The crypto market has shown remarkable resilience and growth over the past week, with the global market cap reaching $3.63 trillion and a daily trading volume of $127.97 billion. Market sentiment leans strongly toward Greed, as indicated by the Fear and Greed Index at 77.

This bullish outlook aligns with the Altcoin Season Index, which stands at 64/100, signaling a shift in momentum favoring altcoins over Bitcoin. While the CoinMarketCap 100 Index recorded a slight decline of 0.49%, the overall market performance remains optimistic, particularly for trending altcoins driving significant activity and adoption.

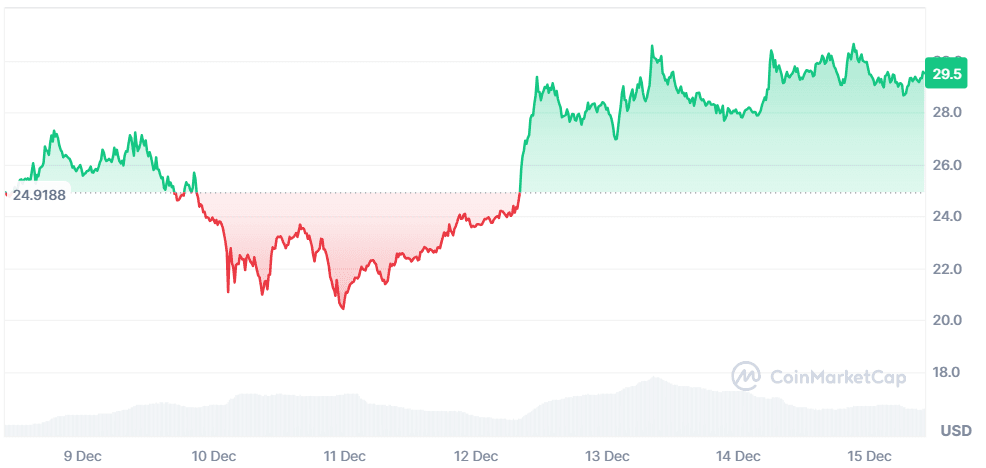

Chainlink (LINK)

Price Change (7D): +18.95% Current Price: $29.67

News: Chainlink has recently reached a market cap of $18.59 billion, signaling strong institutional and retail interest in the cryptocurrency. The surge is accompanied by Lista DAO’s decision to upgrade its infrastructure by adopting Chainlink Price Feeds on the BNB Chain, securing its $180 million BNB-USD market and lisUSD stability with high-quality, tamper-proof data. The integration highlights Chainlink’s role as the leading decentralized oracle network, trusted by institutions like Swift and top DeFi platforms like Aave and GMX, having secured over $17 trillion in transaction value.

The upgrade ensures Lista DAO can deliver enhanced security and reliability, particularly during volatile market events. By integrating Chainlink’s infrastructure, Lista DAO strengthens its liquid staking and CDP mechanisms, allowing users to earn rewards while retaining liquidity. This has further bolstered confidence in Chainlink’s ecosystem, positioning it as an essential player in the blockchain economy.

Forecast: Chainlink is exhibiting strong bullish momentum, having broken out of a prolonged three-year downtrend. The current price action shows LINK nearing a critical resistance at $30.32, with intermediate targets at $32.50 and a long-term projection of $55.39. Key technical indicators such as RSI (67.73) suggest healthy upward momentum, although nearing overbought conditions. Falling wedge patterns observed over recent years point to a bullish reversal, and the recent breakout aligns with historical trends that preceded significant price rallies.

If LINK sustains volume and breaks resistance at $30.32, it could initiate a price discovery phase, targeting higher levels. Support at $27.50 and $25.00 provides safety nets for potential pullbacks, which may offer re-entry opportunities for investors. The convergence of MACD indicators further highlights a strong trend, but cautious monitoring is advised, especially during short-term consolidations. With increasing adoption across institutional and DeFi markets, Chainlink remains poised for significant growth heading into 2025.

Virtuals Protocol (VIRTUAL)

Price Change (7D): +42.75% Current Price: $2.44

News: Virtuals Protocol has seen a major boost in adoption following its Binance Futures listing on December 10, which has significantly increased trading volume and liquidity. Additionally, the protocol’s partnership with Hyperbolic Labs marks a major milestone, as it enables Virtuals Protocol agents to directly access Hyperbolic’s infrastructure for improved performance and scalability. The launch of the Agent Prompting Interface further enhances its functionality by offering seamless integration between external applications and Virtuals Agent Composer, solidifying its position in the AI-driven computational space.

Forecast: With strong recent developments, Virtuals Protocol appears poised for sustained growth. The Binance Futures listing and its Hyperbolic partnership provide a strong foundation for wider adoption. These moves, combined with the introduction of innovative tools like the Agent Prompting Interface, have improved market sentiment and investor confidence. While the token’s bullish trend is likely to continue, short-term corrections could occur as investors lock in profits from the recent surge. Long-term prospects remain positive, particularly as the demand for AI-integrated solutions continues to rise.

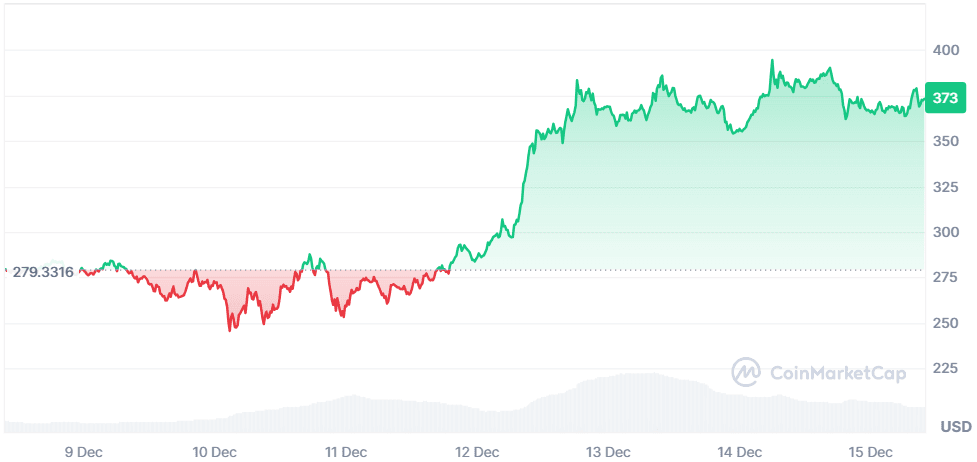

Aave (AAVE)

Price Change (7D): +33.38% Current Price: $372.56

News: Aave has surged past the $300 level for the first time in three years, driven by increased demand and significant token purchases by World Liberty Financial, a DeFi protocol associated with Donald Trump. WLFI’s recent acquisitions have not only boosted AAVE’s price but also contributed to heightened trading volume and investor interest. AAVE tokens that had been dormant for so long have become active, reducing the token’s Mean Dollar Invested Age, which has further strengthened the rally. Additionally, Aave’s market cap-to-TVL ratio of 0.2509 reflects strong fundamentals, while the ongoing bullish momentum highlights renewed confidence in the protocol.

Forecast: Aave’s performance indicates strong bullish sentiment, with potential for further gains if it breaks past the $366.25 resistance level. Technical indicators, such as the current RSI of 81.51, suggest that the token is in overbought territory, which could lead to a short-term pullback. However, if Aave consolidates and sustains its momentum, the price could aim for new highs around $390. Long-term growth prospects remain robust, driven by its utility in the DeFi space and growing adoption by major institutional players like WLFI. Traders should monitor support levels closely, as any corrections could present strategic entry points for investors.

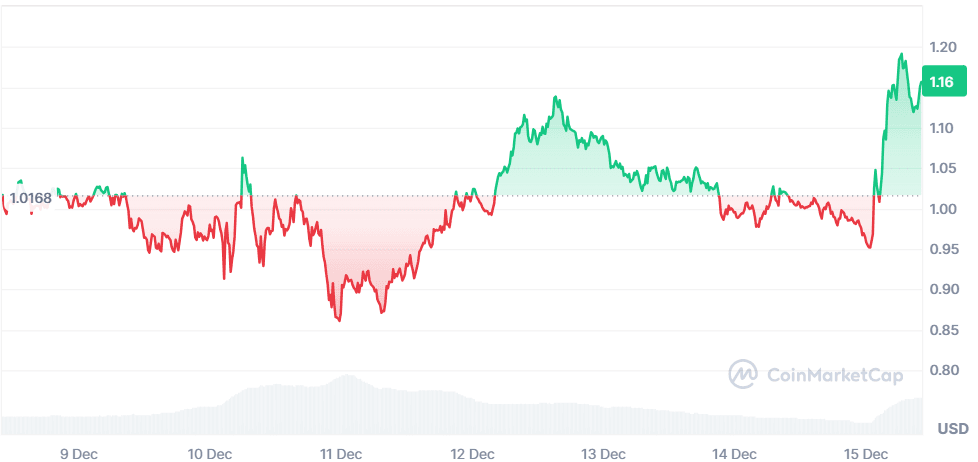

Ethena (ENA)

Price Change (7D): +14.22% Current Price: $1.16

News: Ethena has seen strong market momentum this week, partly driven by a significant purchase from World Liberty Financial (WLFI), a DeFi project backed by Trump. WLFI acquired 509,954 ENA tokens at an average price of $0.98, contributing to increased demand and price growth. Additionally, Ethena Labs is set to launch its USDe stablecoin on December 16. Unlike traditional stablecoins, USDe employs a delta-neutral trading strategy and offers a high yield of 29% per annum, setting it apart in the DeFi ecosystem. However, this innovative model has drawn comparisons to Terra-Luna’s collapse, raising concerns about its long-term sustainability in bearish market conditions.

Forecast: Ethena’s outlook remains cautiously optimistic, supported by recent strategic investments and the upcoming stablecoin launch. With whales controlling 85% of ENA’s circulating supply, price movements could remain volatile, dictated by institutional activity. The market cap-to-TVL ratio of 0.5672 highlights undervaluation, suggesting room for growth if adoption continues. However, the sustainability of USDe’s yield model will play a crucial role in maintaining investor confidence. While bullish trends are expected in the near term, challenges such as funding rate volatility and market efficiency could test Ethena’s resilience in adverse market conditions.

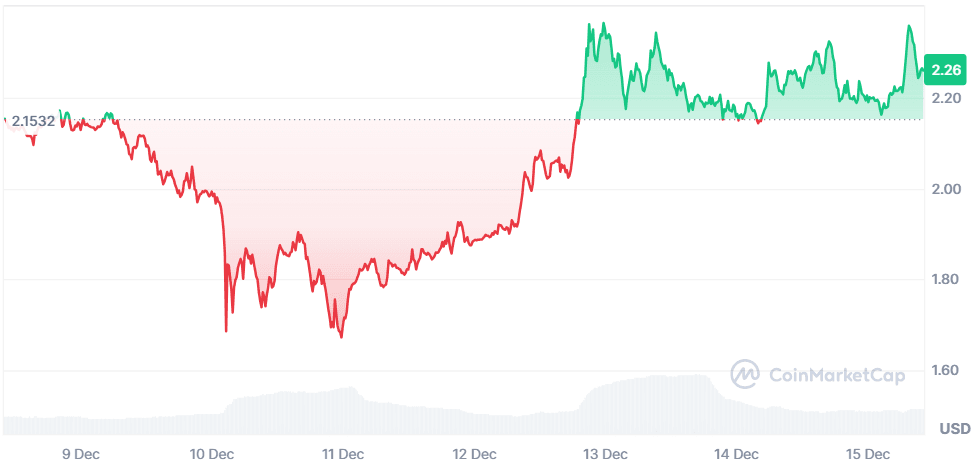

Lido DAO (LDO)

Price Change (7D): +4.89% Current Price: $2.26

News: Lido DAO gained attention following Grayscale’s announcement of its new single-asset investment trusts for LDO and Optimism (OP). This move has opened avenues for institutional investors to gain exposure to Lido’s liquid staking solutions. Currently the leading DeFi protocol by total value locked (TVL), Lido manages over $40 billion in staked assets, enhancing Ethereum’s security and accessibility. Grayscale’s trusts aim to democratize Ethereum staking, further boosting LDO’s appeal among investors. Lido’s integration into Ethereum’s ecosystem solidifies its position as a vital component of the blockchain’s scaling and staking solutions.

Forecast: Lido DAO is poised for steady growth, driven by Grayscale’s institutional backing and its dominant position in the DeFi space. With a TVL of $40 billion and a strong CertiK security score of 93.53, the protocol demonstrates reliability and resilience. As Ethereum staking gains traction, LDO is likely to attract continued interest. However, with a market cap-to-TVL ratio of 0.05308, its valuation suggests potential upside. Near-term resistance at $2.30 could lead to consolidation, while breaking this level may pave the way for a move toward $2.50. Investors should monitor the impact of macroeconomic trends and Ethereum network developments for additional cues.

Ondo (ONDO)

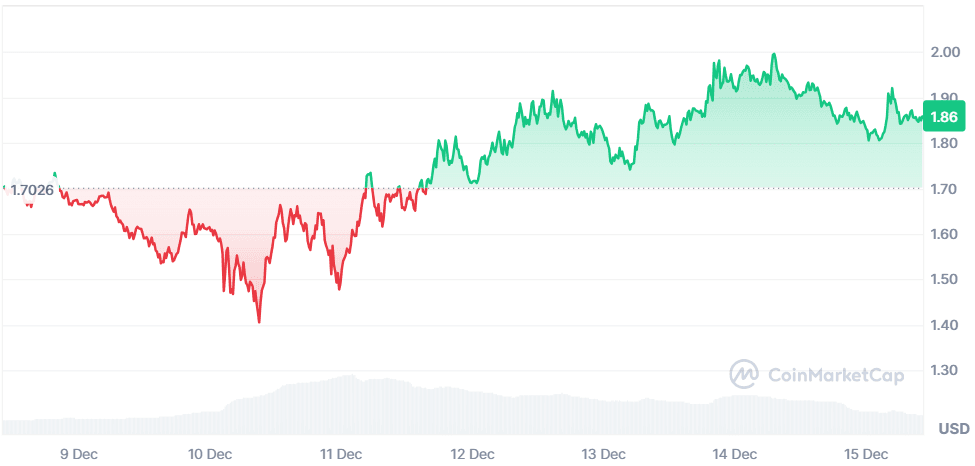

Price Change (7D): +9.06% Current Price: $1.86

News: Ondo Finance has partnered with BounceBit to integrate tokenized real-world assets (RWAs) into BounceBit’s CeDeFi V2 platform. This partnership represents a significant step toward combining traditional finance with decentralized ecosystems. Ondo’s tokenized U.S. Treasuries, including its USDY vault, contribute over $600 million in TVL across multiple blockchains. The vault, supported by U.S. Treasuries, offers daily liquidity and institutional-grade security with variable monthly interest rates. Furthermore, Ondo recently collaborated with Wellington Management to enhance liquidity for its tokenized U.S. Treasury Fund, facilitating blockchain-based representations of Treasury bonds. This collaboration highlights Ondo's pivotal role in integrating real-world assets into DeFi infrastructure.

Forecast: Ondo Finance is well-positioned to capitalize on the rising demand for tokenized RWAs, which are becoming a cornerstone of institutional DeFi adoption. The CertiK security score of 87.50 indicates strong operational and governance standards, instilling confidence among investors. With 79.83% of holdings controlled by whales, price movements may remain highly sensitive to large transactions. Continued partnerships, such as those with BounceBit and Wellington Management, signal growing adoption and institutional interest. If ONDO sustains its current momentum, breaking the $2.00 resistance level could pave the way for a steady climb towards $2.20. Investors should monitor volume trends and macroeconomic conditions, particularly interest rate fluctuations, for any potential headwinds.

Mantle Network (MNT)

Price Change (7D): +6.12% Current Price: $1.23

News: Mantle Network continues to expand its ecosystem, driven by strategic initiatives such as the Mantle Rewards Station campaigns and partnerships like EIGEN and Ethena. As an Ethereum Layer-2 network, Mantle leverages modular architecture to separate transaction execution, data availability, and transaction finality into upgradeable modules. The network focuses on delivering hyperscale performance with low fees and high throughput, powered by Ethereum’s roll-up security and decentralized data availability layers like EigenDA. Additionally, Mantle is the first DAO-spawned Layer-2 protocol, reinforcing its commitment to decentralized governance and scalability. Recent campaigns, including COOK Feast and Mantle Yield Lab, further enhance community engagement and adoption.

Forecast: Mantle Network’s innovative approach to Layer-2 scaling positions it as a leading player in the Ethereum ecosystem. With a CertiK security score of 80.19, Mantle demonstrates solid operational performance but slightly weaker fundamentals and code robustness, indicating room for improvement. The ongoing campaigns and strategic partnerships are likely to fuel adoption and strengthen network activity. MNT faces immediate resistance at $1.30, with a breakout potentially driving the price toward $1.40. Long-term success hinges on Mantle’s ability to maintain low fees, attract developers for dApps, and expand its decentralized infrastructure. Investors should keep an eye on governance updates and adoption metrics within the Mantle ecosystem to gauge sustained growth.

Raydium (RAY)

Price Change (7D): +3.85% Current Price: $5.31

News: Raydium has outperformed Uniswap as the top decentralized exchange (DEX) in monthly trading volume for two consecutive months. In November, Raydium recorded ~$125 billion in volume, surpassing Uniswap’s ~$91 billion by nearly 30%. This performance reflects the broader trend of Solana-based DEXs gaining dominance over Ethereum, primarily due to Solana’s low transaction fees and high throughput. Raydium’s success is also fueled by the surge in memecoin trading, which now accounts for 65% of its daily volume. Binance Futures further boosted interest in Raydium by listing $RAY on December 10, increasing liquidity and market visibility.

Forecast: Raydium’s continued growth is expected to remain strong, driven by memecoin trading and Solana’s expanding ecosystem. With its dominance over Solana DEXs and strategic upgrades, including the V3 interface launch, Raydium is positioned to capture even more market share. Analysts suggest $RAY could test the $6.50-$7 range if Solana’s upward trajectory holds, supported by the platform’s ability to attract traders and liquidity providers seeking lower fees.

Helium (HNT)

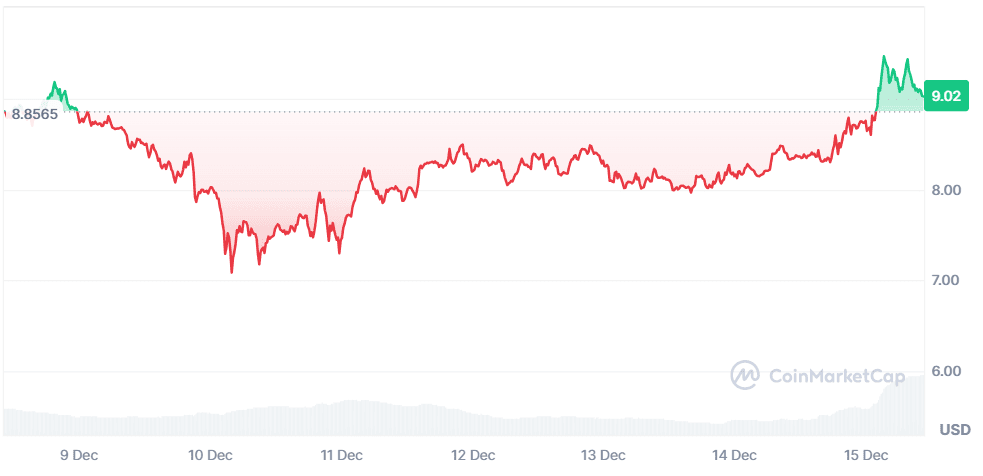

Price Change (7D): +1.54% Current Price: $9.00

News: Helium is experiencing increased network activity, with growing demand for its decentralized physical infrastructure network (DePIN). Analysts highlight HNT’s role as a utility token burned for data credits, driving demand amid rising usage. The Helium Foundation recently announced the successful passage of HIP 139, which phases out CBRS radios with 85.2% community approval. This move aims to streamline rewards and improve ecosystem efficiency. Additionally, demand for DePIN networks like Helium, GEODNET, and Hivemapper is accelerating, positioning Helium as a key player in the decentralized wireless space.

Forecast: Helium’s recent bullish activity aligns with broader market trends and ecosystem developments. Analysts project HNT could test the $10.25-$11 resistance range in the near term, with further upside potential toward $52.76 based on earlier breakout signals. Increased network usage, expanding subscriber numbers, and growing DePIN adoption will continue to support Helium’s upward momentum into 2025.

Sui (SUI)

Price Change (7D): +2.93% Current Price: $4.44

News: Sui Blockchain has partnered with Ant Digital, the tech division of China’s Ant Group, to tokenize real-world assets (RWAs) with a focus on Environmental, Social, and Governance (ESG) initiatives. The first project involves creating tokenized “notes” linked to a Chinese solar materials manufacturer, providing investors with clear, blockchain-powered access to sustainable investments. This collaboration highlights Sui’s growing role in bridging blockchain technology with traditional asset management, meeting the increasing demand for transparency and accountability in ESG investments.

Forecast: Sui’s strategic partnerships and technical innovations position it as a leader in the tokenization space. With its scalable, user-friendly infrastructure and object-centric data model, Sui is well-prepared for global adoption. Analysts predict SUI could test the $4.75 - $5.00 range in the short term, with further potential as interest in tokenized assets and ESG-friendly blockchain solutions continues to grow.

Closing Thoughts

The past week showcased a bullish market trend, with altcoins taking center stage as institutional adoption and strategic partnerships fueled growth. Leaders like Chainlink, Raydium, and Helium demonstrated strong performance, while emerging players like Virtuals Protocol and Sui showcased their potential through innovative solutions.

The Fear and Greed Index suggests continued optimism, but investors should monitor market consolidations and macroeconomic conditions for sustained growth. As we move forward, the growing influence of real-world asset tokenization and Layer-2 scalability solutions positions the crypto market for further expansion into 2024.