The crypto Fear & Greed Index has plunged to 11, marking one of the most pessimistic readings of the past year as total market capitalization shed roughly $530 billion in seven days.

What Happened: Sentiment Collapses

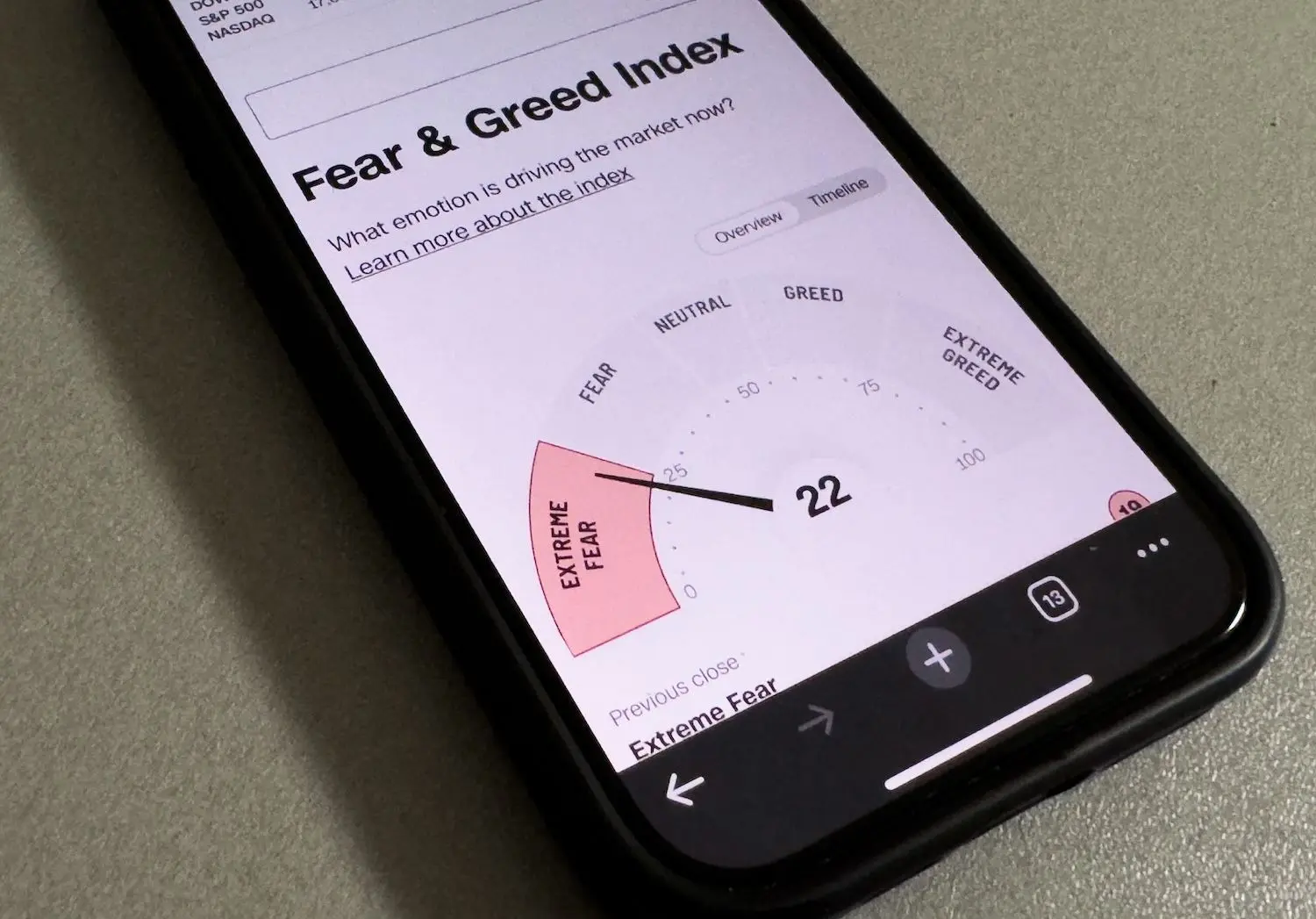

The CMC Fear & Greed Index, which compresses overall crypto sentiment into a 0 to 100 score, registered 11 on Thursday with a label of "Extreme fear." The reading sat at 14 a day earlier.

One week ago, the index showed 38, classified as "Fear." A month ago it stood at 42, placing it in neutral territory.

The rapid deterioration coincided with substantial losses across the market. Total crypto market capitalization fell approximately 18.08 percent over seven days, dropping from $2.97 trillion to $2.44 trillion.

Bitcoin (BTC) dominance remained roughly flat at 58.69 percent, indicating both Bitcoin and altcoins absorbed the selling pressure rather than experiencing a rotation into one segment.

Over the past twelve months, the index peaked at 76 and hit a low of 10. The current reading sits just one point above that floor.

Also Read: Analysts Eye $730 As BNB's Last Stand Before Mid-$600s

Why It Matters: Capitulation Signal

Traders often interpret extreme fear readings as contrarian indicators. Low sentiment can suggest crowds are capitulating and longer-term return potential may be improving.

However, such conditions also tend to coincide with stressed liquidity, elevated liquidations, and wider spreads. These factors can amplify further downside if another shock arrives.

Key metrics to monitor now include whether total market cap stabilizes, whether Bitcoin dominance rises as a defensive refuge, and whether daily volatility cools. An index at 11 can mark either late capitulation or the middle of a deleveraging phase, making stabilization signals more useful than attempts to identify an exact bottom.

Read Next: Can U.S. Government Bail Out Falling Bitcoin? Bessent Says No