The moment arrived quietly but decisively in November 2025. Strategy's perpetual preferred share STRC hit $100.10 - an all-time high and a critical threshold that opened a $4.2 billion capital-raising channel for the world's largest corporate Bitcoin holder.

For Executive Chairman Michael Saylor, this milestone represented far more than a technical trading level. It was validation of an audacious corporate finance experiment that has redefined how companies can use Bitcoin not just as a treasury asset, but as the foundation for an entirely new capital-markets apparatus.

Strategy, the company formerly known as MicroStrategy, now holds 641,205 BTC valued at approximately $69 billion, accumulated at an average cost of $74,057 per coin. But the company is no longer simply buying Bitcoin - it is architecting a complex financial model built around perpetual preferred shares, at-the-market equity programs, and an expanding global investor base.

Whether that model scales sustainably, survives market turbulence, and influences the broader crypto ecosystem is now the central question facing Strategy, its investors, and the dozens of companies attempting to replicate its blueprint.

The Accumulation Phase: From Maverick Bet to Market Dominance

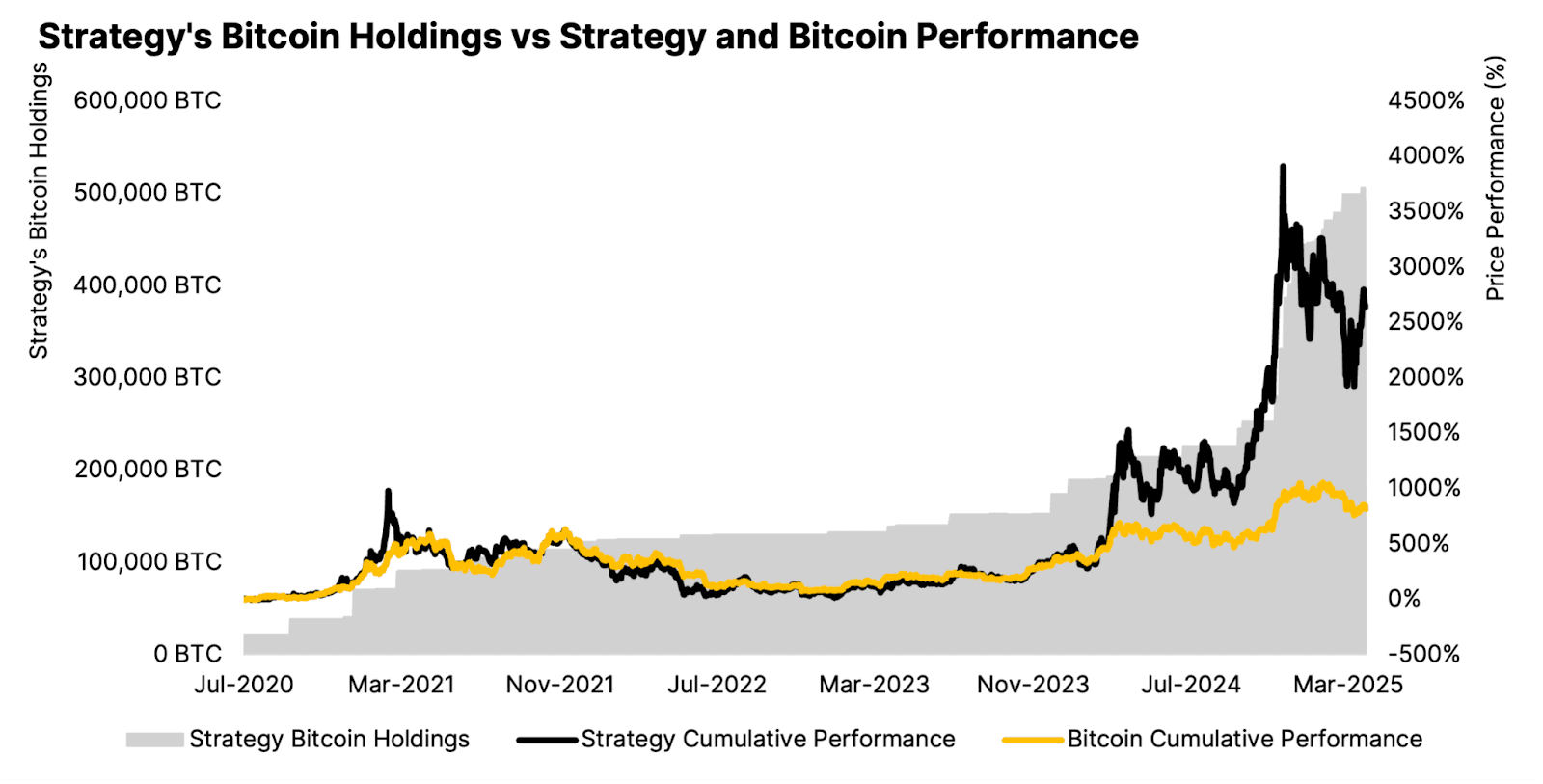

Strategy's journey into Bitcoin began in August 2020 with a $250 million purchase of 21,454 BTC at $11,652 per coin. At the time, Saylor positioned the move as a hedge against inflation and currency devaluation - unconventional for an enterprise software company, but prescient as Bitcoin began its dramatic ascent.

By Q3 2025, Strategy reported holding 640,808 BTC as of October 26, with a cost basis of $47.4 billion. The company's holdings now represent more than 3% of Bitcoin's total 21 million supply, cementing its position as not just the largest corporate holder but a significant force in Bitcoin market structure itself.

The accumulation has been relentless. Strategy achieved a 26.1% BTC Yield year-to-date in 2025, meaning it grew its Bitcoin-per-share ratio faster than it diluted shareholders through equity issuance. Recent purchases have slowed from the blistering pace of early 2025 - just 397 BTC for $45.6 million in late October/early November - but this reflects strategic pacing rather than retreat as the company positions for its next capital-raising phase.

The adoption of fair value accounting rules in January 2025 fundamentally changed Strategy's financial reporting. Previously classified as "indefinite-lived intangible assets," Bitcoin holdings could only be written down when prices fell, never marked up when they recovered. The new FASB rule (ASU 2023-08) allows companies to report Bitcoin at market value each quarter, recognizing both gains and losses. For Strategy, this generated $3.9 billion in operating income and $2.8 billion in net income for Q3 2025 - though it also exposed the company to a potential $17 billion Corporate Alternative Minimum Tax liability on unrealized gains starting in 2026.

Capital-Markets Engineering: The Preferred Share Apparatus

Strategy's true innovation lies not in Bitcoin accumulation itself, but in the sophisticated capital-raising machinery it has built around its holdings. The company has created a suite of perpetual preferred shares - STRK, STRF, STRD, and STRC - each designed to appeal to different investor profiles while funding continuous Bitcoin purchases.

The newest and most significant is STRC, or "Stretch," launched in July 2025 with a $2.5 billion IPO priced at $90 per share. Saylor described STRC as the company's "iPhone moment" - a transformational product that solves the accessibility problem of previous instruments. Unlike the more complex STRK (convertible with 8% dividend) or STRD (10% non-cumulative), STRC functions like a high-yield savings account: perpetual duration, variable-rate dividends currently at 10.5% annually, and engineered to trade near its $100 par value.

The mechanics are deliberately designed for stability. STRC is heavily over-collateralized with Bitcoin. If the security trades below par, Strategy can raise the dividend rate to boost demand; if it trades above, the rate can be lowered. This dynamic adjustment mechanism aims to keep STRC anchored at $100, providing the "peace of mind" that retail investors require while delivering consistent yield.

When STRC reached par on November 6, it unlocked Strategy's $4.2 billion at-the-market (ATM) program tied to the shares. This allows Strategy to issue new STRC stock gradually without conducting another large offering, converting investor capital into Bitcoin purchases on an ongoing basis. The company already operates similar ATM programs for its other preferred shares and common stock, together forming a multi-billion-dollar capital-raising infrastructure.

In total, Strategy has raised approximately $19.8 billion in capital year-to-date through 2025 across its various instruments. The preferred share offerings have raised about $5.6 billion, representing 12% of all U.S. IPO issuance in 2025. Performance varies: STRF has delivered a 31% lifetime return, STRK 19%, STRC 8%, while STRD has lagged at -6%.

The company's convertible debt stands at $8.2 billion with a weighted average maturity of 4.4 years. Combined with preferred equity valued at $6.7 billion as of October 2025, Strategy now has total annual interest and dividend obligations of $689 million. These fixed charges must be serviced regardless of Bitcoin's price, creating structural pressure to maintain access to capital markets.

Strategic Logic: The "Infinite Money Glitch" and Value Proposition

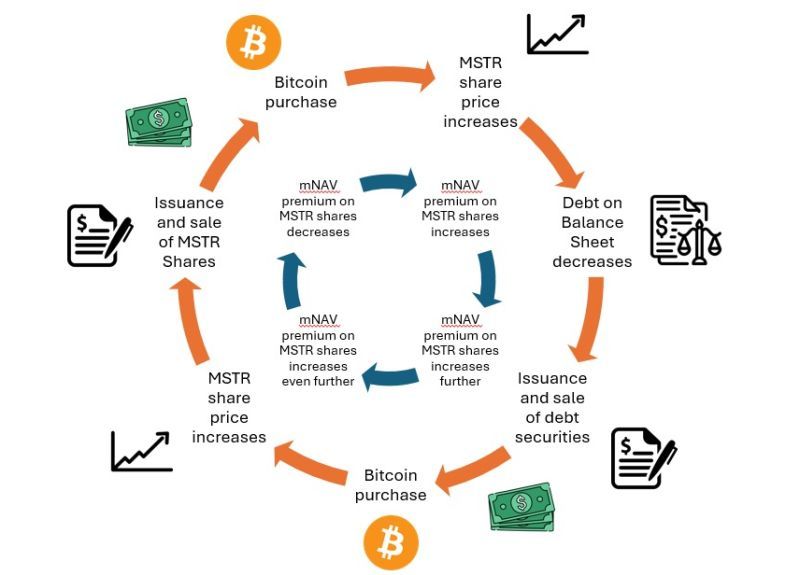

Saylor's thesis rests on a feedback loop: raise capital through equity and preferred shares, use proceeds to buy Bitcoin, and watch the company's valuation rise with Bitcoin's price - creating more capacity to raise capital at attractive terms. He has described the model as using Strategy's Bitcoin treasury as collateral to "monetize liquidity at retail scale."

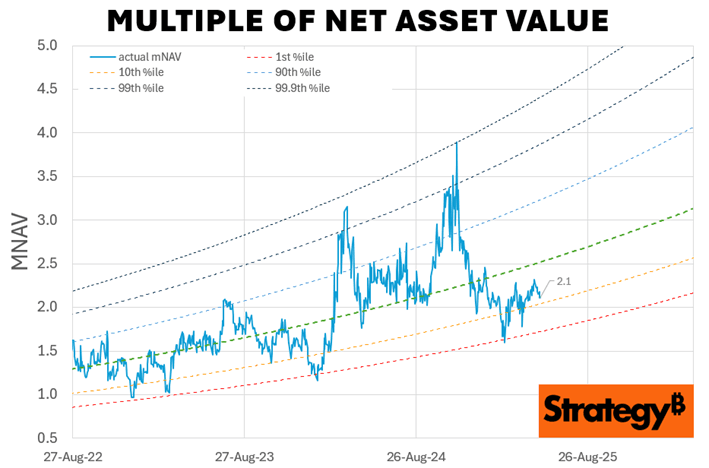

The value proposition for investors is leveraged exposure to Bitcoin without direct custody. Strategy's stock typically trades at a premium to its Bitcoin net asset value - historically ranging from 1.5x to 3.5x - reflecting the market's willingness to pay extra for the company's ability to continuously accumulate Bitcoin through capital-markets access unavailable to individual investors.

This premium, measured as multiple to net asset value (mNAV), serves as the company's "permission slip" to raise more capital. When mNAV is high, Strategy can issue shares at a significant premium to its Bitcoin holdings, acquiring more BTC per share issued and generating "BTC Yield" - the percentage increase in Bitcoin holdings per share. Strategy achieved 26% BTC yield year-to-date in 2025, demonstrating that despite dilution, shareholders gained more Bitcoin exposure per share held.

Critics question whether this constitutes genuine value creation or a sophisticated arbitrage that exploits retail investors' willingness to pay premiums. Legendary short-seller Jim Chanos has been particularly vocal, describing Strategy's model as "buying something for $1 and selling it for $2.50." Chanos simultaneously shorts MSTR stock while holding Bitcoin itself, betting the premium will vanish.

In a July 2025 debate, Chanos called Strategy's capital structure "financial gibberish," arguing the company offers nothing unique beyond Bitcoin ownership. He warned that more than 140 firms worldwide now pursue similar strategies, and compared the proliferation to the SPAC bubble of 2021 - when Wall Street's "printing press" overwhelmed market capacity, ultimately collapsing valuations.

Strategy defenders counter that the company's scale, first-mover advantage, and sophisticated capital-markets execution justify a premium. Strategy's size enables it to leverage more efficiently than competitors, and its preferred share apparatus provides diversified funding sources unavailable to smaller players. The company has received an S&P credit rating of B-, expanding its addressable investor base.

Inflection Points and the Next Phase: International Expansion

Beyond STRC reaching par, Strategy is pursuing international capital-market expansion. The company announced on November 4, 2025 the issuance of STRE - a euro-denominated 10% Series A Perpetual Stream Preferred Stock targeting European institutional investors.

STRE will be issued at €100 per share (approximately $115), with 3.5 million shares planned to raise roughly $370 million. The security offers 10% annual dividends paid quarterly, beginning December 31, 2025. STRE will list on Euro MTF Luxembourg and clear through Euroclear and Clearstream, providing European investors access to Bitcoin-linked securities in their native currency without direct crypto exposure.

The launch is significant as Strategy's first foreign-currency financing, signaling ambitions to tap global capital pools. Major banks including Barclays, Morgan Stanley, Moelis & Company serve as joint bookrunners, reflecting institutional backing for the expansion.

STRE's capital structure places it senior to STRK, STRD, and MSTR common stock but junior to STRF, STRC, and Strategy's debt. The liquidation preference adjusts daily to the greater of €100 stated value, prior day's market price, or 10-day average - linking value to trading performance. If Strategy fails to declare dividends, it must use "commercially reasonable efforts" over 60 days to sell other securities to raise funds for deferred dividends, which compound at progressively higher rates - initially 11%, increasing by 100 basis points each period up to 18% maximum.

The timing coincides with Strategy's expanded "42/42" capital plan, targeting $84 billion in equity and convertible note issuance through 2027 - doubled from the original $42 billion target after exhausting the first tranche. With substantial ATM capacity remaining across multiple securities, Strategy has positioned itself for continued Bitcoin accumulation if market conditions remain favorable.

Yet recent Bitcoin purchasing has decelerated markedly. Strategy acquired just 778 BTC in October 2025 - one of its smallest monthly totals in years - compared to 3,526 BTC in September. Q3 2025 saw roughly 43,000 BTC added, down sharply from 69,000 BTC in Q2 and over 80,000 BTC in Q1. This slowdown reflects compressed mNAV levels that make dilutive equity issuance less attractive, forcing Strategy to rely more heavily on preferred shares until mNAV recovers or STRC's ATM program scales up.

The mNAV Compression Challenge: Structural Risks Emerge

Strategy's model depends fundamentally on maintaining a premium valuation to its Bitcoin holdings. Yet that premium has deteriorated dramatically through 2025, creating what may be the company's most serious challenge.

From a peak of 3.5-3.89x in November 2024, Strategy's mNAV has collapsed to approximately 1.08-1.21x as of late October/early November 2025 - the lowest level in 19 months. At 1.21x, investors pay just a 21% premium for Strategy's Bitcoin stake, down from premiums exceeding 240% a year earlier. The enterprise value-based mNAV, which includes debt and preferred stock, has dropped to 1.31x from over 4.0x in 2024.

The compression is striking given Bitcoin's performance. While BTC gained 31% year-to-date through October 2025, MSTR shares rose only 13.3%. Buying Bitcoin directly would have significantly outperformed owning Strategy stock.

Multiple factors drive the compression. The proliferation of alternative Bitcoin exposure vehicles - particularly spot Bitcoin ETFs like BlackRock's IBIT with nearly $100 billion in assets - provides cheaper, more direct access without corporate overhead or dilution risk. Why pay a 240% premium for Strategy when you can buy Bitcoin through an ETF at a 0.20% annual fee?

Competition has intensified as more than 192 public companies now operate Bitcoin treasury strategies. Japan's Metaplanet, MARA Holdings, and dozens of smaller firms are replicating the model, eroding Strategy's differentiation. As Chanos predicted, the strategy is "nothing proprietary."

Insider selling has also rattled confidence. Strategy board member Carl Rickertsen sold his entire $10 million stake in 2025, and Michael Saylor himself has sold millions of dollars worth of MSTR shares. While such sales may serve personal financial planning, they signal potential concern about valuation sustainability.

Most controversially, Strategy reversed its capital-allocation policy in August 2025. Previously, management pledged not to issue common stock below 2.5x mNAV except for paying preferred dividends and debt interest. The new policy allows equity issuance between 1x and 2.5x mNAV when "otherwise deemed advantageous" - a vague standard that triggered a 7.8% stock plunge the day it was announced.

Critics warn of a potential "doom spiral": declining mNAV forces Strategy to issue more shares to maintain Bitcoin accumulation, which further dilutes shareholders and compresses mNAV, creating a vicious cycle. When mNAV falls below 1x, equity issuance becomes mathematically dilutive to Bitcoin-per-share - the exact opposite of Strategy's value proposition. At that point, the company might need to issue debt to repurchase shares or, in a worst case, sell Bitcoin to service obligations.

Strategy's fixed annual charges of $689 million for interest and dividends must be paid regardless of mNAV or Bitcoin prices. CEO Phong Le stated that if mNAV falls below 1x, the company could sell equity derivatives, Bitcoin derivatives, or "high basis Bitcoin" (coins acquired at high prices with large unrealized losses) to cover dividends while preserving tax advantages. This strategy works only if Bitcoin's price remains above Strategy's average cost basis and capital markets remain receptive.

Management announced in Q2 2025 it would lean more heavily on preferred share issuance when mNAV is compressed, reserving common stock issuance for periods when mNAV exceeds 2.5x. STRC hitting par in November theoretically enables this strategy, but success depends on sustained investor appetite for 10.5% yielding perpetual securities backed by volatile Bitcoin collateral.

Regulatory, Accounting, and Operational Risks

Beyond mNAV dynamics, Strategy faces several structural vulnerabilities. The Corporate Alternative Minimum Tax (CAMT) introduced in the 2022 Inflation Reduction Act imposes a 15% minimum tax on "adjusted financial statement income" - which now includes unrealized fair value gains under the new accounting rules. Strategy's $17 billion in unrealized Bitcoin gains could trigger a multi-billion-dollar tax liability starting in 2026 unless regulatory exemptions are granted.

The company's $128.7 million in annual software revenue - its original business - generated $350 million in gross profit over the past 12 months, a minuscule fraction of its $94 billion market capitalization. Strategy is essentially a pure Bitcoin proxy with nominal operating cash flow. Morningstar analyst Michael Miller noted that Strategy "doesn't actually have the earnings to cover dividend payments" on its preferred shares, relying instead on Bitcoin appreciation to generate cash for distributions through new capital raises or asset sales.

Legal questions persist about shareholder rights to Bitcoin holdings. Common shareholders may not have direct legal ownership of Strategy's Bitcoin in bankruptcy or restructuring scenarios, as the assets are held at the corporate entity level. Preferred shareholders have explicit liquidation preferences and claim priority, but the complex capital structure creates uncertainty about how Bitcoin would be distributed in distress.

Custody and operational risks also loom. Strategy holds Bitcoin across multiple institutional-grade custody platforms, but the concentration of 3% of Bitcoin's supply in a single corporate entity creates systemic vulnerability to regulatory action, security breaches, or management failures.

Broader Implications: The Bitcoin Treasury Ecosystem Evolves

Strategy's model has spawned an industry. Forty-eight new Bitcoin treasury companies emerged in just the final three months of 2025, accelerating a trend that began tentatively in 2020. Digital Asset Treasury Companies (DATCOs) collectively hold approximately $93 billion in Bitcoin, representing 3.98% of circulating supply.

The most prominent follower is Japan's Metaplanet, which now holds approximately 30,823 BTC valued at $3.5 billion, making it the fourth-largest corporate holder globally. Metaplanet targets 210,000 BTC by 2027 - representing 1% of Bitcoin's total supply - using zero-interest bonds, equity offerings, and innovative derivative strategies like covered call options to generate yield on holdings.

MARA Holdings holds 53,250 BTC, XXI Capital (Tether-backed Twenty One) has 43,514 BTC, and Bitcoin Standard Treasury Company (backed by Adam Back and Cantor Fitzgerald) holds 30,021 BTC. Companies across insurance, healthcare, automotive, and energy sectors have announced Bitcoin allocations, with Treasury adoption expanding beyond crypto-native firms to mainstream corporations.

The supply-demand implications are profound. Businesses are acquiring approximately 1,755 BTC per day on average in 2025 - nearly double the roughly 900 BTC mined daily. Institutional investors now control 18% of Bitcoin's total supply, up from negligible levels in 2021. Combined with spot Bitcoin ETFs holding 6% of supply and long-term holders increasing stakes, the available circulating supply is effectively shrinking.

This creates what analysts describe as a structural price floor. Corporate treasuries typically buy over-the-counter to avoid market impact, accumulating quietly during both bull and bear markets. Unlike retail investors prone to panic selling, institutions with long-term mandates provide consistent demand regardless of short-term volatility. This reduces available supply and potentially stabilizes prices at higher levels.

The model is also transforming Bitcoin from purely a speculative asset into institutional-grade collateral. Strategy's preferred shares are effectively Bitcoin-backed securities offering fixed yields - not unlike mortgage-backed securities or other structured products. As these instruments proliferate, Bitcoin becomes embedded in traditional capital markets, accessible to pension funds, insurance companies, and other yield-seeking investors who cannot or will not hold crypto directly.

Yet risks accompany this institutionalization. Chanos warns that rapid issuance by dozens of Bitcoin treasury companies mirrors the SPAC bubble - when Wall Street's "printing press" created more supply of investment vehicles than market demand could absorb, ultimately collapsing valuations. If too many companies compete for capital with similar Bitcoin-backed securities, premiums across the sector could vanish, undermining the fundamental economics.

Concentration risk also escalates. Strategy alone holds more than 3% of Bitcoin's supply, creating systemic exposure to a single corporate entity's management decisions, capital structure, and regulatory standing. If Strategy ever faced forced liquidation - whether due to bankruptcy, regulatory action, or covenant violations - the impact on Bitcoin markets could be severe.

The proliferation of copycat models raises questions about differentiation and sustainability. Many smaller Bitcoin treasury companies lack Strategy's scale, capital-markets sophistication, or first-mover brand recognition. Dozens trade at or below 1x mNAV, unable to command premiums that justify dilutive equity issuance. These firms may struggle to raise capital efficiently, potentially forcing Bitcoin sales to service obligations during market downturns.

What Comes Next: Signals to Monitor

Strategy's playbook faces its most critical test. The company must prove that its capital-markets apparatus can scale sustainably even as its valuation premium compresses, competition intensifies, and Bitcoin's price trajectory becomes uncertain.

Several indicators will determine whether the model succeeds:

ATM Program Utilization: Whether Strategy can effectively deploy its $4.2 billion STRC ATM capacity and multi-billion-dollar capacity across other securities depends on investor appetite for high-yield preferred shares. If STRC trades consistently at or above par, Strategy gains a scalable funding source. If it falls below par despite dividend increases, the mechanism breaks.

BTC Purchasing Pace: Strategy's accumulation rate directly signals capital availability and strategic confidence. Monthly acquisition volumes below 1,000 BTC suggest capital constraints; sustained purchases above 10,000 BTC monthly indicate successful funding. International STRE issuance success will be particularly telling - if European investors embrace euro-denominated Bitcoin exposure, it validates global expansion; if demand disappoints, it suggests market saturation.

mNAV Movement: The premium must recover toward 2x for common stock issuance to resume at scale without diluting Bitcoin-per-share. Continued compression toward or below 1x would force reliance entirely on preferred shares and debt, constraining growth. A sustained move back above 2.5x mNAV would signal restored investor confidence and reopen aggressive equity-funded accumulation.

Preferred Trading and Yield Spreads: STRC, STRF, STRK, and STRD must maintain stable trading and reasonable yield spreads to comparable fixed-income securities. If preferred shares become distressed - trading well below par with widening yield spreads - it suggests loss of confidence in Strategy's ability to service distributions and maintain Bitcoin collateral value.

Regulatory and Accounting Developments: Resolution of the CAMT tax issue is critical. If Strategy faces multi-billion-dollar tax bills on unrealized gains, it could force Bitcoin sales or debt restructuring. Conversely, regulatory exemptions for unrealized crypto gains would remove a major overhang. Fair value accounting's impact on volatility and investor perception will also shape capital access.

Copycat Company Performance: The success or failure of Metaplanet, MARA, and dozens of smaller Bitcoin treasury firms will demonstrate whether the model is scalable or whether only Strategy's unique position allows it to work. If competitors succeed at 1.5x-2x mNAV premiums, it validates the category; if most trade below 1x and struggle to raise capital, it suggests the market can support only a few dominant players.

Bitcoin Price Trajectory: Ultimately, the model's sustainability depends on Bitcoin appreciation. If Bitcoin reaches $150,000-200,000 as Strategy's 2025 guidance assumes, unrealized gains make preferred dividends easily serviceable and mNAV likely expands. If Bitcoin enters a prolonged bear market below $80,000, Strategy's average cost basis, the company faces difficult decisions about dividend cuts, asset sales, or covenant renegotiation.

Final thoughts

Michael Saylor's Strategy has accomplished something remarkable: transforming a mid-tier software company into a Bitcoin financial institution with nearly $70 billion in crypto assets and pioneering capital-markets innovations that are reshaping how companies can leverage digital assets. The perpetual preferred share apparatus - particularly STRC's par-seeking mechanism - represents genuine financial engineering that solves real problems around retail accessibility and yield generation.

Yet the model's sustainability remains unproven at current valuations. The dramatic mNAV compression from 3.5x to barely above 1x reveals that Strategy's premium to Bitcoin holdings is fragile, dependent on market sentiment, competitive differentiation, and continued Bitcoin price appreciation. The policy reversal allowing equity issuance below 2.5x mNAV, combined with insider selling and proliferating competition, raises questions about whether management believes the premium is permanently impaired.

Critics like Jim Chanos may ultimately be proven correct that Bitcoin treasury companies represent a speculative bubble analogous to SPACs - destined to see premiums compress to zero as the market recognizes these are merely holding vehicles, not value-creating businesses. The fact that buying Bitcoin directly has outperformed Strategy stock in 2025 lends credence to this view.

Alternatively, Strategy may successfully scale its preferred share apparatus globally, building a permanent capital-markets franchise that justifies modest premiums through superior execution, liquidity provision, and financial product innovation. If STRC and STRE gain traction as legitimate fixed-income alternatives offering 10% yields backed by Bitcoin collateral, Strategy could evolve into something akin to a Bitcoin-backed investment bank or asset manager.

The resolution will likely take years to unfold. What is clear now is that Strategy is no longer simply accumulating Bitcoin - it has architected an entirely new model for how corporations can structure balance sheets around crypto assets, access capital markets to fund acquisition, and create tradeable securities that bridge traditional finance and digital assets.

Whether that model represents the future of corporate treasury management or an unsustainable arbitrage destined to unwind is the defining question not just for Strategy, but for the more than 190 companies attempting to follow its path and the broader crypto ecosystem watching closely to see if institutional adoption can truly scale beyond speculation.