Three years ago, crypto lending was a smoking crater. Celsius Network owed $4.7 billion to over 100,000 creditors. Voyager Digital collapsed with users expected to recover just 35% of their deposits. BlockFi filed for bankruptcy with liabilities between $1 billion and $10 billion. Genesis owed $3.5 billion to its 50 largest creditors.

The dominoes fell with terrifying speed: Three Arrows Capital's failure triggered losses for Voyager, Celsius, BlockFi, and Genesis, which all had significant exposure to the crypto hedge fund.

The crisis exposed fundamental flaws that turned lenders into Ponzi-like operations. Rehypothecation practices created complex webs of interdependencies, where client collateral was reused multiple times across different lenders. Undercollateralized loans to entities like Three Arrows Capital left platforms with $40 million to over $1 billion in claims when those borrowers defaulted. When Terra's algorithmic stablecoin UST collapsed in May 2022, roughly $40 billion in market value evaporated, setting off a cascade that exposed the fragility beneath crypto credit's promise of double-digit yields.

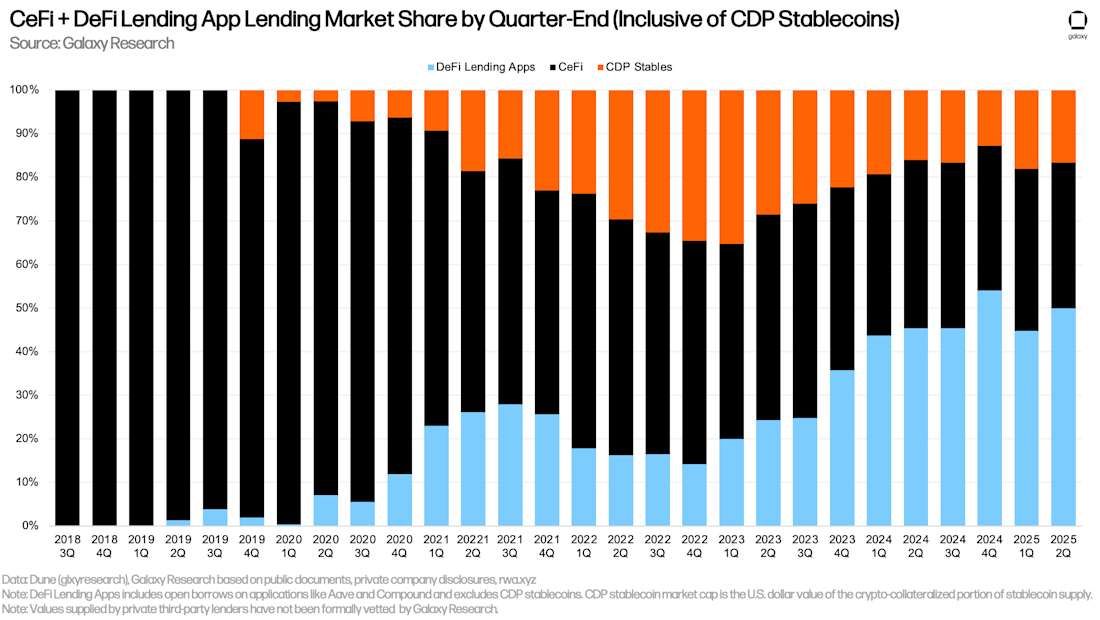

Fast forward to late 2025, and the landscape looks starkly different. The total crypto lending market stands at $53.09 billion as of Q2 2025, representing a 27.44% increase from Q1. Yet this headline figure masks a profound structural transformation. The market has bifurcated into two distinct ecosystems, each following dramatically different paths to recovery.

On the centralized finance side, CeFi lending reached $17.78 billion in outstanding loans by Q2 2025, growing 14.66% quarter-over-quarter. But this growth is concentrated in remarkably few hands. Tether controls 57% of the CeFi market with $10.14 billion in loans, followed by Nexo at 11% and Galaxy Digital at 6.23%. Together, these three firms account for 74.26% of all CeFi lending, creating an oligopoly where systemic risk hasn't disappeared — it's simply been redistributed among fewer players.

Meanwhile, decentralized finance has staged a remarkable comeback that outpaces its centralized counterpart. DeFi lending hit $26.47 billion in active loans by Q2 2025, growing 42% quarter-over-quarter and capturing 59.83% of the lending market. In August 2025, Aave reached $3 trillion in cumulative deposits, with $29 billion in active loans and over $40 billion in total value locked. The protocol's TVL grew 25.7% in a single month, while active loans increased 38%.

This divergence speaks to the fundamental question that haunts crypto lending in 2025: Can centralized platforms build safeguards robust enough to prevent another collapse? Can decentralized protocols maintain their transparency advantage while scaling to institutional demands? And critically, have we learned enough from 2022's catastrophe to prevent history from repeating?

The answers remain uncomfortably ambiguous. CeFi lending still operates with limited transparency, where rehypothecation practices persist despite stronger risk management rhetoric. DeFi's overcollateralization model and on-chain transparency have attracted institutional capital, but smart contract risks and regulatory uncertainty continue to challenge mainstream adoption. Institutions navigate this landscape seeking the operational familiarity of CeFi while recognizing DeFi's superior auditability.

Galaxy Research projects Bitcoin-backed lending alone could grow from $20-25 billion today to $200 billion in the coming years. MiCA regulations in Europe are reshaping institutional participation, with crypto lending platforms seeing 22% user growth under the new framework. Yet beneath these growth figures lies a market still grappling with trust deficits, structural vulnerabilities, and the memory of billions lost.

Below we dive deep into crypto lending's 2025 reality: a sector reborn but not yet reformed, growing but not yet trustworthy, innovative but not yet safe. Through analysis of market data, regulatory developments, platform structures, and industry evolution, we explore whether crypto credit can finally mature beyond its speculative origins — or whether the next crisis is already forming beneath the surface of apparent recovery.

The Rebound — How Crypto Lending Survived Itself

The recovery trajectory from crypto lending's 2022 nadir reveals a market that survived through painful consolidation rather than systemic reform. At the bear market bottom in Q3 2023, CeFi lending had plummeted to just $6.4 billion, an 82% collapse from its Q1 2022 peak of $34.8 billion. DeFi borrowing had similarly cratered to $1.8 billion in Q4 2022, down from highs exceeding $20 billion.

By Q4 2024, CeFi lending had recovered to $11.2 billion, representing a 73% increase from the trough but still 68% below pre-crisis levels. The modest recovery belies the sector's fundamental transformation. The surviving lenders didn't rebuild the same model — they concentrated it. By the end of 2024, Tether held approximately 73% of the CeFi market with $8.2 billion in loans, dwarfing competitors and creating an unprecedented level of market concentration.

The Q1 2025 pause proved temporary. Total crypto-collateralized lending fell 4.9% to $39.07 billion, the first quarterly decline since late 2023. But this proved to be consolidation before acceleration. By Q2 2025, the market exploded to $53.09 billion, with CeFi growing to $17.78 billion and DeFi surging to $26.47 billion.

The recovery's drivers illuminate the changing nature of crypto credit. Galaxy Research identified the reflexive relationship between price increases and lending activity as a primary growth factor. As Bitcoin and Ethereum prices rallied through 2024 and 2025, borrowers could leverage their holdings while maintaining healthier loan-to-value ratios. The value of cryptocurrencies increased significantly during Q2 2025, contributing directly to the general rise in dollar value of crypto loans beyond mere volume growth.

Institutional reentry accelerated the rebound. Institutional participants now account for 52% of crypto lending activity in the EU, up sharply from 26% in 2024. Nasdaq-listed BTCS uses Aave to generate yield on Ethereum holdings, while $6.4 billion of Ethena's USDe stablecoin and related assets are deposited on the platform. This institutional adoption isn't driven by risk appetite — it reflects regulatory clarity and operational maturity that makes crypto credit viable for treasury management and capital deployment.

MiCA implementation has restructured European lending markets. Crypto lending platforms in the EU now hold $275 billion, a 22% rise from 2024. Collateralized lending now comprises 95% of the EU market as unsecured crypto loans dropped 75% under tougher risk rules. Regulated platforms now process 87% of crypto loans in the EU, up from just 55% before MiCA. The regulatory framework has effectively killed undercollateralized retail lending in Europe while enabling institutional participation through clearer legal structures.

The recovery's most significant development is DeFi's ascendance. DeFi protocols saw a 959% increase in lending activity from their 2022 lows. Aave commands 60-62% of the DeFi lending market in 2025, making it not just the largest DeFi protocol but comparable to the 37th-54th largest U.S. commercial banks by deposits.

Aave's cumulative $3 trillion deposit milestone represents more than market share — it signals institutional validation of transparent, programmatic lending. The protocol is available across 11+ blockchain networks, offering advanced features like flash loans, rate switching, and credit delegation that have no CeFi equivalent. Aave founder Stani Kulechov projects the platform could reach $100 billion in net deposits by year-end, positioning it among the world's 35 largest banks.

Tokenized real-world assets are creating a bridge between TradFi and DeFi credit. RWA markets have grown to $25-27.8 billion by 2025, with tokenized private credit representing $15.9 billion and US Treasuries $7.4 billion. Maple Finance manages over $4 billion in assets, focusing exclusively on institutional lending with native Bitcoin collateral. The company aims to grow its AUM by 25% to $5 billion by year-end.

Morpho launched V2 in June 2025, delivering market-driven fixed-rate, fixed-term loans with customizable terms previously unseen in DeFi. Compound maintains approximately $3 billion in TVL, having pioneered many fundamental DeFi lending concepts during "DeFi Summer" in 2020.

The recovery's scale masks its fragility. Total crypto lending remains 43% below its 2021 peak of $64.4 billion. CeFi lending is still 68% below its historical high, and the concentration among three dominant players creates single points of failure that could trigger contagion if any major lender faces stress. The permissionless nature and transparent loan books of DeFi protocols provided competitive advantages during the recovery, but they don't eliminate smart contract risk or regulatory uncertainty.

The question isn't whether crypto lending has recovered — the numbers prove it has. The question is whether this recovery represents genuine structural improvement or simply a market cycle trough finding its next peak before the inevitable correction. The answer lies in examining what changed beneath the headline figures.

The CeFi Rebuild — Fewer, Stricter, But Still Opaque

Centralized finance lending in 2025 operates under the paradox of appearing stronger while remaining structurally vulnerable. The three largest CeFi lenders — Tether, Nexo, and Galaxy Digital — control 74.26% of the market, creating a concentration that industry watchers describe using the Herfindahl-Hirschman Index (HHI), a measure of market power. With Tether alone commanding 57% market share, rough HHI calculations suggest values around 3,450-3,500, well into the "highly concentrated" range that raises antitrust concerns in traditional markets.

This consolidation emerged from necessity rather than design. Celsius, Voyager, BlockFi, and Genesis — once the sector's titans — all filed for bankruptcy between June and November 2022. FTX's collapse in November 2022 added another $6.4-8.9 billion in customer losses. The survivors didn't just outlast competitors — they absorbed their market share while those platforms liquidated through Chapter 11 proceedings.

Tether's dominance warrants particular scrutiny. The stablecoin issuer disclosed $5.5 billion in loans in its Q2 2025 attestation, though Galaxy Research tracks its outstanding loans at $10.14 billion as of June 30, 2025. This discrepancy highlights the opacity challenges that persist in CeFi lending. Tether reported talking with one of the Big Four accounting firms about a reserves audit in March 2025, though no timeline for completion was provided.

Galaxy Digital operates one of the largest active loan books in the industry, self-identifying as such while providing limited public disclosure about lending practices. The firm had $1.11 billion in outstanding loans as of Q2 2025, positioning it as the third-largest CeFi lender despite holding just 6.23% market share — a testament to how drastically the sector has contracted.

Nexo, which began operations in 2018 and currently serves only non-U.S. clients, recently announced plans to re-enter the U.S. market. The platform held $1.96 billion in outstanding loans as of Q2 2025, capturing 11% market share. Nexo operates a crypto-backed line of credit model with rates determined by a Loyalty Tier system, where Base Tier users pay 18.9% APR with no NEXO token holdings required.

The concentration creates systemic vulnerabilities that regulation has failed to address. Many CeFi platforms "still fail to disclose critical details about their rehypothecation policies", leaving clients uncertain about asset status. Rehypothecation — the reuse of client collateral — remains widespread despite its role in the 2022 collapse. Platforms like Nexo, Salt Lending, Strike, and Ledn openly state they may reuse deposited assets.

Ledn offers two loan types: a standard loan at 10.4% APR with rehypothecation, and a custodied loan at 11.4% APR where Bitcoin collateral is held without rehypothecation. The 1% rate premium for non-rehypothecation illustrates the profitability of reusing client assets. Both loan types offer up to 50% LTV with monthly interest-only payments.

A small cohort of lenders has explicitly rejected rehypothecation. CoinRabbit, founded in 2020, emphasizes that "the absence of rehypothecation is vital for the entire market" through its CMO Irene Afanaseva, stating "user assets must remain secure". The platform processes loans in approximately 10 minutes, accepts over 300 cryptocurrencies as collateral, offers LTV ratios up to 90%, and maintains funds in cold wallets with multisig access.

Unchained Capital specializes in Bitcoin-backed loans with no rehypothecation, offering loans up to $1 million with collateral stored in multisig vaults. Arch Lending supports BTC, ETH, and SOL with fixed terms up to 24 months, charging 9.5% APR with a 1.5% origination fee and 2% partial liquidation fee, and explicitly states no rehypothecation with collateral held by qualified custodians.

The challenge remains that transparency about rehypothecation doesn't eliminate its risks. Even with lower LTV ratios and term sheets prohibiting rehypothecation, sudden Bitcoin price swings can still put lending models under stress. Bitcoin frequently moved 5% in a day in early 2025 amid global trade tensions, even dipping to $77,000 in March.

CeFi's appeal to institutions persists despite these vulnerabilities. Institutions prefer CeFi for regulatory clarity, flexible structures, human counterparties, and custodial assurances. Most large institutional borrowers continue to favor CeFi venues over DeFi for structural reasons: legal agreements versus smart contracts, fixed-rate fixed-term loans versus floating rates, and human interface for relationship management.

Qualified custodians like BitGo, Fireblocks, and Zodia Custody provide institutional-grade asset protection that creates comfort for regulated entities. Maple Finance integrates with all the qualified custodians that institutions already use, accepting native Bitcoin collateral and offering proactive risk management with 24-hour response windows for margin calls.

Yet this institutional preference hasn't translated to transparency. Galaxy Research noted that private desks, OTC platforms, and offshore credit providers likely push the actual CeFi total far higher, perhaps by 50% or more. A narrow set of public disclosures limits visibility into the true scope of centralized lending.

The rebuild has created a CeFi sector that is leaner but not necessarily safer. Fewer lenders means less systemic redundancy. If a single large lender repeats Celsius's mistakes, the fallout could be worse this time — there are fewer competitors left to absorb the shock. The oligopoly structure concentrates both market power and systemic risk in ways that serve institutional convenience while maintaining the opacity that enabled the 2022 collapse.

DeFi Dominance — Transparency and Automation Win Trust

Decentralized finance lending's resurgence represents more than market recovery — it signals a fundamental validation of programmatic transparency over institutional promises. DeFi's 59.83% market share in Q2 2025 didn't emerge from better marketing or higher yields. It came from the one advantage CeFi cannot replicate: every loan, every liquidation, and every reserve ratio exists on-chain for anyone to audit in real-time.

Aave's dominance exemplifies this shift. By August 2025, the protocol had reached $3 trillion in cumulative deposits, with $29 billion in active loans and $40 billion in TVL. These aren't private disclosures or quarterly reports — they're immutable on-chain records that update every 12 seconds with each Ethereum block. The protocol's TVL grew 25.7% in a single month, with active loans increasing 38%.

This transparency extends to liquidation mechanics. When collateral values drop, DeFi protocols execute automated liquidations based on pre-programmed thresholds rather than human discretion. Liquidation rates on lending platforms fell 24% under MiCA's stricter rules as improved risk controls prevented cascading margin calls. Users can monitor their positions constantly and receive warnings before liquidation triggers, eliminating the surprise freezes that characterized Celsius and Voyager's final days.

Aave's multi-chain expansion across 11+ blockchain networks demonstrates how permissionless protocols scale without accumulating counterparty risk. The platform operates on Ethereum, Polygon, Arbitrum, Optimism, and seven other chains, with each deployment backed by the same transparent smart contracts. A single MEV bot processed $7.3 billion in borrowing activity on Aave V3 using block-level interest calculation mechanisms, illustrating the sophisticated strategies now operating on DeFi infrastructure.

Institutional adoption has followed transparency. Nasdaq-listed BTCS uses Aave to generate yield on Ethereum holdings. $6.4 billion of Ethena's USDe stablecoin and related assets are deposited on the platform. These aren't retail speculators chasing yields — they're regulated entities deploying capital into protocols where every transaction is auditable and collateral ratios are programmatically enforced.

Compound maintains approximately $3 billion in TVL despite facing competition from newer protocols. Launched in 2018, Compound pioneered algorithmic DeFi lending and famously sparked "DeFi Summer" in 2020 with its COMP token distribution. The platform now offers Layer-2 integration on Arbitrum and Optimism, lowering gas fees while maintaining the transparent lending model that became its trademark.

Morpho's June 2025 launch of V2 brought institutional-grade features to DeFi. The upgrade introduced market-driven fixed-rate, fixed-term loans with customizable terms, addressing one of CeFi's core advantages. Morpho V2 supports single assets, multiple assets, or entire portfolios as collateral, including RWAs and niche assets. The intent-based model lets lenders and borrowers express exactly what they want, and the system finds the best match.

Real-world asset integration is transforming DeFi's collateral base. RWA markets have grown to $27.8 billion by 2025, with tokenized private credit representing $15.9 billion and US Treasuries $7.4 billion. DeFi lending protocols rose 72% year-to-date in 2025, from $53 billion to over $127 billion in cumulative TVL, driven by accelerated institutional adoption of stablecoins and tokenized RWAs.

Maple Finance exemplifies the institutional DeFi model. Managing over $4 billion in assets, the protocol focuses exclusively on institutions rather than retail customers. Maple accepts native Bitcoin collateral and integrates with all qualified custodians that institutions already use. The company aims to grow its AUM by 25% to $5 billion by year-end.

Maple's syrupUSDC product has exceeded $100 million in supply as a permissionless yield product. Anyone can deposit USDC and earn yield, while borrowers remain gated through institutional onboarding. All loans remain overcollateralized, executed on-chain, and custodied with partners like Anchorage and BitGo. Maple seeded a $10 million Uniswap pool in February 2025 for syrupUSDC, enabling instant liquidity and composability with protocols like Pendle and Morpho.

Ondo Finance's tokenized US Treasuries and Centrifuge's business receivables demonstrate how DeFi can access traditional credit markets while maintaining on-chain transparency. Centrifuge allows users to tokenize real-world assets and use them as collateral for DeFi lending, bringing business invoices and trade finance onto blockchain rails.

The transparency advantage extends to governance. Aave's governance model enables token holders to lead innovation, allowing the protocol to adapt to market needs through community decisions rather than executive fiat. AAVE token holders vote on protocol changes, including interest rate models, collateral types, and risk parameters. This decentralized governance creates resilience — there's no CEO to arrest, no board to capture, no single entity to regulate out of existence.

Yet DeFi's dominance doesn't eliminate risk. Smart contracts protect collateral, which is never repurposed or rehypothecated, but they can contain bugs. All DeFi carries smart contract and market risks, and users should understand these risks before committing capital. High Ethereum gas fees during network congestion can make small transactions economically unviable, though Layer-2 scaling solutions are addressing this limitation.

DeFi lending in Europe contracted 20% as protocols struggled to comply with EU regulatory standards. DeFi lending apps had 45.31% of the crypto collateralized lending market at the end of Q1 2025, down from peaks above 60%, as MiCA's stricter KYC rules deterred anonymity-seeking investors.

The regulatory challenge is profound. DeFi's permissionless nature fundamentally conflicts with KYC/AML requirements that regulators consider non-negotiable. DeFi services that are fully decentralized with minimal or no intermediaries are explicitly excluded from MiCA's regulatory scope, but in circumstances where there is only partial decentralization and an identifiable intermediary, MiCA may be applied.

Despite these challenges, DeFi's transparent loan books, automated liquidations, and auditable reserves have proven more resilient than CeFi's promises. The 42% quarter-over-quarter growth in Q2 2025 wasn't built on marketing or unsustainable yields. It was built on a simple proposition: trust code over counterparties, verify over believe, and automate away the human discretion that enabled the 2022 collapse.

Institutional CeFi — Why It Still Matters

The institutional preference for centralized crypto lending persists despite DeFi's transparency advantages, revealing fundamental tensions between blockchain ideology and real-world legal frameworks. Most large institutional borrowers continue to favor CeFi venues not from ignorance of DeFi's benefits, but from operational requirements that smart contracts cannot yet satisfy.

Legal enforceability drives institutional CeFi preference. Most large borrowers operate within regulated frameworks requiring documentation and legal recourse. CeFi platforms offer traditional loan agreements governed by real-world jurisdictions, while DeFi protocols rely entirely on smart contracts with limited remedies if things go wrong. When a $100 million loan goes sideways, institutional treasurers need the ability to pursue legal claims through established court systems rather than hope that immutable code executes fairly.

Maple Finance addresses this by enforcing a KYC process for both lenders and borrowers, ensuring regulatory compliance while maintaining on-chain loan visibility. Each entity must be pre-approved by the Maple team, reducing fraud risk and enabling legal action in case of default. Before receiving funds, borrowers sign agreements defining contract terms: loan amount, interest rate, and repayment schedule.

Fixed-rate predictability matters more than algorithmic efficiency. DeFi loans are typically floating rate and open-term, with borrowing costs that can spike without notice during volatility. CeFi lenders like Maple offer fixed-rate, fixed-duration loans providing borrowers with predictability around funding costs and maturity. Maple's pool rates are set by the Maple team who assess risk and define debt costs accordingly, ensuring rates won't suddenly spike based on supply-demand imbalances.

Human interface provides risk management that algorithms cannot. Institutions choose to work with Maple because they have different risk triggers. Instead of automatic liquidation when collateral drops, Maple's team issues margin calls giving borrowers 24 hours to respond and adjust loans. This prevents large institutions from having collateral liquidated in one hit with expensive penalties.

Qualified custodians provide institutional-grade asset protection. BitGo, Fireblocks, and Zodia Custody offer the segregated account structures, insurance coverage, and audit trails that institutional compliance departments require. Maple integrates with all the qualified custodians that institutions already use, accepting native Bitcoin collateral without requiring assets to move to unfamiliar custody arrangements.

Tether's lending operation exemplifies institutional CeFi's scale. Controlling 57% of the CeFi market with $10.14 billion in loans, Tether lends primarily to institutions seeking dollar-denominated liquidity against cryptocurrency collateral. The stablecoin issuer's dominant position reflects its unique access to dollar reserves and relationships with institutions that require traditional banking interfaces despite operating in crypto markets.

Galaxy Digital operates one of the largest active loan books while maintaining institutional lending standards. The firm had $1.11 billion in outstanding loans as of Q2 2025, serving hedge funds, family offices, and corporate treasuries that view crypto as an asset class within traditional portfolio construction frameworks. Galaxy provides the structured products, term sheets, and relationship management that institutions expect from credit counterparties.

Speed-to-liquidity varies dramatically between CeFi and DeFi. DeFi protocols issue loans in seconds through automated smart contracts. CeFi still lags with average processing times between 24 and 48 hours due to manual KYC checks and liquidity reviews. Yet some CeFi lenders are closing this gap. CoinRabbit claims to have cut issuance time to around 10 minutes, offering near-instant liquidity without compromising verification.

Collateralization ratios reflect different risk models. CeFi loans typically offer 50-60% LTV ratios on Bitcoin, with Arch Lending offering 60% on BTC, 55% on ETH, and 45% on SOL. CoinRabbit's LTV ratios can go up to 90%, accepting higher liquidation risk in exchange for maximum capital efficiency. DeFi protocols generally maintain more conservative ratios to ensure automated liquidations can execute before collateral falls below loan value.

Interest rates reflect operational cost structures. CeFi rates range from 9.5% to 18.9% APR depending on the platform, collateral type, and borrower relationship. Ledn's standard loan charges 10.4% APR with a 2% origination fee, totaling 12.4% APR. Its custodied loan (no rehypothecation) costs 11.4% APR with the same 2% fee, totaling 13.4% APR — a 1% premium for segregated custody.

Maple Finance CEO Sid Powell notes that Bitcoin-backed loan rates are hovering between 5.5%-7%, down from previous months. This suggests many institutional players are sitting on the sidelines during trade war volatility, though the lending market remains in a relatively strong position.

The institutional CeFi model faces inherent tension. It promises the operational familiarity of traditional finance while operating in an unregulated market that lacks the consumer protections underpinning that familiarity. Institutions value regulatory clarity, KYC/AML integration, and qualified custodial frameworks, yet these very institutions know how to navigate traditional lending markets where similar assurances carry legal force.

Galaxy Research's projection that Bitcoin-backed lending could grow from $20-25 billion to $200 billion assumes institutional adoption continues. But that adoption depends on regulatory frameworks evolving to provide the legal certainty that institutions require. MiCA in Europe demonstrates one path, though its impact on DeFi remains contentious.

The question isn't whether institutional CeFi will continue to matter — the capital flows prove it will. The question is whether it can evolve beyond the opacity and rehypothecation practices that caused the 2022 collapse while maintaining the operational flexibility that attracts institutional borrowers. The answer determines whether institutional CeFi becomes a bridge to regulated crypto credit or simply a well-dressed continuation of the same structural vulnerabilities that brought down Celsius.

Risks and Recurring Patterns

The parallels between 2022's collapse and 2025's structure are disturbing. Rehypothecation remains widespread despite its role in previous failures. Market concentration has intensified rather than dispersed. Real-time transparency remains absent from most CeFi operations. The mechanisms that enabled billions in losses three years ago haven't been eliminated — they've been rebranded under stricter compliance rhetoric.

Celsius operated as a Ponzi scheme, according to court filings from creditors. The platform offered double-digit interest rates to lure new depositors whose funds were used to repay earlier depositors and creditors. Celsius faced a liquidity crisis when customers sought to withdraw ether deposits, forcing the platform to buy ether in the open market at historically high prices and suffer heavy losses.

The rehypothecation web created cascading failures. Platforms like Celsius and BlockFi routinely reused customer deposits, often without clear disclosure of capital buffers or regulatory limits. The same collateral was pledged multiple times across different lenders, creating interdependencies where one entity's failure triggered a domino effect.

Three Arrows Capital received loans worth about $2.4 billion from Genesis, $1 billion from BlockFi, $350 million and 15,250 bitcoins from Voyager Digital, and $75 million from Celsius. When 3AC filed for Chapter 15 bankruptcy in July 2022, these undercollateralized loans became unrecoverable claims. Many customers expressed surprise when they discovered loans weren't collateralized.

The speed of bank runs was unprecedented. The five major crypto firms that collapsed — FTX, Celsius, Voyager, BlockFi, and Genesis — offered customers instant withdrawals while their assets were locked inside illiquid, risky investments. Because customers could withdraw funds instantly via their phones, the speed of runs was historic, according to Chicago Fed research.

Voyager and Celsius sustained double bank runs. Both survived the first but were too weak to withstand the second. Large institutional investors pulled money faster than retail customers before withdrawals were frozen, leaving smaller players holding the bag.

Celsius saw outflows of 20% of customer funds over 11 days following Terra's collapse, while Voyager Digital experienced 14% outflows during the same period. BlockFi reported $4.4 billion in outflows from January through May 2022, then another $3.3 billion from June through November.

These patterns persist in modified form. CeFi lenders now speak the language of compliance and prudence, but rehypothecation hasn't gone away — it's just more quietly disclosed in fine print. Platforms like Nexo, Salt Lending, Strike, and Ledn openly state they may reuse deposited assets. Some platforms still fail to disclose critical details about rehypothecation policies, leaving clients uncertain.

The oligopoly structure concentrates risk. Tether controls 57% of the CeFi market, Nexo holds 11%, and Galaxy Digital commands 6.23%. Together these three firms account for 74.26% of CeFi lending. If a single large lender repeats Celsius's mistakes, the fallout could be worse this time — there are fewer competitors left to absorb the shock.

Jurisdictional fragmentation compounds risks. The sector operates across fragmented frameworks — MiCA in Europe, SEC oversight in the US — each with its own interpretation of custody, lending, and digital assets. Complying with multiple jurisdictions is expensive and complex. Larger firms can handle it; smaller ones cannot, deepening consolidation.

Transparency gaps remain profound. Private desks, OTC platforms, and offshore credit providers likely push the actual CeFi total far higher, perhaps by 50% or more. A narrow set of public disclosures limits visibility into the true scope of centralized lending.

Market volatility testing reveals fragility. Bitcoin frequently moved 5% in a day in early 2025 amid global trade tensions, dipping to $77,000 in March. A 5% price fluctuation is still common despite rising institutional interest. Even with lower LTV ratios and term sheets prohibiting rehypothecation, sudden price swings can still put lending models under stress.

Bitcoin-backed loans are safer but not bulletproof, notes industry observers. Lower leverage, public proof-of-reserves, and banking licenses are real improvements. But crypto lenders are still working with a single-asset collateral pool whose value can drop 5% overnight.

The interconnectedness creates contagion risk. Galaxy notes that a narrow set of public disclosures and increasingly interconnected market structure mean stress in a single venue or instrument could reverberate quickly across the ecosystem. Leverage in crypto's current cycle may be more fragmented than before, but it's no less potent.

The regulatory response has been slow. MiCA's implementation has restructured European markets but explicitly excludes fully decentralized DeFi services. The U.S. lacks comprehensive federal crypto lending regulation, leaving state-level patchwork oversight. Nearly all State Attorneys General agreed to a nationwide settlement with BlockFi in 2022 to resolve allegations of unlicensed securities sales, but this reactive enforcement doesn't create the proactive framework that would prevent another crisis.

The lesson from 2022 was clear: opacity enables fraud, concentration amplifies contagion, and rehypothecation transforms lending into leveraged gambling. Three years later, CeFi's high concentration means systemic risk hasn't been reduced — it's simply been redistributed among fewer players. The structural vulnerabilities that enabled the 2022 collapse persist, waiting for the next stress test that will reveal whether this recovery represents genuine reform or merely a respite between crises.

The Road to Safer CeFi

Building trust after catastrophic failure requires more than time — it demands structural changes that make future failures impossible. A small cohort of platforms is attempting this reconstruction through transparency mechanisms that eliminate the discretion enabling 2022's collapse. Their approaches offer a roadmap for how CeFi lending could evolve beyond its current vulnerabilities.

CoinRabbit explicitly rejects rehypothecation as a core principle. CMO Irene Afanaseva states that "the absence of rehypothecation is vital for the entire market" and that "user assets must remain secure". The platform keeps all funds in cold wallets with multisig access, processes loans in approximately 10 minutes, and accepts over 300 cryptocurrencies as collateral with LTV ratios up to 90%.

Unchained Capital specializes in Bitcoin-backed loans with explicit no-rehypothecation policies. Collateral is stored in multisig vaults, loans feature fixed repayment schedules, and the platform offers high borrowing limits up to $1 million for eligible users. The minimum loan amount is $150,000 and processing typically takes 1-2 business days due to KYC procedures.

Arch Lending holds collateral with qualified custodians and explicitly states no rehypothecation. The platform supports BTC, ETH, and SOL with fixed terms up to 24 months, charging 9.5% APR with a 1.5% origination fee and 2% partial liquidation fee. LTV ratios are 60% for BTC, 55% for ETH, and 45% for SOL.

Ledn offers dual models: a standard loan at 10.4% APR with rehypothecation, and a custodied loan at 11.4% APR where Bitcoin collateral is held securely without rehypothecation. This dual structure lets users choose between lower cost with exposure risk or higher cost with segregated custody. Both loan types offer up to 50% LTV with monthly interest-only payments and principal due at term end.

Proof of reserves offers cryptographic transparency that approaches DeFi's auditability. Kraken pioneered PoR in 2014 and publishes quarterly audits showing reserve ratios exceeding 100%. The September 2025 report showed Bitcoin reserve ratio of 100.4%, Ethereum 101.2%, Solana 100.6%, USDC 105%+, and USDT 105%+.

Kraken uses Merkle trees to combine individual balances into a single cryptographic hash. Clients receive personalized Merkle proofs to confirm inclusion without revealing personal details. An independent accountancy firm confirms that on-chain holdings exceed total client balances, effectively verifying full reserves without assumptions. Every client can verify their own inclusion using open-source Merkle verification tools.

Bitget's October 2025 PoR showed 307% BTC coverage, 224% ETH coverage, 105% USDT coverage, and 129% USDC coverage, each above 1:1 and marked as sufficient reserves. BTCC's April 2025 PoR demonstrated a robust 161% total reserve ratio, with reserve ratios exceeding 100% across all major cryptocurrencies.

Chainlink's Proof of Reserve provides smart contracts with data needed to calculate true collateralization of any on-chain asset backed by off-chain or cross-chain reserves. Operated by a decentralized network of oracles, Chainlink PoR enables autonomous auditing of collateral in real-time, helping ensure user funds are protected from fractional reserve practices and fraudulent activity from off-chain custodians.

Yet PoR has limitations. Audits only show reserves at a specific moment, meaning an exchange could borrow funds just for the audit and return them afterward. The procedure cannot identify hidden encumbrances or prove funds hadn't been borrowed for purposes of passing the review. Keys may have been lost or funds stolen since the latest review. The accountant must be competent and independent to minimize duplicity or collusion.

Proof of Reserves is only half the story — true transparency requires Proof of Liabilities showing what an exchange owes compared to what it holds. Kraken and Coinbase are exploring this using zero-knowledge proofs to verify liabilities while protecting privacy.

Regulatory frameworks are slowly emerging. MiCA's full implementation on December 30, 2024 introduced requirements around CASP licensing and market abuse prevention. CASPs must acquire licenses by meeting operational standards including cybersecurity measures, strong governance structures, and AML/CTF compliance.

MiCA-compliant exchanges account for 92% of total crypto trading volume inside the EU. Over €540 million in penalties have been issued to non-compliant firms since enforcement began. 28 crypto firms had licenses revoked, primarily for non-compliance with AML, KYC, or reserve requirements. France issued the highest fine of €62 million to a non-compliant exchange.

Under MiCA, institutional investors now account for 48% of crypto lending activity in the EU, up sharply from 2024. Stablecoin lending rates stabilized at an average of 5.2%, reflecting reduced yield volatility under oversight. Liquidation rates on lending platforms fell 24% as stricter rules improved risk controls.

Zero-knowledge proofs could revolutionize CeFi transparency. Some RWA protocols enable the use of yield-bearing tokenized US Treasury products as collateral for multiple DeFi activities, creating audit trails without revealing individual positions. Platforms like Centrifuge allow users to tokenize real-world assets and use them as collateral for DeFi lending while maintaining privacy through cryptographic verification.

The path to safer CeFi requires five elements: elimination of rehypothecation through segregated custody, real-time proof of reserves using cryptographic verification, proof of liabilities to show solvency comprehensively, regulatory frameworks that mandate transparency without stifling innovation, and zero-knowledge technology that enables auditability while preserving privacy. Platforms like CoinRabbit illustrate what that future could look like: funds kept offline in cold storage with multisig access, no collateral reuse, and real-time withdrawal access.

The broader industry remains split. Many platforms still see rehypothecation as necessary for profitability. Until that changes, every market rally carries the risk of another unwinding. CeFi has proven it can survive. The next step is proving it deserves to.

When Scale Becomes Risk

Market concentration transforms platform failures into systemic crises. The three largest CeFi lenders — Tether, Nexo, and Galaxy Digital — control 74.26% of the market, with Tether alone commanding 57% market share. This oligopoly structure creates single points of failure that could trigger cascading defaults reminiscent of 2022's collapse.

The parallels to traditional banking's "too big to fail" problem are stark. When Celsius owed $4.7 billion to over 100,000 creditors and filed for bankruptcy, the contagion was contained by the presence of alternative lenders. Users could migrate to BlockFi or Nexo. When BlockFi subsequently collapsed, Voyager and Genesis remained operational. Each failure absorbed a shock that might have been catastrophic in a more concentrated market.

In 2025's oligopoly, there is no such redundancy. If Tether's $10.14 billion loan book faces stress — whether from cryptocurrency price crashes, counterparty defaults, or regulatory action — the 57% market share means the entire CeFi sector contracts violently. Borrowers dependent on Tether's liquidity would scramble to refinance through Nexo or Galaxy, overwhelming those platforms' capacity and potentially triggering margin calls that force liquidations across the sector.

The Herfindahl-Hirschman Index (HHI) measures market concentration by squaring each firm's market share and summing the results. Values below 1,500 indicate competitive markets. Values between 1,500 and 2,500 suggest moderate concentration. Values above 2,500 signal high concentration where dominant firms can influence market conditions.

With Tether at 57%, Nexo at 11%, and Galaxy at 6.23%, a simplified HHI calculation yields: (57²) + (11²) + (6.23²) + (remaining ~26% distributed) ≈ 3,249 + 121 + 38.8 + ~260 = ~3,669. This places CeFi lending well into highly concentrated territory, approaching monopolistic conditions where stress in a single venue or instrument could reverberate quickly across the ecosystem.

Celsius's failure began with a $935 million investment in Terra's UST and Anchor protocol. When UST depegged, Celsius faced withdrawals it couldn't honor. The platform saw outflows of 20% of customer funds over 11 days. As customers sought to withdraw ether deposits, Celsius was forced to buy ether in the open market at historically high prices, suffering heavy losses.

Tether's current structure presents analogous risks. The stablecoin issuer operates across multiple jurisdictions with complex reserve structures. Galaxy Research notes that private desks, OTC platforms, and offshore credit providers likely push actual CeFi totals far higher, potentially by 50% or more. If Tether's loans involve cross-collateralization or rehypothecation — practices the company hasn't publicly ruled out — a single large default could force asset sales that cascade through crypto markets.

The interconnectedness amplifies contagion risk. Galaxy Digital's $1.11 billion loan book likely includes exposure to borrowers who also borrow from Tether or Nexo. If a major borrower defaults to one lender, margin calls from all lenders could force synchronized liquidations that crash collateral values and trigger further defaults.

Three Arrows Capital demonstrated this dynamic in 2022. The hedge fund received loans worth $2.4 billion from Genesis, $1 billion from BlockFi, $350 million and 15,250 bitcoins from Voyager, and $75 million from Celsius. When 3AC filed for bankruptcy, all these lenders faced simultaneous losses, creating the cascading failures that characterized the 2022 crisis.

In 2025's concentrated market, fewer competitors means less capacity to absorb shocks. If a single large lender repeats Celsius's mistakes, the fallout could be worse — there are fewer competitors left to absorb the shock. The surviving platforms would face a rush of borrowers seeking refinancing, potentially overwhelming their capital bases and triggering the liquidity crises that forced 2022's bank runs.

DeFi offers structural alternatives that could mitigate concentration risk. Aave commands 60-62% of DeFi lending market share, but its permissionless nature means competitors can fork the protocol or users can migrate to alternatives without intermediary permission. Morpho, Compound, and Kamino provide functional substitutes that users can access instantly.

Credora offers credit scoring infrastructure that could enable better risk assessment of institutional borrowers, reducing the likelihood of undercollateralized loans that triggered 2022's cascade. Aave Arc provides institutional lending with enhanced compliance, bridging DeFi transparency with institutional requirements.

Yet DeFi's 59.83% market share doesn't eliminate concentration risk — it merely shifts it to different infrastructure. Aave's $40+ billion TVL makes it a single point of failure if smart contract bugs or governance attacks compromise the protocol. The difference is transparency: every Aave position is auditable on-chain, enabling early warning systems that could trigger gradual deleveraging rather than panicked runs.

Treasury companies present another concentration risk. Firms like Strategy (MSTR) have issued billions in convertible debt to fund BTC purchases. Total outstanding debt across treasury firms stood at $12.7 billion as of May 2025, much of it maturing between 2027 and 2028. If Bitcoin prices fall sharply when these debts mature, synchronized deleveraging could cascade through both CeFi and DeFi lending markets.

The rate for borrowing against bitcoin is hovering between 5.5%-7%, down from previous months. This suggests many institutional players are sitting on the sidelines during trade war volatility. When these borrowers return to the market, demand could overwhelm the oligopoly's capacity, forcing rapid rate increases that trigger liquidations.

The solution isn't preventing concentration — market dynamics will always favor scale efficiency. The solution is transparency that enables early detection of accumulating risk, diversification across platforms that prevents single points of failure, and automated circuit breakers that halt cascading liquidations before they become systemic crises. DeFi's transparent loan books, automated liquidations, and auditable reserves provide the template. CeFi's challenge is implementing similar mechanisms while maintaining the operational flexibility that attracts institutional capital.

Scale becomes risk when opacity enables accumulation of hidden leverage. Celsius, Voyager, and BlockFi all grew to billion-dollar scale before their structural vulnerabilities became apparent. In 2025's oligopoly, Tether's $10.14 billion loan book operates with limited public disclosure about borrower concentration, collateral quality, or rehypothecation practices. The market won't know if structural vulnerabilities exist until stress testing reveals them — by which point, contagion may already be inevitable.

Final thoughts

The trajectory of crypto lending hinges on whether the sector can reconcile three competing demands: institutional scale that requires operational flexibility, user protection that demands transparency, and innovation that needs permissionless experimentation. Current structures satisfy none completely, suggesting that 2025 represents a transitional phase rather than a stable equilibrium.

Galaxy Research projects Bitcoin-backed lending could grow from $20-25 billion today to $200 billion, representing nearly 10x expansion. The broader crypto lending market could reach $100 billion by 2030 across CeFi and DeFi channels. Tokenized real-world assets are projected to represent 10% of global GDP by 2030, potentially $16 trillion in value that could serve as collateral for on-chain lending.

Hybrid models blending CeFi and DeFi characteristics are emerging. Maple Finance operates as a DeFi protocol with institutional KYC, offering fixed-rate, fixed-term loans through on-chain smart contracts while maintaining human underwriting and relationship management. The platform's syrupUSDC product provides permissionless yield while borrowers remain gated through institutional onboarding, combining DeFi capital formation efficiency with CeFi credit controls.

Morpho V2's June 2025 launch introduced intent-based matching where lenders and borrowers express exactly what they want — fixed-rate, fixed-term loans, specific collateral preferences — and the system finds the best match. The upgrade supports single assets, multiple assets, or entire portfolios as collateral, including RWAs.

Artificial intelligence integration could revolutionize credit risk assessment. Credora provides institutional-grade credit scoring using real-time data analysis. Machine learning models could analyze on-chain transaction histories, collateral volatility patterns, and cross-platform exposures to generate dynamic risk scores that enable undercollateralized lending without human underwriters. This could bridge DeFi's overcollateralization requirement with CeFi's flexible structures.

Cross-chain credit protocols are eliminating fragmentation. Aave operates across 11+ blockchain networks, enabling users to borrow on one chain using collateral from another. Chainlink's Cross-Chain Interoperability Protocol (CCIP) enables seamless value transfer across blockchains, allowing unified lending pools that aggregate liquidity from multiple networks.

Tokenized collateral markets are expanding beyond cryptocurrency. RWA markets have grown to $27.8 billion with tokenized private credit at $15.9 billion and US Treasuries at $7.4 billion. Centrifuge allows users to tokenize business receivables and invoices for use as DeFi collateral, bringing trade finance onto blockchain rails. Ondo Finance's tokenized US Treasuries provide stable yield-bearing collateral that reduces volatility risk.

Institutional adoption is accelerating regulatory clarity. MiCA's implementation has created €1.8 trillion projected European crypto market by end of 2025, growing 15% year-over-year under the framework. Institutional investors increased crypto holdings after MiCA's investor protection measures took effect, with 32% of institutional investors in the EU increasing allocations.

The U.S. regulatory landscape remains uncertain. The SEC's approach to crypto lending has been enforcement-driven rather than framework-building. State Attorneys General secured settlements with platforms like BlockFi for unlicensed securities sales, but comprehensive federal legislation remains absent. This regulatory fragmentation forces platforms to choose between serving U.S. users with limited features or excluding them entirely.

Proof of reserves is becoming standard practice. Kraken publishes quarterly PoR reports with 100%+ reserve ratios. Bitget shows 307% BTC coverage. Chainlink's on-chain PoR feeds enable automated, real-time collateral verification without centralized auditors. The next evolution is Proof of Liabilities using zero-knowledge proofs to verify solvency while protecting privacy.

Stablecoin integration is creating deeper liquidity. In USD markets, stablecoins dominate with 89.78% of trading volume, while only 10.22% settles in traditional fiat. Stablecoin transactions within the EU increased 28% following MiCA's clear rules for issuers. This dollar-denominated stability enables institutions to use crypto lending without direct cryptocurrency price exposure.

Yet fundamental challenges persist. DeFi lending in Europe contracted 20% as protocols struggled with EU regulatory standards. MiCA explicitly excludes fully decentralized DeFi services with minimal intermediaries, creating regulatory uncertainty for protocols attempting to serve European users. The tension between DeFi's permissionless architecture and regulators' KYC/AML requirements remains unresolved.

CeFi concentration continues to intensify. Tether's 57% market share creates systemic vulnerability that could trigger contagion if stress testing reveals hidden leverage. The oligopoly structure concentrates both market power and risk in ways that serve institutional convenience while maintaining the opacity that enabled 2022's collapse.

Smart contract risk remains unquantified. Aave's $40+ billion TVL sits atop smart contracts that, while extensively audited, could contain undiscovered vulnerabilities. The larger DeFi protocols become, the more attractive they become as targets for sophisticated attacks. Formal verification methods and bug bounty programs reduce but don't eliminate this risk.

The cyclical nature of crypto markets presents the ultimate stress test. Bitcoin frequently moved 5% daily in early 2025. When the next bear market arrives — and history suggests it will — over $50 billion in crypto-collateralized loans will face simultaneous margin pressure. Automated liquidations in DeFi should prevent cascading failures, but CeFi's opacity means accumulating risk won't be visible until crisis forces disclosure.

The ideal future combines CeFi's institutional infrastructure with DeFi's transparency. Platforms would offer fixed-rate, fixed-term loans through smart contracts while maintaining qualified custody and regulatory compliance. Real-time proof of reserves and liabilities would enable continuous solvency verification. AI-driven credit scoring would enable undercollateralized lending without human underwriter discretion. Tokenized RWAs worth $16 trillion would provide diversified collateral that reduces single-asset volatility risk.

This vision requires technology that doesn't yet exist at scale, regulations that haven't been written, and trust that hasn't been earned. The crypto lending market in 2025 is growing rapidly — to $53.09 billion — but growth without structural reform simply creates larger potential failures. CeFi is leaner but not safer; DeFi is stronger but not invincible.

Whether crypto lending finally matures or repeats its history depends on choices being made right now: Will platforms choose transparency over profitable opacity? Will regulators enable innovation while mandating protection? Will users demand proof over promises? The 2022 collapse proved that exponential growth built on structural fragility ends in catastrophic failure. The 2025 rebound offers a chance to build differently. Whether that chance is seized or squandered will determine if crypto lending becomes a bridge to the future of finance or merely another chapter in the history of financial folly.

P.S. The Phoenix and the Powder Keg

Crypto lending in 2025 exists in quantum superposition — simultaneously stronger and more fragile than its 2021 predecessor. The market has rebounded to $53.09 billion, yet remains 43% below its $64.4 billion peak. DeFi has reached $26.47 billion in active loans with 42% quarterly growth, demonstrating the power of transparent, programmatic lending. CeFi has recovered to $17.78 billion, but concentration among Tether, Nexo, and Galaxy Digital creates systemic vulnerabilities that mirror — and perhaps exceed — the fragilities that caused 2022's collapse.

The central lesson of the past three years is unambiguous: opacity enables catastrophe. Celsius, Voyager, BlockFi, and Genesis collapsed not because crypto lending is fundamentally flawed, but because these platforms operated with hidden leverage, undercollateralized loans, and rehypothecation practices that created cascading failures when stress testing arrived via Terra's collapse and Three Arrows Capital's bankruptcy.

DeFi's resurgence validates transparency as competitive advantage. Aave's $3 trillion in cumulative deposits and $40+ billion TVL weren't built on unsustainable yield promises. They emerged from automated liquidations, auditable reserves, and permissionless access that eliminate the counterparty risk defining CeFi lending. Institutional adoption by entities like BTCS and Ethena signals that transparency attracts rather than repels sophisticated capital.

Yet CeFi persists because institutions require operational frameworks that smart contracts cannot yet provide: legal agreements with real-world enforceability, fixed-rate predictability, human relationship management, and qualified custody. Maple Finance's $4 billion in institutional lending demonstrates that hybrid models combining DeFi transparency with CeFi operational flexibility can attract capital at scale.

The critical question isn't whether crypto lending will grow — projections suggest $100 billion by 2030 with Bitcoin-backed lending alone potentially reaching $200 billion. The question is whether that growth builds on foundations that can withstand the inevitable stress testing that bear markets deliver.

The 74.26% market concentration among three CeFi lenders creates single points of failure where stress in one platform could trigger contagion across the sector. Rehypothecation practices persist despite their role in 2022's collapse. Transparency gaps mean actual lending volumes may be 50% higher than disclosed figures.

Safer models exist but remain marginal. CoinRabbit's explicit rejection of rehypothecation, Unchained Capital's multisig vault custody, and Ledn's dual-model offering of segregated versus rehypothecated loans demonstrate that transparency and user protection can coexist with profitable lending. Proof of reserves implementations by Kraken, Bitget, and others show that cryptographic verification can replace blind trust.

Regulatory frameworks like MiCA are restructuring markets, with €540 million in penalties enforcing compliance and institutional participation rising to 52% in the EU. Yet MiCA explicitly excludes fully decentralized DeFi, creating regulatory arbitrage where innovation happens in jurisdictions with minimal oversight.

Tokenized real-world assets worth $27.8 billion are creating bridges between traditional finance and crypto lending. Projects like Centrifuge's business receivables and Ondo Finance's US Treasuries demonstrate how blockchain rails can access traditional credit markets while maintaining transparency. The RWA sector could reach $16 trillion by 2030, representing 10% of global GDP.

The crypto lending cycle is repeating — hopefully wiser this time. Market recovery is undeniable. Institutional participation is accelerating. Innovation in fixed-rate lending, RWA collateral, and cross-chain liquidity is addressing limitations that constrained previous generations.

But wisdom requires learning from mistakes, not merely surviving them. The structural vulnerabilities that enabled 2022's $25+ billion in losses persist in modified form. Concentration creates contagion risk. Opacity enables accumulation of hidden leverage. Rehypothecation transforms user deposits into platform leverage.

The path forward demands uncomfortable choices. Platforms must choose between profitable opacity and trust-building transparency. Regulators must enable innovation while mandating protection. Users must demand proof over promises and accept that sustainable yields are measured in single digits, not double. Capital must flow to platforms that build defensively rather than those promising the highest returns.

CeFi needs to prove it can be transparent without sacrificing operational flexibility. DeFi needs to prove it can scale to institutional requirements without compromising permissionlessness. Regulators need to prove they can protect users without stifling innovation. Users need to prove they'll prioritize safety over yield.

Crypto lending in 2025 stands at a crossroads. One path leads toward mature credit markets that bridge traditional finance and blockchain technology through transparent reserves, automated risk management, and regulatory frameworks that enable rather than constrain innovation. The other path leads toward repetition of 2022's catastrophe — growth built on opacity, concentration breeding contagion, and another generation of users learning that unsustainable yields always end in loss.

The rebound is real but the risks are recurring. The phoenix has risen from 2022's ashes, but the powder keg sits beneath its nest. Whether crypto lending becomes the bridge to the future of finance or simply another cautionary tale depends on choices being made right now — by platforms, regulators, and users who must decide whether this time will be genuinely different, or merely different packaging for the same structural failures that $25 billion in user losses already taught us to avoid.