Bitcoin spent the week dozing in a tight range, yet liquidity didn’t stay parked on the sidelines, it spilled into smaller caps with very different stories to tell. Interoperability plays (W) and new-tech Layer-1s (SEI, APT) sprinted ahead on fresh partnerships and ETF chatter, while a modular Layer-2 (MOVE) ripped higher on an aggressive buy-back.

Even the meme corner (BANANAS31, JANITOR) flexed, buoyed by social-media virality, and an AI-for-data micro-cap (TAG) rode new exchange listings. Not everything rallied: delisting overhang kept DeFi veterans (BSW, ALPHA) under pressure and reminded traders that headlines cut both ways. The result was a patchwork tape that feels like the opening act of an altcoin revival, provided the narratives stay funded.

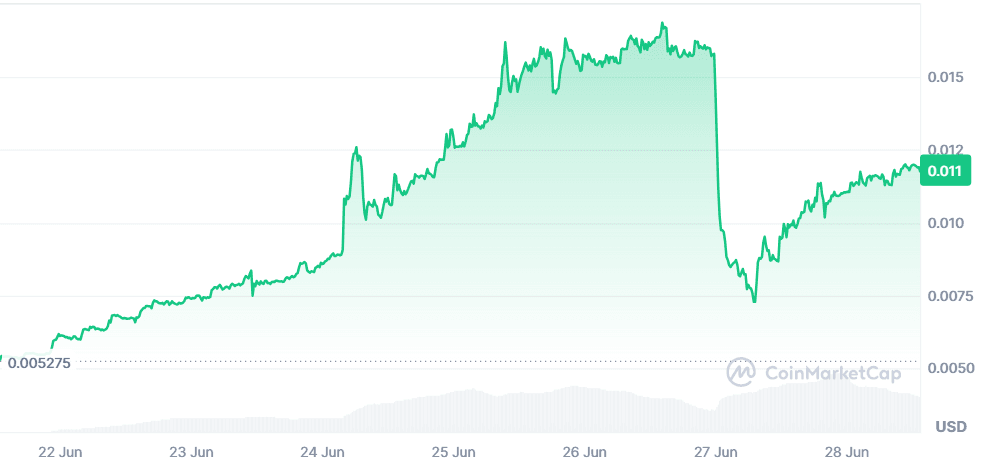

BANANA FOR SCALE (BANANAS31)

Price Change (7D): +118.22 % Current Price: $0.01176

News

BANANAS31 became the week’s breakout memecoin as coordinated X/TikTok campaigns, influencer shout-outs and a GameFi–style NFT-staking teaser propelled volume above $170 M and pushed the market cap past $117 M. Early-stage CEX listings rumours are swirling, while the team hinted at a “banana-run” play-to-earn mini-game in July, helping traders frame the token as more than a fleeting joke.

Forecast (60-90 w):

The parabolic spike to $0.015 was met by a swift 40 % flush, signalling profit-taking; RSI sits near 74 (overbought). Price is now coiling between the 0.382 and 0.5 Fibonacci levels ($0.0092–$0.0118). Holding above the 20-EMA at $0.009 should invite a retest of $0.0138, with a measured-move objective at $0.018. Failure to defend $0.009 opens a slide toward the breakout base at $0.006, where RSI would likely reset below 50.

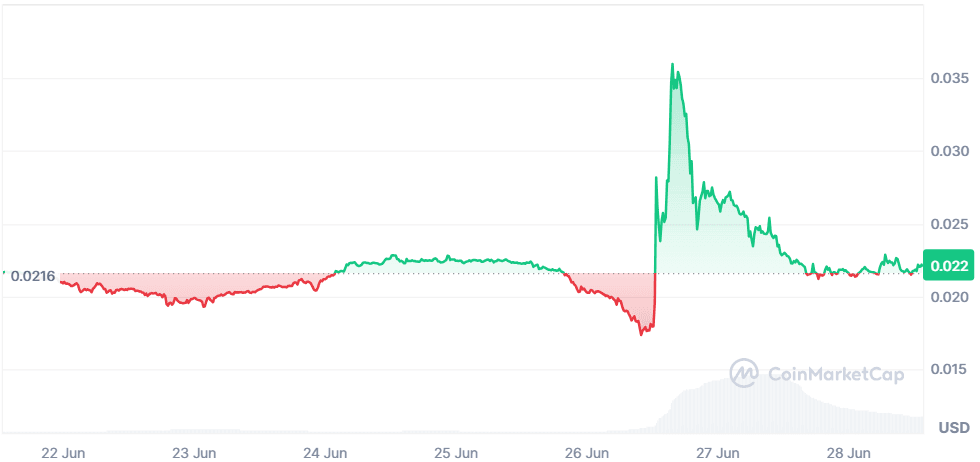

BISWAP (BSW)

Price Change (7D): +1.89 % Current Price: $0.02211

News

Binance will delist BSW on 4 July, citing liquidity and compliance concerns. Although Biswap released an updated roadmap hours after the notice, the token’s 118% knee-jerk bounce evaporated as traders braced for a 70% liquidity hit once the dominant venue closes.

Forecast (60-90 w)

With 14-day RSI at 44 and slipping, BSW is stuck beneath the 23.6 % Fib of its June spike ($0.0323). Expect grind-down pressure into the $0.0167 support (June 26 low) as market-making depth migrates. A brief oversold rally toward $0.026 could materialise if RSI prints sub-30, but structural upside is capped while Binance exit flows persist. A decisive daily close below $0.016 risks capitulation to $0.010.

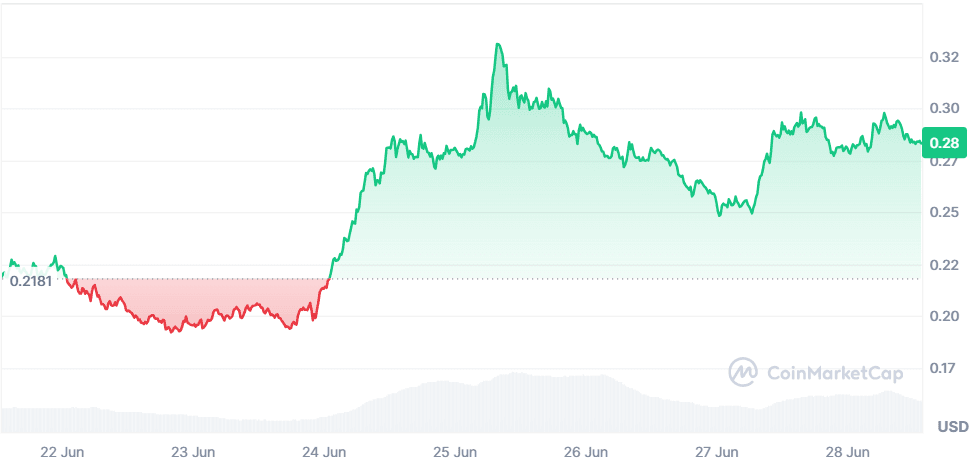

SEI (SEI)

Price Change (7D): +29.7 % Current Price: $0.2831

News

Sei notched record TVL ($570 M) after Wyoming’s stablecoin commission shortlisted the chain for its WYST pilot, dovetailing with an upcoming v2 airdrop snapshot and a 9% validator APY bump. Daily DEX volume crossed $60M as traders chased the narrative of “fast-finality rails for AI gaming.”

Forecast (60-90 w)

RSI around 67 shows healthy momentum but not peak exuberance. The pair reclaimed the March breakdown level at $0.27, turning it into support. As long as price holds above the rising 10-EMA ($0.265), bulls can eye $0.34 (January pivot) and the 0.618 Fib extension at $0.38. A funding spike above +0.05 % or a daily close under $0.25 would warn of leverage-fuelled froth and invite a pullback to $0.22.

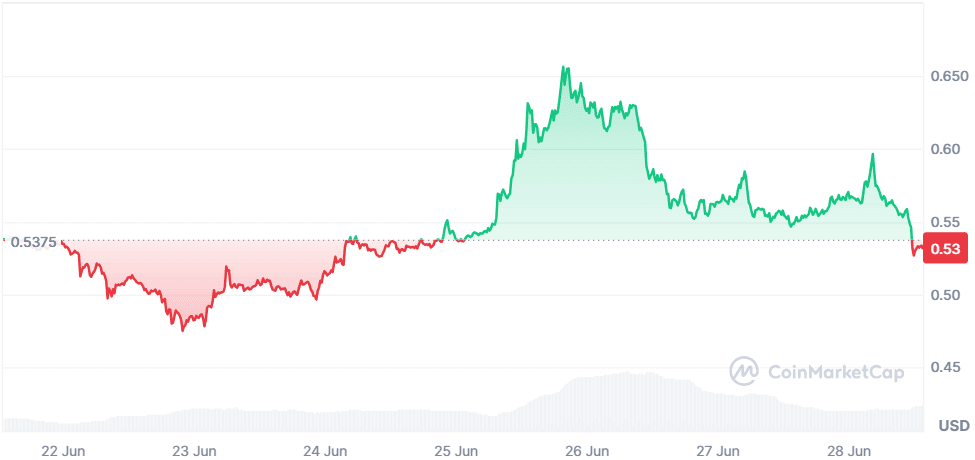

PI NETWORK (PI)

Price Change (7D): -1.07 % Current Price: $0.5318

News

“Pi2Day” delivered substance over spectacle: the no-code, AI-powered PI App Studio lets non-developers spin up Pi-native dApps, while Ecosystem Directory Staking introduces token-weighted ranking for projects. Node software upgrades and an on-ramp aggregator round out the utility push, signalling a shift from closed-beta hype to open-network preparedness.

Forecast (60-90 w)

PI’s RSI hovers near 54, reflecting neutrality after the mid-week fade from $0.66. A rounded base is forming above the 50-SMA ($0.48). Clearing $0.60 would confirm a cup-and-handle and unlock $0.72; rejection keeps the range intact. Watch OBV—if staking inflows accelerate, bullish divergence could propel a breakout. A close below $0.48 exposes $0.42 support.

MOVEMENT NETWORK (MOVE)

Price Change (7D): +36.85 % Current Price: $0.1775

News

MOVE ripped 50 % in two sessions as the foundation executed a 63 M-token June buy-back, funded by assets clawed back from the disgraced Rentech market-maker. Whale addresses added 200 % more tokens, even as “Smart Money” trimmed stakes, underscoring a split between conviction and caution.

Forecast (60-90 w)

Breaking a six-month falling-wedge, MOVE closed above its descending trendline and 200-SMA ($0.14). RSI prints 65, just shy of overbought. If price consolidates above $0.16, measured move points to $0.24—the 23.6 % Fib of the entire 2024-25 decline. Bear case: failure to defend $0.14 reopens $0.11, invalidating the bullish structure.

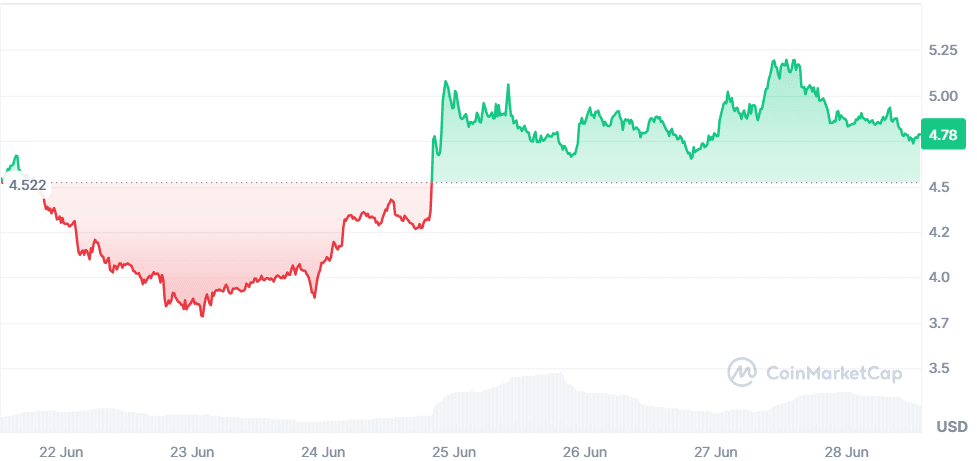

APTOS (APT)

Price Change (7D): +5.09 % Current Price: $4.78

News

Bitwise filed an amended S-1 for an Aptos ETF using in-kind creation, a structure the SEC views more favourably for crypto products. Coupled with Jump Crypto’s “Shelby” hot-storage release and 78 % fee-revenue growth, Aptos is courting both TradFi liquidity and developer mind-share.

Forecast (60-90 w)

APT is carving higher lows above $4.30 with RSI at 59. A daily close above $5.30 (May swing high) activates a target at $5.90 (0.382 Fib of the Q1 dump) and flips the 100-SMA upward. If ETF optimism fades and price loses $4.30, expect a slide to $3.90 where buying previously re-emerged.

TAGGER (TAG)

Price Change (7D): +83.86 % Current Price: $0.0003439

News

Back-to-back listings on Gate Alpha and Hotcoin plus a Binance-Alpha spotlight pumped visibility for Tagger’s AI-powered data-label marketplace. Volume jumped 61 % to $111M as retail chased the low-cap AI narrative.

Forecast (60-90 w)

With RSI at 66 and MACD firmly positive, TAG is trending but not yet overheated. Holding the 10-EMA ($0.00029) keeps momentum pointed to the 1.618 Fib extension at $0.00046. Thin liquidity means wicks can exaggerate moves; a close beneath $0.00027 would indicate momentum failure and could drag price to $0.00020, the prior range top.

JANITOR (JANITOR)

Price Change (7D): +18.89 % Current Price: $0.01421

News

JANITOR cracked several “top-meme” lists this week as traders rotated into micro-caps with under-$20 M liquidity. Social-volume spikes on Telegram and TikTok offset a 71% decline in 24-h exchange volume, illustrating typical meme-coin boom-and-bust churn.

Forecast (60-90 w)

RSI sits at 55 after cooling from 70, giving bulls breathing room. The token defends $0.012 (former breakout line); reclaiming $0.016 sets sights on $0.0185 resistance. Meme momentum could push a blow-off to $0.022, but any dip below $0.011 likely triggers cascading stop-losses toward $0.007, so risk management is paramount.

STELLA (ALPHA)

Price Change (7D): -22.92 % Current Price: $0.01529

News

Stella is on Binance’s July 4 delisting slate alongside BSW, KMD, LEVER and LTO. The announcement erased the brief roadmap-driven spike and accelerated a seven-day slide as traders scramble for alternate venues before deposits halt on 5 July.

Forecast (60-90 w)

RSI has collapsed to 34, nearing oversold extremes. If capitulation drags price to the 2023 low at $0.012, a reflex rally toward $0.018 (gap fill) is plausible. Structural headwinds persist: FDV remains lofty, and liquidity will fragment post-Binance. Sustained closes above $0.018 are needed to neutralise the downtrend.

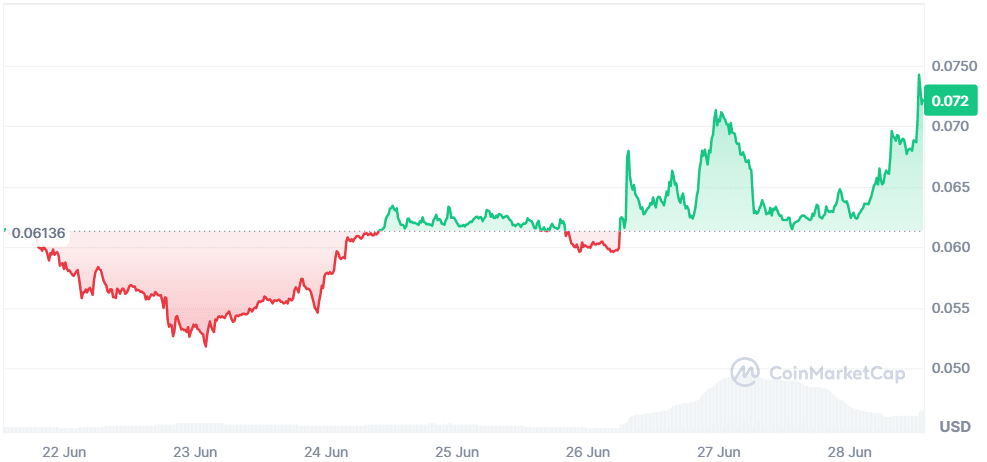

Wormhole (W)

Price Change (7D): +17.15 % Current Price: $0.07206

News

Ripple integrated Wormhole to bridge the XRP Ledger mainnet and upcoming XRPL-EVM side-chain with 35+ networks, framing W as infrastructure for institutional multichain settlement. The tie-up drew praise from BlackRock’s Aladdin-on-chain team and Apollo Global, fuelling a 95% jump in trading volume.

Forecast (60-90 w)

RSI prints 63 as price grinds along an ascending channel. A push through $0.075 targets $0.082 (March supply zone) and the psychological $0.10 level thereafter. The 20-EMA ($0.066) is first-line support; losing it could drag W to the 50-EMA at $0.061, where buyers stepped in during prior pullbacks. Watch for divergence if RSI crosses 70 without fresh highs.

Closing Thoughts

Flows this week reveal a market hunting for catalysts outside the Bitcoin/Ether duopoly. Cross-chain infrastructure (W) and throughput-focused base layers (SEI, APT) drew the deepest spot bids, suggesting builders and institutions alike are prioritising speed and interoperability.

Speculators, meanwhile, chased high-beta themes, AI data pipes (TAG) and meme culture (BANANAS31, JANITOR), showing retail is still eager to gamble when the headline is catchy enough. DeFi stalwarts delisted by Binance (BSW, ALPHA) illustrate the flip side: liquidity can vanish overnight when compliance flags appear. Overall, sector rotation, not a broad “everything rally”, defined the week. If BTC breaks out, this mix of solid fundamentals and speculative froth could evolve into a full-blown alt-season; if macro or regulatory headwinds pick up, expect the weakest narratives to deflate first while real-utility coins keep most of the inflows.