Solana’s surge has set off a wave of renewed enthusiasm across infrastructure tokens, with XRP riding the legal clarity wave and Sui stealing the spotlight in the DeFi lane.

Pi and PEPE added to the energy, one banking on speculative listing hopes, the other riding technical momentum and meme-fueled rallies. This mix of coins, spanning serious infrastructure plays to retail favorites, hints at a market that’s not just recovering but reshuffling what value means in the current cycle.

Bitcoin (BTC)

Price Change (24H): +4.45% Current Price: $101,152.37

What happened today

Bitcoin blasted past the $100,000 mark, marking a major psychological milestone amid a flurry of bullish macro and policy developments. President Trump’s announcement of a U.S.-U.K. trade deal and Treasury Secretary Bessent’s planned talks with China have revived global risk sentiment, helping propel crypto markets upward. Meanwhile, the Federal Reserve’s decision to hold interest rates steady despite presidential pressure suggests stagflation concerns may be keeping monetary policy tight for now something investors see as Bitcoin-positive.

Adding to the momentum, New Hampshire became the first U.S. state to formally adopt a Bitcoin reserve strategy, while institutional flows surged into BlackRock’s IBIT ETF, which has now overtaken SPDR Gold Trust (GLD) in YTD inflows. Analysts from Standard Chartered, VanEck, and ARK Invest continue to raise BTC’s long-term price targets, reinforcing conviction that Bitcoin is becoming a strategic asset class, well beyond just a speculative instrument.

Market Cap: $2T 24-Hour Trading Volume: $61.8B Circulating Supply: 19.86M BTC

Solana (SOL)

Price Change (24H): +9.70% Current Price: $159.73

What happened today

Solana soared on the back of the SNS (Solana Name Service) token launch and a massive airdrop allocating 40% of its total supply to .sol domain holders. The rebranding from Bonfida to SNS reinvigorated digital identity services on Solana, setting the stage for new governance and incentive models. Hashflow also integrated its RFQ liquidity with Kamino on Solana, enhancing DeFi trading efficiency.

On top of this, Robinhood’s plan to tokenize U.S. stocks in the EU, possibly using Solana, drove investor excitement and speculation around Solana’s growing role in traditional asset tokenization.

Market Cap: $82.88B 24-Hour Trading Volume: $6.51B Circulating Supply: 518.89M SOL

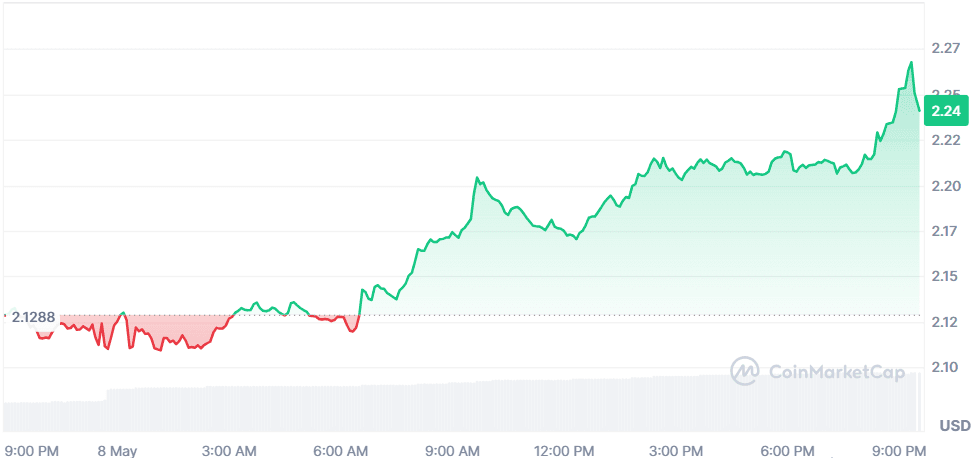

XRP (XRP)

Price Change (24H): +5.58% Current Price: $2.24

What happened today

XRP builds momentum builds as the SEC and Ripple inch closer to a full settlement. The SEC is reportedly ready to lift the injunction on institutional XRP sales and withdraw its appeal, which would affirm Judge Torres’ decision that secondary XRP sales are not securities.

A formal Commission vote is expected today, May 8. If passed, this could clear the way for ETFs and broader institutional adoption. XRP also achieved a major win as its penalty was reduced from $125M to $50M—further signaling regulatory thaw and investor confidence.

Market Cap: $131.11B 24-Hour Trading Volume: $4.98B Circulating Supply: 58.5B XRP

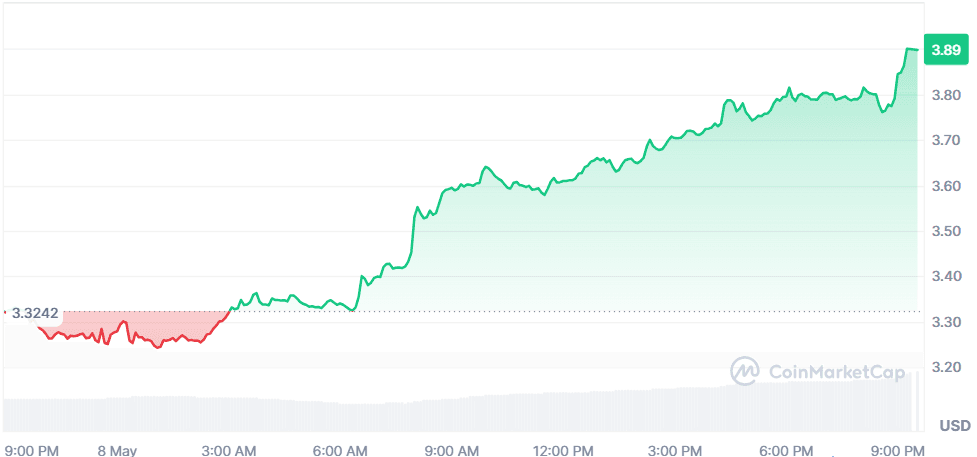

Sui (SUI)

Price Change (24H): +17.77% Current Price: $3.88

What happened today

Sui surged after crossing 10 billion total transactions, highlighting major adoption and DeFi traction. The network’s TVL has hit $1.77B with daily DEX volume around $488M, suggesting increased user activity and accumulation. Sui Basecamp 2025 also wrapped up, showcasing tech updates and rumored high-profile collaborations (including “Pokemon”) which further fueled bullish sentiment. The event emphasized decentralization, scalability, and strong developer engagement—positioning Sui near the top 10 coins by market cap.

Market Cap: $12.96B 24-Hour Trading Volume: $2.64B Circulating Supply: 3.33B SUI

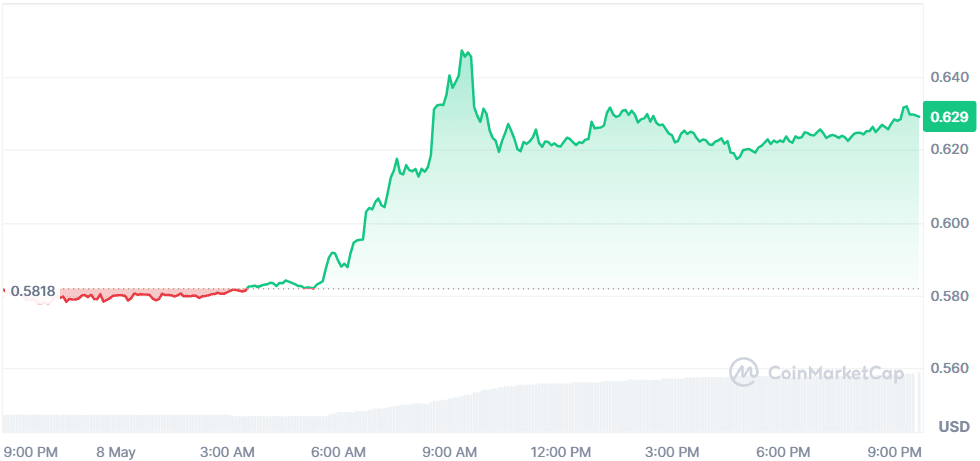

Pi (PI)

Price Change (24H): +8.64% Current Price: $0.6290

What happened today

PI rose as anticipation builds for a major announcement scheduled on May 14 at the Consensus Summit in Toronto. Rumors of an upcoming Binance listing intensified after test transactions were spotted from Binance wallets on the Pi blockchain. Technical indicators like MACD are flashing bullish signals, though recent token unlocks have caused some volatility. The token is nearing the $0.70 resistance; if it breaks, bulls are eyeing $0.90 and $1.00 as next targets.

Market Cap: $4.43B 24-Hour Trading Volume: $137.14M Circulating Supply: 7.04B PI

Pepe (PEPE)

Price Change (24H): +23.99% Current Price: $0.00001002

What happened today

PEPE rallied nearly 24% after completing a macro correction and initiating a bullish wave count. The meme token broke out from a descending channel, reclaimed prior highs, and is now targeting $0.0000108 as immediate resistance. RSI has returned above 60, and if momentum holds, the price could climb to $0.0000141 or higher. The structure remains bullish as long as PEPE stays above $0.0000083, making it one of the most actively traded coins today.

Market Cap: $4.21B 24-Hour Trading Volume: $1.16B Circulating Supply: 420.68T PEPE

Global Market Snapshot

Markets rallied today with the Dow jumping over 500 points after Trump unveiled a new U.K. trade deal, fueling optimism about broader tariff rollbacks.

Meanwhile, Bitcoin surged past $100K, and Standard Chartered revised its BTC forecast upward. In China, however, investor sentiment remains cautious despite new stimulus efforts, as trade tensions and disappointing policy impact weigh heavy. With the SEC easing its grip on crypto enforcement and global trade talks back on the table, markets appear to be balancing caution with selective optimism.

Closing Thoughts

Across both global and crypto markets, sentiment is cautiously bullish. Equities responded positively to Trump’s U.K. trade deal, and Bitcoin’s climb past $100K is reinforcing flows into risk assets. But deeper than the headlines, today’s winners show a market rewarding clarity and traction: XRP’s institutional future is looking brighter, Solana is benefiting from real integrations like Robinhood and SNS, and Sui is gaining credibility through hard metrics like 10B transactions and $1.7B TVL. Meanwhile, PEPE’s chart structure and Pi’s listing rumors show that retail euphoria still has a strong pulse, especially when framed against a rising BTC baseline.

Sector-wise, DeFi and real-world asset tokenization are clearly heating up. From Robinhood building tokenized stock rails on Solana to Sui’s Basecamp momentum, institutional-grade infrastructure is gaining mindshare again. At the same time, retail-driven tokens like PEPE and Pi prove that narratives and accessibility still drive participation. The market isn’t just moving up, it’s moving smart.