After a relatively quiet stretch, today’s charts lit up with action across both majors and speculative plays. Ethereum grabbed headlines with institutional inflows and the Pectra upgrade buzz, while ether.fi gained traction through DeFi integrations.

ConstitutionDAO’s dormant PEOPLE token made an inexplicable comeback, Pi rallied on anticipation of an ecosystem announcement, and GRASS surged past $2, signaling a potential altseason flicker. From legacy chains to newer narratives, the spread of gains hints at growing risk appetite returning to crypto.

Ethereum (ETH)

Price Change (24H): +1.04% Current Price: $2,582.27

What happened today

Ethereum continues to rally following the recent launch of the Pectra Upgrade. This upgrade enhances Ethereum's core protocol with smart account functionality, enabling gasless transactions and streamlining developer onboarding. Additionally, a major bullish signal came from Abraxas Capital, which acquired $477M worth of ETH over six days.

This large institutional move, marked by exchange withdrawals and market liquidity shifts, suggests renewed confidence in ETH. Analysts believe Layer-2 projects like Arbitrum, Starknet, and Mantle stand to gain from Pectra’s improvements, increasing adoption across the Ethereum ecosystem.

Market Cap: $311.75B 24-Hour Trading Volume: $37.5B Circulating Supply: 120.72M ETH

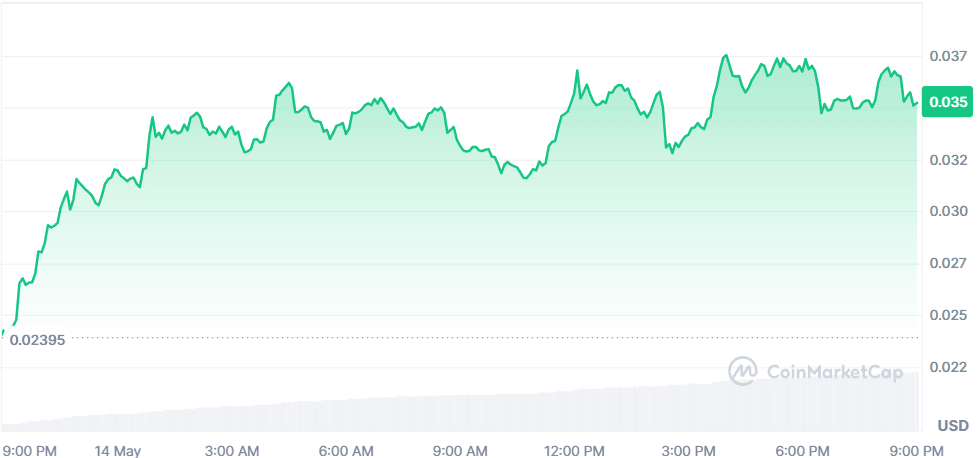

ConstitutionDAO (PEOPLE)

Price Change (24H): +46.65% Current Price: $0.03542

What happened today

Despite the project's official sunset in 2021 and the token having no utility or governance rights, PEOPLE surged nearly 47%. The sudden spike appears unprompted by any official news, though it may be driven by speculative interest or community-led efforts to repurpose the token. The smart contract still allows for redemptions via Juicebox at a fixed 1 ETH : 1,000,000 PEOPLE ratio. Caution is advised as this rally lacks fundamentals and may be short-lived.

Market Cap: $179.23M 24-Hour Trading Volume: $780.98M Circulating Supply: 5.06B PEOPLE

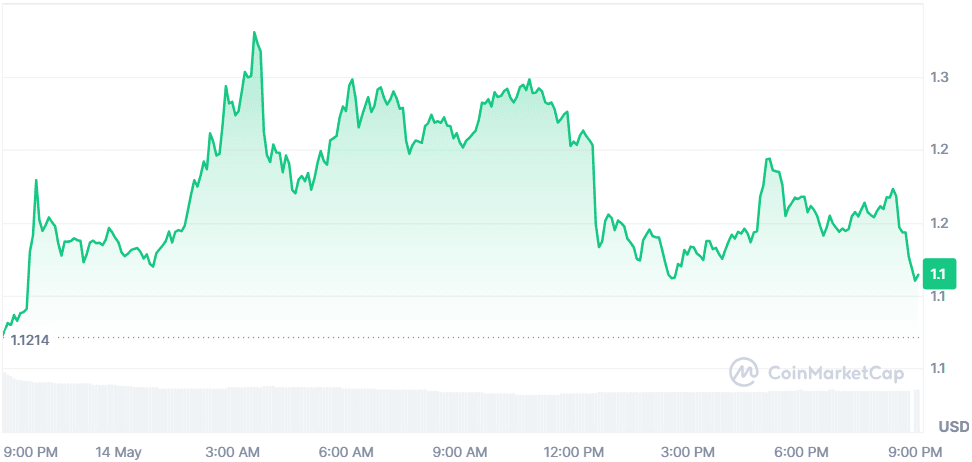

Pi Network (PI)

Price Change (24H): +3.34% Current Price: $1.16

What happened today

Pi Network’s token saw a mild uptick likely due to anticipation around an ecosystem announcement scheduled for May 14, which has yet to be delivered. The project is gaining attention for its unique mobile mining model, KYC-linked mainnet, and lock-up incentives. With over 7.1 billion PI in circulation and a fully verified user base, interest is building ahead of the open mainnet launch later in 2025. However, price action today may be a result of speculative accumulation.

Market Cap: $8.28B** 24-Hour Trading Volume:** $780.78M Circulating Supply: 7.11B PI

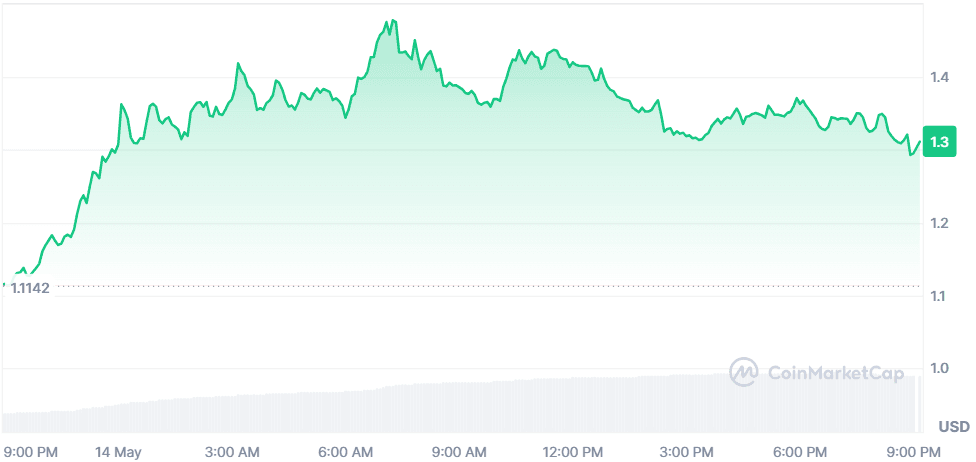

ether.fi (ETHFI)

Price Change (24H): +17.89% Current Price: $1.31

What happened today

ETHFI rallied nearly 18% amid a flurry of ecosystem integrations. ether.fi’s staking derivative, weETH, was added as margin collateral on Polynomial and included in high-yield vaults on Lagoon Finance and Turtle Clubhouse. The increased utility of weETH, paired with 4x EtherFi points and APR incentives (up to 10%), has driven both user activity and token demand. These strategic partnerships are boosting ETHFI’s reputation in the DeFi staking and margin trading sectors.

Market Cap: $364.3M 24-Hour Trading Volume: $526M Circulating Supply: 276.96M ETHFI

Grass (GRASS)

Price Change (24H): +36.28% Current Price: $2.18

What happened today

GRASS broke past the $2 mark for the first time since March, posting a strong 36% surge. The move appears technically driven, with the token breaking out of a long consolidation range. Macro tailwinds from easing U.S.-China trade tensions and positive inflation data have revived risk-on sentiment across altcoins. With open interest steadily rising and RSI just crossing the overbought threshold, traders are eyeing a potential new ATH. Still, a pullback to $2 is possible if momentum fades.

Market Cap: $532.54M 24-Hour Trading Volume: $176.29M Circulating Supply: 243.9M GRASS

Global Market Snapshot

Markets took a breather today after a fierce rally that saw tech stocks and the “Magnificent 7” lead gains. The S&P 500 hovered near the flatline, while the Nasdaq continued to climb on the back of Nvidia’s chip exports to Saudi Arabia and AMD’s $6B buyback. Investors welcomed a temporary U.S.-China tariff truce, driving renewed optimism and appetite for risk assets.

AI and semiconductor plays remain in focus, with institutional activity heating up in both equity and crypto markets. Meanwhile, Super Micro Computer soared 17% on Saudi data center deals, and eToro is set for IPO debut. U.S. rate cut hopes, Middle East investment pledges, and tech earnings may shape the next leg of this run.

Closing Thoughts

Market sentiment today reflects cautious optimism, with both institutional and retail traders stepping off the sidelines. On the crypto front, Ethereum’s rebound underscores growing confidence in core infrastructure, while ether.fi and GRASS tap into DeFi and AI narratives that continue to excite users.

Even GRASS and PEOPLE, less conventional picks, saw unusual volume, hinting at a speculative undercurrent that often precedes broader altcoin rallies. This blend of fundamentals and hype suggests investors are again willing to explore risk across the spectrum, not just play it safe with top tokens.

Globally, easing trade tensions and AI-linked investments from the Middle East have helped stabilize equities. The “Magnificent 7” continue to steer Wall Street, while fresh capital flows into tech-heavy names and altcoins alike. The quiet before the summer macro storms? Maybe. But today, crypto and equities both showed that investor attention is shifting from fear to opportunity one at a time.