Billions in losses. Three collapsing assets. An eight-day window of vulnerability. Inside the theory that last week's historic crypto meltdown wasn't a market crash - but a precision strike on the world's largest exchange.

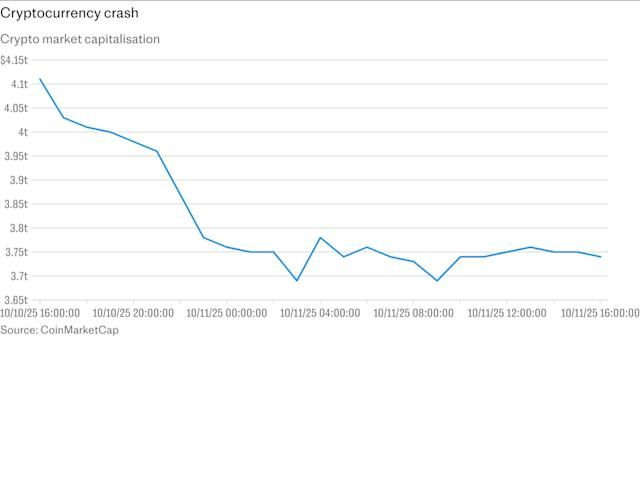

On the evening of October 10, 2025, traders on Binance watched in horror as their portfolios evaporated. Within 40 minutes, three digital assets lost most of their value: Ethena's USDe stablecoin, designed to maintain a one-dollar peg, plummeted to 65 cents; Wrapped Beacon ETH crashed to 20 cents on the dollar; and Binance Staked SOL fell to just 13 cents. Nearly 1.7 million traders were liquidated in what became the largest single liquidation event in cryptocurrency history, wiping out more than 19 billion dollars across the crypto market.

The chaos unfolded against the backdrop of a broader market selloff. U.S. President Donald Trump had announced plans to impose 100 percent tariffs on Chinese imports starting November 1, triggering a shockwave across financial markets. Bitcoin, which had reached an all-time high of 125,000 dollars just days earlier, tumbled more than 13 percent. Ethereum fell 18 percent. But what happened on Binance went far beyond a typical market correction.

Multiple cryptocurrencies, including Enjin and Cosmos, briefly showed prices crashing to near zero amid what users described as system overloads. Traders reported frozen accounts, failed stop-loss orders, and an inability to execute trades for minutes at a time during the market's sharpest decline of the year.

As the dust settled, a provocative theory emerged. Colin Wu, a prominent cryptocurrency journalist, suggested the crash may not have been an accident but rather a coordinated attack aimed directly at Binance and its market makers, exploiting a known weakness in the exchange's Unified Account margin system. The timing was particularly suspicious: the crash occurred in a narrow window between when Binance announced a critical security update and when that update was actually implemented.

Trading volume for the three affected assets on Binance reached 3.5 to 4 billion dollars within 24 hours, with estimated realized losses between 500 million and 1 billion dollars. If the attack theory proves correct, it would represent one of the most sophisticated exploits in cryptocurrency history - a targeted strike that weaponized the very infrastructure designed to help traders maximize their capital efficiency.

Timeline of a Crisis

Understanding how the October 11 crash unfolded requires rewinding to the days before, when Binance's risk team made a fateful announcement that would inadvertently telegraph the exchange's vulnerability to anyone paying attention.

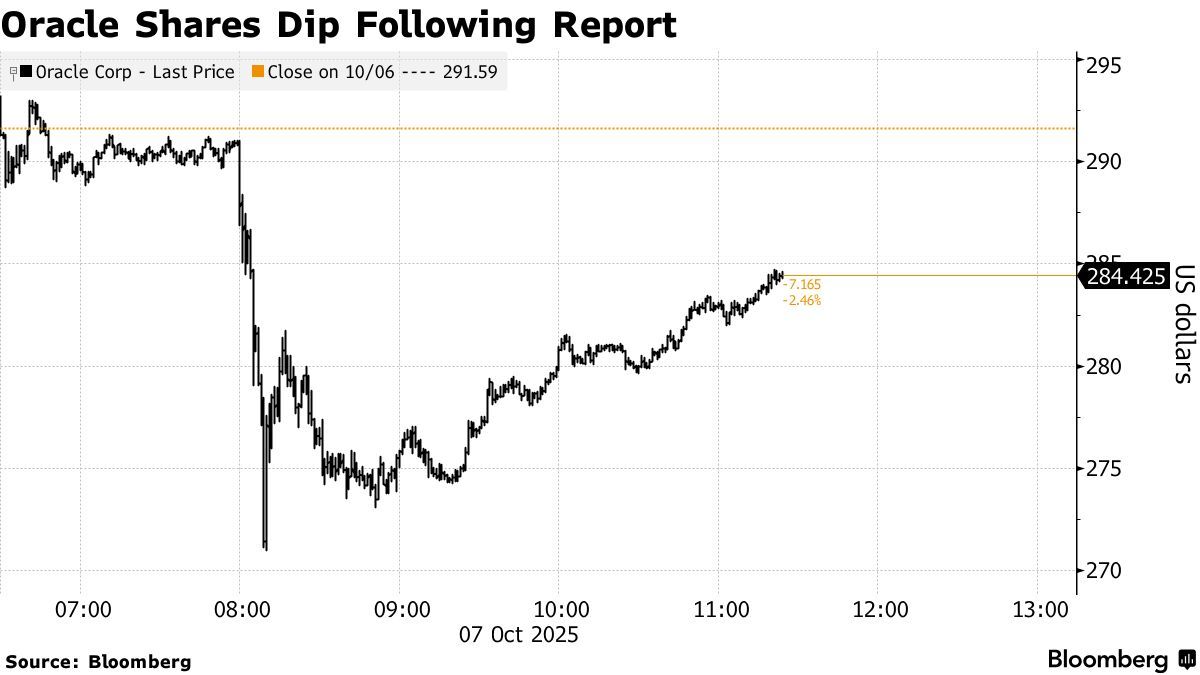

October 6: The Oracle Update Announcement

On October 6, Binance announced plans to modify its pricing system for certain collateral assets used in margin trading. The exchange stated it would switch from using its own internal order book prices to more reliable external data sources, with the change scheduled for implementation on October 14.

The announcement was routine from Binance's perspective - a technical improvement to enhance price accuracy for proof-of-stake derivatives and yield-bearing tokens used as margin collateral. But it also revealed something critical: the exchange's risk team had identified a vulnerability in how these assets were priced for liquidation purposes. They knew there was a problem. They knew they needed to fix it. And they publicly announced an eight-day window during which the vulnerability would remain open.

October 10-11: The Attack Window

The crash began late Friday evening, October 10, U.S. time. Bitcoin tumbled from an intraday high of 122,456 dollars to a low of 105,262 dollars, dropping nearly seven percent. Ethereum fell more than 12 percent. XRP plunged from 2.83 dollars to 1.89 dollars, marking a 13 percent loss.

But the carnage on Binance's margin system told a different story. While Bitcoin and major altcoins experienced steep but relatively orderly declines across all exchanges, three specific assets on Binance entered a death spiral. As market volatility intensified, traders using coin-margined positions saw their losses compounded by the sudden collapse of their collateral. USDe crashed to 65 cents, wBETH plunged to 20 cents, and BnSOL hit 13 cents - even though these same assets maintained significantly higher prices on other exchanges and in on-chain protocols.

On-chain Aave oracle data for USDe still showed a clean one-to-one ratio, indicating that the chaos was confined to Binance's internal pricing system rather than reflecting genuine market-wide collapse. This discrepancy would become central to the coordinated attack theory.

As liquidations mounted, several altcoins on Binance experienced dramatic crashes, with IOTX briefly hitting zero dollars. Market observers noted that rumors pointed to major centralized exchanges automatically liquidating collateral tied to cross-margin positions, triggering the sharp declines.

October 11-12: System Failures and Response

As the liquidation cascade intensified, Binance's systems buckled under the strain. The exchange acknowledged disruptions, citing heavy market activity that caused system delays and display issues, though it assured users that funds remained secure.

Binance co-founder Yi He issued a statement acknowledging the disruptions and announcing that the exchange would review and compensate losses directly caused by system failures. The statement noted that significant market fluctuations and a substantial influx of users had caused some traders to encounter transaction issues.

Data showed that Binance Futures' shared insurance fund for Bitcoin, Ethereum, and BNB USDT-margined contracts fell from 1.23 billion dollars to 1.04 billion dollars, with 188 million dollars deployed to manage risks amid the extreme volatility.

October 14: The Oracle Fix

On October 14, as scheduled, Binance implemented its oracle update, switching to external price feeds and adding redemption prices to the index calculations for all three affected tokens. The vulnerability window had closed - but the damage was done.

How Binance's Unified Account Margin System Works

To understand why Binance became vulnerable, it's essential to grasp how the exchange's Unified Account margin system operates and why it differs fundamentally from traditional margin trading models.

The Promise of Unified Margin

Binance's Portfolio Margin mode, also called Unified Account, consolidates margin calculations and requirements across multiple trading products. Under this system, traders can use a wide range of assets as collateral to increase the overall flexibility of their trading strategies.

Traditional margin trading typically works in one of two ways. In USDT-margined positions, traders borrow and repay in Tether, the dominant stablecoin. In coin-margined positions, traders use Bitcoin or another cryptocurrency as both collateral and the denomination for their positions. Both approaches have clear advantages: USDT provides price stability, while coin-margined positions allow traders to maintain exposure to their chosen asset.

Binance's Unified Account took a different approach. Rather than limiting collateral to stable assets or requiring separate margin pools for each trading pair, the system allowed traders to post virtually any supported asset as collateral for positions across spot, futures, and derivatives markets. This created unprecedented capital efficiency - traders could use their entire portfolio as collateral rather than siloing assets into separate margin accounts.

The Unified Maintenance Margin Ratio

The cornerstone of Portfolio Margin is the Unified Maintenance Margin Ratio, known as uniMMR. This ratio assesses the overall risk level of a trader's entire portfolio, taking into account adjusted equity and maintenance margin across all positions in the trading accounts.

A higher uniMMR indicates lower risk, while a lower uniMMR signals higher risk and potential liquidation. The system calculates uniMMR by dividing unified account adjusted equity by unified maintenance margin amount.

Liquidation occurs when an account's uniMMR falls below 1.05, or 105 percent. The system sends a first margin call when uniMMR drops to or below 1.5, a second when it reaches 1.2, and automatically changes the account to reduce-only mode at that threshold, suspending the ability to open new positions or take margin loans.

Collateral Rates and Asset Valuation

Not all collateral is created equal in Unified Margin. Depending on the amount of assets held in the Cross Margin wallet, certain margin assets may be valued on a discounted basis using a collateral ratio, which is a percentage at which the asset is recognized as collateral.

This is where Binance made a critical design choice. While major assets like Bitcoin and Ethereum received high collateral rates - typically 95 percent or above - the exchange also allowed proof-of-stake derivatives and yield-bearing stablecoins to serve as collateral. These assets included wBETH, BnSOL, and USDe.

The theory behind accepting these assets seemed sound. Wrapped Beacon ETH represented staked Ethereum plus accumulated staking rewards. One wBETH represents one staked ETH along with staking rewards accrued on ETH Staking since April 27, 2023, and the value of wBETH gradually exceeds that of ETH over time due to the accumulation of staking rewards.

Similarly, Binance Staked SOL represents staked SOL plus the staking rewards received, in a tradable and transferable form, allowing users to earn rewards while maintaining liquidity.

And Ethena's USDe, while not a traditional fiat-backed stablecoin, maintained its dollar peg through a sophisticated delta-neutral hedging strategy using staked Ethereum as collateral and offsetting short positions in derivatives markets.

In theory, these assets should have remained relatively stable even during market volatility. In practice, they concealed a critical vulnerability.

The Pricing Problem

Here's where the Unified Margin system's Achilles heel emerged. Unlike other exchanges, Binance used its own internal order book - essentially the buy and sell orders on its platform - to set prices for margin trading. This created a problem when trading volume got thin.

For assets with deep liquidity and tight spreads, internal pricing works reasonably well. But for newer, less liquid assets like proof-of-stake derivatives, internal order books can become dangerously disconnected from true market value. During periods of stress, this gap can widen dramatically.

Guy Young, founder of Ethena Labs which created USDe, explained that the depeg happened because Binance's pricing system relied on its own limited liquidity instead of checking prices across multiple major exchanges.

This design flaw created a closed loop: Binance determined liquidation prices based on its own order book, which could be manipulated or stressed by concentrated selling, which would trigger more liquidations, which would dump more assets onto the same thin order book, creating a feedback loop of cascading liquidations.

It was a time bomb waiting for the right conditions - or the right attacker - to detonate it.

Vulnerability and Exploitation Theory

The question that has consumed cryptocurrency analysts since October 11 is whether the crash represents a catastrophic system failure or something more sinister: a calculated exploit by sophisticated actors who recognized and weaponized Binance's structural weaknesses.

The Attack Thesis

According to Colin Wu's analysis, the crash appeared to be a planned strike aimed at Binance and one of its biggest market makers. The weak spot was the Unified Account margin system, which allowed traders to use certain volatile assets as collateral.

The attack would have required several coordinated elements. First, attackers would need to identify the vulnerability - specifically, that Binance used internal spot order book prices for liquidation calculations on assets with limited liquidity. Second, they would need to establish positions that could profit from a coordinated price collapse. Third, they would need the capital and coordination to execute concentrated selling that could overwhelm the order books for the target assets.

As the broader crypto market started to decline following Trump's tariff announcement, attackers reportedly bombarded Binance with sell orders for USDe, wBETH, and BnSOL. This caused their prices to depeg massively on just Binance's exchange, while on other exchanges and on-chain, these assets remained relatively stable.

The timing proves particularly damning for the deliberate attack hypothesis. The attack happened precisely between Binance's announcement of an oracle price adjustment on October 6 and its scheduled implementation on October 14, providing attackers with a clear window of opportunity. Binance's risk team had noticed some exposure, but the delay created an open window that the exploit slipped right through.

Recursive Lending and Leverage Amplification

The attack's effectiveness would have been magnified by recursive borrowing strategies. In a recursive lending scheme, a trader deposits an asset as collateral, borrows against it, uses the borrowed funds to acquire more of the collateral asset, deposits that as additional collateral, and repeats the cycle. This creates highly levered exposure with relatively little initial capital.

If attackers had built up recursive positions using wBETH, BnSOL, or USDe as collateral before initiating the crash, the liquidation cascade would have been self-reinforcing. As collateral values dropped, leveraged positions would hit liquidation thresholds, forcing the system to dump more of the collateral assets onto the already stressed order book, pushing prices lower and triggering additional liquidations.

The Parallel to DeFi Oracle Attacks

The alleged exploitation method bears striking similarities to previous oracle manipulation attacks in decentralized finance. In October 2022, traders exploited Mango Markets by manipulating the platform's oracle price for its native MNGO token, borrowing against artificially inflated collateral values and draining more than 100 million dollars. In August 2021, Cream Finance suffered multiple oracle manipulation attacks that led to losses exceeding 130 million dollars.

The Binance situation represents a variation on this theme - instead of manipulating an external oracle, attackers allegedly exploited the fact that Binance essentially served as its own oracle for these assets, creating a closed system vulnerable to internal price manipulation through concentrated selling.

The Counterargument: Systemic Failure

Not everyone accepts the coordinated attack narrative. An alternative explanation suggests the crash resulted from systemic design flaws interacting with unprecedented market stress, rather than deliberate manipulation.

Under this view, Binance's decision to accept yield-bearing assets as collateral reflected a fundamental misunderstanding of how these assets behave during volatility. Unlike Bitcoin or Ethereum, which have deep liquidity across dozens of venues, proof-of-stake derivatives and synthetic stablecoins have much thinner markets. During moments of stress, bid-ask spreads can widen dramatically, and available liquidity can evaporate.

Tom Lee, chairman of BitMine, told CNBC the market's pullback was overdue after a 36 percent gain since April. He noted that the VIX jumped 29 percent, calling it one of the top one percent largest single-day volatility spikes in history, and characterized the sell-off as a healthy shakeout.

From this perspective, Trump's tariff announcement provided the initial shock. As Bitcoin and altcoins tumbled across all exchanges, traders on Binance who had leveraged positions using wBETH, BnSOL, or USDe as collateral suddenly faced margin calls. With Bitcoin down 13 percent, their leveraged positions were already underwater. But then their collateral itself started losing value.

Traders rushed to sell their collateral assets to meet margin requirements or exit positions. This selling pressure hit Binance's relatively thin order books for these assets, causing prices to gap down. The lower prices triggered more liquidations, creating more selling pressure in a classic death spiral - no coordination required.

Evidence Pointing Both Ways

The truth likely contains elements of both explanations. Analysts examining the event have noted that evidence points both ways - toward coordinated action and toward an unfortunate convergence of bad timing and system flaws.

Supporting the attack theory: the precise timing during the announced vulnerability window, the fact that asset prices crashed on Binance while remaining stable elsewhere, the massive trading volumes concentrated in just three assets, and the sophisticated understanding required to identify and exploit the internal pricing vulnerability.

Supporting the systemic failure theory: the broader market stress from Trump's tariff announcement providing a catalyst, the known limitations of using yield-bearing assets as collateral during volatility, the technical challenges any exchange faces during extreme volume spikes, and Binance's acknowledgment of system issues rather than malicious activity.

What remains undisputed is that Binance's infrastructure proved inadequate for the stress test it faced, whether that stress was naturally occurring or artificially induced.

Inside the Crash: The Three Collapsing Assets

The October 11 meltdown centered on three specific assets, each representing a different category of crypto-native financial innovation - and each revealing how complex financial engineering can fail catastrophically under stress.

Ethena USDe: The Synthetic Dollar

Ethena USDe is a synthetic dollar stablecoin designed to maintain its peg through crypto-native hedging strategies while offering yield via staking and derivatives. Unlike fiat-backed stablecoins like USDC, it uses crypto collateral such as staked ETH and short positions in ETH perpetual futures to neutralize price volatility.

The protocol uses a dual mechanism: collateralization backed by assets like ETH and stETH, and derivative hedging through short positions in ETH perpetual futures that offset price swings, ensuring the collateral's dollar value remains stable. Yield is generated from staking rewards and funding rates paid by leveraged traders in futures markets.

As of October 2025, USDe had reached a market capitalization exceeding 12 billion dollars, making it one of the largest stablecoins globally. The protocol's rapid growth attracted both admiration for its innovation and concern about its risk profile.

Critics had long questioned whether USDe truly qualified as a stable asset. If short demand suddenly outstrips the demand for long positions, as can happen in a bear market, funding rates go negative, and Ethena's short positions would be required to cover those long holdings. In this scenario, the price of USDe could drop below one dollar.

On October 10-11, those concerns proved prescient. Ethena's synthetic dollar USDe slipped rapidly to 65 cents around the same time as wBETH and BnSOL crashed. However, on-chain Aave oracle data for USDe remained fixed at one-to-one, resulting in no large-scale liquidations outside Binance.

This disparity revealed the critical issue: USDe wasn't breaking its peg in any fundamental sense. The protocol's hedging mechanisms remained intact. Instead, Binance's internal order book simply didn't have enough buy-side liquidity to absorb the concentrated selling pressure, causing the exchange's price to detach from the broader market.

Guy Young, founder of Ethena Labs, explained that the depeg happened because Binance's pricing system relied on its own limited liquidity instead of checking prices across multiple major exchanges.

Wrapped Beacon ETH (wBETH): Staking Rewards Gone Wrong

Wrapped Beacon ETH is a value-accruing liquid staking token where one wBETH represents one staked ETH along with the staking rewards accrued since April 27, 2023. Users can stake ETH or wrap BETH tokens to obtain wBETH or redeem wBETH to ETH on the ETH Staking page at zero fees.

The initial conversion ratio between BETH and wBETH was one-to-one from April 27, 2023, but the value of one wBETH gradually exceeds that of one ETH over time due to the accumulation of staking rewards. The ratio is updated daily to reflect rewards earned from staked ETH.

wBETH's design aimed to solve a fundamental problem in proof-of-stake systems: staked assets are typically locked and illiquid. By tokenizing staked Ethereum into a tradable wrapper, Binance allowed users to earn staking rewards while maintaining the ability to trade, lend, or use their assets as collateral.

This innovation, however, introduced new risks that became apparent during the October crash. Binance's wrapped beacon ether price plunged to as low as 430 dollars around 21:40 UTC on Friday, representing a staggering 88 percent discount compared to the ether-tether spot price, which was trading above 3,800 dollars at the same time.

Tokens like wBETH are designed to track the spot price of their underlying assets closely. Binance valued these wrapped assets based on their spot market prices. Under normal conditions, arbitrageurs help maintain these prices close to their fundamental values by simultaneously buying the cheaper asset and selling the more expensive one.

But normal conditions didn't apply on October 10. As Ethereum itself fell during the broader market selloff, wBETH faced a double shock. First, the underlying asset lost value. Second, as traders scrambled to meet margin calls or exit leveraged positions, they dumped wBETH onto Binance's order book faster than arbitrageurs could respond.

Wrapped tokens crashed as Binance's infrastructure buckled, making it harder for market makers to stabilize prices. The system's reliance on Binance's internal order book meant there was no external price reference to keep wBETH anchored to ETH's true value during the chaos.

Binance Staked SOL (BnSOL): The Solana Liquidation

Binance Staked SOL represents staked SOL plus the staking rewards received, in a tradable and transferable form. The token accumulates staking rewards through the BnSOL-to-SOL conversion rate, even when used in other Binance products or external DeFi applications.

The SOL staking APR is dynamic and follows on-chain staking rewards, which update upon each Solana epoch approximately every two to three days and fluctuate due to various factors including overall network staking participation and validator performance.

BnSOL shared the same structural characteristics as wBETH: a liquid staking derivative designed to provide yield and liquidity simultaneously. And it shared the same vulnerability during the October crash.

Binance Staked SOL also tanked to 34.90 dollars, trading at a massive discount to the spot price of Solana. With Solana trading around 150 to 160 dollars on other exchanges during the crash, BnSOL's collapse to below 35 dollars represented a discount exceeding 75 percent.

Like USDe and wBETH, BnSOL's fundamental value remained intact - the underlying staked Solana continued earning rewards, and the protocol's mechanics functioned normally. The crisis was purely one of exchange-level pricing and liquidity.

The Common Thread: Internal Pricing, External Reality

What united all three asset crashes was the gap between Binance's internal pricing and external market reality. USDE crashed to 65 cents, wBETH plunged to 20 cents, and BnSOL hit 13 cents - even as these same assets maintained significantly higher prices elsewhere.

On other exchanges and on-chain, these assets were relatively stable, suggesting the chaos was confined to Binance liquidity. This geographic concentration of the crisis - limited primarily to a single exchange's internal pricing system - provides perhaps the strongest evidence that something fundamentally broken in Binance's infrastructure allowed the crash to spiral out of control.

The Oracle Gap and Timing Issue

If the October 11 crash was indeed a coordinated attack, the timing reveals sophisticated planning and intimate knowledge of Binance's risk management timeline.

The Eight-Day Vulnerability Window

On October 6, Binance announced plans to fix the exact pricing problem that would later be exploited. The exchange said it would switch from using its own order book prices to more reliable external data sources, with the change scheduled for October 14.

This announcement, while intended to reassure users that Binance was proactively addressing potential risks, had the unintended effect of publicly telegraphing a known vulnerability with a specific timeline for its closure.

The attack occurred precisely between Binance's announcement of an oracle price adjustment and the actual implementation, providing attackers with a clear window of opportunity.

For any sophisticated market participant monitoring Binance's announcements, the October 6 statement provided a roadmap: these specific assets have a pricing vulnerability, the exchange knows about it, and it won't be fixed for eight more days. If an attacker wanted to exploit internal pricing weaknesses, October 6 through October 13 represented the optimal window.

What the Oracle Update Aimed to Fix

The planned oracle update would have addressed the core vulnerability by incorporating external price references into liquidation calculations. Binance announced a shift to using conversion-ratio pricing for wrapped assets, meaning instead of valuing wBETH based on volatile and distressed spot market trades, the exchange would price it according to the underlying staking ratio, which represents the actual amount of ETH each wrapped token represents.

The exchange also announced three fixes: adding redemption prices to the index calculations for all three tokens, setting a minimum price threshold for USDe, and reviewing risk controls more often.

These changes would have prevented the cascading liquidations by disconnecting collateral valuation from the thin, potentially manipulable internal order books. Even if Binance's spot market for wBETH collapsed to 20 cents, the oracle would recognize that each wBETH still represented a specific amount of staked Ethereum with real, verifiable value.

But on October 10, this safety measure didn't yet exist.

Internal Warnings and Risk Management Failures

Binance's risk team had noticed some exposure before the crash, but the delay in implementing fixes created an open window that the exploit slipped through.

This raises troubling questions about Binance's risk management processes. If the team identified a vulnerability significant enough to warrant public disclosure and system changes, why wait eight days to implement the fix? Why not immediately increase risk parameters or collateral requirements for the affected assets as an interim measure?

The answer likely involves the complexity of implementing major infrastructure changes on a live exchange handling billions of dollars in daily volume. Proper testing, staged rollouts, and coordination across multiple systems all take time. But that operational reality created a known period of heightened risk - a risk that, according to the attack theory, someone exploited with devastating precision.

Could the Delay Itself Have Been the Trap?

A more cynical interpretation suggests that publicly announcing an eight-day window before implementing security updates represents a fundamental error in cybersecurity best practices. In traditional finance, major system vulnerabilities are typically patched before public disclosure to prevent exploitation.

Binance's approach - public announcement followed by scheduled implementation - may have been driven by transparency concerns and user communication obligations. Traders using the affected assets as collateral deserved notice that pricing mechanisms would change. But transparency came at the cost of operational security.

Whether through coordination among sophisticated actors who recognized the opportunity or simply market forces overwhelming a known weak point, the eight-day window between announcement and implementation proved catastrophic.

Systemic Design Flaws or Coordinated Attack?

The debate over whether October 11 represents an attack or a structural failure reflects deeper questions about cryptocurrency market architecture, exchange design, and the limits of financial innovation.

The Case for Deliberate Exploitation

Multiple factors support the theory that coordinated actors deliberately exploited Binance's vulnerabilities.

Timing Precision: The crash occurred in the middle of the announced vulnerability window, suggesting actors monitored Binance's announcements and planned accordingly. The probability of a natural market event randomly occurring during this specific eight-day period, rather than before or after, seems low.

Asset Selection: Of the many tokens accepted as collateral in Binance's Unified Margin system, only three experienced catastrophic depegs. These happened to be precisely the assets most vulnerable to internal pricing manipulation due to their limited liquidity and reliance on Binance's order book for valuation.

Coordinated Selling: Attackers reportedly bombarded Binance with sell orders for USDe, wBETH, and BnSOL, causing their prices to depeg massively on just Binance's exchange while remaining stable elsewhere. This pattern suggests concentrated, coordinated selling rather than diffuse market panic.

Profitability: If actors established short positions or removed collateral before initiating the crash, they could profit from both the price collapse and the liquidation cascade. Market rumors suggested that hours before Trump announced 100 percent China tariffs, a 2011 Bitcoin whale opened billion-dollar shorts on BTC and ETH, earning around 200 million dollars as markets plunged.

Sophisticated Knowledge Required: Exploiting this vulnerability required understanding Binance's internal pricing mechanisms, margin calculation formulas, and the specific weaknesses of using yield-bearing assets as collateral during volatility - knowledge suggesting insider information or sophisticated market surveillance.

The Case for Systemic Failure

Equally compelling evidence suggests the crash resulted from structural flaws interacting with market stress rather than deliberate manipulation.

Macro Catalyst: Trump's tariff announcement provided a genuine, exogenous shock to markets. The announcement triggered a selloff of 18 billion dollars in cryptocurrency according to CNN, with effects rippling across all risk assets. This real market event could explain the initial downward pressure without requiring coordination.

Universal Exchange Stress: Binance wasn't the only exchange to experience outages and frozen transactions. Coinbase and Robinhood reported similar issues. This suggests the problem stemmed from unprecedented volume and volatility rather than targeted attack on one platform.

Predictable Failure Mode: Financial engineers have long understood that accepting volatile or illiquid assets as collateral creates pro-cyclical risk. During stress, collateral loses value precisely when it's needed most, forcing liquidations that create more stress. No coordination is required for this dynamic to spiral out of control.

Arbitrage Failures: Market makers and arbitrageurs, who normally prevent large price discrepancies between venues, faced their own liquidity and risk management constraints during the chaos. Their inability to close the gaps between Binance prices and external markets could reflect overwhelming volatility rather than deliberate manipulation.

Insufficient Infrastructure: Binance's system delays and transaction failures, while criticized by users, are consistent with inadequate infrastructure for handling extreme volume spikes. Binance stated that platform modules briefly experienced technical glitches, and certain assets had depegging issues due to sharp market fluctuations.

Hybrid Explanations

The most plausible explanation may involve elements of both theories. Natural market stress provided the initial catalyst - Trump's tariff announcement was real, Bitcoin's decline was genuine, and trading volumes genuinely spiked across all exchanges.

But sophisticated actors may have recognized that this macro event created ideal conditions for exploiting Binance's known vulnerability. By adding concentrated selling pressure on the three vulnerable collateral assets at the precise moment when the exchange's systems were already stressed, they could amplify natural market forces into a catastrophic cascade.

This hybrid model doesn't require advance knowledge of Trump's announcement or the ability to create market-wide panics from scratch. It simply requires:

- Monitoring Binance's announcements to identify the vulnerability window

- Positioning to profit from a price collapse in the three vulnerable assets

- Waiting for any significant market downturn to provide cover

- Executing concentrated selling during the chaos to overwhelm internal order books

- Allowing the recursive liquidation spiral to do the rest

Whether purely coordinated attack or opportunistic exploitation of structural weakness during natural market stress, the result was the same: Binance's infrastructure failed catastrophically, and traders paid the price.

Regulatory and Industry Implications

Crypto.com CEO Kris Marszalek called for regulators to investigate exchanges with high liquidation volumes, noting that 20 billion dollars in losses hurt many users.

The October 11 crash has renewed calls for enhanced regulatory oversight of cryptocurrency exchanges, particularly regarding:

- Collateral requirements: Should exchanges face restrictions on accepting volatile or illiquid assets as margin collateral?

- Pricing methodology: Should regulators mandate the use of external oracles or composite price feeds rather than internal order books?

- Transparency requirements: Should exchanges disclose known vulnerabilities more carefully, or implement fixes before public announcement?

- Insurance funds: Are current exchange insurance funds adequate to cover losses from extreme events?

- System resilience: Should exchanges face uptime and performance requirements during high-volume periods?

These questions will likely shape the evolution of cryptocurrency regulation in the coming years, as policymakers seek to prevent future incidents while preserving the innovation that makes crypto markets distinctive.

Market-Wide Impact and Contagion

While the most severe damage concentrated on Binance, the October 11 crash sent shockwaves through the entire cryptocurrency ecosystem, raising questions about market structure and interconnectedness.

The Scope of Losses

The crash resulted in 19 billion dollars liquidated on the crypto market in 24 hours, with more than 1.6 million traders liquidated. CoinGlass data showed that 7 billion dollars was flushed in a single hour during the peak of the crisis.

Bitcoin, having reached an all-time high of 125,000 dollars earlier in the week, fell to around 105,000 dollars before partially recovering to trade in the 110,000 to 115,000 dollar range. Ethereum fell 12.15 percent, Binance Coin dropped 9.87 percent, and XRP plunged 13.17 percent.

Altcoins bore the brunt of the selloff. Altcoins tumbled between 30 percent and 80 percent as liquidations mounted. Some tokens experienced flash crashes to near-zero values before rebounding.

Contagion or Containment?

Despite the severity of losses, the crisis displayed both concerning contagion effects and surprising resilience in certain areas.

A recent market meltdown exposed vulnerabilities in centralized price oracles, such as Chainlink and Pyth, which feed dollar prices to exchanges, DEXs, and DeFi apps. While longs were liquidated and shorts hit liquidity boundaries, blockchains themselves remained stable, handling DeFi trades and swaps flawlessly.

This divergence reveals an important characteristic of the October 11 crash: it was primarily an exchange-level crisis rather than a protocol-level failure. Ethereum continued processing transactions normally. Solana's validators kept producing blocks. DeFi protocols on multiple chains functioned as designed.

The crisis remained largely confined to centralized exchanges, with Binance bearing the most extreme impact due to its specific infrastructure vulnerabilities. This containment suggests that cryptocurrency markets have developed some resilience against systemic collapse, even as individual platforms remain vulnerable.

Impact on DeFi and Stablecoins

As liquidations mounted, many users of centralized crypto exchanges reported failed orders, with some traders unable to close positions before blowups. This experience drove renewed interest in decentralized alternatives.

In the wake of the chaos, Binance acknowledged disruptions and said it would compensate losses directly caused by system failures. The promise of compensation may partially mollify affected users, but the crisis has intensified the long-standing debate over custody, counterparty risk, and the trade-offs between centralized and decentralized trading venues.

For stablecoins, the crash provided a mixed stress test. Traditional fiat-backed stablecoins like USDT and USDC maintained their pegs throughout the crisis, demonstrating the value of simple, well-collateralized designs during extreme volatility. BUSD remained hard-pegged during the crisis, in contrast to the synthetic and yield-bearing alternatives that collapsed.

USDe's failure to maintain its peg on Binance, even as it held firm on other venues and in DeFi protocols, highlighted the risks of algorithmic and synthetic stablecoins during liquidity crises - but also suggested these risks may be more exchange-specific than protocol-level.

Market Sentiment and Recovery

Tom Lee, chairman of BitMine, characterized the market pullback as overdue after a 36 percent gain since April, calling the sell-off a healthy shakeout and suggesting short-term returns could turn positive soon.

Some analysts suggested that while retail fear dominated, institutions were quietly accumulating, mirroring the pattern seen after the March 2020 COVID crash, which later sparked one of the biggest altcoin seasons in history.

By October 12-13, markets had partially stabilized. Bitcoin recovered from its lows, trading back above 112,000 dollars. Many altcoins retraced a portion of their losses. Trading volumes remained elevated but orderly, suggesting the panic phase had passed.

However, the longer-term impacts on market structure and investor confidence remain uncertain. The crash served as a harsh reminder of the risks inherent in leveraged cryptocurrency trading and the potential for infrastructure failures during stress.

Expert Commentary and Regulatory Implications

The October 11 crash has prompted widespread analysis from industry observers, raising fundamental questions about exchange design, risk management, and the role of regulation in cryptocurrency markets.

Risk Management Failures

Analysts pointed to a clear failure in how margin collateral and liquidation pricing were structured, flaws that made the system easy to exploit.

The choice of margin collateral and the design of liquidation pricing became key points tested by this market event, with experts noting that financial product innovation requires greater prudence, and exchanges still have much to improve in their risk management systems.

The crisis exposed several specific risk management failures:

- Collateral Acceptance Standards: Binance's decision to accept proof-of-stake derivatives and yield-bearing stablecoins as margin collateral without accounting for their liquidity characteristics during stress created unnecessary systemic risk.

- Pricing Methodology: Relying on internal order book prices for assets with limited liquidity created a closed loop vulnerable to manipulation or simply inadequate for calculating true market value during volatility.

- Vulnerability Disclosure: Publicly announcing a known security issue eight days before implementing the fix created a window of exploitation that sophisticated actors could monitor and potentially weaponize.

- Insurance Fund Adequacy: While Binance deployed 188 million dollars from its insurance fund during the crisis, estimated losses ranged between 500 million and 1 billion dollars, raising questions about whether current insurance mechanisms provide adequate protection.

Calls for Enhanced Oversight

The magnitude of losses and the nature of the crash have intensified calls for regulatory intervention in cryptocurrency exchange operations.

Crypto.com CEO Kris Marszalek called for regulators to investigate exchanges with high liquidation volumes, noting that 20 billion dollars in losses hurt many users.

Specific regulatory proposals emerging from industry discussions include:

- Standardized Risk Disclosures: Requirements for exchanges to clearly disclose how they calculate liquidation prices, what assets are accepted as collateral, and the specific risks of using illiquid assets in margin systems.

- External Oracle Requirements: Mandating that exchanges use external, manipulation-resistant price feeds for liquidation calculations rather than relying solely on internal order books.

- Collateral Concentration Limits: Restricting the percentage of margin collateral that can consist of illiquid or volatile assets to prevent cascading liquidations.

- Stress Testing and Scenario Analysis: Requiring exchanges to conduct and publish regular stress tests showing how their systems would perform during extreme market events.

- Real-Time Monitoring and Alerts: Enhanced surveillance systems to detect unusual trading patterns that might indicate manipulation or coordinated attacks.

The Precedent of Traditional Finance

Regulators examining the October 11 crash have relevant precedents from traditional financial crises to draw upon.

The 2008 financial crisis revealed similar dynamics around collateral valuation during stress. Mortgage-backed securities that had traded at par suddenly became illiquid, forcing fire sales that created spiral effects throughout the banking system. Regulatory responses included enhanced collateral haircuts, stress testing requirements, and restrictions on accepting complex securities as margin.

The 2010 Flash Crash demonstrated how automated trading systems can amplify volatility during periods of stress. Subsequent regulations introduced circuit breakers, revised market maker obligations, and enhanced monitoring to prevent similar incidents.

The lessons from traditional finance suggest that cryptocurrency exchanges may face increasing regulatory requirements around risk management, transparency, and system resilience - particularly for platforms offering leveraged trading and accepting complex assets as collateral.

Industry Self-Regulation vs. Government Oversight

The cryptocurrency industry faces a choice between proactive self-regulation and reactive government intervention.

Some exchanges have already announced enhancements following the October 11 crash. Binance implemented its planned oracle updates and compensation program. Other platforms have reviewed their own collateral policies and risk management frameworks.

However, voluntary industry improvements may not satisfy regulators or protect users adequately. The concentration of risk in large centralized exchanges, combined with the potential for cascading failures across markets, suggests that comprehensive regulatory frameworks may be inevitable.

The key question is whether regulatory intervention can preserve innovation while preventing catastrophic failures. Overly restrictive rules could drive trading activity to unregulated offshore venues or entirely decentralized platforms, potentially increasing rather than decreasing systemic risk. Finding the right balance between safety and innovation will challenge policymakers in the years ahead.

Comparative Lessons from Past Crises

The October 11, 2025 crash joins a growing list of catastrophic events in cryptocurrency history, each offering lessons about the interaction between innovation, risk, and system design.

The Luna-UST Collapse (May 2022)

The question of whether USDe is truly backed one-to-one remains hanging. The Luna-UST collapse proved how bad things can get when pegs fail. Back then, Binance lost money defending UST near 70 cents.

The Terra Luna ecosystem's implosion in May 2022 provides the most direct parallel to Binance's October 11 crisis. Terra's algorithmic stablecoin UST maintained its dollar peg through a mechanism involving minting and burning the LUNA token. When confidence wavered and selling pressure intensified, the system entered a death spiral: UST lost its peg, triggering LUNA issuance to restore it, flooding the market with new LUNA tokens, destroying LUNA's value, further undermining confidence in UST, and accelerating the collapse.

The parallel to October 11 lies in the feedback loops. In Terra, loss of peg triggered issuance, which accelerated the collapse. On Binance, collateral devaluation triggered liquidations, which caused more selling, which devalued collateral further, creating a similar spiral.

Both crises revealed the danger of closed-loop systems where the mechanism designed to restore stability can amplify instability under stress. Terra's fix - burning LUNA to restore UST - created more problems than it solved. Binance's system - liquidating collateral to protect margin requirements - similarly intensified the very crisis it was designed to prevent.

The key difference: Terra's collapse stemmed from fundamental protocol design flaws. The system was mathematically destined to fail under sufficient stress. Binance's crisis reflected infrastructure and operational shortcomings rather than unavoidable protocol failures. Better pricing mechanisms, adequate liquidity, and proper risk management could have prevented or mitigated the cascade.

Mango Markets Oracle Manipulation (October 2022)

In October 2022, a trader exploited Mango Markets, a Solana-based decentralized exchange, by manipulating the oracle price for its native MNGO token. The attacker built large positions, used those positions to manipulate the token's price upward through thin order books, borrowed against the artificially inflated collateral value, and withdrew more than 100 million dollars before the protocol could respond.

The Mango attack demonstrates how oracle manipulation can create leverage out of thin air. By controlling the price feed used for collateral valuation, the attacker made worthless positions appear valuable enough to support massive loans.

The October 11 Binance crash, whether coordinated or not, involved similar dynamics. Binance's reliance on internal order book prices for collateral valuation created a closed system where concentrated selling could drive artificial price movements disconnected from external market reality. The primary difference: Mango involved deliberately manipulating prices upward to borrow more, while the alleged Binance attack manipulated prices downward to trigger liquidations.

Both incidents highlight the critical importance of using robust, manipulation-resistant price oracles for any system involving collateralized lending or margin trading.

FTX Collapse (November 2022)

The FTX exchange's spectacular failure in November 2022 revealed how concentrated risk and inadequate separation of customer funds from exchange operations could lead to catastrophic losses.

While FTX's collapse stemmed primarily from fraud and misappropriation of customer funds, it shares with the October 11 Binance crash a common thread: concentrated risk in large centralized platforms creates systemic vulnerabilities that can cascade through markets when confidence breaks.

FTX demonstrated that even well-regarded, heavily-used platforms can harbor critical weaknesses invisible to users until crisis strikes. The parallels to Binance are imperfect - there's no evidence of fraud or misappropriation in the October 11 event - but both cases reveal how dependent cryptocurrency markets remain on the operational integrity of centralized intermediaries.

Cream Finance Repeated Exploits (2021)

Cream Finance, a DeFi lending protocol, suffered multiple exploits in 2021 that collectively drained more than 130 million dollars. Most involved flash loan attacks combined with oracle manipulation or reentrancy vulnerabilities.

The relevance to October 11 lies in the recurring theme: complex financial systems built on fragile foundations become vulnerable to sophisticated exploitation. Cream's fundamental protocol design wasn't necessarily flawed, but the implementation details - how prices were calculated, which assets were accepted as collateral, and how quickly the system could respond to anomalies - created opportunities for attackers.

Binance's October 11 crisis similarly reflects the gap between design intent and implementation reality. In theory, accepting yield-bearing assets as collateral makes sense if properly risk-adjusted. In practice, the details of pricing methodology, liquidity requirements, and stress scenario planning determined whether the system could withstand volatility.

The Recurring Pattern: Innovation Outpacing Risk Management

These historical crises share a common pattern: financial innovation in cryptocurrency markets consistently outpaces the development of robust risk management frameworks.

Terra pioneered algorithmic stablecoins without fully stress-testing the death spiral scenario. Mango built a sophisticated derivatives platform without adequately securing its price oracles. FTX scaled to become the second-largest exchange without implementing proper controls on fund movements. Cream pushed the boundaries of DeFi lending without anticipating complex attack vectors.

And Binance, seeking to offer maximum capital efficiency through unified margin across diverse assets, created a system where collateral valuation could become disconnected from market reality during stress.

The lesson isn't that innovation should cease. Liquid staking derivatives, synthetic stablecoins, and cross-margin systems all offer genuine benefits when properly implemented. The lesson is that each innovation creates new failure modes that must be anticipated, tested, and guarded against before they cause catastrophic losses.

Key Terms Explained

Understanding the October 11 crash requires familiarity with several technical concepts that define modern cryptocurrency trading. Here are concise explanations of the key terms central to this event.

Proof-of-Stake Derivatives: These are tokenized representations of cryptocurrency staked in proof-of-stake blockchains. When users stake assets like Ethereum or Solana, they lock those tokens to help secure the network and earn rewards. Proof-of-stake derivatives like wBETH and BnSOL make this staked value liquid and tradable, allowing stakers to use their assets while still earning rewards. The derivatives' value typically equals the underlying staked asset plus accumulated rewards.

Yield-Bearing Stablecoins: Unlike traditional stablecoins backed by dollars in bank accounts, yield-bearing stablecoins like Ethena's USDe generate returns for holders. USDe maintains its dollar peg through delta-neutral hedging - holding crypto collateral while simultaneously shorting that same crypto in derivatives markets, neutralizing price volatility. The yield comes from staking rewards on the collateral and funding rates from the derivatives positions. These stablecoins offer advantages over non-yielding alternatives but introduce additional complexity and risk.

Margin Collateral: This refers to assets deposited to secure leveraged trading positions. When traders borrow funds to amplify their positions, they must post collateral that the exchange can liquidate if the trade moves against them. Margin collateral acts as a buffer protecting lenders from borrower defaults. The type of assets accepted as collateral and how those assets are valued critically affects system stability during volatility.

Liquidation: When a leveraged position loses too much value, the exchange automatically closes it by selling the collateral to repay the borrowed funds. This process, called liquidation, prevents borrowers from owing more than their collateral is worth. Liquidations occur automatically when predetermined thresholds are breached. During the October 11 crash, cascading liquidations created a feedback loop where forced selling drove prices lower, triggering more liquidations.

Oracles: In cryptocurrency systems, oracles provide external data to smart contracts and trading systems. Price oracles specifically supply information about asset values from various sources. Oracle design proves critical because systems rely on these feeds to calculate collateral values, trigger liquidations, and execute automated strategies. Poorly designed oracles can be manipulated or may fail to reflect true market conditions, as occurred with Binance's reliance on internal order books.

Recursive Borrowing: This strategy involves depositing collateral, borrowing against it, using borrowed funds to acquire more collateral, depositing that additional collateral, and repeating the cycle. Recursive borrowing creates highly leveraged exposure with relatively little initial capital but amplifies both gains and losses. During crashes, recursive positions face compounding liquidations as each layer of borrowed collateral loses value.

Hard Pegs vs. Soft Pegs: A hard peg means an asset maintains a fixed exchange rate through direct redemption mechanisms or regulatory guarantees. For example, BUSD maintained a hard peg because it could be redeemed one-to-one for dollars. A soft peg uses market mechanisms, arbitrage, or algorithmic adjustments to maintain approximate value. USDe uses a soft peg through delta-neutral hedging. During extreme stress, soft pegs can break while hard pegs generally hold - as occurred on October 11 when BUSD remained stable while USDe depegged on Binance.

Unified Margin: Also called portfolio margin or cross-margin, unified margin allows traders to use their entire portfolio as collateral for positions across multiple markets and products. Rather than siloing margin requirements for each position, unified margin calculates risk holistically, enabling greater capital efficiency. The October 11 crash exposed how this efficiency comes at the cost of interconnected risk - problems in one part of the portfolio can trigger liquidations across all positions.

Delta-Neutral Hedging: This strategy maintains exposure to non-price factors like yield or funding rates while eliminating exposure to price movements. For example, USDe achieves delta neutrality by holding long ETH exposure through staked collateral while simultaneously holding equal short ETH exposure through derivatives. If ETH rises or falls, gains in one position offset losses in the other. This approach works well during normal market conditions but can fail if hedge ratios slip or if one leg of the position becomes illiquid.

These technical concepts, while offering genuine innovation and efficiency gains, create complex systems where failures can cascade in unpredictable ways. The October 11 crash demonstrated how even well-intentioned financial engineering can produce catastrophic outcomes when implementation details prove inadequate for extreme stress scenarios.

Aftermath and Open Questions

As the cryptocurrency industry processes the October 11 crash, numerous critical questions remain unanswered, and the full scope of consequences continues to unfold.

The Compensation Question

Binance announced it would review and compensate losses directly caused by its system failures, with co-founder Yi He stating that the exchange would review accounts individually, analyze situations, and provide compensation accordingly.

Binance stated that payouts would equal the difference between the market price at midnight on October 11 and each user's liquidation price, with distribution planned within 72 hours.

However, significant ambiguities remain regarding compensation:

- Scope: Will Binance compensate all users who suffered losses during the crash, or only those who can demonstrate that specific system failures directly caused their losses? How will the exchange distinguish between losses caused by market volatility versus infrastructure failures?

- Methodology: How will Binance calculate the "true" market price for assets like wBETH and USDe when their prices diverged dramatically between Binance and other venues? Using external prices could increase compensation costs substantially; using Binance's distorted internal prices would shortchange affected users.

- Coverage Amount: With estimated losses ranging from 500 million to 1 billion dollars, can Binance's insurance fund and balance sheet absorb the full cost? What happens if total claims exceed available funds?

- Timing: As of mid-October 2025, many users report delays in receiving compensation and uncertainty about claim status. The 72-hour timeline has elapsed, yet questions persist about when and how much users will ultimately receive.

System Changes and Risk Management Reforms

Binance announced it has shifted to using conversion-ratio pricing for wrapped assets and added redemption prices to index calculations for all three affected tokens.

The exchange implemented three specific fixes: adding redemption prices to index calculations, setting a minimum price threshold for USDe, and increasing the frequency of risk control reviews.

These changes address the immediate technical vulnerability but raise larger questions:

- Collateral Policy: Has Binance revised its standards for which assets qualify as margin collateral? Will proof-of-stake derivatives and yield-bearing stablecoins face higher haircuts or lower maximum loan-to-value ratios?

- Liquidity Requirements: Will the exchange implement minimum liquidity thresholds for assets accepted as collateral, ensuring sufficient depth in order books to handle stress scenarios?

- Circuit Breakers: Does Binance plan to implement automatic trading halts or volatility controls that would pause liquidations during extreme price dislocations?

- Third-Party Audits: Will independent risk management firms review Binance's updated systems to verify they can withstand future stress?

The Investigation Question

Perhaps the most consequential unanswered question: will there be a formal investigation into whether the October 11 crash involved market manipulation or coordinated attack?

Crypto.com CEO Kris Marszalek called for regulators to investigate exchanges with high liquidation volumes.

Several potential investigative avenues exist:

- On-Chain Forensics: Blockchain analysis firms could trace transaction patterns to determine whether concentrated selling came from coordinated wallets or exhibited patterns suggesting deliberate manipulation.

- Exchange Data Analysis: Regulators with subpoena power could examine Binance's internal transaction data to identify accounts that established positions before the crash and profited from it.

- Communication Surveillance: If coordination occurred, perpetrators may have communicated via encrypted messaging or social media, leaving digital footprints that investigators could uncover.

- Timing Analysis: Detailed reconstruction of the timeline could reveal whether sell orders arrived in patterns consistent with algorithmic execution, human coordination, or simply panicked market response.

As of mid-October 2025, no formal investigation has been announced by major regulators. Whether U.S. authorities, given Binance's complicated regulatory history, will pursue inquiries remains uncertain. The exchange's offshore status and lack of headquarters complicate jurisdiction questions.

Broader Market Structure Questions

The October 11 crash has catalyzed renewed debate about fundamental cryptocurrency market structure issues:

Centralization vs. Decentralization: Does the crisis demonstrate that cryptocurrency markets remain dangerously dependent on centralized exchanges despite the theoretical availability of decentralized alternatives? Should policy encourage migration to decentralized trading venues, or do centralized platforms offer advantages that justify their continued dominance?

Oracle Standardization: Should the industry develop standardized oracle networks that all exchanges must use for liquidation calculations, similar to how traditional finance relies on established reference rates for LIBOR or SOFR?

Insurance Mechanisms: Are current exchange-level insurance funds adequate, or should the industry create cross-exchange insurance pools or mandatory insurance requirements similar to FDIC coverage in traditional banking?

Leverage Limits: Should cryptocurrency exchanges face regulatory restrictions on maximum leverage ratios, particularly for retail traders, similar to leverage limits in foreign exchange and equity markets?

Real-Time Risk Disclosure: Should exchanges provide real-time public dashboards showing their insurance fund balances, liquidation volumes, and system health metrics to enable users to assess counterparty risk?

Lessons for Market Participants

For traders and investors processing the October 11 crash, several practical lessons emerge:

Collateral Type Matters: Not all collateral is equal during stress. Yield-bearing assets and derivatives that seem stable during normal conditions can experience extreme volatility when liquidity evaporates.

Exchange-Specific Risk: Prices for the same asset can diverge dramatically between exchanges during extreme conditions. Holding positions on multiple venues or understanding venue-specific risks becomes critical.

Leverage Amplifies Failure Modes: Highly leveraged positions face not just market risk but also execution risk, oracle risk, and counterparty risk. Each additional layer of leverage creates new failure points.

System Resilience Varies: The October 11 crash demonstrated that decentralized protocols and blockchains themselves performed reliably while centralized exchange infrastructure failed. This suggests value in diversifying not just across assets but across types of platforms and custody arrangements.

Timing Matters for Security Updates: Public announcements of known vulnerabilities with scheduled fix dates create windows of exploitation. Traders should monitor platform announcements and understand when systems may be particularly vulnerable.

Closing Thoughts: The Price of Innovation

The October 11, 2025 cryptocurrency crash will likely be remembered as a watershed moment - not because of the dollar amounts lost, though those were substantial, but because of what the event revealed about the maturity and fragility of cryptocurrency market infrastructure.

The crash exposed a fundamental tension at the heart of cryptocurrency innovation. The same tools that make markets more efficient - unified margin, liquid staking derivatives, yield-bearing stablecoins - create complex systems where failures can cascade in unexpected ways. Capital efficiency and interconnectedness prove to be two sides of the same coin.

An investor compared the crash to Luna's implosion, noting that the danger comes from exchanges using non-fiat stablecoins as high-value collateral, letting risk spread everywhere. The warning highlighted that mixing market-based pricing with high collateral ratios is the most dangerous setup, especially when centralized exchanges have poor arbitrage mechanisms.

Whether October 11 represents a coordinated attack exploiting known vulnerabilities or simply a catastrophic failure of risk management under natural market stress, the result demonstrates that cryptocurrency markets remain in crucial ways immature and vulnerable despite massive growth in adoption and trading volumes.

The resolution of the attack-versus-failure-mode debate matters less than the systemic lessons the crisis teaches. Either scenario - deliberate exploitation or structural collapse - reveals that accepting illiquid, volatile assets as margin collateral without adequate pricing safeguards creates unacceptable risk. Either scenario shows that relying on internal order books for liquidation calculations in thin markets invites disaster. Either scenario proves that financial innovation must be matched by robust risk management infrastructure.

For the cryptocurrency industry, October 11 offers a choice. The crash can serve as a wake-up call driving substantive improvements in exchange design, risk management, and regulatory frameworks. Exchanges can implement stronger collateral standards, more robust oracle systems, and better stress-testing processes. Regulators can develop sensible oversight that enhances safety without stifling innovation. Traders can demand greater transparency and migrate to platforms that prioritize infrastructure resilience over maximum leverage.

Or the industry can treat October 11 as an isolated incident, implement narrow technical fixes to the specific vulnerabilities exploited, and continue on largely unchanged until the next crisis reveals the next set of systemic weaknesses.

Traditional financial markets have weathered centuries of crises, each teaching hard lessons about risk, leverage, and system design. Cryptocurrency markets, barely fifteen years old, are accelerating through this learning process at remarkable speed. The October 11 crash joins a growing list of expensive lessons in what can go wrong when innovation outpaces risk management.

The critical question is whether the industry will learn from this experience or merely move on to the next innovation, carrying forward the same structural vulnerabilities that made October 11 possible.

As cryptocurrency markets mature and integrate more deeply with traditional finance, the stakes of getting risk management right grow higher. The hundreds of millions or billions lost on October 11 represent tragedy for affected traders but remain relatively contained compared to what could occur if similar vulnerabilities exist at even larger scale during the next major market stress.

The path forward requires balancing competing imperatives: preserving the innovation and efficiency that make cryptocurrency markets valuable while building the robust infrastructure and risk management frameworks necessary to prevent catastrophic failures. Finding that balance will determine whether cryptocurrency markets evolve into resilient, trustworthy components of the global financial system or remain speculative venues prone to periodic crises that erode public confidence and invite heavy-handed regulation.

October 11, 2025, offered the cryptocurrency industry another chance to learn these lessons. Whether that opportunity will be seized or squandered remains to be seen.