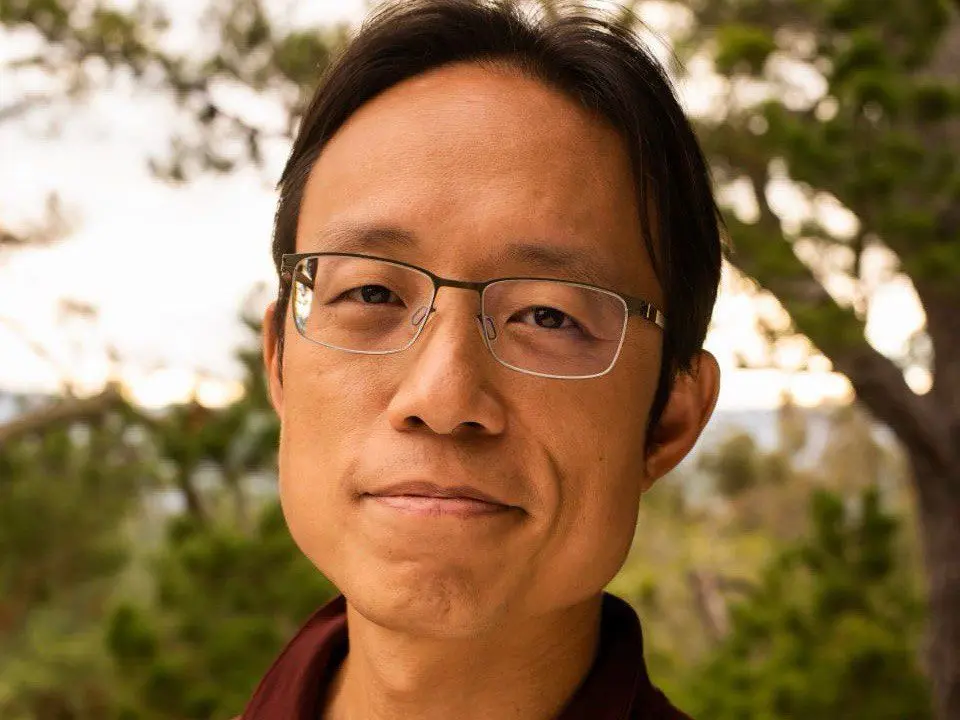

Animoca Brands co-founder Yat Siu on Wednesday said the crypto industry is unlikely to “win” the stablecoin battle against traditional banks, arguing that the biggest fight will be shaped by bank distribution power and the political compromises that come with legislation.

“I don’t think he’s going to get it,” Siu told Yellow.com in an interview, referring to Coinbase founder Brian Armstrong's push to move the industry forward in the U.S. “Because I think he’s realizing that Coinbase is big, but the banks are bigger.”

Siu added that stablecoin rules will likely land short of the open, yield-bearing model many in crypto have advocated for, with policymakers and incumbents forcing concessions as the market matures.

Stablecoins Vs banks: 'The banks Are Bigger'

Siu framed the stablecoin debate as a contest between crypto-native platforms and legacy financial institutions that already control payment distribution.

Asked about the likely end state, Siu said he expects the industry to concede on key features that crypto proponents have treated as central to stablecoin adoption and competitiveness.

Compromise On Yield And Limits Around DeFi

Siu said the regulatory endgame will involve trade-offs that dilute some of crypto’s expectations for stablecoins, particularly on yield.

“I think the end result will be that they’re going to have to give in on yield,” he said. “I think there’s going a lot of things that they’re going have to give in on.”

He also pointed to friction between DeFi’s open design and what lawmakers are willing to permit at scale.

“There are certain restrictions of DeFi and stuff around that that I think won’t fit all the bills and what people are looking for,” he said.

Siu argued that compromise is inherent once policy is codified.

“When you put something in legislation and law, you have to compromise. Both sides,” he said.

Also Read: Why Leading Crypto Wallets Are Building For Inflation And Payments Instead Of Speculation

Why Stablecoins Matter

Even as he cast doubt on crypto outperforming banks in the stablecoin arena, Siu described stablecoins as a direct challenge to fee-heavy payment rails built around bank and card-network distribution.

He argued that modern cashless payments can carry merchant fees of “2 to 3% per transaction,” which he characterized as an embedded cost of convenience and distribution control.

“A stablecoin completely disintermediate sell,” he said, arguing that merchants would not need to pay those fees in a stablecoin-native payment flow and could settle immediately, retain liquidity, and build new financial services around programmable money.

He said stablecoins also lower barriers for builders. “If I’m using stable coins, I can just build it. I don’t even talk to any company for permission,” he said, contrasting that with the permissions required in traditional payments.

Tokenization And Agents As The Next Adoption Layer

Siu tied the stablecoin conversation to a broader thesis about tokenization and the growth of AI agents interacting with digital assets.

“My message on tokenize or die is that if you’re a company or business or individual and you’re not thinking, doing or tokenizing, you’re going to become irrelevant against your competitor who does,” he said.

He also predicted agents will become a major driver of on-chain activity.

“The majority of on-chain activity will be run through agents, no doubt,” he said, arguing that consumer adoption will be led by AI assistants executing tasks on a user’s behalf rather than users directly operating wallets and interfaces.

Read Next: Bitcoin's Strangest Bear Market Ever, With No Capitulation & Just Capital Waiting In The Shadows