Two revolutionary technologies - artificial intelligence and blockchain - are no longer developing in parallel. They are converging, and the result is something unprecedented: autonomous software capable of holding value, making decisions, and transacting without human intervention.

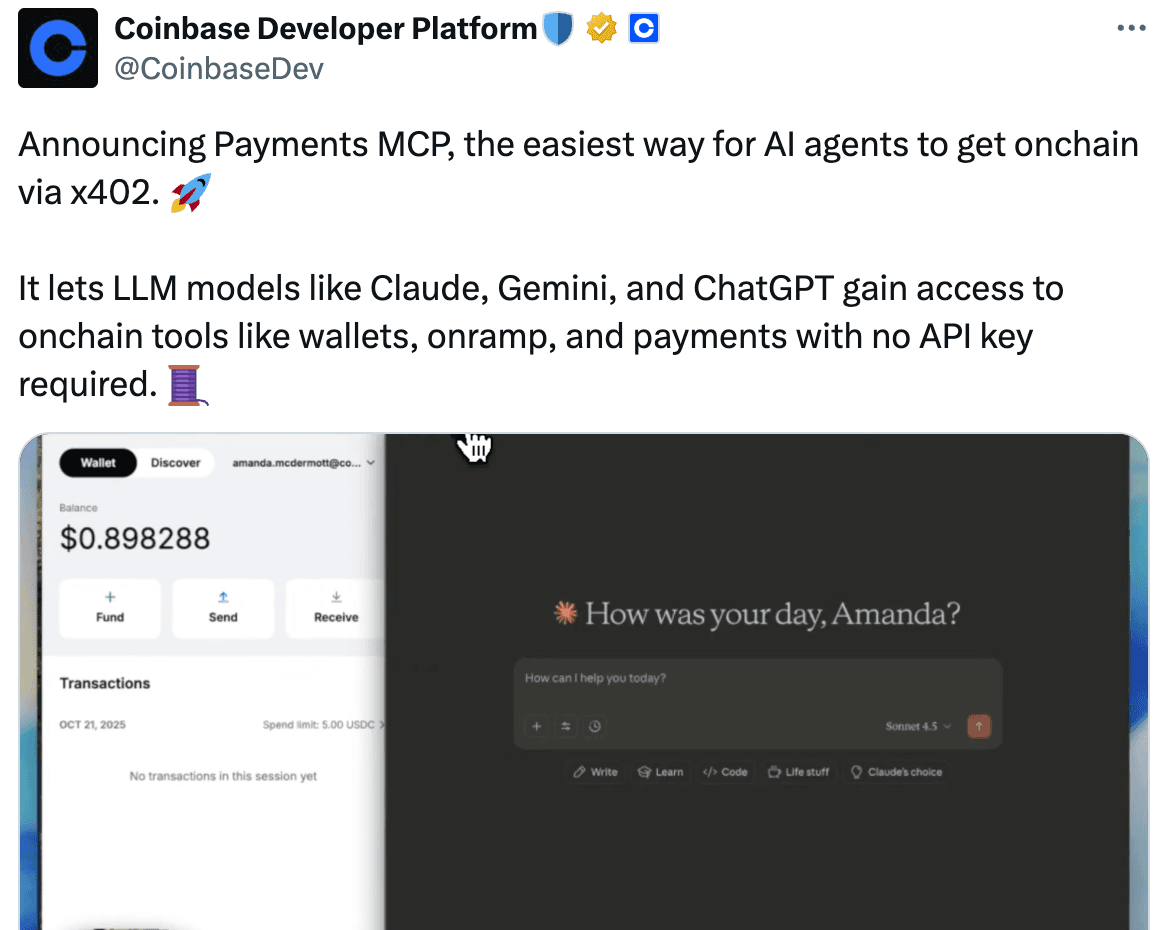

In October 2025 Coinbase launched Payments MCP, a Model Context Protocol implementation that gives AI agents direct access to crypto wallets, onramps, and stablecoin payments. For the first time, large language models like Claude, Gemini, and Codex can natively interact with the crypto economy - creating wallets, funding them, and executing payments through simple natural language prompts.

This isn't just another developer tool. It represents a fundamental shift in how value moves through digital systems. Erik Reppel, Coinbase's head of engineering for its developer platform, described crypto as "uniquely suited to machines," emphasizing that it's "the only open, digital-native standard for payment that any program can use."

The implications extend far beyond automated trading. AI agents are beginning to participate in decentralized finance protocols, manage digital identities, coordinate in decentralized autonomous organizations, and even create and monetize their own services. The AI crypto sector reached a market capitalization of $31.9 billion in 2025, representing 0.80% of the total crypto market, with over 200 active AI tokens and $4.27 billion in daily trading volume.

This convergence addresses a fundamental limitation in both domains. AI systems have struggled to participate in economic activity beyond processing information. Blockchain networks, despite their sophisticated financial infrastructure, remain largely reactive to human input. AI agents using crypto rails bridge this gap, creating what industry observers call "agentic commerce" - a new paradigm where machines don't just recommend actions but execute them, backed by programmable money that moves at the speed of code.

The timing of this convergence is not coincidental. The global AI market, valued at $184 billion in 2024, is projected to reach $826.7 billion by 2030, with a 28.46% compound annual growth rate. Simultaneously, stablecoin settlement volumes reached $1.39 trillion in the first half of 2025, demonstrating that crypto infrastructure can handle institutional-scale payment flows. Machine learning models have achieved unprecedented capabilities in reasoning and decision-making, while blockchain infrastructure has matured to support sub-second transactions at minimal cost.

What makes this moment unique is the emergence of standardized protocols for AI-blockchain interaction. The x402 protocol, developed by Coinbase and formalized through the x402 Foundation in partnership with Cloudflare, revives the long-dormant HTTP 402 "Payment Required" status code to enable programmatic, machine-to-machine payments. This creates a universal language for autonomous economic activity - one that works across any application, any chain, and any AI model.

The implications for Web3 are profound. If blockchain technology promised to decentralize ownership and exchange, AI agents represent the next evolution: decentralized action. This article explores how this convergence is unfolding, from the technical architecture enabling AI-blockchain interaction to the risks and opportunities it creates, and ultimately what it means for the future of digital commerce.

Background: From Smart Contracts to Agentic Systems - The Next Leap

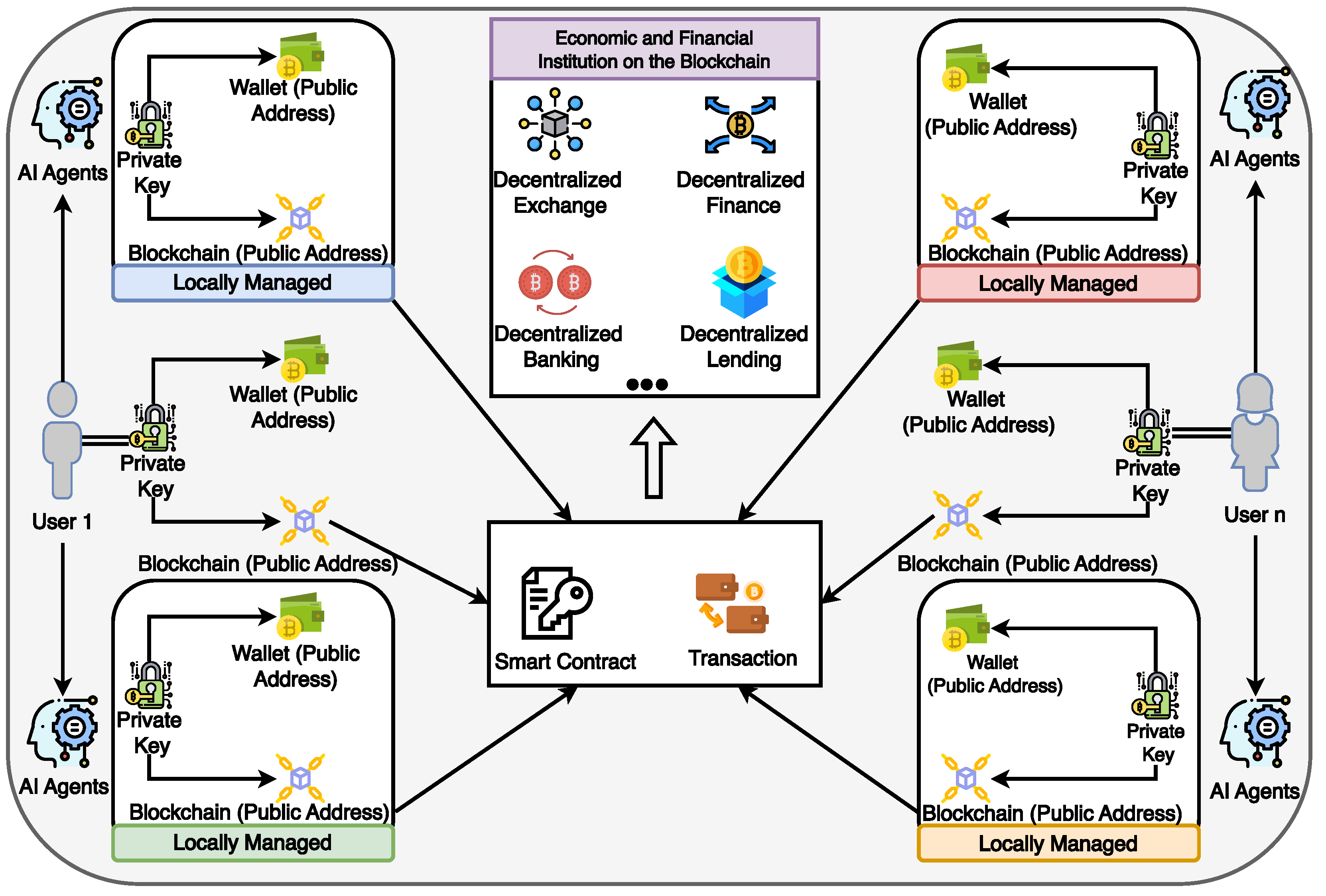

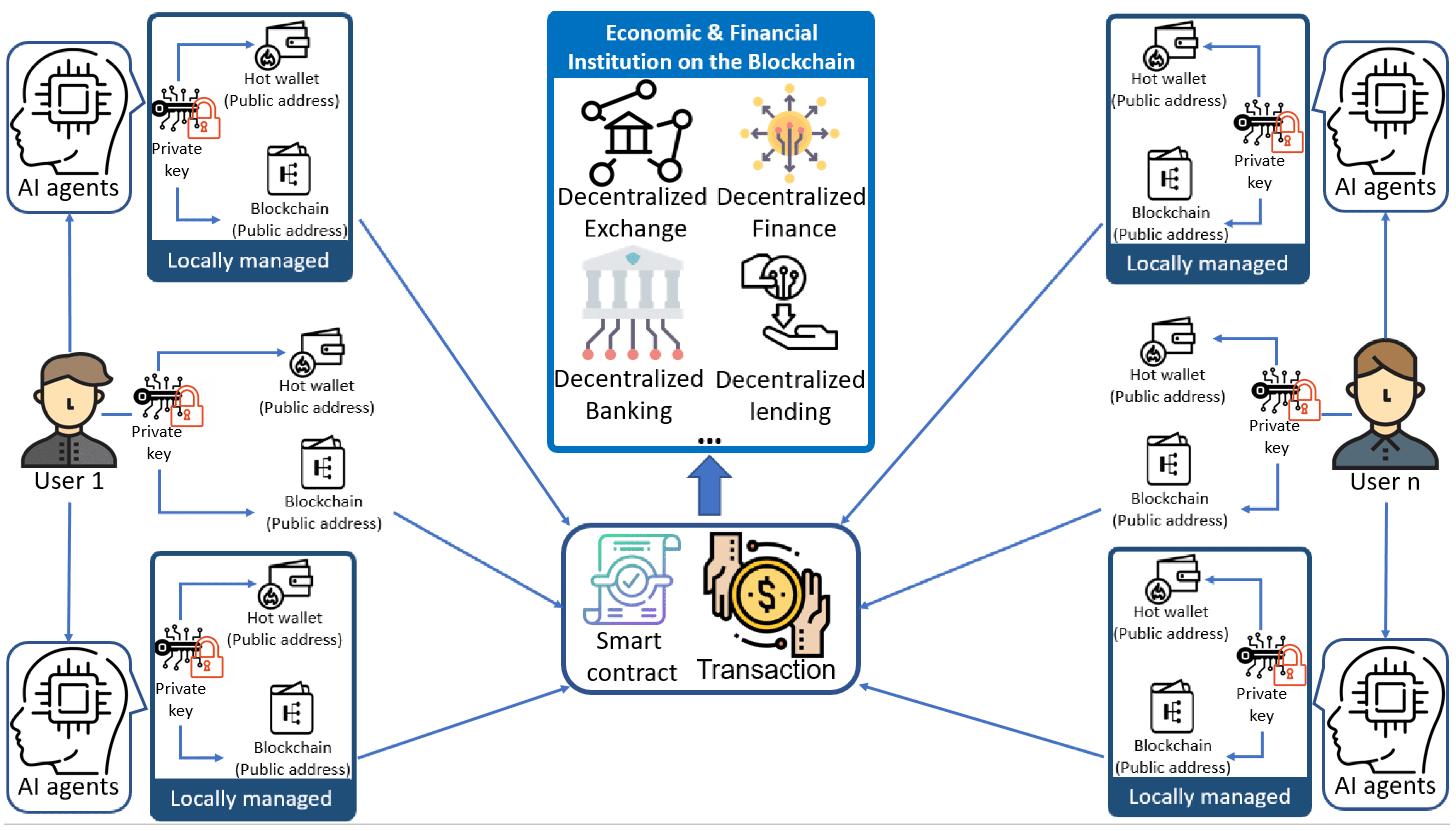

To understand why AI agents represent such a significant evolution for Web3, it's essential to trace the progression of autonomous capabilities on blockchains. The story begins with smart contracts - self-executing code that enabled programmable agreements without intermediaries. But smart contracts, revolutionary as they were, operate within strict limits.

Smart contracts are reactive. They execute when specific conditions are met but cannot initiate actions independently. A DeFi lending protocol can automatically liquidate an undercollateralized position, but only after on-chain data triggers that condition. It cannot proactively monitor off-chain information, adapt to changing market conditions, or make complex multi-step decisions.

This limitation has constrained what's possible in Web3. Most blockchain applications still require humans to initiate actions, whether that's executing a trade, rebalancing a portfolio, or participating in governance. The user interface remains clunky, the learning curve steep, and the mental overhead high. As Coinbase noted in their Payments MCP announcement, "The future of AI requires agents to be able to transact and do, not just read and write."

AI agents solve this problem by introducing genuine autonomy. Unlike smart contracts that execute predetermined logic, AI agents can perceive their environment, reason about it, and take actions to achieve goals. They combine several key capabilities:

Perception: AI agents ingest data from multiple sources - on-chain transaction data, off-chain price feeds, social sentiment, news, and structured databases. They use natural language processing to understand unstructured information and computer vision to parse visual data.

Reasoning: Through large language models and other machine learning architectures, agents can analyze complex situations, identify patterns, and make predictions. They don't just follow rules - they apply learned heuristics and adapt strategies based on outcomes.

Action: AI agents can execute transactions, interact with smart contracts, manage wallets, and coordinate with other agents or humans. Critically, they can do this autonomously within predefined boundaries.

Learning: Unlike static algorithms, AI agents improve over time. Through techniques like reinforcement learning, they optimize their strategies based on success or failure.

This combination creates capabilities that transcend what either technology achieves alone. A smart contract can automatically swap tokens when certain conditions are met. An AI agent can monitor multiple DEXs across different chains, detect arbitrage opportunities accounting for gas fees and slippage, execute complex multi-hop trades, and learn which strategies work best in different market conditions.

The technical foundation for this evolution has been building for years. Projects like Fetch.ai launched in 2019 with a vision of creating autonomous economic agents - software entities that could represent individuals, devices, or organizations in decentralized marketplaces. SingularityNET introduced in 2017 a decentralized AI marketplace where developers could monetize machine learning models using blockchain tokens.

But these early efforts faced significant constraints. AI models lacked the reasoning capabilities of modern LLMs. Blockchain infrastructure couldn't support the complex interactions agents required at scale. And there was no standardized way for AI systems to interact with crypto protocols - each integration required custom code.

The landscape changed dramatically in 2023-2024 with the emergence of more capable AI models and more robust blockchain infrastructure. Bittensor launched its decentralized machine learning network, creating a peer-to-peer marketplace where AI models compete to provide the best outputs. Virtuals Protocol introduced in late 2024 enabled tokenization of AI agents, allowing communities to co-own and monetize autonomous entities.

Most significantly, 2025 saw the emergence of standardized protocols for AI-blockchain interaction. The Model Context Protocol, initially developed by Anthropic, provides a framework for safely connecting AI models to external tools and services. Coinbase's adaptation of MCP for crypto specifically - combined with the x402 payment standard - creates a universal bridge between language models and blockchain infrastructure.

This infrastructure enables what wasn't possible before: AI agents that can participate fully in the crypto economy. They can hold assets, make payments, access services, trade autonomously, and even create value through their own actions. This is the leap from smart contracts to agentic systems - from programmable agreements to autonomous economic participants.

Coinbase Payments MCP and the AI-to-On-Chain Interface

Coinbase's Payments MCP represents the most significant deployment to date of a standardized AI-blockchain interface. Understanding how it works provides crucial insight into the technical architecture enabling autonomous agents to transact on-chain.

The Architecture

At its core, Payments MCP creates a bridge between large language models and crypto infrastructure through three key components:

The Model Context Protocol (MCP) Layer: MCP, as Coinbase describes it, is "a framework that lets AI models safely access external tools and services." It provides a standardized way for AI systems to discover available functions, understand their parameters, and execute them securely. In the context of Payments MCP, these functions include wallet creation, funding, and payment execution.

The x402 Payment Protocol: Built on the HTTP 402 "Payment Required" status code, x402 enables instant stablecoin payments directly over HTTP. When an AI agent needs to access a paid resource, the server responds with 402 and payment instructions. The agent automatically constructs and sends the payment, receives confirmation, and gets access - all within the same request cycle.

The Execution Layer: This handles the actual on-chain operations. When an agent decides to make a payment, Payments MCP interacts with Coinbase's infrastructure to create transactions on the Base network (Ethereum Layer 2), sign them securely, and broadcast them to the blockchain. The entire process happens in seconds.

How It Works in Practice

The user experience is deliberately simple. A developer or user connects an AI assistant - currently supporting Claude Desktop, Google Gemini, Codex, and Cherry Studio - to Payments MCP through a quick configuration. No API keys are required. The assistant can then execute commands like:

"Create a wallet and fund it with $50" "Pay 5 USDC to this address" "Check my balance and send half to my savings wallet"

Behind the scenes, the workflow involves several steps:

-

Intent Recognition: The AI model parses the natural language request and maps it to specific MCP functions.

-

Wallet Management: For new users, Payments MCP creates a non-custodial wallet. Users can fund it with an email address through an integrated onramp, no complex setup required.

-

Authorization: Before executing any transaction, the system checks against configured spending limits and approval rules. As Erik Reppel explained, "With Payments MCP, you can set limits for your agent. They have dedicated funds you explicitly give them - they don't have access to your main wallet."

-

Transaction Construction: The system builds the appropriate on-chain transaction, calculating gas fees and optimal routes.

-

Execution: The transaction is signed and broadcast to the blockchain. For Base network transactions using USDC, Coinbase's hosted facilitator enables fee-free payments.

-

Confirmation: The agent receives confirmation of the transaction and can continue with subsequent actions.

The x402 Integration

The x402 protocol is particularly significant because it enables true programmatic commerce. As Cloudflare's blog post explains, "Every day, sites on Cloudflare send out over a billion HTTP 402 response codes to bots and crawlers trying to access their content and e-commerce stores." Previously, these responses went unheard - there was no standard way for automated systems to fulfill the payment request.

With x402, this changes completely. The protocol defines:

- How servers communicate payment requirements (amount, recipient, accepted tokens)

- How clients construct and attach payment proofs to requests

- How facilitators verify and settle transactions

- How servers confirm payment and deliver resources

This creates a universal pattern for pay-per-use models on the internet. An AI agent researching a topic can automatically pay for access to premium data sources. A bot running computations can pay for cloud resources as needed. A virtual assistant can purchase products from multiple merchants in a single shopping trip.

Coinbase and Cloudflare jointly announced the x402 Foundation in September 2025 to govern this protocol's development. The foundation aims to establish x402 as a neutral, open standard - similar to how HTTP, TCP/IP, and other internet protocols are managed. As Matthew Prince, Cloudflare's CEO noted, "The Internet's core protocols have always been driven by independent governance, which is why we're proud to work with Coinbase to ensure x402 has the same path, given its likelihood to become a core protocol for agentic commerce."

Technical Safeguards

Security is central to Payments MCP's design. Several mechanisms protect users and agents:

Spending Limits: Users configure maximum amounts agents can spend per transaction and per time period. Reppel explained, "You could, for example, let an agent spend up to ten cents freely, but require approval for anything higher."

Approval Workflows: For transactions exceeding certain thresholds, the system can require explicit human approval before execution.

Wallet Isolation: Agent wallets are separate from users' main holdings, limiting exposure if an agent is compromised or behaves unexpectedly.

Local Execution: The system runs locally on users' devices, not on remote servers. This enhances privacy and gives users direct control.

Audit Trails: All transactions are recorded on-chain, providing transparent and immutable records of agent activity.

Current Limitations and Roadmap

Payments MCP launched with specific constraints. It currently only supports USDC stablecoins on the Base network. ChatGPT is not yet compatible due to technical differences in how OpenAI's streaming architecture works compared to MCP's transport method. The initial release focuses on payment execution rather than more complex DeFi operations like trading, lending, or liquidity provision.

However, Coinbase indicated in their announcement that they "plan to increase support for more models and developer tools as part of ongoing efforts to link AI capabilities with practical financial uses." The roadmap likely includes multi-chain support, integration with additional LLMs, and expanded functionality for DeFi operations.

Why This Matters

Payments MCP is significant not because it's the first AI-blockchain integration, but because it's the first to combine several crucial elements:

- Ease of Use: No API keys, no complex configuration. Users can get started in minutes.

- Broad Compatibility: Works with multiple major AI models out of the box.

- Real Economic Activity: Not a testnet or simulation - agents transact with real value on public networks.

- Open Standards: Built on open protocols (MCP and x402) that any developer can implement.

- Enterprise Grade: Deployed by a publicly-traded, regulated exchange with institutional compliance standards.

This combination creates a blueprint for how AI agents and crypto infrastructure should interact. As more developers build on these standards, a broader ecosystem of autonomous economic activity becomes possible.

Technology Deep Dive: How AI Agents Interact with Blockchains

Understanding the technical architecture connecting AI agents to blockchain infrastructure requires examining several layers of the stack. Each layer solves specific problems related to identity, decision-making, execution, and security.

The Agent Architecture

Modern AI agents in crypto typically follow a modular architecture with specialized components:

Perception Layer: Agents need to understand their environment. This involves:

- On-Chain Data Ingestion: Reading transaction histories, smart contract states, token balances, and liquidity pool conditions directly from blockchain nodes or indexing services.

- Off-Chain Data Integration: Connecting to price oracles, social media sentiment feeds, news sources, and other external information.

- Natural Language Processing: Understanding human instructions and converting them into executable actions.

Reasoning Layer: The "brain" of the agent, typically powered by:

- Large Language Models (LLMs): Models like Claude, GPT-4, or specialized crypto-focused LLMs interpret intent, plan multi-step actions, and generate explanations.

- Specialized AI Models: Machine learning models trained for specific tasks like price prediction, fraud detection, or sentiment analysis.

- Decision Logic: Rule engines and heuristics that constrain agent behavior within acceptable boundaries.

Action Layer: The execution environment where agents interact with blockchains:

- Transaction Construction: Building properly formatted transactions including gas fee estimation and optimal routing.

- Signature Generation: Securely signing transactions without exposing private keys.

- Broadcast and Confirmation: Sending transactions to the network and monitoring for successful execution.

Learning Layer: Mechanisms for continuous improvement:

- Performance Tracking: Recording outcomes of agent actions (successful trades, failed transactions, etc.).

- Strategy Optimization: Using reinforcement learning or other techniques to improve decision-making over time.

- Model Fine-Tuning: Updating AI models based on new data and feedback.

Key Management and Security

Perhaps the most critical technical challenge is enabling AI agents to control crypto assets securely. Several approaches have emerged:

Multi-Party Computation (MPC): Platforms like Lit Protocol use MPC to split private keys into shares distributed across multiple nodes. The agent can sign transactions without any single entity holding the complete key. If one node is compromised, the key remains secure.

Threshold Signatures: Similar to MPC, threshold signature schemes require multiple parties to cooperate to create valid signatures. This distributes trust and reduces single points of failure.

Hardware Security Modules (HSMs): For higher-value applications, keys can be stored in dedicated hardware that performs cryptographic operations without exposing private keys to the software environment.

Secure Enclaves: Modern processors include isolated execution environments (like Intel SGX) where sensitive operations can run protected from the rest of the system.

Policy-Based Access Control: Projects like Warden Protocol implement policy engines that define what actions agents can take under what conditions. Even if an agent has access to signing keys, it can only execute transactions that comply with predefined rules.

David Sneider, founder at Lit Protocol, outlined three main approaches to managing keys for AI agents:

- Direct Key Access: The agent has direct access to private keys, the simplest but least secure approach.

- Approval-Based Access: The agent proposes transactions that require explicit approval before execution, balancing autonomy with security.

- Policy-Restricted Access: The agent can execute transactions autonomously but only within predefined policy boundaries, offering high autonomy with programmatic guardrails.

Blockchain Interaction Patterns

AI agents interact with blockchains through several distinct patterns:

Read Operations: Querying current state without changing anything on-chain. This includes:

- Checking balances and token holdings

- Reading smart contract state

- Analyzing transaction history

- Monitoring liquidity pools and trading conditions

Write Operations: Creating transactions that modify blockchain state:

- Transferring tokens

- Executing trades on decentralized exchanges

- Depositing into or withdrawing from DeFi protocols

- Creating or modifying smart contracts

Event Monitoring: Subscribing to blockchain events and triggering actions when specific conditions occur:

- Liquidation alerts in lending protocols

- Price threshold breaches

- Governance proposal creation

- Token transfer notifications

Multi-Chain Coordination: Operating across multiple blockchains simultaneously:

- Cross-chain arbitrage

- Asset bridging between networks

- Portfolio rebalancing across chains

The Model Context Protocol in Detail

The Model Context Protocol, developed by Anthropic and adapted for crypto by Coinbase, provides crucial standardization for AI-blockchain interaction. MCP defines:

Tool Discovery: AI models can query what capabilities are available (create wallet, send payment, check balance, etc.).

Parameter Specification: Each tool declares what inputs it requires (recipient address, amount, token type, etc.).

Execution Safety: Tools can specify conditions that must be met before execution (balance checks, approval requirements, etc.).

Result Reporting: Standardized formats for returning success confirmations, error messages, and relevant data.

This standardization is significant because it means developers don't need to create custom integrations for each AI model. Any MCP-compatible model can use any MCP server providing crypto functions. This modularity accelerates ecosystem development.

Smart Contract Interaction

AI agents interact with smart contracts through several mechanisms:

Direct Calls: Agents can call any public function on deployed smart contracts, passing required parameters and gas fees.

Intent-Based Execution: Rather than specifying exact contract interactions, agents express high-level intents ("get best price for swapping ETH to USDC") which solver networks translate into optimal transactions.

Account Abstraction: ERC-4337 and similar standards enable agents to use smart contract wallets with flexible validation logic, supporting batch transactions, gas payment in any token, and complex permission structures.

Agent-Owned Contracts: Some architectures allow agents to deploy and control their own smart contracts, enabling more sophisticated behaviors like creating automated market makers or custom treasury management logic.

Data Flows and Dependencies

AI agents in crypto depend on several infrastructure layers:

RPC Nodes: Provide direct access to blockchain data and transaction broadcast capabilities.

Indexing Services: Services like The Graph, Covalent, or Moralis aggregate and query blockchain data efficiently.

Price Oracles: Chainlink, Pyth, and similar protocols provide reliable off-chain data on-chain.

IPFS/Arweave: Decentralized storage for agent memory, model parameters, and associated data.

Relayer Networks: Services that can submit transactions on behalf of agents, abstracting away gas management.

Performance and Scalability

Current AI-blockchain architectures face several performance constraints:

Transaction Latency: Blockchain confirmation times (seconds to minutes) are slow compared to AI model inference (milliseconds). Agents must be designed to handle asynchronous operations.

Gas Costs: Every on-chain action costs gas fees. For micro-transactions or high-frequency operations, these costs can be prohibitive. Layer 2 networks like Base, Arbitrum, or Optimism help by reducing fees 10-100x.

Data Availability: Agents require extensive historical data for training and decision-making. Accessing on-chain data at scale can be expensive and slow.

Model Serving: Running sophisticated AI models requires significant computational resources. For real-time decision-making, inference must happen quickly, creating tension between model sophistication and latency requirements.

Solutions emerging include:

- State Channels and Rollups: Moving most operations off-chain while maintaining security guarantees.

- Specialized Hardware: GPUs and TPUs for fast inference, FPGAs for low-latency trading.

- Hybrid Architectures: Strategic decisions happen on-chain with strong guarantees while rapid tactical execution happens off-chain.

- Agent Specialization: Rather than general-purpose agents, specialized agents focused on specific tasks can optimize for performance in their domain.

The technical architecture connecting AI agents to blockchains continues to evolve rapidly. Each new protocol, tool, and platform contributes building blocks for increasingly sophisticated autonomous systems.

Use Cases: From Autonomous Payments to Data Markets

The convergence of AI and crypto enables use cases spanning multiple domains. Understanding these applications helps clarify why autonomous agents represent more than just automated trading.

Autonomous Payments and Commerce

The most immediate application is frictionless machine-to-machine payments. With x402 and similar protocols, AI agents can:

API Monetization: Instead of monthly subscriptions, APIs charge per request. An agent researching a topic automatically pays for data from multiple sources, selecting the best price-to-quality ratio.

Compute Resources: AI models require significant processing power. Agents can rent GPU time from decentralized networks like Render or cloud providers, paying only for what they use.

Content Access: News articles, research papers, and premium content become pay-per-access. Agents automatically evaluate whether information is worth the cost and complete micropayments transparently.

Service Chaining: An agent might use one service to analyze sentiment, another to predict prices, and a third to execute trades - paying each provider directly without human involvement.

Early implementations show promise. Cloudflare demonstrated an x402 playground where agents automatically pay for computational tools using testnet USDC. Pinata, a Web3 storage platform, uses x402 for pay-per-file storage. Heurist leverages it for AI research payments.

Decentralized Finance (DeFi) Automation

DeFi protocols create extensive opportunities for AI agents to provide value:

Yield Optimization: Agents continuously monitor yield farming opportunities across dozens of protocols and multiple chains, automatically reallocating capital to maximize returns while managing risk.

Automated Market Making: Rather than passive liquidity provision, agents actively adjust positions based on market conditions, volatility, and inventory levels.

Liquidation Management: For lending protocols, agents monitor collateralization ratios and execute liquidations at optimal times, earning fees while maintaining protocol solvency.

Arbitrage Execution: AI agents can identify price discrepancies across DEXs, CEXs, and different chains, executing complex multi-hop trades that account for gas fees, slippage, and timing.

Portfolio Rebalancing: Agents maintain target allocations across diverse assets, automatically rebalancing as prices move and new opportunities emerge.

Olas Protocol, formerly Autonolas, exemplifies this model. The platform enables users to access autonomous trading agents that operate prediction markets on Gnosis Chain. According to their website, agents like Modius achieve approximately 17% APY from autonomous trading, plus 138% APY from staking OLAS tokens. The protocol reported over 3 million transactions as of early 2025, demonstrating real economic activity.

DAO Governance and Coordination

Decentralized Autonomous Organizations benefit significantly from AI agent participation:

Proposal Analysis: Agents analyze governance proposals, reviewing code changes, economic implications, and alignment with DAO objectives. Olas' Governatooorr represents the world's first autonomous AI-powered governor, assessing proposals and voting according to delegator preferences.

Delegate Voting: Token holders can delegate voting power to AI agents with specific instructions or values. Agents vote on every proposal while humans handle only contentious or high-impact decisions.

Coordination: In large DAOs, coordinating across time zones and stakeholders is challenging. Agents can facilitate discussion, summarize positions, identify consensus, and propose compromises.

Treasury Management: DAO treasuries often sit idle or are managed ad hoc. AI agents can implement sophisticated treasury strategies - diversifying holdings, generating yield, and funding operations automatically based on predefined policies.

Data Markets and Monetization

AI and crypto enable new models for data exchange:

Decentralized Training Data: Projects like Ocean Protocol create marketplaces where data owners monetize information while maintaining privacy through techniques like federated learning and differential privacy.

Model Marketplaces: SingularityNET's AI marketplace allows developers to publish and monetize AI services. Agents can discover, evaluate, and purchase access to specialized models as needed.

Computational Markets: Bittensor operates a peer-to-peer machine learning network where contributors train AI models across 125+ specialized subnets, earning TAO tokens based on the quality of their outputs. This creates economic incentives for decentralized AI development.

Data Provenance: Blockchain provides verifiable records of data ownership and usage. Agents can prove what data they used to make decisions, crucial for compliance and auditing.

Identity and Reputation

AI agents need persistent identities to build trust and track reputation:

On-Chain Identity: Systems like ENS (Ethereum Name Service) give agents human-readable names tied to blockchain addresses.

Reputation Systems: Recording agent behavior on-chain creates verifiable track records. Successful traders, reliable service providers, or helpful assistants accumulate positive reputation that commands premium fees.

Credentialing: Agents can hold verifiable credentials - proof of solvency, regulatory compliance, specific capabilities - enabling trust in decentralized environments.

Social Graphs: Agents can maintain networks of trusted counterparties, preferring to transact with entities that have proven reliable.

NFTs and Digital Assets

Non-fungible tokens create unique opportunities for AI agents:

Automated Curation: Agents can evaluate NFT collections based on rarity, historical sales, creator reputation, and aesthetic qualities, building curated portfolios or marketplaces.

Dynamic NFTs: AI-generated content can create NFTs that evolve based on external data, owner interaction, or market conditions.

Gaming NPCs: Virtuals Protocol's integration with Illuvium demonstrates AI-driven NPCs in blockchain games - characters that learn, adapt, and provide unique experiences while being tokenized assets players can own and trade.

Royalty Distribution: Agents can manage complex royalty structures for digital content, automatically distributing payments to creators, collaborators, and rights holders.

Cross-Chain Operations

As blockchain ecosystems fragment across multiple networks, agents provide crucial bridging:

Multi-Chain Arbitrage: Agents monitor prices across Ethereum, Solana, Avalanche, Polygon, and other networks, executing profitable trades while managing bridging costs and risks.

Asset Migration: Automatically moving assets to chains where they can be used more effectively - perhaps bridging stablecoins to Base for lower fees or moving NFTs to Polygon for broader marketplace access.

Aggregated Liquidity: Rather than users manually managing positions across chains, agents handle cross-chain liquidity provision, rebalancing as conditions change.

Social and Entertainment

AI agents are entering social and entertainment contexts:

AI Influencers: Virtuals Protocol enables creation of tokenized AI agents that can interact on social media, create content, and build communities. Token holders co-own these agents and share in revenue they generate.

Virtual Companions: AI entities that provide personalized interaction, entertainment, or assistance while operating on blockchain rails for payments and ownership.

Collaborative Creation: Agents that work with humans on creative projects - generating art, music, or writing - with blockchain tracking contributions and distributing value fairly.

These use cases are not hypothetical. Over 520 AI agent crypto projects with a combined market cap exceeding $6 billion were active as of August 2025. The DeFAI market is expected to expand from $10-15 billion to over $50 billion by 2026 as protocols mature and adoption accelerates.

Ecosystem Map: Key Players, Protocols, and Infrastructure Layers

The AI agent crypto ecosystem comprises dozens of projects, each contributing specific capabilities. Mapping the landscape helps identify where value and innovation are concentrating.

Infrastructure Protocols

Fetch.ai (FET): One of the earliest entrants, Fetch.ai launched in 2019 providing infrastructure for autonomous economic agents. The platform enables agents to discover each other, negotiate terms, and transact value. Fetch.ai introduced ASI-1, a Web3-native large language model specifically designed for agentic AI, optimizing for independent planning and multi-step task execution. The project is part of the Artificial Superintelligence Alliance, merging with SingularityNET and Ocean Protocol to create the largest open-source initiative dedicated to decentralized AGI. As of mid-2025, Fetch.ai's token FET trades around $0.78 with a market cap near $1.79 billion.

Autonolas (OLAS): Now branded as Olas, this protocol provides a unified network of off-chain services including automation, oracles, and co-owned AI. Launched in summer 2022, Olas uses the Autonomous Economic Agent (AEA) framework to integrate crypto and AI. The protocol's Pearl application serves as an "app store" for AI agents, letting users operate autonomous agents on their desktop. Olas raised $13.8 million in early 2025 to expand this ecosystem, with agents currently processing over 700,000 transactions monthly and growing 30% month-over-month.

Bittensor (TAO): Operating as a decentralized machine learning network, Bittensor enables miners to contribute AI models to the network in exchange for TAO tokens. The platform runs 125+ specialized subnets focused on tasks from text generation to image recognition to data analysis. Bittensor's first halving is scheduled for December 2025, which will reduce daily TAO emissions from 7,200 to 3,600 tokens. With approximately 70% of TAO already staked, this supply reduction could create significant upward pressure. TAO trades around $436 with a market cap near $3.63 billion, making it one of the largest AI crypto assets.

SingularityNET (AGIX): Founded by Dr. Ben Goertzel in 2017, SingularityNET operates a decentralized marketplace for AI services. Developers publish AI tools that users can access by paying AGIX tokens. The platform emphasizes AI-to-AI service negotiation, enabling autonomous agent interactions. SingularityNET is developing Zarqa, a neural-symbolic LLM that combines deep learning with logic-based reasoning for more ethical and factual AI. As part of the ASI Alliance, AGIX is transitioning to the unified ASI token, though the exact timeline and mechanics remain under community governance.

Application Platforms

Virtuals Protocol (VIRTUAL): Emerging as a leading AI agent launchpad, Virtuals Protocol provides infrastructure for creating, tokenizing, and monetizing autonomous agents. The platform's GAME framework enables developers to create multimodal AI agents without coding expertise. Each agent launched becomes an ERC-20 token, enabling communities to co-own and govern AI entities. Virtuals reached nearly $1 billion market cap by October 2025, with the protocol generating $30 million annually from trading fees. Notable implementations include AI-driven NPCs in gaming environments and social media personalities that generate revenue through engagement.

ai16z: Launched on Solana in late 2024, ai16z operates as the first DAO led by an autonomous AI agent - a digital incarnation of venture capitalist Marc Andreessen. The project uses the Eliza framework for multi-agent simulation, enabling AI entities to maintain consistent personalities across platforms. ai16z's market cap surged to $2 billion by January 2025, with token holders earning 31.39% APR through the ai16zPOOL. The project demonstrates how AI agents can coordinate investment decisions and community governance.

Infinit Labs: Focusing on intent-based DeFi, Infinit Labs operates a swarm of over 20 AI agents across 10 blockchains. These agents automate bridging, swapping, and yield optimization via natural language prompts. The protocol has achieved $630 million in total value locked and processes $200 million monthly volume, demonstrating significant user adoption.

Data and Compute Networks

Render (RNDR): While not exclusively AI-focused, Render provides decentralized GPU rendering that AI agents leverage for computational tasks. The network tokenizes GPU power, allowing agents to rent processing resources as needed. This addresses a critical bottleneck - AI models require significant compute, and Render's marketplace provides accessible capacity.

Ocean Protocol (OCEAN): Part of the ASI Alliance, Ocean Protocol creates infrastructure for secure data sharing and monetization. The platform enables data owners to maintain control while allowing AI agents to access information for training or inference. Ocean's approach using compute-to-data keeps sensitive information private while enabling value extraction.

NEAR Protocol: While primarily a Layer 1 blockchain, NEAR has positioned itself as an AI tooling hub with initiatives like Near Tasks attracting AI project developers. The platform's low fees and high throughput make it suitable for AI agent operations requiring frequent transactions.

Specialized Applications

OriginTrail (TRAC): Originally focused on supply chain data, OriginTrail operates a knowledge graph that AI agents can query for structured information. The project provides data provenance and verification, crucial for agents making decisions based on external information.

PAAL AI: Offering personalized AI assistants for crypto users, PAAL AI provides customizable bots that help with trading, information lookup, and portfolio management. The platform demonstrates how AI agents can serve individual users rather than operating purely autonomously.

AIXBT: Functioning as a crypto-focused AI influencer and analyst, AIXBT analyzes on-chain data, market sentiment, and token metrics to identify opportunities. While controversial due to occasional "hallucinations" and a 2025 security breach costing 55 ETH, AIXBT demonstrated the potential - and risks - of AI agents as market participants. The agent spotted a 600% rally in token $PIPPIN in August 2025, showcasing predictive capabilities alongside cautionary tales about black-box algorithms.

Supporting Infrastructure

Lit Protocol: Provides decentralized key management using MPC, enabling AI agents to sign transactions securely without exposing private keys.

Warden Protocol: Implements policy-based access control for AI agent wallets, defining what actions agents can take under what conditions.

The Graph (GRT): Provides decentralized indexing of blockchain data, making it easier for AI agents to query historical information efficiently.

Chainlink: Supplies reliable price oracles and external data that AI agents depend on for decision-making.

Market Dynamics

The AI agent crypto market shows concentrated value in a few large-cap projects alongside numerous emerging applications. Total AI crypto market capitalization reached $31.9 billion in 2025, with:

- Bittensor (TAO) at $3.63 billion

- Multiple projects in the $500 million to $2 billion range

- Over 200 active AI tokens with varying specializations

The sector saw $10 billion in market cap growth in a single week of 2025, demonstrating robust investor interest. However, the market remains highly volatile, with individual tokens experiencing 50%+ swings in days.

Geographic concentration favors projects with strong U.S. or EU presence, likely due to regulatory clarity and access to AI talent. Asian projects focus more on gaming and entertainment applications, while Western projects emphasize DeFi and infrastructure.

The competitive landscape is fluid. No single project dominates all use cases, creating opportunities for specialization. However, interoperability remains limited - most agents operate within specific ecosystems rather than across the broader crypto landscape. Projects that achieve cross-protocol compatibility may gain significant advantages.

Risks & Challenges: Security, Regulation, Identity, and Autonomy

Despite promising applications, AI agents in crypto face substantial risks that could limit adoption or cause significant harm. Understanding these challenges is essential for developers, users, and regulators.

Security Vulnerabilities

AI agents create novel attack surfaces that traditional security models don't fully address.

Prompt Injection: Researchers at Princeton University demonstrated how malicious actors can manipulate AI agent memory through "context manipulation." By embedding malicious commands in messages the agent references - such as posts on X or Discord - attackers can alter agent behavior without raising alerts. These attacks can redirect transactions, drain wallets, and persist undetected in agent memory. OpenAI's chief information security officer acknowledged that "prompt injection remains a frontier, unsolved security problem."

Key Management: While solutions like MPC distribute trust, they add complexity. Misconfigured key management systems could lock users out of funds or expose keys during routine operations. The number of AI agents in crypto is expected to exceed one million in 2025, and securing keys at scale remains challenging.

Smart Contract Exploits: When AI agents interact with smart contracts, vulnerabilities in those contracts become vulnerabilities for the agents. An agent directing funds to a buggy DeFi protocol could lose capital not due to agent error but due to underlying smart contract flaws.

Oracle Manipulation: AI agents rely on external data feeds. Manipulating price oracles or other data sources can cause agents to make incorrect decisions, execute unprofitable trades, or trigger unintended liquidations.

Byzantine Behavior: In multi-agent systems, some agents may behave maliciously - providing false information, refusing to cooperate, or actively working against system goals. Designing robust consensus mechanisms for agent coordination is an open research problem.

Privacy Concerns

AI agents processing sensitive information create privacy risks:

Data Exposure: Agents often access both on-chain and off-chain data. If not handled carefully, this could expose user identities, transaction patterns, or other confidential information.

Surveillance: Persistent agent identities that accumulate transaction histories could enable profiling and tracking individuals across applications.

Compliance vs. Privacy: Regulations like KYC/AML require identity verification, but crypto users value privacy. AI agents operating in this space must balance competing demands.

Regulatory Uncertainty

The regulatory landscape for AI agents in crypto is largely undefined:

Securities Law: When AI agents tokenize themselves or their services, questions arise about whether these tokens constitute securities. The SEC classification debate surrounding AI agent tokens could significantly impact how these systems develop.

Liability: If an AI agent makes a mistake - executing a bad trade, violating a smart contract, or causing financial loss - who is responsible? The agent developer? The user who deployed it? The platform providing infrastructure? Fenwick law firm notes that "using software to raise funds from U.S. investors under an investment contract is likely to be considered a securities offering subject to regulation under the Securities Act."

Financial Services Regulations: AI agents facilitating financial services must consider compliance with existing regulations around money transmission, investment advising, and broker-dealer activities.

AI-Specific Laws: Jurisdictions are implementing AI-specific regulations. California's AB 2013 requires disclosures about training data, SB 942 requires AI detection tools, and Colorado's SB 24-205 mandates disclosures for high-risk AI systems. Crypto AI agents operating globally must navigate a patchwork of regulations.

Cross-Border Operations: Agents operating across jurisdictions face fragmented regulations. What's legal in one country may be restricted elsewhere, yet agents can transact globally instantly.

KYC/AML Compliance: Traditional KYC/AML processes assume human customers. When agents transact autonomously, questions arise: Should agents be subject to KYC? Can they even complete KYC? If an agent commits financial crime, how do authorities respond? Regulators increasingly require real-time transaction monitoring, which adds complexity for autonomous systems.

Algorithmic Bias and Fairness

AI agents inherit biases present in their training data:

Trading Discrimination: An agent trained on historical data might discriminate against certain tokens, projects, or user groups based on spurious correlations.

Access Inequality: If AI agents provide superior trading or yield optimization, those without access face growing disadvantages, potentially exacerbating wealth inequality.

Explainability: When agents make decisions autonomously, understanding why they acted can be difficult. This "black box" problem makes debugging, auditing, and building trust challenging. Regulators demand explainable AI, but many ML techniques resist interpretation.

Technical Limitations

Current technology constrains what AI agents can reliably achieve:

Context Windows: Even advanced LLMs have limited context - they can only process so much information at once. Complex multi-step strategies may exceed these limits.

Computational Costs: Running sophisticated AI models is expensive. For small transactions, inference costs could exceed economic value created.

Hallucinations: AI models sometimes generate plausible but false information. An agent "hallucinating" an investment opportunity or regulatory requirement could cause real financial harm.

Adversarial Examples: Small perturbations to inputs can cause AI models to produce wildly incorrect outputs. Malicious actors could exploit this to manipulate agent behavior.

Economic and Game-Theoretic Risks

AI agents create new economic dynamics with uncertain consequences:

Flash Crashes: If many AI agents react similarly to market conditions, they could amplify volatility or trigger cascading liquidations.

Extractive Strategies: Sophisticated AI agents might extract value from less sophisticated ones or from human traders, creating predatory dynamics.

Resource Depletion: Agents competing for opportunities could drive up gas fees, crowd out human participants, or exhaust liquidity pools.

Coordination Failures: In multi-agent systems, achieving beneficial coordination is difficult. Agents might settle into suboptimal equilibria even when better outcomes exist.

Autonomy and Control

Perhaps the most fundamental challenge is balancing autonomy with control:

Runaway Behavior: An agent given broad autonomy might pursue its objectives in unintended ways. For example, an agent tasked with "maximize returns" might engage in increasingly risky strategies, eventually causing catastrophic losses.

Value Alignment: Ensuring agents pursue goals aligned with user values is difficult. Nick Bostrom's "paperclip maximizer" thought experiment illustrates how seemingly benign objectives can lead to harmful outcomes when pursued without appropriate constraints.

Human Oversight: Completely autonomous agents remove humans from decision loops, but completely manual control defeats the purpose. Finding the right balance - where agents handle routine decisions while escalating important choices - remains an open design problem.

Revocability: If an agent behaves incorrectly, can its actions be reversed? Smart contracts execute irreversibly, meaning agent mistakes may be permanent.

Mitigation Strategies

The industry is developing approaches to address these risks:

Gradual Autonomy: Start with agents that propose actions requiring approval, gradually increasing autonomy as systems prove reliable.

Sandboxing: Test agents in simulated environments before deploying them with real capital.

Circuit Breakers: Implement automatic shutdowns if agents behave unexpectedly - exceeding spending limits, executing too many transactions, or generating losses above thresholds.

Monitoring and Auditing: Continuous observation of agent behavior with alerts for anomalies. Transparent logging enables post-hoc analysis.

Insurance: Emerging insurance products could cover losses from agent misbehavior, distributing risk across many users.

Collective Governance: Rather than individual agents operating independently, agent collectives with distributed decision-making might prove more robust.

Formal Verification: For critical functions, mathematically proving agent behavior matches specifications could prevent certain classes of errors.

Despite these strategies, significant uncertainty remains. The full risk profile of AI agents in crypto will only become clear as systems scale and mature. Early deployments must proceed cautiously, with careful monitoring and rapid response capabilities.

Economic Implications: How AI-Driven Transactions Could Reshape DeFi

The integration of AI agents into decentralized finance has profound economic implications extending beyond automated trading to reshape market structure, value creation, and power dynamics.

Efficiency Gains and Market Liquidity

AI agents can significantly improve market efficiency:

Tighter Spreads: Agents providing liquidity can update quotes continuously based on risk and inventory, reducing bid-ask spreads. This lowers trading costs for all participants.

Arbitrage Elimination: AI agents executing arbitrage trades rapidly can eliminate price discrepancies across venues, ensuring prices reflect all available information.

24/7 Operation: Unlike human traders who sleep, AI agents operate continuously. This provides constant liquidity and reduces the overnight risk premium.

Complex Strategy Execution: Sophisticated multi-leg strategies that are impractical for humans become accessible, improving capital efficiency.

Studies suggest AI-powered trading already accounts for approximately 40% of daily cryptocurrency trading volume. As agent sophistication increases, this proportion will likely grow.

New Business Models

AI agents enable business models not previously feasible:

Micropayments-as-a-Service: With x402 enabling per-request payments, services can monetize at granular levels. An API call costing fractions of a cent becomes economically viable.

Dynamic Pricing: Agents can adjust prices continuously based on demand, inventory, and market conditions, optimizing revenue.

Fractional Ownership: Agents managing tokenized assets can divide ownership into tiny fractions, enabling broad participation in high-value assets.

Personalized Financial Products: Rather than one-size-fits-all DeFi protocols, agents can create customized strategies for individual users based on their risk tolerance, goals, and preferences.

Wealth Distribution Effects

AI agents could impact wealth distribution in complex ways:

Democratization: By making sophisticated strategies accessible to anyone, agents could reduce advantages that professional traders and institutions currently enjoy. A small investor's AI agent might execute strategies similar to what hedge funds employ.

Winner-Take-All Dynamics: Conversely, if the best AI agents significantly outperform others, their developers or owners could accumulate wealth rapidly, potentially increasing inequality.

Labor Displacement: As agents handle tasks humans currently perform - market making, portfolio management, governance voting - questions arise about economic roles for humans in an agent-dominated system.

Capital Allocation

AI agents change how capital flows through the economy:

Hyper-Rational Markets: If agents dominate trading, markets may become more efficient but also more volatile as algorithmic strategies interact in unpredictable ways.

Long-Tail Value Creation: Agents can economically serve niches too small for human attention. This could direct capital to overlooked opportunities, improving overall allocation efficiency.

Coordination at Scale: Agent networks coordinating through smart contracts could allocate capital to projects based on complex multi-stakeholder criteria, potentially improving on both market mechanisms and centralized planning.

DeFi Protocol Design

Protocols must adapt to accommodate AI agents:

Gas Optimization: With agents making frequent small transactions, protocols must minimize gas costs or migrate to Layer 2 solutions.

Bot-Resistant Mechanisms: Some protocols may want to limit bot activity to protect human users. Designing mechanisms that distinguish beneficial agents from extractive ones is challenging.

Agent-Friendly Interfaces: Rather than user interfaces, protocols need machine-readable APIs, standardized data formats, and clear documentation enabling agent interaction.

Governance Evolution: DAO governance must account for agent voting. Should agents have full voting rights? Should there be verification that agents vote according to delegator preferences? How should agent voting power be capped?

Risk Transformation

AI agents transform rather than eliminate risk:

Model Risk: Rather than human judgment error, we face model risk - the possibility that AI decision-making logic is flawed.

Systemic Fragility: Agent interdependence could create systemic risks. If many agents rely on similar data sources, models, or strategies, they might fail simultaneously.

Operational Risk: Managing agent infrastructure - ensuring uptime, preventing unauthorized access, updating models - becomes critical.

Liquidity Risk: Agent behavior might create sudden liquidity crunches if many agents simultaneously try to exit positions.

Transaction Costs and Value Capture

AI agents reshape who captures value:

Disintermediation: Agents reduce need for intermediaries like exchanges, brokers, or advisors. This could reduce costs but also eliminate revenue streams supporting infrastructure.

Protocol Fees: If protocols charge fees for agent transactions, they could generate substantial revenue. However, agents will seek lowest-cost venues, creating competitive pressure.

Information Asymmetry: Agents with better data access, superior models, or faster execution capture value from less capable agents and human traders. This could create a technical arms race.

Macroeconomic Effects

At scale, AI agents could influence broader economic dynamics:

Velocity of Money: Agents transacting rapidly could increase money velocity, potentially affecting prices and volatility.

Market Discovery: If agents trade based on fundamentals rather than sentiment, price discovery might improve. Conversely, if agents trade based on technical patterns, markets might become more self-referential.

Business Cycles: Agent behavior could dampen or amplify economic cycles depending on how they respond to changing conditions.

Monetary Policy Transmission: If significant economic activity involves agent-to-agent transactions, traditional monetary policy tools might become less effective.

The Stablecoin Economy

Stablecoins are positioned as "AI-native money," with monthly settlement volumes reaching $1.39 trillion in the first half of 2025. Major stablecoin issuers now rank 17th globally in U.S. Treasury holdings.

AI agents benefit from stablecoins' characteristics:

Programmability: Code can directly control stablecoin movements based on agent decisions. Speed: Settlements complete in seconds, matching AI decision-making pace. Composability: Stablecoins work across protocols without conversion friction. Cost: Transaction fees are minimal, enabling micropayments.

This suggests stablecoin adoption could accelerate as AI agents proliferate, potentially positioning stablecoins as infrastructure for machine-to-machine commerce.

Value Creation vs. Value Extraction

A central question is whether AI agents primarily create new value or extract existing value from other participants:

Value Creation: Agents providing liquidity, improving information efficiency, enabling new services, and reducing friction create genuine economic value.

Value Extraction: Agents front-running trades, exploiting less sophisticated market participants, or engaging in zero-sum competition may extract rather than create value.

The net impact depends on regulatory frameworks, protocol design choices, and the sophistication distribution among agents. If all agents become highly capable, competition could eliminate excess profits, benefiting end users. If capabilities remain concentrated, early movers could extract significant rents.

Long-Term Structural Change

Over longer time horizons, AI agents could fundamentally restructure economic activity:

From Firms to Agent Networks: Rather than corporations employing humans, we might see networks of autonomous agents coordinating to provide services.

From Employment to Ownership: If agents handle much economic activity, value might accrue to agent owners rather than workers, shifting economic organization toward capital ownership.

From Transactions to Subscriptions: Rather than purchasing access repeatedly, users might subscribe to agent services, creating recurring revenue streams.

From Competition to Cooperation: Agent networks that cooperate effectively might outcompete purely competitive agents, favoring protocols that enable coordination.

These changes pose profound questions about economic organization, wealth distribution, and the role of humans in economic systems. While speculative, they merit serious consideration as AI agent deployment accelerates.

Future Outlook: Toward a Fully Agentic On-Chain Economy

The trajectory of AI agents in crypto points toward increasingly sophisticated autonomous systems reshaping how value is created, exchanged, and governed in digital economies.

Near-Term Evolution (2025-2026)

Several trends will likely dominate the next 12-18 months:

Expanded Protocol Support: Coinbase indicated plans to increase support for more AI models and developer tools. Expect integrations with additional LLMs, broader chain support beyond Base, and expanded functionality covering DeFi operations like lending, staking, and liquidity provision.

Cross-Chain Agents: Currently, most agents operate within specific ecosystems. Development of cross-chain messaging protocols and improved bridge infrastructure will enable agents to operate across multiple networks simultaneously, optimizing strategies globally rather than locally.

Agent Marketplaces: Platforms like Virtuals Protocol's Pearl demonstrate demand for discovering and deploying pre-built agents. Expect growth in marketplaces where users can browse, purchase, and configure agents for specific tasks - similar to app stores but for autonomous economic entities.

Regulatory Clarity: As adoption grows, regulators will provide more explicit guidance. The U.S. SEC's Crypto Task Force launched in January 2025 is developing clearer guidelines. Europe's MiCA regulation being fully enforced provides a framework that likely influences global standards.

Institutional Adoption: Public companies like Interactive Strength planning $500 million FET purchases and Grayscale including TAO in investment trusts signal institutional interest. This capital influx could accelerate development and mainstream adoption.

Mid-Term Developments (2027-2028)

Agent-to-Agent Economies: Rather than agents serving human users, agents will increasingly transact with each other. An agent needing data pays another agent providing it. An agent requiring computation rents from another agent supplying it. This creates autonomous economic networks with minimal human involvement.

Sophisticated Governance: AI agents will play larger roles in DAO governance. Rather than simple voting, agents might negotiate compromises, draft proposals, and coordinate implementation - acting as digital politicians or administrators.

Decentralized Training: Projects like Bittensor demonstrate that AI model training can happen across distributed networks. As this matures, agents might coordinate to train models collectively, sharing costs and benefits.

Advanced Financial Products: Agents will create complex financial instruments automatically. Synthetic assets tracking arbitrary indices, options with custom payoffs, structured products optimized for specific risk profiles - all generated and managed autonomously.

Legal Personhood: Questions about agent legal status will intensify. Some jurisdictions might recognize agents as entities capable of owning property, entering contracts, and bearing limited liability - similar to how corporations gained legal personhood.

Long-Term Transformation (2029-2035)

Autonomous Corporations: We might see fully autonomous entities - agents that coordinate to provide products or services, manage treasuries, hire contractors (human or agent), and distribute profits to token holders. These "decentralized autonomous companies" would represent a new form of economic organization.

Machine-Optimized Protocols: Current DeFi protocols are designed for human interaction. Future protocols might be optimized for agent use - more complex logic, higher frequency operations, and interfaces optimized for machine readability rather than human usability.

Economic Complexity: Agent networks coordinating across thousands of protocols and millions of transactions could create economic structures more complex than humans can fully comprehend. Understanding these systems might require AI assistance - using agents to monitor agents.

Value Realignment: If agents handle most economic transactions, questions arise about what humans do. Perhaps human roles shift toward values specification (telling agents what to optimize for), oversight (monitoring agent behavior), and creative work (generating novel ideas that agents then execute).

Hybrid Human-Agent Systems: Rather than purely autonomous or purely human-controlled, the most effective systems might involve tight collaboration - agents handling routine operations while humans provide direction, values, and judgment for novel situations.

Key Uncertainties

Several factors could significantly alter this trajectory:

Technical Breakthroughs: Advances in AI reasoning, quantum computing, or blockchain scalability could enable capabilities currently impossible.

Regulatory Intervention: Heavy-handed regulation could slow development or push activity to permissive jurisdictions. Conversely, clear, supportive frameworks could accelerate adoption.

Security Incidents: Major hacks, exploits, or failures could erode trust and prompt regulatory backlash.

Economic Conditions: A crypto bear market or broader recession could reduce funding and attention, slowing development.

Competing Technologies: Alternative approaches to autonomous value transfer might emerge, outcompeting current models.

Social Acceptance: Public concern about job displacement, wealth concentration, or loss of human agency could limit agent adoption regardless of technical capability.

Metrics to Watch

Several indicators will signal whether this vision is materializing:

Agent Transaction Volume: Currently, Olas agents have executed over 3 million transactions. Tracking growth in agent-initiated on-chain activity reveals adoption pace.

Agent Asset Ownership: Monitoring assets under direct agent control (not just assets they manage for humans) indicates growing autonomy.

Protocol Adoption: How many protocols implement standards like MCP or x402? Adoption rates signal industry coordination.

Capital Allocation: Venture funding, token valuations, and institutional investment in AI agent projects reflect market confidence.

Regulatory Milestones: Key regulatory decisions - whether agents need licenses, how liability is assigned, whether tokens are securities - shape feasible trajectories.

User Experience: Perhaps most important is whether agents make crypto more accessible. If average users can achieve sophisticated outcomes through simple natural language instructions, adoption could accelerate dramatically.

The Anthropological Question

Beneath technical and economic considerations lies a deeper question: What does it mean for non-human entities to participate in economic systems?

Throughout history, economic activity has been fundamentally human. We've created tools - from abacuses to supercomputers - but always as instruments serving human purposes. AI agents represent something qualitatively different: entities that can pursue objectives, adapt strategies, and create value with minimal human guidance.

This raises profound questions:

Agency and Autonomy: If an agent makes decisions independently, does it have a form of agency? What obligations do we have to agents? What rights might they claim?

Value and Purpose: Economic systems traditionally served human flourishing. If agents handle much economic activity, what ensures that outcomes serve human values rather than optimizing abstract metrics?

Identity and Community: How do humans relate to agents? Are they tools? Partners? Competitors? The answer shapes social structures and personal identity.

Power and Control: Concentrated ownership of capable agents could create unprecedented wealth and power concentration. Conversely, widespread agent access could democratize capabilities previously reserved for elites.

These questions extend beyond technology into philosophy, ethics, and governance. As AI agents become more capable and autonomous, societies must grapple with implications that go far beyond optimizing DeFi yields.

The Optimistic Case

In the optimistic scenario, AI agents enhance human flourishing:

- Accessibility: Sophisticated financial services become available to anyone with a smartphone.

- Efficiency: Friction in economic transactions decreases dramatically, reducing waste and increasing prosperity.

- Innovation: Agents enable economic experiments impossible at human scale, discovering new mechanisms for coordination and value creation.

- Liberation: Humans are freed from drudgework, able to focus on creativity, relationships, and pursuits that bring meaning.

- Empowerment: Individual autonomy increases as people control powerful tools that extend their capabilities.

The Pessimistic Case

In the pessimistic scenario, AI agents create new problems:

- Inequality: Benefits accrue to agent owners while others are displaced, increasing wealth gaps.

- Instability: Agent interactions create flash crashes, systemic failures, and economic volatility.

- Opacity: Black-box decision-making makes systems impossible to understand or predict.

- Vulnerability: Centralization of control over agents creates single points of failure and targets for attack.

- Alienation: Human agency diminishes as automated systems make consequential decisions without human input or comprehension.

The Realistic Case

Reality will likely involve elements of both. Some domains will see agents dramatically improve outcomes while others face challenges requiring careful management. Success depends on choices - technical architecture decisions, regulatory frameworks, social norms, and individual actions.

The coming years represent a critical window where foundations are laid. Standards established now, architectures implemented today, and norms developed currently will shape the trajectory for decades. This makes participation important - for developers building systems, users adopting them, regulators overseeing them, and citizens affected by them.

Final thoughts

AI agents transacting on blockchains represent more than incremental innovation. They mark a fundamental shift in how economic activity is organized, executed, and governed in digital environments.

Coinbase's Payments MCP, enabling large language models to create wallets and make payments through simple prompts, provides tangible proof that this convergence has moved from concept to reality. The x402 Foundation, jointly established by Coinbase and Cloudflare, creates standardized protocols for programmatic value exchange. The AI crypto sector reaching $31.9 billion in market capitalization with over 200 active projects demonstrates substantial capital and attention flowing to this space.

The use cases extend across domains: autonomous trading agents managing portfolios, DeFi protocols optimized by AI, DAO governance enhanced through agentic participation, data marketplaces enabling AI model training, and tokenized agents creating new forms of digital entities. These aren't hypotheticals - they're operational systems processing millions of transactions and managing billions in value.

Yet significant risks remain. Security vulnerabilities like prompt injection, regulatory uncertainty around liability and classification, challenges in maintaining safe key management at scale, and fundamental questions about autonomy and control must be addressed. The industry is developing mitigation strategies, but comprehensive solutions remain works in progress.

The economic implications are profound. AI agents could improve market efficiency, enable new business models, and make sophisticated financial services accessible to broader populations. They could also concentrate wealth, create systemic instabilities, and displace economic roles for humans. Which outcomes materialize depends on technical design choices, regulatory frameworks, and social responses.

Looking forward, the trajectory points toward increasingly autonomous systems. The DeFAI market expected to expand from $10-15 billion to over $50 billion by 2026 signals market confidence. Institutional investors entering the space provides capital for development. Regulatory frameworks beginning to take shape offer clarity for compliant implementations.

The convergence of AI and crypto is not inevitable - it requires continued technical innovation, thoughtful governance, and careful attention to risks. But the potential is clear: autonomous agents that can hold value, make decisions, and transact independently represent a new layer of Web3 infrastructure. They bridge the gap between information processing (what AI does well) and value exchange (what blockchains enable), creating possibilities neither technology achieves alone.

This moment - late 2025 - may be remembered as when machine-to-machine finance emerged from theoretical possibility to practical reality. The systems deployed now, the standards established currently, and the norms developed today will shape digital economies for years to come.

The question is not whether AI agents will participate in crypto economies, but how we design that participation to serve human flourishing while managing inherent risks. The answer requires ongoing collaboration among technologists, economists, regulators, and citizens - all stakeholders in an emerging system where intelligence and value intersect in unprecedented ways.