The cryptocurrency market showcased a mixed performance over the past week, with the global market cap at $3.35 trillion and daily trading volume reaching $196.46 billion. The Fear and Greed Index climbed to 62, signaling a sentiment leaning toward Greed, while the Altcoin Season Index stands at 46/100, reflecting a market still dominated by Bitcoin.

While the CoinMarketCap 100 Index saw a modest uptick of 0.60%, this week highlighted significant activity in altcoins, driven by key developments in DeFi, AI-tokenization, and Layer-1 networks. Tokens like HYPE and MOVE led the pack with impressive gains, whereas heavyweights like OP and GALA struggled under broader market pressures.

Hyperliquid (HYPE)

Price Change (7D): +42.28% Current Price: $31.57

News: Hyperliquid, a decentralized perpetual trading platform, has seen a meteoric rise in activity since the launch of its native token, HYPE, on November 29. The token's price increased by 590% from its initial $3.90 launch price, driven by community-focused governance and zero allocations to private investors or exchanges. Over $1 billion in USDC inflows and the surge in trading volume, which recently exceeded $10 billion in a 24-hour period, highlight its growing popularity. The total value locked (TVL) skyrocketed over 1000% to $3.2 billion. Key milestones such as an all-time high in open interest of $4.3 billion and the successful introduction of rewards under $HYPE Season 2 have cemented its reputation as a rising DeFi leader.

Forecast: HYPE’s growth trajectory suggests a continued price rally as it solidifies its position in the decentralized exchange market. If the platform successfully addresses current criticisms like the lack of an API, HYPE could potentially break past $35 in the next two weeks, especially with growing trading engagement and liquidity. However, high volatility in the DeFi market might bring short-term corrections. Analysts expect the token’s utility as both a trading and gas token to drive demand further, with potential for $40+ by early 2025.

Movement (MOVE)

Price Change (7D): +56.64% Current Price: $0.9761

News: MOVE, the native token for the Ethereum Layer-2 blockchain Movement, outperformed most assets this week due to a combination of factors. A partnership with BitGo to integrate WBTC into Movement's mainnet has fueled optimism, enhancing its DeFi offerings and liquidity options. The launch of its mainnet last week, coupled with an $830 million airdrop and listings on major exchanges like Binance, Coinbase, and OKX, has attracted both traders and long-term investors. The futures market open interest doubled in one day, reaching $103.93 million, signaling rising trader confidence.

Forecast: MOVE is likely to continue its bullish trend, with technical indicators like the breakout from a bullish pennant pattern pointing to further gains. Analysts project the token to surpass $1.1 within a week and potentially reach $1.3 in the coming months if trading volumes and adoption rates remain strong. However, market-wide volatility, driven by Bitcoin's price movements, may lead to temporary dips. Long-term adoption of Movement's DeFi features will be critical to sustaining growth beyond short-term rallies.

Ethena (ENA)

Price Change (7D): +7.47% Current Price: $1.06

News: Ethena partnered with World Liberty Financial, backed by Donald Trump, to integrate its synthetic stablecoin sUSDe into Aave. This partnership introduces a dual reward system for users, combining sUSDe and WLF tokens, which has increased stablecoin liquidity and utilization rates. Despite initial challenges for World Liberty Financial, a $30 million WLF token purchase by Justin Sun has solidified the partnership’s credibility and bolstered market confidence. Ethena's focus on stablecoin adoption and synthetic dollar ecosystems positions it as a key player in DeFi's stablecoin space.

Forecast: ENA is likely to see moderate but steady growth as its sUSDe token gains adoption in the DeFi ecosystem. Analysts expect the price to rise to $1.15-$1.20 by January 2025 if liquidity and utilization rates continue to improve. However, market volatility and competition from other stablecoin projects remain potential risks.

Virtuals Protocol (VIRTUAL)

Price Change (7D): +2.85% Current Price: $2.65

News: Virtuals Protocol has emerged as a leader in the co-ownership and tokenization of autonomous AI agents. Its platform has enabled developers to build, tokenize, and monetize AI agents, generating $35 million in revenue in just two months since launching its Initial Agent Offering (IAO) launchpad. With a focus on creating an economic ecosystem for AI agents, Virtuals has attracted significant developer interest. The platform aims to scale to 100 differentiated agents by Q1 2025, fostering collaboration and economic interactions between agents and humans.

Forecast: Virtuals Protocol's focus on integrating AI with blockchain technology positions it for long-term success. Analysts predict a price increase to $2.85-$3.00 by the end of Q1 2025, driven by continued developer adoption and the success of its tokenized agent ecosystem. Short-term challenges include scalability issues and competition in the AI and blockchain sectors.

Sui (SUI)

Price Change (7D): +1.42% Current Price: $4.63

News: Sui made significant strides this week, bolstered by the launch of Grayscale’s Sui Trust, providing institutional investors with secure access to the SUI token. Additionally, Arkham Intelligence partnered with the Sui Network to integrate its blockchain data, enhancing analytics capabilities for users. The ecosystem witnessed rapid expansion, with $1 billion added to its TVL and major collaborations, including Circle's Cross-Chain Transfer Protocol (CCTP) for USDC transfers and SatLayer’s Bitcoin restaking integration. These developments have positioned Sui as a major player in blockchain-based tokenization and DeFi.

Forecast: SUI's momentum is expected to persist, with price targets of $4.80-$5.00 in the near term, supported by increased adoption of the cross-chain protocol and the integration of Bitcoin staking. However, concerns about declining developer activity could dampen long-term growth unless addressed. The platform's focus on scalability and liquidity enhancement provides a strong foundation for further market penetration.

Aptos (APT)

Price Change (7D): -27.58% Current Price: $9.90

News: Aptos faced challenges this week with the resignation of co-founder and CEO Mo Shaikh, raising concerns about leadership stability. Avery Ching, the new CEO, has assured stakeholders of continued innovation. Furthermore, Tomarket announced a pivot to Aptos for its TOMA token launch, citing the blockchain’s high-speed infrastructure as a key factor. Despite these developments, Aptos’s market performance was impacted by a broader market slump and uncertainty surrounding the leadership transition.

Forecast: APT’s recent price drop may continue in the short term, with potential support at $9.50. While Tomarket's move to Aptos could boost ecosystem activity, the token’s recovery depends on the new leadership’s ability to instill confidence and drive adoption. Analysts expect a gradual rebound to $10.50-$11.00 if ecosystem traction improves and external market conditions stabilize.

Optimism (OP)

Price Change (7D): -27.90% Current Price: $1.81

News: Optimism faced significant downward pressure this week, with the price decline coinciding with the anticipation of an upcoming unlock event on January 1, 2025. Additionally, Kraken launched its Ink Blockchain, utilizing Optimism’s OP Stack, which attracted attention by processing over 8 million transactions during its testnet phase. Despite the OP tokens granted to support the project, market uncertainty regarding the impact of the unlock event and profit-taking have contributed to the recent price drop.

Forecast: Short-term volatility is expected as the market prepares for the OP token unlock. Analysts project that the price may find support near $1.70 before any potential recovery. The long-term outlook remains optimistic as Optimism’s ecosystem grows with adoption of its OP Stack by major platforms like Kraken and Coinbase’s Base. If ecosystem demand sustains, the price could stabilize around $2.00-$2.20 post-unlock.

Gala (GALA)

Price Change (7D): -26.60% Current Price: $0.03634

News: Gala Games announced its migration of GalaChain to the Byzantine Fault Tolerance (BFT) consensus mechanism, enhancing its network's security and decentralization. While this upgrade positions GalaChain as one of the pioneering Hyperledger Fabric blockchains, the broader market downturn and reduced trading activity weighed heavily on GALA's price. Additionally, the market reacted cautiously to the migration’s timeline, as the mainnet implementation remains pending.

Forecast: GALA may experience further consolidation near $0.035 as market participants await the full implementation of the BFT migration. Positive sentiment around network resilience and decentralization could drive a rebound to $0.040-$0.045 in the medium term. However, external market conditions and competitive pressures may pose risks to immediate recovery.

Avalanche (AVAX)

Price Change (7D): -24.73% Current Price: $38.64

News: Avalanche launched its Avalanche9000 upgrade on the mainnet, drastically reducing deployment costs for Layer-1 blockchains by 99.9%. This upgrade enhances interoperability, scalability, and developer accessibility, further solidifying its position as a major Ethereum alternative. The platform also introduced reduced gas fees by 96% on its Contract Chain, enabling more efficient dApp operations. Despite these advancements, broader market pressures and reduced trading activity resulted in a sharp price drop over the past week.

Forecast: While the price is under pressure, the long-term outlook for AVAX remains positive due to the network’s improved technical features and adoption potential. Analysts expect a recovery toward $40-$45 in the medium term as the upgrade gains traction among developers. However, sustained market volatility may limit immediate upside potential.

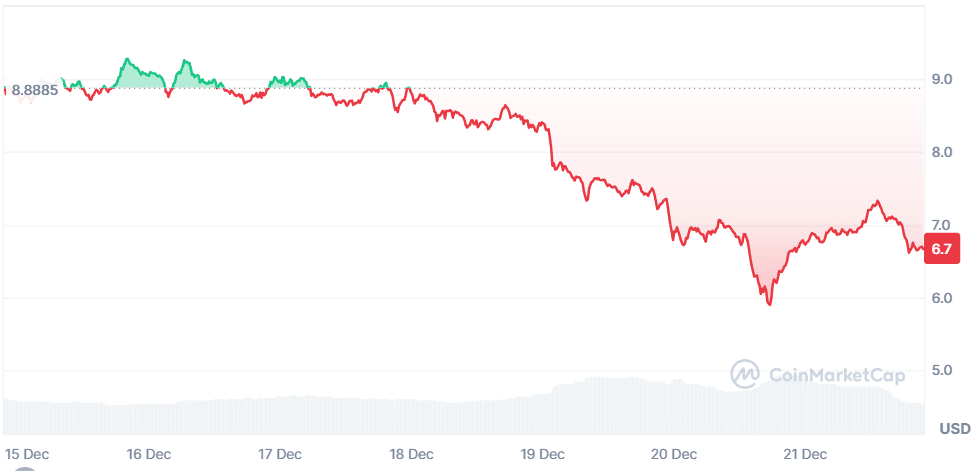

Cosmos (ATOM)

Price Change (7D): -25.04% Current Price: $6.66

News: Cosmos’s Atom Accelerator DAO (AADAO) committed $250,000 in funding to Confio for the development of CosmWasm, a smart contract framework critical to the ecosystem. Neutron matched this funding to ensure the continued maintenance of CosmWasm throughout 2025. These initiatives aim to secure the ecosystem's longevity by supporting infrastructure that drives interoperability and developer innovation. However, reduced trading activity and market sentiment led to a significant price decline.

Forecast: ATOM is expected to stabilize near $6.50 before potentially rebounding to $7.00-$7.50 as ecosystem funding initiatives enhance confidence. Increased activity in smart contract development and interoperability solutions could catalyze further gains, although external market conditions may pose headwinds.

Closing Thoughts

This week reflected the ongoing dynamism in the cryptocurrency market, with innovative projects like HYPE and MOVE capturing attention through their robust performance and ecosystem expansions. ENA and SUI underscored the importance of strategic partnerships in driving adoption and liquidity, while more established tokens like APT, OP, and GALA grappled with macroeconomic challenges and internal shifts.

Investor sentiment remains cautiously optimistic, as evidenced by the Greed signal on the Fear and Greed Index. However, the market remains sensitive to external conditions and upcoming token unlock events, highlighting the need for vigilance. As we move toward the end of 2024, altcoin innovation continues to pave the way for adoption, creating opportunities for investors and developers alike.

Looking ahead, the focus will be on sustaining growth through ecosystem upgrades, regulatory clarity, and institutional adoption. For now, this week reaffirms the evolving narrative of altcoin potential amidst a volatile yet promising market landscape.