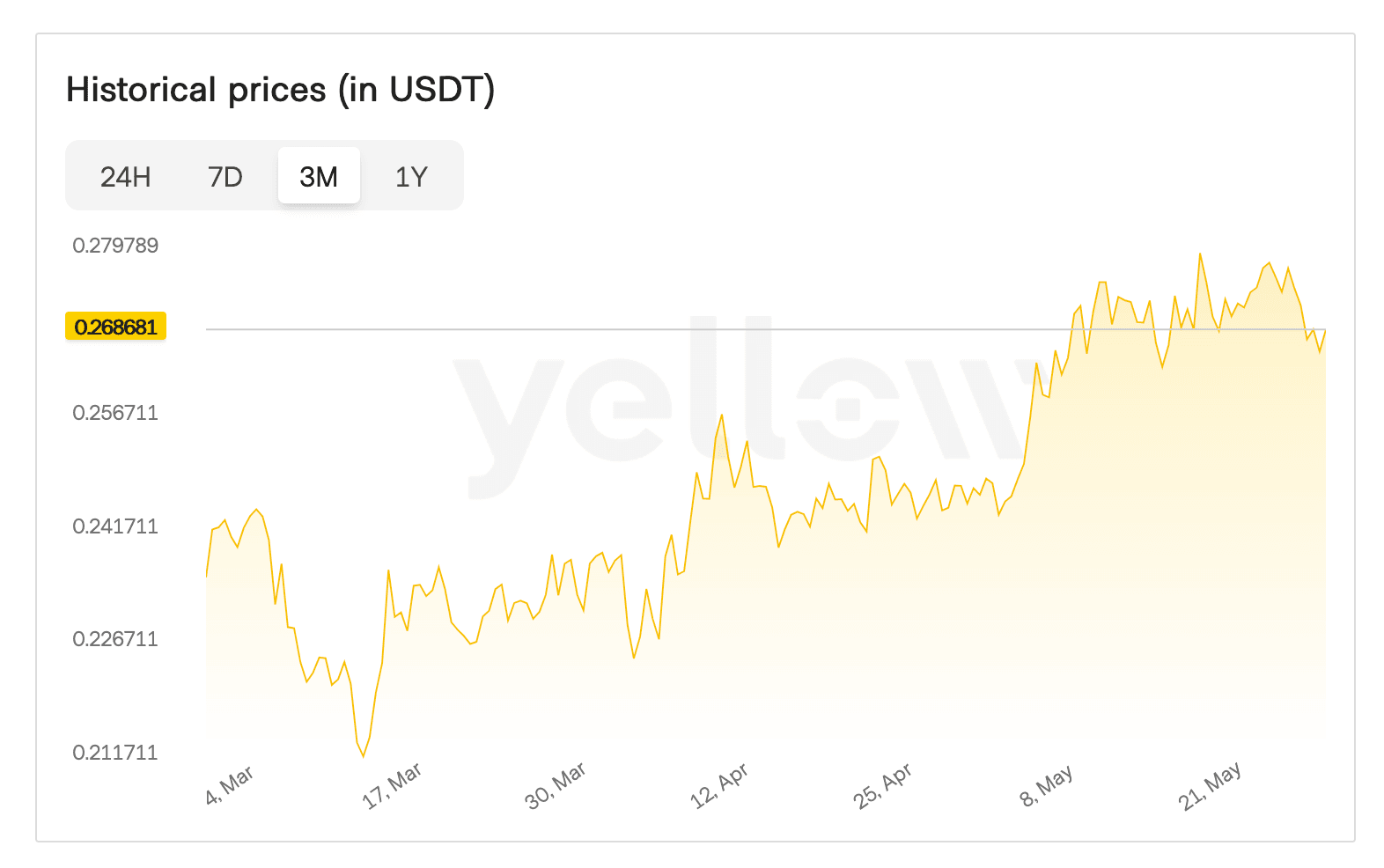

The tenth-largest cryptocurrency by market capitalization has maintained trading levels above $0.26 for more than two weeks, demonstrating resilience during a period of heightened global market volatility. Tron's sustained price performance comes as key risk indicators show significant improvement, with Value at Risk measurements declining and the token displaying reduced correlation with Bitcoin price movements.

What to Know:

- TRX has traded consistently above $0.26 for over 14 days despite market turbulence

- Value at Risk metrics have dropped significantly while Beta correlation with Bitcoin decreased

- Tron network gained $2.12 billion in stablecoins while Ethereum lost $2.44 billion in seven days

Declining Risk Profile Supports Price Stability

Recent data from CryptoQuant reveals Tron's Value at Risk has decreased substantially over recent months. The metric, which calculates potential losses at a 95% confidence level, now indicates a more stable investment profile with reduced downside exposure.

The improvement in risk metrics coincides with Tron's price recovery, creating what analysts describe as an unusual combination. Most cryptocurrencies experience increased volatility during price appreciation phases. TRX has bucked this trend.

Daily rolling Beta measurements against Bitcoin have also declined notably. Lower Beta readings indicate TRX is becoming less sensitive to Bitcoin's price fluctuations, suggesting improved independence from broader cryptocurrency market movements. This decoupling represents a shift toward greater asset maturity. Traditional financial markets often view reduced correlation with dominant assets as a sign of fundamental strength and independent value drivers.

"This powerful combination – price appreciation alongside reduced risk and market correlation – positions Tron as an increasingly attractive asset," according to market analysis. "It highlights a maturing ecosystem and a more robust foundation for future performance."

Stablecoin Migration Drives Network Adoption

Blockchain analytics firm Lookonchain documented significant stablecoin movement favoring the Tron network over a seven-day period. USDT and USDC balances on Tron increased by $2.12 billion during this timeframe.

Ethereum experienced the opposite trend. The network saw stablecoin balances decrease by $2.44 billion over the same period, representing a combined $4.56 billion shift in digital asset allocation. The migration likely stems from Tron's operational advantages. The network offers lower transaction fees compared to Ethereum, along with faster settlement speeds for transfers and smart contract interactions.

This stablecoin flow represents more than just user preference. It indicates growing confidence in Tron's infrastructure and long-term viability as a platform for decentralized finance applications.

Market participants appear to be voting with their capital. The sustained inflow suggests institutional and retail users alike are recognizing Tron's value proposition in the current market environment.

Market Position Strengthens Amid Volatility

Tron's performance during recent market turbulence demonstrates characteristics typically associated with more established assets. While many cryptocurrencies experienced significant price swings, TRX maintained its trading range above $0.26.

The stability comes as global trade tensions and macroeconomic uncertainty have pressured risk assets across multiple sectors. Traditional cryptocurrencies often amplify these broader market movements, making Tron's resilience noteworthy. The combination of technical improvements in risk metrics and fundamental growth in network usage creates a compelling narrative. Investors are increasingly viewing TRX as offering both stability and growth potential.

Closing Thoughts

Tron's recent performance illustrates how cryptocurrency markets are maturing, with individual tokens developing independent characteristics rather than simply following Bitcoin's lead. The combination of reduced risk metrics, sustained price levels, and significant stablecoin adoption suggests TRX is establishing itself as a distinct digital asset with its own fundamental drivers.