Professional crypto market-making now represents a sophisticated ecosystem where firms deploy advanced algorithms, massive capital, and cutting-edge technology to provide liquidity across fragmented markets.

Market makers now control price discovery mechanisms that affect billions of dollars in daily trading volume, yet their operations remain largely opaque to retail traders and even institutional participants. This system creates both essential market efficiency and concentrated points of failure that can trigger catastrophic liquidations.

The liquidity landscape spans centralized exchanges where traditional market-making firms like GSR and Cumberland deploy algorithmic strategies, and decentralized protocols where automated market makers enable permissionless trading through mathematical formulas rather than order matching. These two worlds increasingly intersect through cross-venue arbitrage, creating a complex web of dependencies that can amplify both stability and instability across crypto markets.

Recent events demonstrate both the critical importance and fragility of this system. The FTX collapse eliminated a dominant market maker, creating the "Alameda Gap" that reduced liquidity across venues. Meanwhile, innovations like Uniswap V4's concentrated liquidity and hook system promise up to 4000x capital efficiency improvements while introducing new forms of extractable value. Understanding how these mechanisms actually work - and where they break down - has become essential for anyone trading, building, or regulating crypto markets.

Liquidity fundamentals: order books versus automated market makers

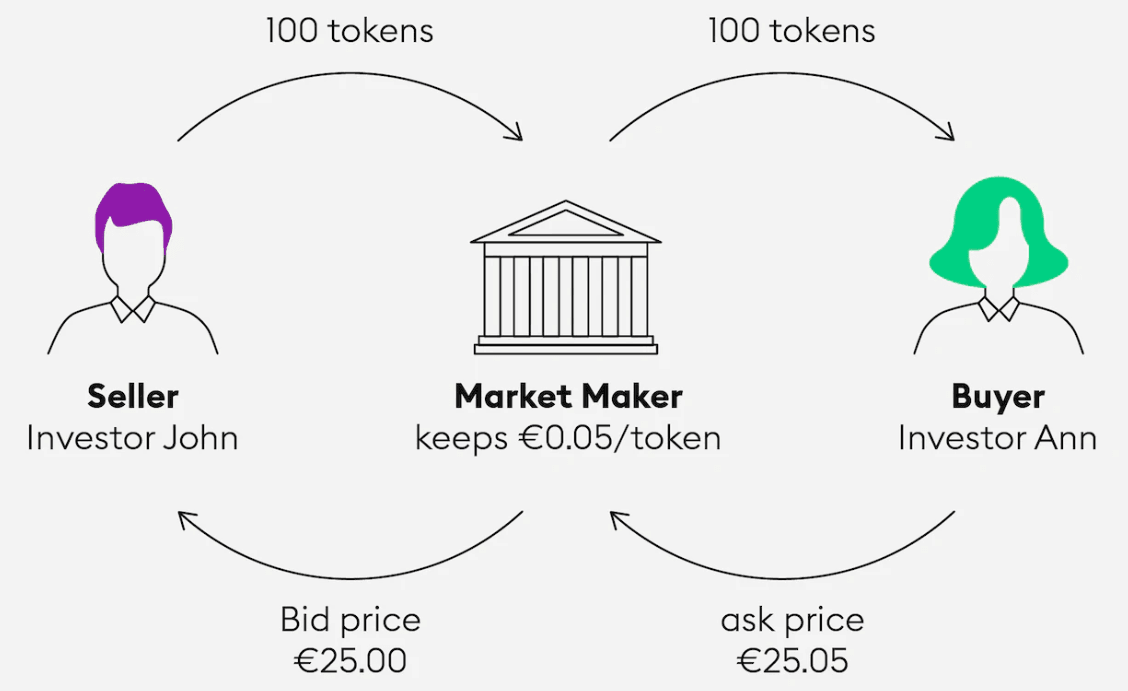

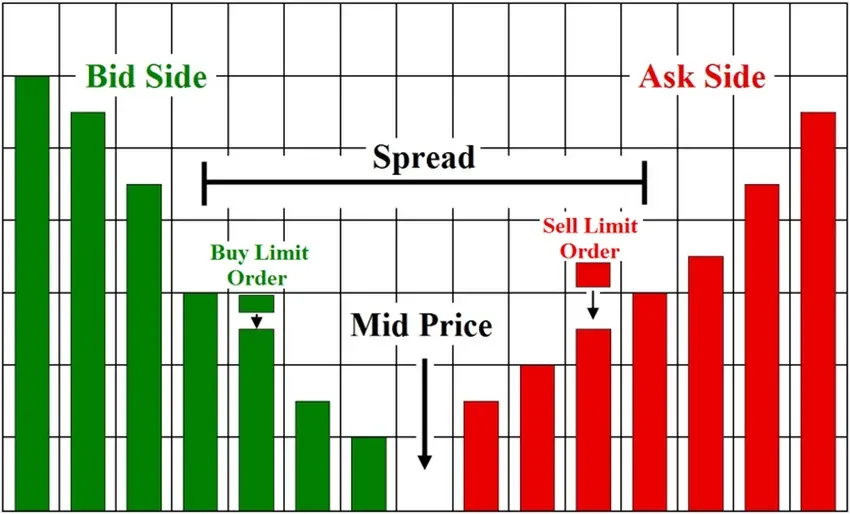

Traditional centralized exchanges operate through order books where market participants submit buy and sell orders at specific prices, creating a continuous auction mechanism. The bid-ask spread represents the difference between the highest buy order (bid) and lowest sell order (ask), while market depth measures the volume of orders at various price levels away from the current market price.

Market depth calculations reveal critical vulnerabilities in crypto markets. For example, Bitcoin's 2% market depth ranges between $50-100 million across major exchanges as of September 2025, meaning orders exceeding this threshold can trigger significant price movements. When OKB suffered a 50% flash crash in January 2024, analysis revealed the exchange token had only $184,000-$224,000 in 2% market depth, demonstrating how thin liquidity can amplify volatility.

Professional market makers provide liquidity by continuously quoting two-sided markets - offering to buy slightly below and sell slightly above the current market price. They profit from the bid-ask spread while taking on inventory risk as prices move against their positions. This model requires sophisticated risk management systems, real-time hedging mechanisms, and substantial capital buffers to absorb temporary losses during volatile periods.

The maker-taker fee model incentivizes liquidity provision by rebating fees to market makers (typically -0.005% to -0.010%) while charging higher fees to takers who consume liquidity (0.01% to 0.60%). This structure aligns exchange interests with deeper, tighter markets while generating revenue from active traders. Leading exchanges like Binance offer progressive rebate structures where the largest market makers can achieve negative effective fees, creating powerful incentives for scale.

Automated market makers fundamentally reimagine liquidity provision. Rather than matching discrete buy and sell orders, AMMs use mathematical formulas to price assets within pooled reserves. The constant product formula (x × y = k) in protocols like Uniswap ensures that as one asset is bought, its price increases along a predictable curve. Liquidity providers deposit equal values of paired assets and earn fees from all trades, but face impermanent loss when prices diverge from their initial ratio.

Concentrated liquidity mechanisms like Uniswap V3 allow liquidity providers to specify price ranges for their capital deployment rather than spreading it across the entire possible price spectrum. For stablecoin pairs like DAI/USDC, traditional AMMs utilized only 0.50% of available capital for trading between $0.99-$1.01 where most volume occurs. Concentrated liquidity enables up to 4000x capital efficiency improvements by focusing resources where trading actually happens.

The economic dynamics differ substantially between CEX market makers and DeFi liquidity providers. Market makers on centralized venues actively manage inventory, adjust quotes continuously, and can rapidly exit positions. DeFi liquidity providers deploy passive capital that earns fees automatically but requires active management to avoid losses from impermanent loss and price range movements. Research from 2025 shows nearly 49.5% of Uniswap V3 liquidity providers experienced negative returns due to impermanent loss, highlighting the challenges of passive liquidity provision.

The players: who provides liquidity in crypto markets

Professional market-making firms

GSR Markets has established itself as a leading crypto-native market maker over ten years of operation, managing significant inventory across 60+ trading venues. The firm combines proprietary trading with client services, providing liquidity for token issuers, institutional investors, miners, and exchanges. GSR won "Crypto Market Maker of the Year 2025" by The Digital Commonwealth , reflecting its dominance in an increasingly competitive landscape. The firm's revenue model spans spread capture, programmatic execution fees, and risk management services for institutional clients.

Cumberland, a subsidiary of DRW Holdings, leverages thirty years of traditional market-making expertise adapted for crypto markets. The firm's privately funded structure enables quick decision-making without outside investor constraints, crucial for navigating volatile crypto markets. Cumberland reported over $20 billion in trading volume as early as 2017 and now trades 30+ cryptocurrencies across 500 pairs. The firm obtained a New York BitLicense in 2024 and successfully defended against SEC enforcement actions in March 2025, demonstrating its regulatory compliance focus.

Jump Trading has transformed from pure market-making to infrastructure development through its Jump Crypto division launched in 2021. With an estimated $15+ billion in trading capital across all asset classes, Jump has shifted focus toward building foundational infrastructure like Pyth Network, Wormhole bridge, and Firedancer Solana validator client. However, the firm faced significant regulatory scrutiny over its Terra/LUNA involvement, paying a $123 million SEC settlement in 2024. This evolution reflects the broader industry trend toward vertical integration and protocol ownership.

Jane Street represents the pinnacle of quantitative trading sophistication, with ~$15 billion in trading capital and $50 billion in daily securities holdings as of 2021. The firm's functional organization structure with 30-40 senior executives rather than traditional CEO hierarchy enables rapid adaptation to new markets. Jane Street generated $10.6 billion in net trading revenue in 2023 with $7.4 billion in adjusted earnings , demonstrating the profitability of sophisticated algorithmic strategies. The firm's crypto operations include the JCX platform for 24/7 crypto trading and all software written in OCaml with a 70 million line codebase.

Technology infrastructure and operational scale

Modern crypto market-making requires substantial technology investments to compete effectively. Firms deploy real-time risk management systems capable of monitoring positions across dozens of venues simultaneously, with automatic circuit breakers for extreme market conditions. Order management systems must process 5+ million operations per second with sub-microsecond latency , necessitating specialized hardware and network infrastructure.

Smart order routing algorithms continuously analyze liquidity across multiple venues, automatically splitting large orders to minimize market impact while optimizing execution prices. These systems must account for different fee structures, order types, and latency characteristics across exchanges while maintaining real-time risk controls. Leading firms maintain direct market access connections and co-location services at major exchanges to minimize execution delays.

The scale of professional operations dwarfs typical institutional trading. Top market-making firms deploy hundreds of millions in inventory capital across 60+ exchanges, managing thousands of trading pairs simultaneously. Their algorithms continuously adjust quotes based on inventory levels, market volatility, order flow toxicity, and cross-venue arbitrage opportunities. This automation enables 24/7 operation across global markets with minimal human intervention.

Risk management systems employ dynamic position limits, real-time VaR calculations, and automated hedging mechanisms. For major cryptocurrencies like Bitcoin and Ethereum, firms hedge inventory directly through perpetual futures and options. For altcoins, they implement proxy hedging using correlated assets or index baskets. Portfolio-level hedging uses cross-asset correlation matrices to manage exposure across entire trading books.

Fee structures and incentive alignment

Exchange fee structures significantly influence market-making economics and behavior. Binance's spot market maker program requires 30-day volume exceeding 1,000 BTC or proven market-making strategies, offering maker fee rebates up to -0.005% with higher API limits. Participants receive composite scores based on maker volume, spread quality, and depth provision, with geographic variations between Binance.com and Binance.US.

Coinbase Advanced Trade implements volume-based fee tiers with maker fees ranging from 0.00%-0.60% and taker fees from 0.05%-0.70%. The exchange's Request for Quote (RFQ) system enables institutional-sized orders with customized pricing, while the Enhanced Execution Engine (EXN) optimizes price discovery through sophisticated matching algorithms. Recent 2025 updates added 237 new USDC trading pairs with free trading on 22 stable pairs.

Kraken Pro launched maker fee rebate programs in June 2025, targeting lower-liquidity pairs to improve market efficiency. The program offers rebates up to negative fees for participants with over $10 million monthly volume across 64+ pairs as of August 2025. Monthly eligibility reviews ensure consistent performance standards while expanding coverage to all new listings demonstrates the exchange's commitment to liquidity incentives.

These incentive structures create powerful network effects where the largest market makers enjoy increasingly favorable economics, enabling them to quote tighter spreads and capture more volume. This dynamic contributes to market concentration while improving overall market efficiency through better pricing and deeper order books.

Inventory management and risk control

Professional market makers face constant tension between providing competitive liquidity and managing inventory risk across volatile crypto markets. Dynamic position management systems continuously adjust inventory levels based on price volatility, market trends, cross-exchange arbitrage opportunities, hedging requirements, and client flow patterns. When holding net long positions, algorithms automatically narrow ask spreads while widening bid spreads to encourage inventory reduction. Conversely, net short inventory triggers tighter bid spreads and wider asks.

Real-time monitoring systems implement position limits across venues and asset classes, with dynamic Value-at-Risk calculations incorporating stress testing scenarios. Automated circuit breakers halt trading during extreme market conditions, preventing catastrophic losses during events like the March 2020 crash or May 2021 liquidation cascade. Cross-venue exposure tracking prevents concentration risk while enabling sophisticated hedging strategies across multiple platforms.

Hedging mechanisms vary significantly by asset class and market structure. For Bitcoin and Ethereum, firms hedge inventory directly through perpetual futures contracts, options, and cross-venue arbitrage. Altcoin hedging proves more challenging, requiring proxy hedging through correlated assets or index baskets. Portfolio-wide risk management employs cross-asset correlation matrices, with algorithms automatically executing hedges when inventory thresholds are breached.

The sophistication of risk controls reflects hard-learned lessons from market disruptions. The FTX collapse demonstrated how interconnected positions across venues can amplify losses, while events like the UST/LUNA collapse showed how correlated altcoin hedges can fail simultaneously. Modern risk systems account for these tail risks through stress testing, correlation monitoring, and diversified hedging approaches.

Inventory skewing strategies reveal how market makers influence price discovery through subtle quote adjustments. Rather than maintaining symmetric spreads, algorithms continuously adjust bid-ask quotes based on desired inventory exposure. However, excessive skewing signals inventory positions to sophisticated competitors, creating a constant game of information asymmetry and strategic positioning.

Pricing and spread-setting mechanics

Spread optimization represents the core profit center for market-making operations, requiring continuous calculation of base spreads from estimated volatility, inventory risk, and adverse selection costs. Machine learning models incorporate microstructure data to predict optimal spread widths, with real-time adjustments based on order flow toxicity, market volatility, and time-to-close dynamics. These algorithms must balance competitive pricing with profitable operations across hundreds of trading pairs simultaneously.

Dynamic spread adjustment mechanisms account for changing market conditions throughout trading sessions. During high volatility periods, spreads widen automatically to compensate for increased inventory risk and adverse selection. Conversely, stable market conditions enable tighter spreads that capture more volume while maintaining acceptable risk-adjusted returns. The challenge lies in detecting regime changes quickly enough to adjust pricing before competitors.

Depth provision strategies employ layered quoting with multiple price levels and decreasing sizes to create the illusion of substantial market depth. Iceberg orders hide large positions by displaying only small visible portions while refreshing logic continuously cancels and replaces orders to maintain competitive quotes. These techniques require sophisticated order management systems capable of handling millions of order updates per second.

Technical implementation relies on optimized data structures including red-black trees for price level indexing with O(log n) performance characteristics and hash tables enabling O(1) order ID lookups. Leading firms benchmark their systems at 5+ million operations per second with sub-microsecond latency requirements, necessitating custom hardware and network optimization.

The microstructure of spread setting reveals how market makers extract value from information asymmetries and order flow patterns. Adverse selection occurs when informed traders consistently trade against market maker quotes, forcing wider spreads to compensate for systematic losses to better-informed participants. Algorithms continuously monitor order flow characteristics to identify potentially toxic flow and adjust pricing accordingly.

Smart order routing systems aggregate liquidity from multiple venues while optimizing for total execution costs rather than simple price matching. These systems account for different fee structures, rebate programs, and latency characteristics across exchanges, automatically routing orders to minimize total transaction costs. Advanced implementations predict short-term price movements to optimize timing and venue selection for large orders.

Arbitrage flows and cross-venue dynamics

Cross-venue arbitrage serves as the primary mechanism linking pricing across the fragmented crypto ecosystem, with professional arbitrageurs capturing price discrepancies while providing essential price discovery services. Latency arbitrage exploits temporary price differences across global exchanges, typically ranging from 0.1-2% during high volatility periods in 2025. These opportunities require co-location services, microsecond execution capabilities, and predictive algorithms to consistently capture profits before price convergence.

Statistical arbitrage strategies identify mean-reverting relationships between correlated cryptocurrency pairs, executing automated trades when prices diverge beyond statistical bounds. Cross-asset arbitrage examines basis relationships between spot prices and futures contracts, while triangle arbitrage exploits price inconsistencies across three currency pairs through high-frequency execution loops requiring sub-second completion times.

Dynamic delta hedging enables continuous portfolio risk management through automatic hedge ratio adjustments based on realized volatility and options Greeks calculations. Professional market makers maintain sophisticated derivatives portfolios requiring constant rebalancing as underlying prices move. Cross-venue hedge optimization minimizes transaction costs while maintaining target risk exposures across multiple trading platforms.

The interconnected nature of crypto markets means disruptions in one venue quickly propagate across the ecosystem through arbitrage mechanisms. When Binance suspended spot trading for over two hours in March 2023 due to a trailing stop-loss bug, Bitcoin initially dropped ~$700 as liquidity disappeared from the world's largest crypto exchange. Alternative venues experienced volume spikes as traders sought liquidity, while market makers faced challenges routing flow during the outage.

Portfolio-level risk management employs factor-based hedging using principal component analysis to identify systematic risk exposures across cryptocurrency sectors. Sector rotation hedging strategies account for relative performance between DeFi tokens, Layer 1 protocols, and meme coins, while macro hedge overlays provide protection against market-wide risk events like regulatory announcements or traditional market spillovers.

Cross-chain arbitrage has emerged as a significant profit center with the growth of multi-chain DeFi ecosystems. Research from 2025 shows cross-chain arbitrage activity increased 5.5x over the study period, with 66.96% of trades using pre-positioned inventory settling in 9 seconds compared to 242 seconds for bridge-based arbitrages. This speed advantage creates powerful incentives for maintaining inventory across multiple blockchains.

Decentralized finance liquidity mechanics

DeFi fundamentally restructures liquidity provision by replacing active market makers with algorithmic pricing mechanisms and passive liquidity providers. Total Value Locked (TVL) exceeded $150 billion globally by September 2025 , representing unprecedented adoption of decentralized financial infrastructure. However, this growth masks significant challenges in capital efficiency, risk management, and value extraction through MEV.

Automated market makers use mathematical formulas rather than order books to determine pricing, with the constant product formula (x × y = k) ensuring predictable price curves as assets are traded. Unlike centralized exchanges where market makers actively manage inventory and adjust quotes, AMMs rely on arbitrageurs to maintain price accuracy through profit-seeking behavior. This creates systematic arbitrage opportunities but can result in significant slippage for large trades.

Concentrated liquidity innovations like Uniswap V3 enable dramatic capital efficiency improvements by allowing liquidity providers to specify price ranges rather than providing liquidity across infinite price curves. For stablecoin pairs, concentrated strategies can achieve up to 4000x capital efficiency compared to traditional AMMs by focusing capital where trading actually occurs. However, this concentration requires active management as positions become inactive when prices move outside specified ranges.

Uniswap V4, launched in January 2025, introduces a hook system enabling modular smart contracts that customize pool behavior. Over 2,500 hook-enabled pools were created by mid-2025 , including Time-Weighted AMM (TWAMM) for time-based pricing, MEV rebate distribution systems, automated position rebalancing, and impermanent loss hedging mechanisms. The singleton architecture provides 99.99% reduction in pool deployment costs while enabling native ETH support without WETH wrapping.

Maximum Extractable Value (MEV) represents a critical challenge for DeFi liquidity provision, with over $500 million extracted on Ethereum through September 2022 and over $1 billion since the merge to proof-of-stake. September 2025 data shows $3.37 million in arbitrage profits over 30 days according to EigenPhi , with arbitrage transactions representing the majority of MEV activity due to billions in daily DEX volume. Sandwich attacks extract value by front-running large trades, creating an "invisible tax" on DeFi participants.

MEV mitigation developments include Proposer-Builder Separation (PBS) implemented by Ethereum in 2024, private mempools through Flashbots and similar solutions, and hook-based protections in Uniswap V4 enabling MEV-resistant swaps and rebate distribution. Protocol-level innovations include batch auction mechanisms, encrypted mempool solutions, and time-weighted pricing to reduce sandwich attack effectiveness.

Impermanent loss remains a persistent challenge for liquidity providers, with 49.5% of Uniswap V3 participants experiencing negative returns despite fee generation. Active management requirements for concentrated positions create ongoing costs through gas fees for range adjustments and opportunity costs when liquidity becomes inactive. Professional LPs employ sophisticated strategies including stablecoin pairs for low-risk steady returns, ETH/stablecoin pairs requiring dynamic management, and volatile pairs demanding continuous optimization.

Cross-chain bridge protocols like Symbiosis Finance (45+ blockchains), Stargate (~50 chains), and Wormhole (35-40 chains) enable liquidity to flow between different blockchain ecosystems. These bridges moved over $4 billion in volume by 2025 , with fee structures ranging from Stargate's 0.06% flat fees to variable AMM models adjusting based on liquidity availability. However, bridge security remains a concern following major exploits like Wormhole's $320 million hack.

Infrastructure and algorithmic systems

Modern crypto market-making requires sophisticated technological infrastructure combining low-latency networks, high-performance computing, and advanced algorithmic strategies. Co-location services at major exchanges provide microsecond advantages crucial for competitive market-making , with direct fiber connections and dedicated hardware enabling sub-millisecond order execution. Leading firms maintain dedicated infrastructure across global data centers to ensure 24/7 operation and optimal positioning relative to exchange matching engines.

Smart order routing represents a critical competitive advantage, continuously analyzing liquidity across multiple venues while optimizing for total execution costs rather than simple price matching. These systems must account for different fee structures, maker-taker rebates, and latency characteristics across exchanges while maintaining real-time risk controls and position monitoring. Advanced implementations utilize machine learning to predict short-term price movements and optimize order timing and venue selection for large executions.

Order management systems require specialized data structures and algorithms capable of processing millions of operations per second. Red-black trees provide O(log n) performance for price level indexing while hash tables enable O(1) order ID lookups. Memory management and CPU optimization become crucial at scale, with custom hardware and FPGA implementations providing additional performance advantages for the most competitive strategies.

Risk engines operate continuously across all positions and venues, implementing dynamic position limits, real-time Value-at-Risk calculations, and automated circuit breakers for extreme market conditions. Cross-venue exposure tracking prevents dangerous concentrations while enabling sophisticated hedging strategies across multiple platforms simultaneously. These systems must process massive data streams while maintaining microsecond response times for risk limit violations.

Market data infrastructure aggregates Level 2+ order book data from 60+ venues through standardized protocols like FIX while processing WebSocket streams for real-time updates. Apache Kafka provides message queuing for high-throughput data distribution while time-series databases store historical tick data for backtesting and analysis. Machine learning models continuously analyze this data for price prediction, order flow toxicity detection, and strategy optimization.

Cloud versus co-location strategies reflect different approaches to infrastructure optimization. Co-location provides deterministic microsecond-level performance with direct market access and specialized connectivity for speed-critical strategies. Cloud infrastructure offers global scalability, cost efficiency, and managed services reducing operational overhead. Leading firms increasingly adopt hybrid approaches combining co-location for hot paths with cloud services for auxiliary functions and global market access.

Case studies: when liquidity shapes market outcomes

The Alameda gap: FTX collapse and market-making concentration

The FTX collapse in November 2022 revealed dangerous concentrations in crypto market-making infrastructure when Alameda Research, the dominant market maker across crypto exchanges, suddenly disappeared from markets. CoinDesk's November 2 report revealing Alameda's $14.6 billion balance sheet heavily dependent on FTT tokens triggered a cascade of events culminating in over $200 billion in total crypto market losses as the interconnected trading ecosystem unraveled.

Alameda Research served as the primary market maker across numerous crypto exchanges, exploiting cross-venue arbitrage opportunities particularly between Asian and Western markets. The firm's privileged position within the FTX ecosystem included secret exemptions from auto-liquidation protocols and access to customer deposits reaching $65 billion to cover trading losses. When Binance announced liquidation of all FTT holdings on November 6, triggering $1 billion in withdrawals followed by additional $4 billion outflows, the liquidity crisis quickly spiraled beyond control.

The "Alameda Gap" concept describes the sudden disappearance of market-making liquidity as the dominant provider exited markets simultaneously across venues. Cross-venue arbitrage opportunities that Alameda exploited between different geographic markets disappeared, leading to increased price fragmentation and wider spreads across the entire crypto ecosystem. This demonstrated the systemic risks created when single entities dominate market-making across multiple venues without adequate backup liquidity providers.

The quantitative impact extended far beyond FTX itself, with total crypto market capitalization falling from over $1 trillion to under $800 billion by December 2022. FTT token declined 72% within days of the Binance announcement while over 1 million users across 130+ affiliated entities faced frozen assets. The incident highlighted inadequate segregation between exchanges and affiliated trading firms, prompting regulatory responses focusing on custody separation and proof of reserves requirements.

Lessons for market participants include monitoring concentration risk when single entities dominate market-making, tracking cross-venue liquidity dependencies and backup providers, conducting enhanced due diligence on exchange-affiliated trading firms, and implementing real-time monitoring of withdrawal patterns and liquidity ratios. The collapse demonstrated how quickly sophisticated market-making operations can become systemic risks during stress conditions.

Oracle manipulation: Mango Markets and thin liquidity exploitation

The Mango Markets oracle manipulation attack executed by Avraham Eisenberg in October 2022 demonstrated how thin liquidity across price oracle sources could be exploited to drain over $110 million from a decentralized lending platform. Eisenberg manipulated the MNGO token price by 1,300% within 30 minutes using flash loans and coordinated trading across multiple low-liquidity exchanges that served as oracle price feeds.

The attack exploited fundamental weaknesses in cross-venue price dependencies common throughout DeFi protocols. Mango Markets relied on external price oracles from exchanges with minimal MNGO liquidity, making them vulnerable to manipulation by sufficiently capitalized attackers. Eisenberg used $30 million DAI flash loans from Aave to create leveraged positions while simultaneously pumping MNGO prices across three exchanges serving as oracle sources.

The technical execution revealed sophisticated understanding of both AMM mechanics and oracle vulnerabilities. By artificially inflating MNGO prices on external exchanges, Eisenberg could borrow additional assets from Mango Markets against his now-overvalued collateral, effectively draining the platform's deposited assets. Only $67 million of the $110+ million was eventually returned, with $47 million retained by the attacker.

Regulatory responses proved complex due to jurisdictional and definitional challenges around decentralized finance. The CFTC filed the first oracle manipulation enforcement action involving a "decentralized exchange" in January 2023, while the SEC classified MNGO as an unregistered security. However, criminal convictions were later overturned in May 2025 by Federal Judge Arun Subramanian due to jurisdictional issues and fraud definition challenges, though civil cases remain active.

The incident highlighted critical infrastructure vulnerabilities that remain relevant across DeFi protocols. Detection and avoidance strategies include monitoring for unusual price movements across oracle source exchanges, implementing circuit breakers for rapid price changes, diversifying oracle sources with time delays, and enhanced liquidity monitoring for governance tokens used as collateral. The attack demonstrated how sophisticated actors can exploit the intersection of centralized and decentralized infrastructure.

Stablecoin crisis: USDC depeg and liquidity flight

The Silicon Valley Bank collapse in March 2023 triggered the largest stablecoin depeg event in crypto history when Circle disclosed $3.3 billion (8% of USDC reserves) stuck at the failed institution. USDC fell to $0.87 representing a 13% depeg from its $1.00 target, causing massive deleveraging across DeFi protocols and demonstrating the interconnectedness of traditional banking and crypto markets.

The crisis timeline began March 10, 2023 when California regulators declared Silicon Valley Bank insolvent, followed by Circle's March 11 disclosure at 04:00 UTC revealing significant exposure. Centralized exchanges immediately suspended USDC redemptions and conversions, with Coinbase pausing critical USDC-to-USD conversions that eliminated a key liquidity source for maintaining the peg.

Market dynamics during the crisis revealed the complex liquidity flows underlying stablecoin markets. Hourly CEX outflows peaked at $1.2 billion at 1:00 AM March 11 as users rushed to exit USDC positions, while Circle redeemed a net $1.4 billion USDC within 8 hours. Decentralized exchanges experienced massive volume spikes as users fled USDC for USDT and other assets, creating substantial trading opportunities for those able to provide liquidity during the crisis.

The quantitative impact demonstrated stablecoin market fragility despite USDC's $37 billion market capitalization at the time of the incident. Cross-venue arbitrage opportunities emerged as USDC traded at significant discounts to par, with sophisticated traders capturing profits by buying discounted USDC and holding for the eventual re-peg. Federal banking regulators announced full depositor protection on March 13, enabling USDC to restore its dollar peg as Circle regained access to its banking reserves.

This incident reinforced systemic risks from stablecoin reliance on traditional banking partnerships and the need for diversified reserve custody. Market participants learned to monitor concentration risk in banking partnerships for stablecoin issuers, track regulatory health of banking partners, implement automated alerts for stablecoin depegs above threshold levels, and diversify stablecoin holdings across multiple issuers to reduce concentration risk.

Flash crashes and thin order books: OKB and market depth

The OKB flash crash in January 2024 provided a stark example of how thin order books can amplify volatility even for major exchange tokens. OKB suffered a 50% price drop in just 3 minutes, falling from approximately $50 to $25.17 before partially recovering to $45.64, demonstrating how inadequate market depth can trigger cascading liquidations.

Analysis revealed that OKB's 2% market depth ranged only $184,000-$224,000, meaning orders exceeding this threshold could trigger significant price cascades. This thin liquidity profile made the fourth-largest exchange token by market capitalization ($2.8 billion) vulnerable to large sell orders or automated liquidation systems. The incident triggered a 2,100% increase in 24-hour trading volume to $79 million as arbitrageurs and automated systems responded to the price dislocation.

OKX's immediate response included announcing a user compensation plan within 72 hours and implementing enhanced risk controls to prevent similar incidents. The exchange committed to optimizing spot leverage gradient levels, enhancing pledged lending risk control rules, and improving liquidation mechanisms to prevent cascading failures. This demonstrated the importance of robust exchange policies for managing extraordinary market events.

Technical factors contributing to the crash included layered liquidation systems that amplified initial selling pressure and inadequate circuit breakers for extreme price movements. Cross-venue arbitrage mechanisms failed to stabilize pricing during the rapid decline, highlighting how thin liquidity can overwhelm natural market correction mechanisms during stress conditions.

The incident reinforced lessons about monitoring 2% market depth ratios as early warning indicators, implementing progressive liquidation mechanisms versus instantaneous triggers, establishing circuit breakers for rapid price movements, and enhancing risk management for leveraged positions. Exchanges learned to maintain adequate compensation reserves and clear incident response policies to maintain user confidence during extraordinary events.

DeFi exploits: Euler Finance and flash loan attacks

The Euler Finance flash loan attack in March 2023 demonstrated the sophistication of modern DeFi exploits while providing a rare example of complete fund recovery. The attacker drained $197 million across multiple transactions in DAI, WBTC, stETH, and USDC, making it the largest DeFi exploit of Q1 2023, before ultimately returning all funds over several weeks.

The technical execution exploited a flaw in Euler's donateToReserves function that lacked proper liquidity validation checks. Using $30 million DAI flash loans from Aave, the attacker manipulated eToken/dToken ratios to create artificial liquidation conditions, enabling extraction of user deposits through the protocol's native mechanisms. The attack affected 11+ connected protocols including Balancer and Angle Finance, with Balancer alone losing ~$11.9 million representing 65% of its bbeUSD pool TVL.

Quantitative analysis revealed the attack's multi-faceted approach: $38.9 million profit from a single pool attack, with total stolen assets including USDC ($34.2M), wBTC ($18.6M), stETH ($116M), and wETH ($12.6M). The interconnected nature of DeFi protocols meant the exploit created cascading effects across the ecosystem, highlighting systemic risks from protocol interdependencies.

The unprecedented full recovery began March 18 with the attacker returning 3,000 ETH, followed by major returns of 51,000 ETH on March 25, and complete recovery by April 4. This outcome, extremely rare in DeFi exploits, resulted from a combination of on-chain detective work, community pressure, and potential legal concerns that convinced the attacker to return all funds rather than attempting to launder them.

Euler's response included 31 comprehensive security audits before launching Euler v2 and a $1.25 million Cantina audit competition to identify potential vulnerabilities. Enhanced "circuit breaker" mechanisms were implemented to prevent similar exploits, along with improved liquidity checks in all token burning/minting functions. The incident demonstrated the importance of comprehensive testing, real-time health score monitoring for leveraged positions, and enhanced monitoring of flash loan usage patterns.

Exchange outages and liquidity dependencies

Binance's March 2023 trading outage revealed dangerous dependencies on centralized exchange infrastructure when the world's largest crypto exchange suspended all spot trading for over two hours due to a trailing stop-loss bug. Bitcoin initially dropped approximately $700 on outage news before recovering to ~$28,000 by trading resumption, highlighting how single exchange disruptions can impact global price discovery.

The technical failure originated in the exchange's trailing stop-loss feature within the trading engine, forcing a complete shutdown of spot trading while maintaining futures and other derivatives markets. "Engine one" came back online around 13:00 UTC followed by full trading resumption at 14:00 UTC after more than two hours of complete spot market suspension across the world's largest cryptocurrency exchange by volume.

Market dynamics during the outage demonstrated both the resilience and fragility of crypto market structure. Alternative exchanges experienced significant volume spikes as traders sought liquidity, while professional market makers had to rapidly route order flow to backup venues. Cross-venue arbitrage opportunities emerged due to price divergences, but the overall market impact remained relatively contained due to quick recovery.

Legal ramifications included class-action lawsuits filed by Italian investors seeking damages for "tens of millions" in losses, similar to litigation following a November 2021 outage. These incidents raised questions about exchange liability for system failures and the need for enhanced infrastructure resilience requirements across critical market infrastructure.

The outage reinforced lessons about diversifying exchange usage to avoid single points of failure, monitoring exchange system health and planned maintenance schedules, implementing automated failover capabilities to alternative venues, and real-time monitoring of cross-venue price divergences during infrastructure disruptions. Professional market makers enhanced their multi-venue strategies and backup connectivity solutions following these incidents.

Detecting manipulation and assessing liquidity quality

Technical indicators for market manipulation

Wash trading detection has evolved into sophisticated on-chain analysis combining transaction patterns, timing analysis, and address clustering techniques. Chainalysis's 2025 methodology employs multiple heuristics including matched buy-sell detection within 25-block windows (approximately 5 minutes), volume differences under 1%, and addresses executing three or more such pairs. Their analysis identified $2.57 billion in suspected wash trading volume during 2024, with individual controllers averaging $3.66 million in suspicious activity.

The most egregious case involved a single address initiating over 54,000 near-identical buy-sell transactions, demonstrating the industrial scale of modern manipulation attempts. Chainalysis's second heuristic targets multi-sender operations where controller addresses manage five or more trading addresses, with some controllers operating up to 22,832 managed addresses simultaneously. This reveals the sophisticated infrastructure behind professional manipulation operations.

Spoofing detection focuses on technical signatures including large orders appearing and vanishing before execution, high-frequency order cancellations without fills, and layer spoofing employing multiple fake orders at different price levels. Cancel-to-trade ratios exceeding 80% serve as suspicious thresholds , while real-time monitoring can identify patterns like the $212 million Bitcoin sell order that appeared on Binance at $85,600 in April 2025 before vanishing without execution.

Pump-and-dump schemes in DeFi follow predictable patterns that can be systematically detected. Chainalysis's 2025 criteria identify addresses that add liquidity then remove 65% or more (minimum $1,000), pools becoming completely inactive with zero transactions for 30 days, and pools previously showing traction with over 100 transactions. Their analysis found 74,037 suspected pump-and-dump tokens representing 3.59% of all launched tokens, with 94% executed by original pool deployers.

Order book imbalance calculations provide real-time manipulation detection through mathematical analysis of bid-ask distribution. The formula (bid_volume - ask_volume) / (bid_volume + ask_volume) produces values ranging from -1 to +1, where imbalances exceeding +0.3 indicate strong buying pressure while values below -0.3 suggest selling pressure. Values near zero represent balanced markets, though sudden shifts can signal coordinated manipulation attempts.

Liquidity quality assessment metrics

Order book depth analysis requires examining cumulative volume at various percentage levels from mid-price to understand true market liquidity. Professional traders calculate depth at ±0.1%, ±0.5%, and ±1% levels to assess potential price impact before executing large orders. Bitcoin's 2% market depth ranging $50-100 million across major exchanges provides benchmarks for institutional trading, while altcoins often show dramatically thinner liquidity profiles.

Volume-to-liquidity ratios (VLR) measure trading activity relative to available market depth, with high ratios above 200 indicating potential price instability. The Trump token (TRUMP) reached a VLR of 290 in January 2025, correctly signaling extreme volatility risk before significant price movements. This metric proves particularly valuable for assessing newer tokens where liquidity provision may not match trading interest.

Cross-exchange depth comparison reveals liquidity concentration and potential manipulation risks through systematic analysis of order book distribution. Professional implementations fetch order books across multiple venues, calculate cumulative depth at specific price levels, and identify exchanges with anomalous depth profiles that may indicate artificial liquidity or manipulation attempts.

Real-time surveillance systems implement comprehensive monitoring combining multiple detection methodologies. Basic implementations track volume spikes exceeding 5x normal levels, spread widening beyond 50 basis points, and depth declines exceeding 30%. Advanced systems incorporate machine learning models analyzing order flow patterns, cancellation behaviors, and cross-venue coordination to identify sophisticated manipulation attempts.

Market microstructure analysis examines tick-level data for manipulation signatures including synchronized trading across venues, unusual order sizes at regular price intervals, and temporal patterns suggesting algorithmic coordination. These analyses require specialized data feeds providing Level 2+ order book information with microsecond timestamps and unique order identifiers.

Practical implementation tools

CCXT library provides standardized access to order book data across 120+ cryptocurrency exchanges through unified APIs abstracting exchange-specific implementation details. Professional implementations aggregate real-time order books, calculate standardized depth metrics, and monitor for anomalous patterns across multiple venues simultaneously. The library's normalized data structures enable consistent analysis regardless of underlying exchange protocols.

CoinAPI offers institutional-grade market data with comprehensive order book depth endpoints supporting limit parameters and real-time WebSocket streams. Their REST API enables depth analysis at up to 20 price levels with microsecond timestamps essential for professional trading applications. Authentication through API keys provides reliable access with appropriate rate limiting for production use cases.

Practical manipulation detection systems combine real-time monitoring with historical pattern analysis to identify emerging threats. Implementation examples include monitoring for specific function signatures like the "0x5f437312" signature associated with Volume.li wash trading operations that typically execute 100 paired trades rapidly. These systems require continuous updates as manipulation techniques evolve and new attack vectors emerge.

Python implementations enable rapid prototyping and deployment of surveillance systems using libraries like pandas for data manipulation, numpy for mathematical calculations, and asyncio for real-time data processing. Professional deployments often migrate to lower-level languages like C++ or Rust for performance-critical components while maintaining Python interfaces for strategy development and analysis.

Database architectures for surveillance systems typically employ time-series databases optimized for high-frequency market data storage and retrieval. InfluxDB and TimescaleDB provide specialized capabilities for storing order book snapshots, trade data, and calculated metrics with efficient querying for pattern detection and historical analysis. These systems must handle millions of data points per day while maintaining sub-second query response times for real-time monitoring.

Regulatory frameworks and ethical considerations

Current regulatory landscape

The United States has achieved unprecedented regulatory coordination through the SEC's Project Crypto and CFTC's Crypto Sprint initiatives launched in September 2025. The joint staff statement clarified that registered exchanges are not prohibited from facilitating spot crypto asset trading, promoting venue choice and optionality for market participants. This represents a fundamental shift from previous regulatory uncertainty toward principles-based approaches encouraging innovation within established frameworks.

The regulatory split assigns CFTC primary authority over spot digital commodities including Bitcoin and Ethereum, while SEC maintains antifraud and manipulation oversight alongside jurisdiction over securities-classified crypto assets. Many intermediaries handling digital commodities require dual registration with both agencies even if previously SEC-registered, creating comprehensive oversight without regulatory gaps. Innovation exemptions under consideration would establish regulatory "sandboxes" enabling testing of new business models under principles-based conditions.

Pending legislation includes the Digital Asset Market CLARITY Act, which passed the House with bipartisan 294-134 support establishing dual SEC/CFTC registration frameworks. The GENIUS Act became law in July 2025, creating comprehensive federal frameworks for "payment stablecoins" while the House Financial Services and Agriculture Committee chairs' Discussion Draft proposes additional market structure reforms.

The European Union's MiCA regulation achieved full operational status across all 27 member states on December 30, 2024, with transitional provisions extending until July 2026 for existing providers. Crypto Asset Service Providers (CASPs) now enjoy passporting rights enabling operations across the entire EU with single authorization from National Competent Authorities. Requirements include mandatory licensing, fit-and-proper management standards, robust governance frameworks, anti-market abuse measures, and comprehensive consumer protection standards.

Asian jurisdictions continue advancing comprehensive regulatory frameworks with Singapore's enhanced Payment Services Act requirements, Hong Kong's ASPIRe Roadmap strategic direction, and Japan's continuing refinement of its established crypto exchange regime. South Korea's Virtual Asset User Protection Act (VAUPA) became effective July 2024, while multiple jurisdictions implement enhanced cross-border coordination and information sharing agreements.

Ethical considerations and conflicts of interest

The COIN Act introduced by ten Democratic lawmakers led by Senator Adam Schiff addresses growing concerns about political conflicts of interest in crypto markets. The legislation prohibits public officials from issuing cryptocurrencies or tokens, leveraging positions for personal crypto gains, and launching memecoin projects while in office. This extends traditional financial ethics oversight to crypto dealings amid concerns about regulatory capture and inappropriate influence.

Regulatory capture concerns intensified with the Trump administration's World Liberty Financial stablecoin arrangements with UAE's MGX and Binance, which Senators Merkley and Warren characterized as "staggering conflicts of interest." Potential Emoluments Clause violations from foreign government payments highlight ongoing tensions between political involvement and appropriate regulatory oversight. These issues demonstrate the challenges of maintaining regulatory independence while encouraging innovation.

Market manipulation enforcement has expanded significantly with initiatives like the FBI's Operation Token Mirrors, the first law enforcement operation using fake crypto tokens to identify fraudulent schemes. The operation resulted in 18 arrests and $25 million in cryptocurrency confiscation, though it raised ethical questions about deception in law enforcement and potential impacts on public trust in legitimate crypto projects.

Exchange conflicts of interest remain pervasive with major platforms managing proprietary trading teams competing against their own customers. Senator Brown's letters highlight "troubling lack of customer-facing disclosure in crypto markets" while platforms like Crypto.com face criticism for trading against customers without adequate disclosure. These "house always wins" scenarios require enhanced transparency about internal trading activities and potential conflicts affecting customer execution.

Professional market makers face ethical challenges balancing client service obligations with proprietary trading profits. Robust surveillance systems must detect wash trading and market manipulation while sophisticated algorithms may create systematic advantages over retail participants. The concentration of market-making among few large firms raises questions about fair access to markets and the potential for coordinated behavior affecting price discovery.

Compliance requirements and best practices

Market surveillance obligations under MiCA Article 60(14) require "effective arrangements, systems, and procedures to detect and report suspicious orders and transactions" with real-time monitoring capabilities for market manipulation detection. Technology solutions from providers like Solidus Labs, Nasdaq Trade Surveillance, and Kaiko Market Surveyor enable coverage of 35+ crypto exchanges and 400+ currency pairs with 24/7 automated monitoring capabilities.

AML/CFT compliance requirements have intensified with enhanced FATF Travel Rule implementation, real-time transaction monitoring through advanced KYC/AML controls, and increased cross-border data sharing for international cooperation. AI-powered detection systems are reducing false positives by 40% while the global RegTech market is projected to exceed $22 billion by mid-2025 with 23.5% CAGR growth in regulatory technology solutions.

Technical infrastructure compliance requires sub-100ms latency for professional operations, comprehensive transaction recording and reporting capabilities, multi-factor authentication with withdrawal whitelists and hardware wallets, and redundant systems with disaster recovery protocols. Professional market makers must prepare for dual SEC/CFTC registration in the US, obtain MiCA CASP licensing for European operations, and comply with Singapore PSA, Hong Kong SFC, and Japanese FSA requirements across jurisdictions.

Surveillance system implementation demands sophisticated technology combining multiple detection methodologies with machine learning algorithms analyzing order flow patterns, cancellation behaviors, and cross-venue coordination. Database architectures must handle millions of data points daily while maintaining sub-second query response times for real-time monitoring, typically implemented through specialized time-series databases optimized for high-frequency market data.

Best practices for ethical market making include establishing clear conflict-of-interest policies separating proprietary trading from client activities, providing detailed disclosure of trading strategies and potential conflicts, implementing robust controls against wash trading and manipulation, and maintaining transparent fee structures with customer-friendly execution policies. Successful compliance strategies require proactive engagement with evolving regulatory requirements across multiple jurisdictions while investing in advanced surveillance and risk management capabilities.

Practical guidance for market participants

For traders: assessing liquidity before execution

Order book quality assessment should precede any significant trade execution through systematic analysis of depth, spread characteristics, and recent trading patterns. Calculate depth at ±2% price levels to understand potential price impact, verify the order book isn't dominated by single large orders that could indicate fake liquidity, monitor recent cancellation patterns for evidence of spoofing or manipulation, compare depth across multiple venues to identify the best execution opportunities, and check for unusual volume spikes that might signal coordinated activity or pending announcements.

Red flag indicators include depth concentrated in a few large orders rather than distributed across multiple price levels, high cancel-to-fill ratios exceeding 70% suggesting aggressive algorithmic activity or potential manipulation, identical order sizes stacked at regular price intervals indicating potential algorithmic spoofing, and volume spikes without corresponding fundamental news or catalyst events that could suggest artificial activity.

Professional traders implement comprehensive pre-trade analysis systems calculating volume-weighted average prices (VWAP), implementation shortfall estimates, and optimal trade scheduling to minimize market impact. Advanced implementations incorporate real-time market microstructure analysis, cross-venue liquidity aggregation, and dynamic routing algorithms that adjust execution strategies based on changing market conditions throughout trade execution periods.

Smart order routing becomes essential for large executions, automatically splitting orders across venues while optimizing for total execution costs including fees, rebates, and market impact. These systems must account for different venue characteristics including maker-taker fee structures, API rate limits, and historical execution quality while maintaining appropriate risk controls and position monitoring throughout the execution process.

For institutions: building surveillance capabilities

Institutional market participants require comprehensive surveillance systems combining real-time monitoring with historical pattern analysis to detect manipulation attempts and ensure regulatory compliance. Implementation should focus on normalized data collection across multiple venues, automated alert generation for suspicious patterns, integration with existing compliance workflows, and comprehensive audit trails for regulatory reporting requirements.

Technology architecture should employ time-series databases optimized for high-frequency market data, machine learning models for pattern recognition and anomaly detection, scalable computing infrastructure supporting real-time analysis across hundreds of trading pairs, and integration capabilities with existing risk management and compliance systems. Professional implementations typically process millions of data points per day while maintaining sub-second response times for critical alerts.

Surveillance methodologies must incorporate wash trading detection through transaction pattern analysis and address clustering, spoofing identification through order book behavior monitoring and cancellation pattern analysis, market manipulation detection through cross-venue coordination analysis and unusual volume pattern recognition, and regulatory compliance monitoring ensuring adherence to reporting requirements and position limits across jurisdictions.

Staff training and procedures require regular updates reflecting evolving manipulation techniques, regulatory requirements, and technology capabilities. Effective programs include technical training on surveillance system operation and interpretation, regulatory training on compliance requirements across relevant jurisdictions, incident response procedures for detected manipulation attempts, and coordination protocols with legal teams and regulatory authorities for serious violations.

For exchanges: enhancing market integrity

Exchange operators must implement robust market surveillance systems providing real-time monitoring of all trading activity, comprehensive audit trails for regulatory inquiries, automated circuit breakers for extreme market conditions, and integration capabilities with law enforcement and regulatory authorities. Leading exchanges deploy sophisticated algorithms monitoring hundreds of thousands of trades daily while maintaining microsecond response times for critical interventions.

Liquidity incentive programs should balance market maker attractions with market integrity concerns through transparent fee structures, performance-based rebate systems rewarding genuine liquidity provision rather than volume manipulation, and regular monitoring of participant behavior to ensure compliance with program requirements. Effective programs establish clear eligibility criteria, ongoing performance monitoring, and enforcement mechanisms for participants who violate program terms.

Technology infrastructure requires high-performance matching engines capable of processing millions of orders per second, comprehensive logging and audit trail systems, robust security measures protecting against system intrusion and data manipulation, and redundant systems ensuring continuous operation during peak trading periods and system maintenance windows.

Risk management frameworks must address operational risk through comprehensive system monitoring and incident response procedures, market risk through position limits and margin requirements appropriate for different participant types, counterparty risk through robust onboarding procedures and ongoing monitoring of participant financial health, and systemic risk through coordination with other exchanges and regulatory authorities during market stress periods.

Regulatory compliance procedures require comprehensive KYC/AML programs with ongoing monitoring and suspicious activity reporting, market surveillance capabilities meeting regulatory expectations for manipulation detection and prevention, regular reporting to relevant authorities including trading statistics and incident reports, and coordination with law enforcement agencies for investigation of serious violations.

Practical metrics and monitoring tools

Order book imbalance monitoring provides real-time indicators of potential manipulation or unusual market conditions through continuous calculation of (bid_volume - ask_volume) / (bid_volume + ask_volume) across multiple depth levels. Values consistently above +0.3 or below -0.3 may indicate coordinated buying or selling pressure requiring further investigation.

Volume-to-liquidity ratio calculations enable early warning systems for tokens with insufficient liquidity relative to trading activity. Ratios consistently above 200 suggest potential price instability while extreme values above 500 indicate high manipulation risk or upcoming significant price movements. These metrics prove particularly valuable for newer tokens where organic liquidity development may lag trading interest.

Implementation examples include Python scripts utilizing CCXT library for cross-exchange order book collection, pandas dataframes for efficient data manipulation and analysis, real-time WebSocket connections for continuous monitoring, and alert systems using email, SMS, or trading system integration for immediate notification of threshold breaches.

Database query examples demonstrate practical surveillance implementations including identification of addresses with multiple rapid buy-sell pairs, detection of unusual order patterns across price levels, analysis of volume spikes relative to historical norms, and correlation analysis identifying potential coordination across venues or time periods. These tools enable systematic monitoring while reducing false positives through appropriate threshold calibration and historical context analysis.

Professional deployment considerations include API rate limit management across multiple exchanges, data storage optimization for high-frequency tick data, alert fatigue reduction through intelligent filtering and prioritization, and integration capabilities with existing trading and compliance systems to ensure actionable intelligence reaches appropriate decision-makers promptly.

Final thoughts

The crypto liquidity ecosystem has evolved from amateur retail market making to a sophisticated infrastructure rivaling traditional financial markets in complexity and scale. Professional market makers now deploy billions in capital across hundreds of venues while DeFi protocols enable permissionless liquidity provision through mathematical algorithms rather than active human management. This transformation has improved market efficiency through tighter spreads and deeper markets while creating new vulnerabilities from concentration risk and algorithmic dependencies.

Recent innovations demonstrate continued rapid evolution with Uniswap V4's hook system enabling 4000x capital efficiency improvements, cross-chain bridge protocols facilitating seamless multi-blockchain liquidity, and regulatory frameworks like MiCA providing comprehensive oversight while preserving innovation incentives. However, persistent challenges include MEV extraction affecting nearly half of DeFi liquidity providers, manipulation schemes identified in $2.57 billion of suspicious trading volume, and systemic risks from market maker concentration revealed during the FTX collapse.

The intersection of centralized and decentralized liquidity provision creates both opportunities and risks as arbitrage mechanisms link order books with AMM curves while cross-venue dependencies can amplify both stability and instability. Professional market makers increasingly operate across both CEX and DEX venues while maintaining sophisticated risk management systems capable of processing millions of operations per second with sub-microsecond latency requirements.

Looking forward, continued regulatory harmonization across jurisdictions promises clearer compliance frameworks while maintaining innovation incentives through sandbox regimes and principles-based oversight. Technology evolution toward AI-powered liquidity management, zero-knowledge privacy enhancements, and hybrid CeFi-DeFi products suggests further structural changes ahead. Market participants who understand these evolving mechanisms while implementing robust surveillance and risk management capabilities will be best positioned to navigate this complex and rapidly changing landscape.

The fundamental challenge remains balancing market efficiency with systemic stability as liquidity provision mechanisms become increasingly sophisticated and interconnected. Success requires continuous adaptation to evolving technology, regulatory requirements, and market structure changes while maintaining focus on the core principles of fair, transparent, and efficient price discovery that serve all market participants.