Altcoins made waves today despite rising tension in global markets. Amid renewed trade friction between the U.S. and China and jitters around Washington’s sweeping foreign tax bill, several AI-aligned tokens took center stage. Livepeer (LPT) and Pocket Network (POKT) surged after high-profile listings on Upbit, while speculative buzz around WhiteRock (WHITE) and new staking milestones from Flock.io (FLOCK) pushed volumes sky-high.

Aethir (ATH) also continued its gradual ascent following strategic updates. Together, these five coins captured the day’s strongest momentum—some on fundamentals, others on hype.

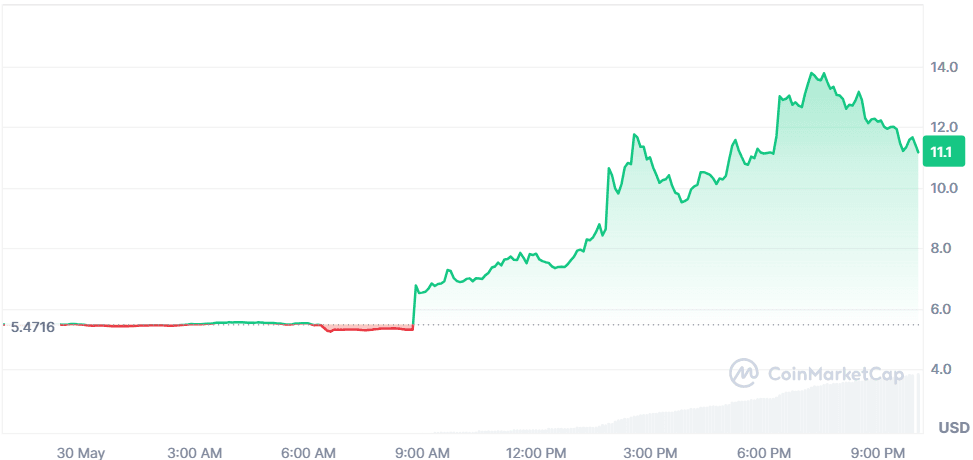

Livepeer (LPT)

Price Change (24H): +112.18% Current Price: $11.14

What happened today

LivepeerAltcoins made waves today despite rising tension in global markets. Amid renewed trade friction between the U.S. and China and jitters around Washington’s sweeping foreign tax bill, several AI-aligned tokens took center stage. Livepeer (LPT) and Pocket Network (POKT) surged after high-profile listings on Upbit, while speculative buzz around WhiteRock (WHITE) and new staking milestones from Flock.io (FLOCK) pushed volumes sky-high. Aethir (ATH) also continued its gradual ascent following strategic updates. Together, these five coins captured the day’s strongest momentum—some on fundamentals, others on hype. surged after being listed on Upbit and dYdX, reaching its highest level since January 23. The 24H volume exceeded $3.13B, signaling massive interest. Additional momentum came from Grayscale’s inclusion of LPT in its AI crypto index. However, inflows to exchanges rose sharply and funding rates dropped to -1.7%, suggesting short-term traders may start taking profits.

Market Cap: $457.18M 24-Hour Trading Volume: $3.13B Circulating Supply: 41.02M LPT

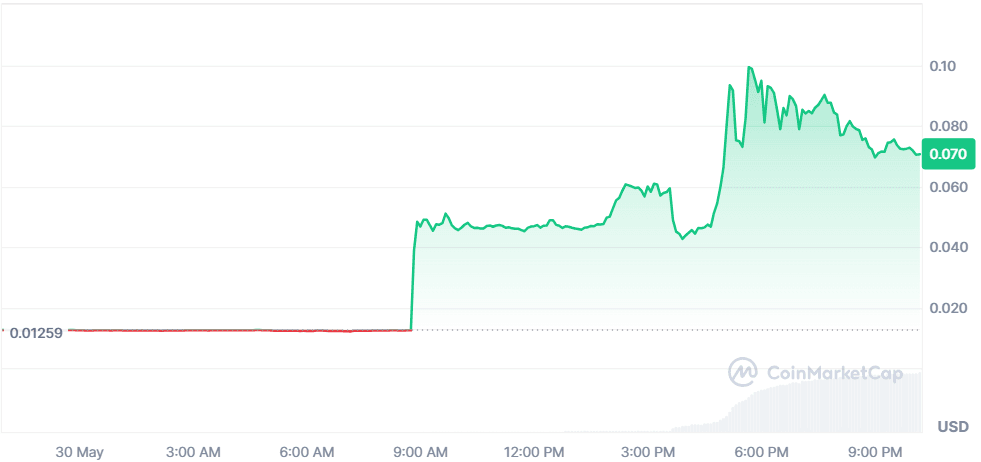

Pocket Network (POKT)

Price Change (24H): +463.85% Current Price: $0.0706

What happened today

POKT skyrocketed after listing on Upbit, gaining exposure to Korean markets. The coin’s infrastructure developments delivering decentralized, cost-effective RPC access boosted sentiment. Market interest is reflected in the 154K%+ surge in volume and bullish chart formation. Despite the rally, technical traders are watching for confirmation candles before further positions.

Market Cap: $142.03M 24-Hour Trading Volume: $874.7M Circulating Supply: 2.01B POKT

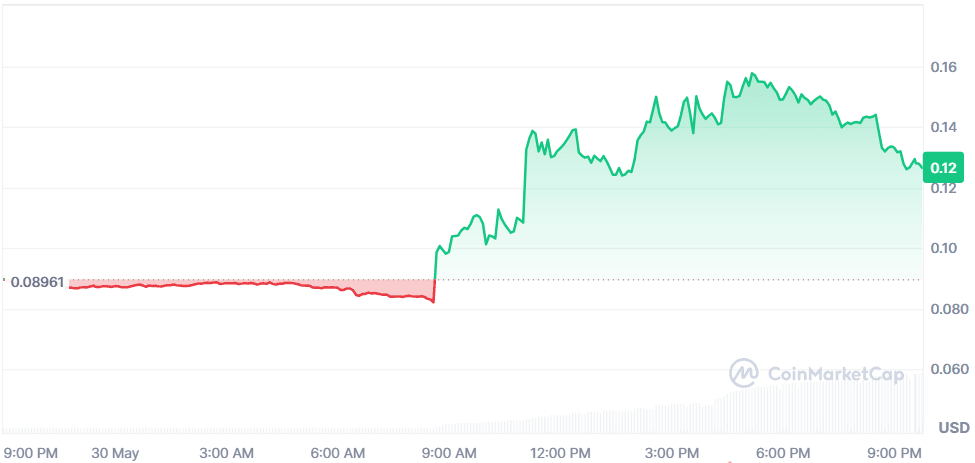

WhiteRock (WHITE)

Price Change (24H): +35.86% Current Price: $0.001170

What happened today

WhiteRock gained traction after rumors of a partnership with Saudi Aramco went viral, including speculation on tokenizing oil supply chains via Ripple’s ecosystem. Open interest hit an all-time high, and retail FOMO kicked in. However, the shared partnership document appears questionable. Meanwhile, $50M was raised in token sales, and a Visa B2B Connect partnership and Solana access was also announced in the past 2 days which can also be the reason for the positive sentiment.

Market Cap: $760.54M 24-Hour Trading Volume: $17.28M Circulating Supply: 650B WHITE

Flock.io (FLOCK)

Price Change (24H): +44.92% Current Price: $0.1272

What happened today

FLOCK rallied after its Bithumb listing and announcement of liquidity support from GSR. The foundation allocated 0.3% of supply to enhance DEX liquidity. Staking is booming with 40 million FLOCK staked for gmFLOCK in 1 day. Messari reported ~40% staking participation, and Flock’s Web3 Agent Model outperforms many LLMs in decentralized AI training boosting long-term conviction.

Market Cap: $23.55M 24-Hour Trading Volume: $50.7M Circulating Supply: 185.03M FLOCK

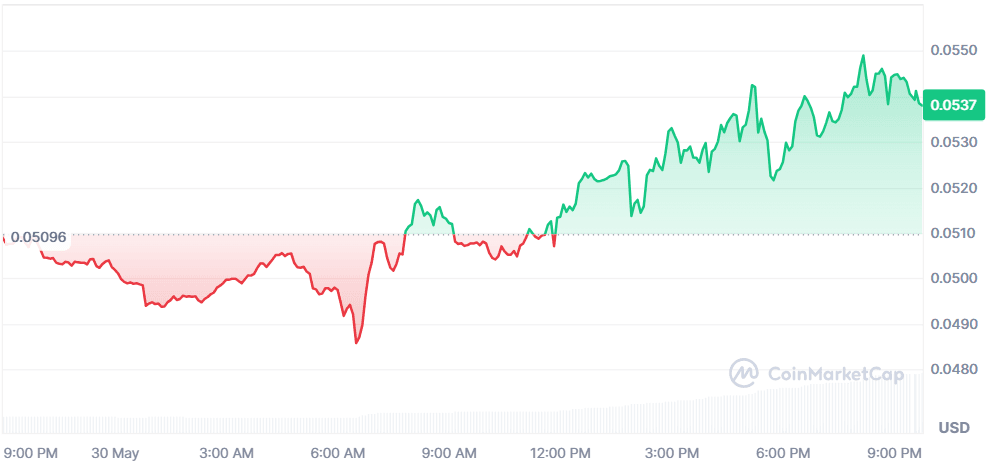

Aethir (ATH)

Price Change (24H): +4.22% Current Price: $0.05256

What happened today

Aethir announced three days ago its Checker Node Buyback Program and the launch of eATH, a new token that offers locked staking rewards. This aims to regulate node supply, improve staking flows, and enhance token management in its decentralized cloud ecosystem. While today’s price action is more muted, volume remains strong as investors react to this strategic update.

Market Cap: $477.58M 24-Hour Trading Volume: $113.15M Circulating Supply: 9.088B ATH

Global Market Snapshot

Markets turned volatile on Friday after U.S. President Donald Trump publicly accused China of violating the preliminary trade agreement signed earlier this month. Trump’s statement, followed by a sharp warning from U.S. Trade Representative Jamieson Greer, revived fears of renewed tariff escalations between the world’s two largest economies. Stock futures declined shortly after the announcement, reflecting heightened investor anxiety around trade policy unpredictability.

Further spooking Wall Street was the advance of the "One Big Beautiful Bill Act" through the U.S. House. The bill, featuring Section 899, proposes steep tax hikes on foreign entities from “discriminatory countries,” such as France and Germany, potentially raising their tax rate on U.S. income to 20%. Analysts warned this could mark the start of a “capital war,” with risks of capital outflows and falling demand for U.S. Treasuries. As global investors digest the implications, early signs of capital reallocation are emerging, with bunds gaining traction as a safe-haven hedge.

Closing Thoughts

Today's market action reveals a clear divergence: while traditional financial markets wavered under geopolitical strain and tax policy risks, crypto assets, especially those aligned with AI and infrastructure continued to attract speculative capital. Exchange listings and strategic ecosystem developments are driving most of the action, but sentiment remains reactive, with traders quick to rotate into trending narratives. The dominance of AI tokens like LPT and FLOCK shows investors are still chasing high-growth sectors, even if valuations outpace utility in some cases.

That said, the sharp inflows into these projects also suggest a short-term crowding effect. With macro volatility intensifying, particularly after Trump’s tariff threats and the Section 899 tax bill, there’s a growing risk that liquidity could retreat as fast as it entered. The crypto market may be decoupling directionally for now, but sustained momentum will depend on how global capital flows respond to policy shocks and whether these trending tokens can deliver beyond the hype.