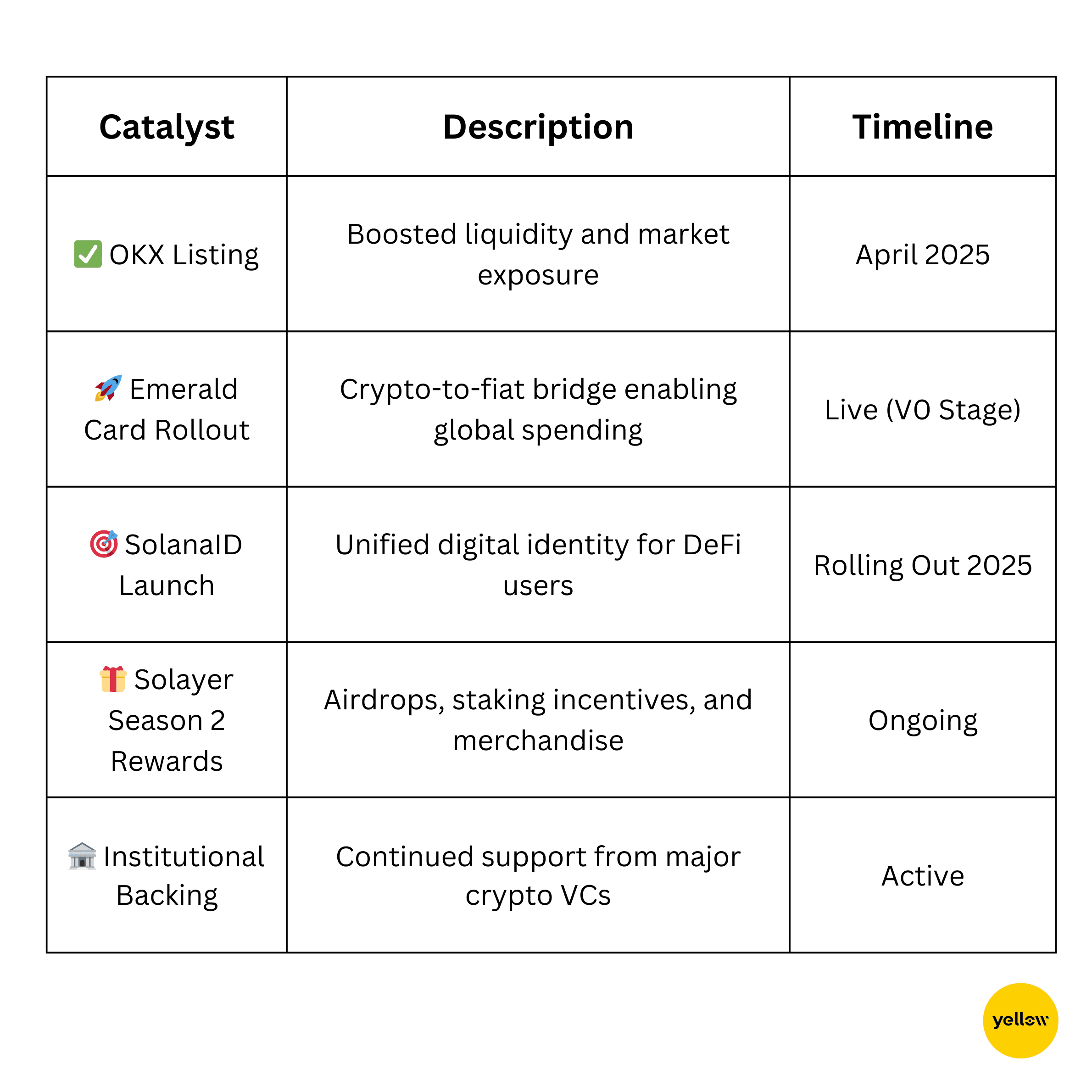

With the Emerald Card rollout, ongoing "Solayer Season 2" rewards, and rapid adoption in DeFi payments, LAYER is capitalizing on both speculative interest and real-world utility.

Technically Speaking

-

ATH Zone: Currently in uncharted territory after breaking past $2.29.

-

Support Levels: Watch for consolidation above $2.20; failure to hold could see a retest around $2.00 psychological support.

-

Upside Potential: No historical resistance—momentum and fundamentals could drive LAYER towards $3.00+ in the near term if volume sustains.

Key Catalysts to Watch

The Verdict

Solayer is pioneering a hardware-accelerated financial ecosystem that seamlessly blends DeFi infrastructure with real-world usability.

With its Emerald Card, Solayer is addressing one of crypto’s biggest hurdles: making digital assets spendable in everyday life without friction. Add to this a scalable backbone, strong institutional alliances, and aggressive ecosystem incentives, and you get a project that’s not just hype—but delivering tangible value. Trading near ATH, with bullish technicals and real utility driving demand, LAYER offers a compelling opportunity for investors seeking exposure to next-gen blockchain infrastructure and payment solutions. If you're looking for a token that's actively bridging DeFi with TradFi - and has the tech to support mass adoption - Solayer could be your next breakout hold.

Closing Thoughts

Scalability, speed, and seamless integration with real-world finance—these aren’t future promises anymore; they’re active ecosystems being built by SUI, LAYER, and SOLAYER. As blockchain adoption accelerates, tokens that offer more than just hype will lead the charge.

All three projects boast strong fundamentals, whether it's institutional partnerships, cutting-edge architecture, or game-changing products like crypto debit cards and ETF prospects. Technically, each token is showing clear bullish signals—breaking key resistance levels, entering price discovery, or setting up for major continuation patterns.

With increasing market interest, catalysts like ETF filings, DeFi integrations, and real-world payment solutions are aligning perfectly. This is a launchpad. For investors looking to ride the next leg of the bull run, SUI, LAYER, and SOLAYER offer some of the most compelling risk-reward opportunities in today’s market.

Now might just be the perfect time to buy the dip before these tokens sprint to new highs.