Binance – the world’s largest cryptocurrency exchange – announced on Monday that it has opened up bitcoin “options writing” access to all its users. In practical terms, this means everyday traders on Binance can now sell call and put options on bitcoin, not just buy them. Previously, such complex strategies were often limited to institutional or advanced users. Binance’s decision comes on the back of a notable increase in retail demand for sophisticated trading instruments beyond simple buy-and-hold tactics.

“Accelerating crypto adoption will increase demand for more sophisticated liquidity tools and we are committed to building a fuller suite of derivative products to support our users,” said Jeff Li, Binance’s VP of Product, regarding the expansion.

Writing an option (also known as selling an option) effectively means the trader is taking the opposite side of an options buyer – in essence, providing insurance to others against big price moves. The option writer earns an upfront premium from the buyer, but must cover the risk of large market moves. As Binance explains, selling a call or put option is akin to selling insurance against bullish or bearish swings in bitcoin’s price. If the market doesn’t move beyond the option’s strike price, the writer keeps the premium as profit; if it does, the writer is obligated to settle the difference (or deliver the asset) as per the contract.

Risk Management: Given the non-trivial risks of writing options, Binance is implementing robust safeguards. Users must pass a suitability assessment to ensure they understand options trading, and they must post margin collateral to cover potential losses. These measures help prevent traders from taking on excessive leverage or risk they cannot fulfill. All Binance options contracts are reportedly fully collateralized (settled in stablecoin) and come with set expiration dates (daily, weekly, monthly, and quarterly cycles at 08:00 UTC).

The timing of Binance’s move coincides with explosive growth in the broader crypto options market. According to Binance’s press release, total bitcoin options trading volume soared from just $4.11 billion in 2020 to about $138.76 billion by June 2025. Such a meteoric rise (over 3200%) reflects how far crypto derivatives have come in five years, as both institutional and retail participants embrace options for speculation and hedging. By enabling more users to write options, Binance aims to empower traders to “express market views, manage risk, earn upfront premiums, and implement strategies beyond simple one-way bets”.

To entice participation, Binance’s 20% fee discount on new options contracts (BTC as well as ETH, BNB, SOL) lowers the cost for early adopters. The exchange is also upgrading its Options Enhanced Program for institutions and high-volume traders – easing entry requirements and offering more attractive fee structures. These incentives indicate Binance’s push to capture a larger share of crypto options trading by making the market more accessible and cost-effective.

In summary, Binance’s opening of bitcoin options writing to all users is a significant development in the crypto trading landscape. It democratizes access to advanced options strategies that were once mainly the domain of pros. It also highlights the maturation and growth of crypto derivatives. But what exactly are bitcoin options, and how can traders use them to their advantage? In the remainder of this guide, we’ll break down the fundamentals of bitcoin options, explain how they work, and explore how to trade these instruments and implement key strategies for both risk management and profit.

What Are Bitcoin Options?

Bitcoin options are a type of derivative contract that give the holder the right, but not the obligation, to buy or sell a specified amount of bitcoin at a predetermined price by a certain date. In simpler terms, an option is a financial contract linked to the price of bitcoin (the underlying asset), which provides flexibility to investors:

-

Call Option (Buy Right): A call option gives its owner the right to buy bitcoin at a set strike price on or before the expiration date. Traders purchase call options if they believe the price of Bitcoin will rise – it’s essentially a bullish bet, since the call becomes more valuable as BTC’s market price exceeds the strike. For example, a 1-month call with a strike of $30,000 gives you the right to buy 1 BTC at $30K even if the market price shoots higher. If BTC’s price goes to $35,000, that call is “in the money” – you could exercise it to buy BTC at $30K and immediately have $5,000 of intrinsic profit (minus the fee or premium paid). If BTC’s price stays below $30K at expiry, the call option expires worthless, and you only lose the premium you paid.

-

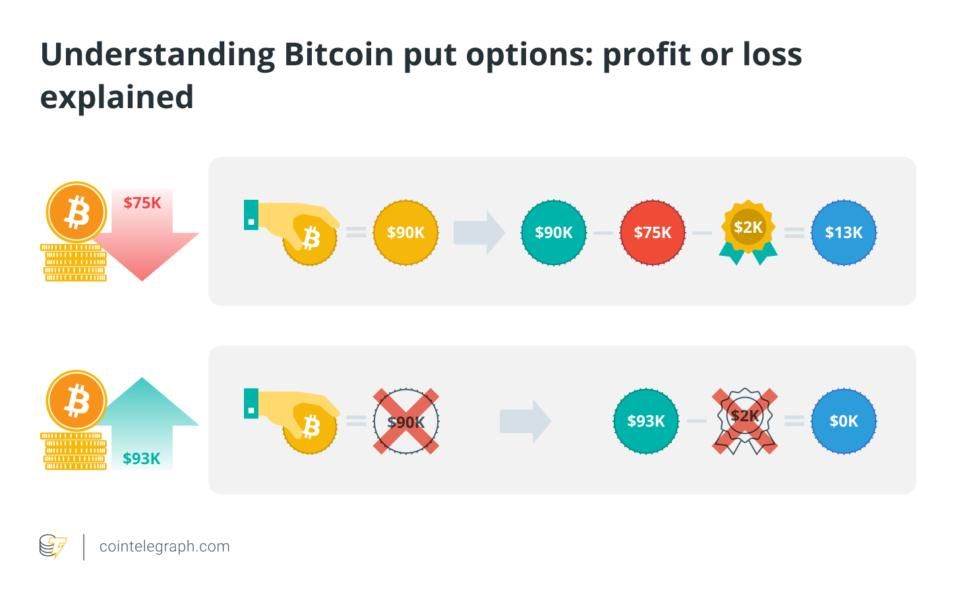

Put Option (Sell Right): A put option gives its owner the right to sell bitcoin at a predetermined price by the expiration date. Buying a put is a bearish or protective move – it gains value if Bitcoin’s price falls below the strike. Investors often buy puts as a form of downside protection (insurance). For instance, owning a $25,000 strike put expiring next month allows you to sell 1 BTC for $25K even if the market price plunges to $20K. That put would be valuable in a downturn, effectively setting a price floor for your BTC. If BTC stays above $25K, the put expires worthless (you wouldn’t sell below market value), and your loss is limited to the premium paid.

In both cases, the option holder is not obligated to exercise the right – it’s optional. If the market moves favorably, the holder can either exercise the option or sell the option contract itself for a profit. If not, they can let it expire worthless and walk away, with the loss limited to the upfront premium. This asymmetric risk – limited downside (premium) with significant upside potential – is a key feature attracting traders to options.

Key Terms: When discussing options, a few fundamental terms come up repeatedly:

- Strike Price: The fixed price at which the option holder can buy (for calls) or sell (for puts) the underlying asset (BTC). It’s essentially the target price. For example, a call with a $30,000 strike means you can purchase BTC at $30K via the option, no matter the market price, before it expires.

- Expiration Date: The date (and time) on which the option contract expires. By this date, the holder must decide whether to exercise the option or let it lapse. Bitcoin options come in various durations – e.g. daily, weekly, monthly, quarterly expiries. After expiration, the contract is settled and ceases to exist.

- Premium: The price of the option itself – this is the amount the buyer pays and the seller (writer) receives upfront. The premium is determined by the market based on factors like current BTC price, strike price, time until expiration, and volatility. It represents the “cost” of the right that the option provides. For instance, a trader might pay a premium of $500 for a one-month call option on BTC. If the option expires worthless, that $500 is the total loss for the buyer (and profit for the seller).

Availability: While options have been a staple in stock and commodity markets for decades, bitcoin options first became widely available around January 2020. Since then, they’ve grown into a popular derivative in crypto. Major exchanges like the Chicago Mercantile Exchange (CME) launched regulated BTC options in 2020, and crypto-native platforms such as Deribit, OKX, and Binance also offer active options markets. Today, traders can access Bitcoin options on both traditional brokerages (for example, CME’s cash-settled contracts or options on Bitcoin ETFs) and on cryptocurrency exchanges that list options.

Bitcoin options provide a flexible tool for traders and investors. A primary advantage is the ability to hedge or profit in a volatile market while capping risk to the premium spent. Unlike directly buying or shorting Bitcoin (which can involve large capital or potential unlimited loss in the case of shorting), options let you express bullish or bearish views with a smaller upfront investment and predefined risk. If used wisely, they can enhance returns or protect portfolios, as we will explore.

How Do Bitcoin Options Work?

To understand how bitcoin options function in practice, let’s break down the mechanics and what happens after you buy or sell an option:

- Option Value and Moneyness: The value of an option at any time depends largely on where the current market price of Bitcoin stands relative to the option’s strike price, as well as how much time is left until expiration. There are three common terms describing an option’s “moneyness”:

- In-the-Money (ITM): A call option is ITM if Bitcoin’s current price is above the strike price (since you could buy at strike cheaper than market). A put option is ITM if Bitcoin’s price is below the strike (since you could sell at strike higher than market). ITM options have intrinsic value. For example, if you hold a $30,000 strike call and BTC is $32,000, your call is $2,000 in-the-money per BTC (minus any premium cost). If you hold a $30,000 put and BTC is $25,000, that put is $5,000 in-the-money.

- Out-of-the-Money (OTM): A call is OTM if Bitcoin’s price is below the strike (market is lower, so the right to buy at a higher price isn’t profitable). A put is OTM if Bitcoin’s price is above the strike. OTM options have no intrinsic value – they are purely “hope” that the market might move into a favorable range before expiry. These options are cheaper, but they expire worthless if the market doesn’t move past the strike. For example, a $30K call when BTC is at $25K is $5K out-of-the-money; unless BTC rallies above $30K, that call won’t pay off.

- At-the-Money (ATM): When Bitcoin’s price is approximately equal to the strike price. An ATM option is right on the cusp – it has little intrinsic value, mostly time value. Traders often favor ATM options for their balance of cost and likelihood of expiring profitable.

The distinction matters because it affects exercise decisions and pricing. An ITM option is likely to be exercised if held to expiration (since it gives a profitable trade at the strike). OTM options will expire unused (worthless) unless the market moves beyond the strike.

-

European vs. American Style: Bitcoin options offered on most crypto exchanges are typically European-style, meaning they can only be exercised at the moment of expiration (on the expiry date). In contrast, American-style options (common in equity markets) allow the holder to exercise at any time before expiry. European options simplify things for exchanges and traders – you don’t have to worry about early exercises. However, it means as a holder you must wait until expiration to capture the option’s value by exercise (though you can still sell the option contract to someone else earlier). Notably, CME’s Bitcoin options and many crypto platforms use European-style contracts, so exercise happens only on expiry. This is important for planning: if you have a profitable European option, you’ll usually sell it on the market before expiry if you want to lock in gains, rather than exercising early.

-

Settlement: Bitcoin options may be physically settled or cash settled. Physically settled means if the option is exercised, actual bitcoin changes hands (the call buyer buys BTC, the put buyer sells BTC). Cash-settled means the payout is done in cash (or stablecoin) equivalent to the profit of the option, without transferring actual BTC. For example, Binance’s options are USDT-settled: profits or losses are paid in the tether (USDT) stablecoin, and you don’t have to deliver or receive actual BTC. CME’s options on futures are cash-settled in dollars. It’s important to know which type you’re trading, especially if you write options – physical settlement means you should be prepared to deliver BTC (for a call seller) or purchase BTC (for a put seller) if the option ends ITM.

-

Pricing Factors: The premium of an option is determined by several factors, often explained by the Black-Scholes model or simply supply and demand in the market. Key factors include: the current spot price of BTC, the strike price relative to spot, time to expiration, volatility of BTC’s price, and interest rates. One can think of an option’s price as having two components: intrinsic value (if any, based on moneyness) and time value (the extra value from the possibility that the option could become profitable before expiry). Generally, the more volatile Bitcoin is expected to be, or the more time until expiry, the higher the premium for a given strike – because there’s a greater chance the option ends up valuable. As time passes, the time value portion decays (this is known as theta decay), which is bad for option buyers but beneficial for option sellers (writers) who earn that decay as profit if the option expires worthless.

-

At Expiration: On the expiration date, the option will either be exercised (if it’s in the money and the owner chooses to exercise) or expire worthless (if out of the money). Many crypto exchanges automatically handle exercise: if you are holding a bitcoin call that’s ITM at expiry, the platform may automatically exercise it for you and either credit you the profit or deliver the BTC per the contract terms. If it’s OTM, it simply expires and stops trading. Before expiry, an option’s market price will fluctuate – you don’t have to wait until the expiration; you can close your position by selling the option (if you bought it) or buying it back (if you wrote it) at the market price any time. This allows traders to realize profits or cut losses before the deadline.

Example Scenario: To illustrate how a bitcoin option works, consider this example adapted from a recent market scenario:

-

Ellen buys a BTC call option with a strike of $55,000, expiring 3 months from now, and pays a $1,200 premium for it. This contract gives Ellen the right to purchase 1 BTC at $55K even if the market price is higher. Suppose within those 3 months, Bitcoin’s price surges to $70,000. Ellen’s call option is now deep in-the-money – she can exercise and buy at $55K, then immediately sell that BTC at market $70K. Her profit would be roughly $70,000 – $55,000 = $15,000 minus the $1,200 premium paid, netting $13,800 gain. If she didn’t have the funds to buy the full BTC, she could alternatively sell the call option itself for about $14K (its intrinsic value) to another trader and take profits that way. Conversely, if BTC’s price had stayed at $50,000 (below the strike) by expiry, Ellen’s call would end out-of-the-money and expire worthless. She’d lose the $1,200 premium – that’s her maximum loss, which was known upfront.

-

Paul buys a BTC put option with a strike of $50,000, expiring in 90 days, as a hedge in case of a market drop. He pays, say, a $1,000 premium. If Bitcoin indeed plunges to $40,000 before expiry, Paul’s put becomes valuable. It gives him the right to sell BTC at $50K while the market is at $40K. By exercising, he could essentially get $10,000 more for his bitcoin than the market would otherwise offer. If Paul didn’t actually own BTC, he could still profit by selling the put option contract (which would be worth up to $10K intrinsic value) to someone else. On the other hand, if BTC stays above $50K, the put isn’t needed and expires worthless, limiting Paul’s loss to the $1,000 premium (the cost of insurance).

Bottom Line: Bitcoin options work as powerful tools that can be used to either speculate on price movements with defined risk or to hedge against adverse moves. They introduce concepts like time decay and volatility into crypto trading, which are new considerations beyond just the price of the coin. Traders should familiarize themselves with how option pricing behaves – for instance, an out-of-the-money option can suddenly become profitable if BTC makes a big move in the right direction, and vice versa, an in-the-money option will lose value rapidly as it approaches expiration if it looks unlikely to stay ITM.

Next, we will discuss why traders use bitcoin options and what benefits they offer over simply trading bitcoin itself, before diving into how you can start trading options and some popular strategies.

Why Trade Bitcoin Options?

Bitcoin options have rapidly grown in popularity because they offer several strategic advantages and use cases that regular spot trading of bitcoin cannot. Here are some key reasons traders and investors turn to options:

-

Risk Management and Hedging: One of the most common motivations is hedging against unfavorable price movements. If you hold a significant amount of BTC, you might worry about a short-term drop. Instead of selling your bitcoin (and potentially missing an upside rebound), you can buy put options as insurance. A put option will increase in value if BTC’s price falls, offsetting some of your losses on the holdings. Professional miners and long-term holders also use options to lock in prices or protect against downturns. In essence, options allow you to insure your crypto portfolio – much like buying insurance on a house – limiting downside without necessarily liquidating your assets.

-

Leverage and Capital Efficiency: Options provide a form of built-in leverage. By paying a relatively small premium, an options trader can control a larger notional amount of bitcoin than if they bought the coin outright. For example, instead of spending $30,000 to buy 1 BTC, a trader might spend $1,500 on a call option that gives exposure to 1 BTC’s upside. If BTC’s price rallies, the percentage returns on that $1,500 could far exceed the percentage gains of holding BTC – yielding a high return on investment. This ability to amplify gains with limited capital is attractive to speculators. (Of course, if BTC doesn’t rise, the call can expire worthless and the premium is lost, so leverage cuts both ways.) The key point is that options let you take meaningful positions with less capital outlay.

-

Limited Risk (for Buyers): When you buy options (calls or puts), your maximum risk is capped at the premium paid. This is a crucial difference from margin trading or futures, where losses can exceed your initial investment. For instance, going long BTC futures could lead to large losses if price drops significantly, potentially even liquidation. But buying a BTC call option will never lose more than the upfront cost, no matter how badly the market moves against you. This limited downside, unlimited upside profile appeals to many traders – you can seek upside exposure to bitcoin, but know exactly how much you’d lose in a worst-case scenario. In a notoriously volatile market like crypto, such clarity on risk is valuable.

-

Flexibility and Strategic Diversity: Options enable complex strategies that can profit from any market condition – up, down, or even sideways. You are not limited to simply betting on price going up (long) or down (short). With options, you can profit from volatility itself (regardless of direction), set target price ranges, or earn yield if the market stays relatively stable. For example, if you expect Bitcoin to trade in a tight range for a month, you could use an options strategy (like selling both calls and puts – an iron condor or strangle) to collect premiums that profit if indeed the price remains range-bound. Conversely, if you expect a major move but aren’t sure of the direction (say, around an important regulatory decision or economic event), you could buy a combination of calls and puts (a straddle strategy) to gain if a big swing occurs either way. This flexibility to design custom payoff profiles is a huge benefit of options. Traders can fine-tune how they want to express a market view, far beyond just “buy or sell”.

-

Income Generation (Yield): As hinted in the Binance news, writing options can generate extra income on your holdings. If you own bitcoin (or another crypto), you can sell call options against your position (a covered call strategy, which we explain later) to earn premiums. Many crypto holders use this as a way to earn yield – essentially “renting out” their coins for income. As long as BTC stays below the strike price, the options expire worthless and you keep the premium, boosting your overall returns. This is similar to how stock investors sell covered calls on shares to earn yield in flat markets. With interest rates on fiat relatively low and many DeFi yields declining, option premiums can be an attractive source of return on crypto assets. (Note: While income strategies like covered calls are popular, they do cap your upside if the asset rallies strongly, so there’s a trade-off of limiting potential future gains in exchange for immediate income.)

-

Access for Institutional Players: The advent of regulated bitcoin options (e.g. CME options) has provided institutions a way to get exposure or hedge exposure to crypto in a familiar format, often without holding the underlying asset directly. Some large funds or traditional financial institutions that have mandates against holding actual crypto can use options and futures to participate indirectly. The growth in options open interest to record highs (nearly $50+ billion by mid-2025 across exchanges) suggests rising institutional involvement. Options allow these players to structure positions that align with risk management rules – for instance, an institution can buy protective puts on their bitcoin investments to limit downside risk to a known amount, which might be required by their risk committees.

-

Price Discovery and Market Sentiment: Options markets can also be insightful for gauging sentiment. The relative demand for calls vs. puts (often measured by metrics like the put/call ratio or the “skew” in implied volatility) gives clues about whether investors as a whole are leaning bullish or bearish. For example, if far more traders are buying puts (downside protection) than calls, it might signal caution or bearish sentiment. Conversely, heavy call buying might indicate bullish speculation is rampant. Additionally, large open interest at certain strike prices can act as magnets or resistance levels for the spot price as expiry approaches (a phenomenon traders watch known as “max pain” theory). In summary, options trading is not only a way to trade, but also provides data that reflect what the market expects about future volatility and price movements.

In essence, bitcoin options add a toolbox for crypto market participants: hedgers use them to protect against adverse moves; speculators use them to bet on moves with defined risk; and yield seekers use them to generate income. All of this contributes to a more mature market ecosystem. As crypto adoption accelerates, demand for such sophisticated tools is likely to continue growing – a trend Binance’s latest offering clearly aims to capitalize on.

How to Trade Bitcoin Options (Step-by-Step)

Trading bitcoin options might sound complex, but getting started can be straightforward if you follow a step-by-step process. Here’s a guide for beginners on how to begin trading BTC options, from choosing a platform to executing your first trade:

-

Pick a Reputable Options Trading Platform: The first step is to find an exchange or brokerage that offers bitcoin options. Not all crypto platforms have options trading, so you’ll need to seek out those that do. Major crypto exchanges known for BTC options include Deribit (a popular platform specializing in crypto options), Binance (for non-U.S. users), OKX, Bybit, and others. In the U.S., regulated options on bitcoin are available via the CME (through futures brokers) or on Bitcoin ETFs (like options on the BITO ETF), since direct crypto platforms are limited for U.S. residents. When choosing a platform, consider factors like security record, liquidity (trading volume and open interest in options), user interface, fees, and whether you can meet any eligibility requirements. For example, some exchanges might require you to pass a quiz or demonstrate understanding of derivatives before enabling options trading (Binance now does this for writing options) to ensure you know the risks.

-

Sign Up and Verify Your Account: Once you’ve chosen a platform, create an account. This usually involves providing an email and password, and then completing any required KYC (Know Your Customer) verification if applicable. Many regulated exchanges will require identity verification (ID upload, proof of address) before you can trade derivatives, in compliance with anti-money laundering rules. Make sure to secure your account with strong 2FA (two-factor authentication) since you’ll be trading valuable assets.

-

Fund Your Trading Account: After your account is set up, you need to deposit funds. Depending on the platform, you may deposit cryptocurrency (like USDT, USDC, BTC, etc.) or fiat currency (USD, EUR) to act as collateral for trading. Many crypto exchanges operate in crypto terms – for example, Deribit uses USD-denominated contracts but requires Bitcoin or Ethereum as collateral; Binance might allow USDT as collateral for options. Ensure you understand what currency your account needs. If you’re using a platform like CME via a broker, you’d deposit cash to your brokerage which then allows you to trade BTC options. On retail crypto platforms, often stablecoins like USDT are convenient to fund your account for options trading (as they’re used for settlement).

-

Navigate to the Options Trading Section: Inside the exchange’s interface, find the derivatives or options section. This might be under a separate tab or menu (sometimes labeled “Options” or under “Derivatives”). On Binance, for example, you’d navigate to the Options trading screen. On Deribit, you’d go to the Options order book for BTC. Familiarize yourself with the layout: you should see a list of available option contracts organized by expiry date and strike price. There’s usually an order book or pricing interface showing premiums for various strikes, often separated into Calls and Puts. Take a moment to understand how to read the option quotes – typically you’ll see the premium (price) and possibly implied volatility for each option.

-

Choose Your Option Contract: Decide on the specific option you want to trade, based on your strategy or market outlook. You’ll need to pick the expiration date, the strike price, and whether it’s a call or put. For example, you might choose a call option expiring in one month with a strike price of $35,000. Or a put option expiring this Friday with a strike of $28,000. Most trading interfaces have filters to narrow down by date and strike. A key consideration is your market view: if you’re bullish, you might buy calls (or sell puts); if bearish or seeking protection, you might buy puts; if aiming for income, you might sell calls against holdings, etc. Ensure you also consider the strike relative to current price – in the money, at the money, or out of the money – depending on how aggressive or conservative you want to be.

-

Examine the Premium and Greeks: Before executing, check how much premium you’ll pay or receive for that option. The platform will show a premium quote (often in BTC or in USD terms). This is the price per unit of the underlying (many exchanges use 1 BTC as the contract unit for simplicity). For instance, a quote might show a premium of 0.010 BTC for a certain option, meaning it costs 0.01 BTC (about 1% of BTC price) to buy one contract. Also be aware of contract size – some platforms use 1 BTC as one option contract, others might use e.g. 0.1 BTC per contract. Additionally, advanced traders will examine the “Greeks” (Delta, Theta, etc.) provided, which measure the option’s sensitivity to various factors. Delta tells you roughly how much the option’s price moves for a $1 move in BTC; Theta tells you how much value the option loses per day from time decay, etc. Beginners need not master these immediately, but it’s useful to note that a near ATM call might have a delta around 0.5 (behaving like half a BTC position) whereas a far OTM call might have a small delta (low probability of paying off).

-

Place Your Trade (Buy or Sell the Option): Now you’re ready to execute. If you’re buying an option (long call or long put), you will pay the premium (make sure you have enough balance). If you’re selling (writing) an option, you will receive the premium, but you must have sufficient collateral/margin to cover the position. Enter the order details: number of contracts, and the price. You can often choose a limit order (setting the premium you’re willing to pay/receive) or execute at the market price for immediate fill. Double-check everything – for a buy, confirm you’re buying the correct call or put, strike, expiry, and that the premium is acceptable. For a sell, ensure you understand the margin impact and have the asset to cover if it’s a covered call (or enough margin if it’s uncovered/naked). Submit the order and wait for it to fill. Once executed, you’ll see the open position in your account.

-

Monitor Your Position: After the trade, keep an eye on how your option is performing. Option prices will change as Bitcoin’s price moves, and as time to expiry counts down. Your exchange interface should show real-time unrealized P&L (profit or loss) for your option positions. Be aware of key moments like approaching expiration (options lose time value rapidly in the final week or days) and any major events (earnings in stock world, but in Bitcoin maybe macro events or ETF decisions) that could cause big volatility swings. Monitoring also means watching your margin if you sold options – if the market moves against a short option, you may need to add collateral to maintain the position.

-

Closing or Exercising the Option: Before or at expiry, you’ll choose how to conclude the trade. If you bought the option and it’s in profit, you have a few choices:

-

Sell the option back to the market to lock in gains (most common).

-

Hold to expiration and (for an ITM option) either exercise it to acquire/deliver BTC or take the cash settlement. Many retail traders simply sell the option before expiry to realize profit instead of dealing with exercise.

-

If the option is out-of-the-money and likely to expire worthless, you may just let it expire (your loss is limited to premium already paid). If you sold the option initially (wrote it), you can:

-

Buy back the option to close your short position (for instance, if you sold at 0.01 BTC and now it’s 0.005 BTC, you could buy it back cheaper and pocket the difference as profit).

-

Hold to expiry:

- If it expires out of the money, it expires worthless and you keep the full premium – best outcome for a writer.

- If it expires in the money, you will be assigned. That means if you sold a call, you’ll have to deliver BTC at the strike (or cash equivalent) to the option buyer; if you sold a put, you’ll have to buy BTC at the strike from the buyer. On many platforms, this is handled via your collateral (they’ll use your posted margin or holdings to settle). Make sure you’re prepared for that scenario.

Many traders new to options start by paper trading (using a testnet or demo account if available) or trading very small position sizes to learn the mechanics. This is highly recommended, as options have more variables to consider than spot trading, and the interface may seem complex at first.

Popular Bitcoin Options Trading Strategies

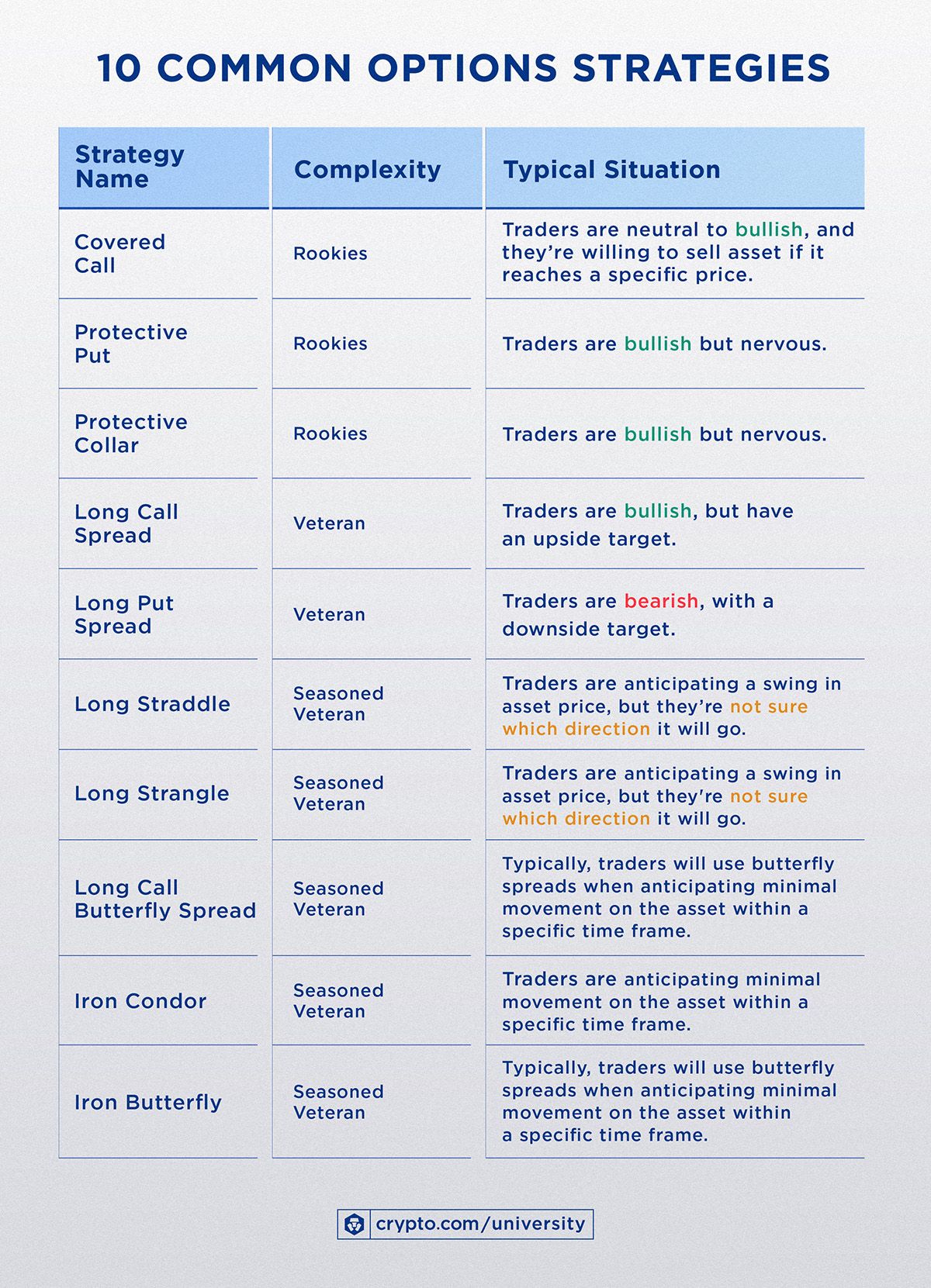

With an understanding of the basics, we can explore some popular strategies involving bitcoin options. Different strategies serve different goals – some aim to maximize profit under certain market conditions, others to protect investments or generate income. Below are a few of the most widely used and useful strategies for bitcoin options, along with how they work:

1. Covered Call (Writing Covered Calls on Bitcoin)

Goal: Generate income (premium) from your BTC holdings in neutral-to-moderately bullish market conditions.

Strategy Outline: In a covered call, you hold the underlying asset (Bitcoin) and simultaneously sell call options against those holdings. Because you own the BTC, your call option is “covered” – you can deliver the bitcoin if the call buyer exercises. This strategy lets you earn the call option premium as income, but in exchange, you agree to sell your BTC at the strike price if it rises beyond that.

How it works: Suppose you own 1 BTC currently worth $30,000. You think BTC will stay relatively flat or only rise modestly in the next month – say, under $35,000. You sell a one-month call option with a strike price of $35,000 for a premium of $500. Here are the possible outcomes:

- If by expiration BTC stays at $30K or only rises to (but not above) $35K, the call will expire out-of-the-money (since market ≤ strike). The buyer won’t exercise, and you keep your 1 BTC. You also keep the $500 premium as profit (minus any fees). Essentially, you earned $500 yield on your asset for that month, boosting your return.

- If BTC rallies above $35K – say to $38,000 – by expiration, the call will be in-the-money and the buyer will likely exercise. You are “called away” to sell your 1 BTC at $35,000 (below market price). You still keep the $500 premium, but you miss out on any upside beyond $35K. In this scenario, you effectively sold your BTC for an effective price of $35,500 (strike + premium) instead of $38,000 market, meaning $2,500 of “missed” upside. This is the trade-off: your profit was capped at the strike price (plus premium).

The covered call is considered a conservative strategy for holders. You only risk losing potential upside beyond the strike; you won’t lose on the BTC you already own unless its price falls (in which case the call premium at least gives a small buffer). It’s most effective when you expect sideways or slow-rising prices – you earn income and don’t think you’ll regret selling at the strike price. It’s not a good strategy if you expect a sharp rally (because then you’d rather not cap your gains). Many long-term investors systematically sell calls on a portion of their crypto to generate yield, especially in range-bound markets. Tools and platforms (like certain DeFi vaults or ETFs) have even emerged to automate covered call strategies on Bitcoin, highlighting its popularity. For example, early 2024 saw filings for a Bitcoin Covered Call ETF, signaling mainstream interest in this income strategy.

Risk: The main risk is opportunity cost – if Bitcoin shoots up past your strike, you’ll have to sell your coins at the strike price, sacrificing some gains. Also, if BTC plunges, the premium earned only slightly offsets your spot losses (you still keep the BTC, which is now worth less). So it doesn’t fully protect against downside; it just gives a small cushion (premium) and income when flat.

2. Protective Put (Buying Downside Protection)

Goal: Protect your BTC holdings from a significant drop in price (like an insurance policy), while retaining upside potential.

Strategy Outline: A protective put involves buying put options while holding the underlying BTC. If you own Bitcoin, you purchase a put option with a strike price near or below the current price, which gives you the right to sell your BTC at that strike. This acts as a floor – no matter how low the market goes, you can still sell at the strike (via the put). It’s essentially insurance against a crash.

How it works: Suppose BTC is $30,000 and you are worried about a short-term downside (perhaps due to an upcoming regulatory decision or bearish technical signals), but you don’t want to sell your BTC holdings. You buy a one-month put option with a strike of $28,000, paying a premium of, say, $500. Now consider outcomes by month-end:

- If BTC plummets to $20,000, your put option becomes very valuable. You have the right to still sell BTC at $28K. In practice, you could exercise the put and sell your 1 BTC for $28,000, far above the market price (or just sell the put contract itself for roughly $8,000 intrinsic value). This means your effective worst-case price for your BTC was $28K, protecting you from deeper losses – minus the $500 cost of the option. Instead of losing $10k (from $30K to $20K) on your holding, you only effectively lost $2k (from $30K down to the $28K insurance level, plus the $500 premium) because the put hedge compensated the rest. This illustrates how a protective put can hedge against crashes.

- If BTC’s price instead rises or stays flat (say ends at $32,000 or $30,000), the put expires worthless (it’s OTM since market > $28K). You wouldn’t use it, since you wouldn’t sell below market price. Your loss in that case is just the premium paid ($500), but your BTC is fine and even gained value if it went to $32K. So you participate fully in the upside (minus the small cost of the put).

In essence, a protective put locks in a worst-case selling price for your BTC, providing peace of mind. Many investors will buy puts ahead of potentially volatile events, akin to buying insurance ahead of a storm. This strategy is common in equities (investors hedging stock portfolios with index puts) and is gaining traction in crypto especially for institutions that need to limit downside risk.

Cost Consideration: Insurance is not free – the premium paid for protective puts can be significant if volatility is high. In very choppy markets, put options get expensive. Traders must decide if the cost is worth the protection. Sometimes they might buy slightly OTM puts (a bit below current price) as a compromise to reduce premium cost while still guarding against tail risk. Another approach to reduce cost is to implement a collar, described next.

3. Collar Strategy (Downside Protection with Upside Trade-off)

Goal: Hedge against a significant price drop at low or zero net cost, by giving up some potential upside beyond a chosen level.

Strategy Outline: A collar combines a protective put and a covered call: you buy a put option for downside protection and simultaneously sell a call option to finance that put. The call premium received helps offset the cost of the put. In effect, you create a band or “collar” around the current price – you’re protected below a certain price (the put strike) and you cap your gains above a certain price (the call strike).

How it works: Continuing the previous example, BTC at $30,000 – you want to insure below $28K but you don’t want to spend much on puts. You decide to sell a call at an upper strike to pay for it. For instance, you buy a $28,000 put (pay $500 premium) and simultaneously sell a $35,000 call (collect $500 premium) with the same expiration. The premiums roughly cancel, making it a zero-cost collar (or low-cost if not exact). Now:

- If BTC crashes to $20K, your put kicks in and protects you at $28K (you can sell at $28K). The call you sold will expire worthless (since market well below $35K), so you keep that premium. You effectively hedged the downside very cheaply. This is great – you largely sidestepped the crash, aside from any small net premium difference.

- If BTC stays in a middle range (between $28K and $35K) until expiry, both options expire worthless. You keep your BTC (which might be roughly same value) and likely paid very little for the collar. No harm, no foul – aside from opportunity cost if BTC did go up a bit and you had no upside cap because it didn’t breach $35K anyway.

- If BTC rallies above $35K, say to $40K, the call you sold is ITM. You’ll be obligated to sell your BTC at $35,000 (or settle the difference) due to the call, even though market is $40K. So you miss out on the gain above $35K. Essentially, you locked your max selling price at $35K. However, remember you had the downside put, so what the collar achieved was: you gave up upside beyond $35K in order to have protection below $28K. You’ve defined an acceptable range for your returns: you will sell no lower than $28K (floor) and no higher than $35K (ceiling), at least for that time period. The trade was “free” in terms of premium outlay, since call and put premiums offset.

A collar is a cautiously bullish strategy – you’re bullish enough to hold the asset (you expect some upside), but you want to guard against a crash, and you’re willing to cap extreme upside in exchange for that protection. Investors who “want to sleep at night” employ collars, knowing they have a worst-case and best-case defined. Jack Ablin, a $65B fund CIO, recently highlighted the collar as a way to “tiptoe into bitcoin without...getting your head handed to you” – i.e., you can get exposure to BTC’s upside while drastically limiting downside risk.

This strategy tends to be popular when volatility is high (making protective puts costly) but there’s also optimism (investors willing to sacrifice some upside). Note that you can adjust the strikes as needed – a tighter collar (closer strikes) might even yield a net credit, or a looser one might cost a bit. It’s all about trade-offs between insurance cost and giving away gains.

4. Long Straddle (Betting on Volatility)

Goal: Profit from a large price move in either direction (high volatility play), when you expect big movement but are unsure of direction.

Strategy Outline: A long straddle involves buying a call and a put at the same strike price and expiration, typically at-the-money. Because you hold both a call and put, a significant move either up or down can make one of them very profitable, ideally enough to cover the cost of both premiums and then some. This strategy is direction-neutral but volatility-positive: you want a big swing.

How it works: Say BTC is around $30,000 and a major event (for example, a SEC decision on a Bitcoin ETF or a macroeconomic announcement) is coming up that you expect will jolt the market, but you aren’t sure if it’ll break bullish or bearish. You buy a 1-month $30,000 call and a $30,000 put. Imagine each costs $1,000 in premium. Your total outlay is $2,000. Now:

- If BTC rockets to $40,000 well before or by expiration (+33% move), the call option goes deep in the money. It would be worth about $10,000 intrinsic (since it gives right to buy at $30K when market is $40K). The put would expire worthless, but that’s fine – your call’s value far exceeds the combined premium cost. You could sell the call for a big profit. So a strong rally yields gains.

- If BTC instead plunges to $20,000 (–33%), the put option becomes valuable (worth about $10,000 intrinsic, right to sell at $30K vs market $20K). The call expires worthless. Again, the gain on the put minus the initial cost leads to a healthy profit.

- If BTC barely moves, say ends around $31K or $29K (small +/-), both call and put will lose value (the call slightly ITM or OTM, the put slightly OTM or ITM but by tiny amount). Likely both might expire near worthless if the move is minimal. Then you lose most of the $2,000 combined premium. That’s the risk – if volatility turns out lower than expected, a straddle loses money on both legs.

The straddle is an attractive strategy before known binary events or when implied volatility is perceived as underpriced relative to future reality. Crypto markets often see big moves on news (e.g., ETF approvals, halving events, regulatory crackdowns), so traders sometimes position with straddles to profit from the anticipated volatility. It is important, however, to consider the cost: you need a move big enough to cover the premiums. In the example, any final price outside the range $28K–$32K (roughly) by expiry would start yielding profit beyond cost. Inside that band, the strategy loses money.

Variations include the strangle, where you buy an out-of-the-money call and an out-of-the-money put (different strikes, e.g. a $32K call and $28K put). That reduces cost since OTM options are cheaper, but requires an even larger move to hit payoff (because the options start out OTM). Traders choose based on how large a move they expect and how much they want to spend.

5. Bull Call Spread (Moderate Bullish Spread)

Goal: Benefit from a modest rise in BTC’s price with limited risk and limited upside, making the trade cheaper than a straight call.

Strategy Outline: A bull call spread involves buying a call option at a lower strike and selling another call at a higher strike (same expiration). Both are calls, so it’s a net bullish position, but selling the higher strike call caps your maximum gain while reducing the net cost of the strategy. This is a vertical spread commonly used to express a bullish view in a cost-efficient way.

How it works: Suppose BTC is $30K and you think it could rise to around $35K in the next month, but probably not beyond $40K. A straightforward call option at $30K might be expensive, so you set up a bull call spread. You buy a 1-month $30,000 call for $1,200 and simultaneously sell a $35,000 call for $400 (just as an example prices). The net cost is $800. The payoff scenario at expiration:

- If BTC indeed rises into your target range, say finishes at $36K, what happens? Your long $30K call is worth $6,000 intrinsic (right to buy at 30K and sell at 36K), and your short $35K call is worth $1,000 intrinsic (because the buyer of that call can buy from you at 35K and it’s 36K market). Net payoff = $5,000 (6k – 1k). Subtract the $800 cost, you have $4,200 profit.

- The max profit occurs if BTC is at or above the higher strike ($35K) at expiry. In that case, your $30K call is fully ITM and your $35K call is also ITM and will be exercised. Effectively, you bought at $30K and have to sell at $35K due to the short call, netting $5,000 gain per BTC. So $5,000 is the maximum spread between strikes you can capture. In our example, $5k minus $800 cost = $4,200 max profit. This happens at any final price $35K or above – beyond $35K, you don’t gain more because any extra profit on the long call is exactly offset by losses on the short call.

- If BTC instead fails to rally and stays below $30K, both calls expire worthless. You lose the $800 net premium – that’s your max loss, considerably less than if you had just bought a call for $1,200 outright.

- If BTC goes up modestly, e.g., to $33K, the $30K call has $3K value, the $35K call expires worthless (OTM). You could profit: $3k – $0 minus $800 cost = $2,200 gain.

- The breakeven point here would be somewhere around $30,800 (lower strike + net cost) in price at expiration.

The bull call spread is thus a risk-managed bullish play. You’re trading off unlimited upside for a higher probability of a decent return at lower cost. This strategy is popular if you have a specific target price or range in mind. It’s also useful when implied volatility is high (making outright calls pricey) – by selling one call, you offset some cost. A similar concept on the bearish side is the bear put spread: buy a higher-strike put, sell a lower-strike put to bet on a moderate decline with limited risk.

6. Iron Condor (Advanced Range-Bound Strategy)

Goal: Earn income by selling volatility when you expect Bitcoin’s price to stay within a certain range, with limited risk on both sides.

Strategy Outline: An iron condor is a combination of two spreads: you sell an out-of-the-money call and an out-of-the-money put (forming a short strangle), and simultaneously buy a further OTM call and put for protection. It consists of four legs: sell 1 OTM call, buy 1 higher strike call (to cap risk), sell 1 OTM put, buy 1 lower strike put (to cap risk). The result is you receive net premium upfront, and you have defined maximum loss. You profit most if Bitcoin’s price remains between the short strikes (so both the short put and short call expire worthless), letting you keep the premiums.

How it works: Suppose BTC is around $30K, and you believe in the next month it will trade sideways between $25K and $35K (no major breakout). You construct an iron condor:

- Sell a $35K call, buy a $40K call (this is a short call spread).

- Sell a $25K put, buy a $20K put (this is a short put spread). Assume you collect $300 for the short call, $200 for the short put, and pay $100 each for the long call and long put for insurance. Net credit = $300+$200–$100–$100 = $300 received.

Now your critical zones:

- Profit zone: roughly between $25K and $35K at expiration (the short strikes). If BTC stays in this range, both the short put and short call expire out-of-the-money. You keep the $300 premium entirely as profit, and the long options you bought expire worthless (which is fine, they were just insurance).

- If BTC crashes below $25K: The short put becomes in-the-money. But thanks to the long $20K put you bought, your downside loss is limited. Essentially below $20K, both puts are ITM but the difference is capped. Your maximum loss on the put side is the difference between strikes (25K–20K = $5K) minus the net premium received. Using smaller numbers relative to premium: say you had a structure so max loss is $500, minus the $300 credit = $200 net max loss on that side. Similarly on the upside…

- If BTC blasts above $35K: The short call is ITM, but the long $40K call limits your loss above $40K. So the max loss on the call spread side is (40K–35K difference) minus the premium. Again limited.

- Worst-case scenarios: The max loss occurs if BTC is beyond either of the long strikes (below $20K or above $40K in this hypothetical) at expiry, where one of your spreads is fully ITM. Your loss would be the width of that spread minus the initial credit. In exchange for taking that risk, you got $300 upfront.

In summary, the iron condor yields a steady (but relatively limited) profit if the market stays in a comfortable range, and it has built-in insurance to prevent catastrophic loss if the market moves too far beyond that range. Traders like iron condors in low-volatility, range-bound markets to systematically earn premiums. It’s considered an advanced strategy because it involves four options and careful risk management. Crypto being volatile means iron condors can be risky if misjudged – sudden breakouts can hit both sides. However, the defined-risk nature (it’s essentially two covered spreads) is safer than a naked short strangle (selling call and put without hedges), which has unlimited risk.

Risks and Considerations in Bitcoin Options Trading

While bitcoin options open up many opportunities, they also come with significant risks. It’s crucial to approach options trading with caution and knowledge. Here are some key risks and considerations:

-

Higher Risk than Spot Trading: Trading options is generally riskier and more complex than trading bitcoin on the spot market. With spot Bitcoin, if the price goes down, you lose value, but you’ll never lose more than you invested (and you can just hold the BTC hoping it rebounds). With options, particularly if you are writing (selling) options or using leverage, you can incur large losses quickly if the market moves against your position. For example, an uncovered call you sold can in theory have unlimited loss if BTC’s price keeps rising. Although buying options has limited loss, the probability of losing your entire premium is not small if the strike isn’t reached. Never trade options with money you can’t afford to lose, especially since they can expire worthless.

-

Options Can Expire Worthless: Unlike holding BTC which has no expiry date, options expire. If your directional thesis doesn’t play out by that deadline, the option may become worthless overnight. Timing is critical – you might be right that “Bitcoin will go up,” but if it goes up a week after your option expired, your trade could still fail. This adds a layer of time risk absent in spot trading. Many new options traders underestimate how much of a jump in price is needed just to break even on an option due to the premium paid. Always factor in the break-even point (strike ± premium) and the time remaining for your scenario to unfold.

-

Complex Pricing and The Greeks: Options prices are affected by more than just the underlying’s price movement. Several key factors (“the Greeks”) affect option value: time decay (Theta), volatility (Vega), delta (sensitivity to underlying price), gamma (curvature of delta), etc. For instance, an option can lose value even if Bitcoin’s price moves in the right direction, if that move happens too slowly and time decay erodes the premium, or if volatility drops. This complexity means option P&L isn’t as straightforward as spot P&L. It’s important to at least conceptually understand these factors:

- Theta (time decay): Each day an option loses some value if other factors remain the same, especially as expiry nears. Options are wasting assets. As a buyer, you’re racing against the clock.

- Vega (volatility): If market volatility decreases after you buy an option, that option’s premium might drop even if BTC’s price hasn’t moved, because a calmer outlook makes the option less expensive. Conversely, high volatility inflates premiums.

- Delta: Deep OTM options have low delta (small immediate sensitivity), ITM options have high delta (like holding the asset), ATM ~0.5.

- Gamma: Risk for option sellers is gamma – as underlying moves, delta changes, which can amplify losses for a seller. A sudden surge can turn a seemingly safe short option position into a deep ITM obligation.

You don’t need to be a mathematician, but appreciate that options don’t move one-for-one with the asset, and their value behavior can sometimes surprise you if you’re only thinking in terms of underlying price.

-

Liquidity and Market Structure: The bitcoin options market, while much larger now than a few years ago, is still relatively young and not as liquid as traditional markets. Most trading volume is concentrated on a few platforms (Deribit historically, now growing on CME, OKX, Binance, etc.). This can mean wider bid-ask spreads and less depth, especially for longer-dated options or far OTM strikes. Illiquidity can make entering or exiting positions costly. Slippage (the difference between expected price and execution price) is a risk. Additionally, outside of major strikes and near expiries, it might be hard to find a counterparty without moving the price. Stick to more liquid expiries (monthly, quarterly) and common strike intervals when starting out.

-

Exchange and Counterparty Risk: When trading on crypto exchanges, remember you often have to trust the platform with your funds (unless using a decentralized options protocol). There is risk of exchange hacks, insolvency, or technical failure. For example, some derivatives exchanges have had system overloads during volatile periods, which could prevent you from managing your options position (a frightening scenario if you needed to cut losses). Using reputable exchanges with strong security track records and insurance funds is important. Even so, don’t put all your capital on any single platform.

-

Margin and Liquidation Risk: If you are writing options, the exchange will require margin. Those requirements can change dynamically if the position moves against you. If Bitcoin’s price swings wildly, your short option could accrue losses and the platform may require additional margin; if you don’t have enough, your position could be liquidated (automatically closed) at a very unfavorable price, potentially locking in a large loss. Ensure you understand an exchange’s margining system for options. Some use portfolio margin that considers hedges, but others might be simplistic. Maintain a cushion of extra collateral and use stop-losses or adjustments to avoid liquidation. Naked options selling (unhedged calls or puts) is particularly risky – it’s akin to picking up pennies in front of a steamroller if not managed well.

-

Regulatory and Tax Considerations: Depending on your jurisdiction, trading derivatives like options may be restricted or require certain qualifications. The regulatory environment for crypto derivatives is evolving. For example, Binance and others have country-specific limitations; U.S. residents largely cannot use offshore crypto options platforms legally and must stick to regulated venues like CME or certain brokerages. Ensure you’re complying with your local laws. Additionally, options trading can have complex tax implications (e.g., in some places, options might be taxed differently or trigger taxable events when exercised/expired). Keep records of your trades for accounting purposes.

-

Education and Strategy: Finally, lack of understanding is itself a risk. Options are often described as non-linear instruments – they behave in ways new traders might not expect. Before diving in with large trades, invest in education. There are many resources on options trading (books, articles, even testnets). Practice different scenarios. It’s also wise to start with simpler strategies (like buying a call or put, or doing a basic covered call) before attempting multi-leg spreads or short option strategies. As the saying goes, don’t run before you can walk. The good news is resources are expanding – even Binance, for instance, mandates a suitability quiz to ensure users know what they’re doing before writing options.

In summary, bitcoin options offer powerful capabilities but demand respect for the risks involved. Always size your positions appropriately relative to your total portfolio (options can be volatile; huge gains and losses are both possible). Use the tools available: set stop-loss orders for directional option trades if possible, monitor Greeks for sensitivity, and consider risk-management strategies like spreads instead of naked positions to cap potential losses. Over time, as you gain experience, you can cautiously increase complexity and size. Options trading can be very rewarding for the informed trader, but very punishing for the careless.

Final thoughts

Bitcoin options have emerged from niche beginnings into a significant facet of the crypto markets – providing traders and investors with new ways to speculate, hedge, and earn income. Binance’s decision to open up option-writing to all users is a testament to how far the market has matured: tools once reserved for Wall Street or veteran traders are increasingly accessible to retail crypto enthusiasts. With trading volumes surging multi-thousand-percent in a few years, options are here to stay as a core part of the cryptocurrency trading ecosystem.

In this guide, we covered the essentials of what bitcoin options are and how they work, from the basic right-to-buy (call) and right-to-sell (put) concepts to the more intricate details of option pricing and expiration. We explored the motivations for using options – whether it’s hedging risk, leveraging a position, or earning yield – and walked through the practical steps of placing an options trade on a platform. We also delved into several popular strategies: from straightforward covered calls and protective puts to spreads and volatility plays, each with its role in a trader’s playbook.

For a general crypto-savvy audience, the key takeaway is that options can significantly enhance how you manage and profit from your crypto investments. They allow for flexibility: you’re no longer limited to profiting only when prices go up – you can benefit from downward moves with puts, or even from mere volatility with straddles, or from stagnation with premium-selling strategies. Additionally, options can introduce a measure of safety (paradoxical as it sounds) when used for hedging – e.g., a well-placed protective put can save you from disastrous losses in a market crash.

However, with great power comes great responsibility. The complexity and leverage inherent in options mean education and caution are paramount. If you’re new to options, start small and simple. Perhaps begin by buying an option or two to get a feel for how their prices move relative to the underlying Bitcoin price. Writing (selling) options, as Binance now enables broadly, can be tempting for the income it offers, but remember that selling options carries obligation and potentially unlimited risk. Ensure you fully grasp scenarios of what could happen if the market swings hard.

It’s encouraging that major exchanges like Binance are incorporating risk controls (quizzes, margin safeguards) – use those resources and test your understanding. The world of options has its own language (calls, puts, strikes, greeks, condors!) and it can feel intimidating. But many traders find that once the lightbulb goes off, options become an indispensable tool for navigating the crypto seas – allowing profits during calm and storm alike, and protection when needed.

As the crypto market continues to evolve, we may see even more sophisticated derivative products and perhaps greater regulatory clarity that invites wider participation. The trend so far is clear: both retail and institutions are embracing crypto options, driving record open interest and even new ETFs based on options strategies. For those willing to put in the effort to learn, bitcoin options offer a new frontier of opportunity in digital asset trading.

In conclusion, bitcoin options can significantly maximize gains and manage risks when used knowledgeably. They add a layer of strategy that goes beyond simply “HODL” or “buy low, sell high.” Whether you want to lock in a price for the future, insure your holdings, bet on a hunch with limited downside, or earn a steady yield on your crypto – there’s likely an options strategy suited for that purpose. Just step carefully, respect the risks, and continuously refine your understanding. With practice and prudence, bitcoin options could become a powerful ally in your crypto trading journey, empowering you to navigate markets with greater versatility and confidence.