Altcoins are making bold moves again, riding the wave of volatility that followed Bitcoin’s record rally and Wall Street’s Q2 earnings surprises. THE, CROSS, and BONK saw notable upside momentum, each fueled by ecosystem expansions, protocol upgrades, or strategic listings while PUMP drew a sharp correction despite high-profile exchange listings and a massive token acquisition by DWF Labs.

Meanwhile, AITECH slipped as profit-booking set in after a solid run-up last week. The divergence in today’s top trending coins underscores a split in investor focus between speculative leverage plays and narrative-driven DeFi and meme coin bets.

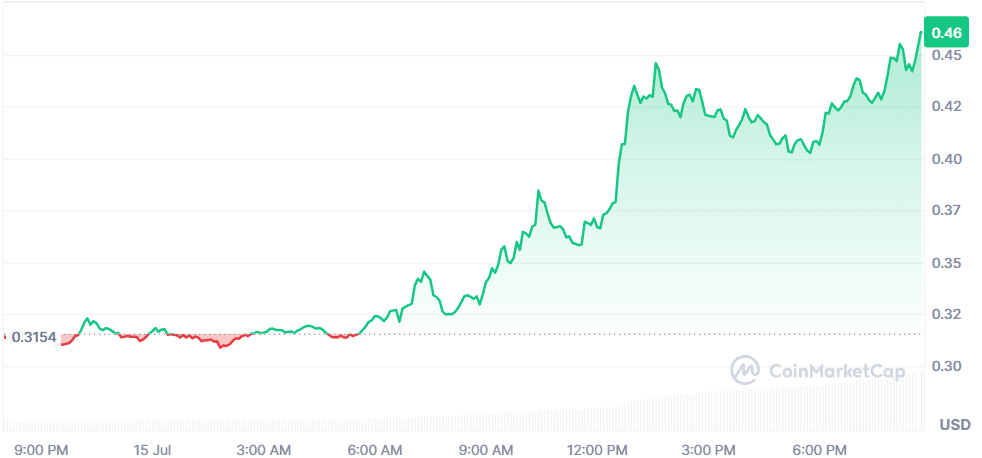

Thena (THE)

Price Change (24H): +46.29% Current Price: $0.4608

What happened today

THENA surged due to a mix of community engagement and key protocol upgrades. The launch of the Italian Telegram community boosted retail interest and visibility. A major V3.3 upgrade increased its DeFi utility on the BNB Chain, while correlation with Bitcoin’s ATH rally positioned THE as a DeFi beta play during bullish sentiment. A technical breakout above resistance further fueled the rally.

Market Cap: $49.25M 24-Hour Trading Volume: $291.6M Circulating Supply: 106.88M THE

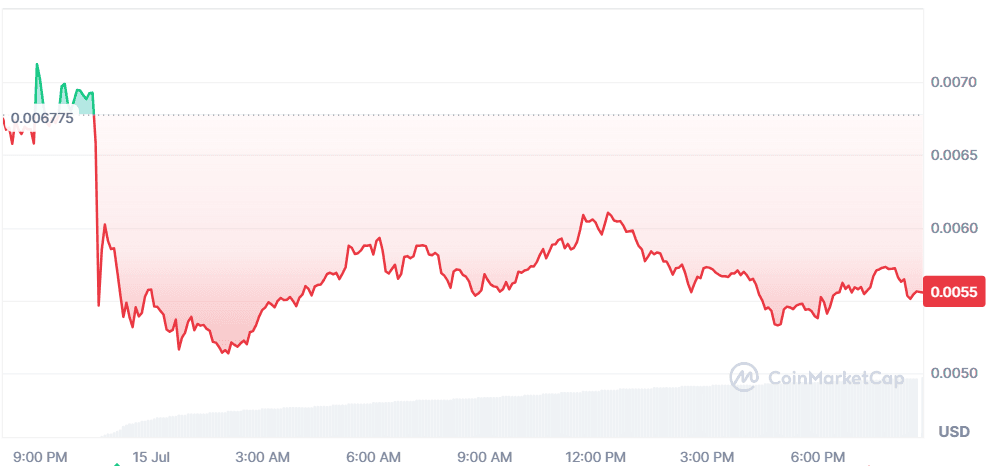

Pump.fun (PUMP)

Price Change (24H): -15.59% Current Price: $0.005553

What happened today

Despite a series of major listings on Bybit (spot and futures), OKX futures, and Coinbase spot, $PUMP fell sharply. The likely cause is profit-taking following a massive surge driven by DWF Labs’ acquisition of 2.5 billion PUMP tokens (worth $17.4M) and a wildly successful airdrop. While the acquisition raised visibility and confidence in the project, short-term volatility from early listings and whale concentration likely triggered a steep pullback.

Market Cap: $1.96B 24-Hour Trading Volume: $1.69B Circulating Supply: 354B PUMP

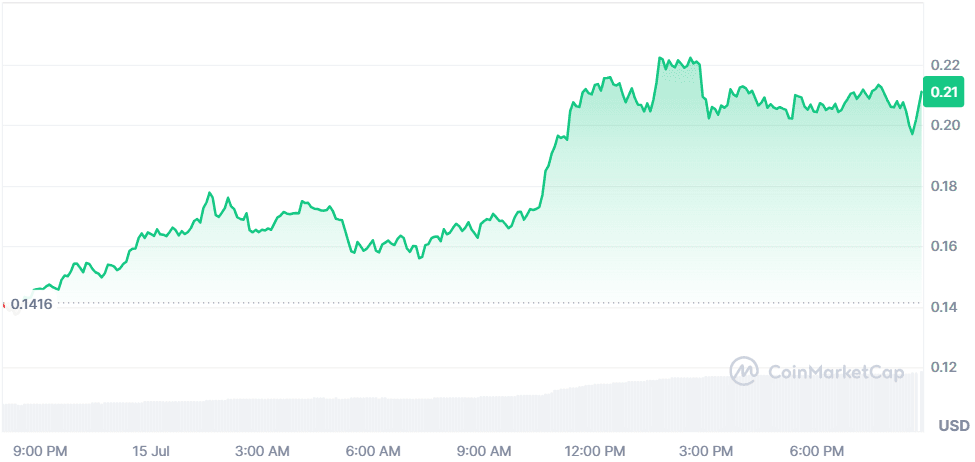

CROSS (CROSS)

Price Change (24H): +44.75% Current Price: $0.2110

What happened today

CROSS saw a major rally driven by leveraged futures listings on Binance and KuCoin (up to 50x). This sparked speculative trading, with volume surging and retail participation growing post BitMart listing. The token benefited from broader altcoin rotation into gaming tokens as BTC dominance dipped. However, RSI at 81.17 signals overbought conditions and possible near-term correction risks.

Market Cap: $73.88M 24-Hour Trading Volume: $62.73M Circulating Supply: 350M CROSS

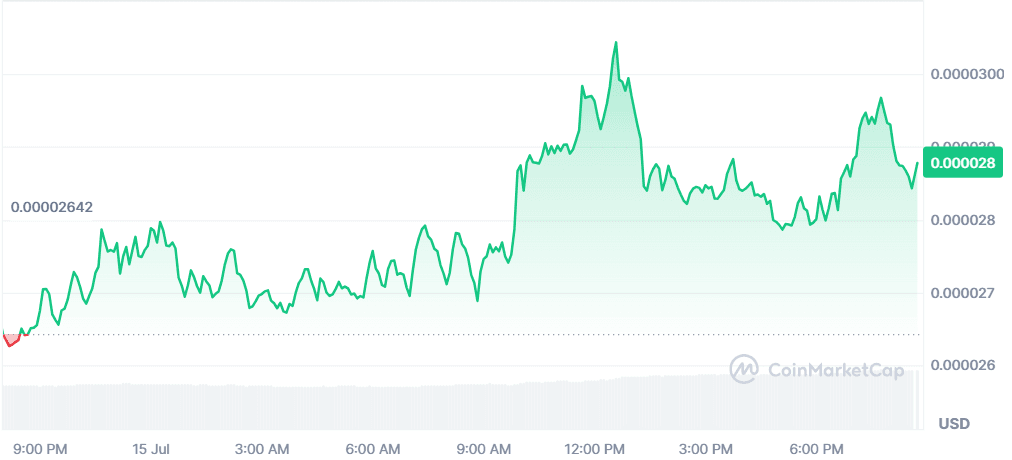

Bonk (BONK)

Price Change (24H): +9.09% Current Price: $0.00002893

What happened today

Bonk rose as its ecosystem project LetsBONK.fun overtook Pump.fun in Solana memecoin revenue. With 55% market share and revenue-driven token utility, BONK attracted strong demand. Anticipation of a 1T token burn and whale accumulation supported price strength. Bitcoin’s new ATH also acted as a macro tailwind, drawing speculative flows into high-beta meme coins.

Market Cap: $2.34B 24-Hour Trading Volume: $1.45B Circulating Supply: 80.88T BONK

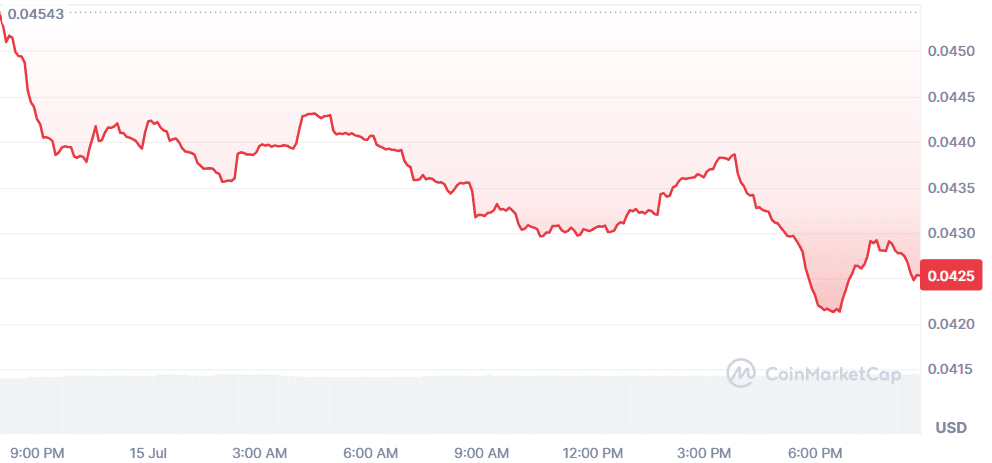

Solidus AI Tech (AITECH)

Price Change (24H): -4.17% Current Price: $0.04253

What happened today

AITECH declined due to profit-taking after last week’s 11.8% gain. While earlier momentum was driven by Solana integration hype, technical resistance near the $0.043–$0.046 zone capped upside. Broader altcoin weakness amid Bitcoin dominance (63.24%) and a dip in the Altcoin Season Index added downward pressure.

Market Cap: $65.86M 24-Hour Trading Volume: $16.48M Circulating Supply: 1.54B AITECH

Global Market Snapshot

U.S. markets delivered a mixed session as inflation data aligned with forecasts but still showed a slight uptick from May, fueling ongoing concerns around tariff-driven price pressures. The Dow fell over 300 points, weighed down by cautious bank earnings and inflation anxiety, while the Nasdaq advanced 0.5%, buoyed by Nvidia’s 4% gain following its announcement to resume H20 chip shipments to China. Despite expectations being met, the CPI’s 0.3% MoM rise and 2.7% YoY increase left investors debating the Fed's next move, especially with President Trump renewing calls for a 300 bps rate cut. Meanwhile, Citigroup and JPMorgan both exceeded earnings estimates on the back of robust trading and banking revenues, with Citi marking its best Q2 markets performance since 2020.

In Europe and Asia, equities edged higher amid investor optimism ahead of the U.K. Chancellor’s Mansion House speech, where fiscal strategy clarity is being closely watched. Concerns over Britain's near-100% debt-to-GDP ratio and the looming Autumn Budget have heightened expectations of possible tax shifts targeting finance.

Meanwhile, across Asia-Pacific, indices posted modest gains, with Japan’s Nikkei rising 0.55% and India’s Nifty climbing 0.43%. The S&P 500 continued its technical strength, closing its 55th day above the 20-DMA, hinting at sustained momentum but with analysts cautioning a potential short-term consolidation ahead. In commodities and AI sectors, MP Materials soared 25% on a $500M Apple deal, and Google’s $25B AI infrastructure push added fresh fuel to Big Tech enthusiasm.

Closing Thoughts

The broader market remains in a holding pattern Altcoins are making bold moves again, riding the wave of volatility that followed Bitcoin’s record rally and Wall Street’s Q2 earnings surprises. THE, CROSS, and BONK saw notable upside momentum—each fueled by ecosystem expansions, protocol upgrades, or strategic listings—while PUMP drew a sharp correction despite high-profile exchange listings and a massive token acquisition by DWF Labs. Meanwhile, AITECH slipped as profit-booking set in after a solid run-up last week. The divergence in today’s top trending coins underscores a split in investor focus between speculative leverage plays and narrative-driven DeFi and meme coin bets.testing enthusiasm with inflation that’s sticky but predictable, and earnings that are solid yet cautious.

While bank giants like Citigroup and JPMorgan delivered strong results on trading and investment banking, the Dow’s 300-point dip reflects persistent inflation anxiety and tariff uncertainties. In contrast, tech and AI names like Nvidia are lifting the Nasdaq, with chip optimism and fresh capital deployment into infrastructure (like Google’s $25B AI push) keeping risk appetite afloat.

In crypto, investor sentiment continues to rotate fast. High-volume speculation around tokens like PUMP and CROSS highlights the renewed hunger for leverage and short-term gains, especially in memecoins and gaming sectors. Meanwhile, coins like THE and BONK are benefiting from stronger community narratives and real ecosystem traction proving that amid all the volatility, investors are still willing to reward tokens that blend utility with market momentum.