Cryptocurrency wealth is increasingly opening doors to global citizenship and residency options. By mid-2025, more than 172,000 crypto millionaires existed worldwide, driving a 64% surge in applications for investment-based passports.

In response, several countries now allow crypto-rich investors to obtain “golden visas” or even second citizenships. Most programs still ultimately require contributions in traditional currency, but a growing number of authorized agents and governments accept Bitcoin, Ether and stablecoins in the process.

In some cases, licensed facilitators convert crypto to local money on the applicant’s behalf, while a few pioneers have begun integrating crypto more directly. The trend marks a significant shift from a fiat-only paradigm to one where digital assets can legitimize and fund an immigration application.

Below we explore the top 10 countries that offer citizenship or residency-by-investment programs with crypto integration. These range from fast-track passport schemes in tropical havens to innovative residency visas in major economies. Each section outlines the program’s requirements, how cryptocurrency comes into play, and key benefits or caveats for crypto investors. All information is up to date as of August 2025 and presented in an unbiased, fact-based manner.

1. Vanuatu – Fast-Track Citizenship via Crypto-Funded Donation

Program Overview: Vanuatu, a South Pacific nation, runs a Citizenship by Investment program called the Development Support Program (DSP). It’s one of the fastest second-passport routes in the world: citizenship is typically approved in about 30 to 60 days. The required contribution is a donation to Vanuatu’s government fund, starting at roughly $130,000 for a single applicant and up to $180,000 for a family of four. In return, investors gain full citizenship and a passport from this peaceful archipelago state.

Crypto Integration: The Vanuatu government itself does not directly take cryptocurrency, but it allows accredited agents to accept crypto on behalf of applicants. Several licensed agencies advertise that they can receive Bitcoin or major stablecoins as payment for the DSP donation, converting the crypto to fiat currency and handling all paperwork. This means a crypto holder can fund their Vanuatu citizenship using digital assets – provided they pass standard Know-Your-Customer and Anti-Money-Laundering checks on the source of funds. Some agents even quote all-inclusive prices in BTC, generally equivalent to about $115,000–$130,000, making the process streamlined for crypto investors.

Benefits for Crypto Investors: Vanuatu’s appeal lies in its speed and simplicity. The process is 100% remote with no residency, travel or interview required at any stage. There are no language or education prerequisites, and dual citizenship is allowed. Uniquely for crypto entrepreneurs, Vanuatu imposes zero taxes on personal income, capital gains, wealth, and inheritance, creating a tax-neutral haven for those with substantial crypto holdings. The passport grants visa-free travel to about 90 countries (including the U.K., Hong Kong and Singapore), although access to the EU Schengen Area is under review as the EU reassesses Vanuatu’s due diligence standards. Families can be included in one application (spouse, dependent children under 25, and parents over 50 are eligible).

Notable Considerations: Vanuatu’s program is often chosen by crypto millionaires and digital nomads seeking a quick “insurance” passport for security and mobility. While it offers speed and discretion, applicants must still convert their crypto to fiat through the agent – a straightforward step, but one requiring transparent documentation of how the crypto was acquired. Overall, Vanuatu stands out as a crypto-friendly route to second citizenship, marrying a lightning-fast timeline with a permissive approach to wealth sourced from digital assets.

2. Antigua and Barbuda – Caribbean Leader in Crypto-Friendly Citizenship

Program Overview: Antigua and Barbuda, an island nation in the Caribbean, operates a well-established Citizenship by Investment (CBI) program. Investors can obtain Antiguan citizenship by making either a donation of at least $100,000 to the National Development Fund (for a single applicant) or investing in approved real estate (usually $200,000 minimum), among other options. Processing typically takes 3 to 6 months and vetted agents handle applications. Antigua’s passport is strong, granting visa-free travel to over 150 countries including the Schengen EU zone and the UK.

Crypto Integration: Antigua has emerged as the regional leader in embracing cryptocurrency in its CBI process. In early 2025, it was reported as the only Caribbean program explicitly accepting crypto holdings as proof of funds for applicants. While the government still requires the actual investment to be paid in traditional currency, Antigua’s Citizenship by Investment Unit allows applicants to demonstrate their net worth via cryptocurrency assets, which was unprecedented in the region. In practice, this means an investor can show Bitcoin or Ether holdings as part of the required financial documentation, so long as those holdings are properly documented and converted through approved channels for the fee payment. Some authorized law firms and agencies in Antigua also facilitate parts of the application using crypto – for example, accepting Bitcoin for their professional fees – thereby reducing reliance on traditional banks.

Antigua’s officials have actively signaled their openness to crypto investors. A government representative stated that while the program doesn’t take direct crypto for the donation, “it does allow investors to convert their cryptocurrency holdings to fiat to fulfill the requirements,” making it a “relatively crypto-friendly option” for those seeking a second passport. This permissive stance, combined with accommodating regulations, positions Antigua as a top choice for crypto-wealthy individuals.

Benefits for Crypto Investors: Beyond the crypto acceptance policy, Antigua offers significant lifestyle and financial perks. Notably, Antigua imposes no personal income tax at all (it abolished income tax in 2016). This means any profits from trading or investing in cryptocurrency are not taxed locally, nor are there capital gains taxes on crypto dispositions. The absence of taxation on worldwide income and capital gains is highly attractive for investors looking to optimize their crypto earnings. The Antigua passport itself provides broad mobility, including visa-free entry to the EU Schengen states for 90 days in 180 (as a Commonwealth country’s passport) and six-month stays in the UK.

Family coverage is generous: a single $100k donation can typically cover a family of up to four or more (additional fees apply per extra person). Another advantage is Antigua’s business environment – the country has been experimenting with becoming a crypto hub, appointing blockchain industry advisors and considering legislation to integrate digital currencies in finance. For example, Antigua has explored creating a digital asset exchange and has generally supportive regulatory attitudes, which suggests a sustainable commitment to crypto innovation.

Notable Considerations: Applicants to Antigua’s CBI must still undergo rigorous due diligence, including background checks and even a virtual interview in some cases. Embracing crypto doesn’t mean lax scrutiny – in fact, declaring crypto funds may invite extra checks on fund origin, and the government often engages third-party forensic firms to verify large crypto transactions. The timeline (3–6 months) is a bit longer than lightning-fast programs like Vanuatu, reflecting these thorough procedures. Finally, while crypto can be used to prove wealth, the final step requires converting to fiat. Investors should be prepared to document their crypto transaction history in detail when applying. Overall, Antigua and Barbuda sets itself apart by officially welcoming crypto wealth under its due diligence framework, striking a balance between innovation and compliance.

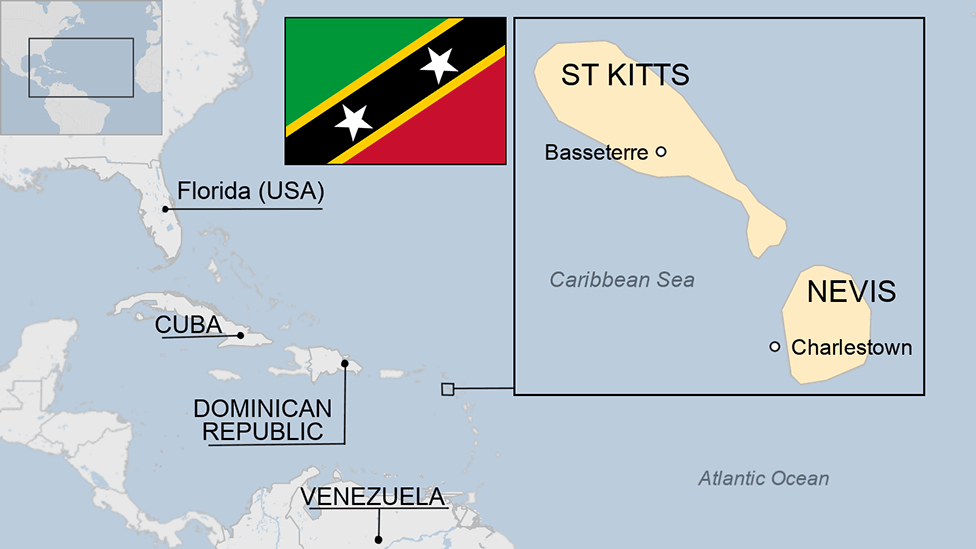

3. St. Kitts and Nevis – A Pioneer Now Accepting Crypto as Proof of Funds

Program Overview: St. Kitts and Nevis runs the oldest citizenship-by-investment program in the world, in operation since 1984. This twin-island Federation offers citizenship in exchange for a qualifying investment, typically either a donation of $150,000 (single) to the Sustainable Growth Fund or a real estate purchase of $200,000 or more in an approved project. The passport of St. Kitts & Nevis is one of the Caribbean’s strongest, with visa-free or visa-on-arrival access to about 150 countries (including Europe’s Schengen area and the UK, similar to Antigua’s reach). Application processing usually takes about 4 to 6 months, subject to due diligence clearance.

Crypto Integration: In a significant move in March 2025, St. Kitts & Nevis updated its CBI regulations to accommodate cryptocurrency assets in the application process. The government’s Citizenship by Investment Unit (CIU) announced it will accept crypto holdings as part of an applicant’s declared wealth. In other words, applicants can list Bitcoin, Ethereum or other major digital assets in their financial statements to prove they meet the program’s financial eligibility. This does not mean the $150,000 donation can be sent in BTC directly to the government – direct crypto payments are not yet taken. Rather, crypto can count toward demonstrating overall net worth and liquidity. By acknowledging digital assets as legitimate wealth, St. Kitts is integrating crypto into its due diligence framework.

With this allowance come additional compliance steps. Applications involving crypto are subject to enhanced due diligence and fees. The CIU requires extensive documentation for crypto funds, including proof of ownership of the assets, full transaction histories to verify how the crypto was acquired, and third-party valuation reports at the time of application. Essentially, an applicant might need to produce exchange account statements or wallet records showing they legitimately obtained their crypto (for example, through trading or as income) and that any gains were legal. These documents help ensure the funds are not proceeds of illicit activities. If satisfied, the CIU allows the crypto to be converted to fiat and used for the investment, or simply counted in net worth calculations before the applicant liquidates a portion to make the required donation.

Benefits for Crypto Investors: St. Kitts and Nevis extending recognition to crypto wealth is a landmark because this program has long been considered a “platinum” standard in the investment migration industry. The country’s willingness to innovate signals greater flexibility for applicants who might have significant assets in crypto rather than cash. Investors who have a large portion of their net worth in Bitcoin, for instance, no longer need to move all of it into a bank account before even applying – they can present their BTC holdings to satisfy wealth requirements (though eventually the donation will still be made in fiat after converting a portion of those holdings).

Once approved, new citizens of St. Kitts & Nevis enjoy one of the best travel documents in the Caribbean. The St. Kitts passport offers visa-free travel across Europe, and under current agreements, citizens can spend up to 90 days in a 180-day period in Schengen countries and up to 6 months per year in the UK without a visa. Like Antigua, St. Kitts imposes no capital gains or income tax on individuals locally, which means crypto profits are not taxed in-country – an attractive feature for those planning to reside or structure assets there. The country also has a stable Eastern Caribbean dollar (pegged to USD) and uses the Eastern Caribbean Central Bank, providing a reasonably safe financial environment.

Notable Considerations: St. Kitts & Nevis is known for stringent vetting of applicants – in recent years they’ve tightened their due diligence to protect the reputation of the program. The inclusion of crypto may lengthen the review process for some files, as extra verification is performed on blockchain transactions. Applicants should budget for higher due diligence fees if using crypto as part of their application, and expect potentially a few extra weeks of background checks. Additionally, St. Kitts does not currently allow dual citizenship for certain nationalities it deems high-risk, and generally, all applicants must have clean source of funds and no criminal record. The acceptance of crypto does not bypass these fundamentals; it simply adds a new avenue for legitimate wealth declaration. Overall, St. Kitts & Nevis has embraced crypto in a cautious but meaningful way, making it a top option for those who want a renowned passport and have crypto wealth to back their application.

4. Dominica – Longest-Running Program Embracing Crypto via Trusted Agents

Program Overview: The Commonwealth of Dominica (not to be confused with the Dominican Republic) operates one of the world’s longest continuously active citizenship-by-investment programs, launched back in 1993. Dominica’s program typically requires a monetary contribution to its Economic Diversification Fund (EDF). The minimum donation is usually $100,000 for a single applicant, with higher amounts for including a spouse or family (for example, around $175,000 for a family of four, plus fees). Dominica also offers a real estate investment route (minimum $200,000 in approved developments) as an alternative. The processing time is approximately 3 to 5 months on average, and no visit to Dominica is required to obtain the passport.

Crypto Integration: Dominica’s government doesn’t directly accept cryptocurrency for payments, but it has signaled openness to crypto-derived funds by allowing the use of authorized agencies that can facilitate crypto-to-fiat conversion. In practice, an investor can work with one of the licensed CBI consulting firms (such as those mentioned in industry sources like Apex Capital Partners or Citizenship Bay) to pay the required donation using Bitcoin, Ethereum, or Tether (USDT). The agency will accept the crypto on behalf of the client, convert it through legal banking channels into USD, and then deposit the fiat donation with Dominica’s government fund. This model ensures the source of funds is transparent – applicants must still provide documentation proving the lawful origin of their crypto (e.g., exchange statements, trading records) so that the funds can be treated like any other asset during due diligence. Essentially, crypto serves as the funding mechanism, even though the final payment to the government is in dollars.

Dominica’s CIU has experience dealing with crypto wealth. It works closely with due diligence firms that understand blockchain transactions, making sure that any digital asset wealth is properly vetted. The use of crypto via trusted intermediaries means that from the government’s perspective, they receive fiat currency – but the investor is conveniently able to liquidate crypto without leaving the migration process. This approach has made Dominica and some of its peer Caribbean programs popular among those “moving abroad with crypto” or seeking a “Bitcoin passport,” since it reduces friction in using digital wealth for a second citizenship.

Benefits for Crypto Investors: Dominica’s passport is often cited as one of the best values in the CBI market. It grants visa-free or visa-on-arrival access to about 140 countries, including the Schengen Area of the EU, the UK, Singapore, Hong Kong and others. For crypto entrepreneurs who travel frequently, this opens up major financial centers and crypto hubs without needing separate visas. The program also allows dependent family members to be included – spouse, children (up to age 30 if financially dependent), and even parents or grandparents over a certain age can all be added, which is convenient for those looking to secure mobility for their whole family. Dominica imposes no residency requirement (you never have to live there before or after citizenship), and there are no language exams or cultural tests involved. It’s truly an investment-for-passport exchange, handled efficiently.

From a crypto standpoint, Dominica has been friendly. The country even announced plans to issue a national digital currency in partnership with the blockchain network TRON in 2022 (granting statutory status to certain Tron crypto tokens), highlighting its innovative stance on blockchain adoption. While that initiative is separate from the CBI program, it underscores that Dominica’s government is not averse to crypto-related ideas. Moreover, Dominica’s banking sector has frameworks for dealing with converted crypto funds, and its regulators are familiar with KYC/AML around crypto, which can make the process smoother for applicants.

Notable Considerations: As with other Caribbean CBIs, thorough due diligence is a cornerstone. Dominica in particular partners with independent investigative agencies to vet applicants – any hint of illicit gain (crypto or otherwise) will result in rejection. Investors must ensure their crypto can be traced back to legal sources and that they have paid any required taxes on those gains in their home jurisdiction, if applicable. Another point is that Dominica’s pricing (especially the $100k donation) is for a single applicant; adding family members raises the contribution significantly (for example, a family of four typically must donate $175k plus around $25k per additional dependent) – so the “$100k Bitcoin citizenship” often touted is really the entry-level cost. Lastly, one must convert the necessary amount of crypto into fiat for the donation. This exposes the investor to market risk (crypto volatility) – agencies usually lock in a rate or require the equivalent fiat value, so plan for that. In summary, Dominica provides a time-tested, efficient pathway to a second passport and welcomes crypto as funding through trusted intermediaries, which has kept it in the spotlight for crypto investors.

5. Saint Lucia – Flexible Investment Options Paid via Crypto Conversion

Program Overview: St. Lucia is another Caribbean nation offering citizenship in exchange for investment, and it’s notable as one of the newer programs (established in 2015). The Saint Lucia Citizenship by Investment Program provides multiple routes: a donation to the National Economic Fund starting at $100,000 for single applicants ($140,000 for a couple, $150,000 for a family of up to four), or an investment in government-approved real estate projects (minimum $200,000–$300,000 depending on the project), or purchase of government bonds (a $300,000 minimum, recently adjusted) among others. Processing is relatively quick, often about 4 months, and like its neighbors, St. Lucia imposes no residency or visit requirement to obtain or keep the citizenship.

Crypto Integration: Saint Lucia’s approach to crypto is similar to Dominica’s – while the official CIU doesn’t take Bitcoin or other coins directly, it allows authorized agents and financial service providers to accept crypto payments from applicants. Several migration agencies working with St. Lucia advertise that they can take USD Tether (USDT), Bitcoin, Ethereum, or other major coins as a form of payment, converting them to fiat to pay the government fees and donation. Essentially, an investor could fund their St. Lucian donation or real estate purchase by transferring crypto to an escrow or to the agent’s account; that crypto is liquidated through exchanges or OTC brokers into U.S. dollars which are then forwarded to St. Lucia’s National Economic Fund or the property developer’s account. This setup means the applicant can complete the whole process without needing to leave the crypto ecosystem until the last step, which the agent handles. As long as the applicant provides documentation (like transaction records and proof of original source of funds that bought the crypto), St. Lucia’s government is satisfied that the investment comes from legitimate money, just as if it had come from a bank account.

In 2022, Saint Lucia’s officials explicitly mentioned they were open to exploring crypto contributions and even considered whether to hold some CBI funds in cryptocurrencies, though ultimately they maintained a fiat-only stance for custody. However, by allowing the back-end conversion via agents, they effectively enable crypto-funded applications. This indirect acceptance has been utilized by many crypto entrepreneurs. For example, someone holding a large amount of stablecoins can apply for St. Lucia citizenship by having an intermediary convert (say) 150,000 USDT into USD for the donation and fees. The key benefit is convenience and potentially speed – transferring stablecoins can be faster and easier than arranging an international wire transfer from a bank, especially for those already operating heavily in crypto.

Benefits for Crypto Investors: St. Lucia’s passport is on par with Dominica’s, granting visa-free access to around 145 countries including all of the EU’s Schengen zone, the UK, much of Latin America, and key Asian destinations like Singapore. This provides excellent global mobility for someone coming from, for instance, a country with a weaker passport. The program allows inclusion of spouse, children up to age 21 (or 30 if supported by the applicant), and even parents over 55, under one application, making it family-friendly. St. Lucia also stands out for offering multiple investment pathways (donation, real estate, bonds), so investors can choose based on their financial strategy – e.g., a crypto investor might prefer the non-refundable donation if they want a lower upfront cost, or they might choose buying property (perhaps hoping the property appreciates). In any case, crypto can be used to facilitate whichever route.

For those concerned about taxation, St. Lucia, like most Caribbean jurisdictions, has a very favorable tax regime for individuals. There are no capital gains taxes, no worldwide income tax, and no inheritance tax for St. Lucian residents or citizens. If a crypto investor decided to relocate to St. Lucia (not required, but possible), they would not be taxed on crypto profits earned abroad. The country is also a member of the Eastern Caribbean Currency Union, and its stable currency and regulatory environment add confidence for business or banking activities.

Saint Lucia’s CBI unit is also known for being efficient and customer-service oriented. As long as applications are complete, they sometimes approve files in as little as 3 months. For a crypto investor, that means one could theoretically convert some Bitcoin into a second passport in hand within one quarter of a year – a compelling proposition in volatile times.

Notable Considerations: Saint Lucia has had to implement robust due diligence after learning from older programs – expect a thorough background check. If your wealth is in crypto, be prepared to explain the origin of the funds used to acquire that crypto. This might include providing bank statements from the time you initially bought crypto, or sale agreements if you sold a business and put proceeds into crypto. Transparency is key; simply showing a wallet with a large balance is not sufficient for their review. Also, St. Lucia’s real estate option requires a hold period (usually 5 years) and those properties can be limited in resale market, so the donation is often the cleanest route for most.

Lastly, as with all these programs, the conversion rate and fees should be considered. If you pay via crypto, agents might charge a fee or set a conservative exchange rate to protect against volatility. Make sure to clarify the terms: e.g., is the USDT pegged 1:1, is there any premium for BTC due to price swings during conversion, etc. Given those caveats, St. Lucia remains an attractive, flexible option for crypto investors seeking a quick second citizenship, and its willingness to integrate crypto via trusted intermediaries keeps it among the top choices.

6. Grenada – Crypto-Friendly Stance and Pathway to a Valuable Passport

Program Overview: Grenada, a Caribbean island state, offers a Citizenship by Investment program that has gained attention for its geopolitical perks. To obtain Grenadian citizenship, investors have two main options: a donation of at least $150,000 to the National Transformation Fund (for single applicants) or an investment in government-approved real estate starting from $220,000 (which must be held for at least 5 years). Processing takes roughly 4–6 months. Grenada’s passport is strong (visa-free access to about 144 countries) and uniquely includes visa-free travel to China – a rare benefit among CBI passports. Moreover, Grenada is the only CBI-country that has an active treaty with the United States allowing E-2 Investor Visas, meaning Grenadian citizens can apply to reside in the U.S. as entrepreneurs. This makes Grenada’s program particularly attractive beyond just the usual travel freedoms.

Crypto Integration: The Grenadian authorities have explicitly embraced applicants with cryptocurrency wealth. The government now accepts crypto-derived funds as evidence of an investor’s net worth and source of funds, so long as those assets are fully documented and converted through approved, regulated channels. While, as with others, the final investment must be in fiat (USD), the key point is Grenada’s CIU will recognize and work with crypto holdings. According to one analysis, Grenada is willing to accept that an applicant’s money comes from selling Bitcoin or other crypto, as long as the crypto’s origin is legal and well-documented. Applicants can provide portfolio screenshots, exchange statements, and letters from exchanges or custodians to substantiate their crypto wealth. The funds can then be converted to dollars in a compliant way (through banks or OTC desks) for the actual donation or real estate purchase.

This is significant because some countries’ immigration units still balk at crypto money, fearing difficulty in verification. Grenada, however, has kept pace with crypto adoption. By 2023-2024, it had put in place a regulatory framework – the Virtual Asset Business Act – to license and oversee crypto businesses. That familiarity has translated into the CBI sphere. In practical terms, many agencies and law firms dealing with Grenada’s program can accept Bitcoin or USDT from applicants, handle the exchange, and present the resulting fiat funds to the government. Grenada’s CIU, comfortable with this arrangement, will review the documentation of the crypto transactions during due diligence and, if everything checks out, approve the application.

Benefits for Crypto Investors: Grenada is often cited as one of the most crypto-friendly jurisdictions, not only for its CBI policy but also its domestic economic policies. For one, Grenada imposes no capital gains tax on individuals. This means if you’re a Grenadian tax resident (which you could be after getting citizenship, if you choose to reside there), any profit from selling or trading cryptocurrency is entirely tax-free at the personal level. There’s also no tax on crypto holdings (no wealth tax) and no specific cryptocurrency transaction taxes in Grenada. The country runs on a largely territorial tax system – foreign-sourced income is often exempt for residents – which can potentially shield active crypto traders or investors who base themselves in Grenada from taxation on their global crypto earnings.

From a regulatory perspective, Grenada provides clarity without hostility. Cryptocurrency trading and usage are legal in Grenada, and the government’s approach has been to regulate rather than restrict. As mentioned, the Virtual Asset Business Act (2021) and its 2024 regulations set up a reasonable licensing regime for exchanges and crypto service providers. This means crypto businesses can operate in Grenada under clear rules, and individual crypto users benefit from an environment that is not arbitrary. For example, a Grenadian citizen running a crypto startup or fund can register it locally with regulatory approval, rather than operate in a grey zone. The local financial watchdog (GARFIN) oversees compliance but has moderate fees and a pro-business attitude.

Another big advantage of Grenadian citizenship for crypto folks is the previously mentioned E-2 investor visa treaty with the United States. Grenada is the only country with a CBI program that has this treaty. It means if you become a Grenadian and you have a bona fide business to invest in the U.S., you can apply for a renewable E-2 visa, allowing you (and your family) to live in the U.S. and run that business. Many crypto entrepreneurs eyeing the U.S. market find this valuable. Additionally, Grenada’s visa-free list includes the UK, EU, Russia, and as noted, China – the China access can be a boon for crypto businesspeople who travel to Asia frequently.

Notable Considerations: Grenada’s CBI program does cost a bit more than some others for families (e.g., the donation for a family of four is $200,000, which is higher than Dominica/St. Lucia’s family donation). However, the value can justify it given the unique benefits. The due diligence process will examine crypto funds closely. Grenada may sometimes request that large crypto-to-fiat conversions be done via specific channels (like a well-known exchange or bank) to ensure a clean paper trail. Applicants might also need to provide a third-party audit or attestation of their crypto wallet holdings – for example, an accountant or forensic firm’s letter confirming the balances and that the coins were acquired legally. This adds to application prep time and cost, but it’s part of ensuring credibility.

It’s also worth noting that while Grenada doesn’t tax crypto gains, the U.S. E-2 treaty option has its own implications. If one uses Grenadian citizenship to live in the U.S. on an E-2 visa, their worldwide income (including crypto gains) would then be subject to U.S. taxes because of U.S. tax residency—so careful planning is needed. For those who plan to physically remain outside high-tax jurisdictions, Grenada’s zero-tax advantage on crypto stands. Lastly, the geographic location: Grenada is a beautiful island with good infrastructure by Caribbean standards, but for those not intending to relocate there, this may be moot. However, it could be a future-friendly place if one ever needed to spend time in a crypto-welcoming, low-tax environment. All said, Grenada’s combination of an open attitude to crypto wealth, a strong passport, and extra U.S. treaty benefits cements its place in the top ranks for crypto citizenship options.

7. Portugal – Golden Visa Residency with Crypto-Funded Investments

Program Overview: Portugal has been a magnet for crypto investors in recent years, thanks to its combination of lifestyle, tax benefits, and residency-by-investment program (known as the “Golden Visa”). The Portugal Golden Visa grants a renewable residence permit in Portugal (an EU country) in exchange for qualifying investments. Traditionally, buying real estate worth €500,000 was the most popular route. However, since 2022–2023, the program shifted focus away from metropolitan real estate and towards alternatives like €500,000 investments in regulated investment funds, €500,000 in scientific research, or €250,000 in cultural heritage support. The investment-fund route has become prominent – investors put at least €500k into a Portuguese venture capital or private equity fund that is approved for Golden Visa purposes. After maintaining the investment and meeting minimal stay requirements (just 7 days in the first year and 14 days in each subsequent two-year period), one can renew the residency and become eligible for permanent residency or citizenship after five years (note: a pending law may extend this to 10 years for citizenship).

Crypto Integration: While Portugal does not allow paying the Golden Visa investment in Bitcoin directly, it has effectively created pathways for crypto holders to participate. Several investment funds geared towards Golden Visa applicants accept subscriptions funded by crypto wealth. For instance, there are Portuguese funds that invest in blockchain startups or even hold a percentage of assets in crypto – often marketed as “crypto-friendly funds.” Examples include a so-called “Golden Crypto Fund” that mixes bonds with up to 35% Bitcoin exposure, or venture funds targeting Portuguese crypto and fintech startups. An investor can use their crypto gains to invest in such a fund by first converting crypto to euros through a bank or exchange; the converted euros are then placed into the fund to meet the Golden Visa threshold. Essentially, the role of crypto is indirect: it’s the source of the money, but it becomes fiat when actually invested.

However, what makes Portugal special is the broader crypto-friendly environment that complements the Golden Visa. For many years, Portugal famously did not tax individual crypto trading profits at all if the activity wasn’t a professional business. As of 2023, Portugal introduced a tax (20% rate) on short-term crypto gains (held under 1 year), but long-term holdings (over one year) by individuals are still exempt from capital gains tax. This favorable tax rule means a Golden Visa holder who moves to Portugal could potentially liquidate large crypto positions after a year and realize gains tax-free under domestic law. Moreover, Portugal has a “Non-Habitual Resident (NHR)” regime that can provide additional tax breaks for 10 years on foreign income, which many expatriates use.

To cater to Golden Visa applicants with crypto, Portuguese banks and lawyers have developed expertise in source-of-funds verification for crypto. Applicants typically must show how they obtained the €500k – if it’s from crypto, that means providing documentation like trading logs, proof of initial purchase, etc. Local institutions, having seen many crypto investors apply, are becoming more adept at handling this without outright rejecting crypto-based wealth. There are even services that will issue a formal report tracing your wallet’s history to satisfy any compliance questions.

Benefits for Crypto Investors: The Portugal Golden Visa is a residency (not immediate citizenship), but it’s one of the few routes into the European Union for crypto entrepreneurs that doesn’t require abandoning crypto activities. Benefits include the right to live, work, and study in Portugal and travel freely across the 26 Schengen countries. Crucially, after five years of holding the Golden Visa (and maintaining the investment), one can apply for Portuguese citizenship – gaining an EU passport – without having to live in Portugal full-time. The physical presence requirement is minimal (an average of 7 days/year), which is perfect for digital nomads or those frequently on the move. If the proposed law extending the wait to 10 years takes effect, that timeline could double, but even so, Portugal remains one of the faster paths to EU citizenship available.

Portugal’s pro-crypto stance extends beyond taxes. The country has a growing blockchain startup scene (particularly in Lisbon) and has hosted major conferences like the Web Summit where crypto features prominently. The government has not taken harsh regulatory actions against crypto businesses; on the contrary, it has issued clear rules (for example, defining how exchanges should be licensed) while fostering innovation. This means as a resident, you can be relatively confident that the regulatory environment won’t suddenly turn hostile to crypto.

Another big plus: quality of life. Many crypto investors have relocated to Lisbon, attracted by the mild climate, safety, and vibrant community. Even if you don’t fully move, spending your 7 days a year in Portugal can be quite enjoyable. English is widely spoken, and services are modern. For those who do choose to reside, Portugal’s cost of living is moderate by Western European standards.

Notable Considerations: The Golden Visa program in Portugal has been undergoing changes. As mentioned, the government moved to end the program’s real estate option in major cities to cool the housing market. By mid-2025, it was still possible to invest in real estate in interior regions, but most crypto folks prefer the fund route to avoid property management hassles. The legislative debate about extending the citizenship timeline to 10 years created some uncertainty, but even if extended, Golden Visa holders would still enjoy residency and EU mobility in the interim. Another consideration is bureaucratic delays – Portugal has faced backlogs in processing Golden Visa applications, sometimes taking over 12 months to schedule biometric appointments or approvals. This has been frustrating for applicants. In other words, even if the law says 5 years to citizenship, practical delays might stretch that.

From the crypto perspective, one must also be mindful of compliance: moving large sums from crypto into Portugal’s financial system will trigger scrutiny. Ensure that any crypto profits you convert have been declared if needed in your home country, and that you use reputable exchanges or OTC brokers. Portuguese banks sometimes temporarily freeze or question incoming large transfers (especially from crypto-related sources) until additional documentation is provided. Working with a lawyer who has handled crypto-funded Golden Visas can smooth this over.

In summary, Portugal doesn’t let you plonk down Bitcoin at a government counter for a visa. But it does let crypto wealth pave the way to EU residency and eventually citizenship, through investment vehicles tailor-made for crypto-savvy applicants and a national policy mix that is arguably the friendliest in Europe toward cryptocurrency holders. That makes it an indispensable entry on this list.

8. El Salvador – The World’s First “Bitcoin Citizenship” Program

Program Overview: El Salvador made global headlines by becoming the first country to adopt Bitcoin as legal tender in 2021. In line with its crypto-forward reputation, the Salvadoran government launched the “Freedom Visa” program in December 2023, designed specifically to attract Bitcoin investors. The program offers immediate permanent residency and a rapid path to citizenship for those who commit a substantial investment in cryptocurrency. The headline requirement is a $1 million investment in Bitcoin or Tether (USDT), which qualifies an individual (and their family) for the Freedom Visa. The program is capped at 1,000 investors per year to maintain exclusivity and manage inflows. Notably, unlike traditional investor visas that might accept stocks or cash, El Salvador’s program is explicitly crypto-only – it was launched in partnership with Tether and is framed as the world’s first fully crypto-funded citizenship pathway.

Crypto Integration: El Salvador’s approach is unique in that it allows direct payment in cryptocurrency to the government. The process is two-fold: First, an applicant submits a non-refundable fee of $999 in BTC or USDT as an application due diligence deposit. This fee covers the processing and background checks. The use of crypto here is straightforward – you literally send roughly 0.03 BTC (at mid-2025 prices) to the government’s designated wallet. Once the application is vetted and approved (initial approval has been taking around 6 weeks), the applicant then must invest the remaining $999,001 (to total $1,000,000) in El Salvador. This investment can be in various approved opportunities – for example, government bonds, funding for infrastructure or tech projects, or possibly equity in public-private partnerships that the program designates. Crucially, this entire investment can be done in Bitcoin or USDT as well. The government partnered with Tether so that the conversion and custody of the crypto are handled smoothly. Tether’s involvement presumably ensures that if someone sends $1M in USDT, those tokens are quickly converted to equivalent fiat or otherwise managed so the government has usable funds while the investor’s obligation is fulfilled in crypto terms.

In summary, El Salvador’s program bypasses fiat intermediaries entirely: you don’t need to wire dollars at any point if you have sufficient crypto. The government itself is willing to receive and hold the crypto (or have Tether convert it to stable assets for them). This is a radical departure from other programs where at some step money enters the traditional banking system. El Salvador, having legal tender Bitcoin, treats the crypto as valid payment. Even the residency cards and process have been tailored to accommodate quick crypto payments.

It’s worth noting that in early 2025, El Salvador’s legislature did modify the Bitcoin Law to make accepting BTC voluntary for merchants (to satisfy the IMF), but this does not affect the Freedom Visa framework – that program was crafted after Bitcoin had already been established nationwide, and the government remains extremely pro-crypto. They effectively just removed the mandate that every shopkeeper must accept BTC; Bitcoin is still legal currency and the government certainly accepts it for its programs.

Benefits for Crypto Investors: The Freedom Visa provides permanent residency in El Salvador immediately, with a fast-track to citizenship. While it’s not instant citizenship, it’s much faster than typical naturalization. Successful participants have reported becoming citizens in as little as 6 to 12 months after residency approval, via an accelerated naturalization process written into the program. Essentially, the residency granted by the $1M investment comes with a presidential prerogative to waive the normal multi-year residency requirement for citizenship, allowing investors to apply for a Salvadoran passport after a short period (the exact timing can depend on case-by-case approvals, but it’s clearly much quicker than the usual 5+ years through ordinary laws). This means within a year or so, one could hold a Salvadoran passport, which currently allows visa-free travel to 134 countries, including the entire EU Schengen area, the UK, Japan, Singapore, and most of the Americas. Moreover, a little-known perk: Salvadoran citizens are eligible for Spanish citizenship after just two years of residence in Spain (Spain has a special rule for citizens of former Spanish colonies), providing a potential gateway to the EU for those interested in ultimately relocating to Europe.

Another benefit is that El Salvador imposes zero capital gains tax on Bitcoin by law, since it was legal tender (and this remained even after IMF negotiations). In general, El Salvador has become very tax-friendly to crypto: no tax on BTC trades or holdings, and various incentives for tech businesses. Participants in the Freedom Visa program also support national development projects with their funds, which the government touts as a way to contribute to the country’s growth (education, technology, infrastructure, etc.). For crypto investors who are idealistic about Bitcoin’s mission, there may be a philosophical appeal to backing El Salvador’s bold experiment.

Importantly, the Freedom Visa covers entire families. An investor can include a spouse, children (even adult dependent children), and dependent parents under the one investment. That $1M is steep, but it’s the same whether you apply alone or with five family members. All family get residency and then citizenship on the same accelerated timeline. The residency granted has no physical stay requirement – you are not obliged to live in El Salvador at all to keep it or to obtain citizenship. This truly makes it a “citizenship by investment” in practical terms: a passport for money, albeit via an unusual cryptocurrency route.

Notable Considerations: The cost is high – $1,000,000 in crypto – which naturally limits this program to very wealthy crypto holders. It targets ultra-high-net-worth individuals, unlike the Caribbean programs which start around $100k. There is also the question of political risk: El Salvador’s Bitcoin policy has been driven by President Nayib Bukele, who is very popular domestically, especially after a dramatic drop in crime rates. But one wonders about the long-term stability; any change in government in the future could potentially alter the priorities around Bitcoin incentives (though rewriting citizenship granted by investment would be difficult legally once people are citizens). As of now, Bukele’s party has a strong hold, and the country continues to double down on crypto – for instance, planning a “Bitcoin City” and issuing Bitcoin-backed bonds.

Another factor is that while the Salvadoran passport is decent (134 countries visa-free), it does not have visa-free access to the United States or Canada (most passports don’t), and notably it currently does not have visa-free entry to China (for those who care about that market, some Caribbean ones like Grenada do). But it does cover all of Europe and is considered one of the stronger Latin American passports.

One should also consider the opportunity cost: locking $1M in Bitcoin specifically for this program (the funds must be invested in government-designated projects, which presumably might lock them up for some period or carry some risk) as opposed to other investments. However, the structure isn’t entirely clear if you eventually get returns or if it’s a pure cost. The initial $999 is a fee; the $999,001 goes into investments which might yield something (or could even be regained if structured as an investment rather than donation – further official clarifications would be needed).

Finally, despite Bitcoin no longer being mandated for use, El Salvador remains crypto-centric. Everyday life in El Salvador does allow one to use Bitcoin for many transactions, and the government has a Chivo wallet system – so if one did move there, they’d find a welcoming environment to spending crypto. But also note, the U.S. dollar is the other legal tender in El Salvador and widely used. Crypto investors considering relocating should also note El Salvador’s incredible improvement in security. The homicide rate has plummeted to historically low levels by 2025 due to tough anti-gang measures, making the country much safer than it was a decade ago (now arguably safer than many U.S. cities by crime stats). Still, acclimating to living in Central America is a personal decision – but the beauty is, you don’t have to live there to get the passport.

In conclusion, El Salvador’s Bitcoin-backed visa/citizenship program is a groundbreaking option that directly leverages crypto wealth for a second passport. It’s expensive but also comprehensive, granting a new nationality in a short time without the traditional fiat hassles. For those in the Bitcoin community seeking a jurisdiction that truly values their holdings as more than just an asset, El Salvador has positioned itself as a haven – making it a top contender, albeit for a select crowd.

9. Kazakhstan – Emerging Crypto Hub Offering a 10-Year “Golden Visa”

Program Overview: In May 2025, Kazakhstan – a resource-rich nation straddling Central Asia and Eastern Europe – launched its first formal residence-by-investment program. This “Golden Visa” is actually a 10-year renewable residency permit (not citizenship) aimed at attracting foreign capital. The required investment is $300,000 (USD), which must be invested either as equity in a local Kazakhstani company or in government-approved securities/bonds. Once the investment is made and verified, the applicant receives a residency card valid for 10 years and can be renewed thereafter, as long as the investment is maintained. Family members (spouse and dependent children) are included under the same permit, enjoying the right to live, work, and study in Kazakhstan. This program makes Kazakhstan the first country in Central Asia to offer a long-term investor visa akin to Golden Visas in Europe.

It’s important to note that this residency does not directly lead to citizenship in the way an outright CBI program would. Kazakh citizenship has separate stringent requirements (at least 5 years of residency, language proficiency in Kazakh or Russian, and renouncing previous citizenship, since Kazakhstan typically doesn’t allow dual citizenship). So this is more of a long-term residency solution – essentially a base to live and do business, with potential for naturalization down the road if one fully integrates and gives up other nationalities.

Crypto Integration: Kazakhstan has been actively trying to brand itself as crypto-friendly, especially after China’s crackdown on Bitcoin mining in 2021 led many miners to move to Kazakhstan’s cheap energy environment. The new Golden Visa, however, currently requires the $300k investment in fiat currency; the legislation did not explicitly provide for crypto contributions. Investors must convert any crypto to dollars or tenge (the local currency) and invest through normal channels. That said, the overall environment in Kazakhstan is very welcoming to crypto businesses and innovation. The Ministry of Digital Development has publicly pushed for initiatives like creating a national crypto asset reserve, licensing banks to handle crypto transactions, and even considering a state-supported crypto exchange. There is also the Astana International Financial Centre (AIFC) in the capital (Nur-Sultan, formerly Astana) which is a special economic zone with its own legal system (based on English common law) and a regulatory sandbox for fintech and crypto ventures. AIFC has already issued licenses to crypto exchanges and even hosted pilot projects for crypto trading under oversight.

All these moves signal that Kazakhstan may integrate crypto more directly into its investment programs in the future. For now, licensed intermediaries in Kazakhstan can assist in converting crypto to fiat for meeting the Golden Visa criteria. It’s plausible that if demand is seen, the government might allow a portion of the $300k to be in crypto or simplify conversion via state channels. But as of 2025, the prudent path is to liquidate your crypto through a legal exchange (perhaps even at the AIFC exchange) and then invest the proceeds into, say, shares of a Kazakh company or bonds, to qualify.

Benefits for Crypto Investors: Kazakhstan’s appeal to crypto investors is partly strategic and partly financial. Strategically, Kazakhstan is positioning itself as a regional crypto hub – it’s at the crossroads of Europe and Asia, bordering China and Russia, and not far from key markets in the Middle East. Having a base here could be useful for entrepreneurs interacting with CIS countries or looking at emerging markets. The country has abundant inexpensive energy, which has already attracted crypto mining operations; the government, rather than banning mining, has tried to regulate and even tax it modestly, indicating a willingness to incorporate crypto industries rather than exclude them.

Financially, the Golden Visa is relatively affordable at $300k compared to many European Golden Visas which ran €500k or more. And unlike those, Kazakhstan’s permit lasts 10 years straight (most others require renewals every 2 years or so). Kazakhstan also provides significant tax incentives: there is a flat 10% income tax rate, one of the lowest globally. Additionally, certain foreign-sourced income might be exempt for residents (Kazakhstan has flirted with territorial tax principles for foreigners, especially in the AIFC zone). So a crypto trader residing in Kazakhstan might benefit from relatively low taxation, depending on the structuring. The AIFC offers even zero tax for 5-10 years for companies registered in that zone, which could include crypto exchanges or startups.

Another plus is the inclusion of family – one $300k investment covers spouse and kids, making it a potentially good Plan B for a family. Unlike citizenship programs, there’s no additional fee per dependent for the visa (though there might be nominal processing fees).

Quality of life in cities like Almaty and Nur-Sultan is also decent, with modern infrastructure. Kazakhstan is culturally welcoming to foreigners; many people speak English in business circles, and Russian is widely used (which many international folks pick up). The cost of living can be much lower than in Western countries.

Notable Considerations: The residency is conditional on maintaining the investment. If the investor pulls out the $300k from the company or sells the securities before 10 years (or without renewing properly), the residency can lapse. It’s not a one-time donation like in the Caribbean; it’s a real investment that ideally should generate returns or at least preserve principal. Therefore, one should do due diligence on where to invest – e.g., putting $300k into a stable Kazakh company or in government bonds (if allowed) might be wise for capital preservation.

Kazakhstan’s political system is stable but essentially an authoritarian republic; it went through a leadership transition in 2019 and some unrest in 2022. The government remains keen on foreign investment and is unlikely to jeopardize a flagship program by policy whim, but it’s a different environment than EU or Commonwealth nations. Laws can change – for instance, while dual citizenship is not allowed for locals, they haven’t clarified how it would work if a foreign investor later qualifies for citizenship (likely you’d have to renounce originals). But since most investors view this as a residency, not immediate passport, it’s not a concern unless planning for the very long term.

Also, as a predominantly Muslim-majority country (secular state), and a former Soviet republic, there are cultural differences. However, most crypto investors would probably treat Kazakhstan as a business base rather than a personal liberty paradise – though it is quite free in many respects (religious freedom, relatively open internet except some political censorship, etc.).

Finally, climate and location: Kazakhstan is landlocked and can be very cold in winter, especially in the north (Nur-Sultan is one of the coldest capitals). Almaty is milder and more cosmopolitan. If you were thinking of actually living there, these factors matter – if not, holding a residence permit to occasionally visit might be fine.

In conclusion, Kazakhstan’s new Golden Visa is a promising option especially for those looking at frontier markets and a jurisdiction actively courting crypto business. While you still need to translate your crypto into a traditional investment, the nation’s embrace of crypto culture and its business incentives make it an intriguing addition to the list of crypto-friendly destinations.

10. Cayman Islands – Crypto-Friendly Residency in a Tax Haven via Investment

Program Overview: The Cayman Islands, a British Overseas Territory in the Caribbean, doesn’t offer citizenship-by-investment per se (very few can actually become Caymanian citizens except through a lengthy residency and British naturalization process). However, it offers prestigious permanent residency visas for wealthy investors, which can eventually lead to British Overseas Territory citizenship and even UK citizenship in the long run. The main route is the Residency Certificate for Persons of Independent Means. To qualify, an individual typically must invest around KYD 2 million (approximately USD $2.4 million) in real estate in the Cayman Islands and demonstrate a stable annual income and substantial net worth. Alternatively, there is a 25-year renewable residency for those who invest at least KYD 1 million in Cayman (with some in property) and maintain financial solvency. The exact amounts and criteria can vary, but essentially, if you invest a few million dollars and have a proven high income, Cayman will grant you the right to reside indefinitely (with no work permit needed, though you can’t take up local employment unless you invest in a business).

While citizenship in Cayman (which is essentially British citizenship via the territory) is a very distant prospect (one could apply after, say, 5 years for naturalization as a BOTC and then for full British citizenship after 12 months as a BOTC – but those are not guaranteed), the residency by investment gives you a safe haven in one of the world’s most affluent, low-tax jurisdictions.

Crypto Integration: Cayman Islands is a major global financial center and has also become a hub for crypto funds and exchanges. There is no specific “crypto passport” scheme, and officials have clarified that Cayman does not offer a special citizenship-by-investment linked to crypto. However, in practice, crypto investors can leverage their assets to meet the investment criteria for residency. Notably, some real estate developers and brokers in Cayman will facilitate property purchases using cryptocurrency. For instance, an investor might buy a luxury condominium in Grand Cayman for $3 million and pay in Bitcoin via an intermediary service; the seller or broker converts the Bitcoin to USD (or keeps it if they choose) and the sale proceeds normally. By doing so, the investor fulfills the requirement for the residency certificate (having invested the required amount in property) using crypto wealth as the source of funds.

Cayman’s government itself has been friendly to blockchain businesses. They have a regulatory framework for virtual asset service providers (VASPs) that is considered sensible, and many crypto hedge funds and decentralized finance projects are domiciled in Cayman for its regulatory advantages. There’s even a community of crypto professionals living on the islands, drawn by the zero income tax and high quality of life. So, while you cannot pay government fees in Bitcoin, every other element – from demonstrating net worth to making qualifying investments – can involve crypto conversion. The process would involve converting crypto to fiat through a reputable channel to deposit into a Cayman bank or directly into the investment (since any large transaction will be scrutinized, one must ensure the crypto origin is clear and it’s converted via a compliant exchange).

Benefits for Crypto Investors: The Cayman Islands is often synonymous with “tax haven”. There are no personal income taxes, no capital gains taxes, no corporate taxes, and no estate or inheritance taxes in Cayman for residents or companies. This means a crypto trader or entrepreneur living in Cayman keeps 100% of their gains – a huge incentive. This tax neutrality is balanced by the islands being well-regulated and not on blacklist (Cayman complies with international standards sufficiently to be a major financial center).

With a Cayman residency certificate, you can live year-round in a tropical paradise that boasts one of the highest standards of living in the Caribbean. Grand Cayman in particular is very developed, safe, and has excellent healthcare, international schools, and connectivity. For travel, Cayman residents (holding just their original passport plus the permit) don’t automatically get new travel benefits – they still use their citizenship’s passport – but as a BOTC territory, once one eventually naturalizes (if they choose to and qualify years down the line), one could obtain a British passport.

For the more immediate future, being a legal resident in Cayman with substantial means also often eases travel visas for other countries (you can show ties and residence in Cayman as opposed to, say, a volatile country). And practically, many crypto folks simply want a physical base where they can go if needed – Cayman offers that safe harbor, literally and figuratively.

Another benefit is Cayman’s robust financial infrastructure. Dozens of banks operate there, and it’s relatively straightforward to open accounts (with proper KYC) and even integrate crypto holdings via institutional custody if needed. The jurisdiction also has no foreign exchange controls, so moving money in and out (fiat or crypto conversions) is not restricted, aside from international AML norms. The Cayman government actively encourages HNW individuals to reside there and often grants the maximum 25 or 30-year initial term for those who qualify, which then can become permanent. Also, after 5 years of residency, one can apply for naturalization as a British Overseas Territory Citizen (BOTC), which gives a Cayman Islands passport (slightly different from a full UK passport). A year after that, one could register as a full British citizen, gaining a UK passport – this path is long but available, meaning ultimately the investment can lead to top-tier citizenship.

Notable Considerations: The buy-in is extremely high (millions of dollars in property). This is in a different league than, say, a $150k donation for a Caribbean passport. So Cayman residency is for those who not only have significant crypto wealth but are willing to tie a portion of it into luxury real estate. The real estate market in Cayman is generally strong (many wealthy individuals buying vacation homes, etc.), but it’s also not very liquid if you needed to pull out money quickly. So it’s a lifestyle/tax play more than a pure investment.

Also, Cayman’s program requires the applicant to demonstrate a continued annual income of a certain amount (often around USD $150k per year) and maintain a substantial bank balance or net worth (over $1 million). Basically, they want only genuinely well-off people who won’t seek employment. This is usually no problem for crypto investors who can show large asset holdings and perhaps yield from investments.

It’s important to stress what the government spokesperson said: Cayman isn’t handing out passports for crypto. They are offering residencies to qualified high-net-worth individuals, including those in the crypto space, via traditional means. The attitude is crypto-inclusive but not crypto-centric. They note they “actively attract blockchain and cryptocurrency businesses” with their policies, which is absolutely true given the number of crypto investment funds there.

For the day-to-day, Cayman can be expensive (cost of living and services are high). And while culturally diverse, it’s a small place – some may find island life limiting after a while. But many residents split time between Cayman and elsewhere (it’s easy to travel out).

One must also obey the residency rules: usually you need to spend a certain minimum time in Cayman to not jeopardize the permit (like 30 days a year, depending on the type of certificate). This is to ensure people are actually using the residence. It’s far less stringent than typical visas though, and certainly you can spend as much time as you want.

In conclusion, the Cayman Islands offer a premium residency option that is compatible with crypto wealth. By investing your crypto profits into a stable asset like Cayman property, you can secure a personal haven with unparalleled tax advantages and an environment that fully embraces financial innovation. It’s not a quick passport in your hand, but for those thinking about a long-term base for wealth preservation and a comfortable lifestyle, Cayman stands out as a top-tier choice.

Important Considerations for Crypto-Funded Immigration

The above countries and programs illustrate that the door is opening for crypto investors seeking global mobility. However, anyone considering these pathways should keep a few critical points in mind:

Regulatory Compliance is Essential: Regardless of which program you choose, strict KYC/AML (Know Your Customer / Anti-Money-Laundering) rules apply. You will need to thoroughly document the origin of your crypto funds. This typically means providing records of how you acquired your cryptocurrency (exchange receipts, mining income records, etc.), and if you traded frequently, possibly transaction histories. Many programs treat crypto like any other asset – if you liquidated stock to raise money, they’d want to see the stock sale contract; similarly for crypto, they might want to see blockchain transaction printouts and exchange withdrawal confirmations. Make sure your crypto wealth is held or moved on regulated platforms when converting to fiat; selling coins peer-to-peer for cash, for example, will raise red flags if you cannot produce solid evidence of the transfer. Using reputable exchanges or OTC desks that provide invoices and receipts will smooth the process. Be prepared for enhanced due diligence if a large portion of your wealth is in crypto – some countries may hire specialized firms to audit your wallet activity as part of background checks.

Convert Through Approved Channels: In almost all cases, the government itself will ultimately want fiat currency for the investment or donation. This means you’ll either convert crypto to fiat yourself or work with an agent who does it for you. It’s crucial to use approved banking channels for this conversion. Many jurisdictions require that the investment funds come from an account in the applicant’s name. So you might need to first cash out crypto to your bank, then send the wire to the program’s account. Some agents can intermediate (you send them crypto, they send the wire from their account), but then you’ll have to show the trail from your crypto to the agent’s fiat. Always comply with any currency reporting rules in your home country when moving large sums, to avoid regulatory troubles that could later complicate your application. Essentially, think of crypto as the origin but ensure it turns into a clean wire transfer on record.

Expect Extra Scrutiny (and Fees) for Crypto: Programs like St. Kitts have explicitly stated that applications involving crypto wealth may face additional due diligence fees and longer processing. This is because they might conduct deeper background investigations to ensure the crypto wasn’t tied to illicit activities. Don’t be surprised if a Caribbean CBI unit asks for an independent audit of your wallet, or if you have to pay a few thousand dollars extra for specialized vetting. It’s wise to budget both time and money for this. It’s also helpful to proactively provide explanations for large or unusual transactions in your past if you know they’ll see them. For example, if a wallet associated with you received funds from a mixer years ago (even innocently), address it upfront with a written explanation and any proof to dispel concerns. Transparency will generally work in your favor.

Policy Changes Can Happen: Investment migration programs are subject to political and policy shifts. Always stay updated on the latest rules. For instance, Portugal’s move to potentially extend the citizenship timeline from 5 to 10 years can affect the value proposition of its Golden Visa – an investor in 2025 should consider that they might not get an EU passport until 2035 under new rules. Similarly, the accessibility of certain passports can change (e.g., if the EU imposes visa requirements on a Caribbean country in response to too many passports being sold). Due diligence controversies or geopolitical events can influence how attractive and easy these programs remain. It’s wise to consult with investment migration professionals or lawyers who specialize in this field and keep track of developments. As of mid-2025, the programs listed here are active and accepting crypto-funded applicants, but always double-check the current status before committing funds.

Tax and Legal Advice: Acquiring a new residency or citizenship can have tax implications. For example, if you become a tax resident of a no-tax country (like Vanuatu or Cayman) that might free you from taxes back home – but only if you properly sever tax residency in your original country. Some countries have “exit taxes” or continue to tax citizens even if they move (the U.S. famously taxes its citizens worldwide regardless of where they live). Before you reposition yourself, get advice on how to optimize your situation legally. You may need to spend a certain number of days out of your home country to stop being tax resident there, or potentially renounce citizenships in extreme cases, to fully enjoy a tax haven benefit. Also, think about inheritance and estate planning – a second citizenship can complicate or enhance those, depending on laws. Professionals who understand both crypto and cross-border planning are invaluable; they can help create structures (like trusts or offshore companies) if needed to hold your crypto during the application to minimize taxation or ensure compliance.

Quality of Life and Responsibility: Finally, remember that citizenship or residency isn’t just a piece of paper – it ties you to that country. Research what being a citizen or resident entails. In some places, citizenship might come with obligations (for example, jury duty, though that’s rare outside the U.S., or in some cases military service – none of the ones we discussed have forced service for economic citizens, but good to confirm). Ensure you’re comfortable with the local laws and culture, especially if you plan to spend time there. El Salvador’s fast-track citizenship is revolutionary, but living there means adapting to a new culture and political climate. Similarly, a second passport can be a lifeline (a place to go if things go awry elsewhere), but use it responsibly – follow the laws of your new country, and don’t treat it as just a flag of convenience without respecting what it stands for.

In summary, buying a citizenship or golden visa with crypto is becoming a reality across multiple countries, each with its own nuances. By choosing the option that fits your goals – whether it’s a quick offshore passport for travel, a long-term EU residency, or a bet on a Bitcoin-powered nation – you can significantly enhance your personal and financial freedom. Just proceed with eyes open: comply with the rules, document everything meticulously, and get expert advice when needed. The convergence of crypto and global citizenship is an exciting development of 2025, turning the once-fiatic confines of investment migration into a more accessible frontier for the crypto wealthy. With the right planning, your digital assets could very well be the key to unlocking a world of new opportunities and safe havens.