When the candles turn red, the smartest money snaps up the rails that keep adding users, unlocking yield, and moving value like buying beachfront property in a thunderstorm: the storm passes, the location endures.

Telegram’s Social-Fi surge, EigenLayer’s restaking boom, and the explosion of omnichain stablecoin flows have all dominated 2025’s headlines. Tokens that sit at the crossroads of these trends, Notcoin (NOT), [Renzo](https://yellow.com/asset/rez (REZ) and LayerZero (ZRO), are quietly building network effects even as wider alt-coins drift lower.

From a 35-million-strong tap-to-earn army, to a one-click restaking gateway, to the message bus already routing $20 B of cross-chain liquidity, these three names funnel fresh capital and real users into crypto’s next growth phase.

Why do these tokens deserve attention right now? Let’s find out.

LayerZero (ZRO): The Interoperability Backbone Powering $20 B+ in Cross-Chain Liquidity

The Macroeconomic Tailwind

Stablecoins, RWAs, and cross-chain DeFi are exploding in tandem, but capital is still siloed behind a dozen layer-1 and roll-up walls. LayerZero’s lightweight messaging protocol is the plumbing that lets value whether it’s USDC, tokenised Treasuries, or game assets move instantly between those walled gardens. Since June, the network has been powering Circle’s omnichain USDC flows across Ethereum, Avalanche, Solana, Base and even XRPL, removing the wrapped-asset risk that wrecked earlier bridges.

The Price Set-Up - A Small Dip, Not a Cave-In

ZRO listed at $2.32 on 10 June 2025; after an initial bout of profit-taking (and the opt-in “donation drama”) it found support around $1.75 and now trades at $1.93 only ~17 % below the listing print. For a brand-new token in a choppy market, that relative resilience screams “strong hands accumulating” rather than a death spiral.

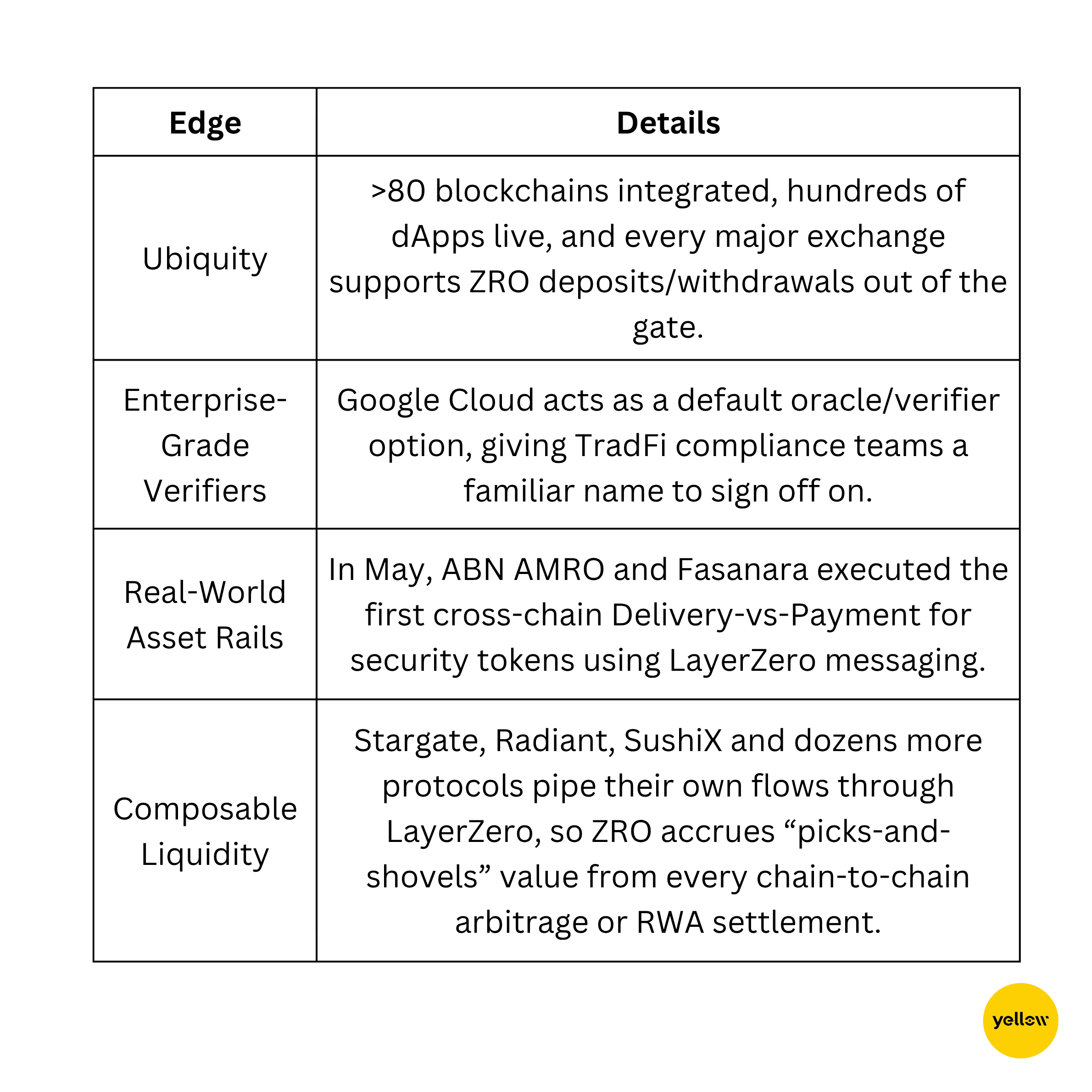

What Makes LayerZero Special?

Tokenomics You Can Model

-

Max Supply: 1B ZRO

-

Circulating: ~120M (12 %)

-

Unlock Schedule: 2.47 % monthly through 2026; next 24.7M tranche landed on 20 June with no violent dump signalling demand can absorb emissions.

Strategic Partnerships & Adoption

-

Stablecoins: Circle’s Cross-Chain Transfer Protocol (CCTP) opts for LayerZero messaging on Aptos and Base.

-

Web2 Bridges: Google Cloud verifier, Stripe’s Aptos integration, and OpenPayd’s fiat/USDC ramp all lean on LayerZero endpoints — expanding beyond native crypto users.

The Growth Opportunity

A recent Animoca Brands deep dive estimates that omnichain messaging volumes hit $20B+ monthly across 80+ networks, with LayerZero handling the lion’s share. If fee revenue tracks even 2 bps of that throughput, annual protocol income would rival mid-cap exchange tokens while ZRO’s FDV sits below $2B, a compelling risk-reward skew.

Why Now?

-

Macro fit: Rising regulatory clarity around stablecoins is driving fresh capital on-chain; the winners will be chains (and bridges) that make those dollars truly mobile.

-

Narrative rotation: After points-farming and meme-season, traders are hunting “infrastructure with cash flow”; interoperability toll-booths are first in line.

-

Technical posture: ZRO has carved a higher-low structure since late June; a push above $2.05 would confirm an ascending triangle and open the door to $2.40–$2.50, recapturing the launch gap.

In short, LayerZero delivers real, fee-generating utility that entire ecosystems already depend on and it’s one of the few 2025 listings that hasn’t been nuked 80 %. For dip buyers who want momentum plus fundamentals, ZRO is a timely second pick ahead of the Q3 liquidity wave.

Renzo (REZ): Restaking’s High-Yield Gatekeeper Trading 96 % Off

The Macroeconomic Tailwind

With U.S. policy rates stuck above 5 % and ETH staking yields compressed below 3 %, investors are hunting the “extra juice” that liquid-restaking unlocks. EigenLayer’s points program has already lured $22 billion in rehypothecated ETH, turning restaking into this cycle’s yield meta. Renzo sits at the center of that flow, abstracting the complexity of EigenLayer while funnelling rewards back to everyday holders via its ezETH liquid-restaking token.

The Recent Pull-Back

REZ listed around $0.21 in April and capitulated to $0.0075 in June, a brutal -96 % as airdrop farmers dumped and risk-off sentiment hit mid-caps. Price has since stabilised near $0.009–0.010, leaving a deep value gap versus the protocol’s fast-growing deposit base.

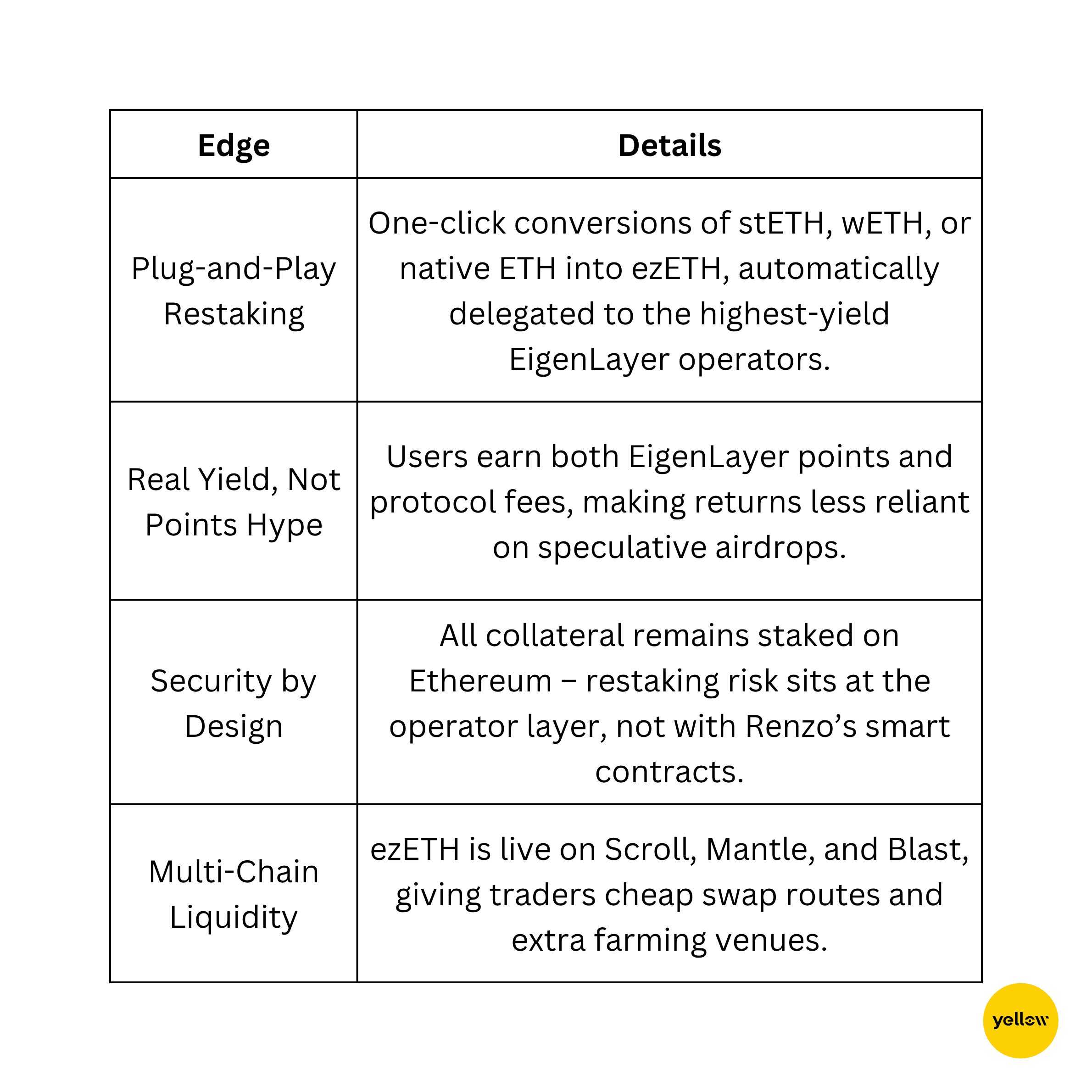

What Makes Renzo Special?

Tokenomics You Can Model

-

Max supply: 10 B REZ

-

Unlocked: ~20 % (next 3.17 % cliff on 31 July 2025)

-

Emission curve: Airdrop seasons and contributor cliffs taper sharply after Q4 2025, meaning 2026-onward inflation falls below 5 % annually.

Strategic Partnerships & Adoption

-

EigenLayer Whitelist: Renzo validators are among the earliest to access AVS slots, giving ezETH holders priority revenue streams.

-

Mantle & Scroll Grants: Foundation grants subsidise ezETH liquidity mining, anchoring deep pools on MantleSwap and SyncSwap.

-

Launchpool Credibility: Binance Launchpool allocation put REZ in front of 10 M+ retail users on day one.

The Growth Opportunity

CoinDCX pegs liquid-restaking TVL at $35 B by 2026 if even 20 % of staked ETH opts in. At today’s ~$970 M ezETH deposits, Renzo owns under 3 % of that addressable market, plenty of headroom without needing ETH price appreciation.

Why Now?

-

Macro fit: Sticky-high rates keep yield-hunting front-and-centre; restaking adds those extra basis points without leaving the ETH universe.

-

Narrative rotation: AI and RWA trades are crowded; analysts see Yield-2.0 (restaking + LRTs) as Q3’s headline theme.

-

Technical set-up: A three-week accumulation range between $0.0087–0.0102 sets up a classic spring, a breakout through $0.011 could target April’s launch-day gap at $0.018–0.020 for a clean 80–100 % move.

Renzo delivers a pure-play on the restaking boom with tangible fee income, aggressive cross-chain expansion, and an entry price many multiples below its debut. For dip buyers positioning ahead of Q3’s yield rotation, REZ is a high-conviction reset.

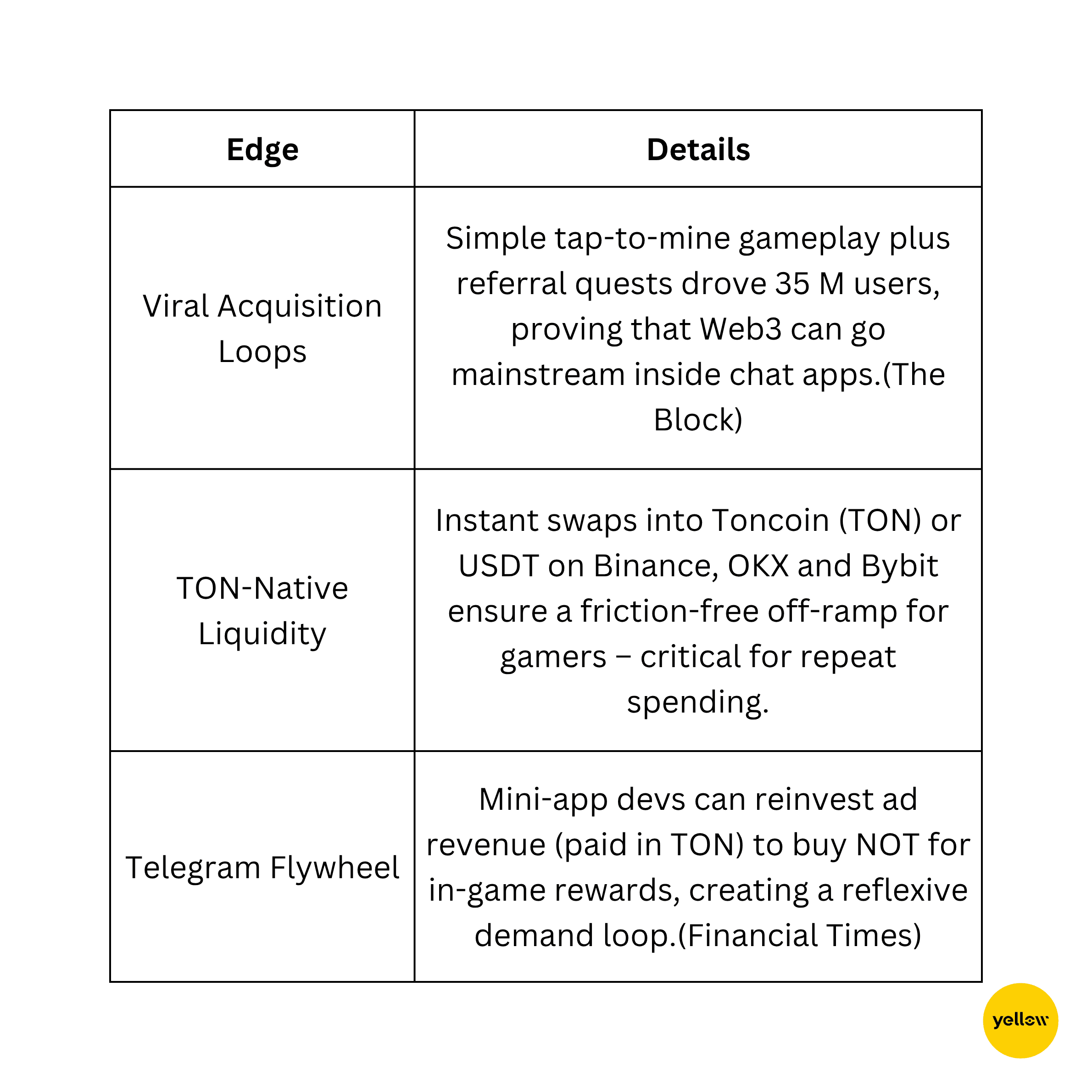

Notcoin (NOT): Telegram’s Social-Gaming Juggernaut on a 93% Discount

The Macroeconomic Tailwind

Social-Fi is one of the few crypto themes scaling to hundreds of millions of users. Telegram’s new ad-revenue model pays channel owners in Toncoin, and its mini-app framework lets games settle micro-transactions on-chain without App-Store tolls. That policy shift has turned the TON ecosystem into the fastest-growing on-ramp for retail crypto in 2024-25 and Notcoin is the poster-child, having onboarded 35 million active players in just months.

The Recent Pull-Back

NOT exploded to an all-time high of $0.02896 on 2 June 2024; today it changes hands near $0.002005, a staggering -93% draw-down. The price slump arrived as early miners rushed to cash out, even while Telegram’s user base, ad-revenue share and gaming catalog kept expanding. Dip buyers now get exposure to the same network effect at pennies on the dollar.

If this cycle teaches anything, it’s that value accrues first to the infrastructure that captures users, liquidity and utility—whether that’s a viral game token, a yield-boosting LRT, or the bridge every stablecoin depends on. NOT, REZ and ZRO each deliver on that trifecta:

Strong fundamentals

NOT rides Telegram’s revenue-share flywheel and boasts one of the largest active communities in crypto.

REZ taps EigenLayer’s $22 B restaking boom, pairing real yield with cross-chain reach.

ZRO already underpins enterprise-grade transfers for Circle, Google Cloud and TradFi pilots.

Technical readiness All three charts are carving higher-low bases near key support zones—a classic “coiled spring” that often precedes trend reversals.

Market interest & catalysts Telegram’s ad-revenue rollout, EigenLayer’s next AVS wave, and LayerZero’s upcoming chain integrations keep each project in the news flow through Q3.

The prices may have dipped, but the stories haven’t. With growing user bases, tangible revenue paths and imminent catalysts, NOT, REZ and ZRO offer exactly what dip-hunters seek: solid projects temporarily on sale—ready to sprint when the market turns risk-on again.

What Makes Notcoin Special?

Tokenomics You Can Model

-

Max supply: ≈ 102.7 B NOT.

-

Circulating: ≈ 99.4 B NOT (97 % already liquid).

-

Emission overhang: With most tokens dispersed, future unlock-pressure is minimal compared with 2024’s initial flood.

Strategic Partnerships & Adoption

-

Exchange Depth: Listed day-one on Binance, OKX, Bybit and Bitget, keeping spreads tight even at sub-cent prices.

-

Ecosystem Catalysts: TON Foundation’s Open League pays builders in TON and NOT; rival mini-game Hamster Kombat (300 M players) primes another wave of Telegram users for on-chain assets.

-

Investor Optics: VCs poured $400 M into TON infra this spring, betting on Telegram’s march toward 1 B+ monthly actives and a 2026 IPO.

The Growth Opportunity

If even 5 % of Telegram’s 950 M users dabble in mini-game tokens, that’s 47 M potential buyers—already bigger than today’s entire NOT float. Paid-ad channels now convert Stars into Toncoin, putting steady buy-pressure on TON…and by extension on the ecosystem’s flagship game token.

Why Now?

-

Macro fit: High mobile-gaming CPI costs push studios to Telegram’s zero-take-rate mini-apps, swelling demand for on-chain reward currencies.

-

Narrative rotation: With AI and RWA plays running hot in H1, traders are scouring for the next sector pop; Social-Fi metrics (daily active wallets, transactions) already outpace DeFi on TON.

-

Technical set-up: NOT has built a three-month base between $0.0016–0.0020; a break above $0.0022 opens room to $0.0035–0.0040, a clean 70 %+ upside toward the Q3 gaming slate.

Closing Thoughts

For investors hunting asymmetry, NOT offers a mass-adoption story backed by Telegram’s business model, yet trades below two-tenths of a cent. In a market starved for new users, that combination, network scale plus bargain pricing makes Notcoin a compelling third pick before the Q3 wave hits.

If this cycle teaches anything, it’s that value accrues first to the infrastructure that captures users, liquidity and utility, whether that’s a viral game token, a yield-boosting LRT, or the bridge every stablecoin depends on. NOT, REZ and ZRO each deliver on that trifecta:

Strong fundamentals

-

NOT rides Telegram’s revenue-share flywheel and boasts one of the largest active communities in crypto.

-

REZ taps EigenLayer’s $22 B restaking boom, pairing real yield with cross-chain reach.

-

ZRO already underpins enterprise-grade transfers for Circle, Google Cloud and TradFi pilots.

Technical readiness

All three charts are carving higher-low bases near key support zones—a classic “coiled spring” that often precedes trend reversals.

Market interest & catalysts

Telegram’s ad-revenue rollout, EigenLayer’s next AVS wave, and LayerZero’s upcoming chain integrations keep each project in the news flow through Q3.

The prices may have dipped, but the stories haven’t. With growing user bases, tangible revenue paths and imminent catalysts, NOT, REZ and ZRO offer exactly what dip-hunters seek: solid projects temporarily on sale—ready to sprint when the market turns risk-on again.