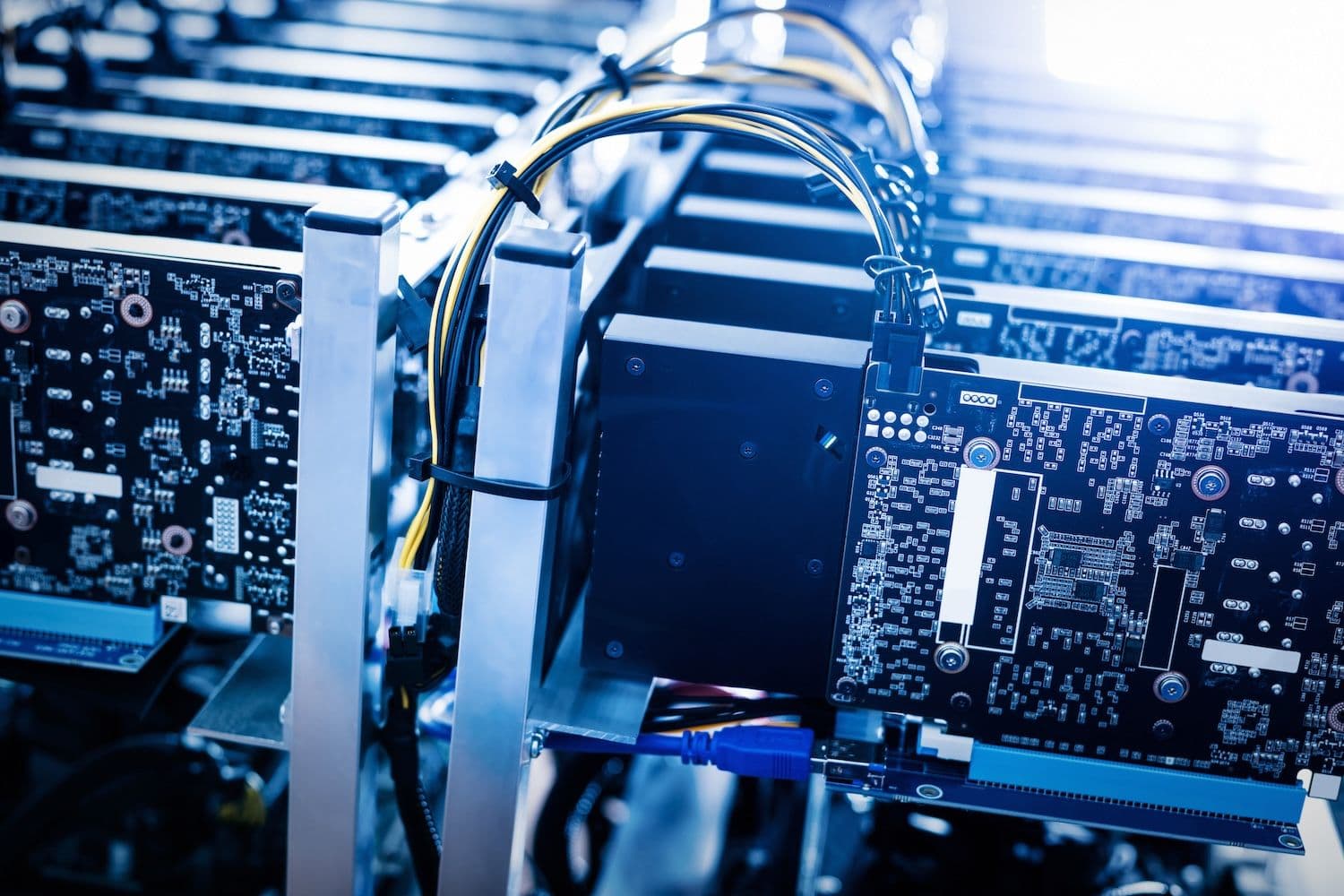

Multiple Bitcoin mining models face shutdown thresholds at industrial electricity rates as Bitcoin trades near $75,000.

Antpool data shows Antminer S21 series requires $69,000-$74,000 per bitcoin to remain profitable at $0.08/kWh power costs.

Older hardware including Antminer S19 XP+ Hydro and WhatsMiner M60S operate at or below breakeven with current pricing.

What Happened

At $0.08 per kilowatt-hour electricity costs, several mid-generation models approach unprofitable territory, according to mining pool calculations.

The Antminer S21 series faces shutdown prices between $69,000-$74,000 per bitcoin, placing operations under pressure as prices hover near that range.

Legacy models including Antminer S19 XP+ Hydro, WhatsMiner M60S, and Avalon A1466I operate near or below shutdown thresholds at current rates.

High-efficiency hydro-cooled units including U3S23H and S23 Hydro maintain profitability above $44,000 per bitcoin, creating widening gaps between hardware generations.

Bitcoin's 12% weekly decline to $74,876 triggered over $520 million in forced liquidations across mining derivatives.

Read also: Russia's BitRiver Bitcoin Miner Enters Bankruptcy As CEO Arrested For Tax Evasion

Why It Matters

Industrial power rates around $0.07-$0.08/kWh represent baseline costs for professional mining operations in North America.

The narrow profit margins force operators to upgrade hardware or face negative daily returns as mining difficulty remains elevated.

Hardware prices crashed 90%+ from 2021 peaks as miners liquidate unprofitable equipment, with S19 units selling for $3-$4 per terahash.

Only operations with sub-$0.05/kWh electricity rates or newest-generation hydro equipment maintain healthy margins under current conditions.

Read next: 74-Year-Old Tortured After Kidnappers Wrongly Believed His Son Held €3M In Crypto