Linea is one of the most influential Layer 2 projects. Well-known for using zero-knowledge roll-up technology, Linea has created a strong community and a strong voice in the fast expanding Web3 environment. A bold choice to forego its own token in favor of developers' familiar Ethereum (ETH) facilitated Linea's growth by creating a welcoming environment. However, Linea also has other intriguing facts to share.

Company Overview

Consensys next-generation Layer 2 blockchain for Ethereum, called Linea, aims to simplify, speed up, and lower the cost of user experience. By handling transactions more effectively and utilising cutting-edge zero-knowledge (zk) roll-up technology, it significantly lowers costs and increases scalability. It is completely compatible with the Ethereum Virtual Machine (EVM).

Project Overview

Linea focuses on increasing the security, effectiveness, and accessibility of decentralised applications (dApps), Linea is establishing itself as a major player in the expanding web3 ecosystem. It provides solid security, rapid transaction throughput, and strong support from its developers and community as an Ethereum Layer 2 solution. With these advantages, Linea is positioned to influence the direction of decentralised technology and advance web3.

Company Offerings

Linea zkEVM (Zero-Knowledge Ethereum Virtual Machine): The core of Linea is its zkEVM, a potent Layer 2 solution for Ethereum that improves the performance of Ethereum smart contracts by utilising zero-knowledge rollup technology. Transactions become cheaper and faster with this product, all without compromising security. Due to its complete compatibility with the Ethereum Virtual Machine (EVM), developers may execute contracts with ease and without modification. In order to accomplish this, Linea groups several transactions into batches and validates them on Layer 1 of Ethereum, which lessens network traffic while maintaining the same high degree of security Ethereum is renowned for.

Developer Tools and SDKs: The Layer 2 platform offers developers a comprehensive set of tools and software development kits (SDKs) that make it simple to create, test, and deploy decentralised apps (dApps). For developers who are currently working in the Ethereum ecosystem, these tools facilitate a smooth transfer because they are fully interoperable with well-known Ethereum development environments like Hardhat and Truffle. Linea offers the option of using the bridge feature in Metamask Portfolio which surveys bridges across Linea to source its routes and rates to provide the best price. This makes it possible for users and developers to communicate with the Layer 2 network straight from their MetaMask wallet, resulting in a smooth experience.

Ecosystem Integrations: Linea supports a broad spectrum of decentralised finance (DeFi) and non- fungible token (NFT) platforms, making it easier for Ethereum-based dApps to scale on its Layer 2 solution. It is made to work smoothly with already-existing decentralised applications (dApps), enabling them to run more effectively without sacrificing any of Ethereum's essential features. Strong interoperability offered by Linea makes it possible to transfer assets between Ethereum and other blockchains without difficulty. As a result, the blockchain ecosystem becomes more integrated and fluid, simplifying platform navigation for both consumers and developers.

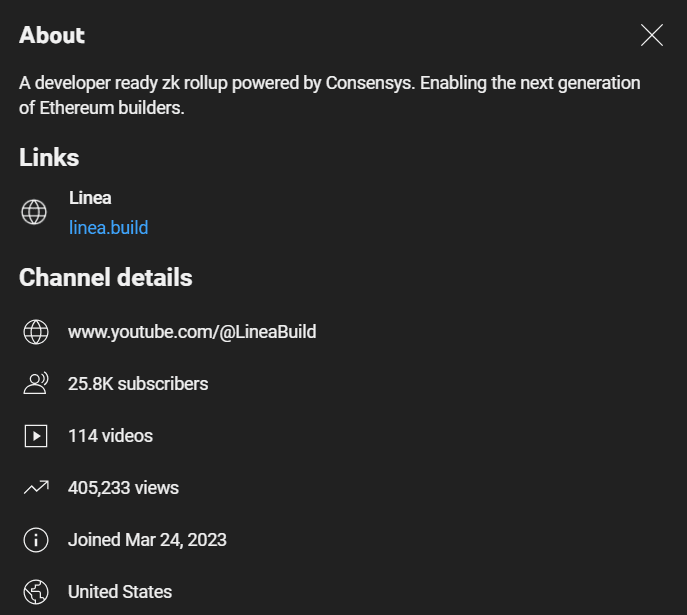

Security Solutions: Linea uses cryptographic methods such as zk-SNARKs to ensure the confidentiality and security of transactions on its network. This technology is essential to preserving the network's trustworthiness and integrity and guarantees that users may work in a safe environment. In order to further demonstrate its dedication to security, Linea collaborates with leading security companies to audit its platform on a regular basis, ensuring that it continuously adheres to the strictest blockchain security guidelines.

Strategic Partnerships and Integrations: Linea partners with various protocols and projects in the Ethereum ecosystem to expand its functionality and support new use cases.

Ecosystem

-

Mainnet Launch and Initial Success: Linea officially launched its mainnet in August 2023 at EthCC in Paris. In its first month, Linea saw over 2.7 million transactions and successfully bridged $26 million in Ether, making it the fastest-growing zkEVM on Ethereum.

-

Seamless Dapp Integration: Linea provides an ERC20 token bridge, enabling seamless integration with DeFi applications, gaming, and NFTs. With over 150 partners, including MetaMask, Banxa, and Circle, Linea's ecosystem allows users to bridge tokens and interact with decentralised applications with reduced transaction fees and high throughput.

-

Security Commitment and Progressive Decentralization: Linea emphasises security through zk-rollup infrastructure and partnerships with over 20 firms to enhance its decentralised trust mechanism. Its phased roadmap aims to transform Linea into a fully decentralised, secure network, setting it apart from other Layer 2 solutions and establishing it as a leader in zkEVM technology.

-

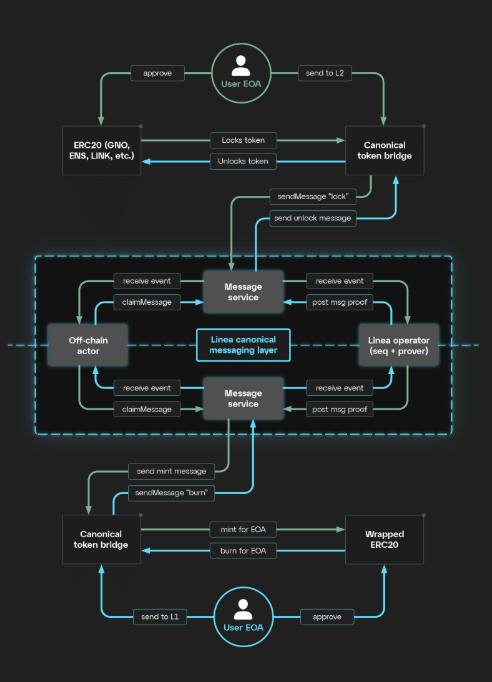

Canonical Message Service: The Canonical Message Service in Linea handles cross-chain messaging between Ethereum and Linea, ensuring secure and verifiable transactions between networks. This system enables permissionless and reliable data transfers, facilitating the movement of assets and other information across blockchain ecosystems seamlessly.

Linea Canonical Messaging System and ERC20 Bridge Architecture

(Source: https://docs.linea.build/architecture/stack/canonical-msg-service)

Linea Canonical Messaging System and ERC20 Bridge Architecture

(Source: https://docs.linea.build/architecture/stack/canonical-msg-service)

-

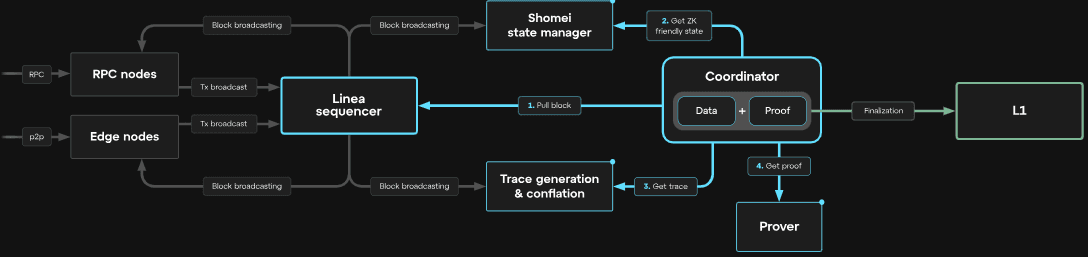

Innovative Sequencer and Prover Architecture: Linea’s architecture relies on its Sequencer, which processes transactions and optimises block generation. The Sequencer works with the Prover, powered by zero-knowledge SNARK proofs, to ensure cryptographically secure transactions that minimise transaction costs and boost network efficiency, offering unparalleled scalability for dApps.

-

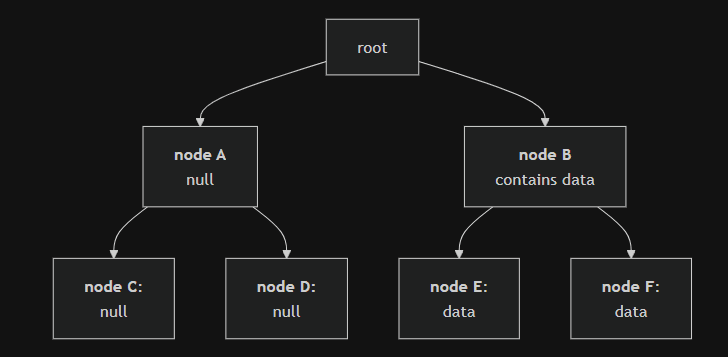

Merkle Tree and State Management: Linea employs advanced state management through sparse Merkle trees, enabling efficient tracking and updating of account states. This architecture ensures data consistency across the network, contributing to Linea’s ability to handle high transaction throughput while maintaining integrity and security across the Ethereum ecosystem.

Sparse Merkle Tree Structure in Linea’s State Management

(Source: https://docs.linea.build/architecture/stack/evm-state-manager)

Sparse Merkle Tree Structure in Linea’s State Management

(Source: https://docs.linea.build/architecture/stack/evm-state-manager)

-

ERC20 Bridge and On-Ramp Solutions: Linea’s ERC20 bridge integrates with popular on-ramp solutions like MetaMask and Banxa, allowing users to bridge stablecoins and other assets seamlessly. The platform offers a fee-free period for early users, further promoting DeFi adoption by lowering barriers to entry for new users.

-

Community Engagement and NFT Initiatives: To promote user participation, Linea launched an NFT collection, rewarding over 27k participants with Omega NFTs and airdropping 350k NFTs. This initiative strengthens community engagement while fostering the use of NFTs within the Linea ecosystem, positioning it as a key player in Ethereum’s NFT landscape.

-

Ecosystem Investment Alliance (EIA): Linea fosters innovation through its Ecosystem Investment Alliance (EIA), a consortium of over 45 venture capital firms. This initiative supports developers and builders by providing capital, resources, and guidance to accelerate the growth of new projects within the Linea ecosystem, boosting long-term ecosystem sustainability.

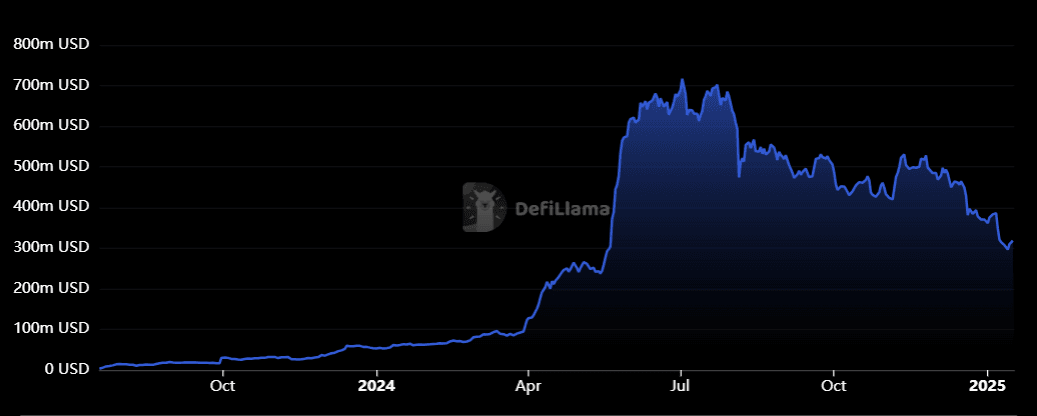

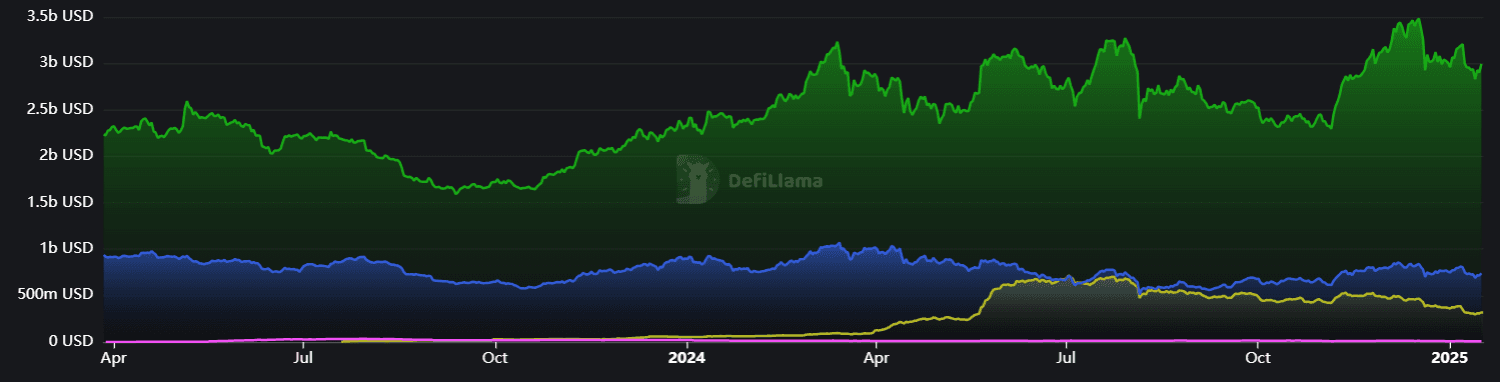

Total Value Locked

Total Value Locked (TVL) is a metric used to measure the total value of digital assets that are locked on a blockchain network or decentralized finance (DeFi) platform. TVL is calculated by adding up the value of all assets that are staked or locked in a DeFi platform. In Linea Total value locked is $320.6 Million (as on 17.01.25)

(Source: https://defillama.com/chain/Linea)

(Source: https://defillama.com/chain/Linea)

Competitors

Optimism: A Layer 2 solution using optimistic rollups, focused on reducing transaction costs and enhancing scalability while maintaining Ethereum’s security.

Arbitrum: Another optimistic rollup solution, Arbitrum has a large user base and developer adoption, offering fast transactions and lower fees on Ethereum.

Polygon zkEVM: Polygon’s zk-rollup solution, similar to Linea, uses zero-knowledge proofs to achieve scalability with Ethereum compatibility, positioning itself as a direct competitor.

TVL Comparison of Linea, Optimism, Arbitrum, and Polygon zkEVM (Source: https://defillama.com/compare?chains=Linea&chains=Optimism&chains=Arbitrum&chains=Polygon+zkEVM&revenue=false&tvl=true)

TVL Comparison of Linea, Optimism, Arbitrum, and Polygon zkEVM (Source: https://defillama.com/compare?chains=Linea&chains=Optimism&chains=Arbitrum&chains=Polygon+zkEVM&revenue=false&tvl=true)

Organisation Focus

Linea is an Ethereum Layer 2 (L2) solution developed by ConsenSys that leverages zero-knowledge (zk) rollups and full Ethereum Virtual Machine (EVM) equivalence to enhance scalability, cost efficiency, and interoperability within the Ethereum ecosystem. Linea’s design is focused on supporting high-performance decentralised applications (dApps) while maintaining Ethereum's security model.

Scalability via zk-Rollups: Linea's zk-rollup architecture enables it to scale transaction throughput significantly beyond the limitations of Ethereum Layer 1 (L1). By batching transactions and submitting succinct proofs to Ethereum, Linea minimises the data and computation needed on L1, thereby reducing network congestion and latency.

Cost Efficiency: By using zk-rollups, Linea reduces the gas fees associated with transactions, ensuring cost-efficiency for both developers and end-users. The platform allows developers to build decentralised applications without facing high operational costs, which would typically be associated with the Ethereum Mainnet. This reduction in gas fees is particularly beneficial for high-frequency dApps, such as those in the DeFi and NFT sectors.

Full EVM Equivalence: Linea is fully EVM-equivalent, meaning it offers seamless compatibility with existing Ethereum developer tools, including MetaMask, Hardhat, and Truffle. This ensures that developers can migrate their applications from Ethereum to Linea without rewriting smart contracts or modifying their development workflows. Full EVM-equivalence also ensures compatibility with Ethereum precompiles and opcodes, allowing for trustless execution.

Security Mechanism: The zk-SNARKs used by Linea ensure cryptographic proof of transaction validity without revealing transaction data, preserving privacy while maintaining verifiability. Linea inherits Ethereum's robust L1 security model and adds an extra layer of verification through its zk-proofs, ensuring that transaction data is secure and accurate without burdening the Ethereum blockchain.

Interoperability: Linea facilitates seamless interoperability with Ethereum and other Layer 2 solutions by supporting cross-chain bridges and asset transfers. Its architecture supports the easy movement of assets between L1 and L2, as well as between different Layer 2 networks. Linea’s bridge contracts ensure efficient and secure bridging between the two layers while preserving transaction integrity.

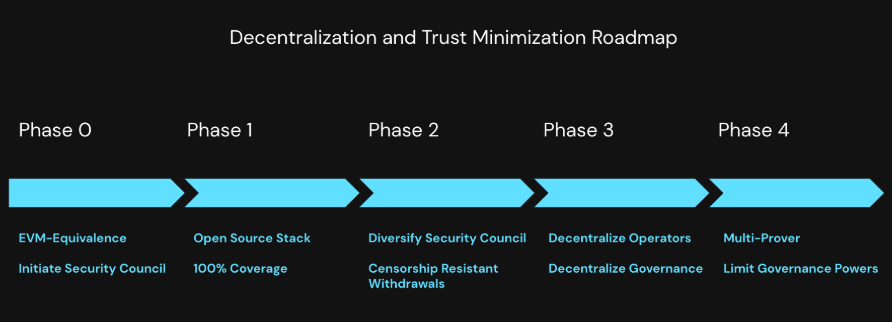

Decentralisation Roadmap: Linea’s current roadmap toward full decentralisation focuses on decentralising its key components: the sequencer, prover, and governance model. In Phase 2, Linea plans to diversify the Security Council and enable censorship-resistant withdrawals, ensuring user sovereignty over assets. Phase 3 will focus on decentralising the prover and sequencer to minimise trust assumptions and improve system resilience.

Linea Decentralisation Roadmap (Source: https://docs.linea.build/architecture/overview/decentralization-roadmap)

Linea Decentralisation Roadmap (Source: https://docs.linea.build/architecture/overview/decentralization-roadmap)

Key Architectural Components

Linea Current Mainnet Status (Source: https://docs.linea.build/architecture)

Linea Current Mainnet Status (Source: https://docs.linea.build/architecture)

- Sequencer: Responsible for ordering, building, and executing transactions on Linea. The sequencer also generates traces, which are essential for zk-proof generation.

- Prover: The zk-SNARK prover generates proofs from transaction data and submits them to Ethereum for validation.

- Coordinator: Oversees the orchestration of transactions, ensuring that zk-proofs and state updates are correctly handled between L1 and L2.

- EVM State Manager: Manages the state of Linea’s L2, ensuring that the system reflects all transactions executed by the sequencer.

No Native Token: Linea does not have a native token; it uses Ether (ETH) as the primary token for transaction fees, ensuring continuity with the broader Ethereum ecosystem. This approach reduces friction for developers and users, who can interact with Linea using familiar assets.

Open-Source Transparency: Linea’s specification and codebase are fully open-source, allowing developers to audit and contribute to its development. The Linea software stack is available under the AGPL-2.0 license, ensuring transparency and fostering community engagement.

On Chain Metrics

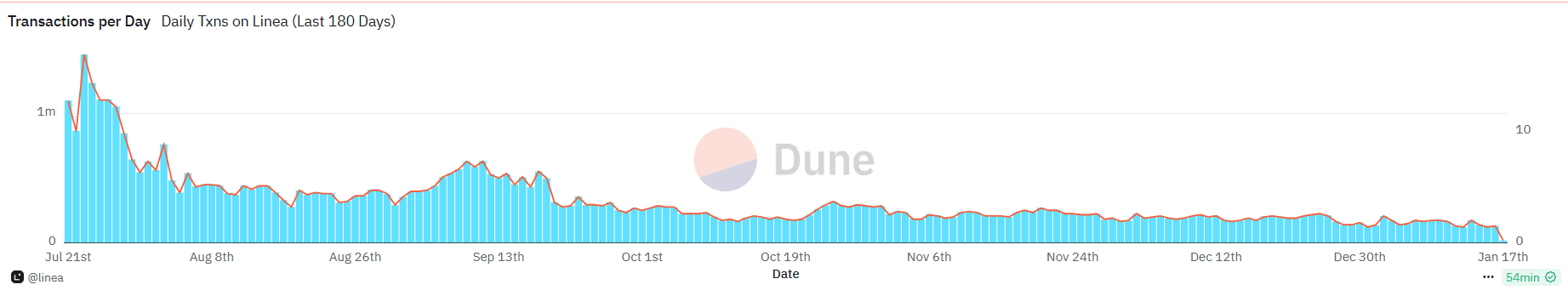

Transaction Count: 243,292,193 transactions have taken place on the Linea network (as of 17.01.25).

_(Source: https://dune.com/queries/3607828/6078692) _

_(Source: https://dune.com/queries/3607828/6078692) _

The daily transaction count has varied, peaking around 1.4 million transactions per day in the earlier months of the period shown. More recently, the transaction rate seems to have stabilized at a lower level, under 100,000 transactions per day.

Transaction Value:

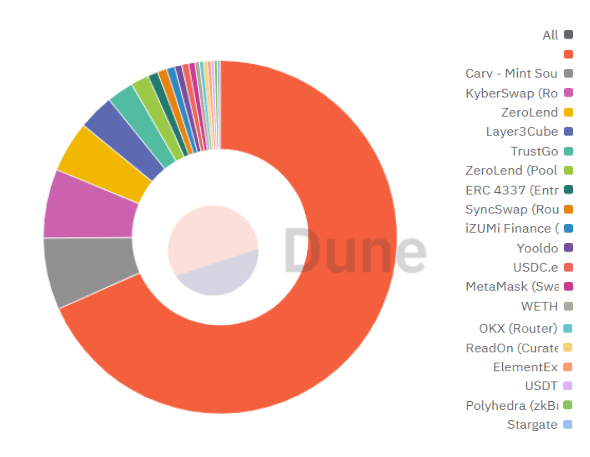

Top Linea Contracts - Past Month (Source: https://dune.com/queries/3619324/6137104)

Top Linea Contracts - Past Month (Source: https://dune.com/queries/3619324/6137104)

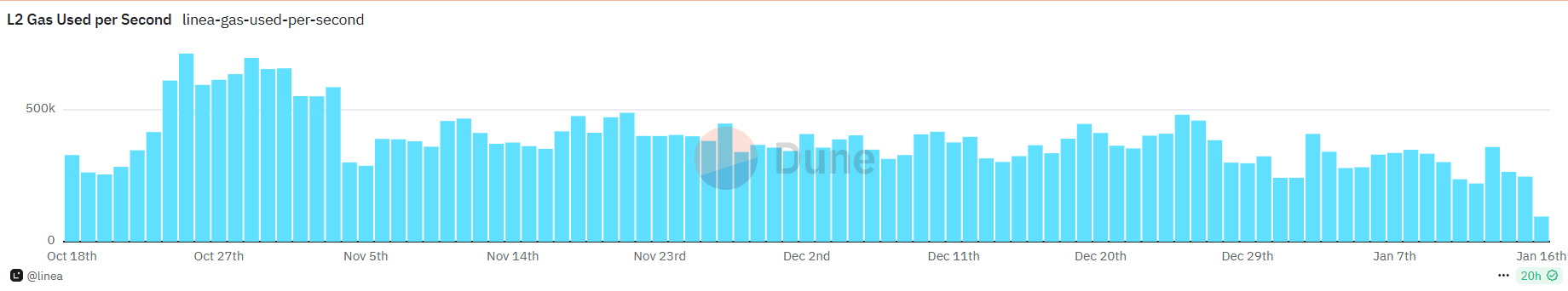

Gas Used Per Second (Source: https://dune.com/queries/3616660/6093629)

Gas Used Per Second (Source: https://dune.com/queries/3616660/6093629)

- No clear data of the total transaction value of Linea is available. Though an approximation can be conducted using the gas spent on transactions of the top contracts, the actual transaction value will vary largely depending on the type of transaction. But it can be assumed that high-gas contracts like DEXs and lending platforms would be processing substantial transaction values which is supported by the Gas Used per second graph.

Active Addresses:

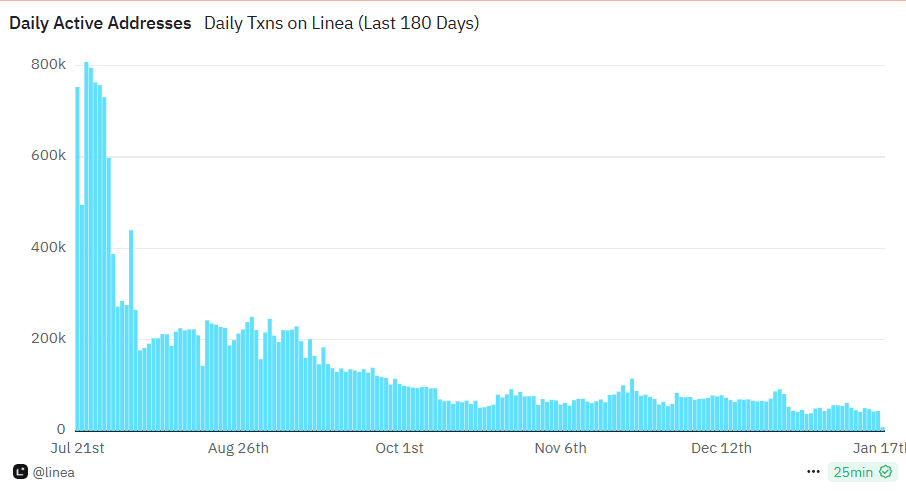

Daily Active Addresses (Source: https://dune.com/linea/linea-overview#linea-transactions)

Daily Active Addresses (Source: https://dune.com/linea/linea-overview#linea-transactions)

- Daily Active Addresses: The number of daily active addresses reached peaks of around 800,000 addresses during July '24 but has generally been fluctuating around 50,00-70,000 in recent months.

- Total Transacting Addresses: There are 6,350,804 unique addresses that have transacted on the Linea network.

Fees Paid:

- Median Transaction Fee: $0.04 (for the last 30 days).

New Addresses:

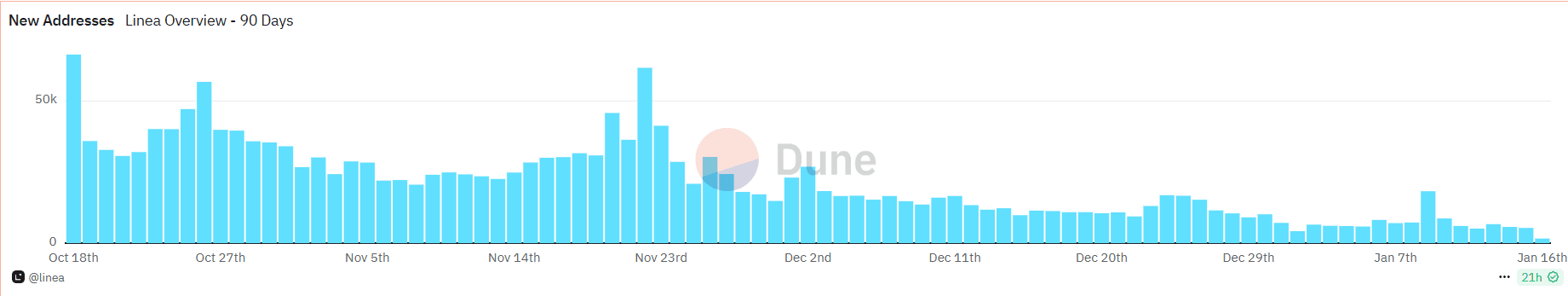

New Addresses on Linea - Last 90 days (Source: https://dune.com/queries/3621523/6101136)

New Addresses on Linea - Last 90 days (Source: https://dune.com/queries/3621523/6101136)

- Contracts Created: A total of 1,492,799 smart contracts have been deployed on Linea.

- Top Contracts in the Past Month: the KyberSwap Routerv2 appears to be the most actively used contract in terms of both gas spend and transactions, followed by other decentralized applications (DApps) such as Carv - Mint Soul and ZeroLend.

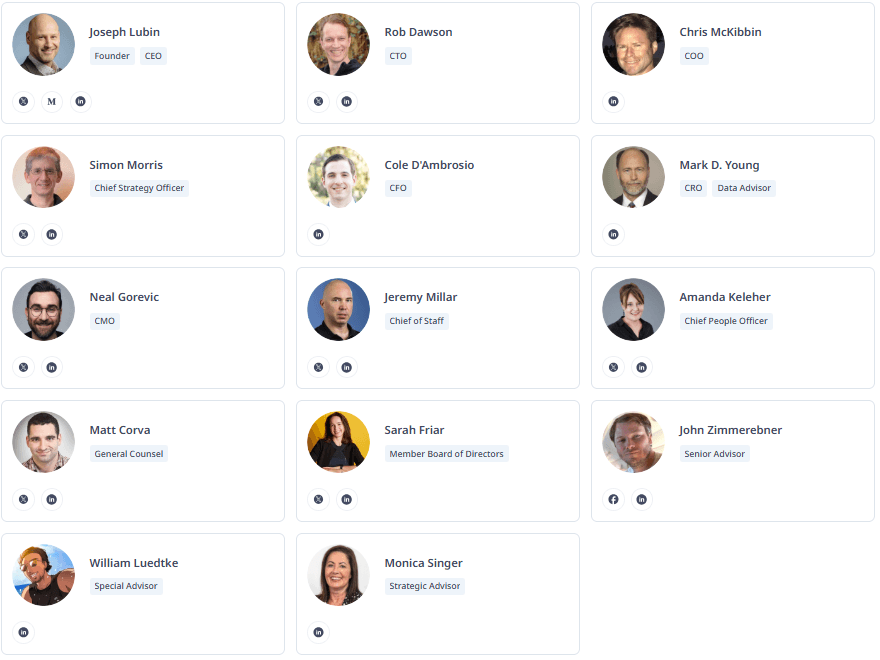

Team

(Source: https://cryptorank.io/price/linea/team)

(Source: https://cryptorank.io/price/linea/team)

The Linea team is composed of professionals with extensive experience in traditional finance, technology, and blockchain. Team members have previously worked at leading financial institutions and technology firms, bringing expertise in structuring financial products, regulatory compliance, and the development of zkEVM technology.

Joseph Lubin Founder & CEO, ConsenSys Joseph Lubin has been leading ConsenSys for the past decade, overseeing its growth into a global blockchain technology company. ConsenSys is known for developing decentralized applications (DApps), enterprise solutions, and blockchain developer tools primarily focused on Ethereum. Under his leadership, the company has become a leading blockchain venture studio. In addition to his role at ConsenSys, Joseph is a co-founder of Ethereum, the revolutionary peer-to-peer platform for decentralized applications.

Rob Dawson Chief Technology Officer, Linea With over seven years at ConsenSys, Rob Dawson serves as the CTO of Linea, where he leads technical strategy and innovation. His work includes launching Palm NFT Studios and shaping developer tools at ConsenSys. Prior to this, he was a product lead and technical leader for PegaSys, where he oversaw the development of the enterprise-grade Ethereum client, Besu. Rob has also been actively involved in driving API standards and building foundational technologies critical to ConsenSys' mission.

Chris McKibbin Chief Operating Officer, Linea Chris McKibbin has been with ConsenSys since 2017, focusing on operational leadership as the Chief Operating Officer for Linea. His extensive background includes consulting roles with high-profile organizations such as Tencent, Google, and Fenway Sports Group. His experience across diverse industries brings strong leadership to the operational side of Linea, ensuring efficient project execution and strategic growth.

Mark D. Young Chief Risk Officer, Linea Mark Young brings over a decade of cybersecurity and risk management expertise to his role as Chief Risk Officer at Linea. He has led advanced technical services for IronNet Cybersecurity and co-founded Ronin Analytics, a cybersecurity firm specializing in intelligence-driven solutions. At ConsenSys, he oversees risk management and data advisory efforts, ensuring that the company remains at the forefront of secure blockchain solutions.

Cole D'Ambrosio Chief Financial Officer, Linea Cole D'Ambrosio has been the CFO of Linea since its inception, responsible for financial strategy, accounting, and operations. He played a key role in the spin-off of GridPlus from ConsenSys, managing financial audits, tax studies, and the growth of the GridPlus subsidiary, which reached over $1.7M in revenue. His expertise in financial management helps ensure Linea's financial stability and growth.

Simon Morris Chief Strategy Officer, Linea Simon Morris brings years of experience in strategic roles, including serving as Chief Strategy Officer at BitTorrent, where he spearheaded the cryptocurrency project "Project Atlas." At ConsenSys, he leads the strategic direction of Linea, leveraging his background in advising startups and working on transformative projects such as Libra (Diem) and BitTorrent's integration into the cryptocurrency ecosystem.

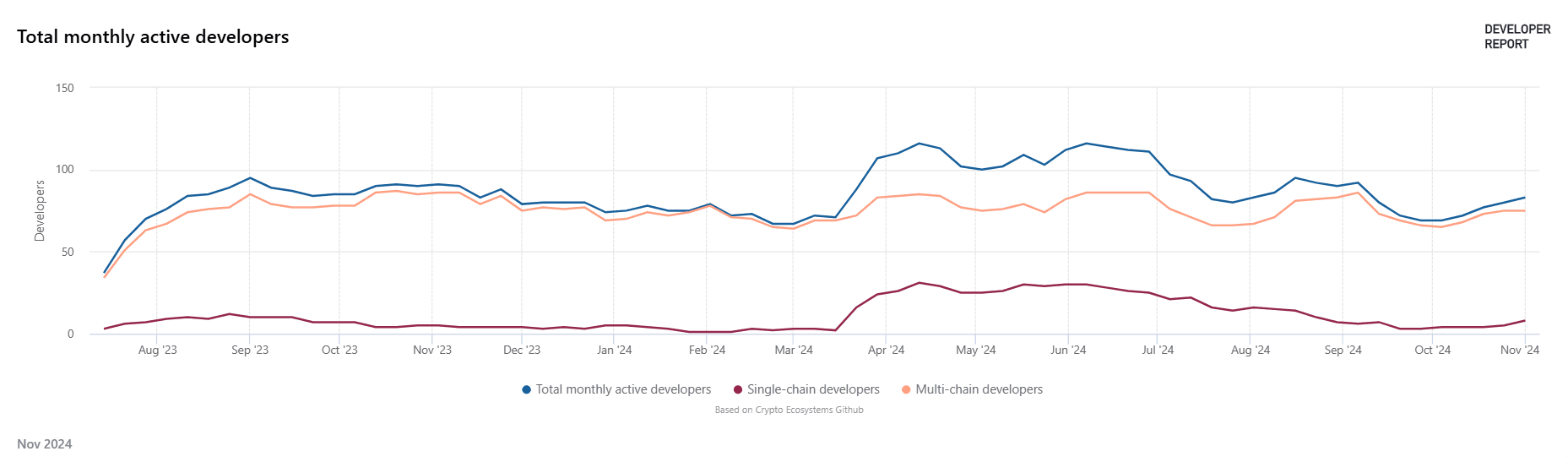

Development Activity

(Source: https://www.developerreport.com/ecosystems/linea)

(Source: https://www.developerreport.com/ecosystems/linea)

Full-time Developers: 20 Monthly Active Developers (Original Code Authors): 83 Total Linea Repositories: 345 Total Linea Commits (Only original code counts): 187k

Linea has ongoing development with integrations across over 100 protocols and tools, indicating a vibrant and growing ecosystem.

Project Developers

-

Consensys: They are involved in the core aspects of Linea, including smart contracts and ZK proofs Github Id: https://github.com/Consensys

-

Guilyx: Contributor to related repositories like TrackDrop Github Id: https://github.com/guilyx/guilyx

-

Elinez19 and Farman Haris: They have developed related tools like arbitrage scanners and guides for the Linea network. Github Id: https://github.com/farman-haris

-

Ultra-Tech-code: Developed contracts and scripts for Linea, specifically for deploying simple contracts on the Linea chain Github Id: https://github.com/Ultra-Tech-code/Hero-bank

Market Fit of Linea Build

As the Ethereum ecosystem continues to evolve, Layer 2 solutions like Linea play a crucial role in addressing scalability challenges. Similar to how Arbitrum Orbit is expanding the multi-chain world, Linea is poised to become a key player in the Ethereum scaling landscape.

With its focus on developer experience and EVM compatibility, Linea is well-positioned to attract a wide range of projects and contribute to the growth of the decentralized web.

thirdweb's full-stack web3 development kit makes it easy to build on Linea: ✦ Frontend: Client-side SDKs to connect users to web3 ✦ Backend: Scalable contract APIs backed by secure wallets ✦ Onchain: Pre-built & extendable contracts ✦ Gaming SDKs: Unity, Unreal Engine, and Mobile (React Native)

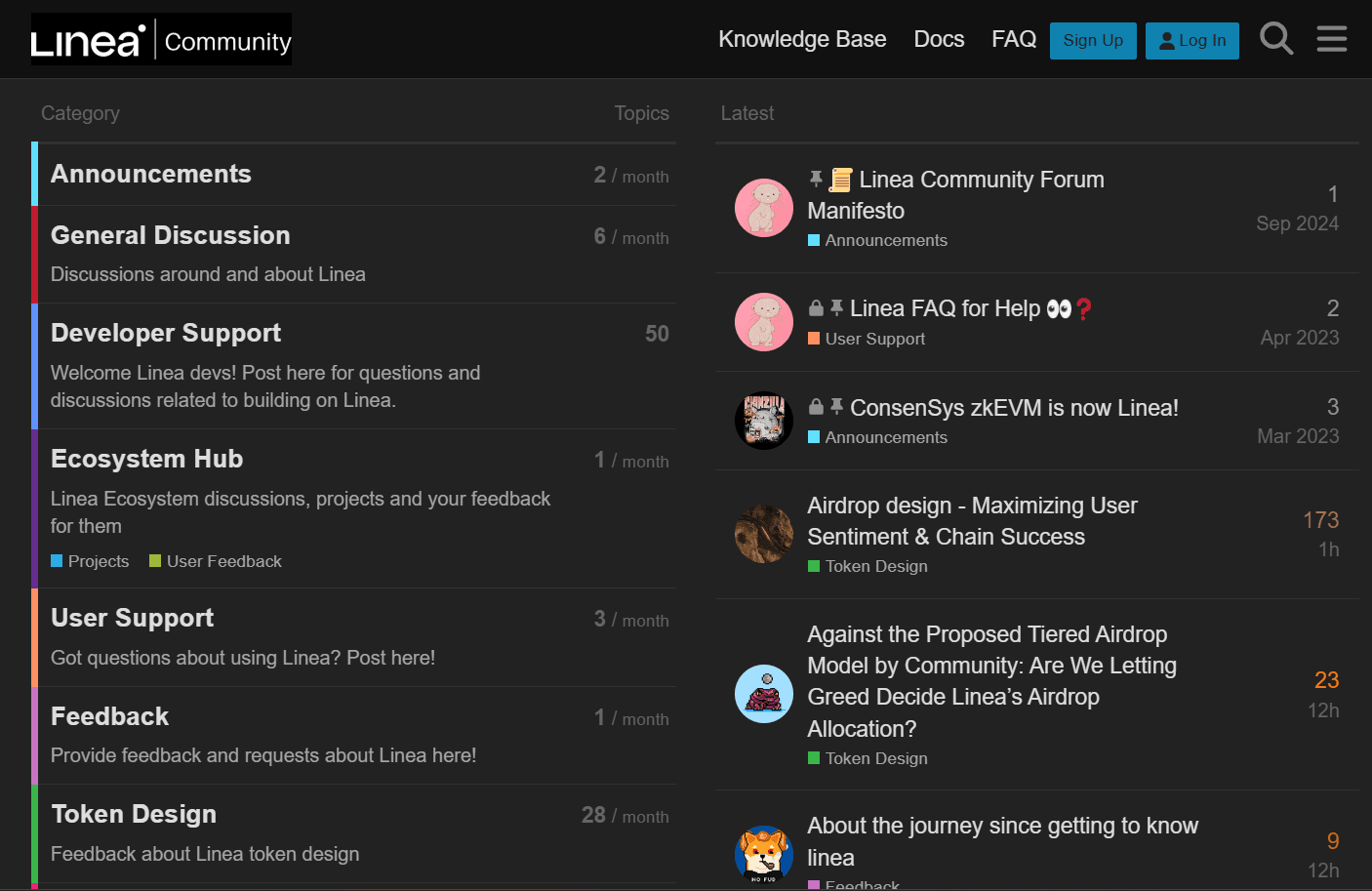

Community Engagement

- Community forum: Linea has an active community with multiple categories for easy communication between developers, report bugs, get latest updates, and more.

(Source: https://community.linea.build/)

(Source: https://community.linea.build/)

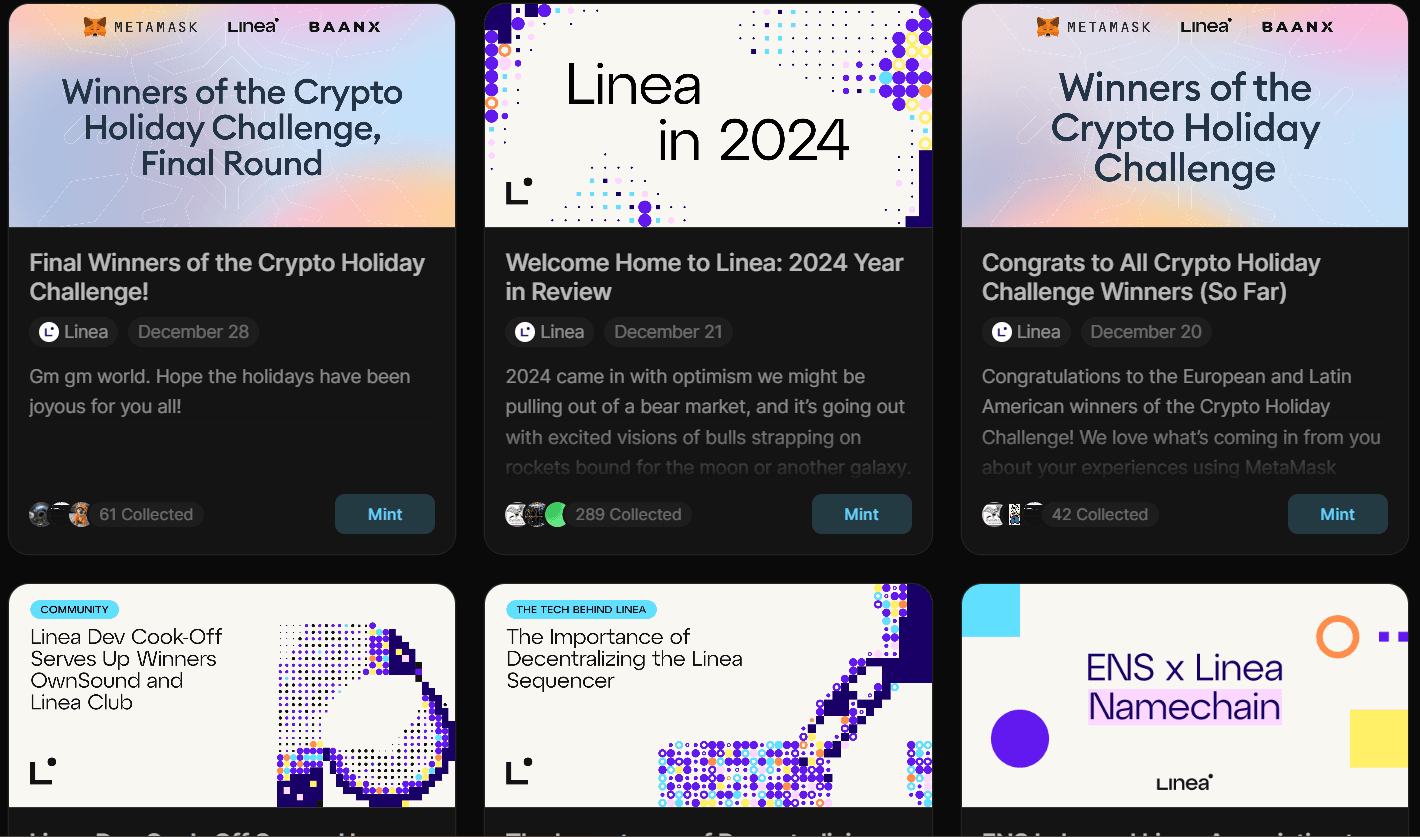

- Mirror Protocol: Linea also actively publishes on Mirror covering various news updates, developer tips, discussing its dApps and more.

(Source: https://linea.mirror.xyz/)

(Source: https://linea.mirror.xyz/)

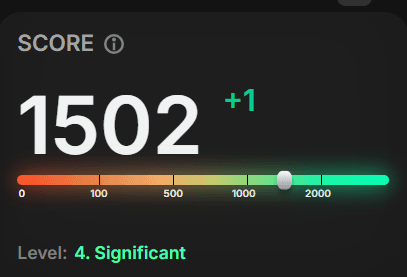

- X: 1.3 Million Followers and Growing Average Interactions: 0.03%+

(Source: https://app.tweetscout.io/search?q=@Lineabuild)

(Source: https://app.tweetscout.io/search?q=@Lineabuild)

-

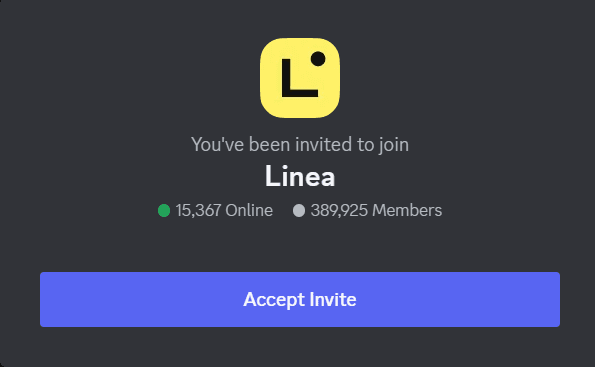

Discord: almost 400k Followers with 20,000+ Daily Active Members

-

Youtube: 25,800+ Growing subscribers

(Source: https://www.youtube.com/@LineaBuild)

(Source: https://www.youtube.com/@LineaBuild)

Financial Metrics

- Linea recently completed its public launch in mid-August 2023. As part of this launch, the network successfully bridged over $26 million in Ether (ETH) and processed more than three million transactions. But there is no clear indication as to what this amount or any amount has been used for the project. Linea is otherwise a bootstrapped project backed by its parent company Consensys which also has not revealed any information about financial allocation towards the future of the project.

- Market Capitalisation: Specific market capitalization data for Linea isn't publicly available, as it doesn’t have its own native token

- Liquidity & Volume: The network supports high transaction volumes, particularly with its integration into various DeFi applications, though detailed liquidity metrics aren't disclosed.

Key Indicators & Ratios

There are no exact values for Linea Finance. However, here are some key insights and metrics:

-

NVT Ratio: NVT ratio is generally a key metric used in blockchain analysis to assess the valuation of a cryptocurrency network relative to its transaction volume. A high NVT ratio can suggest that the network's valuation is outpacing its transaction volume, potentially indicating a bubble, while a low NVT ratio might indicate undervaluation or increasing transaction activity compared to the network's market cap. Specific NVT data isn't provided, but given the high transaction volume, Linea's NVT ratio would likely be competitive with other Layer 2 solutions.

-

MVRV Ratio: MVRV is particularly effective for identifying peaks and troughs in cryptocurrency market cycles. For example, Bitcoin bull markets have historically seen MVRV values of 3.82 to 7.43, while bear market bottoms have been marked by MVRV values as low as 0.69 to 0.76. Similarly, MVRV data is not explicitly mentioned for Linea, as it integrates with Ethereum rather than operating as an independent blockchain with its own token.

-

Stock-to-Flow Model: This model is not applicable to Linea due to the absence of a native token.

Tokenomics

Linea doesn't have a native token; instead, it focuses on enhancing Ethereum's scalability through its zkEVM rollup, which does not involve a separate tokenomics model..

Risk Analysis (SWOT) Strengths

- Security Focus: Linea employs advanced cryptography, including zero-knowledge proofs (zk-rollups), and has multiple partnerships focused on ensuring network security. The platform has addressed critical vulnerabilities like reentrancy attacks through continual auditing and security updates.

- Regulatory Compliance: Developed by ConsenSys, Linea benefits from adherence to stringent regulatory frameworks. This ensures higher trustworthiness in a regulatory environment that is increasingly scrutinizing blockchain technologies.

- Reliance on Ethereum Stability: As a Layer 2 solution, Linea leverages the security and stability of Ethereum, mitigating the volatility risks typically associated with Layer 1 blockchains and allowing for lower-cost, higher-speed transactions.

- Market Positioning: Linea is designed for scalability and speed, enabling it to stand out from competitors, especially with its compatibility with Ethereum's EVM and broader DeFi ecosystem, attracting users and developers alike.

Weaknesses

- Centralization of Core Components: Key components such as the sequencer, prover, and coordinator are currently centralized. This poses a risk of censorship and a single point of failure if any component is compromised or misused by internal actors.

- Rate Limiter Vulnerability: Linea’s rate limiter, designed to protect against large-scale attacks, can be exploited to perform denial-of-service (DoS) attacks. This could prevent legitimate users from completing transactions or withdrawing funds.

- Complexity of Cross-Layer Token Bridges: Tokens that share the same address on Layer 1 (L1) and Layer 2 (L2) chains present a challenge, potentially preventing users from bridging tokens or creating exploitable vulnerabilities. Cross-chain bridging remains an area of complexity for Linea.

- Lack of Escape Mechanism for Failed Transactions: Currently, if a transaction fails during the bridging process, there is no mechanism for users to retrieve their funds, leaving them vulnerable to transaction failure scenarios or unresponsiveness from the centralized coordinator.

Opportunities

- Security Innovation: Linea can continue to solidify its leadership in blockchain security by introducing decentralized elements for its core components and continuing to improve security mechanisms like rate limiters. With its focus on zk-rollups and security partnerships, there is significant potential for becoming the most trusted Layer 2 solution.

- Growing Layer 2 Market: With increasing demand for scalable and low-cost Ethereum solutions, Linea has an opportunity to capture significant market share by offering a more secure, efficient, and affordable alternative to Layer 1 Ethereum.

- DeFi and NFT Expansion: As more decentralized finance (DeFi) applications and non-fungible tokens (NFTs) are built on Ethereum, Linea’s Layer 2 infrastructure, with lower gas fees and faster finality, can attract developers and projects looking for scalability solutions.

Threats

- Intense Competition: Linea faces stiff competition from other Layer 2 solutions like Arbitrum, Optimism, and Polygon. To maintain market share, Linea must continually innovate and address any security or performance vulnerabilities faster than its competitors.

- Regulatory Risks: Despite being developed by ConsenSys and adhering to regulatory frameworks, Linea must navigate the broader and often uncertain regulatory landscape surrounding blockchain, cryptocurrencies, and DeFi, which could pose challenges for its long-term growth.

- Security Risks: Despite its current security measures, Linea is exposed to potential vulnerabilities such as reentrancy attacks, rate limiter abuse, and privileged roles being misused. These risks highlight the importance of continuous monitoring and security audits to prevent breaches.

Recommendations

Buy Recommendation

-

Technological Strength: Linea's use of zkEVM rollup technology and its full compatibility with Ethereum makes it a strong contender in the Layer 2 space. This technology is crucial for the future scalability and security of decentralized applications (dApps).

-

Adoption and Ecosystem Growth: The high transaction volume and integration with over 100 protocols indicate strong adoption. This widespread use can drive further innovation and solidify Linea's position in the market.

-

Long-Term Potential: If you believe in the long-term growth of Ethereum and the necessity of Layer 2 solutions, Linea could be a promising investment, especially as it continues to develop and attract more projects to its ecosystem.

Cautions

-

Competitive Environment: The Layer 2 space is highly competitive, with projects like Optimism and Arbitrum also offering strong solutions. Linea will need to continually innovate to maintain its edge.

-

No Native Token: The lack of a native token means fewer direct financial incentives, which could impact speculative investment interest.

Overall Recommendation If you are a long-term investor with a focus on technology and ecosystem development, buying Linea would align with a belief in its potential to grow as a crucial part of the Ethereum ecosystem. However, if you are looking for immediate returns or are concerned about the competitive landscape, it may be wise to monitor the project closely before making a significant investment.

Conclusion

Linea is a promising Ethereum Layer 2 solution with robust security, high transaction throughput, and strong community and developer support. It's well-suited for dApps looking for scalability and EVM compatibility. The absence of a native token reduces speculative risk, but the project's success will depend on continued innovation and adoption within the Ethereum ecosystem.

Summary

Linea, built by ConsenSys as an Ethereum Layer 2 blockchain, uses zero-knowledge rollup technology to reach EVM equivalence, which allows for the secure, efficient, and scalable execution of Ethereum smart contracts. Linea is a formidable rival in the Layer 2 market, boasting over 28 million active addresses and 193 million transactions. Its cheap transaction fees and strong security features set it apart from the competition. If your decentralized application (dApp) needs to scale without sacrificing security, this platform is perfect for you. Despite not having its own native token, Linea is well-positioned for further growth within the Ethereum ecosystem thanks to its dedicated community and continuous development.