Privacy-focused cryptocurrencies emerged as some of the strongest performers of 2025, defying a year marked by weak sentiment and broad underperformance across the altcoin market.

According to data from CryptoRank.io, a small group of tokens tied to transaction privacy posted outsized gains even as most alternative cryptocurrencies struggled to attract sustained inflows.

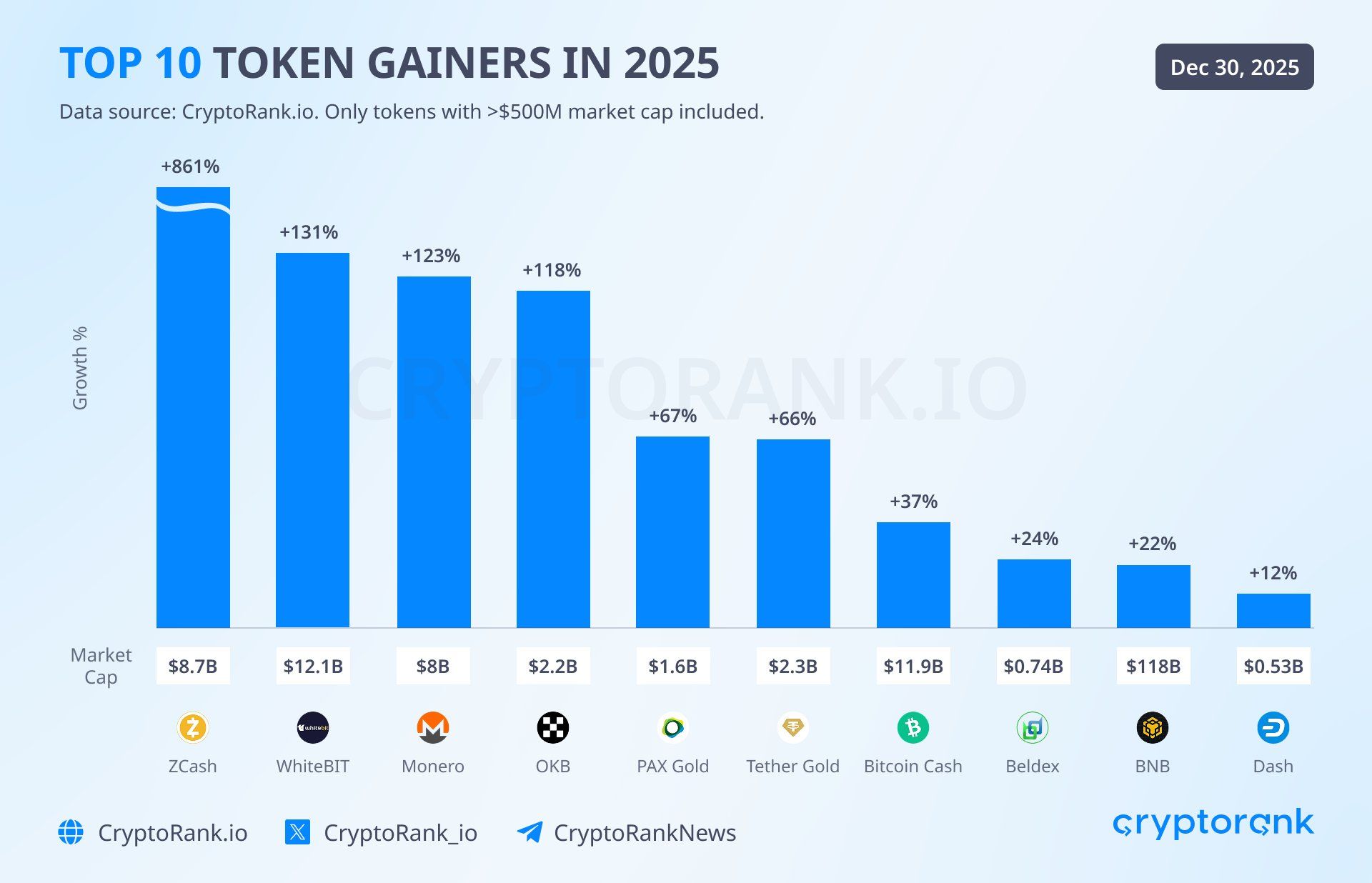

Zcash (ZEC) recorded the largest advance among large-cap tokens, rising more than eightfold during the year.

Monero (XMR) also posted triple-digit gains, while Dash (Dash) ended the year higher despite a more modest increase.

The divergence stands out in a market where capital largely gravitated toward Bitcoin and a narrow set of defensive large-cap assets, leaving many altcoin narratives sidelined.

Privacy Tokens Buck The Altcoin Slump

Throughout 2025, crypto markets were shaped by tightening financial conditions, uneven liquidity, and growing regulatory scrutiny.

Many sectors that had driven prior cycles, including gaming, metaverse applications, and experimental DeFi, failed to regain momentum, leading to prolonged drawdowns across the altcoin complex.

Against that backdrop, the strong performance of privacy-focused tokens suggests a shift in investor priorities.

Rather than rotating into high-growth narratives, market participants appeared to favor assets aligned with core crypto attributes such as censorship resistance and self-custody.

Zcash’s rally was particularly notable given its market capitalization threshold, which places it outside the thinly traded segments often prone to sharp speculative moves.

Monero’s advance reinforced the pattern, highlighting sustained demand rather than short-lived momentum.

Regulation And Surveillance Shape Investor Behavior

The renewed interest in privacy assets coincided with an increasingly assertive regulatory environment.

Also Read: Epic US Strike Captures Maduro: What It Means for Venezuela's Vast Oil And Crypto Bypass Era

Over the course of the year, authorities expanded enforcement of travel-rule compliance, increased oversight of centralized exchanges, and advanced frameworks aimed at monitoring digital asset flows, particularly in stablecoins and cross-border payments.

At the same time, geopolitical tensions and sanctions enforcement continued to fragment global financial rails.

In that context, privacy-oriented cryptocurrencies appear to have been treated less as speculative instruments and more as defensive exposures, offering insulation from surveillance-heavy systems.

The relatively muted gains in larger utility tokens such as BNB (BNB) and Bitcoin Cash (BCH) further underscore the trend, suggesting capital rotated toward ideological primitives rather than application-layer growth stories.

What the Market May Be Pricing For 2026

The outperformance of privacy tokens in 2025 may carry implications for the next market cycle.

Rather than signaling a standalone “privacy coin” trade, the trend points toward a broader focus on financial sovereignty, combining privacy-preserving infrastructure, censorship-resistant payments, and selective disclosure technologies.

As crypto increasingly interfaces with regulation-first financial systems, demand may grow for tools that preserve user autonomy without fully abandoning compliance.

Whether that demand is expressed through standalone assets, modular blockchain layers, or privacy-enabled wallets remains an open question.

What is clearer is that in a difficult year for altcoins, the market rewarded assets most closely aligned with crypto’s original use case.

That recalibration may shape both capital allocation and narrative leadership as the industry moves into 2026.

Read Next: Classified Intel Or Lucky Guess? New Polymarket Account Profits $400K From Maduro Arrest