Bitcoin’s breakout to a new all-time high has sparked renewed energy across the crypto landscape, drawing altcoins like PEPE, BNB, TRUMP, and PI into the spotlight. Institutional demand is pouring into BTC through ETFs, while memecoins and infrastructure tokens are benefiting from a wave of renewed speculation and ecosystem growth. With macro volatility brewing, crypto assets ranging from meme coins to foundational layers are again becoming a magnet for capital rotation and retail excitement.

Bitcoin (BTC)

Price Change (24H): +4.25% Current Price: $109,166.62

What happened today

Bitcoin reached a new all-time high amid institutional demand, surging ETF inflows, and a broader shift in global monetary dynamics. Analysts like Fred Krueger are forecasting a seismic transformation in finance, where the USD could become partially backed by Bitcoin and gold. A record $667M net inflow into Spot Bitcoin ETFs, dominated by BlackRock’s IBIT, fueled optimism. Technical patterns like the impending “golden cross” and a $73B open interest in futures markets further point to a continuation of this bullish momentum.

Market Cap: $2.16T 24-Hour Trading Volume: $62.1B Circulating Supply: 19.86M BTC

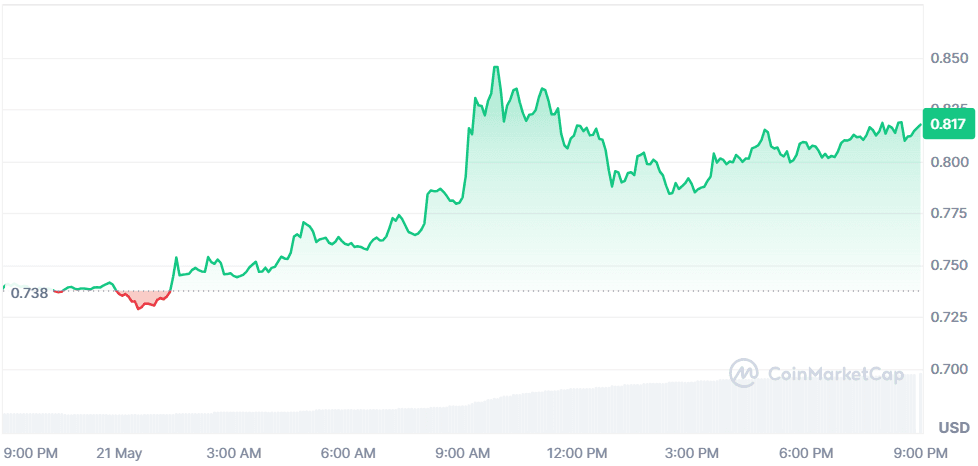

Pi Network (PI)

Price Change (24H): +10.53% Current Price: $0.8178

What happened today

Pi Network rallied after stabilizing from its earlier dip triggered by the announcement of a $100 million venture fund. While initial investor reaction was mixed, the fund aims to integrate Pi into real-world applications across fintech, AI, e-commerce, and more. With funding to be deployed primarily in Pi tokens, the initiative reflects a long-term strategy to grow Pi’s ecosystem, positioning it as a serious contender beyond its “mobile mining” reputation.

Market Cap: $5.89B 24-Hour Trading Volume: $406.79M Circulating Supply: 7.2B PI

Official Trump (TRUMP)

Price Change (24H): +10.80% Current Price: $14.62

What happened today

Hype surrounding the upcoming “Dinner with Trump” event on May 22 is fueling the TRUMP meme coin’s rally. Top holders, including high-profile crypto figures like Justin Sun, are expected to attend, creating a media storm and heightening interest. The overlap with Bitcoin Pizza Day is adding to the meme-fueled bullish momentum, aligning TRUMP with today’s pop-culture-infused crypto activity.

Market Cap: $2.92B 24-Hour Trading Volume: $1.84B Circulating Supply: 199.99M TRUMP

BNB (BNB)

Price Change (24H): +2.21% Current Price: $659.56

What happened today

BNB sees renewed interest following major developments across its ecosystem. THENA launched its V3.3 modular liquidity layer, and BUILDon(B) surpassed $100M in daily transactions. Despite legal pressures surrounding Binance’s arbitration clauses, ecosystem expansion and improved DeFi tooling are reinforcing BNB’s role as a dominant L1. Analysts forecast prices up to $1,275 by end-2025, further fueling long-term bullish sentiment.

Market Cap: $92.92B 24-Hour Trading Volume: $1.96B Circulating Supply: 140.88M BNB

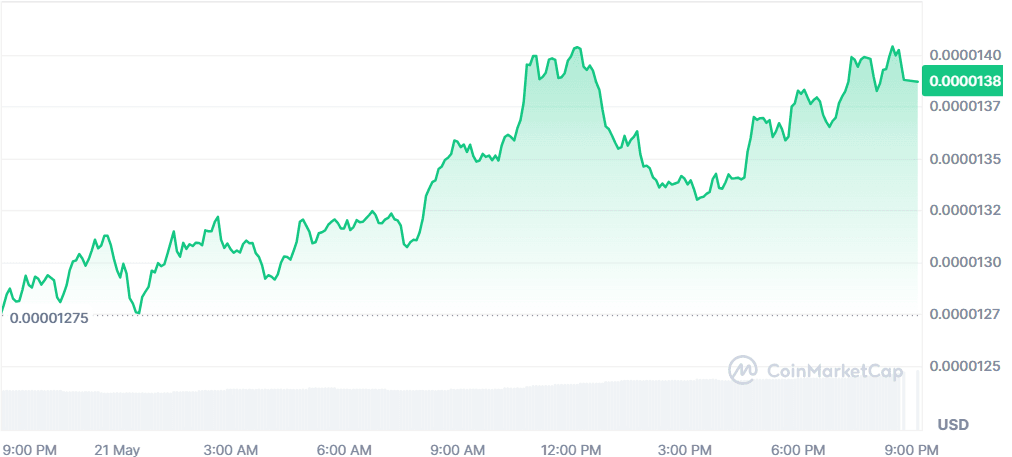

Pepe (PEPE)

Price Change (24H): +8.21% Current Price: $0.00001387

What happened today

PEPE’s price rallied from a key support level, rising over 5% amid increasing open interest ($599.98M) and a positive funding rate. Technical indicators point to a possible double-digit breakout. PEPE seems to ride the momentum of Bitcoin's rallies, a pattern repeated today, making its place on the trending list expected. With rising RSI and MACD strength, trader sentiment leans heavily bullish.

Market Cap: $5.83B 24-Hour Trading Volume: $1.76B Circulating Supply: 420.68T PEPE

Global Market Snapshot

Markets worldwide are on edge as the European Central Bank signals a “fundamental regime shift” in how global capital views U.S. assets. Spurred by tariffs and fiscal unpredictability, investor sentiment is shifting away from traditional safe havens like U.S. Treasuries toward assets like Bitcoin and gold. The ECB’s Financial Stability Review highlights how volatility and high valuations, previously warned about, are beginning to materialize.

UK inflation came in hot at 3.5%, pushing the pound up and keeping policymakers on alert. Meanwhile, SSE cut its clean energy investment by $4B due to macroeconomic uncertainty. Across Europe, equities opened lower, with energy and tech in the green but broader sentiment cautious.

Cisco CEO Chuck Robbins expressed optimism about Europe’s AI potential, announcing a major AI training hub in Paris. However, he also warned that the business community is grappling with uncertainty amid global policy ambiguity, particularly concerning U.S. tariffs.

Closing Thoughts

Investor sentiment is pivoting in both traditional and crypto markets. Bitcoin’s rally isn’t happening in isolation, it coincides with the ECB warning of a “regime shift” in how global capital views U.S. assets. Tariffs, inflation uncertainty, and credit downgrades are pushing institutions and individuals alike toward alternatives. The fact that spot ETFs are soaking up billions even amid equity volatility suggests that crypto, particularly BTC, is increasingly seen as a hedge rather than a gamble.

Meanwhile, the action across altcoins reveals shifting preferences: memecoins like PEPE and TRUMP are gaining traction through cultural relevance and community hype, while tokens like BNB and PI show that infrastructure and real-world application still matter. This mix of speculative fervor and foundational growth suggests a maturing but emotionally reactive market—one where users aren’t just chasing pumps, but responding to deeper anxieties in the global financial system.