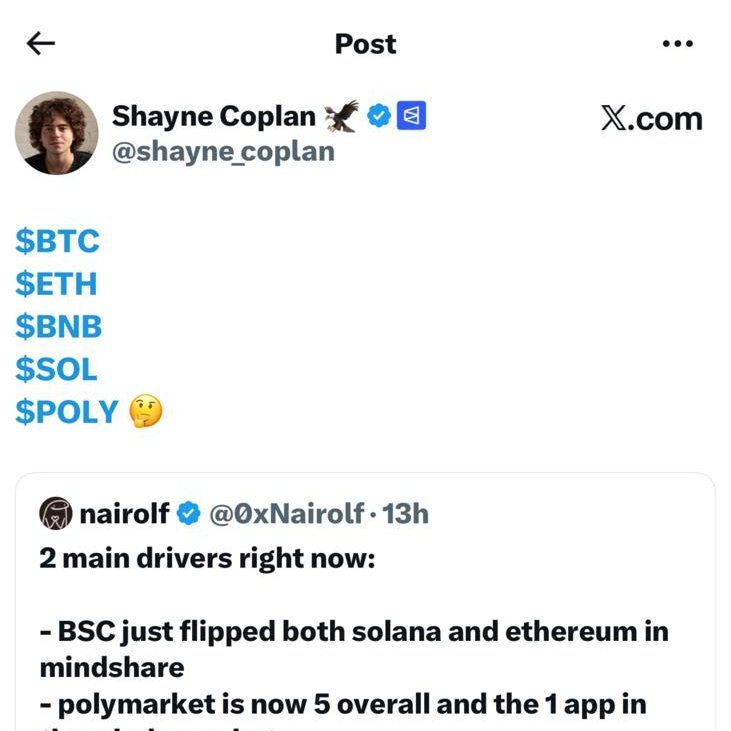

Polymarket founder Shayne Coplan sent crypto markets into speculation overdrive with a five-word social media post that included no explanation, no context and no confirmation — just five ticker symbols and a thinking emoji.

"$BTC $ETH $BNB $SOL $POLY," Coplan wrote on X, positioning a hypothetical POLY token alongside Bitcoin, Ethereum, Binance Coin and Solana — the four largest cryptocurrencies by market capitalization, excluding stablecoins.

The timing amplified the impact. The post came just one day after Intercontinental Exchange, parent company of the New York Stock Exchange, announced it would invest up to $2 billion in Polymarket at an $8 billion pre-money valuation. The deal catapulted the 27-year-old Coplan onto Bloomberg's Billionaires Index as the youngest self-made billionaire, and it positioned his prediction market platform as one of the most valuable crypto-native startups in history.

For traders, the implications were immediate: If Polymarket were to launch a native token and distribute it via airdrop to early users — a common practice in decentralized finance — it could rank among the largest token distributions ever executed. Based on ICE's valuation and typical airdrop allocations, a POLY token drop could potentially exceed the $1.97 billion distributed by Arbitrum in March 2023, which remains the gold standard for crypto airdrops when measured by day-one value.

But beyond the speculation lies a complex intersection of hype, regulation, institutional capital and technical uncertainty. Polymarket operates in a regulatory gray zone, having settled with the Commodity Futures Trading Commission in 2022 and only recently securing clearance to return to U.S. markets. The platform's core business — enabling users to bet real money on the outcomes of elections, sports events and macroeconomic indicators — straddles the line between financial derivatives and gambling, a distinction that could determine whether a POLY token is legally viable.

This article examines the evidence, the precedents, the risks and the broader implications of what could become one of the most significant token launches in crypto history — if it happens at all.

Polymarket's Rise to Prominence: From Bathroom Startup to $9 Billion Valuation

Polymarket operates as a blockchain-based prediction market, allowing users to trade binary outcome contracts on future events. Each market poses a yes-or-no question: Will Donald Trump win the 2024 presidential election? Will the Federal Reserve cut interest rates in November? Will Ethereum exceed $3,000 by year-end?

Users purchase shares priced between $0 and $1, with prices representing implied probability. A share trading at $0.65 suggests the market assigns a 65% likelihood to the outcome. When an event resolves, winning shares pay $1 in USDC, a dollar-pegged stablecoin, while losing shares expire worthless. The mechanism aggregates collective belief through financial incentives, theoretically producing more accurate forecasts than traditional polling.

Founded in June 2020 by Coplan, then 21 years old and a college dropout working from a makeshift office in his Manhattan bathroom, Polymarket initially struggled to gain traction. Coplan had spent the prior two years experimenting with crypto projects after leaving New York University, where he had studied computer science. Inspiration came from reading economist Robin Hanson's academic work on prediction markets and their potential to aggregate dispersed information more efficiently than expert forecasts.

The platform runs on Polygon, an Ethereum layer-2 blockchain that processes transactions for less than a cent with settlement times under five seconds. This infrastructure allows Polymarket to offer near-instant trade execution without the prohibitive gas fees that plague Ethereum mainnet applications. Liquidity pools use automated market makers to dynamically adjust share prices based on buying and selling pressure.

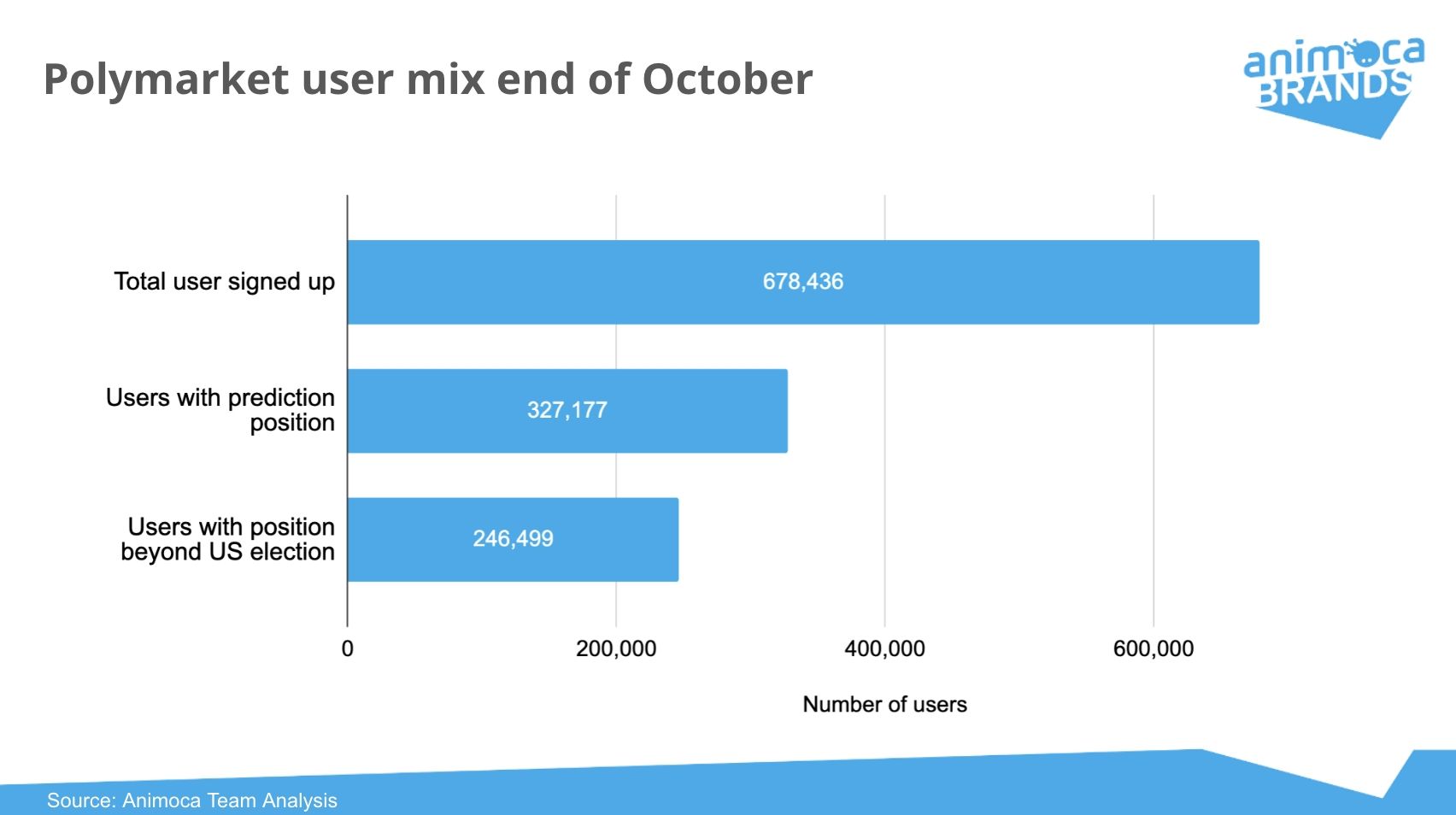

Polymarket's breakthrough came during the 2024 U.S. presidential election. The platform processed more than $3.3 billion in volume on the Trump-Harris race alone, with total election-related markets accounting for 76% to 91% of October 2024 trading activity. Monthly volume surged from $54 million in January 2024 to $2.63 billion in November, representing a 48-fold increase within a single year.

The platform's predictions proved remarkably accurate. In late June 2024, days after a presidential debate, Polymarket assigned a 70% probability that Joe Biden would withdraw from the race — weeks before his official announcement. Similarly, the platform correctly forecast Trump's victory approximately one month before Election Day, even as traditional polling aggregators like FiveThirtyEight showed Kamala Harris with a slight advantage.

By year-end 2024, Polymarket had processed more than $9 billion in cumulative trading volume since its 2020 launch, according to data from The Block. Active monthly traders peaked at 314,500 in December 2024, with open interest — the total value locked in unresolved markets — reaching $510 million during the November election.

The platform's user base spans retail traders seeking entertainment and speculation, political analysts gauging election sentiment, and increasingly, institutional observers using Polymarket data as a real-time forecasting tool. Notable partnerships include a June 2024 agreement with X (formerly Twitter) owned by Elon Musk, which integrated Polymarket predictions into the social media platform's data offerings.

Coplan's journey from broke college dropout to billionaire epitomizes the crypto industry's mythology of entrepreneurial risk-taking rewarded. Bloomberg's recognition of his billionaire status followed ICE's Oct. 7, 2025, announcement, which valued Polymarket at $9 billion post-money. The deal gave Coplan's equity stake — reportedly exceeding 10% of the company — a paper value surpassing $1 billion.

ICE's $2 Billion Bet: Why Wall Street Suddenly Cares About Crypto Prediction Markets

Intercontinental Exchange's investment represents one of the most significant endorsements of crypto infrastructure by a traditional financial institution. ICE operates the New York Stock Exchange, founded in 1792, along with 13 other global exchanges. The company processes trillions of dollars in trading volume annually and maintains strict regulatory compliance across multiple jurisdictions.

The Oct. 7, 2025, announcement outlined a strategic investment of up to $2 billion at an $8 billion pre-money valuation, implying a $9 billion post-money figure. ICE will become the exclusive global distributor of Polymarket's event-driven data, providing institutional clients with real-time sentiment indicators on market-relevant topics. The partnership also includes collaboration on future tokenization initiatives, though specific details remain undisclosed.

"Our investment blends ICE, the owner of the New York Stock Exchange, which was founded in 1792, with a forward-thinking, revolutionary company pioneering change within the Decentralized Finance space," said Jeffrey Sprecher, ICE's chair and CEO, in the announcement.

For ICE, the deal represents a bet on prediction markets as a legitimate financial instrument rather than a fringe gambling platform. The company sees value in Polymarket's data as a complement to traditional market intelligence, offering real-time aggregation of crowd-sourced beliefs on everything from monetary policy to geopolitical risk.

Several factors likely motivated ICE's investment. First, prediction markets have demonstrated forecasting accuracy that rivals or exceeds expert opinion, particularly for binary outcomes with clear resolution criteria. During the 2024 election, Polymarket's Trump victory forecast proved more prescient than consensus polling, validating the platform's information-aggregation mechanism.

Second, regulatory clarity has improved. After years of operating offshore to avoid U.S. restrictions, Polymarket acquired QCEX, a CFTC-licensed derivatives exchange and clearinghouse, for $112 million in July 2025. The acquisition, combined with a CFTC no-action letter, provided a legal pathway for U.S. operations under existing commodity derivatives regulations.

Third, prediction markets represent a growing sector. Piper Sandler estimates that industry revenue could reach $8 billion by 2030, driven by expansion into sports betting, financial forecasting and corporate decision-making tools. Polymarket's main U.S. competitor, Kalshi, raised $185 million at a $2 billion valuation in 2024, demonstrating investor appetite for regulated prediction platforms.

ICE's involvement brings institutional credibility and compliance infrastructure that could accelerate mainstream adoption. The company's regulatory expertise spans securities, commodities and derivatives markets, positioning it to help Polymarket navigate the complex legal landscape surrounding event contracts.

However, the investment also raises questions about how ICE's heavily regulated status might constrain Polymarket's innovation. Exchange operators face extensive oversight from the Securities and Exchange Commission, CFTC and international regulators. Any future POLY token would likely require compliance structures far beyond typical crypto launches, potentially including securities registration, anti-money-laundering protocols and know-your-customer verification.

Market observers note that ICE's entry validates prediction markets as a serious financial product category. "This is a major step in bringing prediction markets into the financial mainstream," Coplan said in the announcement. The deal follows a broader pattern of traditional finance institutions cautiously entering crypto infrastructure — from JPMorgan's blockchain initiatives to BlackRock's tokenized money market funds.

The partnership's tokenization component hints at potential future directions. ICE could leverage Polymarket's blockchain infrastructure to create regulated event contracts accessible to institutional clients, or to tokenize existing derivatives products for on-chain settlement. These possibilities remain speculative, but they suggest that ICE sees Polymarket as more than just a data provider.

The POLY Token Speculation: Clues, Models and Market Hype

No official documentation exists for a POLY token. Polymarket has not filed formation documents, published a whitepaper or announced distribution plans. The entire speculation rests on Coplan's cryptic five-ticker post and circumstantial evidence suggesting token launch preparations.

The most direct prior hint came in November 2024, days after Trump's election victory, when Polymarket's X account briefly posted a message reading "we predict future drops." The tweet was quickly deleted, but crypto traders interpreted it as a veiled reference to an upcoming airdrop.

More substantively, in September 2025, Polymarket's parent company Blockratize filed SEC Form D documents revealing "other warrants" in its latest funding round. This structure mirrors the approach taken by decentralized exchange dYdX before its September 2021 token launch, where early investors received token warrants alongside equity stakes. The filing suggests Polymarket may be preserving optionality for future token distribution.

Additionally, Coplan disclosed on Oct. 7, 2025, that Polymarket had raised two previously unannounced funding rounds: $55 million led by Blockchain Capital in 2024, and $150 million led by Founders Fund in early 2025 at a $1.2 billion valuation. The latter round included Ribbit Capital, Valor Equity Partners, Point72 Ventures, SV Angel, 1789 Capital, 1confirmation and Coinbase Ventures. These investors — particularly Founders Fund and Coinbase — have extensive experience with token-based projects and typically negotiate token allocation rights in funding agreements.

The five-ticker format of Coplan's post carries symbolic weight. By positioning POLY alongside BTC, ETH, BNB and SOL — the four largest free-floating crypto assets — Coplan suggests ambition for top-five market cap status. At current crypto valuations, a top-five position would require POLY to achieve a fully diluted market capitalization exceeding $80 billion, implying aggressive tokenomics and widespread distribution.

Market participants have begun speculating about potential airdrop structures based on precedents from successful DeFi launches. The most common model allocates tokens based on platform usage metrics, rewarding early adopters who contributed liquidity, trading volume or market creation. Polymarket could snapshot user wallets to determine eligibility, distributing POLY proportional to historical trading volume, profitable positions, or time spent on the platform.

Alternative models exist. Blur's dual airdrop in 2023 rewarded NFT marketplace users based on gamified point accumulation, with some recipients claiming over $1 million worth of tokens. Arbitrum's March 2023 airdrop distributed tokens using a complex eligibility matrix that considered transaction count, value bridged and time active on the network. Celestia's October 2023 airdrop targeted specific beneficiaries — developers, rollup users and Cosmos ecosystem participants — without requiring farming behavior.

For Polymarket, several allocation criteria seem plausible:

- Trading volume: Rewarding users based on total USDC wagered would incentivize liquidity provision but could favor wash trading, where users artificially inflate volume by trading with themselves. Polymarket has historically discouraged this behavior to maintain prediction accuracy.

- Profitable trading: Allocating tokens to users with positive profit-and-loss records would reward skill and conviction. However, this approach might exclude casual users who provide valuable liquidity despite losing money.

- Market creation: Users who propose and fund new prediction markets contribute to platform growth. Rewarding market creators would encourage ecosystem expansion into new event categories.

- Time-based: Long-term users who participated before mainstream adoption provide early liquidity and feedback. A tiered system rewarding account age could recognize these contributions.

- Hybrid approach: Combining multiple factors with weighted scoring offers flexibility and reduces gaming incentives. Users would earn eligibility points across categories, with final allocation based on total score.

The snapshot date remains unknown, creating uncertainty about whether recent activity will count toward airdrop eligibility. If Polymarket has already taken a snapshot, new users farming tokens would be excluded. If the snapshot occurs in the future, trading behavior may become increasingly artificial as speculators position for allocation.

Market psychology around airdrop speculation creates self-reinforcing dynamics. Anticipated distributions drive user acquisition, which increases trading volume and platform visibility, which attracts more speculative users hoping to qualify. This flywheel effect helped Arbitrum grow its total value locked by 147% between January and May 2023, ahead of its March token launch.

However, speculation also carries risks. If POLY fails to launch, or if the airdrop excludes the majority of users, sentiment could turn negative. Platforms that over-promise and under-deliver face reputational damage and user attrition. Polymarket has thus far maintained silence, likely to manage expectations and avoid regulatory scrutiny of unregistered securities offerings.

Regulatory Complications: Polymarket's CFTC Settlement and the Path to Compliance

Polymarket's regulatory history complicates any potential token launch. In January 2022, the CFTC entered an order against Blockratize Inc., operating as Polymarket, for offering unregistered binary options contracts and failing to register as a designated contract market or swap execution facility.

The order found that since June 2020, Polymarket had operated an illegal facility for event-based binary options trading. The platform offered contracts on outcomes such as "Will $ETH (Ethereum) be above $2,500 on July 22?" and "Will the 7-day average COVID-19 case count in the U.S. be less than 15,000 for the day of July 22?" The CFTC determined these constituted swaps under its jurisdiction and could only be offered on registered exchanges.

Polymarket agreed to pay a $1.4 million civil penalty, wind down non-compliant markets, facilitate user withdrawals, and cease violations of the Commodity Exchange Act. The order recognized Polymarket's substantial cooperation, which resulted in a reduced penalty. The platform subsequently blocked U.S.-based users and restructured operations to serve only non-U.S. markets.

"All derivatives markets must operate within the bounds of the law regardless of the technology used, and particularly including those in the so-called decentralized finance or 'DeFi' space," said Vincent McGonagle, then acting director of enforcement, in the CFTC announcement.

The settlement created immediate obstacles to U.S. market access. For three years, Polymarket operated exclusively offshore, building a user base in Europe, Asia and Latin America while American traders watched from the sidelines. Despite geoblocking measures, regulators suspected the platform continued serving U.S. customers through VPNs and other circumvention tools.

In November 2024, one week after Trump's election victory, FBI agents raided Coplan's Manhattan apartment, seizing his phone and electronic devices. The Justice Department launched an investigation into allegations that Polymarket allowed U.S.-based users to place bets in violation of the 2022 settlement agreement. Polymarket characterized the raid as "politically motivated," suggesting the investigation stemmed from the platform's accurate Trump victory forecast contradicting mainstream polling.

The investigation concluded in July 2025 when both the Justice Department and CFTC formally ended their probes without bringing new charges. This resolution, combined with a more crypto-friendly regulatory environment under the Trump administration, opened a pathway for U.S. re-entry.

In July 2025, Polymarket announced the $112 million acquisition of QCEX, a Florida-based derivatives exchange and clearinghouse holding CFTC registration. The deal provided the licensed infrastructure necessary for compliant U.S. operations. In September 2025, the CFTC's Division of Market Oversight and Division of Clearing and Risk issued a no-action letter granting relief from certain reporting and recordkeeping requirements, effectively clearing Polymarket for U.S. launch.

"Polymarket has been authorized to launch in the USA by the CFTC," Coplan announced on Sept. 4, 2025.

The regulatory journey illustrates the challenges of operating prediction markets under U.S. law. Event contracts blur distinctions between commodities derivatives (CFTC jurisdiction), securities (SEC jurisdiction) and gambling (state jurisdiction). Prediction markets argue they aggregate information rather than facilitate betting, but the functional mechanics resemble wagering.

A POLY token would face similar classification challenges. Token legal status depends on how it functions:

- Utility token: If POLY grants access to platform features — such as reduced trading fees, governance voting rights, or market creation privileges — it might qualify as a utility token outside SEC jurisdiction. However, the "utility token" defense has failed in numerous enforcement actions when tokens are primarily held for speculative investment.

- Security token: If POLY represents ownership claims, profit-sharing rights, or investment in Polymarket's business, it would likely constitute a security requiring SEC registration. The Howey Test, established by a 1946 Supreme Court case, defines securities as investment contracts involving money, common enterprise and profit expectations derived from others' efforts.

- Commodity token: If POLY functions as a pure medium of exchange without governance or profit rights, it might be classified as a commodity under CFTC oversight. Bitcoin and Ethereum have received this treatment, though their decentralization distinguishes them from single-company tokens.

- Gaming asset: State gambling regulators might argue POLY enables illegal betting, particularly if tokens can be exchanged for fiat currency. This classification would trigger state licensing requirements and potentially criminalize distribution in jurisdictions where online gambling is prohibited.

ICE's involvement adds both credibility and constraint. As a heavily regulated entity, ICE cannot easily partner with platforms offering unregistered securities or facilitating illegal gambling. Any POLY token would likely require extensive legal vetting, potentially including SEC registration, CFTC approval, and state-by-state gambling license review.

The compliance requirements could delay launch indefinitely or result in a heavily restricted token available only to accredited investors through private placement. Such an outcome would undermine the community-building ethos of crypto airdrops, which typically distribute tokens widely to reward grassroots adoption.

Alternatively, Polymarket might structure POLY as a pure governance token with no economic rights, similar to how Uniswap's UNI token grants voting power without profit-sharing. This approach reduces securities risk but limits token value capture, potentially disappointing users expecting financial upside.

International regulatory approaches vary significantly. European Union frameworks under the Markets in Crypto-Assets (MiCA) regulation provide clearer pathways for tokenization, though prediction markets remain contested. Several European countries, including Switzerland, France and Poland, have blocked or restricted Polymarket access under national gambling laws. A POLY token might face similar jurisdiction-by-jurisdiction battles.

Airdrop Mechanics: What "One of the Biggest Ever" Might Mean

To contextualize potential POLY distribution scale, examining historical airdrops provides reference points. Crypto airdrops serve multiple functions: distributing governance rights, rewarding early adopters, generating marketing buzz, and achieving decentralization to bolster regulatory defense.

The largest crypto airdrop by day-one value remains Uniswap's UNI distribution in September 2020, which allocated $6.43 billion worth of tokens at all-time-high prices. Every address that had used the decentralized exchange received 400 UNI tokens. The airdrop shocked recipients who had used Uniswap casually, suddenly finding themselves holding five-figure sums.

Uniswap's success established the airdrop as a standard DeFi launch mechanism. Subsequent protocols adopted similar strategies with varying scales:

- Arbitrum (ARB) — March 2023: Distributed 1.162 billion tokens worth approximately $1.97 billion at launch, making it the largest airdrop by day-one market value. Eligible users had to meet multiple criteria including bridging funds to Arbitrum, executing transactions over multiple months, and conducting certain transaction types. The complex eligibility matrix reduced farming effectiveness while rewarding genuine usage.

- Optimism (OP) — May 2022: Allocated $672 million worth of tokens to early adopters of the Ethereum layer-2 network. Distribution followed multiple rounds, with subsequent airdrops targeting different user segments.

- Ethereum Name Service (ENS) — November 2021: Distributed $1.87 billion to .ETH domain holders, with allocation based on domain registration duration and account age.

- Celestia (TIA) — October 2023: Allocated $730 million to developers, rollup users and Cosmos ecosystem participants, explicitly avoiding farming incentives.

- Blur (BLUR) — February 2023: Two airdrops totaling $818 million rewarded NFT marketplace users based on trading activity. Some power users received over $1 million, though allegations of wash trading controversy followed.

For a POLY airdrop to qualify as "one of the biggest ever," it would need to match or exceed Arbitrum's $1.97 billion day-one value. Given ICE's $9 billion post-money valuation and typical token allocation structures, several scenarios emerge:

- Conservative scenario: 10% of total token supply allocated to users. If POLY launches at a fully diluted valuation matching Polymarket's equity value ($9 billion), a 10% airdrop would distribute $900 million worth of tokens — substantial but below Arbitrum's record.

- Moderate scenario: 15-20% allocation to users, combined with a token valuation premium over equity valuation (common in crypto markets where tokens trade at multiples of underlying business value). A 15% allocation at a $15 billion fully diluted valuation would yield a $2.25 billion airdrop, exceeding Arbitrum's record.

- Aggressive scenario: 25-30% allocation with significant valuation premium, driven by hype and ICE's institutional backing. A 25% allocation at a $20 billion fully diluted valuation would create a $5 billion airdrop — nearly 2.5x larger than any previous distribution.

The latter scenario might seem implausible, but crypto markets have repeatedly demonstrated willingness to assign valuations disconnected from traditional metrics. Tokens often trade at premiums to equity valuations, reflecting greater liquidity, speculative interest and governance value.

However, achieving a successful large-scale airdrop requires careful design to balance competing objectives:

- Sufficient distribution breadth to achieve decentralization and regulatory defensibility. Securities law analysis often considers whether token ownership is sufficiently dispersed that no single entity controls the network.

- Adequate allocation depth to create meaningful economic stakes for recipients, incentivizing ongoing participation and governance engagement.

- Anti-gaming measures to prevent wash trading, sybil attacks (creating multiple accounts to claim multiple allocations), and other manipulation tactics that dilute rewards for genuine users.

- Vesting schedules to prevent immediate mass dumping that could crash token price, destroying value for long-term holders.

Reserve allocations for future community initiatives, ecosystem development, and team retention, ensuring the project remains sustainable beyond the initial launch.

Past airdrops offer lessons in pitfalls to avoid. Arbitrum's launch experienced severe technical issues, with the blockchain explorer crashing and users paying exorbitant gas fees to claim tokens. Blur's gamified farming incentives led to wash trading that distorted NFT market metrics. Worldcoin's biometric verification approach raised privacy concerns and regulatory scrutiny.

If Polymarket pursues an airdrop, its decentralized structure on Polygon provides advantages. Polygon's low transaction costs would make claiming tokens inexpensive, avoiding the gas fee catastrophe that plagued Arbitrum. The blockchain's high throughput could handle concurrent claim transactions without network congestion.

However, Polymarket's regulatory constraints create unique challenges. The platform's U.S. ban from 2022-2025 means many early users were international. An airdrop including international recipients might face securities law complications if tokens are deemed investments. Conversely, restricting distribution to U.S.-cleared users would exclude the community that sustained Polymarket during its offshore years, potentially triggering backlash.

The ICE partnership adds another layer of complexity. Would ICE want its name associated with a massive, unregulated token distribution that might enrich speculators? Or would the exchange operator insist on a controlled rollout with extensive KYC, potentially undermining crypto's permissionless ethos?

Technical Unknowns: Chain, Governance and Token Utility

No technical specifications exist for POLY, leaving fundamental architecture questions unanswered:

- Blockchain selection: Polymarket currently operates on Polygon, making it the natural choice for a native token. Polygon's infrastructure advantages include sub-cent transaction fees, five-second settlement, and established institutional adoption — BlackRock's BUIDL tokenized money market fund runs on Polygon, as do enterprise partnerships with Nike and Stripe. The network recently completed the Rio upgrade, increasing throughput to 5,000 transactions per second with near-instant finality and zero reorganization risk.

- However, alternatives exist. Ethereum mainnet offers maximum security and decentralization but suffers from high fees that would make frequent POLY transactions impractical. Other layer-2 solutions like Base (Coinbase's network), Arbitrum, or Optimism could provide competitive infrastructure with different tradeoffs in decentralization versus performance.

- Solana represents another option, offering high throughput and low costs comparable to Polygon but with different validator economics and ecosystem positioning. However, migrating from Polygon to Solana would require substantial technical work and abandon existing infrastructure investments.

- Multi-chain deployment could maximize accessibility, allowing POLY to exist simultaneously on Ethereum, Polygon, and other networks via bridges. This approach increases complexity but expands potential user base and liquidity venues.

- Token supply and distribution: Total token supply fundamentally determines value and inflation dynamics. Fixed supply models (like Bitcoin's 21 million cap) create scarcity but limit flexibility for future rewards and ecosystem incentives. Inflationary models with programmed issuance support ongoing network security but dilute existing holders.

Distribution mechanisms include:

- Airdrop to existing users (10-30% of supply)

- Team and investor allocations with multi-year vesting (20-30%)

- Ecosystem reserves for market creation incentives, liquidity mining, grants (20-30%)

- Treasury for governance-directed initiatives (10-20%)

- Public sale or liquidity provision (0-10%)

The balance between immediate distribution and long-term reserves affects token velocity (how quickly tokens circulate) and scarcity. Heavy front-loading through airdrops creates selling pressure but generates buzz. Conservative distribution preserves future optionality but may disappoint immediate expectations.

Governance mechanisms: Most DeFi tokens grant voting rights over protocol parameters. For Polymarket, POLY could enable governance over:

- Market resolution rules and oracle selection

- Fee structures for trading and market creation

- Treasury allocation for ecosystem development

- Protocol upgrades and technical improvements

- Listing standards for new event categories

Governance models range from simple token-weighted voting (one token = one vote) to more complex systems like vote delegation, quadratic voting, or time-locked voting where longer commitment periods grant amplified influence.

Effective governance requires balancing plutocracy (wealth concentration determines outcomes) against populism (low-information voters make poor technical decisions). Many protocols struggle with low participation rates, with governance proposals often seeing less than 10% of tokens voting.

Utility mechanisms: Beyond governance, POLY could serve multiple platform functions:

- Fee rebates: Users staking POLY receive reduced trading fees, similar to Binance's BNB model. This creates holding incentives and reduces token velocity.

- Market creation deposits: Requiring POLY deposits to create new prediction markets would deter spam while rewarding successful market creators who attract trading volume.

- Liquidity mining: Users providing liquidity to prediction markets earn POLY rewards, incentivizing market depth and tighter spreads.

- Resolution staking: POLY holders stake tokens to vote on disputed market outcomes, earning rewards for correct judgments and suffering slashing for wrong votes. This mechanism aligns incentives for accurate resolution.

- Data access: Premium data feeds or advanced analytics could require POLY payment, creating revenue streams for token holders.

- Advertising: Market creators could pay POLY to promote their prediction markets to platform users, creating organic demand.

The combination of utility functions determines token value accrual — how much economic activity translates into token price appreciation. Strong utility creates consistent demand, while weak utility results in tokens that are held only for speculation.

Technical risks: Smart contract vulnerabilities represent significant risk for any token launch. Bugs in token logic, governance contracts, or staking mechanisms could enable theft, unintended inflation, or governance attacks. Extensive auditing by reputable security firms (Trail of Bits, OpenZeppelin, ConsenSys Diligence) is standard practice, but audits cannot guarantee zero risk.

Oracle dependencies also matter. If POLY governance relies on off-chain voting aggregation or market resolution data, oracle manipulation could compromise system integrity. Chainlink, Pyth, and other oracle networks provide data feeds, but each carries specific trust assumptions.

Regulatory classification affects technical design. If POLY must comply with securities law, the token might require transfer restrictions, investor accreditation verification, or lock-up periods — all of which complicate technical implementation and reduce composability with DeFi protocols.

Risk and Compliance Perspectives: ICE Changes the Game

ICE's involvement fundamentally alters the risk profile of a potential POLY token. When a heavily regulated NYSE parent invests $2 billion, it brings institutional risk management standards that crypto-native projects rarely face.

Anti-money laundering (AML) and know-your-customer (KYC) requirements: ICE operates under Bank Secrecy Act requirements, European Market Infrastructure Regulation, and dozens of other compliance frameworks. Any POLY token distribution or trading venue associated with ICE would likely require identity verification to prevent money laundering, terrorist financing, and sanctions evasion.

Traditional airdrops often distribute tokens to anonymous blockchain addresses with no KYC requirements, embracing crypto's pseudonymous ethos. However, ICE cannot partner with anonymous token distributions without regulatory exposure. This tension might force a hybrid model: unverified users receive limited allocations with transfer restrictions, while KYC-compliant users access full functionality.

Smart contract auditing and insurance: Institutional involvement demands rigorous technical diligence. ICE would likely require multiple independent security audits, formal verification of critical smart contract logic, bug bounty programs, and potentially smart contract insurance coverage. These measures add significant development time and cost but reduce catastrophic risk.

Custody and key management: Institutional token holders require qualified custodians with proper insurance, segregated wallets, and disaster recovery procedures. If POLY grants governance rights, ICE might need custody solutions that enable vote delegation without exposing private keys to online systems.

Tax reporting: U.S. tax law treats cryptocurrency as property, requiring cost basis tracking and capital gains reporting for every transaction. Institutional investors need detailed transaction histories for tax compliance. Polymarket would need to provide Form 1099 reporting infrastructure for POLY distributions and trading activity, adding operational complexity.

Market manipulation surveillance: Securities regulators prohibit wash trading, spoofing, and other manipulation tactics. Even if POLY is not classified as a security, ICE's reputational risk demands robust market surveillance. Polymarket would need systems to detect and prevent coordinated manipulation, insider trading ahead of market resolution, and other abusive practices.

Legal classification: The token's legal status remains the central question. Several frameworks apply:

- The Howey Test (SEC securities analysis) examines whether POLY involves: (1) an investment of money, (2) in a common enterprise, (3) with expectation of profits, (4) derived from others' efforts. If all four prongs are satisfied, POLY is a security requiring registration.

- The Reves Test (debt security analysis) considers whether tokens represent loans with fixed returns, as opposed to equity or utility assets.

- The Lanham Act (consumer protection) evaluates whether token marketing makes false or misleading claims about functionality, value, or regulatory status.

- State-level securities laws (Blue Sky Laws) add another layer. Even if POLY passes federal scrutiny, individual states might require separate registration or impose restrictions.

Recent case law provides limited guidance. The SEC has pursued numerous token issuers, achieving settlements that establish certain tokens as securities (XRP partially, various DeFi tokens). However, courts have also found that tokens can evolve from securities to non-securities as networks mature and decentralize.

Compliance strategies: Several approaches could mitigate regulatory risk:

- Registration approach: File Form S-1 registration with the SEC, treating POLY as a security from inception. This ensures legal clarity but imposes extensive disclosure requirements, financial auditing, and ongoing reporting obligations. Only accredited investors could purchase tokens in private placements, limiting distribution breadth.

- Regulation A+ exemption: Use Reg A+ mini-IPO provisions to offer up to $75 million in tokens annually to non-accredited investors with simplified disclosure. This allows broader distribution than traditional securities offerings but still requires SEC review.

- Utility token defense: Design POLY strictly as a governance and utility token with no economic rights, arguing it falls outside securities law. Emphasize decentralized governance, community ownership, and use-case functionality rather than investment potential. This approach carries enforcement risk if SEC disagrees.

- International structuring: Launch POLY through foreign entities in jurisdictions with clearer crypto frameworks (Switzerland, Singapore, UAE), restricting U.S. access until regulatory clarity improves. This limits U.S. market exposure but abandons Polymarket's largest potential user base.

- Progressive decentralization: Begin with centralized control, KYC requirements, and conservative distribution. Gradually transition toward decentralization as the network matures, arguing that initial security status evolves into commodity status. This follows the approach suggested in SEC Commissioner Hester Peirce's "safe harbor" proposal.

ICE's involvement likely favors conservative compliance. The company has negligible risk tolerance for securities violations, money laundering exposure, or sanctions breaches. A POLY token backed by ICE would probably include extensive identity verification, transaction monitoring, and restricted distribution — disappointing crypto purists but reassuring regulators.

U.S. vs. International Prediction Market Regulation: A Fragmented Landscape

Regulatory treatment of prediction markets varies dramatically across jurisdictions, complicating any global token launch.

United States: Federal oversight splits between CFTC (commodity derivatives) and state gambling regulators. The CFTC permits event contracts but requires designated contract market registration. States maintain independent authority over gambling, with most prohibiting or heavily restricting online betting outside sports.

Kalshi operates as a CFTC-registered designated contract market, offering fully compliant event contracts on elections, economic indicators, and weather. However, Massachusetts regulators sued Kalshi in 2025, claiming its NFL contracts constitute illegal sports betting under state law. The case could determine whether federal CFTC jurisdiction preempts state gambling prohibitions.

The Unlawful Internet Gambling Enforcement Act of 2006 prohibits processing payments for illegal online gambling but contains exemptions for "skill games" and certain financial instruments. Prediction markets argue they qualify as skill-based information aggregation rather than gambling, but this distinction remains contested.

European Union: MiCA regulation establishes comprehensive crypto asset frameworks but largely omits prediction markets, leaving member states to determine classification. Individual countries diverge significantly:

- France: The National Gaming Authority (ANJ) blocked Polymarket in November 2024, requiring geo-restriction for French users due to violations of gambling and sports betting laws.

- Poland: The Ministry of Finance blocked Polymarket in January 2025 under anti-gambling provisions.

- Switzerland: The Federal Gaming Board blocklisted Polymarket in November 2024 for controversial prediction market aspects violating gambling regulations.

- United Kingdom: Gambling Commission oversees betting markets, requiring operator licenses. Prediction markets on financial outcomes may fall under Financial Conduct Authority oversight.

Asia-Pacific: Approaches range from restrictive to permissive:

- Singapore: Blocked Polymarket under gambling laws, restricting access for residents.

- Japan: Gambling restrictions are strict, though regulated sports betting exists. Crypto prediction markets lack clear legal framework.

- Australia: Interactive Gambling Act prohibits offshore gambling services without Australian licensing. Prediction markets might qualify as derivatives outside gambling law, but classification remains ambiguous.

The fragmented landscape creates operational challenges. A global POLY token would need to navigate dozens of legal regimes, potentially requiring geo-restrictions, market-specific features, or separate token variants for different jurisdictions.

ICE's international exchange operations provide expertise in multi-jurisdiction compliance. The company manages regulatory requirements across North America, Europe and Asia, offering a template for POLY token structuring. However, ICE's conservative approach might result in overly restrictive access, limiting token utility in major markets.

Market Reaction: Trading, Memes and Tokenized Information Futures

Coplan's five-ticker post ignited immediate social media speculation. Within hours, crypto Twitter flooded with analysis threads, meme posts, and eligibility guides for potential POLY recipients.

"Is this confirmation of the coin release?" asked Unstoppable Domains, a blockchain domain service provider, in response to Coplan's post.

Community members dissected Coplan's tweet history for additional clues. The thinking emoji (🤔) suggested intentional ambiguity, neither confirming nor denying token plans. The choice of BTC, ETH, BNB and SOL — rather than smaller-cap assets — signaled ambitious market positioning.

Prediction markets on competing platforms reflected uncertainty. Myriad, a prediction market operated by Decrypt's parent company, showed 65% odds that Polymarket would not announce a token in 2025 — though those odds improved from 83% after Coplan's post, indicating the tweet shifted sentiment despite lack of confirmation.

Polymarket's own markets showed no official prediction on POLY token launch, likely to avoid creating conflicts of interest or regulatory complications. However, Discord and Telegram communities dedicated channels to airdrop speculation, with users sharing on-chain heuristics and eligibility models.

Several behaviors emerged as traders attempted to position for potential airdrops:

- Volume farming: Users artificially inflated trading activity by repeatedly buying and selling the same position, hoping volume-based allocation would reward them. Polymarket's order book structure makes this easier than automated market makers, where large trades face price impact.

- Wash trading: Coordinated trading between multiple accounts controlled by the same person creates apparent activity without genuine risk. Blockchain analytics firms like Chainalysis can detect some wash trading patterns, but sophisticated actors employ mixing techniques to obscure connections.

- Market creation: Users proposed new prediction markets across diverse categories, hoping that market creator rewards would factor into airdrop calculations. The platform saw a surge in niche markets on obscure topics, some with minimal trading volume.

- Profitability optimization: Rather than chasing volume, some traders focused on maintaining positive PnL records, anticipating that profitable users might receive preferential allocation. This approach requires genuine prediction skill rather than mechanical farming.

- Social engagement: Users increased activity on Polymarket's social channels, participated in Discord discussions, and promoted markets to followers. If the airdrop includes social engagement metrics, early community builders could benefit.

- The speculation itself became a subject of prediction markets on other platforms. Kalshi and PredictIt created contracts on whether Polymarket would announce a token by specific dates, effectively allowing users to hedge their POLY speculation.

Crypto media coverage amplified the hype cycle. CoinDesk, The Block, Decrypt, and other major publications ran analysis pieces examining the evidence, potential scale, and regulatory implications. Bloomberg's billionaire list addition for Coplan provided mainstream credibility, with CNBC and Wall Street Journal coverage introducing prediction markets to traditional finance audiences.

Meme culture embraced the speculation. Social media filled with images of Coplan's bathroom office setup, contrasting humble origins with current billionaire status. "Against all odds" became a recurring phrase, lifted from Coplan's own tweet contextualizing his journey.

The attention created reflexive dynamics. Increased coverage drove new user acquisition, which boosted trading volume, which generated more coverage. Polymarket's daily active users fluctuated but maintained elevated levels compared to pre-speculation baseline, suggesting sustainable interest beyond pure airdrop farming.

Market sentiment data from Kaito, which tracks crypto mindshare across social platforms, showed prediction market discussion rising from under 1% of crypto conversation in early 2025 to nearly 3% by October — a threefold increase correlated with election activity and ICE investment news.

Expert Opinions and Industry Outlook: Between Validation and Skepticism

Industry analysts offered mixed perspectives on both Polymarket's future and potential POLY token implications.

Thomas Peterffy, founder of Interactive Brokers, framed prediction markets as educational tools: "Prediction markets teach the public to think in probabilities. They turn opinion into measurable confidence." This perspective emphasizes social value beyond pure profit-seeking, aligning with arguments that prediction markets improve collective decision-making.

However, skepticism persists. CFTC Commissioner Kristin Johnson warned in 2025 that "speculative incentives can blur intent" in prediction markets, expressing concern that platforms marketed as information aggregation tools function primarily as gambling venues.

"The greatest thing crypto has done is rebranding 'betting' as 'prediction markets,' right up there with calling salt and rocks 'electrolytes,'" wrote mert, CEO of blockchain infrastructure firm Helius and former Coinbase engineer. The critique highlights how linguistic framing shapes regulatory and public perception.

Venture capital perspectives reflect cautious optimism. Claude Donzé, a principal at Greenfield Capital, told DL News: "This is a major challenge for them. I would be surprised if they can get another bet of similar size sometime soon," referring to Polymarket's post-election volume decline. The comment questions whether platform engagement can sustain without marquee events like presidential elections.

Rennick Palley, founding partner at early-stage venture firm Stratos, offered a more positive outlook: "The product market fit for a prediction market and an election is as good as it can get. It happens every four years, people are anticipating what's going to happen, and there's a huge amount of media coverage."

Douglas Campbell, economics professor at the New Economic School and founder of prediction platform Insight Prediction, noted that volume declines post-election were inevitable but emphasized upcoming catalysts: "The next big US election is only two years away," referring to 2027 midterms.

Institutional adoption signals continue to emerge. A 2025 OECD report indicated that 58% of hedge funds now use DeFi derivatives, up from 23% in 2023, as they diversify risk exposure and enhance liquidity. Additionally, 42% of institutional investors plan to increase digital asset allocations in coming years.

Crypto market analysis firm Delphi Digital issued research suggesting prediction markets could achieve $8 billion annual revenue by 2030, echoing Piper Sandler's estimate. The analysis highlighted sports betting as a major growth vector, with prediction markets potentially capturing market share from traditional bookmakers through lower fees and greater transparency.

Technical analysts at blockchain research firm Messari examined potential POLY tokenomics, modeling scenarios where governance tokens for major DeFi protocols typically trade at 0.5x to 3x underlying platform valuation. Applied to Polymarket's $9 billion equity valuation, this suggests POLY could achieve $4.5 billion to $27 billion fully diluted valuation depending on utility design and market conditions.

Kaiko, a crypto market data firm, analyzed liquidity dynamics for potential POLY markets. The report suggested major exchanges including Binance, Coinbase, and Kraken would likely list POLY given Polymarket's profile and ICE backing, ensuring adequate liquidity for price discovery. However, initial volatility could be extreme, with potential 50-70% price swings in the first weeks as early airdrop recipients sell to realize gains.

Legal experts weighed in on regulatory viability. Lewis Cohen, partner at law firm DLx Law, suggested that a carefully structured governance token could avoid securities classification if designed purely for protocol parameter voting without profit rights. However, he cautioned that SEC enforcement staff has shown skepticism toward pure governance defenses, particularly when tokens trade on exchanges where buyers clearly expect price appreciation.

Preston Byrne, partner at law firm Byrne & Storm, offered a more pessimistic view: "Any token distributed in connection with a platform that takes custody of user funds and intermediates financial bets is going to face an uphill battle arguing it's not a security." He noted that ICE's involvement actually increases regulatory scrutiny rather than providing safe harbor.

Blockchain analytics firm Chainalysis published research on airdrop farming patterns, finding that approximately 30-40% of addresses claiming major airdrops showed characteristics consistent with sybil attacks or wash trading. The analysis suggested that effective anti-gaming measures typically require complex multi-factor eligibility scoring combined with human review of suspicious patterns.

Future Scenarios: If POLY Launches (and If It Doesn't)

Multiple pathways exist for potential POLY token development, each carrying distinct implications:

Scenario 1: Traditional Airdrop with Governance Token

Polymarket announces a POLY governance token distributed to historical users based on trading volume, profitability, and platform tenure. The token grants voting rights over market resolution rules, fee parameters, and treasury allocation. Distribution occurs over multiple phases to reduce immediate selling pressure.

Implications: Strong initial hype drives exchange listings and media coverage. Token price likely shows extreme volatility, with early airdrop farmers selling immediately while long-term users and new speculators accumulate. Governance participation may be low initially, typical of DeFi tokens where less than 10% of supply votes on proposals. Polymarket gains decentralization defense against securities law but faces ongoing governance coordination challenges.

Scenario 2: Hybrid Model with ICE-Compliant Distribution

POLY launches with strict KYC requirements, vesting schedules, and restricted distribution to prevent immediate dumping. Only verified U.S. users and qualified international users receive allocations. Institutional investors access tokens through separate channels with additional restrictions.

Implications: Reduced hype compared to traditional airdrops due to identity verification friction and vesting lock-ups. However, institutional credibility increases, potentially attracting serious long-term investors. Price stability may be better with restricted supply, but liquidity could suffer. Crypto community may view the launch as compromising decentralization principles, though regulatory risk declines substantially.

Scenario 3: Exchange Listing Without Airdrop

Polymarket launches POLY through exchange initial offerings or traditional fundraising, with no airdrop to existing users. Tokens are purchased rather than distributed freely.

Implications: Community backlash would likely be severe. Users who spent years providing liquidity and platform validation would feel cheated. Competitors offering airdrops could capitalize on resentment to poach users. However, Polymarket avoids securities law risks associated with free distributions and maintains revenue from token sales. This approach mirrors traditional equity markets but contradicts crypto's ethos of rewarding early adopters.

Scenario 4: Institutional-Only Token

POLY exists exclusively for institutional participants, serving as settlement currency or governance mechanism for large-scale event contracts. Retail users continue using USDC.

Implications: Minimal community impact since retail users wouldn't expect allocation. Institutional adoption could be stronger without retail speculation complicating governance. However, this defeats the decentralization narrative and limits token liquidity. Polymarket might struggle to justify why the token exists if it doesn't broaden stakeholder participation.

Scenario 5: No Token Launch

Coplan's post was mere speculation, meme-posting, or testing market reaction. No POLY token ever materializes.

Implications: Short-term disappointment among users farming potential airdrops. However, Polymarket continues operating profitably without token distribution complexities. The company maintains complete control over platform direction without governance token constraints. Users might appreciate avoiding the volatility and distraction of token speculation. The decision could be seen as responsible restraint or missed opportunity depending on perspective.

Strategic considerations: Several factors will likely influence Polymarket's decision:

- Regulatory environment: If crypto regulation becomes more favorable under continued Trump administration policies and CFTC modernization, token launches face lower legal risk. Conversely, aggressive SEC enforcement under a different future administration could make tokens legally untenable.

- Competitive dynamics: Kalshi's success as a regulated U.S. prediction market without a token demonstrates viability of token-free models. However, if competitors launch successful governance tokens that attract users through financial incentives, Polymarket may feel pressured to respond.

- ICE partnership terms: The investment agreement likely contains provisions affecting token launch decisions. ICE might have veto rights over significant corporate actions, or the deal structure might include token warrant provisions obligating future distribution.

- Market timing: Crypto market conditions affect optimal launch windows. Bull markets support higher valuations and positive sentiment, while bear markets create skepticism and selling pressure. Polymarket would likely time any launch to coincide with strong broader market conditions.

- Technical readiness: Building secure token infrastructure requires significant development time. Smart contract auditing, governance frameworks, and distribution mechanisms need thorough testing before launch. Rushing to meet speculative timelines risks catastrophic technical failures.

Final thoughts

Shayne Coplan's five-symbol post captured the crypto industry's perpetual tension between genuine innovation and speculative frenzy. The possibility of a POLY token represents a legitimate question about how decentralized prediction markets should be governed, financed, and sustained. The market hype reflects both rational interest in potentially valuable assets and irrational exuberance driven by get-rich-quick psychology.

What we know with certainty: Intercontinental Exchange has invested $2 billion in Polymarket at a $9 billion valuation. This unprecedented endorsement from a traditional financial powerhouse validates prediction markets as serious financial infrastructure, not just gambling curiosities. The deal gives Polymarket resources, credibility, and distribution channels that could accelerate mainstream adoption.

We also know that Coplan has hinted at token possibilities through cryptic social media, strategic silence, and corporate structuring that mirrors pre-launch patterns from other DeFi protocols. Whether these signals indicate genuine intent or merely strategic positioning remains ambiguous.

What remains uncertain: whether a POLY token will actually launch, what form it might take, how it would be distributed, and when any announcement might occur. The regulatory complexity alone could delay launch indefinitely or render it impossible under current law. ICE's involvement simultaneously increases token legitimacy and constrains design flexibility.

The broader context matters more than any single token launch. Polymarket represents a test case for whether crypto-native financial infrastructure can mature into regulated, institutionally-backed systems without losing the permissionless innovation that made the technology valuable. If successful, POLY could demonstrate a pathway for other DeFi protocols to achieve legitimacy while maintaining decentralization.

If unsuccessful — whether through regulatory shutdown, technical failure, or design flaws — it would reinforce skeptics' view that crypto remains fundamentally at odds with compliance requirements necessary for mainstream finance.

For users contemplating whether to farm potential airdrops, the calculus is straightforward: genuine platform usage costs nothing beyond trading capital and time. Artificial volume farming through wash trading risks account restrictions without guaranteed rewards. The most rational approach is to use Polymarket for its intended purpose — aggregating information about future events — and treat any potential airdrop as a bonus rather than primary motivation.

For the prediction market industry, POLY's potential launch represents a watershed. A successful token distribution could catalyze competitor launches, accelerate institutional adoption, and establish prediction markets as a permanent financial infrastructure layer. A failed or compromised launch could trigger regulatory crackdowns and validate critics who view the sector as gambling masquerading as finance.

The answer to whether POLY becomes one of crypto's biggest airdrops depends on variables beyond market speculation: regulatory rulings, technical implementation, strategic priorities, and market conditions months or years in the future. Coplan's cryptic tweet may have been genuine foreshadowing, strategic positioning, or mere trolling.

Until Polymarket makes an official announcement, POLY remains exactly what the thinking emoji suggests: a possibility worth considering, but not a certainty worth assuming. In crypto markets where sentiment moves billions and where lines between information and hype dissolve, that ambiguity is perhaps the most predictable outcome of all.

Whether POLY launches as the game-changing distribution Coplan hints at, or remains an inside joke among crypto Twitter, the speculation itself has already achieved something significant: elevating prediction markets from niche DeFi curiosity to mainstream financial conversation. In an industry where attention often precedes adoption, that may be the most valuable signal Coplan's five-symbol post could send.