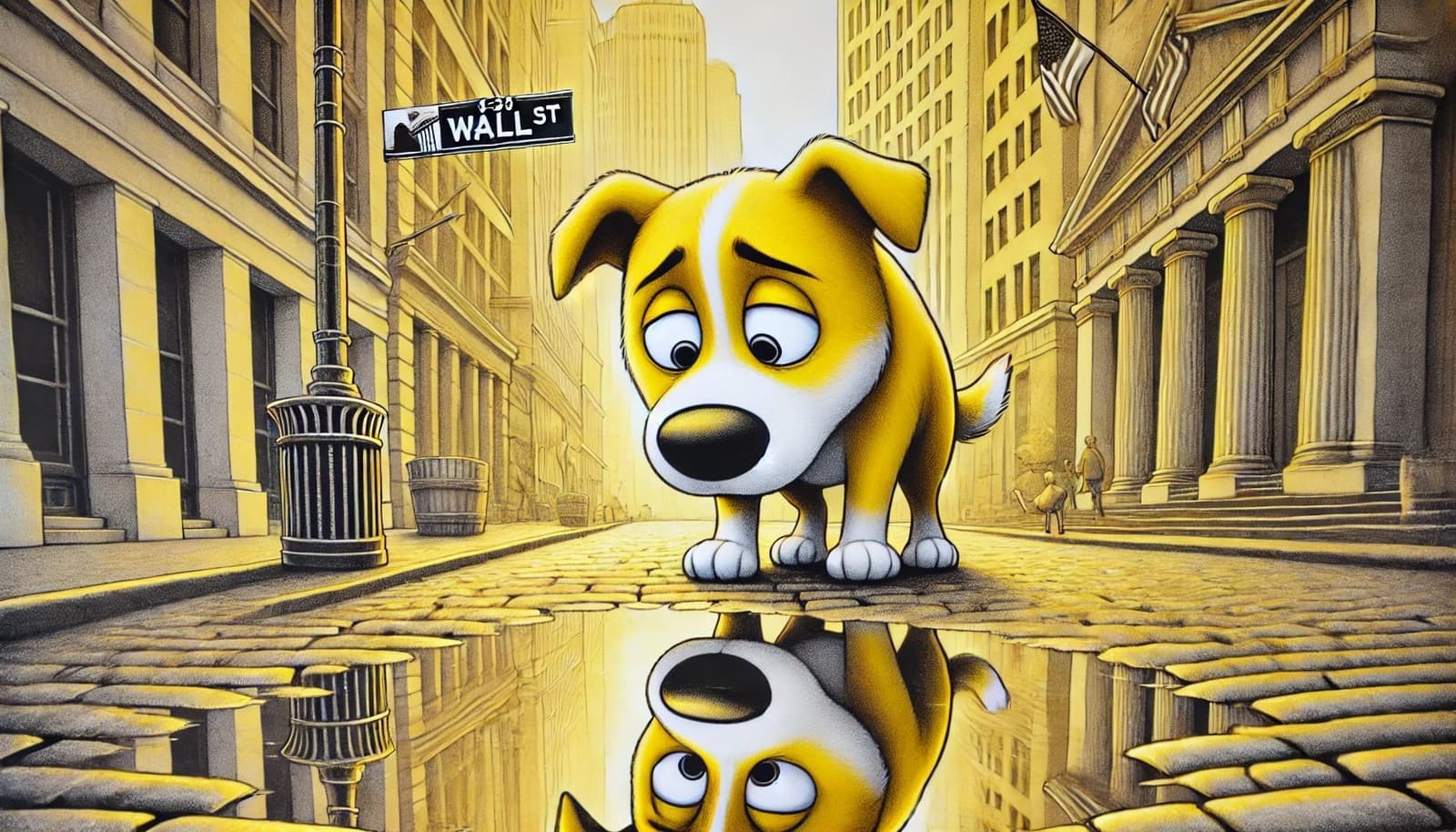

Dogwifhat (WIF) has fallen out of the top 50 cryptocurrencies by market capitalisation. The Solana-based memecoin saw a 38% price decline over the past week. No other crypto has fallen this drastically as long as we can recall. At list among top 100 cryptos out there.

On June 23, Dogwifhat's market cap decreased 9% to $1.60 billion in just 12 hours. Dogwifhat now trades at $1.62.

"Many people are talking about how WIF is in their accumulation zone, but I just checked the chart, and it doesn't seem like anyone is accumulating," noted crypto trader Blockgraze on X.

Despite the drop, Dogwifhat remains the fourth largest memecoin by market cap, just below Pepe.

The price decline has impacted futures trading. Open Interest has fallen 25% to $209.64 million over the same period, according to CoinGlass data.

A 13% rebound to $1.81 would liquidate $13.53 million in short positions. This price point was seen just two days ago.

The current sentiment contrasts sharply with recent optimism. On March 14, when Dogwifhat hit $3, Arthur Hayes predicted a rally to $10.

"The hat stays on while I count to $10," Hayes posted on X. Hayes is the former CEO of BitMEX and current chief investment officer at Maelstrom.

The dramatic shift in Dogwifhat's fortunes highlights the volatile nature of memecoins. It serves as a reminder of the risks inherent in cryptocurrency investments, especially in newer, less established tokens.

Market observers will be watching closely to see if Dogwifhat can regain its position. The coming weeks may prove crucial for the memecoin's long-term prospects.