Today, Ethereum’s institutional dominance and the explosive debut of Sign Protocol have fueled renewed excitement among both retail and professional investors.

While ETH continues its evolution as the backbone of decentralized finance and tokenized assets, SIGN grabbed the spotlight with a multi-exchange launch and rare market support. Meanwhile, ALPACA’s price nosedive post-Binance delisting sparked panic selling despite its deflationary momentum. Pi Network faced criticism over its flawed KYC rollout, dampening sentiment. On the other end, Solayer gained traction thanks to its DeFi-meets-RealFi card product that links synthetic yield with mainstream spending cementing its place in the crosshairs of yield-hungry investors. These five trending coins represent a complex market where innovation meets volatility.

Ethereum (ETH)

Price Change (24H): +3.23% Current Price: $1,817.57

What happened today

Ethereum remains a dominant force in decentralized finance following its post-Merge upgrades. The network’s shift to Proof of Stake significantly improved energy efficiency and made staking central to its value proposition. Recent upgrades (Shanghai, Pectra) enhanced scalability and staking rewards. On April 28, the Ethereum Foundation appointed Aya Miyaguchi as President and introduced new leadership to meet transparency and governance demands. Meanwhile, Ethereum maintains 57% of the $21B tokenized real-world asset market, with strong institutional backing from BlackRock and Fidelity. EIP 9698, proposing higher gas limits, and upcoming Pectra deployment are key technical catalysts.

Market Cap: $219.43B 24-Hour Trading Volume: $16.3B Circulating Supply: 120.72M ETH

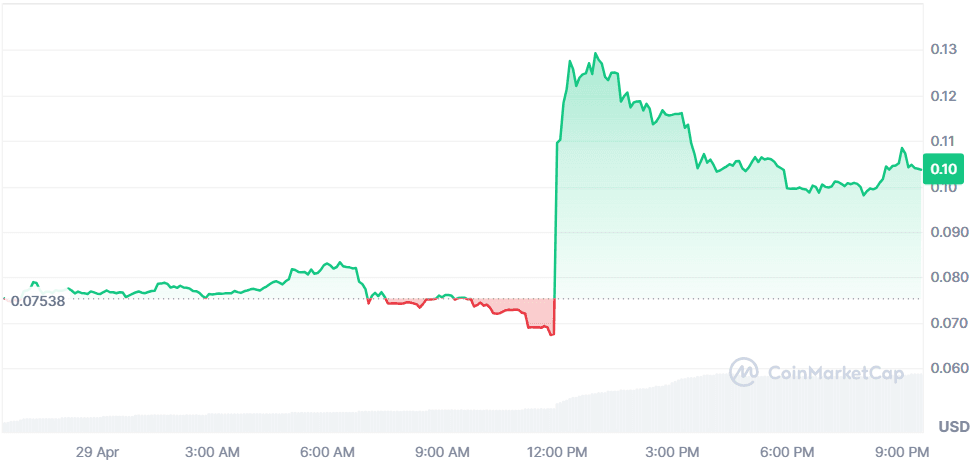

Sign (SIGN)

Price Change (24H): +37.46% Current Price: $0.1036

What happened today

Sign Protocol launched on Binance and four other major exchanges following its Token Generation Event. Backed by Sequoia and Circle, SIGN supports multi-chain attestations for decentralized identity verification. With just 12% of its 10B supply in circulation and an initial surge in trading activity, SIGN is attracting attention for its limited market supply and use case in verifiable credentials. Its listing on Binance Alpha and airdrop initiatives added to the buying momentum.

Market Cap: $124.33M 24-Hour Trading Volume: $962.15M Circulating Supply: 1.2B SIGN

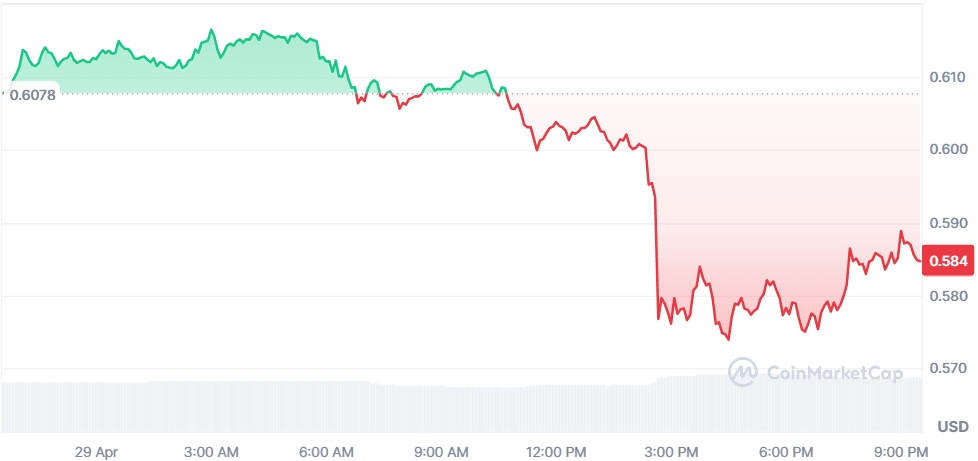

Pi (PI)

Price Change (24H): -3.74% Current Price: $0.5847

What happened today

Pi Network faced mounting criticism from users struggling with its KYC process and account login issues. The team shared fixes, but the community remains frustrated. Meanwhile, Pi’s price declined amid concerns about usability and a lack of clarity on how verification issues could affect long-term adoption and token value.

Market Cap: $4.07B 24-Hour Trading Volume: $99.34M Circulating Supply: 6.96B PI

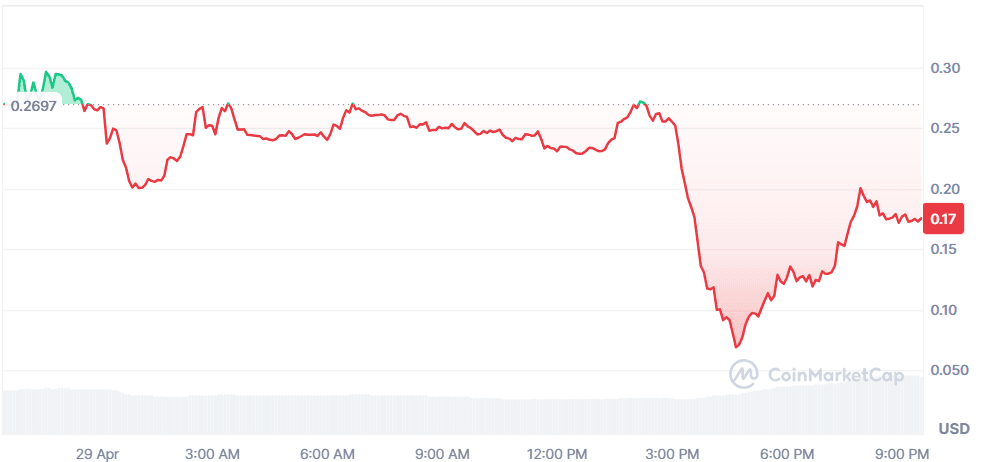

Alpaca Finance (ALPACA)

Price Change (24H): -37.95% Current Price: $0.1671

What happened today

After peaking at $0.323 following strong buyback momentum and deflationary announcements, ALPACA crashed nearly 38% amid news of its delisting from Binance. Despite a completed buyback & burn of 188,888 tokens and a cumulative burn exceeding 34.98 million tokens (18.61% of supply), investor sentiment turned bearish post-delisting. Market panic appears to have outweighed the token’s deflationary credentials.

Market Cap: $25.14M 24-Hour Trading Volume: $375.48M Circulating Supply: 150.46M ALPACA

Solayer (LAYER)

Price Change (24H): +16.74% Current Price: $3.15

What happened today

Solayer has gained momentum after unveiling its Emerald Card — a DeFi-linked debit card with Visa integration, synthetic T-bill yield via sUSD, and wallet support for Apple and Google Pay. The project’s infiniSVM engine promises transaction speeds up to 1 million TPS. With its V0 release in progress, early users are being rewarded through Emerald Rewards and airdrops. Market enthusiasm for its real-world DeFi utility continues to drive price gains.

Market Cap: $662.63M 24-Hour Trading Volume: $271.48M Circulating Supply: 210M LAYER

Global Market Snapshot

Markets opened this week grappling with the aftershocks of Donald Trump’s first 100 days in office, as the U.S. dollar slid nearly 8% from its 2025 peak — its worst monthly performance in years.

Amid chaotic tariff policies and signs of de-globalization, Deutsche Bank warned of a looming “megashock” and the beginning of a major dollar downtrend. While Trump rolled back some automotive levies, businesses and investors remain wary, especially with no concrete de-escalation in U.S.–China trade tensions. In Canada, Prime Minister Mark Carney secured re-election, signaling a break from past U.S.-Canada trade dynamics.

Meanwhile, optimism is building globally around crypto markets: Brazil became the first country to launch a spot XRP ETF, further cementing its status as a crypto innovation hub.

With eurozone confidence data pending and mega-cap earnings (Apple, Microsoft, Meta) ahead, investors are watching for signals amid volatile policy swings, weakening fiat confidence, and accelerating demand for decentralized assets.

Closing Thoughts

Investor sentiment today reflects a sharp bifurcation: while projects with real-world utility, institutional alignment, or regulated product rollouts (like ETH and LAYER) are enjoying sustained interest, speculative excitement is clustering around launch hype (SIGN) and reactionary sell-offs (ALPACA).

The trend toward digital identity (SIGN), traditional finance tokenization (ETH), and payment-integrated DeFi (LAYER) shows that market participants are increasingly focusing on infrastructure plays—assets that offer lasting value through functionality, not just meme momentum.

Across global and crypto markets, the signals are mixed.

With the U.S. dollar showing weakness and geopolitical volatility rising, investors are hedging into non-sovereign digital assets. Ethereum's resurgence as a "settlement layer" for TradFi reflects this shift, while Brazil's XRP ETF signals growing global interest in regulated crypto exposure. At the same time, the burst of speculative energy into coins like SIGN shows that risk appetite hasn’t disappeared—it's simply becoming more selective. This market is rewarding utility, punishing uncertainty, and closely watching how innovation intersects with regulation.