Venezuela’s position as the country with the world’s largest proven oil reserves has come back into sharp focus following the United States’ capture of President Nicolás Maduro, an event that exhibits how political power, sanctions, and financial access, not resource abundance, have defined the country’s economic trajectory.

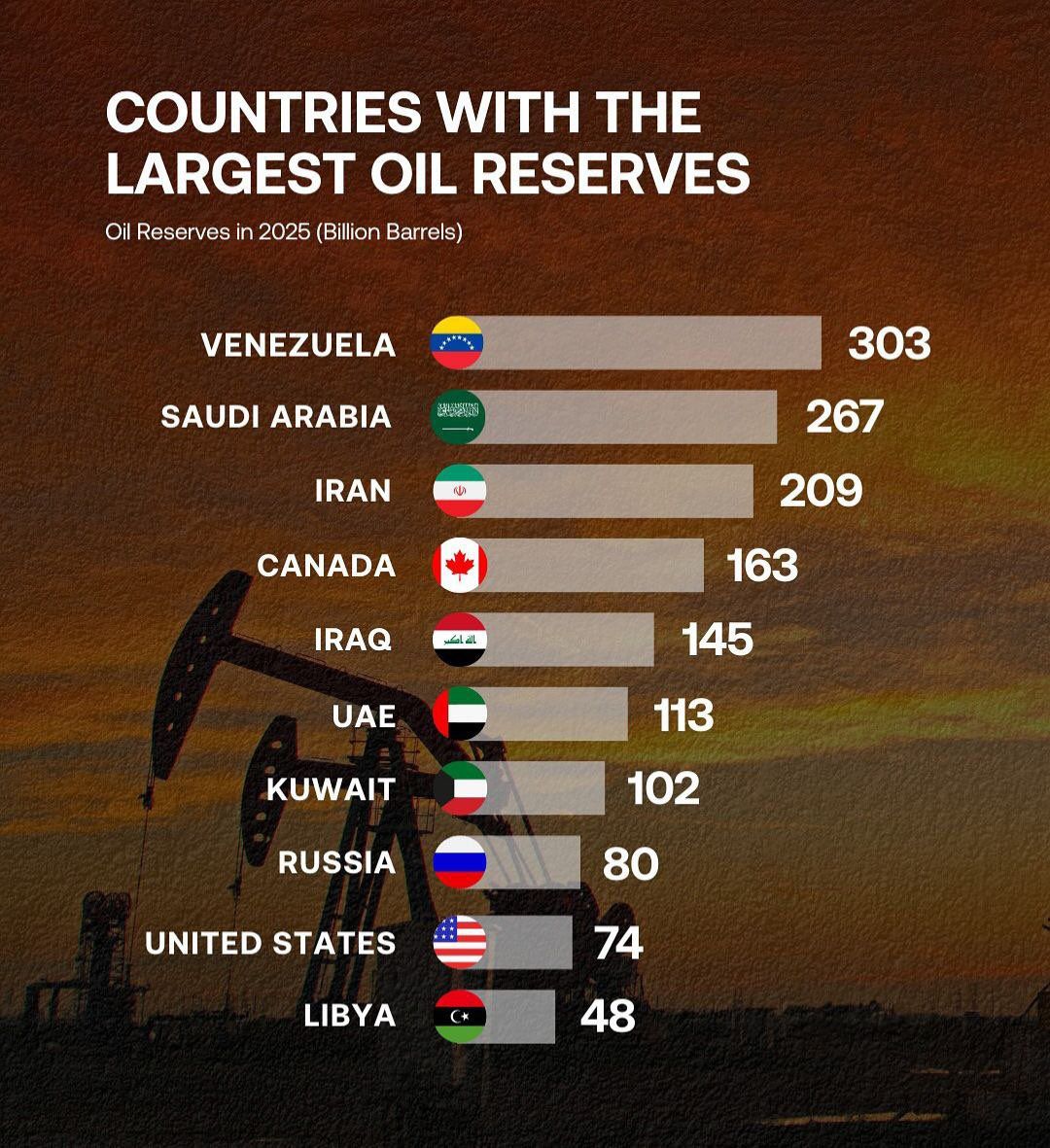

According to the Organization of the Petroleum Exporting Countries (OPEC), Venezuela holds approximately 303 billion barrels of proven crude oil reserves, the largest share globally.

Yet despite this geological dominance, Venezuela’s oil sector has remained largely cut off from global markets for years due to sanctions, institutional collapse, and restricted access to international financial systems.

U.S. Capture Of Maduro Follows Years Of Sanctions And Criminal Allegations

The capture of Maduro followed longstanding U.S. allegations that accused the Venezuelan leader of overseeing narcotics trafficking networks and using state institutions to facilitate illicit financial activity.

In a press conference on Saturday, U.S. President Donald Trump stated that Maduro would face trial on American soil, marking a dramatic escalation in Washington’s confrontation with the Venezuelan government.

The U.S. government has previously sanctioned Maduro and senior Venezuelan officials, citing corruption, drug trafficking, and efforts to bypass international financial controls.

The enforcement action comes after years in which sanctions severely constrained Venezuela’s ability to export oil, receive payments, and attract foreign investment.

EIA: Sanctions Crippled Oil Exports And Revenue Collection

The U.S. Energy Information Administration (EIA) has repeatedly documented how sanctions on Petróleos de Venezuela S.A. (PDVSA) disrupted Venezuela’s oil production and export capacity.

In its Venezuela country analysis, the EIA stated that sanctions “restricted Venezuela’s ability to export crude oil and receive oil revenues through the global financial system,” contributing to a sustained collapse in production.

EIA data show that Venezuela’s crude oil production fell from more than 3 million barrels per day in the late 1990s to well under 1 million barrels per day in recent years, reflecting underinvestment, infrastructure degradation, and loss of access to capital.

Because global oil trades are predominantly settled in U.S. dollars and cleared through Western banks, sanctions left Venezuela dependent on opaque intermediaries, barter arrangements, and non-standard payment mechanisms.

Also Read: Why Crypto's $49B Funding Surge Went To Exchanges, Not Builders In 2025

IMF: Economic Collapse RootedIn Financial Isolation And Institutional Breakdown

The International Monetary Fund (IMF) has consistently emphasized that Venezuela’s economic collapse is not the result of resource scarcity, but of institutional erosion and external financing constraints.

In its most recent country assessments, the IMF noted that Venezuela’s prolonged contraction reflects “macroeconomic imbalances, institutional deterioration, and constraints on external financing,” compounded by sanctions that limited trade and payment flows.

The IMF has also warned that sanctions complicated the import of equipment, technology, and diluents required to process Venezuela’s extra-heavy crude, further weakening its ability to monetize reserves.

Why Crypto Entered The Sanctions Narrative

U.S. authorities and international institutions have documented that Venezuela explored digital assets during periods when access to traditional financial rails was restricted.

This included the launch of the state-backed Petro token, which the U.S. government explicitly banned in 2018 through an executive order prohibiting transactions involving digital currencies issued by the Venezuelan government.

Separately, the U.S. Treasury and the IMF have warned that sanctioned jurisdictions, including Venezuela, have examined the use of crypto assets as alternative value-transfer mechanisms when conventional banking channels were unavailable.

However, regulators have also emphasized that such efforts did not resolve underlying economic constraints and introduced additional risks related to transparency, compliance, and enforcement.

International institutions have not characterized crypto as a substitute for oil revenues or a durable solution to sanctions-induced isolation.

Oil Wealth Without Financial Access

Venezuela’s experience showcases a broader structural reality in global markets: ownership of physical resources does not translate into economic leverage without access to settlement systems, banking infrastructure, and long-term investment capital.

Despite holding the world’s largest proven oil reserves, Venezuela remained largely excluded from global energy finance under Maduro’s leadership.

Countries with smaller reserves but stronger institutional integration continued to dominate production and trade flows.

The EIA has stated that restoring Venezuela’s oil sector would require substantial foreign investment, access to technology, and stable commercial frameworks, conditions that were absent under the prevailing sanctions regime.

A Structural Inflection Point, Not A Resolution

Maduro’s capture represents a major political development, but international institutions have consistently stressed that economic recovery depends on rebuilding institutional credibility, restoring financial connectivity, and resolving sanctions, not solely leadership change.

For cryptocurrency industry, Venezuela remains a case study in how sanctions and financial exclusion can prompt exploration of alternative payment mechanisms, even as regulators caution against overstating their effectiveness.

Until financial access is restored, Venezuela’s oil reserves stand as one of the clearest examples of resource abundance constrained by political and financial isolation, with digital assets appearing not as a solution, but as a limited and heavily scrutinized byproduct of that disconnect.

Read Next: Crypto's Biggest Critic Gone: SEC Commissioner Crenshaw Exits, Leaving All-Republican Panel