Real-world data rails, enterprise-grade consensus, and Bitcoin-style PoW programmability rarely trend on Crypto Twitter, yet that quiet competence is exactly what markets are starting to reward. As regulators soften and TradFi pilots move on-chain, infrastructure-first networks are finally grabbing a slice of the spotlight.

Enter Chainlink (LINK), Hedera (HBAR), and Ergo (ERG): three fundamentally robust projects that spent most of the bull run building, not broadcasting. Together they cover the oracle layer, an ESG-friendly enterprise ledger, and a fair-launch proof-of-work smart-contract platform. Each sits well below its previous all-time high, yet each just unlocked a catalyst that could rerate valuations in the next liquidity wave.

Ergo: The Programmable-Bitcoin Sleeper Pick for the Next Cycle

In a market fixated on Bitcoin’s march past $110 k, Ergo (ERG) is quietly ticking all the boxes hardcore crypto believers say they want: decentralised, fair-launch, proof-of-work, and smart-contract capable. Yet the token still trades below $0.90 with a sub-$75 million market cap.

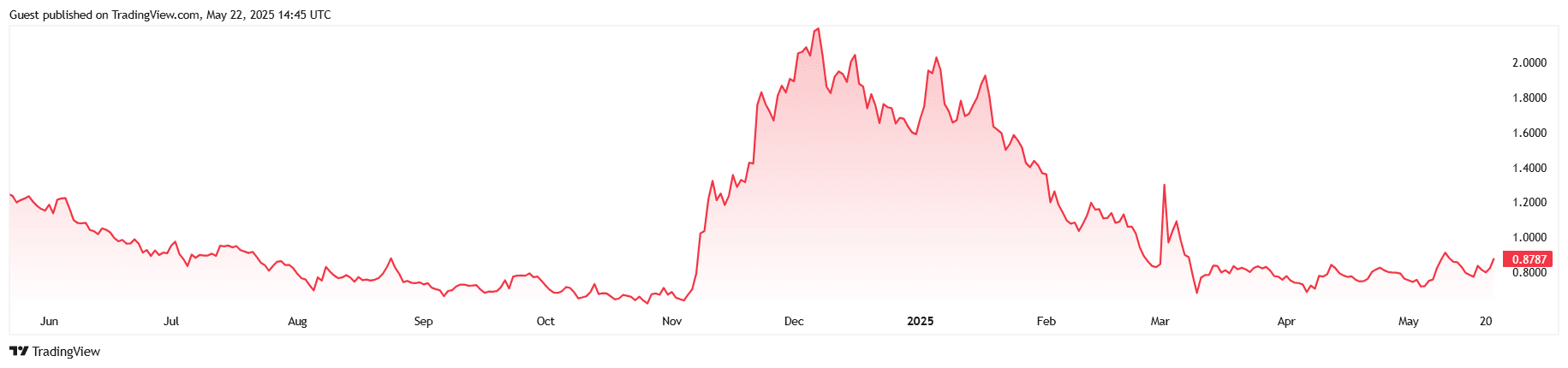

The (Unnoticed) Price Swings

Ergo bottomed near $0.40 in mid-2024, ripped to just over $2.10 during Q1 2025, and has since cooled back to the $0.80-$0.90 band. That whiplash tells two stories:

-

Liquidity is thin = small inflows move price fast.

-

There’s proven appetite when the broader market starts hunting for value outside the majors. A stage-one accumulation range of flat 30-/40-week MAs and drying volume, now suggests the next decisive break could be up, not down.

What Makes Ergo Special?

-

Autolykos ASIC-resistant PoW: Keeps mining open to GPU miners, preserving decentralisation and discouraging cartel-level hash power.

-

Storage Rent: A built-in demurrage fee (~0.14 ERG every four years per idle UTXO) that funds miners long-term solving the “security-budget cliff” every PoW chain faces.

-

Sigma Protocol-based Smart Contracts: Native zero-knowledge proofs enable privacy-preserving, deterministic dApps without gas-fee roulette.

-

NiPoPoWs: Light-client proofs let anyone verify the chain with ~1 MB of data which is ideal for mobile DeFi and IoT use cases.

-

Extended-UTXO Design: Offers Bitcoin-level security with Cardano-style programmability; perfect for complex, parallelisable DeFi.

-

Rosen Bridge: Live bridges to Cardano, Bitcoin, Ethereum and now Binance Smart Chain removes the “CEX gatekeeper” problem and unlock liquidity on demand.

Strong Tokenomics

-

95.57% of the supply is allocated for public.

-

No VC unlocks, no foundation war-chest overhang, therefore, market price truly reflects free-float demand.

Strategic Partnerships & Ecosystem Builders

Ergo’s research-driven culture has attracted collaborators such as EMURGO (Cardano’s commercial arm) for stable-coin R&D, Flux, Alephium, Zelcore, Waves Tech and members of the UTXO Alliance/BPSAA. Grass-roots dev activity shows up in projects like Rosen Bridge, ErgoRaffle v2, lending protocol qX and the autonomous-agent framework Celaut.

The Growth Opportunity

-

Valuation Gap: If ERG simply revisits its last cycle’s Bitcoin-denominated 0.000026 BTC peak with BTC at $100 k, the math points to ~$26 per ERG, a 30× move from today.

-

PoW Scarcity Trade: With Ethereum now PoS and Bitcoin block rewards halving again in 2028, investors hunting “sound-money + smart-contracts” have few options; Ergo is the purest play.

-

Cross-Chain Liquidity: BSC integration makes ERG immediately swappable on dozens of DEXs, bypassing the CEX listing bottleneck.

Why Now?

Community marketing may be lacklustre, but that also means entry prices are still cheap. As Bitcoin dominance peaks and risk capital rotates, small-cap layer-1s with uncompromised fundamentals tend to outperform. Ergo’s mix of fair-launch credibility, self-funding PoW economics, and a steadily expanding DeFi tool-set positions it to be one of the first beneficiaries of that rotation.

For investors who missed Bitcoin’s early-days asymmetric upside, or who believe block-chains should remain trust-minimised and permissionless, Ergo offers a second chance, hiding in plain sight.

Hedera: The Enterprise-AI Dark Horse Sitting at Twenty Cents

Bitcoin hogs the headlines, but Hedera HBAR has quietly climbed ≈ 78 % year-on-year and still trades near $0.20 with an $8.6 billion market cap, less than one-tenth of Solana’s. Its recent chart shows a classic “cup-and-handle” reset: an explosive run to $0.40 in January, a three-month cool-off to the $0.17–$0.22 band, and volume tapering just as new catalysts hit. If risk flows rotate from megacaps to real-utility L1s, Hedera is positioned to re-rate fast.

Why Hedera Deserves a Second Look

-

AI-native Data Layer: Mavrik-1, Validation Cloud’s GPT-style engine, lets anyone query on-chain DeFi data in plain English. It’s live on Hedera first, turning the network into an AI-ready analytics back-end.

-

Open-Source AI Studio: Hedera’s new AI Studio bundles verifiable data feeds, token services and consensus ordering so builders can prove their models aren’t hallucinating.

-

NVIDIA Integration: Hedera now pipes time-stamped, tamper-proof data directly into Nvidia’s AI workflow stack which is critical for enterprises that need audit trails.

-

Cross-Chain Liquidity: Chainlink CCIP is live on main-net, letting HBAR and HTS tokens move into 46+ chains with a single API call.

-

Institutional Rail: FedNow added Hedera-based Dropp to its instant-payments service list which is proof that U.S. regulators are comfortable with Hedera’s compliance model.

-

Tokenization Showcase: Archax used Hedera to tokenize a BlackRock U.S.-Treasury MMF, hinting at broader TradFi adoption.

-

ETF Optics: Nasdaq has a “[Canary HBAR ETF(https://www.federalregister.gov/documents/2025/03/13/2025-03969/self-regulatory-organizations-the-nasdaq-stock-market-llc-notice-of-filing-of-proposed-rule-change?utm_source=chatgpt.com)” filing in review, small, but an SEC-blessed wrapper would open mainstream capital funnels.

Tokenomics & Governance

-

Supply: 50 B max, 42 B circulating (84 %).

-

War Chest: The Hedera Council set aside 4.86 B HBAR (~$408 M) for ecosystem grants and retail growth—fuel for dev incentives without venture-dump risk.

-

Energy & ESG: Hashgraph consensus uses ~0.00017 kWh/tx, orders-of-magnitude lower than PoW chains, an edge with sustainability-minded corporates.

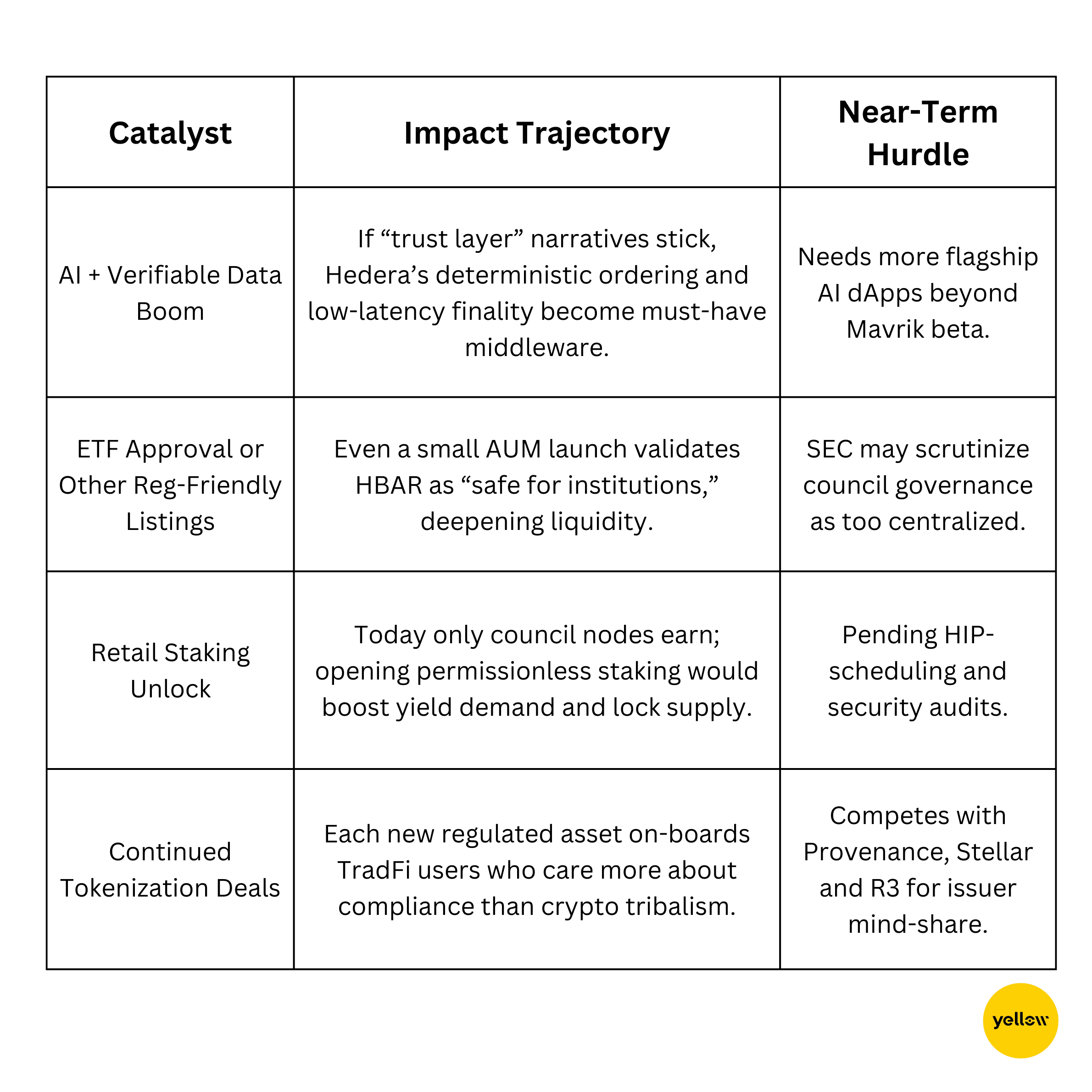

What Could Move the Needle

Why Now?

Hedera’s blend of provable data, sub-second finality and council-grade governance was built for boring, regulated use cases just when AI, tokenized funds and instant payments are crossing the chasm. The market still prices HBAR like a niche alt; yet a single hype cycle that reframes Hedera as the enterprise-AI settlement layer could push the token toward its 2021 ATH ($0.56) and, on a full rotation, the oft-cited $1 bull-case for 2030.

For investors hunting real revenue paths, not just memetics, Hedera offers asymmetric upside with fundamentals already battle-tested by Google, IBM and (now) Nvidia. The question isn’t whether hashgraph tech works; it’s how long the market will ignore a chain designed for exactly the use-cases dominating headlines today.

Chainlink: The Middleware Kingpin Still Trading Like a Mid-Cap

At just $16–17, barely one-half of its 2021 high, Chainlink (LINK) commands “only” an $11 B market cap even as its oracle layer underwrites more than $19 B in tokenized value and is now wiring traditional finance straight into public blockchains. The chart shows a year of broad consolidation between $12 and $20 while fundamentals have gone vertical: JPMorgan, SWIFT pilots, Solana main-net CCIP, and a new rewards flywheel that turns protocol fees into perpetual LINK demand.

Why Chainlink Is Still the One to Watch

-

CCIP Everywhere: Cross-Chain Interoperability Protocol just lit up Solana (first non-EVM chain) and is now the standard bridge for Ronin, Zeus, The Graph and more, extending LINK’s toll-booth model across 20+ chains.

-

Institutional Proof Point:** JPMorgan settled tokenized U.S. Treasuries over Ondo Finance using Chainlink to link its private ledger with Ethereum, its first real-money deal on a public chain.

-

Reg-Tech Whisperer: Chainlink’s “smart-contract compliance” templates informed the SEC’s May 2025 guidance for broker-dealers and transfer agents lowering walls for Wall-Street adoption.

-

Economics 2.0: Three launches: SVR (MEV-sharing oracles, live on Aave), Payment Abstraction (auto-converts fees into LINK), and Chainlink Rewards: Season Genesis (100 M SXT airdropped to stakers), create new fee streams and lock up float.

-

Data Dominance: Price/FX feeds now power 16+ fiat-pegged stable-coins on Celo and on-chain RWAs from Maple to Mento, while Kamino and other Solana DeFi majors replaced custom oracles with Chainlink Data Streams.

-

Thought-Leader Halo: WEF’s May report cites Chainlink/Swift tests as the template for $63T mutual-fund tokenization.

The Growth Setup

-

Narrative Alignment: Tokenization, cross-chain DeFi, and TradFi compliance are 2025’s headline themes; Chainlink already owns the pipes.

-

Flywheel Economics: CCIP fees + SVR MEV share convert to LINK, which can be restaked for rewards, tightening supply.

-

Enterprise On-Ramps: SEC clarity plus JPMorgan’s production trade signal a green light for other banks, insurers, and asset managers to plug in.

-

Alt-Season Optionality: If oracles reclaim their 2021 relative valuation versus L1s, LINK’s market cap could double without touching new fundamentals.

Why Now?

LINK has spent 18 months churning below $20 while every major on-chain and off-chain institution quietly standardised on its services. With Solana, Bitcoin (via zBTC), and non-EVM chains now CCIP-ready, Chainlink’s addressable fee base just multiplied. Meanwhile, the Rewards–SVR–Payment loop begins siphoning protocol revenue back into LINK demand each week.

For investors hunting a large-cap that still carries genuine underdog upside, Chainlink offers the rare blend of enterprise traction, cash-flow potential, and a chart that hasn’t yet priced any of it in. If interoperability and real-world asset tokenization are this cycle’s breakout memes, the network that connects them all is poised to move from background infrastructure to centre stage.

Closing Thoughts

LINK, HBAR, and ERG share a common thread: they solve mission-critical problems that bigger narratives (AI, tokenization, cross-chain DeFi) cannot scale without. Chainlink’s CCIP is quietly standardising value transfer across 20+ chains; Hedera’s AI Studio and FedNow integrations prove public ledgers can meet institutional compliance; and Ergo’s storage-rent PoW model keeps miners paid while adding ZK-level programmability that Bitcoin lacks. Their fundamentals are not promises, they’re production-grade features already in use.

Technically, all three charts are carving multi-month bases with declining volume, textbook setups that precede fresh bull legs. Catalysts line up through year-end: LINK’s MEV-sharing SVR rollout, HBAR’s ETF review and open staking, ERG’s stage-two breakout if Bitcoin dominance rolls over. When market breadth widens, liquidity hunts for real yield and verifiable usage, exactly where these networks lead. For investors who prefer utility over hype, adding or holding positions now offers asymmetric upside before the crowd realises the next cycle’s heroes were quietly working all along.