The crypto market has been buzzing with activity, with Pi Network (PI) soaring 400% before retracing, KAITO rallying over 40%, and HBAR gaining traction with institutional interest. While Bitcoin has been relatively stable, altcoins in AI, tokenized assets, and health data monetization are showing strong momentum.

AI-related projects like MyShell (SHELL) and Kaito (KAITO) are drawing investor interest, while traditional finance is embracing blockchain, as seen with HBAR’s ETF push. The question now is whether these trends are sustainable or if the hype will fade as quickly as it came.

Pi Network (PI)

Price Change (7D): +42.14% Current Price: $1.89

News

Pi Network’s price surged this week, reaching a peak of $3, marking a 400% increase from last week’s low of $0.60. The rise in price has boosted the network’s self-reported market capitalization to over $16.3 billion, placing it among the best-performing cryptos of the week. The surge is fueled by increased trading volume on OKX, HTX, Bitget, MEXC, and Gate.io, with speculation that Binance could soon list Pi following a community poll. Additionally, Pi Network has extended its KYC verification cdeadline to March 14, 2025, urging users to verify their accounts to transition to the mainnet.

Forecast

PI has shown strong price action over the past week, surging to a high of $3 before retracing. Technical analysis suggests a bearish short-term outlook after breaking below the 10-day moving average. The price may test the $1.70 support level before attempting a fresh rally. If it reclaims the 10D MA, PI could see renewed momentum toward $2.50. RSI is neutral, indicating no immediate overbought or oversold conditions.

Vana (VANA)

Price Change (7D): +38.59% Current Price: $8.74

News

Vyvo Smart Chain has announced a strategic integration with Vana, allowing users to monetize their anonymized health data through blockchain-secured transactions. The initiative aims to reward users fairly while ensuring transparency and privacy, with earnings based on the Health Index system, which evaluates wellness factors.

Forecast

VANA has maintained a strong uptrend, consolidating above $8. A breakout past $9.50 could propel it toward $12. The RSI is currently near 65, indicating bullish momentum but not yet in overbought territory. Support lies at $7.50, and a drop below this level could trigger a correction to $6.80.

KAITO (KAITO)

Price Change (7D): +31.95% Current Price: $2.14

News

KAITO has seen a major boost following its airdrop claims on the Base network ahead of exchange listings. Coinbase International Exchange has announced perpetual futures support for KAITO, further increasing demand. Whale activity has also contributed to its price surge, with a major investor accumulating $1.39 million worth of KAITO tokens.

Forecast

KAITO has broken past resistance at $2.10, signaling bullish momentum. The Aroon Up indicator at 100% and RSI at 82 suggest continued strength. If the uptrend holds, KAITO could hit $3 in the near term, with a potential long-term target of $5. However, a pullback to $2.36 is possible if momentum slows.

Story (IP)

Price Change (7D): +7.56% Current Price: $5.40

News

Story Protocol (IP Coin) has seen a strong rally, reaching $7 before retracing. The token's recent listing on major exchanges like OKX and Coinbase has driven investor interest. Additionally, the platform’s partnership with StabilityAI and the tokenization of BTS and Steve Aoki’s music rights have bolstered demand.

Forecast

IP is facing selling pressure after hitting $7. The MACD has turned bearish, and social dominance has dropped, suggesting a potential decline to $5. If bulls regain control, the next resistance is at $7.05. A breakout could send IP toward $9, while failure to hold $5 could trigger a drop to $4.20.

MyShell (SHELL)

Price Change (7D): +7.61% Current Price: $0.5077

News

MyShell has been added to Bithumb's KRW market, expanding its accessibility in South Korea. The listing comes with an airdrop event to incentivize trading. MyShell is a decentralized AI consumer layer that connects users, creators, and researchers, with its native SHELL token facilitating payments and access to premium features.

Forecast

SHELL is holding above $0.50, but resistance at $0.65 remains strong. If buyers push through, the next target is $0.75. The RSI is neutral, suggesting room for further movement. A drop below $0.45 could see a retest of $0.38 support.

Hedera (HBAR)

Price Change (7D): +7.11% Current Price: $0.2342

News

Nasdaq has officially filed for a Spot Hedera ETF, marking a key milestone for institutional adoption. The 19b-4 filing triggers a 240-day review period by the SEC, with analysts seeing increased odds of approval. Meanwhile, the Federal Reserve has acknowledged BFT consensus mechanisms, validating Hedera, XRP, and XLM as leading candidates for secure digital payments.

Forecast

HBAR is holding above $0.22 but faces resistance at $0.25. If it clears this level, a push to $0.30 is likely. RSI is at 55, showing steady bullish momentum. A dip to $0.21 would still be a healthy retracement.

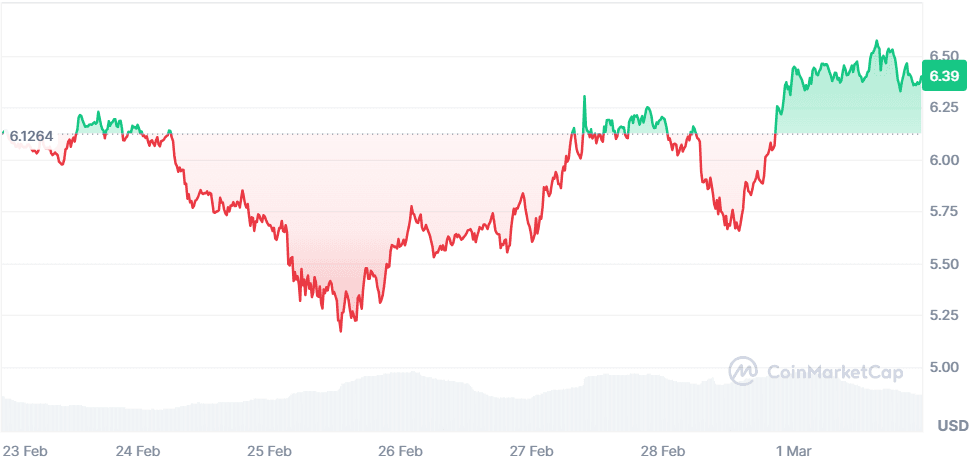

Aptos (APT)

Price Change (7D): +4.54% Current Price: $6.40

News

Bitwise has officially filed for an Aptos ETF in Delaware, signaling growing institutional adoption. Aptos' TVL has surged to $977M, driven by Aave V3’s integration. Meanwhile, its European staking ETPs are gaining traction, reinforcing its position as a top blockchain contender.

Forecast

APT is trading above a key inversion point at $6.25. If bullish sentiment continues, Aptos could test $7.00 and push toward $10. However, if $6.25 support fails, a decline to $5.87 is likely.

Closing Thoughts

The past week has highlighted key sectors driving the crypto market. AI-focused tokens, including KAITO and SHELL, have seen significant trading volume spikes, largely fueled by Nvidia’s earnings and growing demand for AI-integrated blockchain solutions. Meanwhile, the push for ETFs and institutional adoption has led to renewed interest in HBAR and APT, both of which saw regulatory developments that could pave the way for wider adoption.

Community-driven projects like Pi Network remain volatile, with speculation and exchange listings dictating short-term price movements. At the same time, Vana’s health data monetization model is tapping into a new category of blockchain adoption, drawing early excitement.

AI remains the most active sector, dominating both hype and investor participation, while ETFs and tokenized assets are steadily gaining ground as institutions position themselves for long-term exposure. With so much movement across different sectors, next week could see even more breakouts—or corrections—as the market continues to shift.