The cryptocurrency market in 2025 continues to captivate investors with its blend of innovation, volatility, and growing institutional interest. For those willing to dive deeper, this year presents a golden opportunity to 'buy the dip' on projects with robust fundamentals, cutting-edge technology, and the potential for long-term growth. In a market defined by rapid change and regulatory speculation, identifying projects that align with institutional priorities is more crucial than ever.

This article focuses on three standout blockchain projects - Ondo Finance (ONDO), Hyperliquid (HYPE), and Kaspa (KAS) - that are making waves in the crypto ecosystem.

Redefining DeFi via real-world asset tokenization, scaling distributed trading platforms, or transforming proof-of- work technology, these projects are driving the charge toward a more dynamic and powerful blockchain future.

Ondo: Democratizing Institutional-Grade Finance

The Meteoric Rise

Ondo (ONDO) has demonstrated remarkable growth in the past year, with its price surging 591.09% to reach $1.12 as of January 2025. This impressive performance highlights the project's ability to capture market interest and drive adoption. The circulating supply of 1.38 billion ONDO tokens and a total market capitalization of $1.55 billion signify the token's growing relevance in the decentralized finance (DeFi) space.

What Makes Ondo Special?

- Adoption and Ecosystem: Ondo has built an expansive ecosystem bridging traditional and decentralized finance. Its standout product, USDY, provides tokenized access to U.S. Treasury-backed yields, serving both individual and institutional investors. Over 76% of ONDO holders are classified as "cruisers," showcasing long-term engagement and trust in the platform's mission. Additionally, ONDO's growing community includes over 18,000 initial token holders, emphasizing its widespread adoption since launch.

- Market Position:

Ondo has carved a niche in Real-World Assets (RWA) tokenization, establishing itself as a pioneer in offering stable, yield-bearing financial products. Its partnership with institutional heavyweights like BlackRock, Morgan Stanley, and Coinbase further solidifies its position as a market leader.

By facilitating the tokenization of stable, income-generating assets, Ondo merges the best of traditional finance with blockchain innovation.

- Partnerships and Investments:

Ondo's collaborations include alliances with top-tier entities such as BlackRock and NAV Consulting for financial infrastructure and Ankura Trust for independent verification.

The platform has also garnered support from angel investors and VC firms like Tiger Global and Triblock, underscoring the confidence of institutional investors in its long-term potential. These partnerships ensure Ondo's continued expansion and product diversification.

The Growth Opportunity

Ondo is uniquely positioned to capture growth in the burgeoning RWA tokenization market, which is expected to exceed $16 trillion by 2030.

With its innovative products like USDY and OUSG and integrations across major blockchains such as Ethereum, Solana, and Aptos, Ondo stands at the forefront of blockchain's intersection with traditional finance. Its robust governance model, managed by the Ondo DAO, ensures alignment with community interests, further strengthening its growth trajectory.

Why Now?

Recent developments, including the launch of USDY on multiple blockchains and strategic integrations with platforms like Injective and Pendle Finance, have amplified Ondo's utility and accessibility.

With increasing whale participation (78.59% of holdings) and a steady climb in adoption metrics, ONDO is poised for another breakout. Its alignment with market trends, such as the growing demand for tokenized financial products, makes ONDO a compelling choice for investors seeking a stable yet innovative crypto asset.

Kaspa: Revolutionizing Proof-of-Work Blockchain Technology

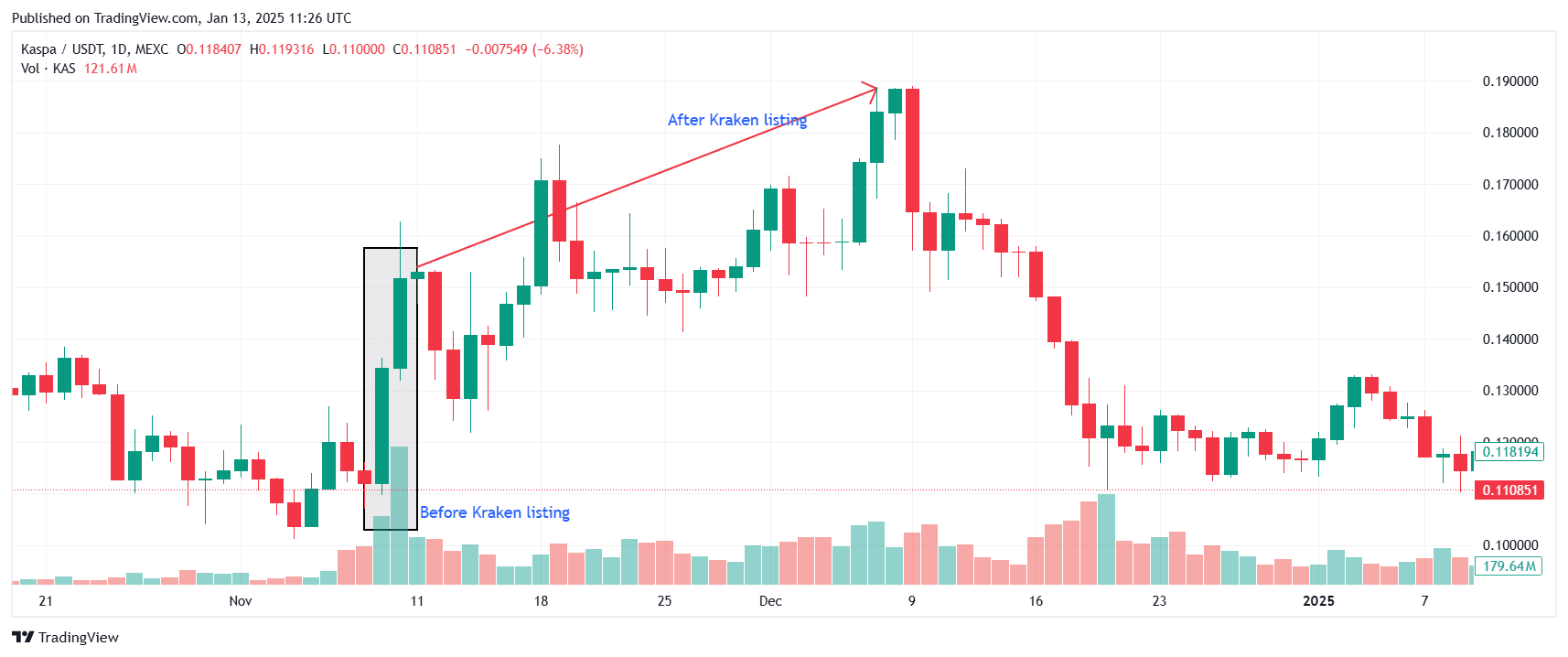

The Meteoric Rise Kaspa (KAS) has positioned itself as a game-changer in the blockchain space, with its market cap reaching $2.82 billion and a circulating supply of 25.54 billion KAS. While the price has seen fluctuations, currently trading at $0.1107, its technological advancements and ecosystem upgrades have kept it in the spotlight. Notable events like its integration with Ledger Live, the Kraken listing, and discussions around a potential Binance listing have bolstered its community's enthusiasm and market activity.

What Makes Kaspa Special?

- Adoption and Ecosystem:

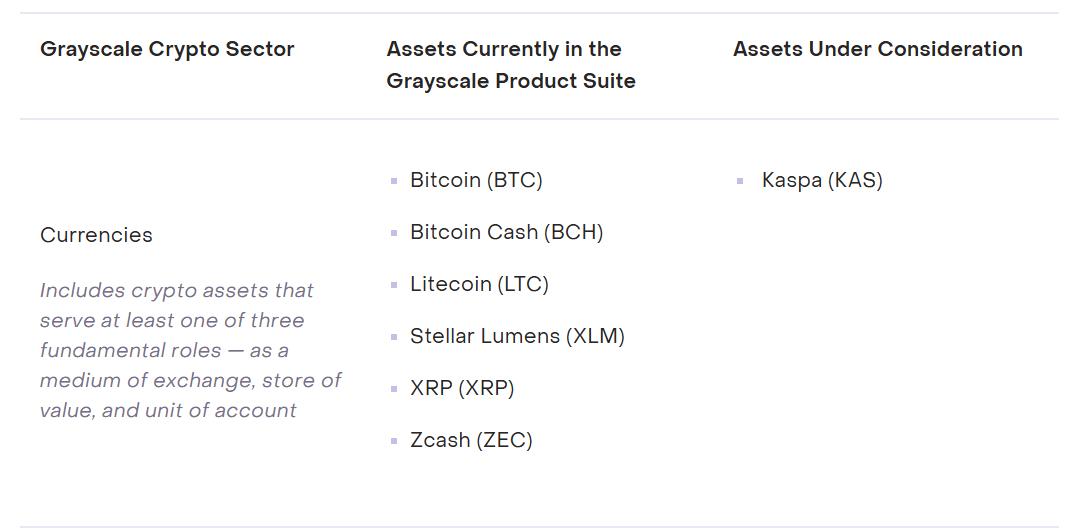

Kaspa boasts a vibrant and active community, reflected in its substantial social engagement and ongoing ecosystem development. It is the only currency asset under consideration by Grayscale, which underscores its potential to enter the institutional market.

The introduction of KRC20 tokens has also expanded its ecosystem, laying the groundwork for decentralized applications and broader developer adoption.

- Market Position: Powered by the GHOSTDAG protocol, Kaspa is solving the blockchain trilemma by achieving high security, scalability, and decentralization simultaneously. It supports rapid block creation and transaction efficiency unmatched by traditional proof-of-work blockchains. With scalability improvements like the Crescendo hard fork targeting 10 blocks per second, Kaspa is setting new standards for blockchain infrastructure.

- Partnerships and Investments: Backed by key investors such as Iconium Blockchain Ventures and Yesss Capital, which has previously invested in prominent projects like Algorand, Quant, Binance, and more, Kaspa is well-positioned for growth. These partnerships not only provide financial support but also enhance its credibility and market visibility. With potential listings on major exchanges like Binance, Kaspa is expected to capture both retail and institutional attention.

The Growth Opportunity Kaspa's focus on protocol-level innovation, including the shift to DAGKNIGHT and the integration of smart contract capabilities, positions it as a leader in blockchain scalability. The Crescendo upgrade and advancements in mining profitability further enhance its appeal to developers, miners, and investors alike. With its unique emission reduction model based on the chromatic scale, Kaspa offers a sustainable and innovative economic framework.

Why Now?

With key developments like the Kraken listing, ecosystem expansions, and Grayscale's consideration, Kaspa is primed for short- and long-term growth. Its focus on technological innovation and solving the blockchain trilemma makes it a standout project in the crypto space. Additionally, a potential Binance listing could provide a significant short-term price catalyst, driving market momentum and attracting new participants to the ecosystem.

Hyperliquid (HYPE): Redefining Decentralized Trading

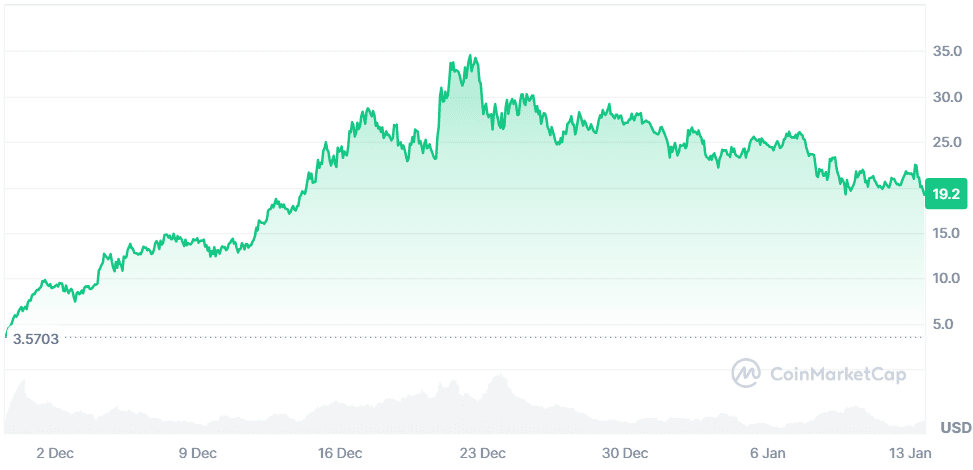

The Meteoric Rise Hyperliquid (https://yellow.com/asset/hype) has emerged as a standout project in the blockchain space, powered by its innovative on-chain infrastructure and community-centric economic model. HYPE’s market cap currently stands at $6.41 billion, with a circulating supply of 333.92 million HYPE tokens. Despite a recent price correction, HYPE’s value remains strong at $19.20, up 499.87% over the past year. Key developments, such as its Layer-1 blockchain launch, groundbreaking perpetual futures trading, and zero-gas-fee model, have made it a dominant force in decentralized finance (DeFi).

What Makes Hyperliquid Special?

- Adoption and Ecosystem:

Hyperliquid boasts a rapidly growing user base of 371,821 active users, with daily trading volumes surpassing $4 billion. Its infrastructure supports up to 200,000 transactions per second, ensuring speed and efficiency.

The fully on-chain order book design provides unparalleled transparency and security, setting a new benchmark for decentralized exchanges (DEXs).

- Market Position: Positioned as a leader in decentralized derivatives trading, Hyperliquid leverages its HyperBFT consensus algorithm to enable instant transaction finality within 0.2 seconds. The platform supports up to 50x leverage, zero-cost trades, and a unique maker rebate system, distinguishing itself in the competitive DeFi landscape. Hyperliquid currently commands a leading share of the decentralized derivatives market.

- Partnerships and Investments: Institutional interest in Hyperliquid continues to grow, with notable players like Amber Group acquiring 730,749 HYPE tokens worth $16 million during recent market dips. Furthermore, validators such as Chorus One and Figment are integral to the Hyperliquid ecosystem, enhancing its credibility and operational strength. The platform's self-funded approach ensures independence and a long-term commitment to innovation.

The Growth Opportunity Hyperliquid’s innovative tokenomics and economic model allocate 54% of platform revenue to token buybacks, driving consistent upward pressure on HYPE’s price. The upcoming launch of its HyperEVM—a permissionless and interoperable execution layer—will further expand its ecosystem, enabling new decentralized applications and cross-chain compatibility. These developments, alongside its robust trading architecture, position Hyperliquid as a growth powerhouse in the DeFi space.

Closing Thoughts

Projects like Ondo Finance, Hyperliquid, and Kaspa represent a new era of innovation, practicality, and scalability in the crypto world.

Whether it’s Ondo bridging DeFi with traditional finance, Hyperliquid leading decentralized trading advancements, or Kaspa breaking new ground in proof-of-work efficiency, these projects stand out as prime opportunities for growth-focused investors.

The decision to act now could determine your position in the next wave of blockchain success stories. With institutional interest building, regulatory frameworks taking shape, and groundbreaking technologies entering the scene, this is the perfect time to seize the opportunity and invest in projects with strong potential. Don’t let this moment pass—buy the dip and secure your foothold in the future of blockchain innovation.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or legal advice. Always conduct your own research or consult a professional when dealing with cryptocurrency assets.