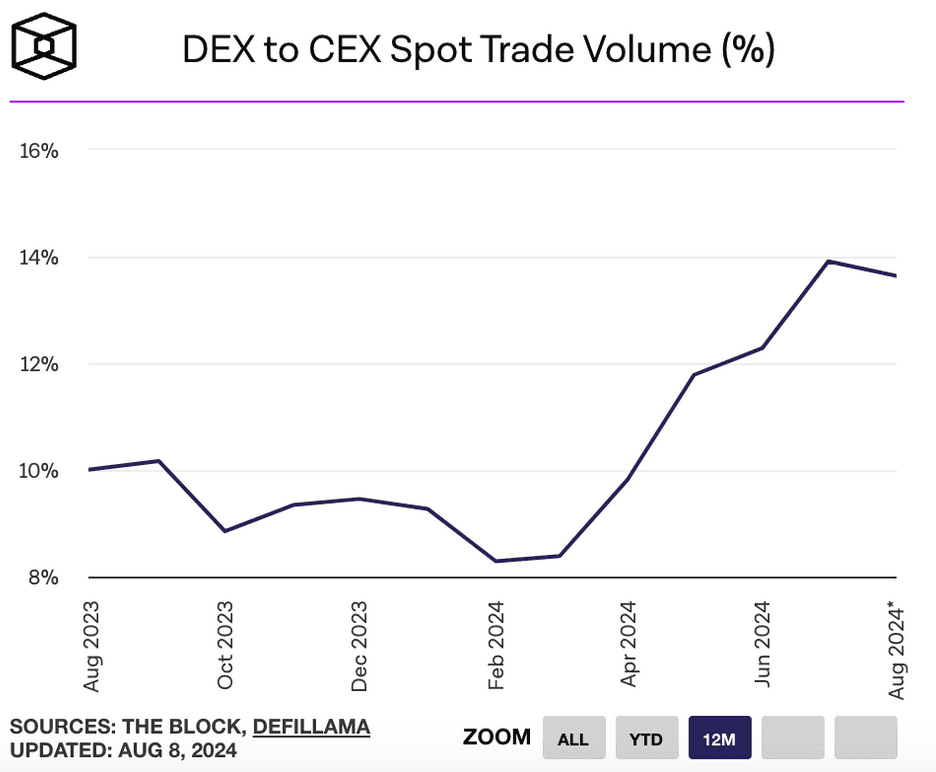

Decentralized Exchange (DEX) volume is on the rise, showing the increasing shift in crypto trading from Centralized Exchanges (CEX) to on-chain trading.

DEXs saw a 15.7% quarter-on-quarter increase in spot trading volume, while CEX experienced a 12.2% decline, according to CoinGecko’s second quarter report.

The ratio of DEX to CEX trading is at an all time high, indicating changing users habits and preferences.

So, DEXs are gaining ground, reshaping the landscape of cryptocurrency trading.

This shift isn't just a passing trend—it's a seismic change in how traders engage with the market.

While CEXs like Binance and Coinbase have long dominated the crypto space, the appeal of DEXs is becoming harder to ignore.

Data from recent reports highlights a marked increase in DEX trading volumes, while CEXs face mounting challenges.

Why is that happening and where does it lead to?

Let’s find out why DEXs are overcoming CEXs, focusing on the core distinctions and the five critical factors driving this shift.

Understanding the Differences: CEXs vs. DEXs

First, why don’t we clear the basic terms.

It is essential to understand what sets CEXs and DEXs apart.

Centralized Exchanges are managed by a single entity that controls the platform, often acting as an intermediary between buyers and sellers. This model, while offering certain conveniences like high liquidity and ease of use, also introduces significant risks, such as security breaches and loss of funds. You might even have some painful memories of your own that illustrate this, like from the FTX collapse in 2022.

Decentralized Exchanges operate on blockchain networks, allowing users to trade directly with each other without intermediaries. Transactions are facilitated by smart contracts. Transparency and security are the obvious and default options here. The decentralized nature of DEXs means that there is no single point of failure, and users retain full control over their assets. However, this also means that DEXs can be more complex to use. That might be a problem for novice users. Transaction costs are typically higher. And speeds are often slower.

And yet, something drives users to DEXs. Let’s see what it is.

TOP-5 Reasons Why DEXs Are Overcoming

Enhanced Security and Self-Custody

One of the most compelling reasons traders are flocking to DEXs is the enhanced security they offer.

In CEXs, users must trust the exchange with their funds, which can be vulnerable to hacks or mismanagement. The infamous hack of Mt. Gox and the more recent collapse of FTX highlight these risks.

In contrast, DEXs allow users to maintain custody of their assets at all times, reducing the risk of losing funds due to an exchange's failure or malicious attacks.

This shift towards self-custody is significant.

As more traders become aware of the risks associated with centralization, the appeal of DEXs—where users' assets remain under their control—is growing. The decentralized model eliminates the need for trust in a central entity, making it inherently more secure against threats such as hacking and fraud.

Regulatory Pressures and Censorship Resistance

CEXs have increasingly come under the scrutiny of regulators worldwide.

The push for tighter regulations and compliance measures, including Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, has added a layer of complexity and cost to their operations.

For users, this often translates into reduced privacy and the risk of account freezes or asset seizures.

In contrast, DEXs operate in a decentralized environment, which makes them more resistant to censorship and regulatory overreach.

Users can trade with greater anonymity, as DEXs typically do not require extensive personal information. This privacy aspect is particularly appealing to users in regions with strict financial controls or where access to traditional financial systems is limited.

Lower Costs and Zero Intermediary Fees

Another factor driving the popularity of DEXs is the lower cost of trading.

CEXs charge fees not only for transactions but also for deposit and withdrawal operations, and they often include hidden costs related to the exchange’s profit margins.

DEXs, however, cut out the intermediaries, allowing users to trade directly with each other. The fees on DEXs are typically lower since they are based on the cost of executing smart contracts on the blockchain, with no added margin for a central operator.

This cost efficiency is particularly noticeable in high-volume trading, where the savings can be substantial. As a result, many traders are turning to DEXs to maximize their profits by minimizing the fees they pay on each transaction.

Innovation and Access to New Markets

The decentralized finance (DeFi) boom has spurred innovation in the DEX space, bringing about new trading mechanisms and financial products that are unavailable on traditional CEXs.

Automated Market Makers (AMMs) have revolutionized the way liquidity is provided, allowing users to earn fees by contributing to liquidity pools.

Moreover, DEXs often list assets that are not available on CEXs, providing access to a broader range of tokens and investment opportunities.

This includes emerging tokens and those that are not listed due to regulatory constraints on CEXs. As more projects and tokens launch in the DeFi space, DEXs are becoming the go-to platforms for accessing new and innovative markets.

The bridge between traditional finance (TradFi) and decentralized finance (DeFi) is increasingly becoming a focal point for institutional investors looking to capitalize on the benefits of both worlds.

According to Louis Bellet, CEO of Yellow Network, as institutions seek greater transparency, security, and efficiency in their trading operations, they are progressively exploring on-chain trading and innovative solutions in DeFi.

This transition is facilitated by advancements in blockchain technology and regulatory frameworks that aim to integrate DeFi features with established financial systems. By leveraging DeFi's decentralized infrastructure, institutions can access new opportunities and optimize their trading strategies in a rapidly evolving market landscape.

“A market featuring 24/7 trading of digital assets is set to become a nonstop parallel trading environment”, says Louis Bellet.

The Rise of Institutional Adoption and Meme coins

Institutional interest in decentralized finance is another factor contributing to the rise of DEXs.

Major financial institutions, once hesitant to enter the crypto space, are now exploring DeFi as a way to enhance transparency, security, and efficiency in their operations.

The creation of funds on the Ethereum network by giants like BlackRock is a testament to the growing confidence in decentralized financial systems.

As institutional players seek exposure to DeFi, they are increasingly turning to DEXs for their trading needs.

This shift is further accelerated by advancements in blockchain technology, which are making it easier for institutions to integrate DeFi solutions into their existing systems. The result is a growing bridge between traditional finance and decentralized finance, with DEXs at the forefront of this integration.

Now, let’s not forget about the meme coins. There is a new hysteria that seems to be only growing with time. No signs of fading or losing momentum even despite the fact that 97% of meme coins fail miserably. The remaining 3% help people make fortunes.

And some of those appear on DEXs ages before they find their way to CEXs.

The above-mentioned fortunes are more likely to happen on early stages with DEXs, then much later when a behemoth like Coinbase or Binance finally get their paws on those coins. That keeps driving more and more attention to DEXs.

Conclusion

The rise of DEXs over CEXs marks a significant evolution in the cryptocurrency landscape.

Driven by the desire for greater security, privacy, cost efficiency, and access to new markets, traders are increasingly moving away from centralized platforms.

The picture is not perfect for DEXs yet. There are significant problems with scalability and user experience. Sometimes users are simply more comfortable in the CEXs simple and effective environment. Ongoing innovations in blockchain technology are poised to address these issues.

Nothing can stop evolution. And DEXs are likely to play an increasingly central role, not just for retail traders but also for institutional investors seeking to tap into the benefits of decentralized finance.

The shift towards DEXs is more than a trend—it’s a fundamental transformation that could redefine the future of trading in the digital age.