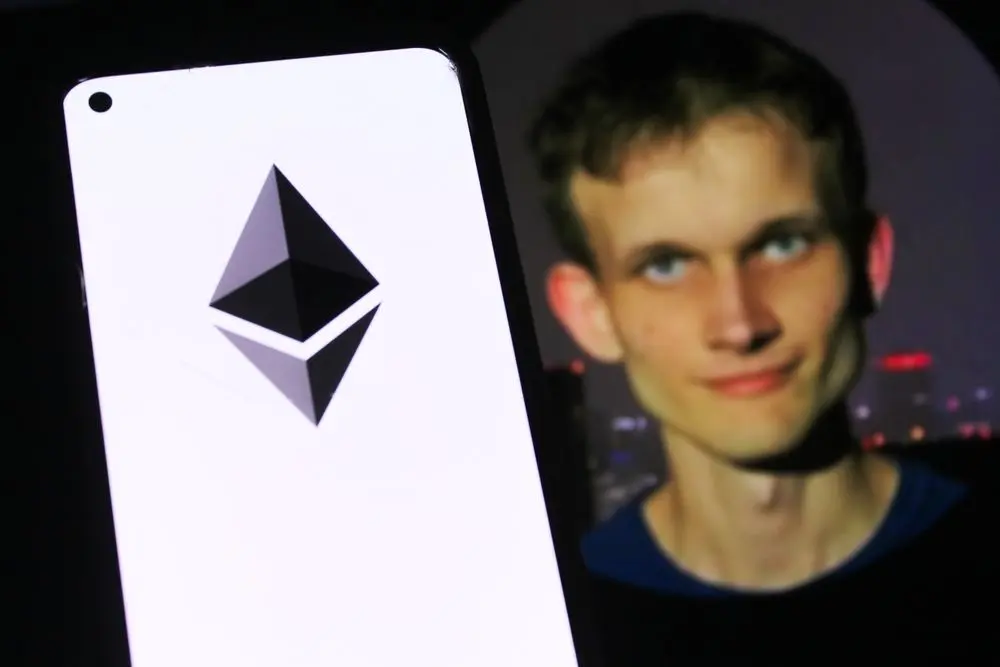

Ethereum co-founder Vitalik Buterin outlined a vision for the network's future that combines global scalability with institutional trust.

What Happened: Decentralization Framework

In a Jan. 7 post on X, Buterin compared Ethereum to BitTorrent and Linux to illustrate how the blockchain can maintain decentralization while serving enterprise users and governments.

Buterin pointed to BitTorrent as proof that decentralized networks can operate at massive scale without compromising their core structure. He wrote that Ethereum's goal is to achieve similar scale "but with consensus."

The comparison extended to real-world adoption.

"BitTorrent is depended on by enterprises too: many businesses and even governments (!!) use it to distribute large files to their users," Buterin said.

He argued this demonstrates that decentralization supports rather than blocks practical implementation, allowing Ethereum's Layer 1 to remain accessible without intermediaries as usage expands.

Also Read: Solana Spot ETFs Break Record With $220M Trading Volume Jump

Why It Matters: Infrastructure Model

Buterin's Linux comparison addresses how Ethereum can serve different user needs without fragmenting its foundation. Linux remains open-source and value-consistent while powering systems used by billions, with companies and governments relying on it daily.

He noted that Linux offers multiple versions, from mass-market distributions to minimal builds like Arch Linux that prioritize user control over convenience.

Ethereum can follow this pattern, keeping its base layer robust while allowing specialized systems to handle ease-of-use or specific requirements.

Buterin said Layer 1 should serve as infrastructure for finance, identity, social applications and governance, giving users direct network access without dependence on single entities.

He added that businesses view what crypto calls "trustless" as reducing counterparty risk—systems they can rely on without sudden failure or outside control.

Read Next: Bitcoin Slides Following MSCI U-Turn On Digital Asset Treasury Company Inclusion