Bitcoin’s new all-time high has injected fresh energy into the market, with altcoins and even controversial memecoins following in its wake. While BTC’s rally to $111,000 has captured headlines, the real story lies in how different sectors are responding to shifting investor appetite.

Ethereum is gaining traction with institutional inflows and tech upgrades, ICP is rallying on native cross-chain breakthroughs, and BUILDon is riding a speculative wave fueled by political endorsements.

Meanwhile, Sui’s ecosystem faces a reckoning after a major DeFi exploit, just as global financial markets reel from a bond rout sparked by rising U.S. yields.

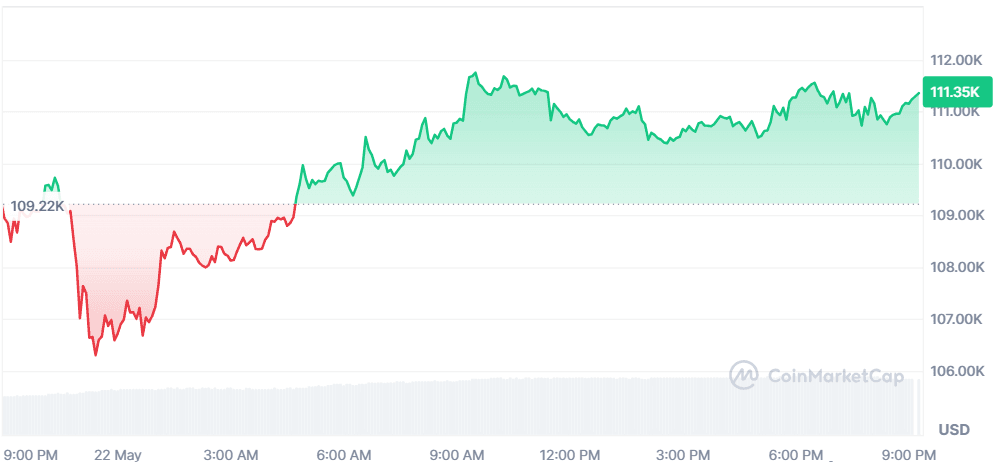

Bitcoin (BTC)

Price Change (24H): +2.54% Current Price: $111,425.21

What happened today

Bitcoin shattered its previous record and soared above $111,000 for the first time, driven largely by surging institutional demand. This latest all-time high signals a shift in market dynamics, where institutional players—not retail—are steering the rally. Catalysts include the Strategic Bitcoin Reserve Bill passing in Texas, BlackRock’s IBIT ETF recording a $530M inflow in one day, and rising investor interest amid speculation of Fed rate cuts. Bitcoin ETFs are absorbing BTC faster than it can be mined, suggesting long-term conviction in its value as a store of wealth.

Market Cap: $2.21T 24-Hour Trading Volume: $88.95B Circulating Supply: 19.86M BTC

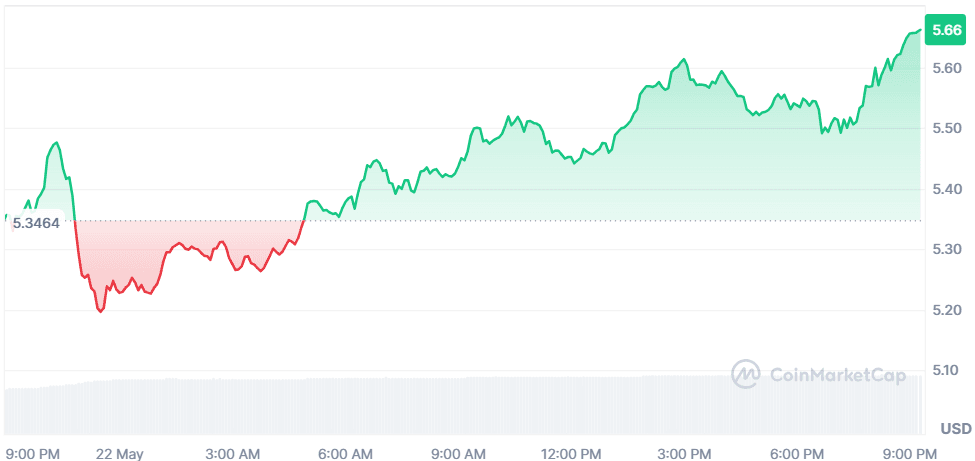

Internet Computer (ICP)

Price Change (24H): +5.47% Current Price: $5.64

What happened today

Internet Computer jumped over 5% as investors reacted positively to its novel cross-chain bridging tech. Unlike traditional third-party bridges, ICP uses Chain-Key cryptography to enable secure, native transfers of wrapped assets like ckBTC, ckETH, and ckUSDT. This eliminates common vulnerabilities tied to bridge hacks, which have cost the market over $2B. With transaction speeds under a second and negligible fees, ICP is increasingly attractive for DeFi and gaming ecosystems seeking secure cross-chain operability.

Market Cap: $3.01B 24-Hour Trading Volume: $91.05M Circulating Supply: 533.49M ICP

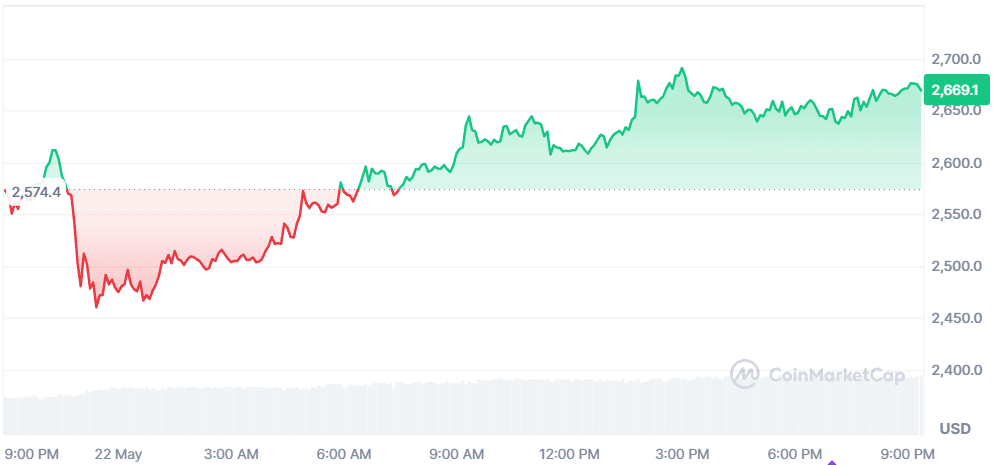

Ethereum (ETH)

Price Change (24H): +4.22% Current Price: $2,668.79

What happened today

Ethereum surged over 4% amid two major developments. First, Vitalik Buterin suggested the gas limit could expand 10x–100x, allowing for unprecedented scalability. Second, Ethereum led crypto fund inflows for the fifth straight week, as the recent Pectra upgrade and new leadership under Tomasz Stańczak boosted investor confidence. With zkVM proving advancing and institutional capital flowing in, Ethereum’s long-term appeal as the "Swiss Army Knife" of crypto remains intact.

Market Cap: $322.19B 24-Hour Trading Volume: $38.09B Circulating Supply: 120.72M ETH

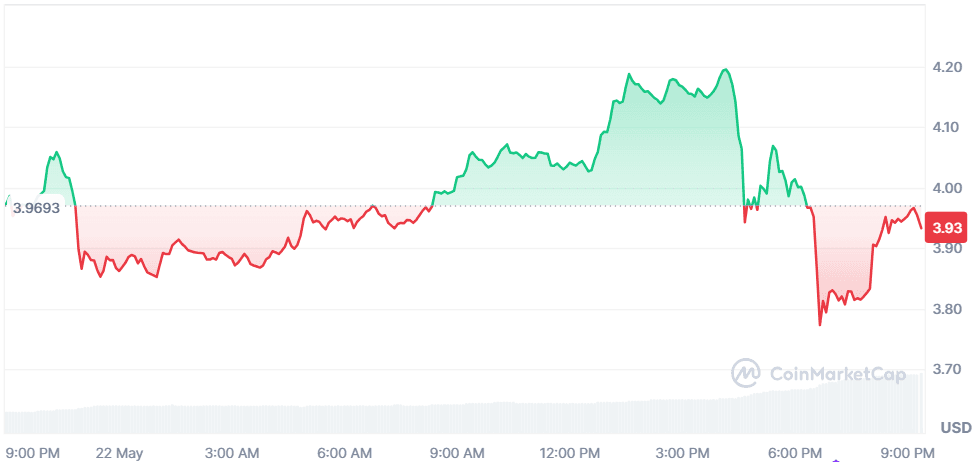

Sui (SUI)

Price Change (24H): –1.05% Current Price: $3.92

What happened today

Sui dipped slightly after a mixed day of headlines. On the upside, OKX launched xBTC support on Sui, enhancing Bitcoin utility across its DeFi ecosystem. However, the positive momentum was overshadowed by a $260M exploit targeting Cetus Protocol, one of Sui’s core DeFi apps. The breach drained over 32M SUI and crashed token prices across several pools, raising critical concerns about the network’s security infrastructure. Binance has stepped in to support the ecosystem, but sentiment remains cautious.

Market Cap: $13.11B 24-Hour Trading Volume: $3.59B Circulating Supply: 3.33B SUI

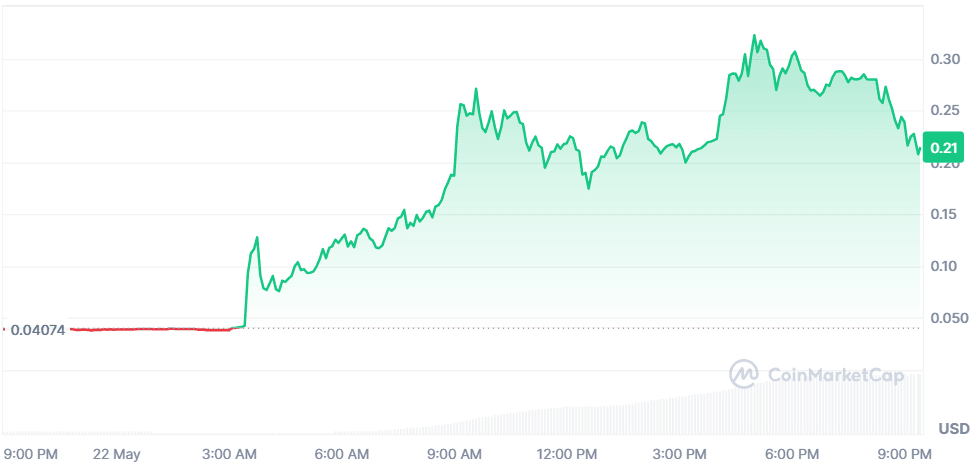

BUILDon (B)

Price Change (24H): +428.92% Current Price: $0.2134

What happened today

BUILDon skyrocketed by over 400% after receiving public support from Trump’s WLFI project and a high-profile listing on Binance Alpha. WLFI bought $25K worth of $B and openly backed it as part of its USD1 stablecoin ecosystem. Speculation grew that this move is part of a $2B coordinated campaign involving Binance and WLFI to promote USD1. With smart money piling in, $B accounted for over 90% of USD1’s volume and saw its market cap jump from $40M to over $213M in a single day. However, questions about long-term stability and regulatory scrutiny remain.

Market Cap: $213.48M 24-Hour Trading Volume: $1.21B Circulating Supply: 1B B

Global Market Snapshot

A global bond sell-off is accelerating as U.S. Treasury yields soar past 5.1%, stoking fears about mounting fiscal deficits and triggering a reassessment of fixed income portfolios worldwide. Investors are dumping long-duration bonds not only in the U.S., but also in Japan and Europe, where yields have surged to multi-decade highs. The shift is fueled by concerns over debt sustainability, credit downgrades, and political risk, especially after Trump’s controversial tax bill. Meanwhile, emerging markets like Indonesia and Malaysia are benefiting from the exodus, offering higher yields and attracting capital from increasingly cautious global investors.

Closing Thoughts

The broader market mood reflects both risk appetite and risk aversion coexisting uneasily. On one hand, Bitcoin's record-breaking run, massive ETF inflows, and Ethereum’s gas scalability proposals show that confidence in core blockchain assets is strengthening, particularly among institutional players.

On the other, the Sui ecosystem’s vulnerability post-hack and BUILDon’s meme-driven rise underline that retail speculation still thrives—especially where narratives are loud, even if fundamentals are weak. DeFi remains split between innovation and risk.

Globally, a sell-off in U.S., Japanese, and European long bonds suggests that fixed income is no longer seen as the safety net it once was. With traditional markets gripped by fiscal worries, the crypto space appears to be absorbing some of that dislocated capital. Institutions are consolidating around blue chips like BTC and ETH, while opportunistic capital is flowing into high-volatility plays. As legacy markets wobble, crypto—ironically—looks more stable in parts, especially when supported by tangible developments or regulatory clarity.