Seattle-based VivoKey Technologies is pushing the envelope in cryptocurrency storage. The company offers subdermal crypto wallets for secure transactions. These wallets use NFC and RFID technology.

VivoKey's solution is a form of biohacking. It's a field that includes life extension experiments and brain-computer interfaces. Many biohackers use subdermal computer chip implants.

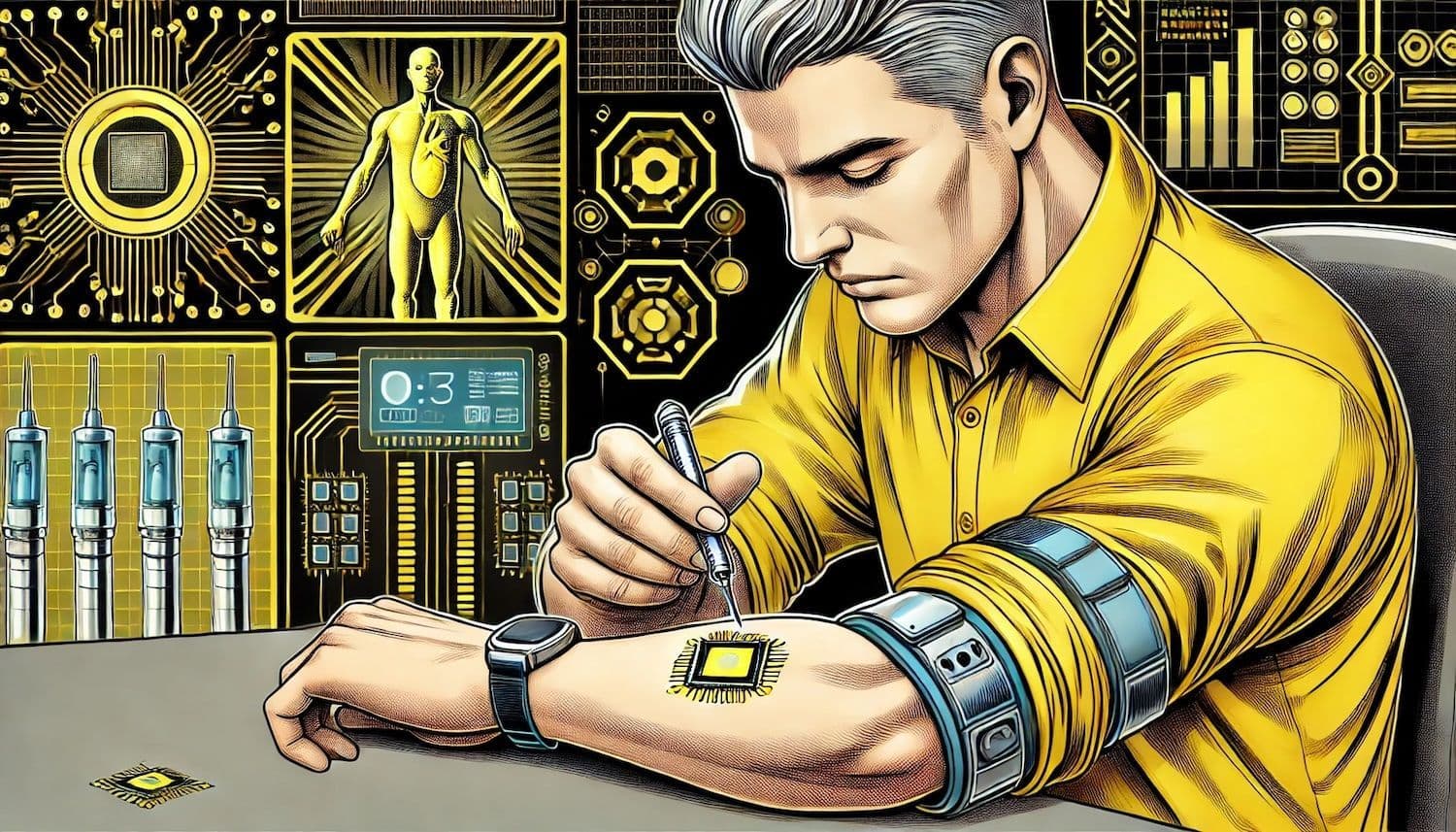

The company's Apex wallet is the size of a pill. It secures data under the skin. "These wallets are hardware wallets meant to be used for sending cryptocurrency," says Amal Graafstra, founder and CEO of VivoKey Technologies and Dangerous Things.

Graafstra explained the wallet's function to Decrypt. "Your phone app is your interface, but it doesn't have any private keys. The private key and the actual signing of the Bitcoin transaction, or the crypto transaction, is done in the chip."

The Apex chip has multiple uses. It can store Bitcoin, open doors, or pay for coffee. "We have a couple of different Bitcoin and crypto wallets right now that are supported," Graafstra said. These include Satochip, Seedkeeper, and Status IM key card wallets.

VivoKey and Dangerous Things launched in 2017 and 2013, respectively. They specialize in NFC and RFID technology for human implantation. The Satochip is a BIP32/39 wallet applet. It allows safe cryptocurrency storage and secure blockchain transactions.

The implantation process is quick. "The Apex currently comes in a 'Flex' form factor, which is a much wider device, but very thin," Graafstra explained. A needle is used to insert the device under the skin.

Graafstra's journey into biohacking began in 2005. He was inspired by RFID chips used for pets. He got his first implant to open a door without a key. "The initial impetus for getting an implant in the first place was pure laziness," he admitted.

Manufacturing challenges exist. "The probably the biggest challenge is low volume manufacturing in a very high volume industry," Graafstra said. VivoKey produces batches of 2,000 to 5,000 transponders. This contrasts with millions for cards or 10,000 for animal transponders.

Customers aren't put off by the price. Graafstra noted, "At the end of the day, people expect it to be expensive because it's a device that goes in your body." The implant's lifetime value justifies the cost for many users.

Notable futurists have embraced the technology. Entrepreneur Briar Prestidge documented her chip implantation for an upcoming film. However, some people remain skeptical.

Graafstra addressed common concerns. "The first thing they're doing is they're saying, 'I can't see a use case for me, therefore, I need to come up with a reason not to get one.'" He emphasized that the chip is not a tracker.

The CEO highlighted the wallet's benefits. "The reality is you're owning a very secure, effective hardware wallet that you never lose, you can't forget, right under your skin." He also noted that the implant is removable and replaceable.

VivoKey's subdermal wallets represent a bold step in cryptocurrency security. As digital assets evolve, such innovative storage solutions may become more commonplace. The intersection of biohacking and finance continues to push boundaries in unexpected ways.