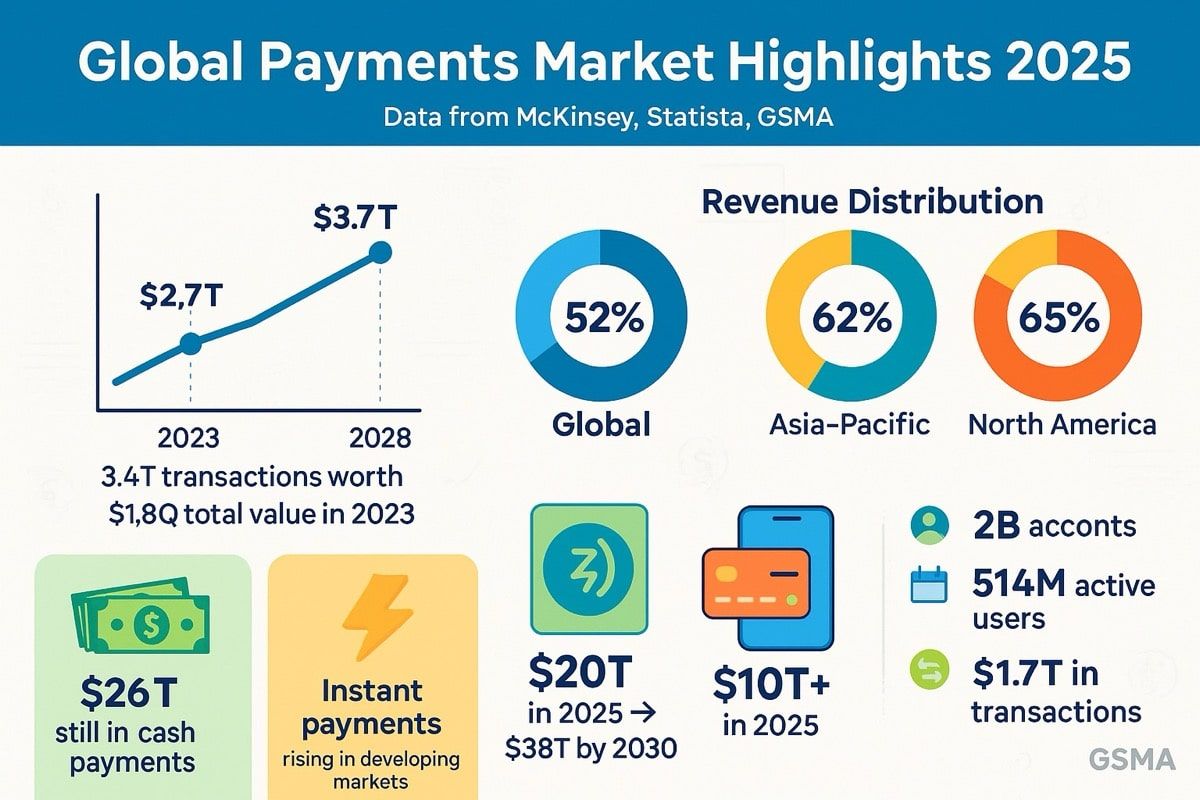

The global payments industry operates at a scale that defies easy comprehension. In 2023, the sector processed approximately 3.4 trillion transactions worth $1.8 quadrillion in value, generating a revenue pool of $2.4 trillion. To put that in perspective: $1.8 quadrillion equals $1,800 trillion - roughly 90 times the size of the entire U.S. economy.

Yet despite this astronomical scale and decades of technological progress, the modern payments infrastructure remains remarkably inefficient. Funds sit idle in pre-funded accounts for days. Cross-border transfers crawl through correspondent banking networks. Settlement windows stretch across time zones. Working capital languishes in accounts receivable. The machinery works, but it grinds slowly - and expensively.

Meanwhile, decentralized finance has demonstrated something revolutionary: money can move instantly, settle in seconds, and be programmed to execute complex logic automatically. Stablecoins have emerged as the bridge between these worlds, with transaction volumes surpassing both Visa and Mastercard in annualized value, hitting $15.6 trillion in 2024 and climbing. By the first quarter of 2025, on-chain stablecoin transaction volume exceeded $8.9 trillion globally.

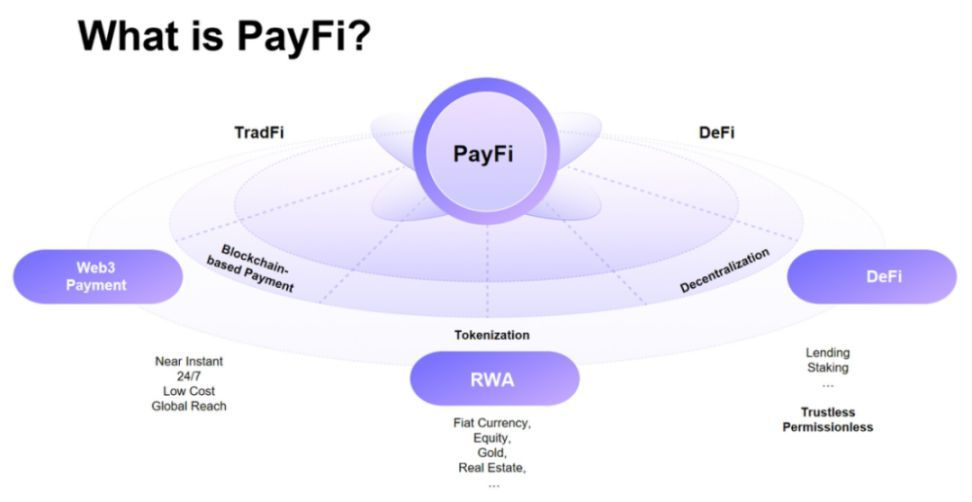

Enter PayFi - Payment Finance - the convergence layer where traditional payment rails meet decentralized infrastructure. This is not merely about faster transactions or lower fees, though both are significant. PayFi represents something more fundamental: the ability to unlock the time value of money trapped in payment flows, transform settlement from batch processes to continuous streams, and program financial logic directly into the movement of value itself.

The concept was first articulated by Solana Foundation President Lily Liu, who framed it around a fundamental principle: any given sum of money now is worth more than that amount in the future, as it can be used immediately for investment, income generation, or consumption. PayFi combines the distribution and regulatory frameworks of legacy payment networks with the transparency, interoperability, and automation of blockchain-based infrastructures, creating a convergence layer where money movement is instant, borderless, composable, and identity-aware.

The opportunity is not hypothetical. Stablecoin market capitalization reached $251.7 billion by mid-2025, with USDC circulation hitting record highs above $56 billion and USDC monthly transaction volume reaching $1 trillion in November 2024 alone. Traditional payment processors like Visa have launched pilots to settle with USDC on Solana with acquirers including Worldpay and Nuvei. Major asset managers including BlackRock and Fidelity have invested in stablecoin infrastructure. Hong Kong passed its Stablecoin Ordinance in May 2025, and the United States enacted comprehensive stablecoin legislation - the GENIUS Act - in July 2025.

Below we dive deep into how PayFi is reshaping the payments landscape: the infrastructure enabling it, the use cases it unlocks, the regulatory frameworks emerging around it, and the risks that remain. The convergence is accelerating. Understanding PayFi is essential for anyone working in payments, finance, or digital assets.

Why Now? The Time-Value of Money and Payments Infrastructure

The timing of PayFi's emergence is not coincidental. It reflects the convergence of long-standing inefficiencies in traditional payments with newly mature blockchain infrastructure capable of addressing them at scale.

The Inefficiency Problem

Traditional payment systems suffer from a fundamental constraint: they operate in batches, not streams. When a business receives a credit card payment, the funds do not arrive instantly. Instead, they enter a settlement process that can take two to three days. When a company sends an international wire transfer, correspondent banks route it through multiple intermediaries, each adding time, cost, and opacity. When workers receive paychecks, they wait until the end of a pay period, even though they have already earned the money.

These delays create what economists call "float" - money in transit that benefits no one. For decades, financial institutions profited from this float, earning interest on funds that belonged to customers but had not yet settled. From the customer's perspective, however, float represents locked value: money they cannot access, cannot invest, cannot use to meet obligations or seize opportunities.

The global payments industry's $1.8 quadrillion in annual transaction value generates approximately $2.4 trillion in revenue. Much of this revenue derives from the inefficiencies: interchange fees, foreign exchange spreads, wire transfer charges, and the opportunity cost of capital tied up in pre-funding accounts and settlement delays.

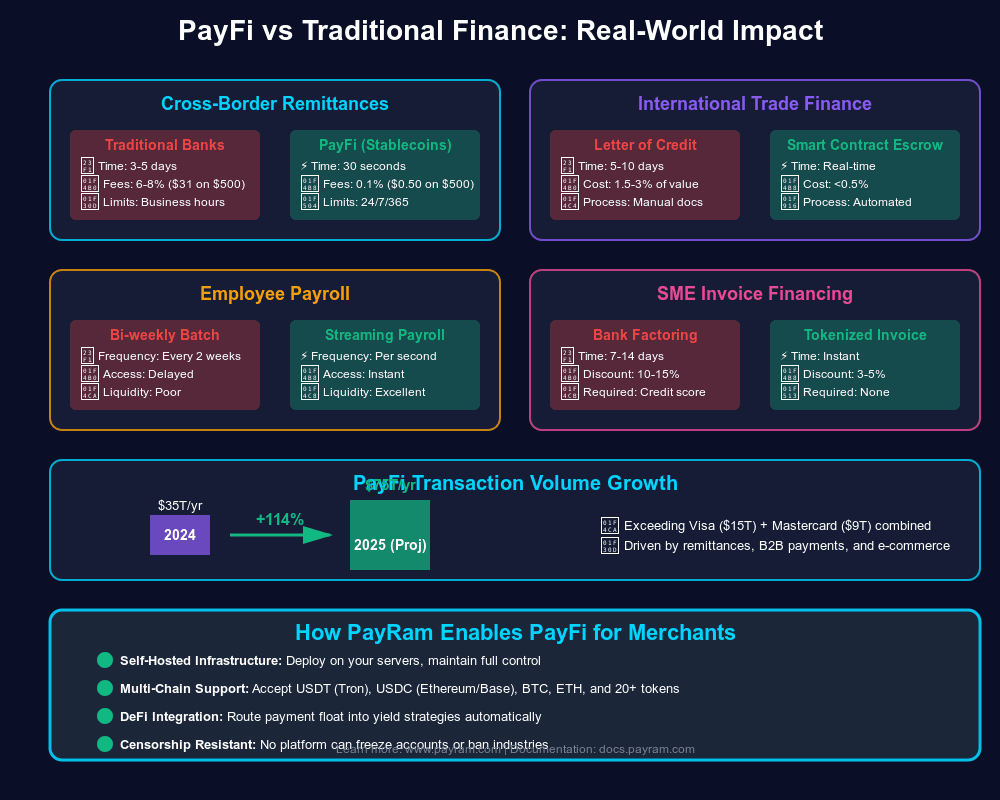

Cross-border payments exemplify the problem. The World Bank reports that remittance fees averaged 6.2% globally for sending $200 in 2023 - more than double the United Nations Sustainable Development Goal target of 3%. For the approximately 150 million migrant workers worldwide who send money home to families, these fees represent a significant tax on their earnings. Yet the service they receive is slow: cross-border payments can take three to five days to settle, during which exchange rates may shift and funds remain inaccessible.

The Real-Time Rails Gap

Recognizing these inefficiencies, many countries have launched real-time payment systems. India's Unified Payments Interface (UPI) processes billions of transactions monthly. Brazil's PIX has driven rapid digitization of payments. The Federal Reserve launched FedNow in 2023 to enable instant payments in the United States. Europe has mandated instant SEPA payments.

These systems represent meaningful progress. Yet they face limitations. Most operate only domestically - a PIX payment works within Brazil, but not for sending value to Mexico or Nigeria. Many lack programmability - they move money instantly, but cannot attach business logic or automate complex workflows. Some face monetization challenges: India's UPI processes massive volumes but charges no fees, contributing less than 10% of future revenue growth.

More fundamentally, real-time rails still operate within traditional account-based systems. They accelerate the movement between accounts, but they do not fundamentally change what money can do during that movement. They cannot, for example, automatically split incoming revenue between multiple stakeholders, escrow funds pending contract fulfillment, or enable instantaneous multi-currency settlement without pre-funded nostro accounts.

The Blockchain Infrastructure Maturation

While traditional payments struggled with these constraints, blockchain infrastructure matured significantly between 2020 and 2025. Early blockchain networks could not handle payments-grade throughput - Bitcoin processes roughly seven transactions per second, Ethereum about 15-30 before scaling solutions. For comparison, Visa's network handles thousands of transactions per second.

This changed with newer architectures and layer-two solutions. Solana supports PayFi with high performance, featuring 400-millisecond block times and deep liquidity. Base, Arbitrum, and Polygon offer low-cost settlement for stablecoins. The Stellar network, designed specifically for cross-border payments, provides fast finality at minimal cost.

Equally important, stablecoins solved blockchain's volatility problem. A payment rail cannot function if the medium of exchange fluctuates 10% during settlement. USDT (Tether) maintains a market capitalization exceeding $150 billion, while USDC (Circle) reached approximately $70-75 billion by mid-2025. These dollar-backed tokens provide price stability while retaining blockchain benefits: programmability, 24/7 operation, instant settlement, transparent reserves.

USDC monthly transaction volume reached $1 trillion in November 2024 alone while surpassing $18 trillion in all-time volume. By early 2025, the number of unique addresses using stablecoin transactions exceeded 32 million, marking a rapid development trend with addresses increasing by over 200% compared to 2022.

The Time-Value Unlock

This infrastructure maturation enables something that was previously impossible: unlocking time-value during the payment process itself. Traditional systems cannot do this because settlement is opaque and delayed. You cannot build a lending market on funds in transit through correspondent banks because you do not know when they will arrive or what their final value will be after fees and FX conversion.

PayFi changes this. When a business knows it will receive $10,000 in revenue tomorrow, it can tokenize that future receivable today, access liquidity against it immediately, and have the smart contract automatically settle the obligation when payment arrives. When a freelancer in the Philippines has $500 in completed work pending payment, they can receive advance liquidity, have it settle automatically when the client pays, and avoid waiting weeks for international wire transfers.

PayFi applies the time-value principle by enabling users to utilize tomorrow's money to pay for today, a feat traditional finance struggles to match. The difference between PayFi and traditional invoice factoring or supply-chain financing is infrastructure: blockchain settlement eliminates much of the overhead, smart contracts automate the workflows, and stablecoins provide the stable value reference.

The moment has arrived not because blockchain is new - it is more than a decade old - but because the infrastructure has finally matured to payments-grade requirements while traditional payment inefficiencies have become increasingly untenable in a globalized, digitally native economy.

Infrastructure: How PayFi Works

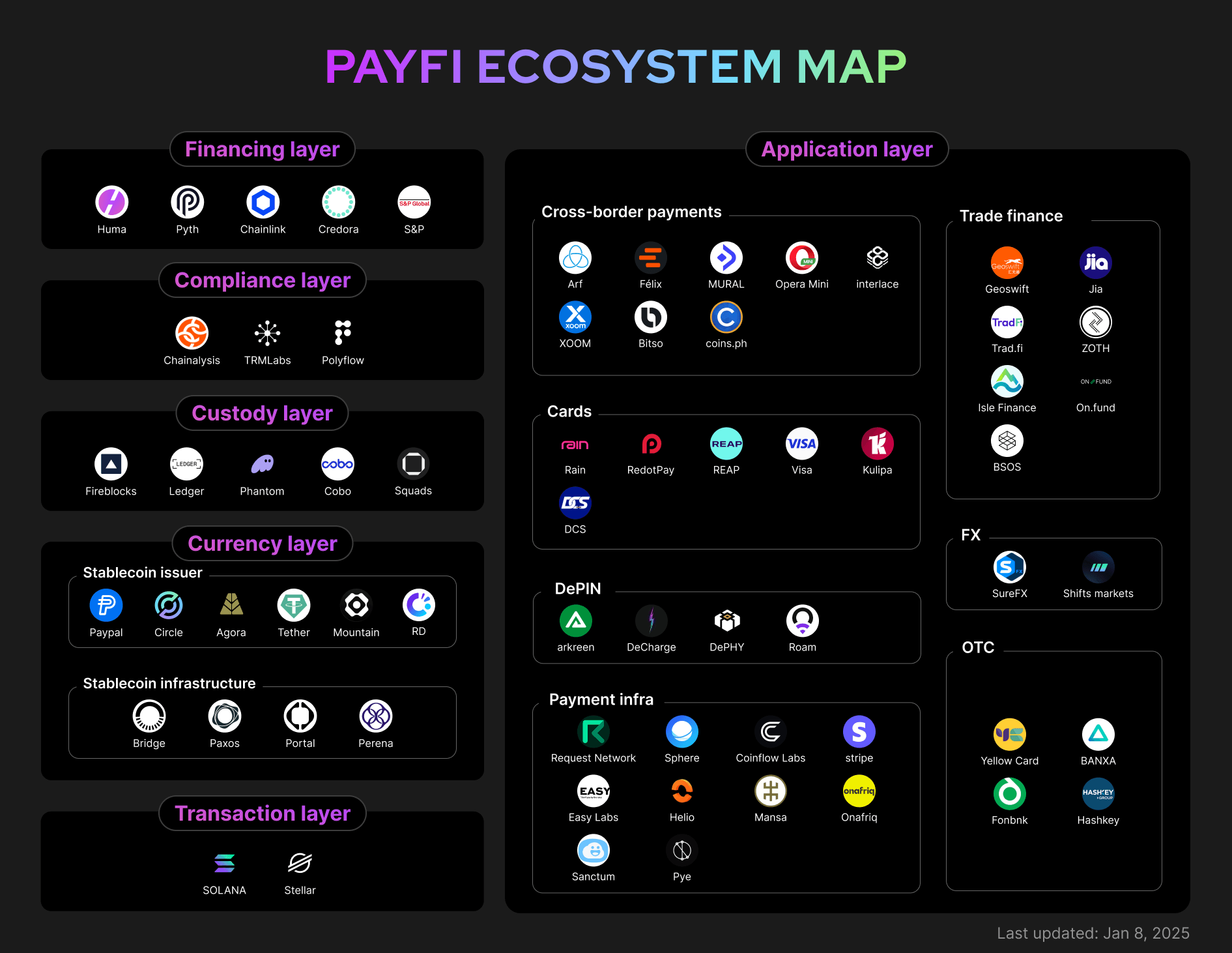

PayFi's technical architecture represents a deliberate fusion of traditional financial infrastructure with blockchain settlement layers. Understanding how this works requires examining the component layers, the key players providing infrastructure, and the mechanisms that enable real-time, programmable settlement.

Architectural Layers

The PayFi stack includes stablecoins and digital assets that serve as the medium of exchange, ensuring speed, security, and global interoperability, with protocols like the Bitcoin Lightning Network, Stellar, and Ethereum Layer-2 solutions enabling instant, low-cost transactions at scale.

The architecture typically comprises four layers:

Settlement Layer: This is where value actually moves and final settlement occurs. It can be a Layer-1 blockchain like Ethereum, Solana, or Stellar, or a Layer-2 scaling solution like Base, Arbitrum, or Polygon. The settlement layer must provide fast finality (seconds to minutes), low transaction costs (fractions of a cent to a few dollars), and sufficient throughput (hundreds to thousands of transactions per second).

Asset Layer: Stablecoins serve as the bridge between fiat currency and on-chain value. USDT (Tether) remains the largest stablecoin, surpassing $150 billion in market cap by mid-2025, while USDC ranks second at approximately $70-75 billion. These are not cryptocurrency speculations; they are dollar representations designed to maintain 1:1 parity with USD through reserve backing.

Circle's USDC reserves consist of 98.9% held in short-dated U.S. Treasuries and cash equivalents. This structure provides liquidity (Circle commits to 1:1 redemption) while generating yield from Treasury holdings. USDC is natively supported on 28 blockchain networks including Ethereum, Solana, Base, Arbitrum, Stellar, and Polygon, enabling cross-chain interoperability.

Bridging Layer: Traditional payment systems do not speak blockchain protocols natively. The bridging layer translates between worlds. This includes:

- On-ramps: Services that convert fiat to stablecoins (e.g., bank transfers to USDC)

- Off-ramps: Services that convert stablecoins to fiat (e.g., USDC to local currency cash-out)

- Payment processors: Integrations with card networks, ACH, wire systems

- Compliance infrastructure: KYC/AML verification, transaction monitoring, sanctions screening

Application Layer: This is where business logic lives. Smart contracts automate escrow, split payments, enforce conditional releases, route funds to multiple recipients based on pre-defined rules, and enable programmable financial products. Applications include payment widgets, treasury management dashboards, embedded finance APIs, and invoicing platforms with instant settlement.

Key Infrastructure Players

Several organizations have emerged as critical infrastructure providers enabling PayFi:

Circle and USDC: Circle operates as both stablecoin issuer and infrastructure provider. Beyond minting USDC, Circle provides payment APIs, cross-chain transfer protocols (Circle's Cross-Chain Transfer Protocol enables seamless USDC movement between blockchains), and compliance infrastructure. Circle's stack, including the Circle Payments Network, targets institutional-grade reliability and compliance - key for mainstream payments.

In 2025, Circle acquired Hashnote to expand into tokenized money markets, providing yield-generating opportunities for USDC holders. Circle also partnered with BlackRock (as primary asset manager for USDC cash reserves) and BNY Mellon (as primary custodian of backing assets), bringing traditional finance credibility to stablecoin infrastructure.

Solana Foundation: Solana has positioned itself as a high-performance PayFi network. With 400-millisecond block times, Solana provides the speed necessary for near-instant settlement. Visa expanded pilots to settle with USDC on Solana with acquirers like Worldpay and Nuvei, demonstrating that PayFi can mesh with existing merchant infrastructure.

The Solana ecosystem includes numerous PayFi-specific projects. These range from accounts receivable financing platforms to creator monetization tools to supply-chain settlement applications. Solana's focus on low transaction costs (typically fractions of a cent) makes it economically viable for small-value payments that would be prohibitive on higher-fee networks.

Stellar Network: Stellar was designed from inception for cross-border payments. Stellar has tokenized over $400 billion in real-world assets and is the second-largest chain for asset tokenization. The network's architecture optimizes for fast finality and low cost rather than general-purpose computation.

MoneyGram's partnership with the Stellar Development Foundation enables digital wallets connected to the Stellar network to access MoneyGram's global retail platform, providing a bridge between digital assets and local currencies for consumers. The partnership provides the ability to seamlessly convert USDC to cash, or cash to USDC, revolutionizing the settlement process with near-real-time settlement using Circle's USDC.

Stellar USDC has processed billions of dollars in payments, with over $4.2 billion in cumulative payment volume by mid-2023. The network sees particularly high activity in Latin America, Africa, and Southeast Asia - regions where cross-border payments are critical but expensive through traditional channels.

Ethereum Layer-2 Networks: While Ethereum's main network can be expensive for payments, Layer-2 solutions like Base (Coinbase's network), Arbitrum, and Polygon provide Ethereum security with significantly lower costs. Base has one of the largest cumulative stablecoin transaction bases, reflecting growing adoption for payments applications.

These networks benefit from Ethereum's established developer ecosystem, security model, and institutional comfort level. Many traditional financial institutions exploring blockchain payments begin with Ethereum-based infrastructure due to familiarity.

Traditional Finance Integration Partners: PayFi cannot scale without bridges to traditional finance. Key players include:

-

Visa and Mastercard: Both networks have launched stablecoin settlement initiatives. Visa's crypto advisory services help clients integrate USDC settlement. Mastercard has partnered with multiple stablecoin projects for card payments.

-

Banking Infrastructure: United Texas Bank serves as a settlement bank between Circle and MoneyGram, facilitating the bridge between traditional banking and blockchain rails. Other banks including Signature Bank (before its closure) and Silvergate provided crypto banking services.

-

Payment Processors: Companies like Stripe, Adyen, and PayPal have integrated stablecoin acceptance. PayPal operates its own stablecoin PYUSD. Stripe has explored USDC integration for merchant settlement.

Mechanics of PayFi Settlement

Understanding PayFi requires examining how value actually moves through the system. Consider a cross-border payment from a U.S. business to a supplier in the Philippines:

Traditional Process:

- Business initiates wire transfer through bank ($25-50 fee, 3-5 days)

- Correspondent banks route payment through SWIFT network

- Foreign exchange conversion occurs (spread typically 2-4%)

- Receiving bank credits supplier account (local fees apply)

- Total time: 3-5 business days. Total cost: 5-8% including fees and FX spread.

PayFi Process:

- Business converts USD to USDC via Circle Mint or exchange (near-instant)

- USDC transferred on-chain to supplier's wallet (seconds to minutes, cost <$0.01-1)

- Supplier either holds USDC or converts to Philippine pesos via local off-ramp

- Total time: Minutes to hours. Total cost: <1-2% depending on off-ramp.

The difference is dramatic. But speed and cost are only part of the story. The more significant innovation is programmability.

Programmable Payment Logic

Traditional payments can carry reference numbers or memos, but they cannot execute logic. PayFi payments can. A smart contract can:

-

Split incoming payments automatically: When a creator receives $1,000 for content, the smart contract immediately splits it: 70% to creator, 20% to platform, 10% to collaborators.

-

Escrow with conditions: When a buyer pays for goods, funds lock in escrow. Smart contract releases payment when shipping confirmation arrives on-chain or after time-based conditions meet.

-

Cascade routing: When a business receives payment, the smart contract automatically routes portions to various obligations: supplier payments, loan repayments, treasury reserves, tax withholding accounts.

-

Time-locked releases: Investors provide capital that unlocks gradually over time, with smart contracts releasing tranches automatically as milestones meet.

This programmability enables financial products that were previously impossible or too expensive to build. Invoice factoring traditionally requires extensive infrastructure: credit assessment, legal contracts, collections processes, reconciliation systems. With PayFi, much of this can be automated: smart contracts verify invoices on-chain, provide instant liquidity, and settle automatically when payment arrives.

The infrastructure is complex, involving multiple layers and numerous players. But the user experience can be simple: click send, value arrives in seconds, programmable logic executes automatically. This combination - sophisticated infrastructure with simplified interfaces - is what makes PayFi viable at scale.

Use Cases Deep Dive

PayFi's real-world applications extend far beyond simple value transfer. The combination of instant settlement, programmable logic, and reduced costs enables entirely new financial products and business models. Several use cases are already moving from pilot projects to production deployment.

Cross-Border Remittances

Remittances represent one of PayFi's most immediate and impactful applications. Remittance flows to Southeast Asia are projected to reach nearly $100 billion in 2025, growing at more than 8% annually. For the families receiving these funds, traditional remittance costs are crushing: fees average 6.2% globally, and recipients wait days for money to arrive.

PayFi offers a superior alternative. Consider the typical remittance corridor from the United States to the Philippines. Traditional services like Western Union or MoneyGram charge 5-8% in combined fees and FX spreads. PayFi alternatives can reduce this to 1-2%, with funds arriving in minutes rather than days.

MoneyGram's partnership with Stellar provides the ability to seamlessly convert USDC to cash or cash to USDC, increasing the utility and liquidity of digital assets while enabling more consumers to participate in the digital economy. By connecting to the MoneyGram network, users can now withdraw USDC on Stellar and pick up cash at any participating MoneyGram location, creating a direct bridge between global digital dollars and local economies.

The MoneyGram integration launched initially in key remittance markets including Canada, Kenya, Philippines, and the U.S., with global cash-out functionality available by June 2022. MoneyGram operates in 180+ countries, providing extensive reach for stablecoin on/off-ramps.

In September 2025, MoneyGram partnered with Crossmint to launch stablecoin-powered cross-border payments initially in Colombia. The Colombian peso has lost over 40% of its value in the past four years, making dollar-denominated savings critical. The service allows U.S. senders to transmit funds as USDC, which recipients hold in a smart wallet until they need to cash out in pesos, protecting value from currency devaluation.

This model addresses multiple pain points simultaneously:

- Speed: Near-instant settlement versus 3-5 days

- Cost: 1-2% fees versus 5-8%

- Currency protection: Recipients can hold USD-backed stablecoins rather than immediately converting to depreciating local currency

- Accessibility: MoneyGram's cash network provides last-mile access even for recipients without bank accounts

The remittance use case demonstrates PayFi's potential scale: even capturing 10-20% of the approximately $700 billion global remittance market would represent $70-140 billion in annual volume.

Supply-Chain Finance and Invoice Factoring

Supply chains run on credit. Small manufacturers need to purchase raw materials before they receive payment for finished goods. Suppliers ship inventory to retailers who pay 30, 60, or 90 days later. This creates a working capital gap: businesses have completed work and incurred costs but cannot access revenue until payment arrives.

Traditional invoice factoring addresses this by having businesses sell receivables to specialized firms at a discount. The factor provides immediate cash (typically 70-90% of invoice value), then collects the full amount when it arrives. This works, but it is expensive (annual rates often exceed 15-30%) and slow (application, credit review, underwriting, documentation).

PayFi transforms this model. PayFi use cases include accounts receivable financing, where businesses can access capital by tokenizing future receivables and receiving instant liquidity when smart contracts automatically settle obligations upon payment arrival.

Projects like Arf Financial and Huma Finance are deploying such systems. Arf demonstrates this with over $1.6 billion in default-free on-chain transactions, offering 24/7 USDC settlements without requiring pre-funded accounts. The key advantages:

- Automation: Smart contracts verify invoices, assess creditworthiness using on-chain history, and provide instant liquidity

- Cost reduction: Overhead is dramatically lower when workflows are automated, enabling rates of 5-10% rather than 15-30%

- Accessibility: Small businesses that traditional factors would ignore can access financing based on verified transaction history

- Speed: Approval and funding occur in minutes rather than days or weeks

Consider a practical example: A small manufacturer in Vietnam produces goods for a U.S. retailer. The retailer's payment terms are Net 60. Traditionally, the manufacturer must either:

- Wait 60 days for payment (losing time-value, unable to take new orders)

- Factor the invoice at 20% annual rate through a traditional lender (expensive)

- Use working capital loans with strict covenants (restrictive)

With PayFi, the manufacturer tokenizes the invoice as an NFT or on-chain asset representing the receivable. A liquidity pool or lender reviews the on-chain verified purchase order and the retailer's payment history. If approved, the manufacturer receives 90% of invoice value in USDC immediately. When the retailer pays 60 days later, the smart contract automatically settles the obligation, paying the lender principal plus interest. The effective rate might be 8-10% annualized - expensive relative to bank loans but far better than traditional factoring, with instant availability.

PayFi could streamline capital access for SMEs by automating receivables financing and eliminating complex regulatory hurdles and lengthy risk assessments. The availability of faster funds helps businesses maintain safety cushions and expand growth opportunities without the constraints of delayed payments.

Real-Time Wage Access

The traditional payroll model is fundamentally mismatched with how people work and live. Employees earn wages daily but receive payment biweekly or monthly. This creates financial stress: bills arrive continuously, but income arrives in lumps. Workers facing emergencies often resort to expensive payday loans or credit card advances because they cannot access money they have already earned.

PayFi enables "earned wage access" - the ability for workers to receive payment for work as soon as it is completed. Real-time wages through PayFi allow content creators to finance their video production by receiving funds beforehand, which they can return automatically based on streaming revenue, enabling creators to continuously deliver content without waiting.

The mechanics are straightforward: An employer maintains a treasury of USDC. As employees complete work (verified by time-tracking systems, milestone completion, or other metrics), smart contracts automatically stream payment to their wallets. Workers receive value continuously rather than in batches.

This has several benefits:

- Financial stability: Workers can access earned wages when needed, reducing reliance on predatory lending

- Employer benefits: Companies can attract workers by offering better payment terms

- Reduced overhead: Payroll processing occurs automatically via smart contracts rather than manual batch processes

- Global accessibility: Works seamlessly for remote workers in any country with internet access

Companies like Zebec and Sablier have built streaming payment protocols on Solana and Ethereum. These allow continuous value transfer - literally every second, a fraction of payment flows from employer to employee based on elapsed time and agreed rate. The employee's wallet balance increases in real-time, and they can withdraw at any moment.

For the gig economy, this is transformative. A freelance designer completes a project for a client in another country. Instead of waiting for the client to process payment, approve it through accounting, initiate an international wire, and wait for settlement - a process that might take two weeks - the designer receives payment continuously as they work, with final settlement within minutes of completion.

Merchant Settlement and Interchange Bypass

Credit card acceptance costs merchants 2-3.5% in interchange fees plus processing costs. For a restaurant operating on 5-10% profit margins, card fees represent a significant expense. Yet cards are essential - consumers demand payment flexibility.

PayFi offers merchants an alternative: stablecoin acceptance with instant settlement and fees below 1%. Consider the comparison:

Credit Card Payment:

- Customer pays $100

- Interchange and processing fees: $2.50-3.50

- Merchant receives: $96.50-97.50

- Settlement: 2-3 days

- Chargeback risk: 6-12 months

Stablecoin Payment:

- Customer pays equivalent of $100 in USDC

- Processing fees: $0.50-1.00

- Merchant receives: $99.00-99.50

- Settlement: Instant (on-chain finality in seconds)

- Chargeback risk: None (blockchain transactions are final)

The merchant benefits are compelling:

- Lower costs: 0.5-1% versus 2.5-3.5%

- Instant liquidity: Funds available immediately rather than 2-3 days later

- No chargebacks: Eliminates fraud risk from disputed transactions

- Working capital improvement: Instant settlement means better cash flow management

The challenge is customer adoption. Most consumers do not yet hold stablecoins or use crypto wallets. However, this is changing. Digital wallets accounted for 49% of global e-commerce transaction value in 2023, expected to increase to 54% by 2026. As stablecoin-enabled wallets proliferate, merchant acceptance will follow.

Some implementations blend approaches: customers pay with familiar methods (cards, bank transfers), but backend settlement occurs via stablecoins. This allows card acceptance at the edge while using USDC in the core - consumers pay with familiar methods while acquirers and issuers settle in USDC for speed and cost reduction.

Emerging Use Cases

Beyond these established categories, PayFi enables novel applications:

Programmable Subscriptions: Services can charge dynamically based on usage, with smart contracts automatically calculating costs and withdrawing appropriate amounts. This enables usage-based pricing models that were previously too complex to implement.

Conditional Payments: Escrow services built into payment flows - funds release automatically when shipping confirmation arrives, when milestone verification occurs, or when multi-party approval completes.

Yield-Generating Payments: Recipients can automatically route incoming payments into yield-generating protocols, earning returns on balances that would otherwise sit idle.

Cross-Border Payroll: Companies with global remote teams can pay workers in any country instantly, in stablecoins that can be converted to local currency or held as dollar savings.

The use cases share common attributes: they eliminate intermediaries, reduce friction, lower costs, improve speed, and enable programmability. These are not incremental improvements. They represent fundamental shifts in how payments function and what they can accomplish.

Asia's PayFi Push: Regional Dynamics and Innovation

Asia has emerged as a particularly dynamic region for PayFi adoption, driven by several converging factors: rapidly digitizing payments infrastructure, significant cross-border remittance flows, underbanked populations, currency volatility concerns, and progressive regulatory approaches in key markets.

The Asian Payments Landscape

Asia's payments evolution has followed a distinct trajectory from Western markets. While the United States and Europe built extensive credit card infrastructure over decades, many Asian markets leapfrogged directly to mobile and digital payments.

India's Unified Payments Interface (UPI) processes billions of transactions monthly, enabling instant peer-to-peer payments via QR codes and phone numbers. In India, while cash payments still account for 60% of consumer expenditure, digital payments have doubled in the past three years. Yet UPI faces a challenge: it operates domestically only and charges no transaction fees, making international expansion and monetization difficult.

Southeast Asia presents a different dynamic. Remittance flows to the region are projected to reach nearly $100 billion in 2025, with countries like the Philippines receiving over $30 billion annually. Millions of workers labor abroad and send money home to families. Traditional remittance channels charge heavily for this service.

China's digital payments ecosystem, dominated by Alipay and WeChat Pay, demonstrates the potential scale of mobile-first payments. However, these are closed systems operating within strict capital controls. Cross-border functionality is limited, creating opportunities for alternative solutions.

MoneyGram-Stellar Corridor: A Case Study

The partnership between MoneyGram and Stellar provides insight into how PayFi infrastructure is being deployed in practice across Asia.

Announced in October 2021, the partnership enables digital wallets connected to the Stellar network to access MoneyGram's global retail platform, providing a bridge between digital assets and local currencies for consumers. The implementation focuses on key remittance corridors including the United States to the Philippines, the U.S. to Kenya, and flows within Southeast Asia.

The service launched with initial availability in Canada, Kenya, Philippines, and the U.S., with global cash-out functionality available by June 2022. Users of Stellar-connected wallets like Vibrant and LOBSTR can now convert USDC to cash at MoneyGram's thousands of retail locations, or convert cash to USDC for sending abroad.

The mechanics illustrate PayFi principles in action:

- Cash-to-Crypto On-Ramp: A sender visits a MoneyGram location in the U.S., provides cash, and receives USDC in their Stellar wallet

- On-Chain Transfer: The sender transmits USDC on Stellar to a recipient in the Philippines (settlement in 3-5 seconds, cost less than $0.01)

- Crypto-to-Cash Off-Ramp: The recipient converts USDC to Philippine pesos at a local MoneyGram location or through integrated mobile money services

The partnership revolutionizes the settlement process, with settlement occurring in near-real-time using Circle's USDC, enabling accelerated collection of funds, improving efficiency, and reducing risk.

In late 2025, Hana wallet integrated with MoneyGram Ramps across Southeast Asia, expanding access further. The integration provides instant stablecoin-to-cash withdrawals, making stablecoins usable in daily life for freelancers, families, and small businesses.

The impact extends beyond individual transactions. By providing instant, low-cost remittance rails, the infrastructure addresses financial inclusion. Many recipients lack bank accounts but can access MoneyGram locations. They can now receive digital dollars, hold them as a store of value (protecting against local currency depreciation), and cash out only when needed.

Regulatory Environment and Innovation

Asia presents a varied regulatory landscape. Some jurisdictions have embraced innovation, while others maintain restrictive approaches.

Singapore has positioned itself as a digital asset hub. The Monetary Authority of Singapore (MAS) provides clear licensing frameworks for payment services, stablecoin issuers, and digital asset exchanges. Major crypto firms including Coinbase, Gemini, and Crypto.com have established regulated entities in Singapore.

Hong Kong passed its Stablecoin Ordinance in May 2025, requiring all issuers of Hong Kong dollar-backed stablecoins to obtain licenses from the Hong Kong Monetary Authority. Stablecoins must be backed by high-quality, liquid reserve assets, with the market value of reserves equal to the par value of stablecoins in circulation. This provides regulatory clarity while enabling innovation.

Japan has maintained a cautious but progressive stance. The country recognizes cryptocurrency as property and regulates exchanges stringently. Stablecoin regulations were implemented in 2023, allowing licensed entities to issue yen-backed digital currencies. Asia's Liquid exchange in Japan and Singapore was the first major exchange to enable USDC withdrawals on Stellar, demonstrating institutional adoption.

India presents complexity. While UPI has driven domestic payment digitization, cryptocurrency regulations remain uncertain. The government has proposed crypto taxes and regulatory frameworks but has not banned usage. This creates opportunity - India's large diaspora sends substantial remittances home, creating demand for low-cost alternatives.

The Philippines is particularly receptive. The Bangko Sentral ng Pilipinas has licensed several cryptocurrency exchanges and remittance platforms. Given the country's dependence on overseas worker remittances (exceeding $30 billion annually), there is strong motivation to facilitate lower-cost channels.

Local Innovations and Adaptations

Asian PayFi implementations often reflect local conditions and needs:

Mobile-First Design: Given high smartphone penetration and limited desktop usage, Asian PayFi solutions prioritize mobile interfaces. Wallets like Hana, designed specifically for Southeast Asian users, emphasize simplicity and local currency support.

Cash-Bridge Integration: Recognizing that cash remains dominant in many markets, successful implementations integrate with cash networks. The MoneyGram partnership exemplifies this - enabling cash-in and cash-out maintains accessibility for populations without bank accounts.

Local Currency Stability: Many Asian currencies experience volatility relative to the dollar. This creates natural demand for dollar-denominated stablecoins as savings vehicles. In Colombia, where the peso has lost over 40% of its value in four years, similar dynamics exist - this pattern appears across numerous emerging markets globally, including many in Asia.

Merchant Adoption: Asian merchants, particularly in tourism-dependent areas, increasingly accept stablecoins. This reflects both customer demand (tourists avoiding currency conversion fees) and merchant benefits (lower costs, instant settlement).

Cross-Border Corridors

Asia's PayFi growth centers on specific corridors where need and infrastructure align:

Middle East to South Asia: Labor flows from Pakistan, India, Bangladesh, and the Philippines to Gulf states create massive remittance volumes. Cross-border B2B settlements using Tether surged in the Middle East and Southeast Asia, with $30+ billion settled in Q1 2025 alone. PayFi solutions targeting these corridors can capture significant market share from traditional services.

Intra-ASEAN Flows: Trade and labor mobility within the Association of Southeast Asian Nations (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam) generates substantial payment flows. PayFi can enable near-instant settlement for cross-border trade that currently requires days and significant banking fees.

China Outbound: While domestic Chinese payment rails are advanced, moving value out of China faces capital controls and regulatory constraints. Stablecoins provide an alternative channel, though regulatory risk remains significant.

The Path Forward

Asia's PayFi trajectory suggests several developments:

Increasing Corridor Connectivity: As more countries establish clear regulatory frameworks, additional corridors will open. Each new jurisdiction that licenses stablecoin operations enables connections to the global network.

Integration with Regional Payment Systems: Future iterations may bridge PayFi rails with systems like UPI, PIX (Brazil), and SEPA (Europe), enabling seamless value flow between instant payment systems regardless of underlying infrastructure.

Central Bank Digital Currency Interaction: As Asian central banks pilot CBDCs (China's digital yuan, Singapore's Project Orchid), questions arise about how stablecoins and CBDCs will interact. Likely outcome: coexistence, with stablecoins serving international flows and CBDCs serving domestic use.

Mobile Money Convergence: Mobile money services like GCash (Philippines) and M-Pesa (Kenya, expanding regionally) may integrate stablecoin functionality, combining their extensive distribution networks with blockchain settlement.

Asia's combination of need (expensive remittances, currency volatility, financial inclusion gaps), receptivity (mobile-first populations comfortable with digital payments), and progressive regulation (in key markets) positions the region as a PayFi growth center. The innovations emerging here may eventually flow back to influence Western market implementations.

Institutional Adoption and Economic Implications

PayFi's progression from cryptocurrency enthusiasts to mainstream finance marks a critical inflection point. When major financial institutions, payment processors, and asset managers deploy capital and build infrastructure around stablecoin-based payments, it signals a shift from experimentation to production deployment. This institutional embrace carries profound economic implications.

The Institutional Shift

Traditional financial institutions are recognizing that programmable payments represent not just a technological upgrade but a structural change in how money moves through the global economy.

Asset Manager Involvement: Circle received $400 million in funding with participation from BlackRock, Fidelity, Fin Capital, and Marshall Wace LLP. This was not passive investment - BlackRock entered into a broader strategic partnership with Circle to explore capital market applications for USDC and serves as primary asset manager of USDC cash reserves, while BNY Mellon serves as the primary custodian of assets backing USDC stablecoins.

Fidelity is preparing to launch its own stablecoin, tentatively named "Fidelity Token", aiming to provide a stable and secure medium of exchange leveraging Fidelity's reputation in traditional finance.

Banking Sector Entry: Despite regulatory uncertainty, banks are exploring stablecoin offerings. Several major financial firms are seeking banking charters to hold customer deposits, manage stablecoin reserves, and offer banking services under regulatory oversight. Stripe is seeking a special banking charter to reduce costs and broaden business models, motivated by processing transactions directly.

Payment Network Integration: Visa expanded pilots to settle with USDC on Solana with acquirers like Worldpay and Nuvei, demonstrating that card networks see value in blockchain settlement even while maintaining existing customer-facing rails.

Treasury Management: Corporations are beginning to use stablecoins for treasury operations. The benefits include:

- 24/7 Liquidity: Unlike bank accounts (limited by operating hours), stablecoin holdings can be deployed instantly at any time

- Programmable Treasury: Smart contracts can automate sweeping, rebalancing, and allocation across multiple accounts and purposes

- Yield Generation: Circle's acquisition of Hashnote enables yield-generating opportunities for USDC holders through tokenized money market funds

- Simplified Multi-Entity Management: Companies with subsidiaries in multiple countries can manage global treasury using stablecoins rather than maintaining numerous bank accounts across jurisdictions

Economic Impacts: The Disappearing Float

Traditional payments generate revenue from multiple sources: interchange fees, processing charges, FX spreads, and float. Of these, float is perhaps the most fundamental yet least visible to end users.

Float occurs whenever money is in transit but not yet settled. When you swipe a credit card, the merchant does not receive funds immediately. The payment processor holds the money for 2-3 days before settlement. During that time, the processor earns interest on the aggregate balance - millions or billions of dollars sitting across thousands of transactions.

Similarly, when businesses hold operating accounts at banks, they typically receive minimal or no interest while the bank deploys those deposits profitably. When companies maintain pre-funded nostro accounts for international payments, that capital sits idle, earning nothing while waiting to facilitate future transactions.

PayFi eliminates much of this float:

- Instant Settlement: Merchants receive funds in seconds, not days. No float exists during settlement because settlement is immediate.

- No Pre-Funding Required: Arf Financial demonstrates this with 24/7 USDC settlements without requiring pre-funded accounts, eliminating capital tied up in anticipation of future transactions.

- Transparency: All balances are visible on-chain in real-time. Companies know exactly what they have available at any moment.

This represents a massive shift in working capital efficiency. A retailer processing $10 million monthly in credit card sales previously had $600,000-900,000 perpetually in transit (2-3 days of sales volume). With instant settlement, that capital becomes immediately available for inventory purchases, debt service, or investment.

Aggregate this across the global payments industry's $1.8 quadrillion in annual transaction value. Even a small percentage shifting to instant settlement represents trillions of dollars in working capital that becomes more productive.

New Economic Models

As traditional revenue sources (float, slow settlement) diminish, PayFi creates opportunities for new monetization models:

Liquidity Provision: DeFi-style liquidity pools can provide instant settlement to merchants, earning fees for providing capital that enables same-day settlement. This is similar to traditional merchant cash advances but automated and with transparent pricing.

Smart Contract Fees: Developers building payment automation logic can charge for usage of their contracts. A supply-chain finance protocol might charge 0.5% for providing instant invoice factoring, far less than traditional factors but sustainable at scale with low overhead.

Treasury Services: Financial institutions can offer yield optimization services: automatically routing idle stablecoin balances into highest-yield protocols, rebalancing based on risk parameters, and providing sophisticated cash management that was previously only available to large corporations.

Data Services: Blockchain payment data is transparent (though often pseudonymous). Analytics services can provide business intelligence: cash flow forecasting, credit assessment based on on-chain payment history, and fraud detection using pattern analysis.

Embedded Finance: Companies can integrate payment functionality directly into their applications using PayFi infrastructure. A SaaS platform can offer instant payouts to users, a marketplace can provide automatic escrow and settlement, and a content platform can split revenue in real-time - all using embedded PayFi services with revenue-sharing models.

Competition and Disruption

Institutional adoption is not uniform. It creates winners, losers, and new competitive dynamics.

Payment Processors: Companies like Stripe and Adyen that embrace stablecoin settlement may gain advantages in cost structure and capability. Those that cling exclusively to traditional rails risk being disrupted.

Banks: Traditional correspondent banking for international payments faces existential pressure. If remittance costs drop from 6.2% to 1-2%, the banks extracting that margin face revenue collapse. Banks that pivot to providing stablecoin services (custody, on/off-ramps, compliance) can capture new revenue. Those that resist may lose relevance.

Card Networks: Visa and Mastercard face a dilemma. Their interchange-based business model depends on 2-3% fees. If stablecoin payments offer 0.5-1% costs, merchants will migrate. The networks' response - piloting stablecoin settlement while maintaining card-based user experiences - attempts to preserve distribution while adapting to new infrastructure.

New Entrants: Companies like Circle, with stablecoin infrastructure and compliance expertise, position themselves as critical intermediaries in the new system. If USDC becomes global payment infrastructure, Circle captures significant value despite not directly charging users for basic transfers.

Scale and Projections

The potential scale is substantial. The 2025 McKinsey Global Payments Report indicates the payments industry generates $2.5 trillion in revenue from $2.0 quadrillion in value flows. If even 10-20% of this flow shifts to PayFi rails over the next decade, it would represent $200-400 trillion in annual transaction value.

By 2030, on-chain value is projected to grow to $10-25 trillion, fueled by innovations in real-time settlement and tokenized assets. Stablecoin market cap reached $251.7 billion as of mid-2025, up from virtually nothing five years prior. The growth trajectory suggests continued rapid expansion.

Institutional adoption validates the technology, provides liquidity, ensures regulatory compliance, and drives mainstream accessibility. As more financial institutions deploy PayFi infrastructure, network effects strengthen: more merchants accept stablecoins, more consumers hold them, more developers build applications, more capital flows into the ecosystem. This self-reinforcing cycle is characteristic of platform shifts - and suggests PayFi's institutional phase is just beginning.

Regulatory and Compliance Landscape

PayFi operates at the intersection of payments regulation, banking law, securities oversight, and emerging digital asset frameworks. The regulatory environment has evolved rapidly from 2023 through 2025, with the United States enacting comprehensive stablecoin legislation that may serve as a model for global frameworks. Understanding these regulations is essential for anyone building or using PayFi infrastructure.

The GENIUS Act: U.S. Stablecoin Framework

On July 18, 2025, President Trump signed into law the Guiding and Establishing National Innovation for US Stablecoins Act (the GENIUS Act), legislation that establishes a regulatory framework for payment stablecoins. This represents the first comprehensive federal legislation specifically addressing digital assets in U.S. history.

Definitional Framework: The GENIUS Act defines payment stablecoin as a digital asset issued for payment or settlement and redeemable at a predetermined fixed amount. Critically, the definition excludes national currencies, bank deposits, and securities, creating a distinct regulatory category.

Reserve Requirements: Issuers must hold at least one dollar of permitted reserves for every one dollar of stablecoins issued, with permitted reserves limited to coins and currency, deposits held at insured banks and credit unions, short-dated Treasury bills, repurchase agreements backed by Treasury bills, government money market funds, central bank reserves, and any other similar government-issued asset approved by regulators.

This mandate ensures that stablecoins are fully backed by highly liquid, low-risk assets. The regulation prevents scenarios like algorithmic stablecoins that attempt to maintain pegs through arbitrage rather than reserves - a response to the TerraUSD collapse that wiped out $40 billion in value in 2022.

Issuer Licensing: Stablecoins can be issued by banks and credit unions through subsidiaries, or by nonbanks restricted to financial firms unless the Treasury Secretary and chairs of the Federal Reserve and FDIC unanimously find they do not pose risks to the banking or financial system.

This creates a two-tier structure: banks can issue through subsidiaries with approval from their existing regulators, while nonbanks must obtain federal licenses from the Office of the Comptroller of the Currency (OCC) or qualify under a state regime.

State Regulatory Option: The bill creates a state regulatory option for nonbank issuers with fewer than $10 billion in outstanding stablecoins, provided the state regulatory regime is "substantially similar" to its federal counterpart as determined by the Stablecoin Certification Review Committee.

This federal-state structure attempts to balance innovation (enabling states to charter smaller issuers) with safety (requiring federal oversight once issuers reach systemic scale).

Transparency and Reporting: Issuers must establish and disclose stablecoin redemption procedures and issue periodic reports of outstanding stablecoins and reserve composition, which would be certified by executives and "examined" by registered public accounting firms, with issuers having more than $50 billion in stablecoins outstanding required to submit audited annual financial statements.

Circle already provides monthly reserve attestations by a Big Four accounting firm, demonstrating that such transparency is operationally feasible. The GENIUS Act codifies this as a requirement.

AML and Sanctions Compliance: The bill requires that FinCEN facilitate "novel methods to detect illicit activity involving digital assets" and requires issuers to certify that they have implemented AML and sanctions compliance programs. All stablecoin issuers must possess the technical capability to seize, freeze, or burn payment stablecoins when legally required and must comply with lawful orders to do so.

This addresses law enforcement concerns that stablecoins could enable sanctions evasion or money laundering. The requirement that issuers maintain technical capability to freeze or seize stablecoins balances innovation with security.

Securities Law Carve-Out: A payment stablecoin issued by a permitted payment stablecoin issuer is not a "security" under U.S. federal securities laws or a "commodity" under the Commodity Exchange Act, and therefore is not subject to the oversight of the SEC or CFTC.

This provides crucial clarity. Previously, whether stablecoins were securities remained unclear, creating regulatory risk. The GENIUS Act definitively places compliant payment stablecoins outside securities regulation, though it preserves SEC and CFTC oversight for other digital assets.

Implementation Timeline: The act provides approximately 18 months from enactment for existing issuers to come into compliance. However, for custodians or other entities that sell or transact in payment stablecoins, the Act gives a longer grace period - no later than three years after enactment, any person that transacts or provides custody of payment stablecoins must restrict their activities to only payment stablecoins that have been issued by an approved issuer under the Act.

Global Regulatory Landscape

While the GENIUS Act provides a U.S. framework, PayFi operates globally. Other jurisdictions have taken varied approaches:

European Union - MiCA: The EU's Markets in Crypto-Assets (MiCA) framework addresses stablecoin regulation through e-money tokens (EMT) and asset-referenced tokens (ART). EMTs refer to digital tokens backed by a single fiat currency, while ARTs are backed by a basket of assets. Under MiCA, only e-money institutions or credit institutions can issue EMTs, while ART issuers must be EU-based and authorized by regulators.

MiCA provides comprehensive regulation earlier than the U.S., with enforcement beginning in phases through 2024-2025. However, its approach is more restrictive - limiting issuers to regulated financial institutions from the start rather than creating a pathway for nonbank innovation.

Hong Kong: Hong Kong's Stablecoin Ordinance, passed in May 2025, requires all issuers of stablecoins backed by the Hong Kong dollar to obtain a license from the Hong Kong Monetary Authority, with all stablecoins backed by high-quality, liquid reserve assets and the market value of the reserve pool equal to the par value of the stablecoins in circulation.

Hong Kong's approach targets local currency stablecoins specifically, positioning Hong Kong as a digital asset hub while maintaining monetary sovereignty.

Singapore: The Monetary Authority of Singapore (MAS) has established licensing frameworks through its Payment Services Act. Major stablecoin issuers including Circle and Paxos have obtained licenses. Singapore balances innovation support with consumer protection, requiring license holders to maintain capital adequacy, technology risk management, and AML/CFT controls.

United Kingdom: The UK is developing stablecoin regulation through its Financial Services and Markets Act, treating certain stablecoins as regulated payment instruments. The approach focuses on systemic stablecoins that could impact financial stability, with proportionate regulation based on scale and usage.

Compliance Challenges

Despite regulatory clarity improving, significant compliance challenges remain for PayFi participants:

Cross-Border Complexity: Payments are inherently cross-border, but regulations are jurisdictional. A stablecoin issuer must comply with regulations in every country where its stablecoin is used. This creates compliance complexity: KYC requirements differ across jurisdictions, reporting obligations vary, and sanctions lists are not uniform.

The GENIUS Act attempts to address this through provisions for foreign stablecoin issuers. The Act allows foreign payment stablecoin issuers to offer or sell in the United States under certain circumstances, with Treasury authorized to determine whether a foreign regime for regulation and supervision of payment stablecoins is comparable to requirements established under the GENIUS Act.

This "comparability" framework could enable mutual recognition: if the EU's MiCA regime is deemed comparable, MiCA-licensed stablecoin issuers could operate in the U.S. without separate licensing. However, comparability determinations involve complex policy negotiations.

Transaction Monitoring: AML compliance requires monitoring transactions for suspicious activity. With blockchain's transparency, this is theoretically easier than traditional banking - every transaction is publicly visible. However, identifying beneficial owners behind wallet addresses remains challenging.

Solutions are emerging: blockchain analytics firms like Chainalysis, Elliptic, and TRM Labs provide transaction monitoring tools that identify high-risk wallets, trace funds, and flag suspicious patterns. Elliptic provides MoneyGram with blockchain analytics solutions for their Stellar integration.

Sanctions Compliance: The GENIUS Act explicitly subjects stablecoin issuers to the Bank Secrecy Act, thereby obligating them to establish effective anti-money laundering and sanctions compliance programs with risk assessments, sanctions list verification, and customer identification.

Sanctions compliance is particularly complex for stablecoins because they can move globally without intermediaries. Traditional correspondent banking allows sanctions screening at multiple points. With stablecoins, enforcement depends on issuers and on-ramps/off-ramps implementing controls.

Circle demonstrated this capability in 2022 by freezing USDC associated with addresses sanctioned by the U.S. Treasury. This ability - built into the smart contract - ensures issuers can comply with lawful orders. However, it creates tension with blockchain's censorship-resistance ideals.

Privacy Considerations: Transaction monitoring and sanctions compliance require identifying users. This conflicts with cryptocurrency's privacy culture. The compromise emerging is selective disclosure: users provide identity to regulated on/off-ramps and issuers but can transact pseudonymously on-chain, with issuers retaining ability to freeze wallets when required by law.

Regulatory Risks

Despite progress, regulatory uncertainty remains in several areas:

Algorithmic Stablecoins: The GENIUS Act focuses on fiat-backed payment stablecoins. Endogenously collateralized stablecoins - digital assets pegged to the value of another digital asset rather than fiat - are not explicitly banned but the Treasury Secretary must conduct a study on non-payment stablecoins within one year.

This leaves open questions about algorithmic stablecoins like DAI (backed by crypto collateral) and other non-payment stablecoins. The House's competing STABLE Act proposed a two-year moratorium on such stablecoins. Future regulation may restrict or ban them.

DeFi Integration: Many PayFi use cases integrate with DeFi protocols: liquidity pools, lending markets, yield aggregators. How do AML obligations extend to these interactions? Can a compliant stablecoin issuer allow its tokens to be used in DeFi protocols that lack KYC? These questions remain unresolved.

Taxation: Cryptocurrency taxation is notoriously complex. Does converting USD to USDC create a taxable event? What about on-chain transfers? The answer varies by jurisdiction. In the U.S., stablecoins are generally treated as property, meaning each conversion could technically trigger capital gains reporting even if gains are negligible (due to 1:1 peg).

The GENIUS Act directs Treasury to address tax issues, but implementation rules are still being developed. Clearer guidance is needed to avoid turning every stablecoin payment into a complex tax reporting event.

Global Coordination: Without international coordination, regulatory arbitrage becomes possible. If the U.S. imposes strict requirements but offshore jurisdictions do not, issuers may charter elsewhere. The GENIUS Act's comparability framework attempts to address this by requiring foreign issuers to meet equivalent standards.

However, achieving global regulatory harmonization is notoriously difficult. Payments historically operated within fragmented national regimes. Blockchain's borderless nature makes this fragmentation more problematic - but also creates pressure for coordination.

The Path Forward

Regulatory clarity has improved dramatically with the GENIUS Act and similar frameworks globally. This clarity enables institutional adoption: banks and asset managers can build PayFi infrastructure knowing the regulatory parameters.

However, regulation will continue evolving as use cases emerge and risks materialize. Key areas to monitor include:

- CBDC Interaction: How will regulations treat interactions between stablecoins and central bank digital currencies?

- Cross-Border Frameworks: Will major economies achieve mutual recognition of regulatory regimes?

- DeFi Integration Rules: How will regulators address stablecoins used in decentralized protocols?

- Privacy Technologies: How will regulations treat privacy-preserving technologies like zero-knowledge proofs if applied to stablecoins?

- Insurance Requirements: Should stablecoin issuers be required to carry insurance protecting holders if reserves are compromised?

The regulatory landscape is stabilizing, but not static. PayFi participants must maintain active compliance programs, monitor regulatory developments globally, and engage constructively with policymakers to shape frameworks that protect consumers while enabling innovation.

Risks and Challenges

PayFi's promise is significant, but so are the risks. Technical vulnerabilities, economic instabilities, regulatory uncertainties, and adoption barriers all threaten to slow or derail the convergence between payments and DeFi. A balanced assessment requires examining these challenges honestly.

Technical Risks

Scalability and Congestion: Blockchain networks have finite capacity. When demand spikes, transaction fees rise and confirmation times slow. Ethereum experienced this during the 2021 NFT boom, with transaction fees reaching $50-200 for simple transfers. Such fees make small payments economically unviable.

Layer-2 solutions and high-performance Layer-1 chains address this, but risks remain. If a payment processor builds on a specific blockchain and that network experiences congestion or outages, payment flow interrupts. Solana has experienced network disruptions multiple times, though reliability has improved significantly.

Smart Contract Vulnerabilities: Bugs in smart contract code can be catastrophic. Once deployed, many smart contracts are immutable - bugs cannot be easily fixed. The history of DeFi includes numerous exploits: reentrancy attacks, flash loan exploits, governance hijacks. If PayFi infrastructure contains vulnerabilities, attackers could steal funds or disrupt operations.

Mitigation requires rigorous security practices: formal verification, multiple independent audits, bug bounties, gradual rollouts with limited initial deposits. However, even well-audited contracts can contain subtle vulnerabilities that only become apparent in production.

Cross-Chain Bridge Risks: Many PayFi use cases involve moving stablecoins between blockchains - Ethereum to Polygon, Solana to Base, etc. Bridge exploits have been among the most costly in crypto history, with billions stolen. Circle's Cross-Chain Transfer Protocol (CCTP) provides a native solution, but not all transfers use it, and bridge security remains an ongoing concern.

Key Management: Blockchain security depends on private key control. If a user loses their private key, funds are irrecoverable. If a business's hot wallet is compromised, funds can be stolen instantly with no recourse. Traditional banking provides recovery mechanisms and fraud reversal. Blockchain does not.

Solutions include multi-signature wallets (requiring multiple keys to authorize transactions), hardware security modules, and account abstraction (smart contract wallets with social recovery). However, these add complexity and are not yet mainstream.

Economic Risks

Stablecoin Peg Risk: Stablecoins maintain value through redemption guarantees and reserve backing. But pegs can break. USDC briefly lost its peg in March 2023 when Circle held reserves at Silicon Valley Bank, which failed. USDC traded as low as $0.87 before recovering when Circle confirmed reserves were secure.

If a major stablecoin loses its peg during a crisis, PayFi systems built on it could experience massive disruption. A merchant expecting $10,000 in settlement might receive the equivalent of $8,000 if the stablecoin depegs. Such volatility undermines payments use cases.

Reserve Transparency and Audits: Circle publishes monthly attestation reports for USDC reserves, providing transparency about backing](https://coinlaw.io/usd-coin-statistics/). However, attestation is not the same as a full audit. Tether has faced repeated questions about reserve composition, though it has increased transparency over time.

The GENIUS Act mandates detailed reporting and audits for large issuers, which should improve transparency. However, if an issuer were to misrepresent reserves (as some algorithmic stablecoins did), significant harm could occur before detection.

Liquidity Crises: Even well-backed stablecoins can face liquidity mismatches. If reserves are in Treasury bills (which take days to sell) and redemption demand spikes (requiring immediate cash), issuers may struggle to meet obligations. This is the classic banking crisis dynamic: assets are sound long-term but illiquid short-term.

Circle and Tether have demonstrated ability to handle large redemptions, including billions of dollars within days. However, a true panic - everyone attempting to redeem simultaneously - has not been tested at current scale.

Yield Competition: Traditional banks pay minimal interest on deposits, allowing them to profit from the spread between what they pay depositors and what they earn deploying those funds. The GENIUS Act explicitly prohibits stablecoin issuers from paying interest or yield to holders.

This creates competitive dynamics. If a user can hold USDC and earn 0% or deposit dollars in a money market fund earning 4-5%, why choose USDC? Issuers cannot compete on yield. They must compete on utility (instant settlement, programmability, global accessibility). Whether this is sufficient to drive mass adoption remains to be seen.

Regulatory and Political Risks

Regulatory Reversal: The GENIUS Act passed with bipartisan support and presidential backing. However, political winds shift. A future administration or Congress could impose restrictions, increase reserve requirements, limit cross-border usage, or even attempt to ban stablecoins perceived as threatening monetary sovereignty.

China banned cryptocurrency transactions in 2021. India has considered similar measures. While unlikely in the U.S. given the GENIUS Act's passage, regulatory risk never disappears entirely.

Sanctions and Enforcement Overreach: The requirement that stablecoin issuers maintain ability to freeze funds creates a new pressure point. If governments demand freezes for activities beyond universally recognized crimes - political dissent, unapproved transactions, association with sanctioned regions rather than individuals - stablecoins could become tools of censorship.

This is not hypothetical. Traditional banking already faces pressure to freeze accounts for reasons beyond clear illegality. If stablecoins replicate traditional banking's control points, they may replicate its vulnerabilities to political pressure.

Fragmentation: If each jurisdiction develops incompatible regulations, the result could be fragmented stablecoin markets. A U.S. GENIUS Act-compliant stablecoin might not be usable in Europe. An EU MiCA-compliant stablecoin might face restrictions in Asia. This would undermine PayFi's promise of seamless global payments.

The GENIUS Act's comparability framework attempts to address this, but international coordination is challenging. Without it, PayFi could split into regional systems with limited interoperability - the opposite of its global vision.

Adoption Barriers

User Experience: Despite improvements, blockchain technology remains complex for average users. Private keys, gas fees, network selection, wallet management - these concepts confuse non-technical users. If PayFi requires users to understand blockchain mechanics, mass adoption will be limited.

Solutions include account abstraction (wallets that hide complexity), fiat on/off-ramps integrated directly into applications, and custodial services (where users don't manage keys). However, each solution involves tradeoffs between user-friendliness and the decentralization that makes blockchain valuable.

Business Inertia: Existing payment systems work, even if inefficiently. Businesses have integrated credit card processors, accounting software, payroll providers. Switching to PayFi requires integration work, staff training, and risk tolerance. For many businesses, the benefits are not yet compelling enough to justify the transition costs.

Volatility Perception: Even though stablecoins maintain pegs, cryptocurrency's reputation for volatility creates hesitation. A treasurer comfortable with the business may resist because they perceive crypto as speculative and risky. Education and demonstrated stability over time can address this, but perception shifts slowly.

Network Effects: Payments systems exhibit strong network effects - they become more valuable as more participants join. Today, USDC is accessible to more than 500 million end-user wallet products, which sounds impressive but is less than 10% of global internet users. Until PayFi reaches mainstream penetration, it will face chicken-and-egg challenges: merchants don't accept because users don't have it, users don't adopt because merchants don't accept.

Existential Questions

Beyond specific risks, broader questions remain about PayFi's long-term viability:

Central Bank Digital Currency Competition: If central banks issue digital currencies with similar properties (instant settlement, programmability), would stablecoins still be needed? CBDCs could have regulatory advantages (no reserve risk, government backing, mandatory acceptance) that crowd out private stablecoins.

However, CBDCs may not replicate all stablecoin benefits. Governments might limit cross-border usage to preserve capital controls. They might restrict programmability to prevent regulatory arbitrage. Stablecoins and CBDCs might coexist, serving different use cases.

Traditional Payment System Evolution: Payment systems are not standing still. FedNow, PIX, instant SEPA, and UPI demonstrate that traditional infrastructure can provide real-time settlement without blockchain. If these systems solve the speed problem, what advantage does PayFi offer?

The answer lies in programmability and composability - capabilities difficult to retrofit onto legacy systems. However, if traditional systems add programmable features, the distinction blurs.

Security-Decentralization Tradeoff: Truly decentralized systems are harder to regulate, more vulnerable to illicit use, and more difficult to provide recourse when things go wrong. Compliant PayFi systems sacrifice some decentralization for regulatory fitness and user protection. This might make them essentially traditional finance with blockchain branding - faster and cheaper but not fundamentally different.

Finding the right balance between decentralization (which enables innovation and reduces central points of failure) and centralization (which enables compliance and user protection) remains an open challenge.

Risk Mitigation

Understanding risks enables addressing them:

- Technical: Invest in security audits, bug bounties, formal verification, and gradual rollouts

- Economic: Maintain conservative reserves, provide transparent reporting, stress-test for liquidity crises

- Regulatory: Engage constructively with policymakers, build compliance infrastructure proactively, support international coordination

- Adoption: Simplify user experience, demonstrate value compellingly, invest in education and ecosystem development

The risks are real, but not insurmountable. Traditional payments faced similar challenges during their evolution: check fraud, credit card theft, electronic banking security, cross-border regulation. Each was addressed through combination of technology, regulation, and best practices. PayFi will likely follow a similar path, with risks being managed as the ecosystem matures rather than eliminated entirely.

The Macro Picture and Future Outlook

PayFi is not merely an incremental improvement in payments technology. It represents a structural shift in how value moves through the global economy. Understanding its macro implications and future trajectory requires examining the convergence at multiple scales: technical infrastructure, economic incentives, regulatory evolution, and behavioral adoption.

Five-Year Outlook: 2025-2030

By 2030, PayFi infrastructure is likely to have matured significantly. Key developments to watch include:

Mainstream Stablecoin Adoption: By 2030, on-chain value is projected to grow to $10-25 trillion. This would represent roughly 1-2% of global financial assets. While small by traditional finance standards, it would mark an inflection point where stablecoins become standard treasury management tools, not exotic alternatives.

Stablecoin market cap reached $251.7 billion by mid-2025. If growth continues at current trajectory (doubling every 2-3 years), market cap could reach $500 billion-$1 trillion by 2027-2028. At that scale, stablecoins would rival many national currencies in circulation.

Institutional Treasury Integration: Large corporations already maintain complex treasury operations: multi-currency accounts, hedging strategies, liquidity management. PayFi enables:

- 24/7 Operations: No waiting for banking hours or settlement windows

- Programmable Cash Management: Automated sweeps, rebalancing, and allocation via smart contracts

- Global Liquidity Pools: Single stablecoin treasury deployed instantly to any subsidiary or obligation worldwide

- Yield Optimization: Automated routing to highest-yield protocols within risk parameters

By 2030, treasury management software will likely integrate blockchain settlement as a standard feature alongside traditional banking. The question won't be whether to use stablecoins, but how much of the treasury to hold on-chain.

Cross-Border Payment Transformation: Global remittances exceed $700 billion annually, with fees averaging 6.2%. If PayFi captures even 30% of this market by 2030, it would represent $200 billion in annual flows, saving remittance senders approximately $10-12 billion annually in fees.

More significantly, the speed improvement transforms lives. Workers supporting families abroad can send money that arrives in minutes, not days. Recipients can hold dollar-stable value rather than immediately converting to depreciating local currency. The economic impact in developing nations could be substantial.

Embedded Finance Proliferation: Today, most embedded finance (payments integrated directly into platforms) runs on traditional rails. Stripe, PayPal, and Adyen power checkout flows, but settlement remains slow and expensive.

By 2030, embedded PayFi could be standard: e-commerce platforms settling merchants instantly, creator platforms splitting revenue automatically, marketplaces providing programmatic escrow without third-party trust services. The user experience looks similar, but the backend transforms.

Regulatory Maturation: The GENIUS Act provides a U.S. framework, but global coordination remains incomplete. By 2030, expect:

- Mutual Recognition Agreements: Major economies accepting each other's stablecoin licenses, similar to financial passporting

- CBDC-Stablecoin Coexistence Frameworks: Regulations clarifying how private stablecoins interact with central bank digital currencies

- Standardized Reporting: Unified formats for reserve attestations, transaction monitoring, and tax reporting across jurisdictions

- International Coordination: G20 or similar bodies establishing baseline standards for stablecoin issuance and operation

This regulatory maturity will reduce uncertainty and enable broader institutional adoption.

Ten-Year Vision: 2025-2035

Looking further out, PayFi could fundamentally reshape several aspects of the global financial system:

Real-Time Global Economy: Today, the global economy operates in batches. Stock markets close. Banks have operating hours. Settlement takes days. PayFi enables a truly 24/7/365 economy where value moves continuously. The implications are profound:

- Capital Efficiency: If settlement happens instantly, less capital sits idle. A business can receive payment and redeploy it within seconds rather than days.

- Global Coordination: Teams in different time zones can transact without waiting for overlapping business hours.

- Market Liquidity: Financial markets can operate continuously without the daily close that creates liquidity gaps and price discontinuities.