Altcoin momentum returned to the spotlight today with SEI, APT, and RENDER leading the charge—boosted by narratives spanning ETFs, gaming chain expansion, and AI compute. BLUM made its debut with exchange listings and airdrop buzz, while XRP dipped on lingering regulatory drag despite its ETF exposure. Across the board, traders leaned into high-beta assets with clear catalysts, even as global equity markets adjusted to inflation beats and geopolitical tech crackdowns.

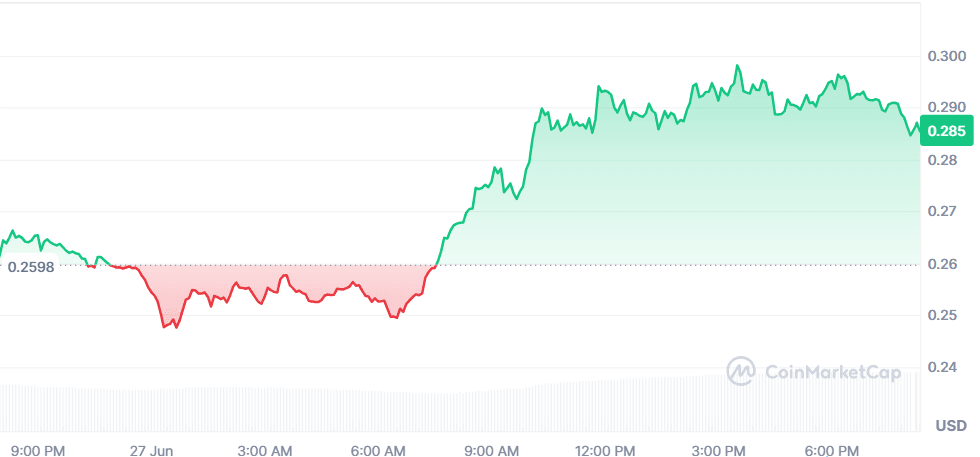

SEI (SEI)

Price Change (24H): +6.52% Current Price: $0.2817

What happened today

SEI surged as it became the top gainer among major coins, up over 50% in the past week. Momentum was driven by:

-

Wyoming selecting SEI for its stablecoin pilot, boosting institutional credibility.

-

Snapshot for the v2 airdrop.

-

An increased staking APY of 9%.

Record DEX volumes ($60M+) and TVL crossing $570M, marking SEI as a leading gaming chain. The rally is believed to be spot-driven, indicating strong organic demand rather than leveraged speculation.

Market Cap: $1.56B 24-Hour Trading Volume: $633.41M Circulating Supply: 5.55B SEI

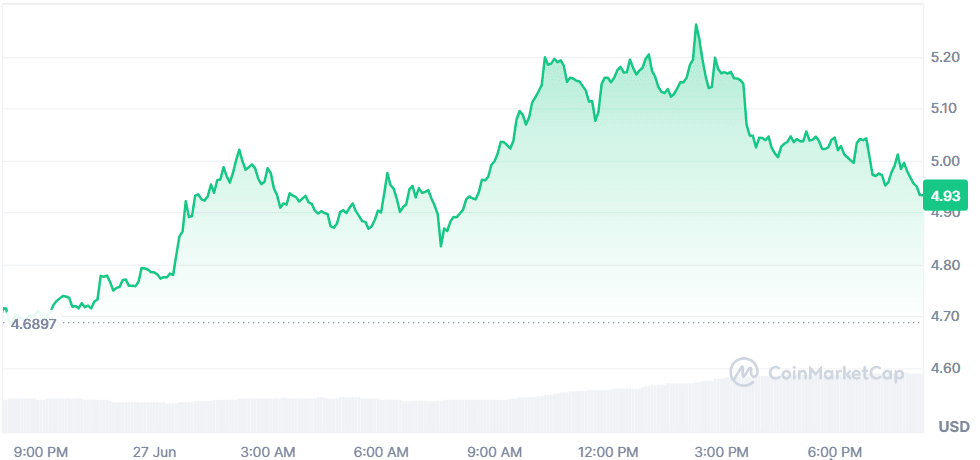

Aptos (APT)

Price Change (24H): +4.32% Current Price: $4.90

What happened today

APT climbed after Bitwise amended ETF filings for Aptos and Dogecoin, boosting approval odds to 90%. This reflects increased regulatory engagement and rising market confidence. Additionally, Aptos led June’s staking surge (up 18%), outpacing Sui and Solana, owing to its parallel execution, validator strength, and Move-based architecture.

Market Cap: $3.15B 24-Hour Trading Volume: $444.46M Circulating Supply: 644.16M APT

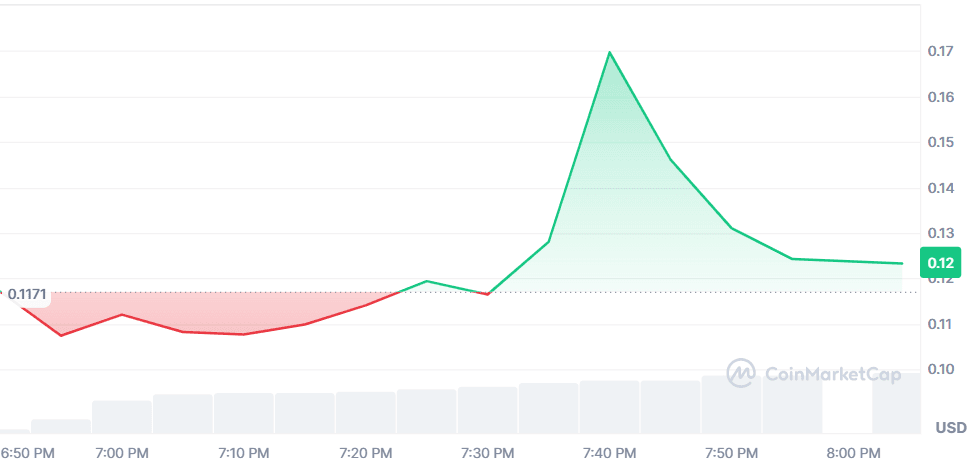

Blum (BLUM)

Price Change (24H): +3.52% Current Price: $0.1173

What happened today

Blum’s TGE and exchange listings (CoinW, Bitget) sparked immediate price discovery.

-

1.3M users became eligible for airdrops, with 30% unlocked at launch.

-

CoinW offered $13,000 in USDT trading incentives.

-

Sector buzz around TON-based apps and Blum’s Q3 roadmap (AI tools, Memepad, multichain) kept interest high despite airdrop backlash.

Market Cap: $0 24-Hour Trading Volume: $9.24M Circulating Supply: 0 BLUM

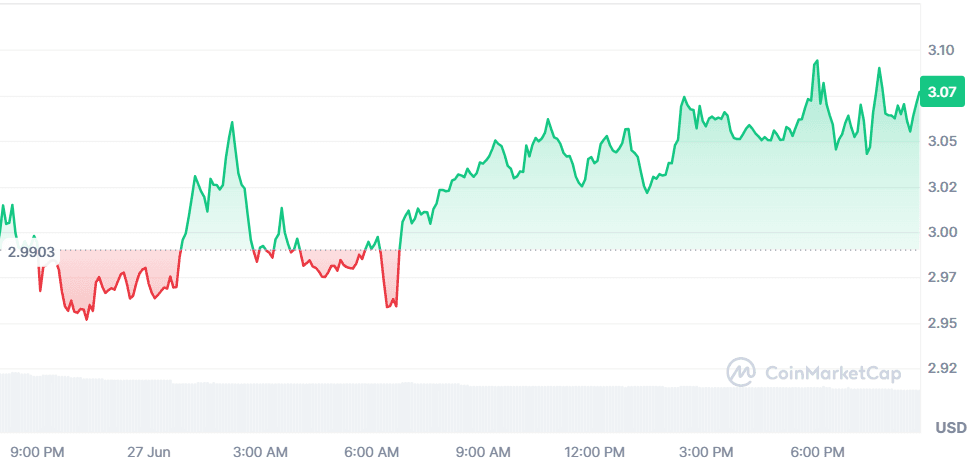

Render (RNDR)

Price Change (24H): +2.84% Current Price: $3.07

What happened today

Render rebounded from oversold technical levels, with RSI climbing and bullish setups eyeing $3.20–$3.40. Catalysts included:

-

NYC DePIN event focused on GPU compute infrastructure.

-

AI/DePIN narrative rotation gaining steam.

-

A new Hollywood partnership (Andrey Lebrov) boosting visibility.

-

Migration to Solana is now paying off with 99% lower fees and improved network performance.

Market Cap: $1.59B 24-Hour Trading Volume: $61.1M Circulating Supply: 518.12M RNDR

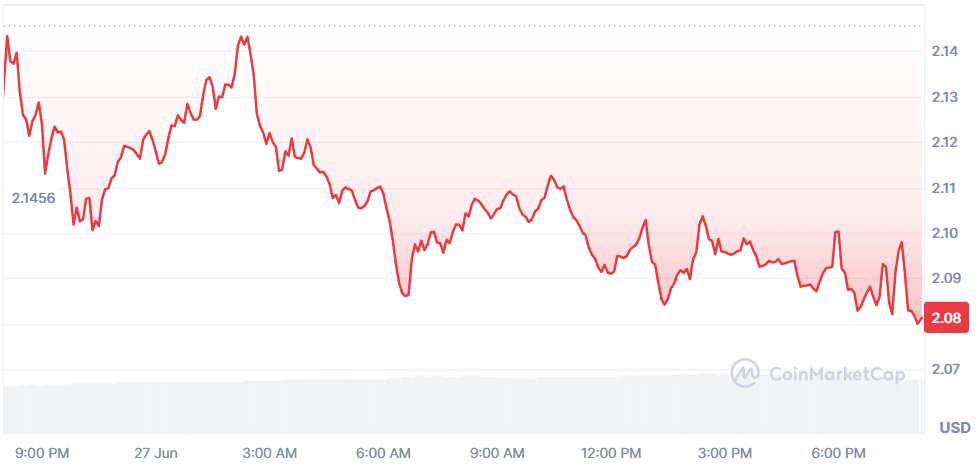

XRP (XRP)

Price Change (24H): –2.38% Current Price: $2.07

What happened today

Despite the ETF approval wave lifting XRP in recent weeks, the token dipped after Judge Torres denied Ripple’s $50M settlement with the SEC. The permanent injunction on institutional sales remains. Retail trading continues, but institutional limitations weigh on broader adoption. Nonetheless, ETF offerings (Grayscale, Bitwise, Purpose, etc.) are expanding access globally, reinforcing XRP's role in cross-border finance.

Market Cap: $122.44B 24-Hour Trading Volume: $2.97B Circulating Supply: 59B XRP

Global Market Snapshot

Global equities extended gains this Friday as optimism around trade agreements and ETF approvals drove risk-on sentiment. The S&P 500 and Nasdaq both hit fresh all-time highs, powered by renewed hopes of a finalized U.S.-China trade framework and core inflation data that, while slightly above expectations (2.7%), didn’t derail investor confidence. AI and EV sectors saw significant inflows, with Tesla rallying on successful robotaxi trials and CATL's post-IPO surge fueling momentum in battery tech.

Meanwhile, investors cheered signs of easing tariff pressures as President Trump’s July deadlines were declared “not critical,” opening space for Europe and the U.S. to finalize key trade deals.

In Europe, digital and data concerns took center stage after Germany called on Apple and Google to potentially ban DeepSeek, the Chinese AI app, over unlawful data transfers, raising the risk of an EU-wide crackdown on Chinese tech. Elsewhere, CATL’s aggressive expansion into Hungary and Germany positioned it to dominate Europe’s battery-swapping market, amid rising geopolitical tension. With Bitcoin dominance steady and AI tokens outperforming, capital continued rotating into smaller-cap, high-beta narratives. Markets appear poised for a tech-led continuation, so long as macro and regulatory pressures remain in check.

Closing Thoughts

Investor sentiment across crypto and traditional markets is shifting back into risk-on mode, but with a clear preference for narratives that promise yield, regulatory progress, or infrastructure value. AI and staking sectors saw renewed attention today: Render's rebound aligned with capital rotation into GPU-powered DePIN projects, and Aptos outpaced peers as the most staked network. Meanwhile, the market’s warm reception to SEI’s institutional traction via Wyoming’s stablecoin pilot hints that utility-based infrastructure plays may be the next institutional favorite.

On the global front, rising trade optimism and cooling inflation jitters powered Wall Street’s rally, while Europe grappled with rising scrutiny over Chinese tech (DeepSeek) and simultaneously doubled down on U.S. defense ties, setting up a curious duality of cooperation and caution. Altcoins outperformed large caps in this environment, signaling that despite macro uncertainty, the crowd is still hunting for asymmetric upside, especially in coins with real-world integration or sectoral alignment.