HYPER Token Soars 321% as BTC Breaks $113,000 Barrier in ETF Rally

As Bitcoin crossed a fresh all-time high and altcoins rallied behind it, today’s market action proved just how quickly momentum can return across sectors. Hyperlane (HYPER) led the charge with a parabolic breakout after its South Korean exchange debut, while PENGU soared on ETF buzz and whale demand.

Meanwhile, BTC hit new records driven by massive institutional inflows, SUI capitalized on DeFi expansion with its tBTC integration, and PI rebounded off key technical zones. It’s a day that showcased how catalysts whether listings, ETFs, or ecosystem upgrades can still light a fire under both majors and small caps.

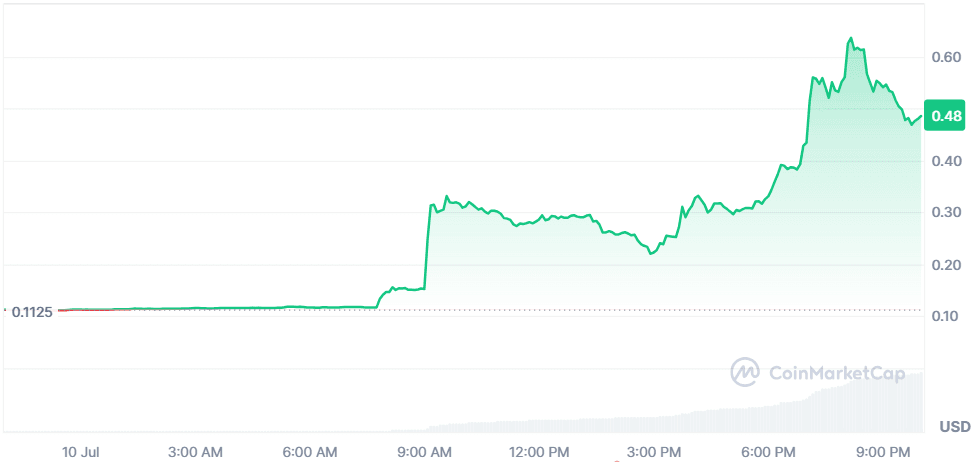

Hyperlane (HYPER)

Price Change (24H): +321.42% Current Price: $0.4736

What happened today

HyperlaneAs Bitcoin crossed a fresh all-time high and altcoins rallied behind it, today’s market action proved just how quickly momentum can return across sectors. Hyperlane (HYPER) led the charge with a parabolic breakout after its South Korean exchange debut, while PENGU soared on ETF buzz and whale demand. Meanwhile, BTC hit new records driven by massive institutional inflows, SUI capitalized on DeFi expansion with its tBTC integration, and PI rebounded off key technical zones. It’s a day that showcased how catalysts—whether listings, ETFs, or ecosystem upgrades—can still light a fire under both majors and small caps. exploded by over 320% following dual listings on major South Korean exchanges Upbit and Bithumb. These platforms are known to drive surges in trading volume, and this event was no exception, 24h volume skyrocketed by 2,548% to $832M. Technicals reinforced the rally with a breakout above the $0.35 resistance. Traders piled in as HYPER pushed past its ATH, with RSI still leaving room for upside and MACD confirming bullish strength.

Market Cap: $82.98M 24-Hour Trading Volume: $863M Circulating Supply: 175.2M HYPER

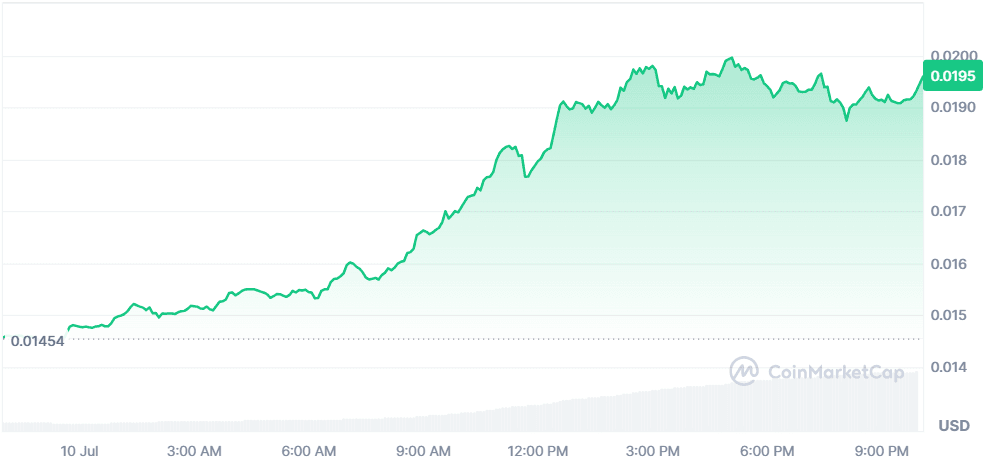

Pudgy Penguins (PENGU)

Price Change (24H): +34.11% Current Price: $0.01958

What happened today

PENGU surged after the SEC formally acknowledged the Canary Spot ETF filing, which combines PENGU tokens and Pudgy Penguins NFTs mirroring Bitcoin ETF dynamics that historically fuel rallies. Technically, PENGU confirmed a cup-and-handle breakout with a projected target of $0.0318. Whale accumulation added more strength, with holdings up 21% and exchange supply dropping, suggesting reduced sell pressure. Open interest also spiked, hinting at leveraged long bets.

Market Cap: $1.23B 24-Hour Trading Volume: $1.01B Circulating Supply: 62.86B PENGU

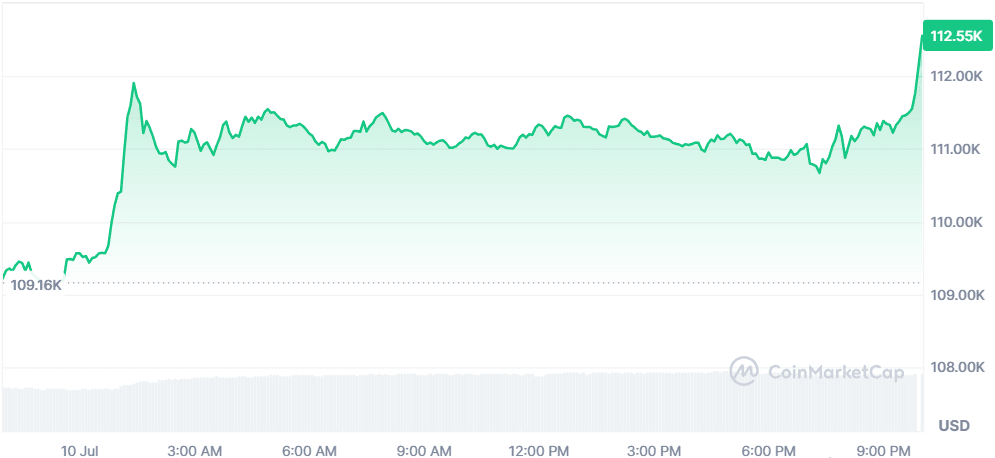

Bitcoin (BTC)

Price Change (24H): +3.75% Current Price: $113,050.09

What happened today

Bitcoin set a new all-time high of $113,050 as ETF-driven capital inflows topped $50B in net investments, led by BlackRock's IBIT. Whales are back in accumulation mode while retail investors take profits. Meanwhile, corporate treasuries continue adopting BTC, with Japan’s Metaplanet acquiring $237M worth. Trump’s “pro-Bitcoin” policy remarks, alongside short liquidations of $200M, helped push BTC through key resistance levels.

Market Cap: $2.23T 24-Hour Trading Volume: $61.49B Circulating Supply: 19.89M BTC

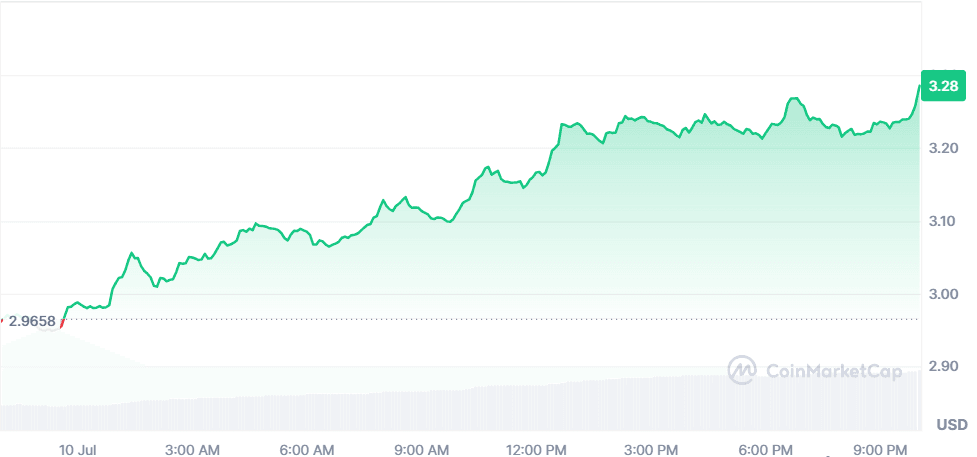

Sui (SUI)

Price Change (24H): +10.77% Current Price: $3.28

What happened today

SUI broke out of a multi-week downtrend after the launch of Threshold Network’s tBTC on Sui, bringing $500M+ in BTC liquidity to its DeFi ecosystem. This positions SUI as a central hub for Bitcoin DeFi. Bluefin's rollout of institutional-grade HFT support added to the bullish fuel, alongside positive coverage from Grayscale. Analysts project a target of $5 if momentum holds.

Market Cap: $11.34B 24-Hour Trading Volume: $1.4B Circulating Supply: 3.45B SUI

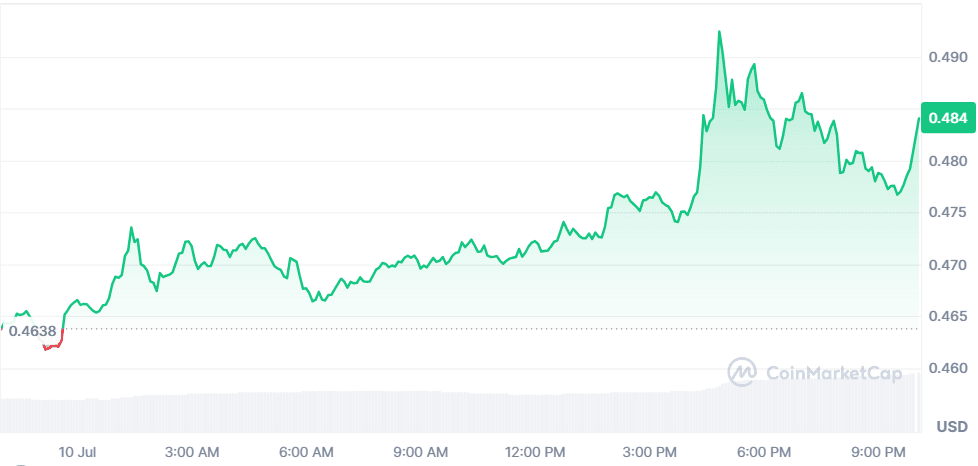

Pi (PI)

Price Change (24H): +4.32% Current Price: $0.4842

What happened today

PI bounced off the $0.44–$0.47 demand zone, rebounding from oversold levels. Negative funding rates combined with $1T+ open interest suggest potential for a short squeeze. Despite concerns over token unlocks (376M PI on exchanges), adoption of Pi App Studio has helped maintain market optimism. Traders are eyeing $0.50 as a key resistance level to reclaim bullish momentum.

Market Cap: $3.71B 24-Hour Trading Volume: $97.86M Circulating Supply: 7.67B PI

Global Market Snapshot

Equity markets shrugged off tariff fears as the “TACO trade” (Trump Always Chickens Out) narrative gained traction. The STOXX Europe 600 rose for the fourth consecutive session (+0.5%), while the FTSE 100 soared to a record high driven by mining stocks benefiting from copper tariff news. Investors are pricing in hopes of a favorable U.S.–EU trade agreement and minimal global growth disruption.

Across the Atlantic, U.S. indices extended gains. The Dow added 235 points, the S&P 500 edged up 0.2%, and the Nasdaq hit a new record high. Copper prices surged again as a 50% U.S. tariff on imports are confirmed, fueling a rally in mining equities. Bitcoin continued to lead the crypto market higher, supported by record-breaking ETF inflows and renewed institutional interest. Risk appetite remains strong across equities and crypto, despite rising geopolitical noise.

Closing Thoughts

Investor sentiment remains broadly risk-on, even as trade tension headlines swirl. In global equities, traders brushed off fresh tariff announcements with confidence that diplomacy or delay is still on the table.

Mining stocks exploded higher on the copper tariff news, showing sector-specific optimism despite macro noise. In the U.S., strong ETF inflows and earnings optimism pushed indices back to record levels, highlighting how much liquidity is still chasing growth narratives.

In crypto, all eyes are on interoperability and Bitcoin DeFi. The day’s top performers, HYPER and SUI, are both part of the cross-chain and infrastructure trend, while BTC’s rally confirms institutional conviction. Even memecoins like PENGU are drawing in ETF enthusiasm, mimicking the 2024 Bitcoin ETF cycle. As the market recalibrates for a potential second-half rally, narratives with real infrastructure backing or major exchange access are seeing the strongest participation.