Crypto markets are back in motion, and today's buzz cuts across both fundamentals and fever dreams.

Ethereum’s long-awaited upgrade has finally gone live, setting the stage for a wave of changes across staking, scalability, and smart wallets. Meanwhile, Pi is trending hard on the back of a supply mystery and whispers of a Binance listing. On the riskier end of the spectrum, MOODENG has exploded with triple-digit gains, Saros is quietly pushing forward with DeFi innovation on Solana, and TRUMP is, well, doing exactly what you'd expect a politically-charged memecoin to do. In a market looking for direction, these five coins are painting a picture of where conviction, speculation, and community power are all converging.

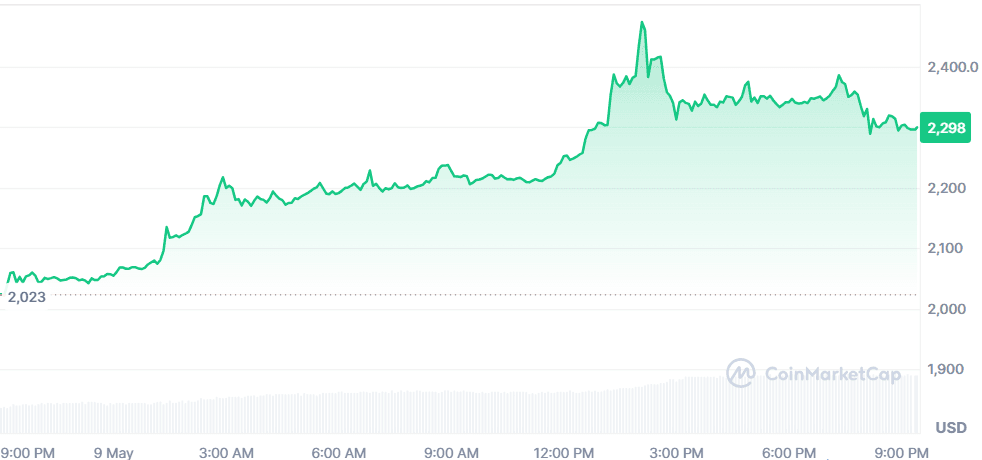

Ethereum (ETH)

Price Change (24H): +12.26% Current Price: $2,300.92

What happened today

Ethereum surged over 12% as its largest post-Merge upgrade, Pectra, officially went live on May 7. The hard fork introduced a 64x increase in validator staking caps (from 32 to 2048 ETH), new smart wallet capabilities (EIP-7702), and expanded blob capacity for scaling. Combined with the announcement of a 66% gas limit increase (from 36M to 60M), the network is poised for cheaper, faster transactions. Adding to bullish momentum, the Ethereum Foundation distributed $32.65 million in Q1 grants, reinforcing confidence in Ethereum’s developer and research ecosystem. Lastly, Coinbase launched 24/7 ETH futures trading, aligning U.S. markets with global activity and fueling retail + institutional interest.

Market Cap: $277.79B 24-Hour Trading Volume: $53.4B Circulating Supply: 120.73M ETH

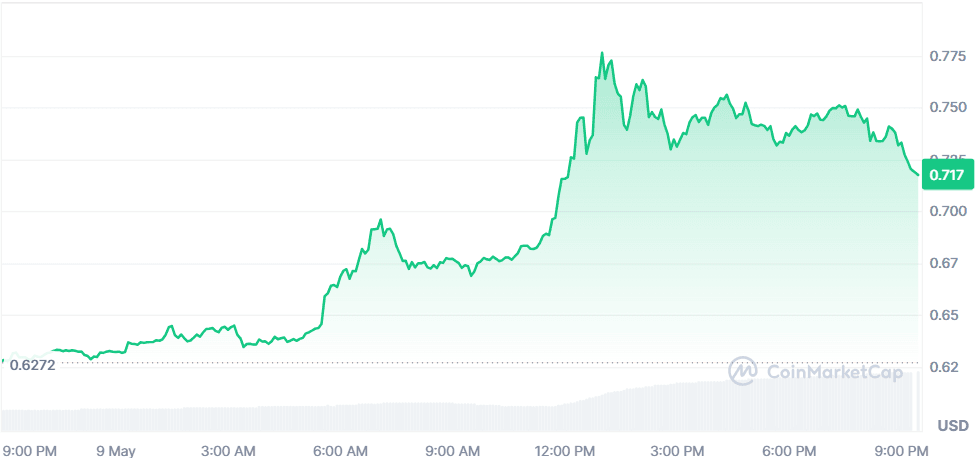

Pi (PI)

Price Change (24H): +13.77% Current Price: $0.7174

What happened today

Pi Coin spiked nearly 14% on rumors of a Binance listing, a mysterious 5B token supply jump, and a teased May 14 ecosystem update. While CoinMarketCap still lists 7B tokens in circulation, community sources cite a sudden increase to 12.7B Pi sparking speculation around staking unlocks or backend prep for CEX liquidity. On-chain data revealed Binance wallet activity on Pi’s mainnet, adding fuel to the listing rumors. Despite upcoming unlock risks, traders are bullish, targeting $0.80–$0.92 levels ahead of the May reveal.

Market Cap: $5.06B 24-Hour Trading Volume: $366.04M Circulating Supply: 7.06B PI

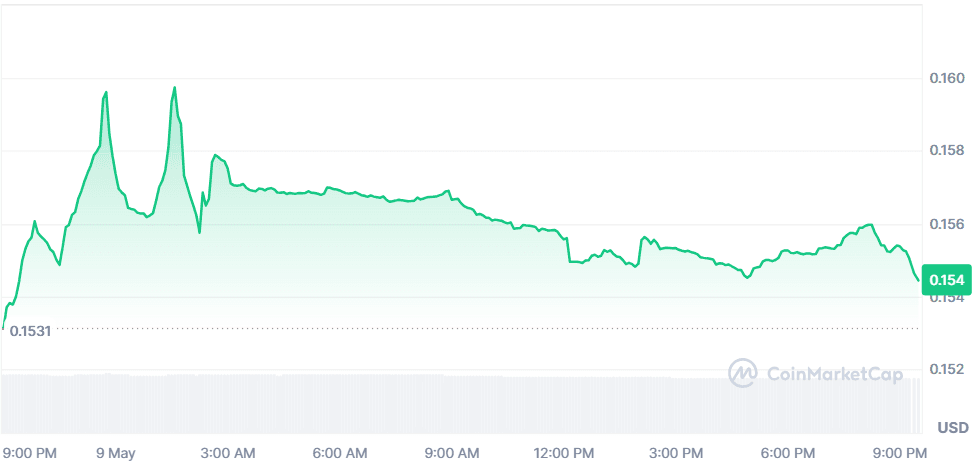

Saros (SAROS)

Price Change (24H): –0.36% Current Price: $0.1544

What happened today

Saros fell slightly despite announcing a major tech leap: its v3 DLMM model (Dynamic Liquidity Market Maker) will launch on Solana in mid-May. Developed with support from the TraderJoe DLMM team, this upgrade will enable customized liquidity ranges and better LP earnings positioning Saros as a key infrastructure layer in Solana DeFi. The beta launch will preview at Token 2049, and early stakers are promised airdrops and yield boosts. This move also reaffirms Saros’s commitment to transparency post-meme token scandals like the Kelsier collapse.

Market Cap: $180.1M 24-Hour Trading Volume: $16.63M Circulating Supply: 1.16B SAROS

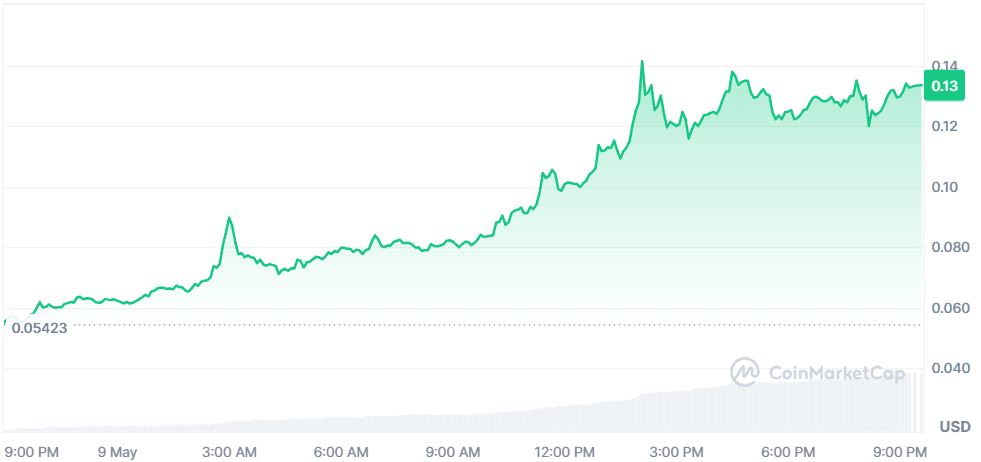

Moo Deng (MOODENG)

Price Change (24H): +134.85% Current Price: $0.1323

What happened today

MOODENG skyrocketed over 280% in a parabolic move, breaking out of a long-term correction structure. The surge pushed the price past resistance zones at $0.082 and $0.141. RSI hit extreme overbought levels (above 85), signaling a potential cooldown or retracement. Analysts expect a dip toward $0.075–$0.060 before the next leg up. If MOODENG holds above its key support, a sustained macro bull trend may be forming.

Market Cap: $131.04M 24-Hour Trading Volume: $730.11M Circulating Supply: 989.97M MOODENG

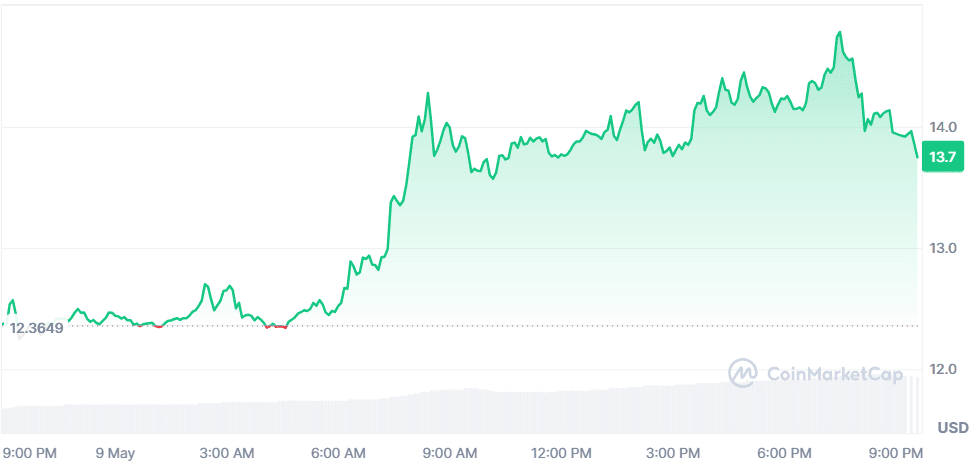

TRUMP (TRUMP)

Price Change (24H): +11.08% Current Price: $13.71

What happened today

The [Trump-themed memecoin}(https://yellow.com/asset/trump) rallied 11% as community engagement peaked ahead of a leaderboard contest closing on May 12 where top users win dinner with Donald Trump. Additionally, Trump’s declaration that “80% tariff on China seems right” spurred heavy news cycles and speculator buzz, tying political sentiment to token price. With memecoins gaining traction again, TRUMP saw renewed volume and social momentum.

Market Cap: $2.74B 24-Hour Trading Volume: $2.71B Circulating Supply: 199.99M TRUMP

Global Market Snapshot

Markets remain on edge as investors await the outcome of U.S.-China trade talks in Switzerland. President Trump’s bold 80% tariff comment added uncertainty, though optimism persists following the UK-U.S. deal. Wall Street hovered near March highs, while MSCI’s global index rose slightly. Bitcoin hit a new high for the year, breaching $103K, while Ethereum climbed above $2.3K post-Pectra upgrade. U.S. Treasury yields fell, the dollar dipped, and gold prices strengthened on safe-haven demand. Sectors like energy and tech outperformed, but caution is evident as investors brace for potential disruptions from prolonged trade negotiations.

Closing Thoughts

Today’s market action reflects a split but energetic investor sentiment. On one end, Ethereum’s technical milestone and funding commitments affirm long-term conviction in Layer 1 development. The rapid adoption of its Pectra upgrade and the anticipation around gas fee reductions signals strong institutional and builder interest. On the other, the surge in speculative plays like MOODENG and TRUMP, alongside Pi’s chaotic supply rumors, point to a retail crowd hungry for volatility and “what-if” upside. It’s clear both tech and hype sectors are alive, with very different drivers fueling them.

Global macro signals show a market in cautious optimism. The upcoming U.S.-China talks have investors in traditional markets trimming risk slightly, yet crypto seems unfazed, buoyed by innovation on Ethereum and momentum in Bitcoin. The memecoin rally, rising volumes, and consistent developer push suggest renewed participation across all layers of crypto from retail degens to protocol-level contributors. If the macro environment doesn’t shock the system, the setup going into mid-May looks poised for continued rotation and upside—especially in narratives tied to utility, scalability, and exchange access.