Mastercard, one of the world's largest payment networks, stands at a crossroads that could fundamentally alter how money moves through the global financial system. In late October 2025, reports emerged that the payments giant was in advanced talks to acquire Zero Hash for between $1.5 billion and $2 billion. The acquisition, if completed, would represent Mastercard's most significant bet on cryptocurrency infrastructure to date.

This isn't just another corporate M&A transaction. It's a signal that one of the pillars of traditional finance is preparing to embrace a fundamentally different model for how payments settle. For decades, card networks, banks, and merchants have operated within the constraints of "banking hours" - batch processing windows, weekday-only settlement, and correspondent banking chains that can take days to reconcile cross-border payments. Zero Hash's infrastructure offers something different: the ability to settle transactions in stablecoins around the clock, every day of the year.

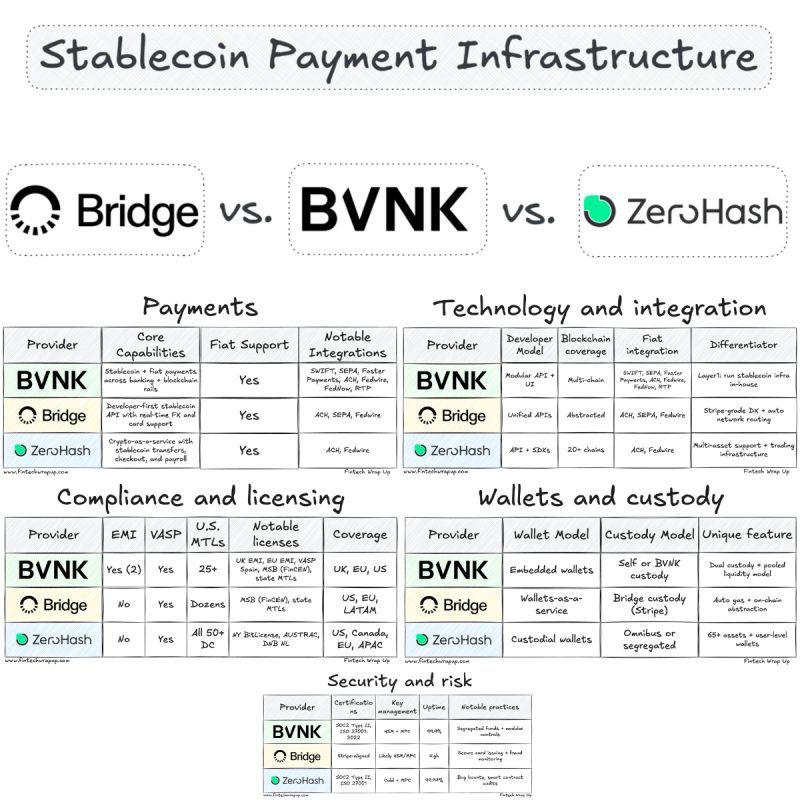

The Zero Hash deal follows earlier reports that Mastercard had also explored acquiring BVNK, another stablecoin platform, in negotiations that reportedly valued the company at around $2 billion. These parallel pursuits suggest a strategic imperative: Mastercard needs turnkey crypto infrastructure, and it needs it now.

Why now? The stablecoin sector has exploded. In 2025, stablecoins moved an estimated $46 trillion in total transaction volume, rivaling Visa's payment throughput. The total stablecoin supply reached over $280 billion in September 2025, up from approximately $200 billion at the start of the year. Major projections suggest the market could reach $1.9 trillion by 2030 in a base case scenario, with bullish forecasts climbing as high as $4 trillion.

For Mastercard, this growth presents both opportunity and threat. Stablecoins could theoretically disrupt its core business model by enabling peer-to-peer transfers that bypass interchange fees entirely. Yet they also offer a way to extend the company's reach into markets where traditional payment infrastructure is weak or nonexistent. By acquiring Zero Hash - which provides custody, regulatory compliance, and stablecoin orchestration for banks and fintechs - Mastercard would gain instant access to production-ready crypto rails without having to build them from scratch.

The implications extend far beyond Mastercard's balance sheet. If a network processing billions of transactions annually begins settling obligations in USDC or EURC instead of waiting for batch windows to close, it could fundamentally change how businesses manage treasury operations, how merchants receive funds, and how cross-border payments flow. Weekend and holiday delays could become relics of the past. Daylight overdrafts and pre-funding requirements might shrink. The invisible infrastructure of "banking hours" could begin to fade.

Below we analyze how and why that transformation might unfold, exploring the traditional payment model and its limitations, ans details what Mastercard is building through its Multi-Token Network and Crypto Credential initiatives. The goal is not to predict the future with certainty but to map the forces at play and identify the indicators that will signal whether this vision becomes reality.

The Traditional Payment Settlement Model and Its Limits

To understand why Mastercard's stablecoin push could be transformative, it's essential first to understand how payment settlement works today - and where the model breaks down.

How Card Payments Settle Today

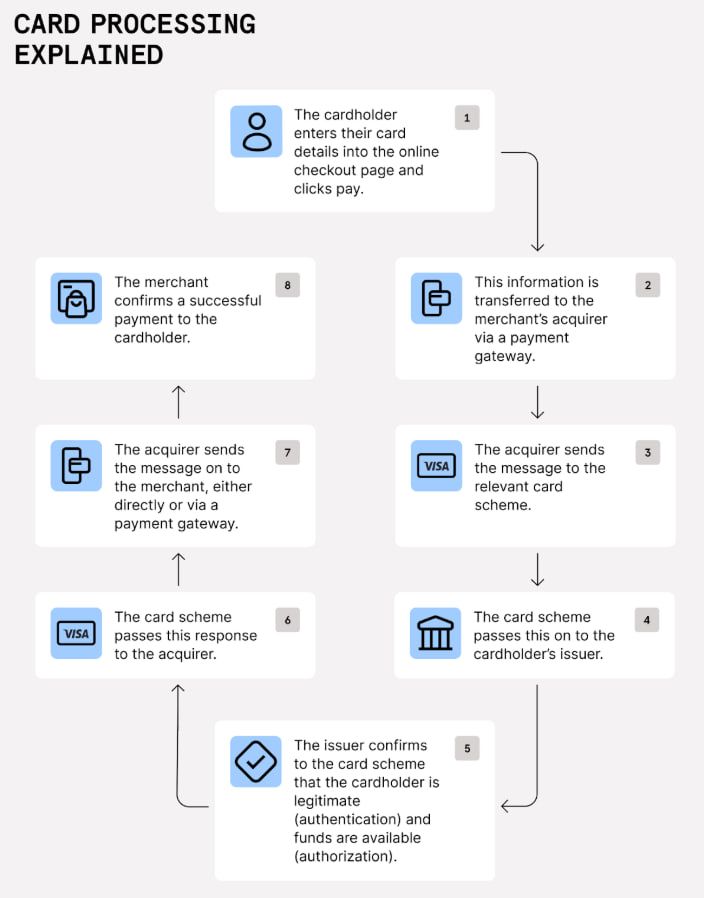

When a consumer swipes a Mastercard at a merchant, several parties are involved in moving money from the cardholder's bank (the issuer) to the merchant's bank (the acquirer). The transaction happens in stages: authorization (checking that funds are available), clearing (batching and exchanging transaction details), and settlement (the actual movement of money between banks).

Settlement is where time and infrastructure constraints become visible. Card payments reconcile through batch windows, weekday cutoffs, and correspondent chains. Banks don't settle card transactions individually in real time. Instead, they aggregate them into batches and process them at specific intervals - typically once or twice per day during business hours.

In the United States, this process often follows a T+1 or T+2 schedule, meaning settlement occurs one or two business days after the transaction. Cross-border transactions can take even longer, as they may pass through multiple correspondent banks, each adding time, cost, and complexity to the process.

The Constraints of Banking Hours

Traditional payment systems operate on what might be called "banking hours": Monday through Friday, excluding holidays. The ACH network in the United States processes transactions in batches during specific settlement windows managed by the Federal Reserve. If a payment is initiated on Friday evening, it will not process until Monday morning at the earliest.

The same limitations apply to Europe's SEPA system. SEPA Credit Transfers and SEPA Direct Debits do not work on weekends. Only the real-time SEPA Instant Credit Transfer scheme operates 24/7, and even then, adoption has been uneven.

These constraints create friction at every layer of the payment stack:

For merchants: Funds from weekend sales don't arrive until Monday or Tuesday. This delays access to working capital and complicates cash flow management. Businesses that operate on thin margins - such as restaurants or retailers - often need to prefund accounts to ensure they can cover expenses before revenue arrives.

For banks and acquirers: Batch processing creates operational bottlenecks. Banks must manage liquidity carefully to ensure they have sufficient funds available during settlement windows. Daylight overdrafts - temporary negative balances that occur when outgoing settlements exceed incoming funds during the day - require careful monitoring and sometimes incur fees.

For cross-border payments: The problem multiplies. A payment from a U.S. company to a supplier in Europe might pass through several correspondent banks, each with its own cutoff times and processing schedules. The total time from initiation to final receipt can stretch to multiple days. Fees accumulate at each step. Exchange rate risk grows with every hour the payment remains in transit.

For consumers and gig workers: Direct deposits typically settle overnight but are constrained by the same batch schedules. If payday falls on a weekend, most employers process deposits on Friday to avoid leaving employees waiting until Monday.

Why the Model Persists

If these constraints create so much friction, why do they persist? The answer lies in history, risk management, and infrastructure lock-in.

Batch processing was designed in an era when computing power was expensive and communication networks were slow. Aggregating transactions into batches made economic sense: it reduced the number of messages banks had to exchange and allowed for efficient reconciliation. Over time, this model became embedded in regulatory frameworks, bank operations, and merchant contracts.

Banks also use settlement delays as a risk management tool. The time between authorization and settlement allows them to detect fraud, handle disputes, and unwind erroneous transactions. Instant settlement would compress these timelines and require new mechanisms for managing chargebacks and reversals.

Finally, correspondent banking networks - while slow - provide connectivity across jurisdictions with different currencies, regulations, and legal systems. Replacing them requires not just new technology but also new legal agreements, liquidity arrangements, and regulatory approvals.

The Tokenization Vision

Mastercard has been signaling for several years that it sees tokenization as a path forward. In a corporate blog post, the company described its vision for "the invisible handshake" - a world where tokenized money and assets can be exchanged securely across blockchain networks, with the same level of trust and consumer protection that Mastercard has built over decades in traditional payments.

But tokenization alone isn't enough. For stablecoins to replace batch settlement, they need to be integrated into the existing payment infrastructure. Merchants need to be able to accept them. Banks need to be able to hold them. Regulators need to approve them. And the technology needs to be reliable enough to handle billions of transactions without fail.

This is where Mastercard's strategic moves - both organic and inorganic - come into play.

What Mastercard Is Building: Infrastructure, Tokenization, and Rails

Mastercard's approach to crypto isn't about creating a consumer-facing wallet or launching its own stablecoin. Instead, the company is building infrastructure - the pipes and protocols that will allow banks, fintechs, and merchants to transact in tokenized money without having to manage the complexity of blockchain technology themselves.

The Multi-Token Network (MTN)

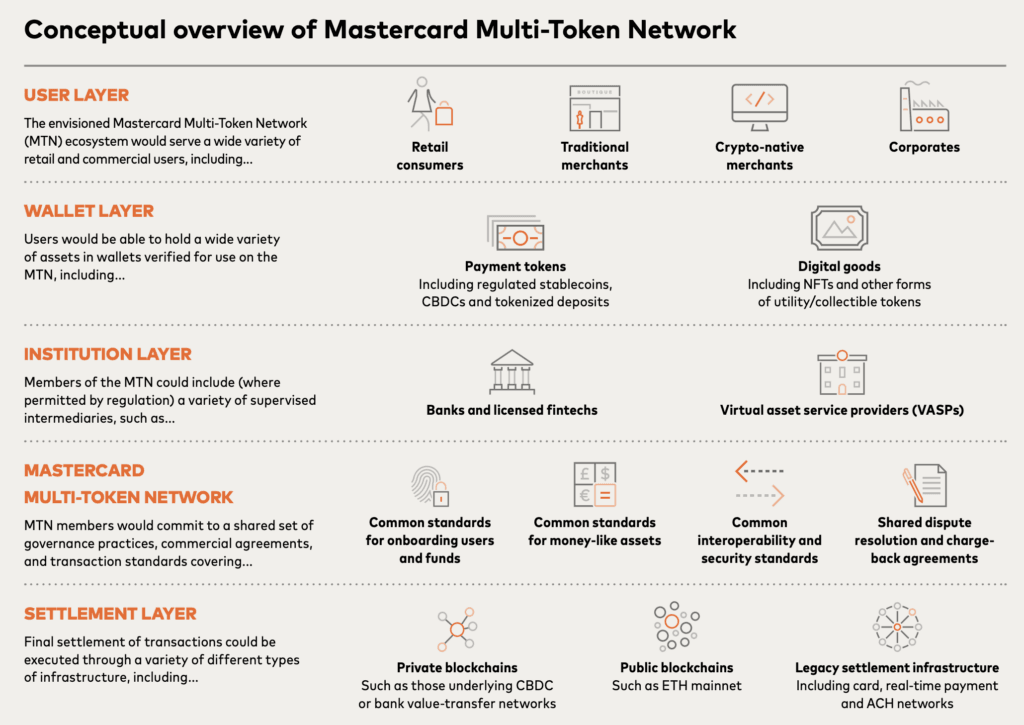

At the center of this strategy is the Multi-Token Network (MTN), announced in June 2023. MTN is a set of API-enabled blockchain tools designed to make transactions with tokenized money and assets secure, scalable, and interoperable.

The network is built on four pillars of trust:

Trust in counterparty: Effective identity management and permissions are essential for building trusted networks. This is where Mastercard's Crypto Credential (discussed below) comes in - verifying that wallets and exchanges meet certain standards before they can transact on the network.

Trust in digital payment assets: For MTN to work, it needs stable, regulated payment tokens. Last year, Mastercard tested the use of tokenized commercial bank deposits between financial institutions, settling through its existing network. The company also participated in the Regulated Liability Network (RLN), a consortium exploring how central bank digital currencies (CBDCs) and tokenized deposits might work together.

Trust in technology: Blockchain networks need to be scalable and interoperable. MTN aims to support multiple blockchains and payment tokens, allowing institutions to choose the networks that best fit their needs without being locked into a single ecosystem.

Trust in consumer protections: Mastercard's decades of experience with chargeback rules, fraud detection, and dispute resolution will be layered onto MTN. The goal is to ensure that tokenized payments offer the same protections consumers expect from traditional card transactions.

MTN went into beta testing in the UK in 2023 and has since expanded. In 2024, Mastercard executed its first live test of tokenized deposits with Standard Chartered Bank Hong Kong, involving a client purchasing a carbon credit using tokenized deposits.

In February 2025, Ondo Finance became the first real-world asset provider to join MTN, bringing its tokenized U.S. Treasury fund (OUSG) to the network. This integration allows businesses on MTN to earn daily yield on idle cash and deploy funds into tokenized Treasury bills 24/7 using traditional fiat rails - no need for stablecoin onramps or waiting for settlement windows.

Raj Dhamodharan, Mastercard's executive vice president for blockchain and digital assets, described the vision: "This connectivity will enable the banking ecosystem to move to 24/7 functionality on a global basis."

In November 2024, Mastercard integrated MTN with JPMorgan's Kinexys Digital Payments platform (formerly JPM Coin) to enable on-chain foreign exchange and "automation of 24/7, near real-time multicurrency clearing and settlement."

MTN is not a finished product. It's a framework - an evolving set of standards and tools that Mastercard is testing with partners. But the pieces are coming together: tokenized deposits, real-world assets, integration with major banks, and 24/7 settlement capabilities.

Crypto Credential: Building Trust in Blockchain Transactions

Parallel to MTN is Mastercard Crypto Credential, a verification layer announced in April 2023 and launched for live peer-to-peer transactions in May 2024.

Crypto Credential addresses one of the biggest pain points in blockchain transactions: the complexity and risk of wallet addresses. A typical blockchain address is a long string of alphanumeric characters - easy to mistype and impossible to verify at a glance. Crypto Credential allows users to create human-readable aliases (similar to email addresses or Venmo handles) that map to their wallet addresses.

But Crypto Credential does more than simplify addresses. It also verifies that:

- The user has met a set of verification standards (KYC/AML compliance).

- The recipient's wallet supports the digital asset and blockchain being used.

- Travel Rule information is exchanged for cross-border transactions (a regulatory requirement to prevent money laundering).

When a user initiates a transfer, Crypto Credential checks the validity of the recipient's alias and confirms wallet compatibility. If the receiving wallet doesn't support the asset or blockchain, the sender is notified and the transaction doesn't proceed - protecting both parties from lost funds.

The first live transactions went live in May 2024 on Bit2Me, Lirium, and Mercado Bitcoin exchanges, enabling cross-border and domestic transfers across multiple currencies and blockchains in Argentina, Brazil, Chile, France, Guatemala, Mexico, Panama, Paraguay, Peru, Portugal, Spain, Switzerland, and Uruguay.

In January 2025, Crypto Credential expanded to the UAE and Kazakhstan, with exchanges including ATAIX Eurasia, Intebix, and CoinMENA joining the network.

Crypto Credential is critical to Mastercard's stablecoin strategy because it addresses a key barrier to institutional adoption: trust. Banks and payment processors need to know that their counterparties are verified, compliant, and using compatible technology. Crypto Credential provides that assurance.

Stablecoin Settlement Pilots

While MTN and Crypto Credential provide the infrastructure, Mastercard has also been piloting actual stablecoin settlement with merchants and acquirers.

In August 2025, Mastercard and Circle announced an expansion of their partnership to enable USDC and EURC settlement for acquirers in the Eastern Europe, Middle East, and Africa (EEMEA) region. This marked the first time that the acquiring ecosystem in EEMEA could settle transactions in stablecoins.

Arab Financial Services and Eazy Financial Services were the first institutions to adopt the capability. Acquirers receive settlement in USDC or EURC - fully-reserved stablecoins issued by regulated affiliates of Circle - which they can then use to settle with merchants.

Dimitrios Dosis, president of Mastercard's EEMEA region, described the move as strategic: "Our strategic goal is to integrate stablecoins into the financial mainstream by investing in the infrastructure, governance, and partnerships to support this exciting payment evolution from fiat to tokenized and programmable money."

The pilot builds on earlier work. Mastercard and Circle had already collaborated on crypto card solutions like Bybit and S1LKPAY, which use USDC to settle transactions.

Mastercard's stablecoin strategy isn't limited to USDC. The company supports a growing portfolio of regulated stablecoins, including Paxos' USDG, Fiserv's FIUSD, and PayPal's PYUSD, and is driving use cases across remittances, B2B transactions, and payouts to gig workers via platforms like Mastercard Move and MTN.

These pilots are incremental steps. They're limited in geography and transaction volume. But they demonstrate that the technology works and that there's demand from acquirers and merchants who want faster settlement and lower liquidity costs.

The Strategic Acquisition: Zero Hash and BVNK

With MTN and Crypto Credential providing the scaffolding, Mastercard now needs production-scale infrastructure to handle custody, compliance, and stablecoin orchestration across hundreds of financial institutions. This is where Zero Hash comes in.

What Zero Hash Does

Zero Hash is a U.S.-based fintech infrastructure company founded in 2017 that provides backend technology for crypto, stablecoin, and tokenized asset services. The company enables banks, brokerages, fintechs, and payment processors to offer crypto and stablecoin products to their customers without having to build their own infrastructure or navigate the regulatory maze themselves.

Zero Hash's services include:

- Custody and wallet infrastructure: Secure storage of digital assets with institutional-grade security.

- Stablecoin orchestration: Tools to convert between fiat and stablecoins, manage liquidity, and route payments across blockchains.

- Regulatory compliance: Licensing and regulatory frameworks that allow clients to operate in multiple jurisdictions.

- Payouts and settlements: Infrastructure for paying merchants, gig workers, and contractors in stablecoins.

The company has grown rapidly. In September 2025, Zero Hash raised $104 million in a Series D funding round led by Interactive Brokers, with backing from Morgan Stanley and SoFi. The round valued the company at $1 billion. Zero Hash processed more than $2 billion in tokenized fund flows in the first four months of 2025, reflecting surging institutional demand for on-chain assets.

In November 2025, Zero Hash obtained a MiCA (Markets in Crypto-Assets) license from Dutch regulators, enabling it to offer stablecoin services across 30 countries in the European Economic Area. This makes Zero Hash one of the first infrastructure providers authorized under the EU's comprehensive crypto regulatory framework.

The BVNK Alternative

Before targeting Zero Hash, Mastercard was reportedly in late-stage talks to acquire BVNK for around $2 billion. BVNK is a stablecoin platform that focuses on enabling businesses to use stablecoins for global payroll, treasury management, and payments. Coinbase was also reportedly pursuing BVNK, creating a bidding war.

The fact that Mastercard was willing to pay $2 billion for either company underscores the strategic value of turnkey stablecoin infrastructure. Building such capabilities in-house would take years and require expertise in blockchain development, custody technology, regulatory compliance, and client integrations. Acquiring Zero Hash or BVNK provides an instant on-ramp.

Why Acquire Instead of Build?

Mastercard is no stranger to blockchain technology. It acquired CipherTrace, a blockchain analytics firm, in 2021. It has participated in CBDC pilots, launched MTN, and deployed Crypto Credential. So why buy Zero Hash instead of continuing to build organically?

The answer comes down to speed, scale, and regulatory moats.

Speed: The stablecoin market is growing fast, and competitors are moving aggressively. Stripe acquired Bridge for $1.1 billion in October 2024 and has been rapidly integrating stablecoin payments across its platform. Visa is expanding its own stablecoin settlement capabilities. Mastercard can't afford to fall behind.

Scale: Zero Hash already serves a roster of clients and processes billions in tokenized flows. Acquiring the company gives Mastercard instant scale and a proven platform that works in production.

Regulatory moats: Navigating crypto regulations is complex and time-consuming. Zero Hash holds multiple licenses and has built compliance frameworks that allow it to operate across jurisdictions. With its new MiCA license, Zero Hash can serve the entire European Economic Area - a capability that would take Mastercard years to replicate on its own.

Jake, a research analyst at Messari, noted: "If Mastercard pays $1.5-$2 billion, that's a 50-100% markup for late-stage investors in one quarter. For Mastercard, that's the cost of speed. Buying a fully licensed, production-grade crypto infrastructure provider is faster than building one."

Risks and Uncertainties

The deal is not yet closed. Fortune reported that negotiations are at an advanced stage, but the transaction "may still fall through." Integration challenges, regulatory approvals, and due diligence could derail the acquisition or delay its completion.

Even if the deal closes, Mastercard will face the challenge of integrating Zero Hash's technology into its own network. The companies operate in different regulatory environments and serve different customer bases. Ensuring seamless interoperability between Zero Hash's stablecoin rails and Mastercard's existing payment infrastructure will require careful engineering and coordination.

Still, the strategic intent is clear. Mastercard is betting that stablecoin settlement is the future of payments - and it's willing to pay a premium to secure the infrastructure it needs to compete in that future.

How the Move Could End 'Banking Hours'

If Mastercard acquires Zero Hash and integrates stablecoin settlement into its core payment network, the implications for "banking hours" could be profound. To understand how, it's useful to walk through a concrete example of how settlement might work in a stablecoin-enabled system.

The 24/7 Settlement Model

In the traditional model, a cardholder makes a purchase on Saturday. The merchant receives authorization immediately, but settlement doesn't happen until Monday or Tuesday. The merchant must wait for the batch window to close, the acquiring bank to process the transaction, and Mastercard to net the obligations between the issuing and acquiring banks.

In a stablecoin-enabled model, the process looks different:

-

Authorization: The cardholder makes a purchase. Mastercard verifies that funds are available and approves the transaction. This step is unchanged.

-

Settlement option: Instead of waiting for batch processing, the acquiring bank can choose to receive settlement in USDC or EURC. This option is available 24/7, including weekends and holidays.

-

On-chain netting: Obligations between the issuing bank and the acquiring bank are netted on-chain. Mastercard uses its MTN infrastructure to execute an atomic swap: the issuer's stablecoins move to the acquirer, and the acquirer's stablecoins (if any) move to the issuer.

-

Instant liquidity: The acquiring bank receives USDC or EURC immediately. It can choose to hold the stablecoins, convert them to fiat through approved liquidity partners, or use them to settle with merchants directly.

-

Treasury automation: Treasury teams can sweep funds in near real-time. They can apply programmable rules for foreign exchange, fees, and reserve management. Funds can be converted back to fiat whenever needed, without waiting for banking hours.

Use Case: A Merchant in Argentina

Consider a merchant in Buenos Aires that accepts Mastercard payments from international tourists. Under the traditional model, settlement happens in U.S. dollars via correspondent banks. The funds take several days to arrive, and exchange rate fluctuations during that time can erode profit margins.

With stablecoin settlement, the merchant's acquiring bank could receive USDC on Saturday night - immediately after the tourist makes the purchase. The bank can convert USDC to Argentine pesos at the current exchange rate and deposit the funds in the merchant's account the same day. No batch delays. No correspondent chains. No weekend wait.

This is not a hypothetical. Mastercard's EEMEA pilot with Circle is already testing this model with Arab Financial Services and Eazy Financial Services. The acquiring institutions receive settlement in USDC or EURC and use those stablecoins to settle with merchants.

Quantifying the Benefits

What are the concrete benefits of 24/7 settlement?

Reduced pre-funding: Banks and acquirers currently need to prefund merchant accounts to ensure timely payments. With instant stablecoin settlement, pre-funding requirements can be reduced or eliminated, freeing up capital for other uses.

Lower daylight overdraft risk: Banks that run negative balances during settlement windows often incur fees or regulatory scrutiny. Real-time settlement reduces the window of exposure and the associated risk.

Faster cross-border flows: Cross-border transactions that currently take 3-5 days can settle in minutes. This is especially valuable for remittances, B2B payments, and supply chain finance.

Improved working capital: Merchants that receive funds faster can reinvest them sooner, improving cash flow and reducing the need for short-term credit.

Weekend and holiday availability: Businesses that operate 24/7 - such as e-commerce platforms, gig economy companies, and hospitality providers - no longer face delays when settlement falls on a weekend or holiday.

The Contrast with T+1 Settlement

It's worth emphasizing how different this is from the current T+1 model. In the traditional ACH system, transactions initiated on Friday evening don't begin processing until Monday morning. If Monday is a federal holiday, processing is delayed until Tuesday. The same constraints apply to card settlement.

With stablecoin settlement, time zones and holidays become irrelevant. A transaction initiated at 11 PM on Christmas Eve settles just as quickly as one initiated at 10 AM on a Tuesday. This "always-on" capability is not just an incremental improvement - it's a fundamental shift in how money moves.

Ecosystem-Wide Impacts: Banks, Merchants, Cross-Border, and Crypto

The implications of Mastercard's stablecoin push extend far beyond the company itself. If 24/7 settlement becomes the norm, it will reshape how banks, merchants, cross-border payment providers, and the crypto industry itself operate.

For Banks and Payment Processors

Banks and payment processors face both opportunities and challenges.

Opportunities:

-

Fewer vendors: By using Mastercard's MTN and Zero Hash infrastructure, banks can reduce the number of vendors they need to manage. Instead of contracting separately with blockchain networks, custody providers, and compliance platforms, they can plug into Mastercard's turnkey solution.

-

Faster time to market: Rolling out stablecoin services in-house can take years. Mastercard's infrastructure allows banks to launch new products in months.

-

New revenue streams: Banks can offer stablecoin-based treasury management, cross-border payments, and programmable payment features to corporate clients.

Challenges:

-

On-chain risk: Stablecoins introduce new risks - smart contract vulnerabilities, de-peg events, custody breaches, and blockchain network outages. Banks will need to develop expertise in managing these risks.

-

Key management: Holding and transferring stablecoins requires managing private keys. Banks accustomed to centralized ledgers will need to implement robust key management systems and controls.

-

Operational complexity: Running both fiat and stablecoin rails in parallel increases operational complexity. Banks will need new accounting systems, reconciliation processes, and reporting tools.

For Merchants and Treasurers

Merchants stand to benefit significantly from faster settlement, but they will also face new choices and complexities.

Benefits:

-

Settlement transparency: Blockchain-based settlement provides a transparent audit trail. Merchants can verify that funds have been sent and track their movement across the network.

-

Faster reconciliation: Real-time settlement simplifies reconciliation. Merchants no longer need to match batches of transactions that arrive days after the sale.

-

Option to hold stablecoins: Merchants that operate internationally may choose to hold USDC balances to avoid currency conversion fees and exchange rate risk.

Challenges:

-

Treasury management: Deciding when to convert stablecoins to fiat becomes a treasury decision. Holding stablecoins exposes merchants to de-peg risk and regulatory uncertainty.

-

New accounting standards: Stablecoins are not yet recognized as cash equivalents under IFRS or GAAP. Treasurers will need to navigate complex accounting treatments.

-

Vendor relationships: Merchants will need to ensure their acquiring banks support stablecoin settlement and understand the fees, terms, and risks involved.

For Cross-Border Payments

Cross-border payments have long been a pain point for businesses. Correspondent banking chains, SWIFT fees, and multi-day settlement times make international transfers slow and expensive.

Stablecoins offer a compelling alternative. A payment from the U.S. to Nigeria can be executed in USDC in seconds, with minimal fees. The recipient converts USDC to local currency at the current exchange rate, avoiding the markups imposed by traditional remittance providers.

This is already happening at scale. Stablecoins moved $46 trillion in transaction volume in 2024, rivaling Visa's throughput. Much of this volume is driven by cross-border flows - remittances from the U.S. to Latin America, payments for digital goods in emerging markets, and B2B settlements.

For businesses, the implications are profound:

-

Shorter settlement times: Cross-border payments that once took 3-5 days can settle in minutes.

-

Lower costs: By eliminating correspondent banks and reducing FX fees, stablecoins can cut cross-border payment costs by 50% or more.

-

Access to underserved markets: Stablecoins enable businesses to transact in countries where traditional banking infrastructure is weak or nonexistent.

For the Crypto Industry

Mastercard's stablecoin push represents mainstream validation for the crypto industry. When one of the world's largest payment networks commits $2 billion to acquiring stablecoin infrastructure, it sends a powerful signal: crypto is no longer a niche experiment - it's core financial infrastructure.

This validation has several effects:

Increased institutional flows: Banks and payment processors that were hesitant to touch crypto may now feel comfortable offering stablecoin services under Mastercard's umbrella.

Regulatory momentum: Mainstream adoption by Mastercard and other incumbents may accelerate regulatory clarity. Policymakers are more likely to create clear frameworks when major financial institutions are involved.

New rails for tokenized assets: Stablecoins are just the beginning. The same infrastructure that enables USDC settlement can be extended to tokenized securities, commodities, and real-world assets. This opens the door to a much larger tokenization market.

Industry Projections

The growth projections for stablecoins are staggering. Citigroup's September 2025 report forecasts that stablecoin issuance could reach $1.9 trillion by 2030 in a base case scenario, with a bull case of $4 trillion. On an adjusted basis, stablecoin transaction volumes could support nearly $100 trillion in annual activity by 2030.

These projections assume continued regulatory clarity, institutional adoption, and integration into traditional payment systems - exactly the path Mastercard is pursuing.

Competitor Responses

Mastercard is not alone in this race. Stripe acquired Bridge for $1.1 billion and has since launched stablecoin financial accounts, card issuing, and payment acceptance across 101 countries. Visa has partnered with Bridge to issue stablecoin-linked Visa cards, enabling cardholders to spend stablecoins at any of the 150 million merchants that accept Visa.

This competitive dynamic is accelerating the pace of innovation. No major player wants to cede market share to rivals. The result is a strategic arms race, with each company trying to build or buy the best stablecoin infrastructure.

Operational, Compliance, Liquidity, and Risk Challenges

For all the promise of 24/7 stablecoin settlement, significant challenges remain. These obstacles - operational, regulatory, and market-related - will determine how quickly the vision becomes reality.

Fiat Rail Limits

Stablecoins may operate 24/7, but fiat rails do not. ACH and SEPA transfers still observe banking hours. This creates a mismatch: a merchant might receive USDC on Saturday night, but converting it to fiat for deposit in a traditional bank account requires waiting until Monday.

This isn't an insurmountable problem - merchants can hold stablecoins over the weekend and convert them on Monday morning - but it limits the benefit of instant settlement. Until fiat on-ramps and off-ramps operate 24/7, there will always be a bottleneck.

Some banks are addressing this by offering instant payment services like FedNow and RTP, which operate around the clock. But adoption is still limited, and international instant payment networks are fragmented.

Custody and Key Management

Holding stablecoins requires managing private keys - the cryptographic credentials that control access to funds. Unlike traditional bank accounts, where access is mediated by usernames and passwords, blockchain assets are controlled by whoever holds the private key.

This creates new risks:

- Key loss: If a private key is lost, the funds are irrecoverable.

- Key theft: If a key is stolen, the funds can be drained instantly.

- Operational errors: Sending funds to the wrong address or blockchain can result in permanent loss.

Banks and payment processors will need to implement institutional-grade custody solutions with multi-signature controls, hardware security modules, and rigorous access policies. Zero Hash and other providers offer custody infrastructure, but integrating these systems into existing bank operations is non-trivial.

Smart Contract Vulnerabilities

Many stablecoin transactions involve smart contracts - self-executing programs that run on blockchains. While smart contracts enable programmability, they also introduce vulnerabilities. Bugs in smart contract code can be exploited by attackers, resulting in loss of funds.

High-profile exploits - such as the $600 million Poly Network hack in 2021 - have underscored the risks. For mainstream adoption, stablecoin infrastructure must be audited, tested, and continuously monitored for vulnerabilities.

Stablecoin De-Peg Risk

Stablecoins are designed to maintain a 1:1 peg with fiat currencies, but this peg can break. In 2022, TerraUSD (UST) lost its peg and collapsed, wiping out tens of billions of dollars in value. While USDC and EURC are backed by reserves and have maintained their pegs, the risk is not zero.

A de-peg event during settlement could create losses for banks, merchants, or payment processors. Risk management frameworks will need to account for this possibility - perhaps by using stablecoins only for short-duration settlements or by maintaining reserve buffers.

Compliance Challenges: AML, Travel Rule, Chargebacks

Traditional payment systems have well-established compliance frameworks. Banks conduct KYC (Know Your Customer) checks. Transactions are monitored for suspicious activity. Chargebacks allow consumers to dispute fraudulent charges.

Stablecoin systems must replicate these protections, but the mechanisms are different:

AML/CTF: Anti-money laundering and counter-terrorism financing rules require that transactions over certain thresholds be reported. Mastercard's Crypto Credential supports Travel Rule compliance, but implementing this at scale requires coordination with exchanges, wallets, and regulators.

Chargebacks: Blockchain transactions are generally irreversible. Once funds are transferred, they cannot be clawed back without the recipient's consent. This makes implementing chargeback mechanisms more complex. Some solutions involve multi-signature escrow accounts or programmable smart contracts that can reverse transactions under certain conditions, but these add complexity and cost.

Accounting systems: Existing accounting systems are designed for fiat transactions that settle on T+1 or T+2 schedules. Continuous stablecoin settlement requires new accounting standards and software that can handle real-time reconciliation and reporting.

Liquidity and Market Risks

Stablecoin markets are still maturing. While USDC and Tether are highly liquid, spreads can widen during off-hours or periods of market stress. Converting large amounts of stablecoins to fiat may incur slippage, especially on weekends when liquidity is lower.

Additionally, stablecoin liquidity is concentrated on certain blockchains. Ethereum and Tron account for 64% of stablecoin transaction volume. If a bank needs to settle on a different blockchain, it may face liquidity constraints or higher conversion costs.

Integration Risk

Integrating stablecoin infrastructure with legacy payment systems is a major engineering challenge. Banks operate on decades-old core banking systems that were never designed to handle blockchain transactions. Ensuring seamless interoperability - without creating new points of failure or security vulnerabilities - will require careful planning, testing, and phased rollouts.

Vendor consolidation poses another risk. If Mastercard acquires Zero Hash and becomes a dominant provider of stablecoin infrastructure, banks and merchants may become dependent on a single vendor. This concentration risk could lead to higher fees, reduced innovation, or systemic vulnerabilities if Mastercard's systems experience outages.

Regulatory Uncertainty

While the regulatory environment for stablecoins has improved - particularly with the passage of the GENIUS Act in the U.S. and the implementation of MiCA in Europe - many questions remain unresolved:

- Cross-border regulation: Different jurisdictions have different rules for stablecoins. A stablecoin that is compliant in the U.S. may not be authorized in the EU or Asia.

- Tax treatment: How are stablecoin transactions taxed? Are they considered currency exchanges, property transactions, or something else?

- Systemic risk: If stablecoins become a significant part of the financial system, regulators may impose stricter capital requirements, reporting obligations, or operational standards.

Where This Could Lead: Scenarios and What to Look For

Given the opportunities and challenges, how might Mastercard's stablecoin push unfold over the next several years? It's useful to consider three scenarios: a base case, an accelerated adoption case, and a stalled transition case.

Base Case: Hybrid Model Persists

In this scenario, Mastercard completes the acquisition of Zero Hash and integrates stablecoin settlement into MTN. Stablecoin usage grows steadily, but legacy fiat rails remain dominant.

Key characteristics:

- Stablecoin settlement is available as an option for acquirers and merchants, but most transactions still settle in fiat via traditional batch processing.

- Geographic rollout is gradual, starting with emerging markets where stablecoins provide the most value (e.g., high-inflation countries, cross-border corridors with limited banking infrastructure).

- Regulatory frameworks continue to evolve, with ongoing debates about capital requirements, reserve standards, and systemic risk.

- Banks and payment processors maintain dual infrastructure - supporting both fiat and stablecoin rails in parallel.

Timeline: By 2028, stablecoin settlement accounts for 10-15% of Mastercard's transaction volume, concentrated in specific use cases (cross-border payments, gig economy payouts, remittances).

What to watch:

- Completion of the Zero Hash acquisition and integration roadmap.

- Expansion of USDC/EURC settlement beyond EEMEA to additional regions.

- Adoption metrics: How many banks and acquirers are using MTN? What percentage of merchants are receiving stablecoin settlements?

Accelerated Adoption: Banking Hours Fade

In this scenario, stablecoin adoption exceeds expectations. Regulatory clarity accelerates, liquidity deepens, and both institutional and retail users embrace 24/7 settlement.

Key characteristics:

- Mastercard completes the Zero Hash acquisition and rapidly rolls out stablecoin settlement globally. By 2027, stablecoin settlement accounts for 30-40% of Mastercard's transaction volume.

- Banks begin offering stablecoin-denominated accounts to corporate clients. Treasurers hold USDC balances to earn yield and manage liquidity more efficiently.

- Citigroup's bull case forecast materializes: stablecoin market cap reaches $4 trillion by 2030, with transaction volumes exceeding $100 trillion annually.

- Traditional batch settlement becomes the exception rather than the rule. Weekend and holiday delays are eliminated for most transactions.

Timeline: By 2030, "banking hours" as a concept no longer constrains most payment flows. Merchants and businesses operate in a continuous settlement environment.

What to watch:

- Regulatory milestones: Does the U.S. pass additional legislation supporting stablecoin issuance and use? Do other jurisdictions follow MiCA's lead?

- Liquidity indicators: Are stablecoins trading with tight spreads 24/7? Are market makers providing liquidity on weekends?

- Institutional adoption: Are Fortune 500 companies holding stablecoin balances? Are central banks issuing CBDCs that interoperate with stablecoins?

Stalled Transition: Legacy Rails Dominate

In this scenario, operational and regulatory challenges slow adoption. Stablecoin settlement remains a niche offering, and traditional fiat rails continue to dominate.

Key characteristics:

- The Zero Hash acquisition faces regulatory hurdles or integration challenges. Rollout is delayed or limited in scope.

- Stablecoin de-peg events or smart contract exploits create reputational damage and regulatory backlash.

- Banks and merchants are reluctant to adopt stablecoin settlement due to concerns about custody risk, accounting complexity, or regulatory uncertainty.

- Competitor offerings (e.g., instant payment networks like FedNow) provide a fiat-based alternative that meets the need for faster settlement without the complexity of crypto.

Timeline: By 2030, stablecoin settlement accounts for less than 5% of Mastercard's transaction volume, concentrated in niche use cases.

What to watch:

- Deal closure: Does the Zero Hash acquisition actually close? If not, does Mastercard pursue an alternative target or pivot to a different strategy?

- Regulatory setbacks: Are new restrictions imposed on stablecoins? Do accounting standards fail to recognize stablecoins as cash equivalents?

- Competitive dynamics: Do instant payment networks capture the market share that stablecoins were expected to win?

Indicators to Monitor

Regardless of which scenario unfolds, several indicators will signal the direction of travel:

-

Zero Hash acquisition status: Does the deal close? What is the integration timeline?

-

BVNK outcome: If Mastercard doesn't acquire BVNK, does Coinbase or another competitor do so? How does this affect the competitive landscape?

-

MTN adoption: How many banks and fintechs are integrated with MTN? What transaction volumes are they processing?

-

Crypto Credential rollout: How many exchanges and wallets support Crypto Credential? Is it expanding beyond remittances into other use cases?

-

USDC/EURC settlement volumes: Are stablecoin settlements growing quarter-over-quarter? Which geographies and sectors are driving adoption?

-

Regulatory developments: Are new stablecoin frameworks enacted in key markets? Do they create tailwinds or headwinds for adoption?

-

Competitor moves: What are Visa, Stripe, PayPal, and other payment giants doing in the stablecoin space?

Broader Implications for Crypto and Finance

Mastercard's stablecoin push has implications that extend beyond settlement efficiency. It touches fundamental questions about the role of crypto in the financial system, the future of stablecoins as a global settlement layer, and the convergence of traditional finance and decentralized finance (DeFi).

From Speculative Asset to Core Infrastructure

For much of its history, crypto has been viewed as a speculative asset class - volatile, risky, and disconnected from real economic activity. Stablecoins, by contrast, are designed to be boring: they're meant to hold their value, not generate returns. They're infrastructure, not investment.

Mastercard's bet on stablecoin settlement reinforces this shift. When a payment network processes billions of transactions in USDC, stablecoins are no longer a fringe experiment - they're a core component of the global payment system.

This reframing has several consequences:

- Legitimacy: Stablecoins gain legitimacy as a payment method. Merchants, banks, and regulators that were skeptical may reconsider.

- Regulation: Policymakers are more likely to create clear, supportive frameworks for assets that are embedded in mainstream finance.

- Investment: Institutional capital flows into stablecoin infrastructure - custody platforms, liquidity providers, compliance tools - accelerating the build-out of the ecosystem.

Stablecoins as a Global Settlement Layer

If stablecoins become the dominant medium for cross-border payments, they could function as a global settlement layer - a kind of "Eurodollar 2.0" that operates on blockchain rails.

The original Eurodollar market - U.S. dollars held in banks outside the U.S. - emerged in the 1960s and became a critical source of global liquidity. Stablecoins could play a similar role, providing dollar-denominated liquidity to businesses and individuals worldwide without requiring access to U.S. banks.

Over 99% of stablecoins are denominated in USD, and they're projected to grow 10x to more than $3 trillion by 2030. This growth could reinforce dollar dominance, as businesses around the world use USDC for payments, savings, and treasury management.

For the U.S., this has geopolitical implications. U.S. Treasury Secretary Scott Bessent has emphasized that a thriving stablecoin ecosystem could "bolster US dollar supremacy" by embedding USD in digital payments and trade settlements. Stablecoins already hold over $132 billion in U.S. Treasuries, exceeding South Korea's holdings. At $5 trillion in market cap, stablecoins could channel $1.4–$3.7 trillion into Treasuries, providing a stable, domestic-oriented buyer base.

Tokenized Assets and Real-World Asset Markets

Stablecoins are just one category of tokenized assets. The same infrastructure that enables USDC settlement can be extended to tokenized securities, commodities, real estate, and other real-world assets (RWAs).

Mastercard's integration with Ondo Finance, which brought tokenized U.S. Treasury funds to MTN, is an early example. Businesses can now earn yield on idle cash by deploying funds into tokenized Treasury bills 24/7, without leaving the Mastercard network.

This opens the door to a much larger tokenization market. Citigroup estimates that bank tokens (tokenized deposits) could reach $100 trillion in transaction volume by 2030, potentially exceeding stablecoin volumes. These tokenized instruments offer familiar regulatory frameworks and easier integration with existing treasury systems.

The convergence of stablecoins, tokenized deposits, and tokenized RWAs could create a unified infrastructure for programmable money and assets - blurring the lines between payments, treasury management, and capital markets.

Accelerating Institutional Adoption

Mainstream entry by Mastercard, Visa, and other incumbents accelerates institutional adoption in several ways:

Risk reduction: When major financial institutions validate stablecoin infrastructure, it reduces perceived risk for other banks and corporations. The "first-mover penalty" diminishes.

Standardization: Mastercard's MTN and Crypto Credential provide common standards for identity, compliance, and interoperability. This reduces fragmentation and makes it easier for institutions to adopt.

Network effects: As more banks and merchants join Mastercard's stablecoin network, the value of participation increases. This creates a flywheel: adoption drives adoption.

Regulatory Convergence

Mastercard's involvement may also drive regulatory convergence. Policymakers are more likely to create clear frameworks when major financial institutions are building on stablecoin rails. The passage of the GENIUS Act in the U.S. and the implementation of MiCA in Europe reflect this dynamic.

As regulatory frameworks mature, they may converge around common principles:

- Reserve requirements: Stablecoins must be backed by high-quality, liquid assets.

- Transparency: Issuers must provide regular attestations of reserves.

- Redemption rights: Holders must be able to redeem stablecoins for fiat at par.

- Compliance: Stablecoin platforms must comply with AML/CTF and Travel Rule requirements.

This convergence reduces regulatory arbitrage and creates a more stable foundation for global stablecoin adoption.

Consumer Impact

For consumers, the implications of Mastercard's stablecoin push are more subtle but still significant.

Faster payments: Consumers may not notice that settlement is happening in stablecoins, but they will benefit from faster refunds, instant payouts from gig platforms, and reduced delays on international transfers.

New wallet experiences: As stablecoin infrastructure matures, consumers may gain access to new financial products - such as high-yield savings accounts denominated in USDC, or payment cards that automatically convert crypto balances to fiat at the point of sale.

Custodial risk: On the flip side, holding stablecoins involves custodial risk. If a consumer's wallet is hacked or they lose access to their private key, they may have no recourse. Consumer protection frameworks will need to evolve to address these risks.

Final thoughts

Mastercard's reported $2 billion pursuit of Zero Hash represents more than an acquisition - it's a signal that one of the world's most influential payment networks believes stablecoin settlement is the future. If executed well, this strategy could redefine "banking hours" by enabling merchants, banks, and businesses to transact 24/7 without waiting for batch windows, weekends, or holidays.

The vision is compelling. Instead of waiting days for cross-border payments to clear, funds could move in minutes. Instead of managing complex correspondent banking chains, treasury teams could net obligations on-chain. Instead of accepting the constraints of T+1 settlement, acquirers could receive liquidity in real-time - any time.

But vision is not destiny. The road from pilot programs to global adoption is long and uncertain. Operational challenges - fiat rail limits, custody risks, smart contract vulnerabilities - must be addressed. Regulatory frameworks must continue to mature. Liquidity must deepen across blockchains and time zones. Banks, merchants, and consumers must be convinced that the benefits outweigh the risks.

Three scenarios capture the range of possible outcomes. In the base case, stablecoin settlement grows steadily but remains complementary to legacy fiat rails. In the accelerated case, adoption surges and banking hours fade into obsolescence by the end of the decade. In the stalled case, technical or regulatory setbacks limit stablecoin usage to niche applications.

Which scenario unfolds depends on execution, competition, and external factors beyond Mastercard's control. The completion of the Zero Hash acquisition will be an early indicator. The expansion of USDC/EURC settlement to new regions, the adoption of MTN by major banks, and the rollout of Crypto Credential to more exchanges will provide additional signals. Regulatory developments - both supportive and restrictive - will shape the pace of change.

What is already clear is that the technological foundation is being laid. Mastercard has built the scaffolding: MTN for secure, programmable transactions; Crypto Credential for verified, compliant interactions; and pilot programs demonstrating that stablecoin settlement works in practice. Acquiring Zero Hash would provide the production-scale infrastructure to accelerate these efforts.

This is less about "crypto hype" and more about the next infrastructure layer. Payments, rails, and tokens are becoming indistinguishable from everyday finance. The invisible handshake that Mastercard envisions - where tokenized money flows seamlessly across blockchain networks with the same trust and protection as traditional payments - is moving from concept to reality.

The transition may take years. It may face setbacks. But the direction of travel is unmistakable. Banking hours, as we have known them for decades, are beginning to give way to an always-on, globally connected payment system. Mastercard's $2 billion bet is a wager that this future is not only possible but inevitable.

For readers - whether bankers, merchants, policymakers, or observers - the task now is to monitor the indicators, track the adoption curves, and watch how this infrastructure evolves. The payments revolution is not coming. It's already here. The question is no longer whether stablecoin settlement will reshape finance, but how quickly, how broadly, and with what consequences.