A cooling market is when conviction pays. The smartest money isn’t chasing tops, it’s quietly accumulating the rails that everyone will need once the tap-back turns into a sprint.

From liquidity engines on Coinbase’s Base (AERO) to the most capital-efficient perps chain in crypto (HYPE) to biometric identity that could unlock mass-market AI wallets (WLD), utility-driven tokens are back in focus. Each sits at the intersection of real revenue, headline catalysts, and whale accumulation—three traits the market eventually rewards with violent upside.

This article spotlights Aerodrome (AERO), Hyperliquid (HYPE), and Worldcoin (WLD), projects already posting hard numbers while their prices hover at what could be the last great accumulation range.

Why do these tokens deserve attention right now? Let’s find out.

Worldcoin (WLD)

The Pullback Opportunity

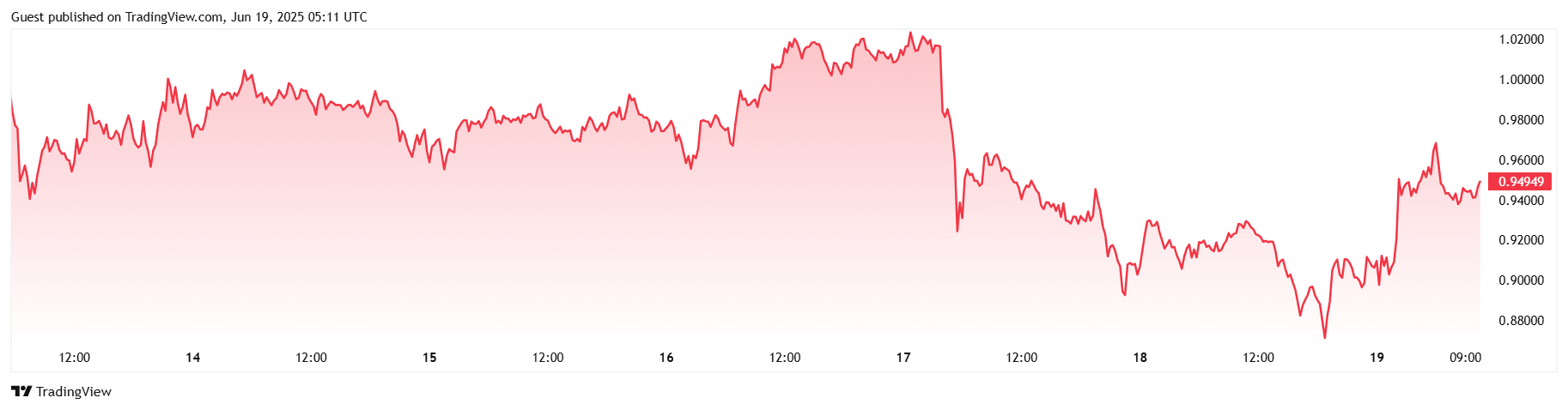

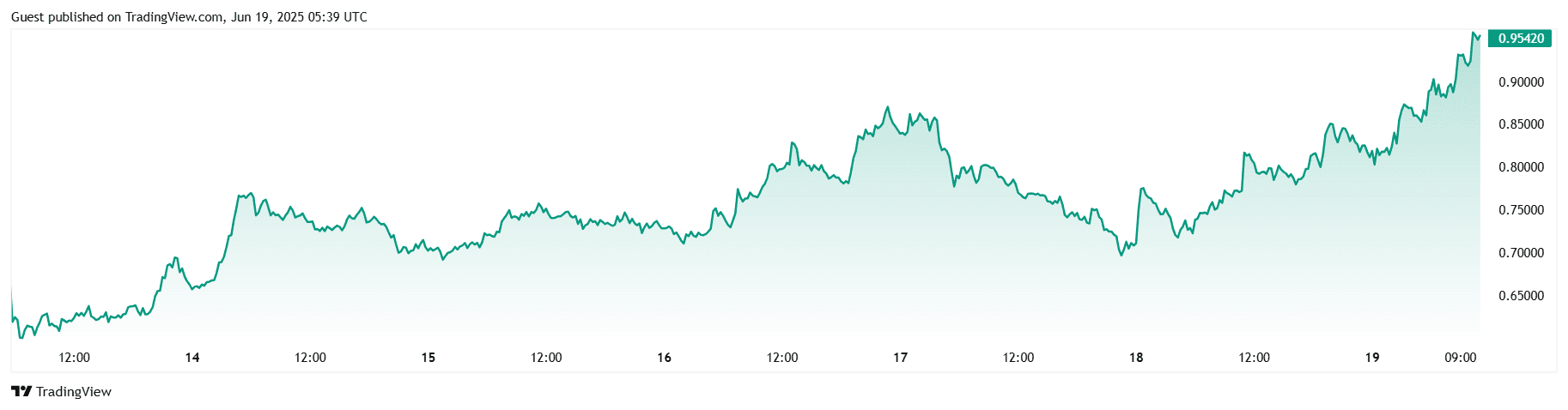

Worldcoin is changing hands at $0.94–0.96 after a bruising 14 % slide over the last week, leaving the market-cap just above $1.5 B and the price 92 % below last year’s high. Technicals have flipped deeply oversold on the daily RSI, while Bollinger Bands are pinching, a classic recipe for a volatility spike once sellers exhaust.

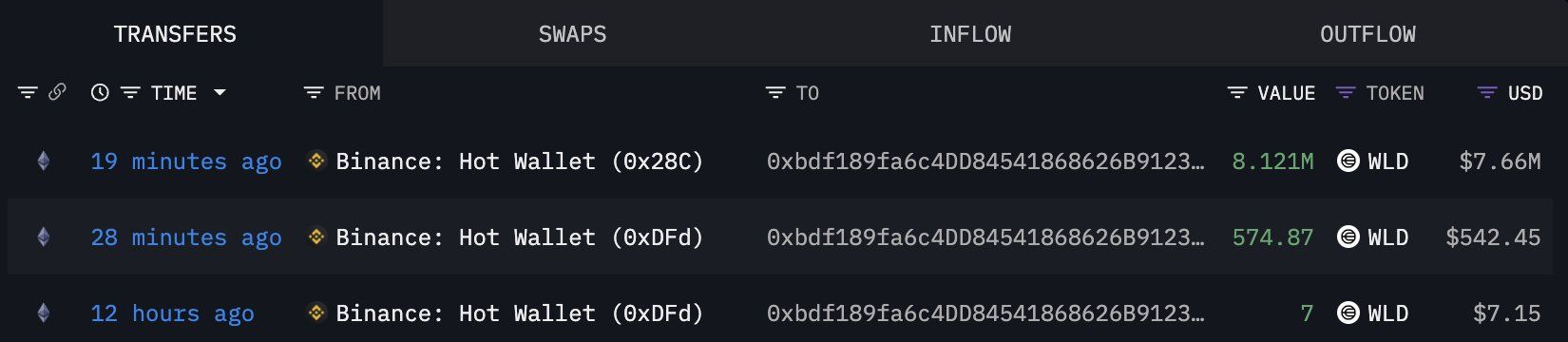

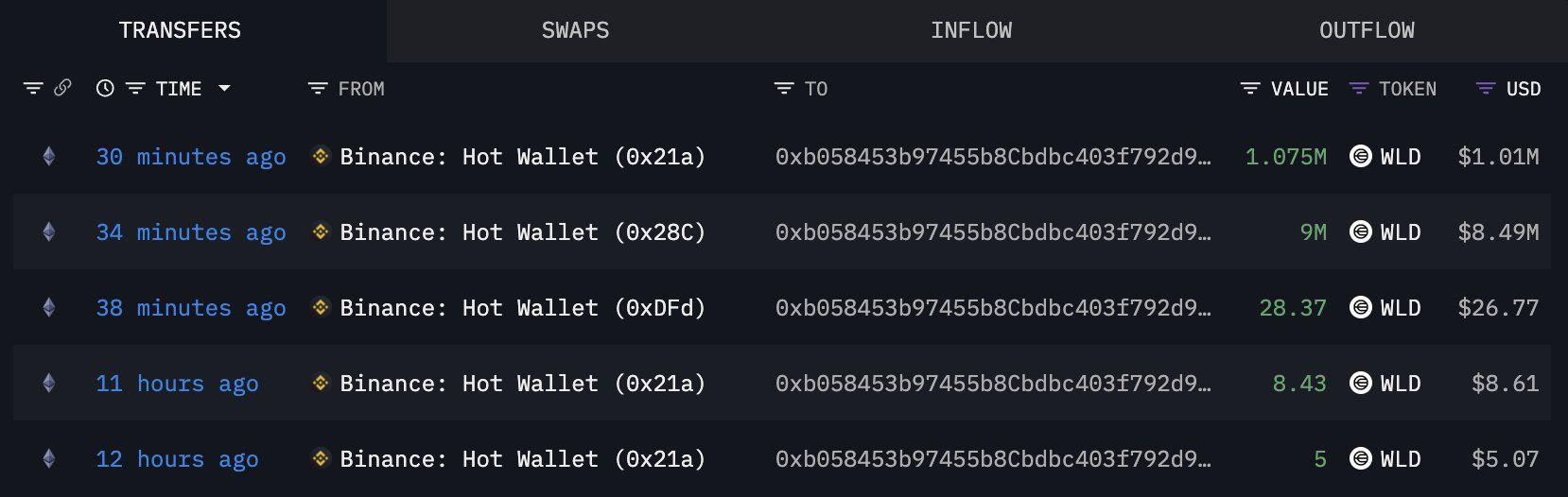

Whale Accumulation Signals a Floor

Smart-money wallets are already positioning for that snap-back: two newly created addresses yanked 18.2M WLD (~$17.2 M) off Binance on 17 June, shrinking exchange liquidity at the very moment late shorts are pressing. Large withdrawals of this size often front-run OTC deals or long-term cold-storage, both historically bullish for spot price.

What Makes Worldcoin Special?

-

Proof-of-Personhood: The iris-scan-secured World ID tackles Sybil resistance for AI, payments and DeFi log-ins at global scale.

-

World Chain L2: A dedicated Ethereum L2 slated for main-net this year, designed to prioritize verified humans and throttle bots.

-

Native USDC + CCTP V2: Circle just minted native USDC on World Chain and enabled cross-chain transfers, giving builders a dollars-on-rails stablecoin without risky bridges.

-

Big-Tech Adjacency: Sam Altman’s OpenAI just inked a surprise cloud deal with Google, underscoring the project’s access to Tier-1 compute and keeping WLD tied to the hottest AI narratives.

Tokenomics Snapshot

Circulating supply: 1.63 B WLD

Total supply: 10 B (unlocks are <1 % per month through 2026)

FDV: $9.5 B implying an 85 % discount to the March-2024 peak.

Unlock tempo is gentle relative to daily volume, and whale behavior suggests coming tranches may be soaked up quickly.

Strategic Partnerships & Ecosystem Momentum

-

Circle & Visa rails: USDC mint/burn directly on World Chain plus Circle Mint on-/off-ramps give enterprises a regulated dollar bridge.

-

OpenAI & Google Cloud: Faster model training lifts the entire Altman stack, and Worldcoin is the permissioned-identity layer riding shotgun.

-

DeFi integrations: early pilots for on-chain credit scoring and airdrop sybil filters are already testing World ID verifications.

The Growth Opportunity

Stablecoins settled >$9 T last year, yet identity fraud costs firms $26 B annually. A network that marries KYC-grade identity to fee-light stablecoin transfers has TAM on both sides of that chasm. With 2 M+ World App users already interacting with native USDC, network effects can ignite quickly once World Chain main-nets.

Why Now?

✅ Oversold & illiquid: RSI sub-30 plus whale drain dents sell walls.

✅ Catalyst stack: World Chain main-net, USDC liquidity mining, and fresh AI-cloud headlines could conspire for a hard rebound toward $1.25–1.45 near-term (technicals), with $1.62 the breakout target if volume confirms.

✅ Asymmetry: A dip to $0.90 or even $0.50 (strong horizontal support) risks -25 %/-45 %, while reclaiming February’s $1.80 prints offers +90 % upside, a 2-3:1 reward/risk skew.

Bottom Line

Worldcoin’s price action is ugly, sentiment is fearful, and unlock FUD is loud, exactly the backdrop that disciplined dip-buyers crave. With whales front-running a supply squeeze, native USDC lighting up fresh utility, and AI tail-winds back in the headlines, the current sub-$1 zone looks less like a falling knife and more like a spring being coiled. For investors willing to brave near-term volatility, WLD’s proof-of-personhood bet could be the most human trade on the board.

Hyperliquid (HYPE)

The Pullback Opportunity

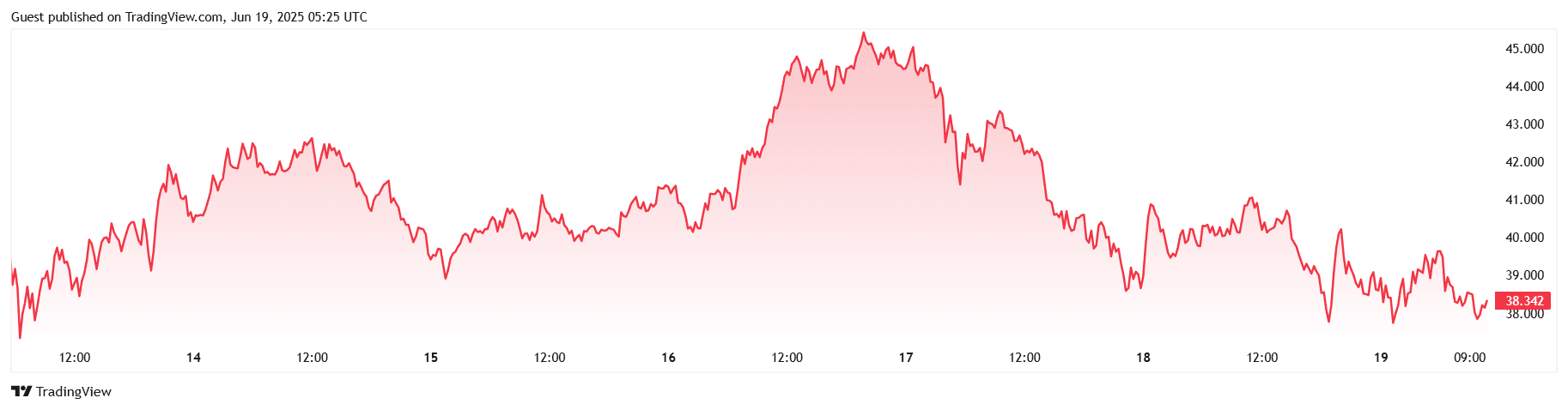

Hyperliquid is changing hands near $38.3, down ~9 % on the week and 14 % below its fresh $45 all-time high. Market-cap sits at $12.7 B with 334 M HYPE in circulation, giving a tame 3.6 % vol/m-cap reading despite the retrace. Price is now testing the lower rail of a two-month ascending channel that bottoms in the $36–40 zone; previous bounces off this band have produced double-digit rallies. Momentum remains constructive with daily RSI still hovering near 60, flagging cooling, not collapsing, buy pressure.

Corporate-Treasury Binge Sends a Signal

-

Eyenovia (EYEN) is injecting $50M to build a HYPE reserve, making it the first U.S.-listed company to park the token on its balance-sheet.

-

Lion Group (LGHL) lined up a $600M facility to amass “the world’s largest HYPE treasury.”

-

Four listed firms (DDC, Fold, BitMine, Eyenovia) have now earmarked $844M for BTC + HYPE treasuries, evidence that institutions are comfortable treating HYPE as a strategic reserve asset alongside Bitcoin.

Futures Market Muscle

HYPE has vaulted into the #5 slot globally by futures open interest, over $2B, leap-frogging DOGE and trailing only BTC, ETH, SOL and XRP. The derivatives bid underlines deep liquidity and makes spot squeezes more violent once funding resets.

What Makes Hyperliquid Special?

-

HyperBFT L1: Custom consensus optimized for order-book logic delivers CEX-level throughput while remaining fully on-chain.

-

97% Fee Buy-Backs; Almost every dollar of protocol revenue auto-buys HYPE on the open market, creating perpetual bid pressure.

-

Staking → Fee Rebates: Delegating HYPE to validators slashes trading fees and unlocks future referral + builder-market rewards (HIP-3).

-

Deep On-Chain Perps: Hyperliquid handled 60% of all on-chain perp volume last week—proof of dominant product/market fit.

Tokenomics Snapshot

Circulating / Max: 334M / 1B

FDV: $38.3 B

Fee Sink: 97% of trading fees repurchase HYPE; burns remove bought-back tokens permanently.

Unlock cadence is slow (community-heavy emission schedule), while aggressive buy-backs absorb float faster than it drips out.

Strategic Partnerships & Ecosystem Momentum

-

Anchorage Digital custody for corporate treasuries signals institutional-grade security.

-

BitGo safeguarding LGHL’s stake broadens blue-chip infrastructure around the token.

-

Nasdaq listings + ticker swaps (EYEN → HYPD) will throw HYPE’s ticker on financial terminals watched by traditional-finance desks.

The Growth Opportunity

On-chain derivatives notched $94B in weekly volume, and Hyperliquid captured the lion’s share. Every incremental trade widens the protocol’s buy-back cannon, mechanically reducing circulating supply. If fee growth merely tracks last quarter’s run-rate, the system retires ~30 M HYPE per month, nearly 9% of current float, forcing a structural supply squeeze as corporate demand accelerates.

Why Now?

-

Technical inflection: Channel support + moderate RSI create a defined risk window around $36 with upside targets at $46 (channel top) and $55 (measured-move).

-

Treasury arms race: $650 M of fresh corporate fire-power has yet to hit order books; initial stake deals typically dribble in over weeks.

-

Derivatives depth: Record open interest means any spot rally can catalyze short liquidations, amplifying moves.

Bottom Line

HYPE’s dip isn’t a crack in the story, it’s breathing room. A deflationary buy-back engine, soaring on-chain volumes, and a suddenly corporate-friendly narrative put the token at the crossroads of real revenue and institutional FOMO. With price camped on structural support and nine-figures of treasuries waiting in the wings, sub-$40 prints look more like onboarding ramps than exit doors for investors hunting the next large-cap breakout.

Aerodrome (AERO)

The Pullback Opportunity

AERO has rocketed +70 % in seven days to ~$0.95, yet it still trades 10 % under its November-2024 ATH ($1.06) and a full 40 % below the $1.55 Fibonacci target that last cycle’s buyers are eyeing. Market-cap is just $800 M on a $1.58 B FDV, while 24-h volume tops $150 M (a punchy 19 % of m-cap) — proof that fresh money is already circling. Circulating float sits at 839 M AERO against 1.66 B total supply, leaving ample room for emissions-fuelled boot-strapping without smothering price.

What Makes Aerodrome Special?

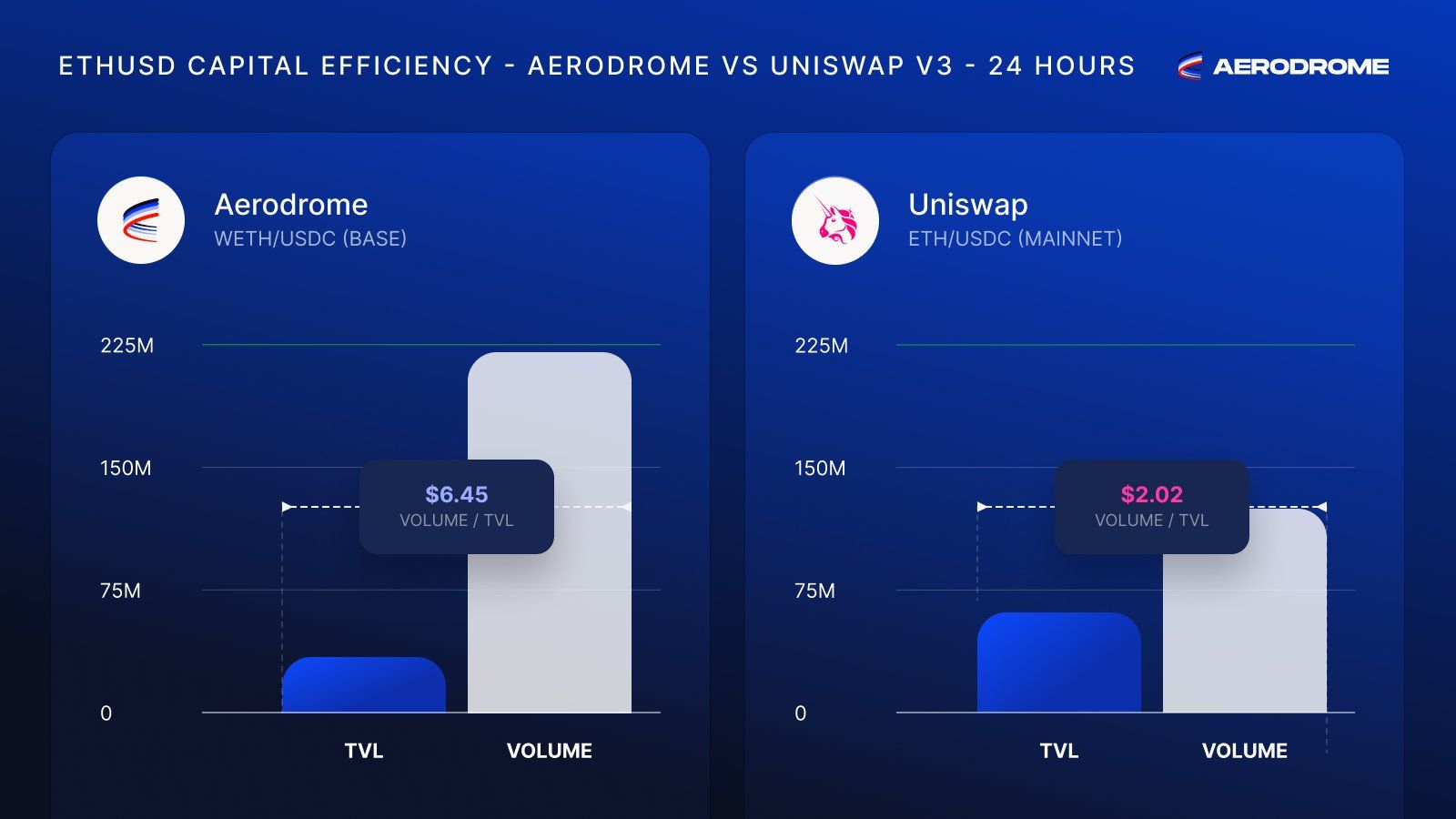

- Base’s Liquidity Engine: Aerodrome processes as much swap volume on Coinbase’s Base L2 as the top Uniswap-v3 pool handles on Ethereum main-net, with roughly half the TVL, underscoring superior capital efficiency.

-

Blue-Chip Integrations: Shopify’s new USDC checkout on Base and Coinbase’s plan to surface Base-native DEXs inside its retail app funnel millions of mainstream users directly into Aerodrome pools.

-

ve(3,3) Tokenomics: Locking AERO for veAERO directs emissions toward whitelisted pools, rewarding long-term holders while deepening liquidity where it matters most, a proven flywheel borrowed from Velodrome.

-

Exploding On-Chain Revenue: Daily DEX fees jumped from $0.34M to $1.7M within a week of the Coinbase-Shopify reveal, lifting average seven-day revenue to ~$730 K and validating sticky, organic usage.

-

Dominant Market Share: Aerodrome already accounts for 60 %+ of Base’s on-chain trading activity, consistently out-gunning Uniswap on the same network.

Tokenomics Snapshot

-

Circulating / Total: 839M / 1.66B

-

Inflation: Emissions taper quarterly, but veAERO voting directs most rewards to the highest-volume pools, keeping sell-pressure modest relative to throughput.

-

Fee Capture: 100 % of swap fees go to LPs; protocol revenue flows to lockers via bribes, creating a reflexive “lock → vote → earn → relock” loop.

Strategic Partnerships & Ecosystem Momentum

-

Coinbase Retail App: direct DEX routing puts AERO pairs one tap away for 100 M+ verified accounts.

-

Shopify Merchants: USDC purchases across 30 + countries widen stable-coin inflows, and Aerodrome is the primary Base AMM for routing those dollars into DeFi.

-

Capital-Efficiency Narrative: the viral tweet showing Aerodrome’s $6.45 volume / TVL ratio vs. Uniswap’s $2.02 has traders hunting the next “productive liquidity” winner.

The Growth Opportunity

Layer-2 volumes are snowballing, Base alone moved >$40 B in on-chain trades last quarter. Aerodrome’s share has risen alongside that tide, meaning even a flat network can triple AERO fee-flows if Coinbase’s funnel materialises. With veAERO locks incentivising permanent liquidity, incremental USDC inflows translate almost 1-for-1 into depth, tighter spreads, and still more volume, the textbook reflexive loop.

Why Now?

-

Technical Setup: Price is pressing the top line of an eight-week ascending triangle ($0.96–$0.98). A decisive close above $1 would unleash a measured-move target near $1.35, with Fibonacci confluence at $1.55.

-

Relative Value: Even after the rally, AERO’s FDV / annualised revenue ratio (<8 ×) screens cheaper than UniSwap (>25 ×) and PancakeSwap (>15 ×).

-

Liquidity Catalyst: Coinbase’s in-app DEX aggregation rolls out this quarter; early positioning ahead of that UX switch can front-run retail flow.

Bottom Line

AERO has shaken off the winter lows and reclaimed its growth narrative, yet the market still prices the token below its prior cycle high and at a single-digit revenue multiple. With Shopify’s USDC rails and Coinbase’s user fire-hose both set to pour fresh stable-coin liquidity into Base, Aerodrome is poised to turn that flow into swap fees, and fees into veAERO demand. For investors willing to buy before the Coinbase front-page moment, sub-$1 AERO looks less like a blow-off top and more like the runway before take-off.

Closing Thoughts

Infrastructure that moves money, liquidity, and identity is the plumbing of the next bull cycle—regardless of whether the narrative is AI, DeFi, or consumer payments. AERO, HYPE, and WLD each bring a differentiated piece of that puzzle, and their recent partnership headlines (Coinbase, Shopify, corporate treasuries) validate real-world demand.

-

Fundamentals: rising on-chain revenues, sticky user growth, and corporate integrations signal durable product-market fit.

-

Technical readiness: all three charts are carving higher lows while sitting just below breakout levels, classic “spring-loading” before momentum ignites.

-

Catalysts: Base DEX routing inside Coinbase, multi-hundred-million-dollar HYPE treasuries, and World Chain’s USDC rollout offer clear event triggers.

Put together, the trio combines tangible cash-flow potential with near-term news flow, exactly the mix that historically turns dips into launchpads. For investors willing to front-run the crowd, this may be the moment to strap in and buy the dip before the runway lights up.