Bitcoin's dramatic ascent through 2025 has been one of the year's defining financial narratives. The world's largest cryptocurrency surged past $126,000 in early October, propelled by a wave of institutional capital that flowed through newly approved spot Bitcoin exchange-traded funds. These ETFs, launched in January 2024 following a landmark decision by the U.S. Securities and Exchange Commission, fundamentally altered the dynamics of Bitcoin access for traditional investors. For months, the appetite from institutional buyers appeared insatiable, with spot Bitcoin ETFs absorbing far more coins than miners could produce.

Yet beneath this bullish surface, a critical shift has emerged. For the first time in seven months, institutional demand through ETFs and corporate treasury purchases has dropped below the pace of newly mined Bitcoin, according to analysis from Capriole Investments. This development, confirmed on November 3, 2025, marks a potential inflection point in Bitcoin's market structure. The blue line representing total institutional buying, which once towered above the red line of daily mining issuance, has now fallen beneath it.

The implications extend far beyond simple market mechanics. When institutional demand consistently exceeds new supply, Bitcoin's scarcity narrative intensifies, providing fundamental support for price appreciation. The inverse scenario introduces uncertainty. If the entities most capable of absorbing Bitcoin's fixed daily issuance step back from the market, questions arise about who will fill that void and at what price.

This dynamic matters because Bitcoin's value proposition rests heavily on its programmed scarcity. Unlike fiat currencies that central banks can print at will, Bitcoin's supply is capped at 21 million coins, with new issuance following a predictable halving schedule every four years. After the April 2024 halving, daily issuance dropped to approximately 450 BTC per day. When demand from the most sophisticated market participants fails to keep pace with even this reduced supply, it signals a potential weakness in the bullish thesis that has driven Bitcoin to unprecedented heights.

The story becomes more complex when examining the composition of institutional demand. Spot Bitcoin ETFs represent only part of the equation. Digital asset treasury companies, corporate entities that hold Bitcoin on their balance sheets as a strategic reserve, have emerged as another significant demand source. Yet this channel too shows signs of strain. Net asset value premiums have collapsed, and many treasury firms now trade below the value of their underlying Bitcoin holdings.

Bitcoin's recent price action reflects this shifting sentiment. After touching its all-time high above $126,000 in early October, the cryptocurrency has consolidated in a range, trading near $109,000 as of late October. This consolidation occurred even as the broader cryptocurrency market absorbed a liquidation event that wiped out nearly $1 billion in leveraged long positions. The resilience at these levels suggests underlying support, but the question remains whether that support can withstand sustained institutional selling or indifference.

Understanding this supply-demand crossover requires examining multiple interconnected factors. The supply side encompasses not just daily mining issuance but also miner behavior, operational economics, and the infrastructure that secures Bitcoin's network. The demand side involves spot ETF flows, corporate treasury strategies, regulatory developments, and the macroeconomic forces shaping institutional risk appetite. Each component influences the others, creating a complex system where small changes can cascade into significant market movements.

This article provides a comprehensive analysis of Bitcoin's current supply-demand dynamics, exploring how institutional flows through ETFs have evolved from dominant buyers to net sellers, why corporate treasury demand has weakened, and what these shifts mean for Bitcoin's market structure and price trajectory. The analysis draws on academic frameworks for supply-demand modeling, on-chain data, regulatory filings, and real-time market observations to present a fact-based assessment of Bitcoin's position at this critical juncture.

The Supply Side of Bitcoin's Economic Model

Bitcoin's supply mechanics represent one of the cryptocurrency's most distinctive and economically significant features. Unlike traditional financial assets whose supply can fluctuate based on company decisions, central bank policy, or market conditions, Bitcoin's issuance follows an immutable, predetermined schedule encoded in its underlying protocol. This fundamental characteristic shapes every aspect of Bitcoin's market dynamics and provides the foundation for understanding current supply-demand imbalances.

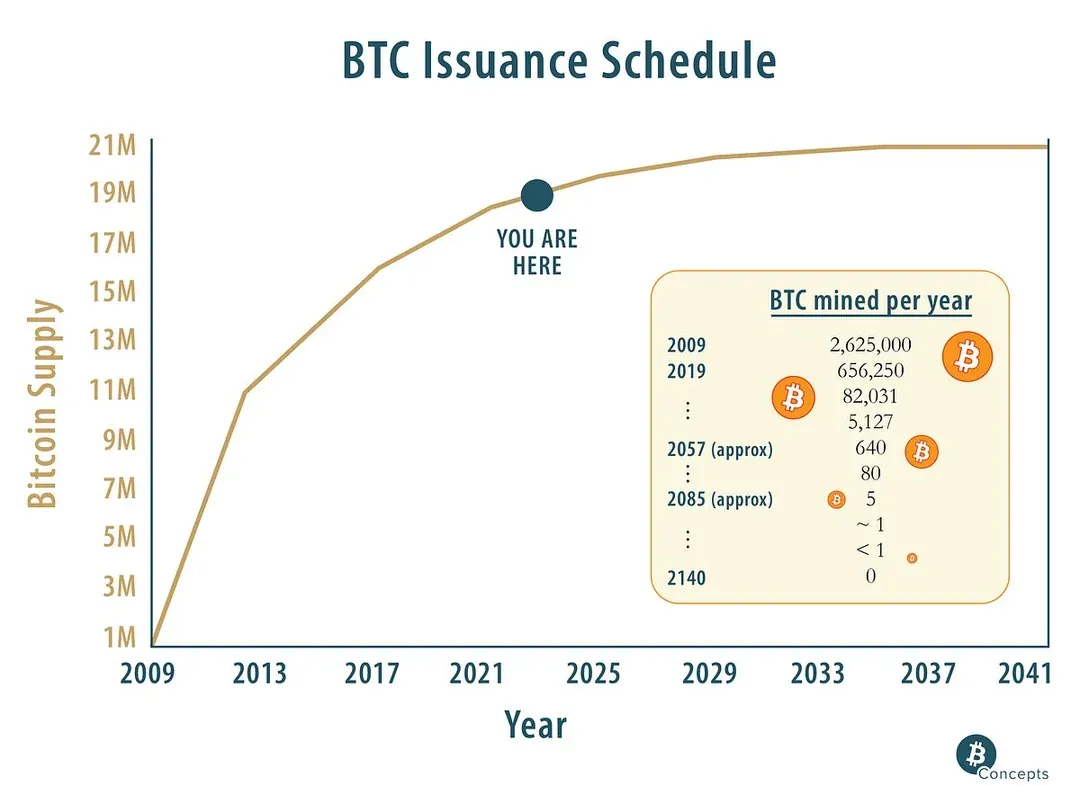

The creation of new Bitcoin occurs through a process called mining, where powerful computers compete to solve complex cryptographic puzzles. When a miner successfully solves a puzzle, they earn the right to add a new block of transactions to Bitcoin's blockchain and receive a reward of newly created Bitcoin. This block reward started at 50 BTC per block when Bitcoin launched in 2009, but the protocol includes a built-in deflationary mechanism: approximately every four years, or every 210,000 blocks, the block reward is cut in half.

The fourth Bitcoin halving occurred on April 19, 2024, reducing the block reward from 6.25 BTC to 3.125 BTC per block. This event fundamentally altered Bitcoin's supply dynamics. Before the halving, with blocks occurring approximately every 10 minutes, the Bitcoin network produced roughly 900 new coins per day. After the halving, daily issuance dropped to approximately 450 BTC. At Bitcoin's October 2025 price levels near $110,000, this represents about $50 million in new supply entering the market each day, compared to roughly $100 million before the halving.

Academic research has developed sophisticated frameworks for understanding how Bitcoin's fixed supply interacts with demand. A 2025 study by Rudd and Porter published in the Journal of Risk and Financial Management presents a supply-demand equilibrium model specifically designed for Bitcoin price forecasting. Their framework integrates Bitcoin's perfectly inelastic supply curve with a constant elasticity of substitution demand function, calibrated to real-world data from the April 2024 halving. The model demonstrates how even modest increases in institutional demand can trigger substantial price appreciation when liquid supply becomes constrained.

The supply schedule extends far into the future, with halvings continuing until approximately 2140, when all 21 million Bitcoin will have been mined. Currently, about 19.7 million Bitcoin have already been issued, meaning roughly 94% of Bitcoin's total supply exists today. This high percentage of completed issuance means that future halvings will have progressively smaller impacts on total circulating supply, even as they dramatically affect the daily flow of new coins.

Yet supply is not simply a matter of new issuance. The behavior of existing holders significantly affects available supply. Bitcoin held in long-term storage by entities unwilling to sell at current prices effectively reduces liquid supply, even though those coins technically exist. On-chain analysis reveals that approximately 75% of Bitcoin supply has remained unmoved for six months or longer, suggesting a large cohort of long-term holders who view Bitcoin as a strategic asset rather than a trading vehicle.

Mining operations themselves face significant economic pressures that affect how quickly new supply reaches the market. The April 2024 halving cut miners' block reward revenue in half overnight, forcing the industry to adapt or face insolvency. Bitcoin miners have responded to this pressure in two primary ways: increasing operational efficiency through hardware upgrades and diversifying revenue streams into artificial intelligence and high-performance computing services.

The mining industry's debt burden has exploded as companies scramble to remain competitive. According to a VanEck analysis, total debt among Bitcoin miners surged from $2.1 billion to $12.7 billion between Q2 2024 and Q2 2025, representing a nearly 500% increase in just twelve months. This massive borrowing funded purchases of more efficient mining equipment and infrastructure investments aimed at diversifying revenue beyond Bitcoin mining.

Major mining firms have issued billions in debt and convertible notes. TeraWulf announced a $3.2 billion senior secured notes offering, the largest ever by a public mining company. IREN closed a $1 billion convertible bond offering, while Bitfarms proposed $300 million in convertible notes. The quarterly pattern shows the scale of this borrowing: $4.6 billion in Q4 2024, a pullback to $200 million in early 2025 following the halving, a rebound to $1.5 billion in Q2, and approximately $6 billion in Q3 2025 alone.

This debt carries significant costs. TeraWulf's latest issuance features a 7.75% interest rate, translating to approximately $250 million in annual interest payments, nearly double the company's 2024 revenue of $140 million. This financial structure places miners under intense pressure to generate revenue, either through Bitcoin mining or alternative business lines. When Bitcoin prices fail to support profitable mining operations, overleveraged miners may be forced to sell their holdings, adding to market supply at potentially inopportune times.

VanEck analysts Nathan Frankovitz and Matthew Sigel describe this challenge as the "melting ice problem": every day a miner delays upgrading equipment, their share of the global hashrate declines, reducing their daily Bitcoin earnings. This competitive dynamic forces continuous capital expenditure, perpetuating the debt cycle even as the rewards for mining continue to halve.

The supply side of Bitcoin's equation has thus become more complex than simple issuance schedules suggest. While the protocol ensures a predictable flow of new coins, the behavior of miners and long-term holders introduces variability into how much Bitcoin actually becomes available for purchase in spot markets. The combination of fixed new issuance, stressed mining economics, and substantial long-term holder conviction creates an environment where available supply can tighten considerably, particularly when institutional demand remains strong. The question facing markets now is whether that demand will persist.

Institutional Flows and Bitcoin ETFs

The launch of spot Bitcoin ETFs in January 2024 fundamentally restructured how institutional capital accesses Bitcoin exposure. Prior to this development, institutions seeking Bitcoin allocation faced substantial operational hurdles: establishing custodial relationships with specialized crypto service providers, implementing security protocols, navigating uncertain regulatory treatment, and addressing concerns from compliance departments unfamiliar with digital assets. Spot Bitcoin ETFs eliminated most of these friction points, packaging Bitcoin exposure in a familiar, regulated wrapper that institutional investors could purchase through standard brokerage accounts.

The Securities and Exchange Commission approved eleven spot Bitcoin ETFs on January 11, 2024, marking a watershed moment for cryptocurrency market structure. These products offered direct exposure to Bitcoin's spot price through physically-backed holdings, contrasting with earlier futures-based ETFs that suffered from contango costs and tracking errors. The lineup included offerings from financial giants BlackRock, Fidelity, Grayscale, Bitwise, ARK Invest, and others, each competing for institutional and retail allocation.

Initial demand proved explosive. During February 2024, spot Bitcoin ETFs saw net inflows averaging $208 million per day, far exceeding the approximately $54 million worth of Bitcoin being mined daily at pre-halving rates. This immediate imbalance between ETF demand and new supply created strong upward price pressure, contributing to Bitcoin's rally from roughly $45,000 at the start of 2024 toward its eventual peak above $126,000 in October 2025.

BlackRock's IBIT emerged as the dominant player, attracting $28.1 billion in net inflows since the start of 2025, outpacing all competitors combined. The fund's success reflects BlackRock's distribution network, brand recognition, and competitive fee structure. By late 2025, IBIT held more than 805,000 BTC in its balance sheet, worth approximately $87 billion at current prices, making it one of the largest Bitcoin holders globally.

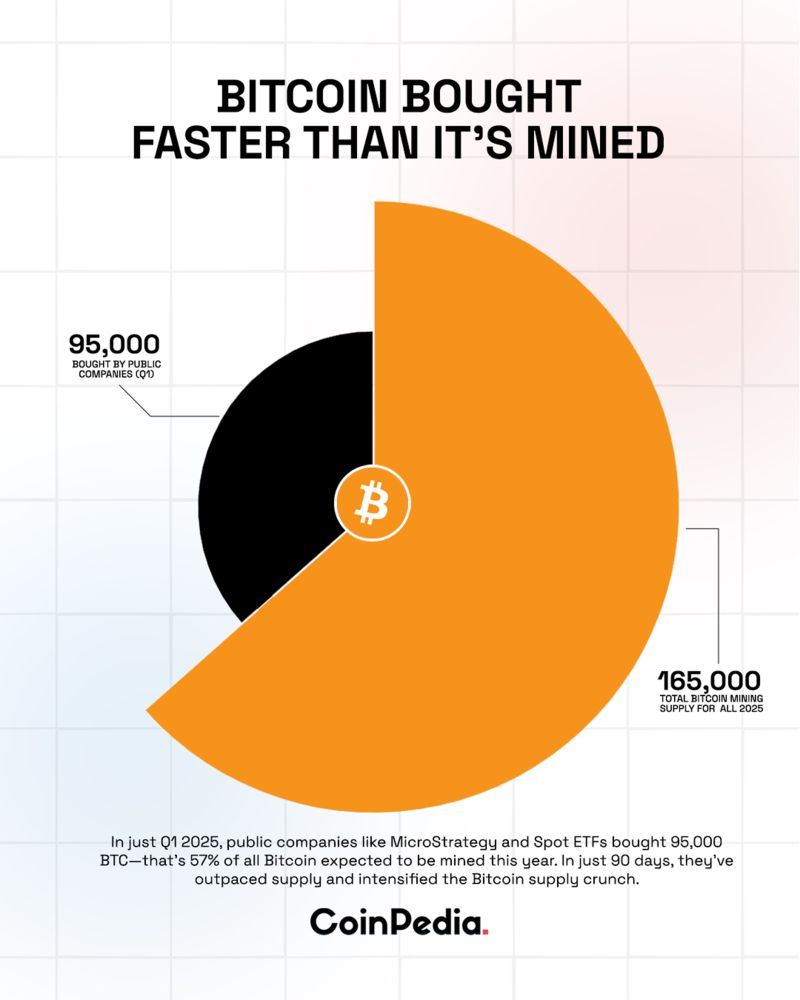

The supply-demand dynamic reached its most extreme levels in May 2025. During that month, Bitcoin ETFs purchased 26,700 BTC while miners produced only 7,200 BTC over the same period. This 3.7-to-1 ratio of ETF buying to new supply represented unprecedented institutional absorption. Some weekly periods saw ETF purchases exceed mining output by six times, with funds buying 18,644 BTC in a single week when daily production hovered around 450 BTC per day.

Academic research on Bitcoin ETF price discovery has documented how these products now dominate Bitcoin's price formation. A 2025 study published in Computational Economics analyzed high-frequency trading data from the ETFs' January launch through October 2024. Using information leadership share metrics, researchers found that the three most actively traded Bitcoin ETFs - IBIT, FBTC, and GBTC - dominate price discovery over Bitcoin spot markets approximately 85% of the time. This finding suggests that institutional flows through ETFs have become the primary driver of Bitcoin's short-term price movements, displacing the previously dominant role of spot cryptocurrency exchanges.

The mechanics of ETF operation amplify their market impact. When net inflows occur, authorized participants must purchase Bitcoin in spot markets to create new ETF shares, directly increasing demand. The process operates in both directions: redemptions require selling Bitcoin to return cash to exiting investors. This creates a direct transmission mechanism between institutional sentiment, as reflected in ETF flows, and Bitcoin spot prices.

However, the strong inflows that characterized much of 2024 and early 2025 began reversing in late summer. By mid-August, institutional demand started showing signs of fatigue, with combined demand from ETFs and digital asset treasuries declining relative to daily mining output. The trend accelerated through October.

Early October told a deceptive story. Spot Bitcoin ETFs saw $3.55 billion in inflows during the week ending October 4, 2025, helping push Bitcoin to its all-time high above $126,000. The cryptocurrency community celebrated what appeared to be the "Uptober" rally, with social media buzzing about inevitable mainstream adoption and new price targets. Yet this euphoria proved short-lived.

By October 20, 2025, sentiment had shifted dramatically. Bitcoin ETFs collectively experienced $40.47 million in outflows, with BlackRock's IBIT alone seeing $100.65 million in withdrawals. The outflows accelerated. On October 30, Bitcoin ETFs recorded $488.4 million in net outflows, with all twelve funds seeing zero inflows - an ominous signal of unanimous selling pressure.

The weekly picture painted an even starker portrait of declining institutional appetite. Spot Bitcoin ETFs saw $600 million in net outflows during the week ending October 31, 2025. Since October 11, cumulative outflows had reached $1.67 billion, representing a significant reversal from the record inflows just weeks earlier.

BlackRock's IBIT, despite maintaining its position as the largest Bitcoin ETF, experienced its largest single-day redemption since August 4 when $290.88 million flowed out on October 30. ARK & 21Shares' ARKB saw $65.62 million in outflows, while Bitwise's BITB recorded $55.15 million in redemptions. Even Grayscale's products, which had been hemorrhaging assets since converting from a trust to an ETF, saw continued bleeding with no offset from competitors' inflows.

The shift from record inflows to persistent outflows within a matter of weeks reflects how quickly institutional sentiment can reverse. Multiple factors contributed to this turnabout. Federal Reserve policy uncertainty played a role, with Chair Jerome Powell casting doubt on a December rate cut following the central bank's October decision. The resulting repricing of rate expectations reduced risk appetite across asset classes.

Macroeconomic concerns extended beyond monetary policy. Analysts at CryptoQuant noted that U.S. investor demand for crypto had dropped sharply, with spot BTC ETFs recording their weakest seven-day average outflow since April. The CME futures basis dropped to multi-year lows, suggesting that profit-taking by institutional and retail traders, rather than new demand for exposure, drove recent trading activity.

Yet the most significant development may be the crossing point reached on November 3, 2025, when institutional demand through ETFs and corporate treasuries fell below daily mining supply for the first time in seven months. This metric, tracked by Capriole Investments head Charles Edwards, combines spot ETF flows with digital asset treasury corporate activity to measure total institutional absorption. The blue line representing combined institutional demand, which had consistently exceeded the red line of daily Bitcoin production since March, dipped below it, signaling a fundamental shift in market structure.

Edwards expressed concern about this development, noting it was "the main metric keeping me bullish the last months while every other asset outperformed Bitcoin." The implication is clear: when institutions that previously absorbed supply in excess of mining output become net neutral or sellers, Bitcoin loses a crucial support mechanism that had underpinned its rally.

The question facing markets is whether this represents a temporary rebalancing following Bitcoin's vertical ascent to all-time highs or signals a more structural change in institutional appetite for cryptocurrency exposure. The answer will likely determine Bitcoin's trajectory through the remainder of 2025 and into 2026.

When Demand Lags Supply: Conceptualizing the Market Impact

Understanding what happens when institutional demand falls below new supply requires conceptualizing Bitcoin's market as a dynamic equilibrium system where price emerges from the interaction between available supply and competing bids. Unlike traditional commodities where producers can adjust output in response to price signals, Bitcoin's supply schedule is fixed and immutable, making demand the sole variable component in short-term price determination.

The current situation presents a scenario where approximately 450 BTC enter the market daily through mining rewards, representing roughly $50 million in new supply at recent price levels. When institutional buyers through ETFs and corporate treasuries consistently absorb more than this amount, they create a supply deficit that must be filled from existing holdings. Holders willing to sell at current prices face competition from institutional buyers, creating upward price pressure that often manifests as higher bids required to attract sufficient supply.

The inverse scenario - demand falling short of new supply - forces a different market dynamic. Miners receiving their 450 daily Bitcoin face a choice: hold the coins in anticipation of higher future prices or sell to cover operational costs and service debt. Given the significant financial pressures facing mining companies, with industry debt exceeding $12.7 billion and many firms carrying interest expenses that exceed their total revenue, the pressure to sell remains considerable. When institutional buyers fail to absorb this daily production, miners must find alternative buyers at potentially lower prices.

Academic frameworks for supply-demand modeling provide insight into how these dynamics unfold. The Rudd and Porter model demonstrates that Bitcoin's perfectly inelastic supply curve creates conditions for extreme volatility when demand shifts. Their research, calibrated to data from the April 2024 halving, shows that "institutional and sovereign accumulation can significantly influence price trajectories, with increasing demand intensifying the impact of Bitcoin's constrained liquidity."

The model's implications work in reverse as well. Just as aggressive institutional accumulation can drive hyperbolic price increases by removing coins from liquid supply, institutional indifference or selling can weaken support levels by increasing the available float. When demand consistently falls short of new issuance, the excess supply must clear through one of several mechanisms: price decline until lower levels attract new buyers, absorption by retail traders and smaller entities stepping in as institutions step back, or accumulation on cryptocurrency exchanges where coins wait for eventual buyers.

On-chain metrics reveal how Bitcoin's supply distributes across different holder cohorts. Exchange reserves, representing Bitcoin held on trading platforms and theoretically available for immediate sale, have declined to multi-year lows in recent years as more coins moved to long-term storage. This structural reduction in liquid supply had amplified the impact of institutional ETF buying when it dominated market flows. The same dynamic means that renewed selling pressure or even neutral flows from institutions could have outsized effects if exchange reserves remain constrained.

The behavior of different market participant groups becomes critical when institutional demand wanes. Retail investors, who typically demonstrate more price-sensitive buying patterns than institutions executing strategic allocation decisions, may lack the capital to fully offset institutional outflows. Long-term holders, sometimes called "HODLers" in cryptocurrency parlance, generally buy during bear markets and hold through volatility, but they represent a finite pool of demand. Leveraged traders on derivatives platforms can provide short-term buying or selling pressure, but they amplify rather than stabilize price moves.

The experience from earlier periods when demand lagged supply offers limited guidance. Prior to the January 2024 ETF launches, no comparable institutional demand channel existed. Bitcoin's price discovery occurred primarily on spot cryptocurrency exchanges through a fragmented global market of retail traders, miners, and early institutional participants like hedge funds and treasury companies. The ETF structure and its authorized participant creation-redemption mechanism represent a structurally different demand source whose behavior under stress remains somewhat untested.

Historical examples from other asset classes where ETF demand became a dominant factor show mixed outcomes. In equity markets, when ETF flows reverse, underlying stocks can experience amplified volatility as passive flows dominate price-insensitive active management. For commodities like gold, where ETF holdings represent a significant but not dominant share of demand, periods of net selling through ETFs have coincided with price weakness, though physical demand from jewelry, industrial users, and central banks provided alternative support.

Bitcoin's situation differs from these analogues in important ways. The cryptocurrency lacks industrial demand that might provide a floor during periods of investment selling. It generates no cash flows that could anchor valuations through discounted cash flow analysis. Its utility as a medium of exchange remains limited despite original ambitions. Bitcoin's value proposition rests primarily on its scarcity, network security, and status as an uncorrelated asset or "digital gold" - characteristics that require sustained belief and demand from holders.

When institutions that previously validated Bitcoin's investment case through massive capital allocation suddenly reverse course, they challenge that narrative. The supply-demand gap of roughly 450 BTC per day, equivalent to about $50 million at current prices, may seem modest compared to Bitcoin's approximately $2 trillion market capitalization. Yet this daily flow represents the marginal pricing mechanism. Just as oil markets worth trillions can swing dramatically based on marginal supply-demand imbalances measured in millions of barrels per day, Bitcoin's price can move significantly when daily flows shift from institutional buying to selling.

The practical implications manifest across several dimensions. Price momentum weakens when institutional buying that previously propelled rallies turns to selling. Volatility tends to increase as the absence of large, patient institutional buyers removes a stabilizing force and exposes the market to sharper moves on lower volume. The scarcity premium that Bitcoin commands relative to its limited utility may compress if the most sophisticated market participants signal reduced confidence through redemptions.

Market depth and liquidity suffer when large buyers step away. Bid-ask spreads can widen, making execution more costly for all participants. Large orders face greater price impact, potentially creating feedback loops where selling begets more selling as stop-losses trigger and leveraged positions face liquidation. These dynamics can persist until prices fall sufficiently to attract value buyers willing to absorb available supply.

Yet the relationship between institutional demand and price is not mechanically deterministic. Bitcoin has demonstrated remarkable resilience through previous drawdowns, often recovering to surpass prior peaks after extended periods of consolidation. The question facing markets now is whether the current demand weakness represents a brief pause in institutional adoption or signals a more fundamental reassessment of Bitcoin's role in professional portfolios. The answer will likely determine whether Bitcoin's latest rally represents a sustainable advance or an exhaustion peak.

Corporate Treasuries and the Digital Asset Treasury Model Under Stress

The corporate treasury trend, pioneered by MicroStrategy (now rebranded as Strategy) in 2020 under CEO Michael Saylor's leadership, introduced a novel capital allocation strategy: converting corporate cash reserves into Bitcoin holdings. The approach rested on a straightforward thesis - Bitcoin's fixed supply and disinflationary monetary policy would preserve purchasing power better than cash, which loses value to inflation and opportunity cost. By 2025, this model had expanded dramatically, with over 250 organizations, including public companies, private firms, ETFs, and pension funds, holding Bitcoin on their balance sheets.

The digital asset treasury model operates through a self-reinforcing mechanism during bull markets. Companies issue equity or debt at valuations above their net asset value (NAV) - the per-share value of their Bitcoin holdings - then use proceeds to purchase more Bitcoin. This increases their Bitcoin-per-share metric, theoretically justifying the premium valuation and enabling further capital raises. When Bitcoin's price appreciates, these companies' stock prices often rise faster than Bitcoin itself, creating a leveraged exposure that attracts momentum investors.

Strategy exemplifies this approach at scale. By mid-2025, the company held over half a million BTC, more than half of all Bitcoin held by public companies. Strategy's stock traded at a significant premium to its Bitcoin NAV, typically 1.7 to 2.0 times the underlying asset value, signaling sustained investor confidence in the company's capital allocation strategy and its ability to grow Bitcoin-per-share through disciplined fundraising.

The model spawned imitators. Companies like Marathon Digital, Riot Platforms, Bitfarms, Cipher Mining, Hut 8, and others transformed from pure-play mining operations into hybrid enterprises holding substantial Bitcoin treasuries. International players joined the trend, with Japan's Metaplanet emerging as a prominent example. The company transformed from an unprofitable hotel business into the fourth-largest Bitcoin treasury firm, accumulating significant holdings through a combination of debt financing, asset sales, and creative financial engineering.

By late 2024 and into 2025, approximately 188 treasury companies had accumulated substantial Bitcoin positions, many with minimal business models beyond Bitcoin accumulation. These entities effectively operated as publicly traded Bitcoin proxies, offering investors leveraged exposure to cryptocurrency price movements through traditional equity markets. During Bitcoin's ascent, this structure worked brilliantly, generating impressive returns for early participants.

However, the model contains inherent fragilities that surface during periods of price weakness or market skepticism. The central risk involves a scenario researchers describe as the "death spiral" - a cascading failure triggered when a company's stock price falls too close to or below its Bitcoin NAV. When this happens, the multiple of NAV (mNAV) that justified further capital raises compresses or disappears entirely. Without the ability to issue equity at premiums to NAV, companies lose their primary mechanism for acquiring more Bitcoin without diluting existing shareholders.

A Breed VC report outlined seven phases of decline for Bitcoin treasury companies. The sequence begins with a drop in Bitcoin's price that reduces the company's NAV premium. As market capitalization contracts relative to Bitcoin holdings, access to capital tightens. Without equity buyers or willing lenders, companies cannot expand holdings or refinance existing Bitcoin-backed debt. If loans mature or margin calls trigger, forced liquidations follow, depressing Bitcoin's price further and dragging other treasury companies closer to their own spirals.

By October 2025, signs of this stress had become apparent. Net asset value premiums collapsed across the digital asset treasury sector. According to a 10x Research analysis, "The age of financial magic is ending for Bitcoin treasury companies. They conjured billions in paper wealth by issuing shares far above their real Bitcoin value - until the illusion vanished." Retail investors who paid two to seven times the actual Bitcoin value when buying treasury company shares during periods of hype saw those premiums evaporate, leaving many shareholders underwater while companies converted inflated capital into real Bitcoin holdings.

Metaplanet's experience illustrates the boom-bust dynamic. The company effectively transformed a market capitalization of $8 billion, supported by just $1 billion in Bitcoin holdings, into a $3.1 billion market cap backed by $3.3 billion in Bitcoin. The compression from an 8x premium to trading near or below NAV represented wealth destruction for equity holders even as the company accumulated more Bitcoin. Strategy experienced a similar pattern, with its NAV premium compressing significantly from November 2024 peaks, resulting in a slowdown of Bitcoin purchases.

The debt burden these companies accumulated amplifies downside risks. By 2025, Bitcoin treasury companies had collectively raised approximately $3.35 billion in preferred equity and $9.48 billion in debt, according to Keyrock Research. This creates a wall of maturities concentrated in 2027 and 2028, along with ongoing interest and dividend payments through 2031. Companies' ability to service these obligations depends heavily on Bitcoin maintaining price levels that support their business models.

Cash flow from underlying core businesses varies dramatically across the treasury company cohort. Strategy generates software licensing revenue that provides some cash flow cushion. Mining companies like Marathon and Riot produce Bitcoin directly, though at costs that fluctuate with hashrate difficulty and energy prices. Some treasury companies lack meaningful operating businesses entirely, relying exclusively on capital markets access to sustain operations and acquire more Bitcoin.

The weakening demand from digital asset treasuries compounds the broader institutional demand shortfall. When these companies actively accumulated Bitcoin, they provided consistent buying pressure that helped absorb mining output alongside ETF flows. As NAV premiums collapsed and capital markets access tightened, treasury companies' Bitcoin acquisition pace slowed or stopped entirely, removing another significant demand channel from the market.

The structural issues extend beyond individual company health to broader market implications. If overleveraged treasury companies face forced liquidations to meet debt obligations or margin calls, they add to selling pressure precisely when Bitcoin least needs additional supply. The interconnected nature of these companies' fortunes means that weakness in one can cascade through the sector, as declining Bitcoin prices compress all NAVs simultaneously, limiting everyone's capital-raising ability.

Fortunately, most treasury companies in 2025 still rely primarily on equity financing rather than extreme leverage, limiting contagion risk if some entities fail. Strategy's approach of balancing equity issuance with convertible debt, maintaining conservative loan-to-value ratios, and actively managing its capital structure provides a template for sustainable Bitcoin treasury operations. However, the sector's growth attracted less disciplined operators whose capital structures may prove unsustainable if Bitcoin consolidates or corrects from recent highs.

The 10x Research analysis suggests that the NAV reset, while painful for equity holders, creates a cleaner foundation for the next market phase. Companies now trading at or below NAV offer pure Bitcoin exposure with optionality on future operational improvements. The shakeout "separated the real operators from marketing machines," suggesting that survivors will be better capitalized and capable of generating consistent returns. Whether this optimistic view proves correct depends partly on whether Bitcoin's price can stabilize and resume its upward trajectory, restoring the conditions that made the treasury model viable in the first place.

Contrasting Periods: When ETFs Absorbed Supply Faster Than Mining

The period from late 2024 through mid-2025 represented Bitcoin's golden age of institutional demand dominance. During these months, the combination of spot ETF flows and corporate treasury accumulation consistently exceeded daily mining output, often by substantial margins. This dynamic created what supply-demand frameworks describe as a supply shock - a structural imbalance where available supply fails to meet demand, forcing prices higher to attract sellers from existing holders.

May 2025 exemplified this pattern at its extreme. As documented earlier, Bitcoin ETFs purchased 26,700 BTC while miners produced only 7,200 BTC during that month. This 3.7-to-1 ratio meant institutions absorbed nearly four times the new supply entering circulation. Some weekly periods showed even starker imbalances, with ETFs buying 18,644 BTC in a single week when daily production averaged 450 BTC. At these rates, institutional buyers absorbed the equivalent of more than 40 days of mining output in just seven days.

The macroeconomic context supported this aggressive accumulation. Bitcoin reached $97,700 in early May, posting approximately 4% gains before pulling back to around $94,000. The relatively mild correction following such rapid appreciation, combined with continued institutional buying, signaled robust underlying demand. Each dip found buyers willing to absorb available supply, creating a rising floor under prices that emboldened further institutional allocation.

BlackRock's IBIT demonstrated particular strength during this period, posting 17 consecutive days without capital outflows, a remarkable streak indicating sustained institutional conviction. The fund raised nearly $2.5 billion over just five days, showcasing the velocity of capital flowing into Bitcoin through ETF wrappers. By this point, spot Bitcoin ETFs collectively surpassed $110 billion in assets under management, representing a substantial portion of Bitcoin's accessible supply locked into these vehicles.

The concentrated nature of this demand intensified its market impact. With BlackRock's IBIT alone absorbing such massive flows, single-day purchase requirements could exceed multiple days of mining output. Authorized participants creating new ETF shares had to source real Bitcoin from spot markets, often executing large block trades that removed coins from exchange inventories. This mechanical buying pressure operated independently of traditional supply-demand signals, as ETF flows reflected allocation decisions made days or weeks prior rather than real-time price-sensitive trading.

Analysis from 2025 shows that institutional demand surpassed new supply by 5.6 times over extended periods. Institutions accumulated 545,579 BTC while miners produced only 97,082 BTC during comparable timeframes. This sharp imbalance fundamentally altered Bitcoin's market structure, transforming the cryptocurrency from an asset primarily traded on fragmented spot exchanges to one increasingly influenced by institutional flows through regulated U.S. ETF channels.

The supply shortage manifested in observable market behaviors. Exchange balances - representing Bitcoin held on trading platforms and theoretically available for sale - declined to six-year lows. Long-term holders refused to sell at prevailing prices, anticipating further appreciation driven by continued institutional accumulation. The combination of reduced exchange inventories and aggressive ETF buying created conditions where even modest additional demand moved prices significantly.

This dynamic validated the bullish thesis that had driven Bitcoin from the low $40,000s at the start of 2024 to eventual peaks above $126,000 in October 2025. The rally's fundamental underpinning rested on quantifiable supply-demand imbalances rather than speculative fervor or leverage buildup. When institutions consistently absorbed multiples of new supply, price appreciation became almost mechanical, with each successive wave of buying forcing prices to levels that would attract sufficient selling from existing holders.

The April 2024 halving amplified these effects. By cutting daily issuance from 900 to 450 BTC, the halving reduced new supply by 50% while institutional demand continued growing. Pre-halving, ETFs absorbed roughly 3 times daily mining output. Post-halving, with production cut in half, the same institutional buying represented 6 times or more of new supply. This mathematical reality created powerful upward pressure that persisted for months.

Academic modeling suggests these supply shocks can trigger hyperbolic price trajectories under certain conditions. When liquid supply drops below approximately 2 million BTC while institutional demand remains strong, relatively modest daily purchases can drive exponential price appreciation. The Rudd and Porter framework demonstrates that institutional accumulation rates of 1,000-4,000 BTC per day, easily achievable given observed ETF flows, could lead to six- or seven-figure Bitcoin prices over multi-year horizons if sustained.

The contrast between this earlier period of institutional demand dominance and the current environment where demand lags supply illustrates Bitcoin's sensitivity to marginal flow changes. Despite Bitcoin's approximately $2 trillion market capitalization, daily flows measured in tens of millions of dollars drive short-term price action. When institutions flip from absorbing 3-5 times daily production to absorbing less than daily production, the impact manifests quickly in price momentum and volatility.

The sharp reversal from record inflows in early October to sustained outflows by month's end exemplifies this volatility. Bitcoin peaked above $126,000 on the strength of those early October inflows, only to consolidate in the $105,000-$110,000 range as outflows persisted through month's end. The $20,000+ decline from peak to trough occurred over just a few weeks, demonstrating how quickly sentiment can shift when the marginal buyer - in this case, institutional ETF allocators - steps away from the market.

The question facing investors now is whether institutional demand will resume levels that exceed supply, restoring the favorable dynamics that powered Bitcoin's rally, or whether the current demand weakness persists or worsens, forcing a more substantial repricing. Historical precedent offers limited guidance, as spot Bitcoin ETFs represent a structural innovation whose behavior through complete market cycles remains unknown. The answer will likely emerge through the daily flow data that has become the most closely watched real-time indicator of Bitcoin's institutional adoption trajectory.

Macro, Regulatory, and Sentiment Factors Driving Demand Changes

The dramatic shift in institutional Bitcoin demand through late 2025 reflects a convergence of macroeconomic headwinds, regulatory uncertainties, and evolving market sentiment. Understanding these factors provides context for why previously aggressive institutional buyers suddenly retreated, allowing demand to fall below new supply for the first time in months.

Monetary policy represents the primary macroeconomic force shaping institutional risk appetite. The Federal Reserve's cautious stance on further rate cuts introduced uncertainty precisely as Bitcoin approached its all-time highs. Following the central bank's October 2025 rate reduction, Chair Jerome Powell cast doubt on a December move, noting that another cut was "far from guaranteed." This statement triggered repricing across risk assets, with investors recalibrating expectations for the pace of monetary easing.

Bitcoin's correlation with broader risk assets intensified through 2024 and 2025. Analysis shows Bitcoin's correlation with the S&P 500 reached 0.77 by 2024, up from 0.3 in 2020, transforming Bitcoin from an uncorrelated alternative asset into a high-beta extension of equity market risk appetite. When equity markets face pressure, as occurred following disappointing tech earnings in late October 2025, Bitcoin absorbs proportional or amplified selling pressure. The cryptocurrency's inverse correlation with the U.S. Dollar Index reached -0.72 by 2024, meaning dollar strength, often associated with risk-off positioning, coincides with Bitcoin weakness.

Interest rate expectations directly influence institutional capital allocation decisions. When Treasury yields rise on expectations of sustained higher rates, the opportunity cost of holding non-yielding assets like Bitcoin increases. Institutional allocators face pressure to justify Bitcoin positions when risk-free rates offer attractive returns without the volatility inherent in cryptocurrency markets. The repricing of rate expectations following Powell's October comments contributed to the institutional selling that manifested in Bitcoin ETF outflows.

Broader macroeconomic anxiety amplified these dynamics. Persistent inflation, elevated interest rates, and uncertainty around Fed policy created an environment of heightened caution among institutional investors. The specter of a potential U.S. government shutdown in late October added to political uncertainty, prompting risk reduction across portfolios. Crypto-specific concerns, including periodic exchange security incidents and regulatory enforcement actions, maintained elevated risk premiums for cryptocurrency exposure.

The regulatory landscape presents a complex picture of progress mixed with ongoing uncertainty. The January 2024 approval of spot Bitcoin ETFs represented a watershed regulatory endorsement, validating Bitcoin's legitimacy as an investable asset class for institutional participants. However, questions about broader cryptocurrency regulation, particularly regarding the classification and treatment of other digital assets, continue creating uncertainty.

The Trump administration's stance on cryptocurrency regulation generated initial optimism but uncertain execution. While campaign rhetoric suggested a more favorable regulatory environment for digital assets, specific policy implementations remained ambiguous through late 2025. The Securities and Exchange Commission's leadership transition, with Paul S. Atkins confirmed as Chairman in April 2025, raised expectations of accelerated approvals for additional cryptocurrency products and greater regulatory clarity. However, translating pro-crypto sentiment into concrete policy changes proved slower than markets anticipated.

Institutional investors particularly value regulatory clarity, as compliance frameworks and capital requirements depend on definitive classification of assets and activities. The absence of comprehensive cryptocurrency legislation or clear agency guidance keeps many large allocators, particularly those subject to strict fiduciary standards, cautious about significant cryptocurrency exposure. Until major regulatory questions find resolution, a subset of potential institutional demand remains locked out despite the availability of regulated ETF access.

Market structure considerations influenced institutional behavior during late 2025. The concentration of ETF assets in BlackRock's IBIT raised concerns about systemic risk. As one analysis noted, removing IBIT's influence, the remaining ETF sector would have seen net outflows of $1.2 billion through 2025. This concentration meant that any change in BlackRock's flows or client sentiment could disproportionately impact overall ETF demand. When IBIT experienced its largest single-day redemption since August on October 30, 2025, it signaled that even the most successful fund faced selling pressure.

Sentiment indicators reflected deteriorating market psychology. The Fear & Greed Index slid deeper into "fear" territory through late October, suggesting that trader confidence eroded even as prices remained elevated by historical standards. Social media discussion shifted from euphoria during the "Uptober" rally to anxiety and debate about market sustainability following the reversal to outflows. This sentiment shift often becomes self-reinforcing, as deteriorating confidence prompts selling that validates concerns and triggers additional selling.

Technical factors contributed to the demand shift. Bitcoin's rapid appreciation to $126,000 extended significantly above psychological resistance levels and moving averages that had contained prior rallies. When prices stretched too far too fast, profit-taking became rational behavior for institutions that had accumulated at much lower levels. The absence of sustained follow-through buying above $120,000 suggested exhaustion of near-term demand, prompting technically-oriented traders to reduce exposure or establish short positions.

The derivatives market structure provided additional insight into institutional positioning. CME Bitcoin futures basis - the premium of futures contracts over spot prices - dropped to multi-year lows through late October. This compression typically indicates that participants prefer selling futures rather than establishing long positions, suggesting skepticism about near-term appreciation. Low funding rates on perpetual futures contracts confirmed limited demand for leveraged long exposure, as speculators avoided paying carry costs to maintain bullish positions.

Institutional portfolio rebalancing may have contributed to outflows. Bitcoin's strong performance through 2024 and into 2025 increased its weight in portfolios that initially established small positions. When position sizes grow beyond target allocations, institutional investors face pressure to trim regardless of short-term price views, particularly approaching year-end when performance gets locked in. This mechanical selling from rebalancing can occur independently of fundamental views on Bitcoin's long-term prospects.

The interplay of these factors - monetary policy uncertainty, regulatory ambiguity, deteriorating sentiment, and technical exhaustion - created conditions where institutional demand that previously dominated market flows shifted to selling or neutrality. The mathematical outcome manifested in the early November crossing point where institutional demand fell below daily mining supply. Whether this represents a temporary consolidation phase or a more concerning reversal of institutional adoption trends remains the central question for Bitcoin's near-term outlook.

Risks and Consequences for Bitcoin Price and Market Structure

The sustained period where institutional demand trails daily Bitcoin production introduces several interconnected risks for price stability and market structure. Understanding these risks requires examining potential scenarios ranging from benign consolidation to more concerning demand deterioration, along with their implications for different market participant groups.

The most immediate risk involves continued downward price pressure if institutional selling persists or accelerates. Bitcoin's October peak above $126,000 established a local top that markets have so far failed to reclaim. Each attempt to rally back toward that level faces selling pressure, creating a pattern of lower highs that technical analysts interpret as trend deterioration. Without renewed institutional buying through ETFs to absorb both daily mining supply and existing holder selling, Bitcoin faces the prospect of testing lower support levels.

The $100,000 to $105,000 range represents the first major support zone where buyers might emerge in sufficient size to stabilize prices. This level coincides with several technical factors: the 200-day moving average, previous consolidation areas that may now serve as support, and psychological importance as a round number. However, if institutional selling intensifies or if macro conditions deteriorate further, this support could fail, opening the possibility of deeper corrections toward $90,000 or even the $80,000 levels that marked prior local highs.

Volatility represents another significant consequence of reduced institutional participation. Large institutional buyers provide market stability through patient, price-insensitive accumulation based on strategic allocation decisions. When these participants exit, markets become more susceptible to sharp moves driven by smaller, more price-sensitive traders and leveraged speculators. The $1 billion in liquidations that occurred during October's market correction illustrates this dynamic - when prices fall, stop-losses trigger and leveraged long positions face forced selling, creating cascading declines that exacerbate volatility.

Increased volatility creates challenges for institutional adoption even beyond the immediate market turbulence. Pension funds, endowments, and other conservative institutional investors require relatively predictable risk characteristics for position sizing and risk management. When volatility spikes, these participants reduce position sizes or avoid the asset entirely, creating a negative feedback loop where reduced institutional participation increases volatility, which further deters institutional participation.

Market depth and liquidity suffer when large buyers withdraw. Order books on exchanges become thinner, meaning that large transactions face greater price impact. Bid-ask spreads widen, increasing execution costs for all market participants. This liquidity deterioration particularly affects institutional-sized trades, potentially creating a vicious cycle where poor execution quality discourages institutional participation, which further degrades liquidity.

The shift in price discovery mechanisms represents a structural change with lasting implications. Research shows Bitcoin ETFs dominate price discovery approximately 85% of the time since their launch, meaning that institutional flows through these regulated products drive short-term price formation more than spot exchange activity. When ETF flows turn negative, price discovery shifts back toward fragmented spot exchanges where trading is often more speculative and less informed by fundamental allocation decisions. This transition can increase noise in price signals and reduce market efficiency.

The scarcity premium that Bitcoin commands faces erosion if institutional demand remains weak. Bitcoin's value proposition rests significantly on its status as a scarce, supply-capped asset that institutions increasingly adopt as a strategic reserve or portfolio diversifier. When the most sophisticated market participants signal through their selling that they no longer find Bitcoin attractive at current valuations, it challenges the narrative that scarcity alone justifies premium pricing. This psychological shift can prove more damaging than immediate price weakness, as it undermines the fundamental thesis driving long-term investment.

Corporate treasury companies face acute risks if institutional demand remains subdued and Bitcoin prices fail to advance. As documented earlier, these companies accumulated significant debt loads while building Bitcoin positions, creating fixed obligations that must be serviced regardless of market conditions. If Bitcoin consolidates or declines while institutional demand remains weak, treasury companies lose their ability to issue equity at premiums to NAV, blocking their primary capital-raising mechanism. This scenario could force distressed selling from overleveraged entities, adding to downward price pressure precisely when markets can least absorb it.

The mining industry confronts similar pressures. With debt loads approaching $13 billion and many firms carrying interest expenses exceeding operating revenues, miners require sustained high Bitcoin prices to remain profitable. If prices decline while operational costs remain elevated, less efficient miners face bankruptcy, potentially reducing network hashrate and security. While Bitcoin's difficulty adjustment mechanism compensates for hashrate changes over time, severe miner distress could create temporary network vulnerability or perception problems that undermine confidence.

Distribution channel risks emerge if wealth management platforms and financial advisors become less enthusiastic about Bitcoin ETF allocation following performance disappointments. The institutional adoption story depends partly on Bitcoin ETFs gaining acceptance across major brokerage platforms and wirehouses. While some firms like Morgan Stanley began allowing advisor access, many major platforms including Merrill Lynch, Wells Fargo, and UBS still restrict proactive pitching of cryptocurrency products. Extended underperformance or continued outflows could delay or reverse progress toward broader platform acceptance, limiting the potential addressable market for ETF products.

Regulatory risks intensify during periods of market stress. Policymakers and regulators often respond to volatility and consumer losses by implementing restrictions or additional oversight. While spot Bitcoin ETF approval represented regulatory progress, sustained market weakness accompanied by retail investor losses could trigger renewed skepticism about cryptocurrency products' appropriateness for mainstream portfolios. This risk becomes particularly acute if leveraged products or complex derivatives contribute to market dislocations that generate negative headlines.

However, not all consequences of reduced institutional demand portend disaster. Market consolidation following rapid appreciation serves healthy functions in price discovery and shakeout of weak holders. Bitcoin has repeatedly demonstrated resilience through drawdowns of 30%, 50%, or even 70% before resuming uptrends and surpassing prior peaks. The current situation may represent normal volatility within an ongoing bull market rather than a fundamental regime change.

The compression of corporate treasury NAV premiums, while painful for equity holders, creates a cleaner foundation for sustainable growth. Companies now trading near NAV offer direct Bitcoin exposure without paying premiums for questionable added value. This reset separates disciplined operators from promotional entities, potentially strengthening the sector long-term even if near-term pain persists.

The ultimate consequence of sustained institutional demand weakness depends on whether alternative buyer groups emerge to fill the gap. Retail investors, sovereign entities exploring Bitcoin reserves, continued accumulation by existing believers, or renewed institutional interest following consolidation could all provide demand support. The coming months will reveal whether the late 2025 institutional retreat represents a worrying exodus or merely a pause before the next wave of adoption.

Forward Outlook: What Needs to Happen for Demand to Catch Up

Reversing the current dynamic where institutional demand lags Bitcoin's mining supply requires analyzing the catalysts that could restore or accelerate ETF inflows and corporate treasury accumulation. Several potential developments could shift the supply-demand balance back toward demand dominance, though their likelihood and timing remain uncertain.

Macroeconomic conditions represent the most powerful potential catalyst. A clear Federal Reserve pivot toward sustained monetary easing would reduce the opportunity cost of holding non-yielding Bitcoin and improve risk appetite across institutional portfolios. If inflation pressures moderate while economic growth remains resilient, creating a "Goldilocks" environment for risk assets, institutional allocators would likely increase cryptocurrency exposure. Rate cuts combined with ending quantitative tightening could inject new liquidity into markets that historically flows partly into Bitcoin and cryptocurrency markets.

Regulatory clarity could unlock substantial pent-up institutional demand currently sidelined by compliance constraints. Comprehensive cryptocurrency legislation establishing clear classification frameworks, custody standards, and regulatory oversight would remove a major impediment to institutional participation. While spot Bitcoin ETF approval represented significant progress, many potential allocators await more definitive guidance before committing substantial capital. If Congress passes comprehensive crypto legislation or regulators issue clear guidance, it could trigger a wave of previously restricted institutional buying.

Geographic diversification of Bitcoin ETF offerings could expand the addressable market significantly. U.S. ETFs currently dominate flows, but similar products in major markets like Europe, Asia, and emerging economies could tap new institutional capital pools. Some jurisdictions already offer cryptocurrency ETPs, but expanded product availability in major financial centers would broaden access. If sovereign wealth funds, pension systems, or insurance companies in additional jurisdictions gain regulatory clearance for Bitcoin exposure, it would diversify and potentially expand demand beyond current U.S.-dominated flows.

Product innovation within the ETF structure could attract different investor segments. The launch of options on Bitcoin ETFs, enhanced yield products, or actively managed cryptocurrency strategies might appeal to institutional participants seeking more nuanced exposure than simple spot holdings. If major ETF sponsors introduce products targeting specific use cases - income generation, downside protection, tactical trading - they could capture demand from allocators who find pure spot exposure unattractive.

Corporate adoption beyond treasury companies could provide incremental demand. If major corporations outside the crypto industry begin allocating meaningful portions of cash reserves to Bitcoin, as Strategy pioneered, it would signal broader acceptance and potentially trigger competitive adoption. The model works best when companies can issue equity at premiums to NAV, so renewed market enthusiasm would likely accompany any expansion of this trend. Sovereign adoption would prove even more significant - if nations establish Bitcoin reserves beyond El Salvador and the Central African Republic, the supply impact could prove substantial given the scale of potential allocations.

Improved miner economics could paradoxically help by reducing selling pressure. If Bitcoin miners successfully transition to sustainable business models incorporating AI and HPC revenue alongside mining, their dependence on selling newly mined Bitcoin would decrease. This transition would effectively remove some daily supply from markets even without increased demand, tightening the supply-demand balance. The success of this pivot remains uncertain given the massive debt loads miners accumulated, but positive developments would improve market structure.

Technical factors could catalyze renewed buying if Bitcoin establishes clear support at current levels. Traders and algorithms watching for reversal signals might initiate buying if Bitcoin successfully tests and holds $105,000-$110,000 support multiple times, creating a basing pattern that technical analysts interpret as accumulation. Momentum-following strategies that sold on breakdown below key levels would reverse to buying if Bitcoin reclaims important technical thresholds, potentially creating self-reinforcing upward momentum.

Scenario analysis helps frame possible outcomes over coming months. In a base case scenario, institutional demand remains roughly flat at current subdued levels, matching or slightly trailing mining supply. Bitcoin consolidates in a range between $95,000 and $115,000, with neither sustained uptrend nor significant breakdown. This outcome would require macro conditions remaining stable without dramatic improvement or deterioration, regulatory status quo continuing, and no major catalysts emerging to shift sentiment dramatically.

An optimistic scenario envisions renewed institutional interest driven by improving macro conditions, positive regulatory developments, or successful technical basing. ETF inflows resume at levels exceeding mining supply, perhaps reaching 2-3 times daily production as occurred in May 2025. Bitcoin breaks above $125,000 resistance and extends to new all-time highs in the $140,000-$160,000 range by mid-2026. This outcome would restore the favorable supply-demand dynamics that powered 2024-2025's rally and validate the bullish adoption narrative.

A pessimistic scenario sees institutional outflows accelerating rather than reversing, potentially driven by macroeconomic deterioration, regulatory setbacks, or systematic failures among corporate treasury companies. Demand falls to 50-75% of daily mining supply, forcing Bitcoin to clear excess supply through price declines. The cryptocurrency tests $80,000-$90,000 support, potentially breaking below these levels if selling pressure intensifies. This outcome would require significant negative catalysts - recession, hawkish Fed pivot, major regulatory crackdown, or cascading treasury company failures.

Probabilities for these scenarios remain inherently uncertain and depend on developments across multiple dimensions. Market participants should monitor several key indicators to assess which scenario is materializing:

ETF flow data provides the most direct real-time signal of institutional demand. Daily and weekly flow reports reveal whether the late October selling represented a temporary adjustment or marks the beginning of sustained institutional exodus. If flows stabilize near neutral or return to modest inflows, it suggests consolidation rather than breakdown. If outflows accelerate or persist for multiple consecutive weeks, pessimistic scenarios gain credibility.

On-chain metrics reveal whether long-term holders remain committed or begin distributing. The percentage of Bitcoin supply unmoved for 6+ months, currently around 75%, indicates conviction among existing holders. If this metric declines substantially, suggesting long-term holders selling, it would signal weakening fundamental support. Exchange reserves and the pattern of transfers to or from exchanges provide insight into whether holders prepare to sell or continue accumulating for long-term storage.

Corporate treasury behavior indicates whether the digital asset treasury model retains viability. If treasury companies resume Bitcoin purchases following NAV compression, it suggests the model adapts and survives. If purchases remain frozen or companies begin selling holdings to service debt, it indicates structural problems that could force liquidations.

Miner selling pressure reveals whether producers add to or reduce market supply beyond new issuance. Tracking miner wallet balances shows whether newly mined coins immediately reach exchanges or remain in miner treasuries. Increased miner selling would compound institutional demand weakness, while miner holding would partially offset reduced ETF buying.

Macroeconomic conditions and Fed policy remain the dominant external force. Fed communications, inflation data, employment reports, and market pricing of future rate cuts all provide insight into the macro backdrop for risk assets. Improving conditions that boost equity markets typically support Bitcoin, while deteriorating macro environments create headwinds.

Regulatory developments in major jurisdictions could prove decisive. Congressional action on comprehensive crypto legislation, SEC rule-makings, international regulatory coordination, or sovereign adoption announcements all could significantly impact institutional appetite for Bitcoin exposure.

Investors and market participants face decisions about positioning given this uncertainty. Conservative approaches suggest reducing exposure or maintaining tight stop-losses until demand-supply balance improves. Aggressive strategies might view current prices as opportunities to accumulate, betting that temporary demand weakness will reverse once macro conditions improve. Balanced approaches might maintain positions while hedging downside risk through options or position sizing appropriate to elevated uncertainty.

The central question remains whether Bitcoin's long-term adoption trajectory remains intact despite short-term institutional demand weakness. If Bitcoin represents a legitimate emerging reserve asset and uncorrelated portfolio component, temporary periods where ETF flows disappoint should present buying opportunities rather than reasons for concern. However, if institutional retreat signals that Bitcoin failed to deliver on promises of mainstream financial adoption, current weakness might mark a more significant setback requiring years to overcome.

Historical perspective suggests patience. Bitcoin has weathered numerous periods of declining demand, adverse headlines, and price drawdowns of 50% or more, only to recover and reach new all-time highs. The cryptocurrency's longest-duration bear market lasted roughly 18 months from the 2021 peak to late 2022's bottom, and that period included spectacular failures like Terra/Luna, Three Arrows Capital, Celsius, FTX, and others that current conditions don't approach in severity.

The supply-demand framework developed by Rudd and Porter suggests that Bitcoin's fixed supply creates conditions where even modest sustained demand can drive substantial long-term price appreciation. Their modeling indicates that daily withdrawals from liquid supply equivalent to 1,000-4,000 BTC - easily achievable by ETFs during strong periods - could push Bitcoin toward six- or seven-figure prices over 5-10 year horizons if maintained. The challenge is whether institutional demand resumes at levels that enable this trajectory or whether the late 2025 slowdown represents the high-water mark of institutional adoption's first wave.

Ultimately, the forward path depends on Bitcoin proving it offers sufficient utility - whether as an inflation hedge, portfolio diversifier, decentralized alternative to traditional finance, or digital store of value - to justify sustained institutional allocation despite volatility and regulatory uncertainty. The coming months will provide crucial data points revealing whether institutional conviction in Bitcoin's value proposition withstands its first significant test since spot ETFs introduced this powerful but volatile new demand channel.

Final thoughts

Bitcoin's journey through 2025 has tested the fundamental proposition underlying its multi-trillion-dollar valuation: that programmed scarcity, by itself, justifies premium pricing and ongoing institutional adoption. The cryptocurrency's fixed supply schedule represents an elegant and immutable feature of its design, distinguishing Bitcoin from fiat currencies subject to inflationary monetary policies and even from gold whose annual mine supply responds to price incentives. The April 2024 halving reduced new issuance to approximately 450 BTC daily, creating mathematical scarcity that Bitcoin advocates argue must drive long-term value appreciation as adoption grows.

Yet the experience of late 2025 demonstrates that scarcity alone provides insufficient support for prices when demand fails to materialize at expected levels. For the first time in seven months, institutional demand through spot Bitcoin ETFs and corporate treasury accumulation fell below the pace of daily mining supply. This crossing point, confirmed on November 3, 2025, represents a potentially significant inflection in Bitcoin's market structure and challenges the complacent assumption that limited supply automatically translates to ever-increasing prices.

The supply side of Bitcoin's equation has performed exactly as designed. The halving occurred on schedule, cutting issuance with mathematical precision. Miners continue securing the network despite compressed economics, though the massive debt accumulation required to maintain operations introduces concerning fragilities. The protocol's supply schedule extends predictably into the distant future, with each successive halving further reducing new issuance until the final Bitcoin is mined around 2140. This supply reliability stands as one of Bitcoin's core features and differentiators.

The demand side has proven far less predictable. The spot Bitcoin ETF launch in January 2024 initially delivered on promises of mainstream institutional access, with billions flowing into these products and absorption rates exceeding mining output by multiples. This dynamic powered Bitcoin's appreciation from the $40,000s to above $126,000, validating the thesis that accessible institutional products would unlock substantial pent-up demand. However, the reversal to net outflows through late October, totaling $1.67 billion since October 11 and culminating in $600 million weekly outflows, demonstrated how quickly institutional sentiment can shift.

The corporate treasury channel that provided complementary demand also weakened substantially. NAV premiums collapsed across the digital asset treasury sector, blocking the capital-raising mechanism these companies used to acquire Bitcoin. With 188 treasury companies holding substantial positions and many facing significant debt obligations, this demand source may provide limited support until market conditions improve enough to restore equity issuance capabilities.

The implications for investors and market participants are sobering. Bitcoin's scarcity creates potential for supply shocks and dramatic price appreciation when demand growth meets or exceeds supply growth. However, the inverse scenario - where demand growth lags or reverses - introduces downside risk that scarcity itself cannot prevent. The academic frameworks that model Bitcoin price trajectories demonstrate this symmetry: fixed supply amplifies both upside from demand growth and downside from demand contraction.

Market structure considerations suggest increased importance of monitoring institutional flows. Given that Bitcoin ETFs now dominate price discovery approximately 85% of the time, these products function as the primary transmission mechanism between institutional capital allocation decisions and Bitcoin spot prices. When ETF flows reverse, they directly remove demand from markets while simultaneously signaling deteriorating institutional confidence. This creates both mechanical selling pressure and psychological headwinds that can become self-reinforcing.

The forward trajectory depends on factors largely outside Bitcoin's protocol control. Macroeconomic conditions, particularly Federal Reserve policy and broader risk appetite, influence institutional willingness to allocate to volatile, non-yielding assets. Regulatory developments in major jurisdictions can either unlock new institutional participation or introduce additional barriers. Technological improvements in custody, execution, and product structures may reduce friction and expand addressable markets. None of these factors relate to Bitcoin's fixed supply, yet all profoundly impact demand and thus price.

For long-term investors, the current episode reinforces several lessons. First, Bitcoin remains a high-volatility asset whose price can decline substantially even from elevated levels, regardless of supply constraints. Second, institutional adoption through ETFs represents genuine progress for mainstream acceptance but introduces new volatility sources as institutions prove more fickle than ideologically committed retail holders. Third, the interaction between fixed supply and variable demand creates asymmetric outcomes - massive gains during demand surges and significant drawdowns during demand droughts.

The thesis supporting long-term Bitcoin investment has not fundamentally changed. The cryptocurrency remains the largest, most secure, and most widely recognized digital asset, with growing infrastructure, improving regulatory clarity, and expanding institutional access. Its supply schedule remains immutable and its scarcity property intact. However, realizing the value that scarcity theoretically creates requires sustained demand growth from institutions, corporations, and individuals who find Bitcoin sufficiently compelling to allocate meaningful capital despite its volatility and uncertainty.

The current supply-demand disconnect may mark an important turning point where the market separates sustainable institutional adoption from speculative excess. If Bitcoin weathers this period of reduced institutional demand and eventually attracts renewed interest at higher price levels, it would strengthen the case for Bitcoin as a maturing asset class finding its place in diversified portfolios. If instead institutional retreat persists or accelerates, it would challenge assumptions about Bitcoin's inevitability and mainstream adoption pace.

The cryptocurrency has survived numerous crises and bear markets through its 16-year history, repeatedly recovering to surpass prior peaks. Whether 2025's institutional demand weakness represents another cyclical challenge Bitcoin will overcome or a more structural setback remains to be determined. The answer will emerge through the daily flow data, on-chain metrics, and price action of coming months as the market digests the reality that scarcity, while necessary, requires sustained demand to translate into sustained value appreciation. The Bitcoin story continues, but its next chapter will be written by the institutional allocators whose enthusiasm has proven more variable than the fixed supply schedule they once found so compelling.