The United States stands at a pivotal moment in cryptocurrency regulation. For years, the digital asset industry has operated in a regulatory gray zone, caught between overlapping jurisdictions of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), with neither agency holding unambiguous authority over the sprawling crypto markets. Market participants — from major exchanges to token issuers to retail investors — have navigated this uncertain terrain through cautious compliance and costly litigation.

That landscape may be about to change dramatically. On November 10, 2025, Senate Agriculture Committee Chairman John Boozman and Senator Cory Booker unveiled a bipartisan discussion draft that would fundamentally reshape crypto regulation in America. The proposal would shift primary oversight of spot digital commodity trading from the SEC to the CFTC, classify most cryptocurrencies as digital commodities rather than securities, and establish the first comprehensive federal framework for crypto market structure.

This marks the Senate's most serious attempt yet to match the House's legislative momentum. In July 2025, the House passed the Digital Asset Market CLARITY Act by a 294-134 vote, signaling strong bipartisan support for regulatory clarity. The Boozman-Booker draft builds upon that foundation, incorporating lessons learned from the House's experience while addressing unique Senate concerns about enforcement resources, consumer protection, and the CFTC's capacity to oversee this massive new market.

The stakes could not be higher. The United States has fallen behind other major jurisdictions in establishing clear rules for digital assets. The European Union's Markets in Crypto-Assets Regulation (MiCA) became fully applicable in December 2024, creating the world's most comprehensive crypto regulatory framework. Meanwhile, Singapore, the United Kingdom, and the United Arab Emirates have all advanced their own approaches. The question is no longer whether the U.S. will regulate crypto markets, but how — and which agency will lead.

Below we dive deep into what is happening, how the proposed regulatory shift would work in practice, and why it matters for innovation, markets, investors, and global competition. We analyze the historical evolution that brought us to this moment, detail the mechanics of the proposed legislation, analyze its implications for different market participants, assess the risks and challenges ahead, and situate the U.S. approach within the global regulatory landscape.

Historical Overview: How We Got Here

The Origins of Crypto Regulatory Ambiguity

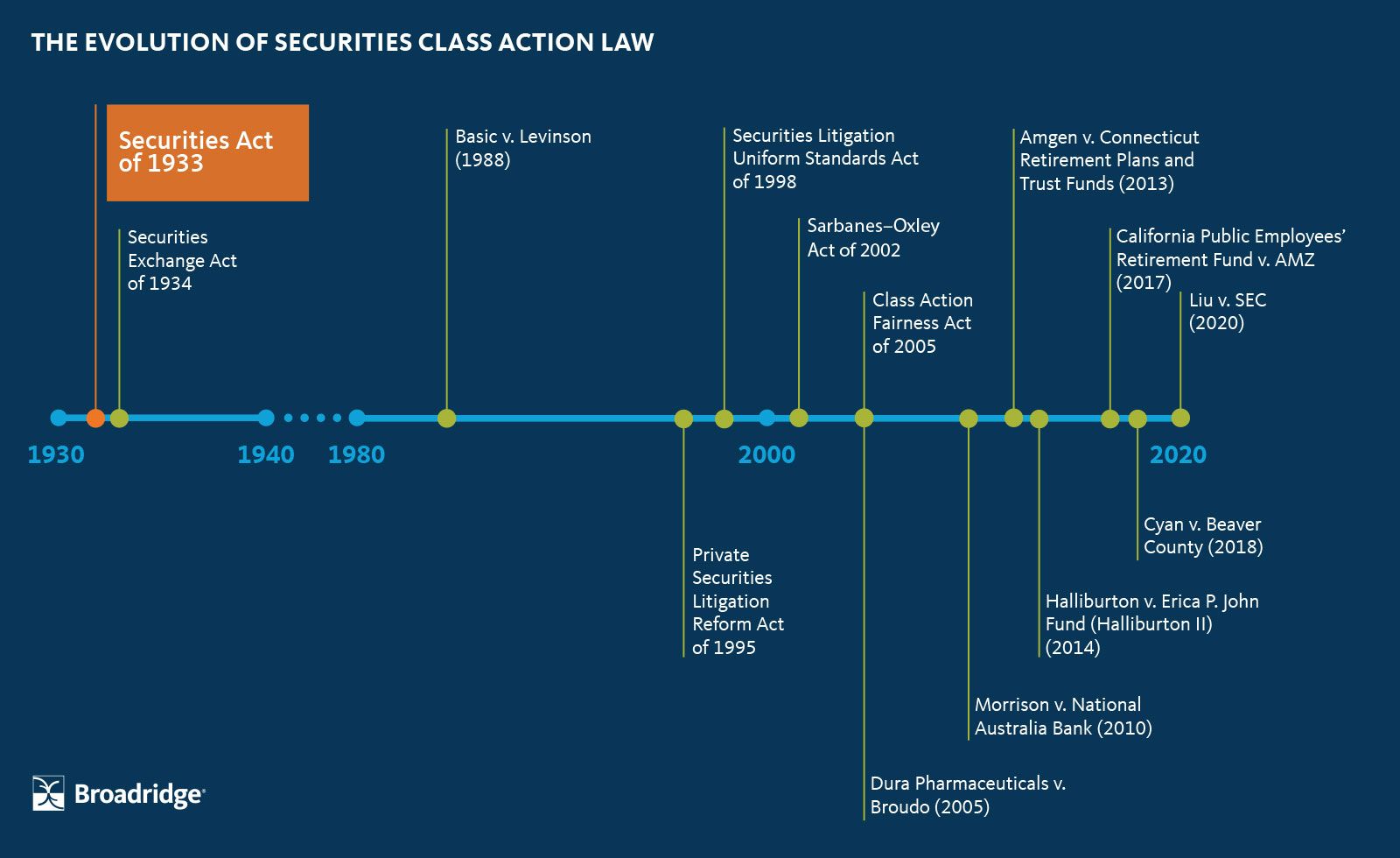

The regulatory confusion surrounding cryptocurrencies stems from a fundamental mismatch: digital assets emerged in 2009 with Bitcoin, but the primary laws governing them date to the 1930s and 1940s. The Securities Act of 1933, the Securities Exchange Act of 1934, and the Commodity Exchange Act of 1936 were designed for a world of physical stock certificates, grain futures, and centralized trading floors. They did not contemplate decentralized, peer-to-peer networks that blur the lines between commodities, currencies, securities, and payment systems.

The Commodity Futures Modernization Act of 2000 set important precedent by deregulating certain over-the-counter derivatives and exempting some digital financial instruments from traditional commodity regulation. The law established the CFTC's jurisdiction over commodity futures and options, while the SEC maintained authority over securities. But crypto assets existed in neither category clearly. Were Bitcoin transactions securities offerings? Commodity trades? Money transmissions? All three?

For years, this ambiguity persisted with little consequence. Crypto markets remained small, niche, and largely retail-focused. Regulators adopted a wait-and-see approach, allowing the industry to develop organically while issuing occasional warnings about fraud and risks. That began to change after 2017, when the initial coin offering (ICO) boom drew mainstream attention and billions in investment capital.

The SEC's Enforcement-Led Approach

The SEC moved first and most aggressively. Under various administrations, the agency applied the Howey test — a 1946 Supreme Court standard for determining what constitutes an investment contract — to assert that most tokens sold through ICOs were unregistered securities. This led to a wave of enforcement actions against token issuers, forcing many projects to register with the SEC, return investor funds, or pay steep fines.

The agency's stance intensified under Chair Gary Gensler, who took office in 2021. Gensler, a former MIT blockchain professor, argued that most crypto tokens are securities and that existing securities laws apply robustly to digital assets. He rejected calls for new legislation, insisting that "the crypto industry's record of failures, frauds, and bankruptcies is not because we don't have rules or because the rules are unclear", but rather because firms refuse to comply with established law.

This approach culminated in high-profile lawsuits against major exchanges. The SEC sued Coinbase in 2023, alleging it operated as an unregistered securities exchange, broker, and clearing agency. It similarly sued Binance, Kraken, and numerous other platforms. The agency's message was clear: comply with securities laws or face enforcement.

The CFTC's Parallel Jurisdiction

The CFTC took a different approach. While the SEC focused on whether tokens were securities, the CFTC asserted jurisdiction over Bitcoin and Ethereum as commodities, particularly in the derivatives markets. The agency took the position that digital assets like Bitcoin were commodities subject to the Commodity Exchange Act when traded on futures and options markets.

The CFTC's enforcement efforts focused on derivatives exchanges offering unregistered products. In 2023, the agency charged Binance, founder Changpeng Zhao, and former chief compliance officer Samuel Lim with operating an illegal digital asset derivatives exchange and willfully evading U.S. law. The settlement required Binance to pay nearly $3 billion, including a record $1.35 billion civil monetary penalty to the CFTC. It marked the largest recovery the agency had ever secured.

The following year brought even larger recoveries. The CFTC's settlement with FTX and Alameda Research required $12.7 billion in restitution and disgorgement, the largest sanctions in CFTC history. These massive cases demonstrated the agency's enforcement capabilities but also raised questions about whether it had sufficient resources to oversee a vastly expanded mandate.

Overall, 47 of the CFTC's 96 enforcement actions in fiscal year 2023 involved digital assets, representing more than 49 percent of all cases filed. By 2024, digital asset matters generated nearly 75 percent of the agency's monetary relief, totaling $17 billion. The CFTC had become a major crypto enforcer despite lacking explicit authority over spot markets.

The Push for Legislative Solutions

The regulatory overlap and uncertainty prompted calls for congressional action. Industry participants argued that dual regulation created impossible compliance burdens. Token issuers faced the risk that the same asset could be classified as a security by the SEC and a commodity by the CFTC depending on how and where it was sold. Exchanges struggled to determine which rules applied to which products.

Early legislative efforts made limited progress. Senators Kirsten Gillibrand and Cynthia Lummis introduced the Responsible Financial Innovation Act in 2022, a comprehensive bill to establish clear crypto regulations, but it never advanced beyond committee discussions. Other proposals similarly stalled amid partisan divisions and lobbying from both the crypto industry and consumer protection advocates.

The breakthrough came in the House. Representatives Glenn Thompson and Patrick McHenry championed the Financial Innovation and Technology for the 21st Century Act (FIT21), which sought to establish clear jurisdictional boundaries between the SEC and CFTC. The bill proposed that digital assets meeting decentralization standards would be regulated as commodities by the CFTC, while those controlled by centralized entities would remain securities under SEC oversight.

FIT21 passed the House in May 2024 by a vote of 279-136, with 71 Democrats joining Republicans in support. It marked the first time comprehensive crypto legislation had cleared a chamber of Congress. However, the Senate took no action on the bill, and it died at the end of the congressional session.

The House tried again in 2025 with the CLARITY Act, a refined version of FIT21. Passed in July 2025 with 294 votes in favor, including 78 Democrats, the legislation demonstrated even stronger bipartisan support. But it still required Senate action to become law.

The Trump Factor

The political landscape shifted significantly with President Donald Trump's return to office in January 2025. Having previously expressed skepticism about cryptocurrencies, Trump reversed course and vowed to make America the "crypto capital of the planet". His administration actively lobbied Congress to pass comprehensive crypto legislation before the August 2025 recess.

This pressure bore fruit. In July 2025, Congress passed and Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), establishing the first federal framework for payment stablecoins. The law marked a historic milestone: the first major crypto legislation to become law in the United States.

The Trump administration's enthusiasm for crypto regulation stemmed partly from ideological alignment with the industry's focus on financial innovation and deregulation. But it also reflected practical concerns. Without clear rules, the U.S. risked losing its competitive edge to jurisdictions like the EU, Singapore, and the UAE that were actively courting crypto businesses with regulatory certainty.

The administration endorsed giving the CFTC primary authority over spot crypto markets. Officials argued the agency's principles-based approach and focus on market integrity made it better suited than the SEC for overseeing trading platforms and commodity transactions. Critics, however, noted that the president's family held significant personal investments in crypto ventures, raising conflict-of-interest concerns.

What is the Draft Legislation?

The Boozman-Booker Discussion Draft

The November 2025 draft represents months of quiet bipartisan negotiation between Senate Agriculture Committee Chairman John Boozman, an Arkansas Republican, and Senator Cory Booker, a New Jersey Democrat. Unlike the House's CLARITY Act, which covers both SEC and CFTC jurisdiction, the Senate Agriculture Committee's draft focuses specifically on the CFTC's new authorities. It will eventually need to merge with separate legislation from the Senate Banking Committee, which oversees the SEC, to create a comprehensive framework.

The timing is deliberate. The draft builds upon the House CLARITY Act while addressing concerns raised by Democrats and some moderate Republicans about enforcement capacity and consumer protection. Senator Booker noted that the discussion draft is "a first step" and significant work remains before advancing the legislation out of committee, particularly regarding resources for the CFTC, preventing regulatory arbitrage, and ensuring guardrails against corruption.

Key Provisions and Definitions

At the heart of the legislation is a formal legal definition of "digital commodity". The bill describes digital commodities as fungible digital assets that can be exclusively possessed and transferred person-to-person without necessary reliance on an intermediary, and are recorded on a public, distributed blockchain or similar decentralized system. This definition deliberately excludes most tokenized securities while capturing Bitcoin, Ethereum, and similar decentralized cryptocurrencies.

The definition matters enormously because it determines regulatory jurisdiction. Assets classified as digital commodities would fall under CFTC oversight for spot trading, meaning the agency would regulate how they are bought, sold, and exchanged on trading platforms. Assets that do not meet the digital commodity definition — particularly those that represent ownership stakes, profit-sharing rights, or other characteristics of traditional securities — would remain under SEC jurisdiction.

The draft explicitly protects self-custody rights, a priority for the crypto community. Individuals could hold and transact digital assets directly through hardware or software wallets without being treated as money transmitters under federal law. Software developers would also gain protection from regulation simply for publishing code or running blockchain infrastructure, though the draft clarifies this is "not a safe harbor for operating DeFi interfaces."

Registration Requirements and Market Structure

The bill would establish a formal registration system for digital commodity trading platforms, similar to how traditional commodity exchanges must register with the CFTC. Platforms facilitating spot trading in Bitcoin, Ethereum, and other digital commodities would need to register and comply with rules on anti-fraud measures, recordkeeping, fund segregation, and dispute resolution. This represents a fundamental shift: currently, crypto exchanges operate largely outside the traditional regulatory perimeter for commodity markets.

Separate registration frameworks would apply to brokers and dealers in digital commodities. The bill includes bracketed sections — legislative shorthand indicating unresolved policy questions — around whether the CFTC should have broad exemption powers for certain types of brokers or dealers. This remains a point of negotiation, with industry advocates seeking flexibility for smaller market participants while consumer protection advocates want comprehensive oversight.

Customer protection rules would require trading platforms to segregate customer funds from the platform's own operational money, preventing the type of commingling that contributed to FTX's collapse. Platforms would need clear disclosure requirements for retail investors, making explicit the risks of digital commodity trading, custody arrangements, insurance coverage (if any), and potential conflicts of interest.

The bill creates a 270-day transition period after enactment, allowing existing operators to continue functioning while awaiting registration approval. This gradual implementation aims to prevent market disruption while ensuring firms have adequate time to build compliance infrastructure.

Funding and Resources

Recognizing the CFTC's limited resources, the draft proposes a dedicated funding stream for the new spot market regime. Registration fees collected from digital commodity platforms, brokers, and dealers would go directly to the CFTC without requiring further congressional appropriation. This follows the model established by the FIT21 and CLARITY Acts, which proposed capping CFTC fee revenue at $40 million annually.

The resource question looms large in the debate. The SEC employs approximately 4,500 staff members focused on securities regulation, enforcement, examinations, and rulemaking. The CFTC, by contrast, has roughly 700 employees overseeing all U.S. commodity derivatives markets. Critics worry that adding oversight of the massive spot crypto market — valued in the trillions of dollars with millions of retail participants — could overwhelm the smaller agency.

Senator Booker's statement acknowledged these concerns directly, noting he is "specifically concerned about the lack of resources and the bipartisan commissioners at the CFTC". The issue may become a key negotiating point as the bill advances, with Democrats likely to demand substantial funding increases and staffing commitments as a condition for their support.

Relationship with SEC Authority

The draft requires coordination between the CFTC and SEC through joint rulemaking on overlapping issues. This includes portfolio margining of securities and digital commodities, oversight of intermediaries that operate in both markets, and establishment of the boundaries between each agency's jurisdiction. The coordination mandates echo provisions in the Dodd-Frank Act, which required similar cooperation between agencies after the 2008 financial crisis.

Securities-classified tokens — those meeting the Howey test as investment contracts — would remain under SEC jurisdiction for both primary issuance and secondary trading. The draft acknowledges that some digital assets may start as securities (when first sold in a centralized offering) but later transition to commodities (once the underlying network achieves sufficient decentralization). The agencies would need to develop joint guidance on how and when such transitions occur.

Some sections include bracketed minority views from Democratic committee members, indicating disagreement over which committee has jurisdiction over certain provisions. For instance, Democrats on the Agriculture Committee believe provisions on blockchain developer immunity properly belong under the Banking Committee's oversight. These jurisdictional disputes will need resolution before the bill advances.

DeFi: The Unresolved Question

Perhaps the draft's most notable feature is what it leaves unanswered about decentralized finance (DeFi). The entire section on DeFi oversight currently reads "Seeking further feedback," with numerous bracketed provisions indicating ongoing debate. DeFi protocols — which enable peer-to-peer trading, lending, and other financial services without traditional intermediaries — present unique regulatory challenges.

Should DeFi protocols themselves be subject to registration if they facilitate digital commodity trading? What about the developers who build them? The liquidity providers who fund them? The governance token holders who vote on protocol changes? These questions lack clear answers in traditional commodity or securities law, and legislators are still grappling with how to address them without stifling innovation or driving development offshore.

The draft's caution on DeFi reflects genuine uncertainty about the right regulatory approach. Overly broad rules could make it impossible to operate decentralized protocols from the U.S., pushing innovation to friendlier jurisdictions. But exempting DeFi entirely could create massive regulatory loopholes, allowing billions of dollars in transactions to occur beyond the reach of anti-fraud, anti-money laundering, and consumer protection rules.

How Will It Work in Practice?

The New Regulatory Architecture

If enacted, the legislation would create a fundamentally different regulatory landscape for digital assets. The CFTC would gain explicit statutory authority to regulate spot digital commodity markets, moving beyond its current jurisdiction over only derivatives. This expansion would require the agency to build out entirely new regulatory frameworks, examination programs, enforcement strategies, and industry guidance.

Digital commodity trading platforms would face a comprehensive set of obligations. They would need to register with the CFTC, implement anti-fraud and anti-manipulation controls, maintain detailed transaction records, segregate customer assets from firm capital, establish robust cybersecurity programs, adopt dispute resolution mechanisms, and provide clear disclosures to retail customers about risks, fees, and terms of service.

Broker-dealers would operate under separate rules tailored to their role as intermediaries. They would need to meet capital requirements ensuring they can fulfill customer obligations, implement supervisory systems monitoring employee conduct, manage conflicts of interest, and maintain records of all customer interactions and transactions. These requirements mirror, to some extent, the obligations already imposed on securities broker-dealers by the SEC, but would be adapted for the unique characteristics of digital commodities.

Classification and the Decentralization Question

The most consequential aspect of the new regime involves how tokens are classified. Under current law, classification often depends on subjective judgments about whether a token sale constitutes an investment contract. The new framework would establish more objective criteria, focusing on factors like network decentralization, control over governance, and the expectation of profits from others' efforts.

Bitcoin and Ethereum would clearly qualify as digital commodities given their high degree of decentralization. No single entity controls either network, both have distributed governance, and neither depends on a central issuer's efforts for value appreciation. Other established proof-of-work and proof-of-stake networks with sufficient validator distribution would likely also qualify.

Newer tokens present more complexity. A project might launch with a centralized team controlling most governance tokens, making it an investment contract (and thus a security) under SEC jurisdiction. Over time, as the team distributes tokens more broadly and implements decentralized governance, the project could transition to digital commodity status under CFTC oversight. The agencies would need to establish clear guidance on when and how such transitions occur.

Investor Protections and Disclosure

Disclosure requirements would mark a significant change for the crypto industry. Trading platforms would need to provide customers with detailed information about how assets are held, whether customer funds are insured or guaranteed (typically they are not), the platform's financial condition, potential conflicts of interest (such as proprietary trading), and comprehensive fee schedules.

These disclosures would need to be clear, prominent, and accessible to retail investors. The CFTC would likely require platforms to use plain English explanations rather than dense legal or technical jargon. Customers would need to affirmatively acknowledge understanding the risks before opening accounts, similar to the process for opening traditional brokerage accounts.

Custody and segregation rules aim to prevent another FTX-style collapse. Customer assets would need to be held separately from the platform's own funds, clearly identified as customer property, and protected from claims by the platform's creditors in bankruptcy. Regular attestations by independent auditors would verify that customer assets are fully reserved and accessible.

Transition Mechanics

The 270-day transition period would begin upon enactment. During this time, the CFTC would need to issue interim final rules establishing registration procedures, application requirements, compliance standards, and examination priorities. Existing platforms could continue operating while awaiting approval of their registration applications, creating a grandfathering mechanism that prevents market disruption.

Platforms would need to submit comprehensive registration applications including information about their organizational structure, key personnel, custody arrangements, cybersecurity systems, financial resources, and compliance programs. The CFTC would review applications, request additional information, conduct examinations of applicants' systems and controls, and grant or deny registration based on whether applicants meet statutory and regulatory standards.

Some firms might face difficult choices during the transition. Platforms currently offering both digital commodities and securities-classified tokens would need to either separate their operations into distinct entities (one registered with the CFTC, another with the SEC) or choose to focus on one asset class. Compliance costs could push smaller platforms to consolidate or exit the market.

Global Context and Cross-Border Issues

The U.S. framework would need to coordinate with international approaches, particularly the EU's MiCA regulation. Many crypto platforms operate globally, serving customers across multiple jurisdictions. A platform registered with the CFTC for U.S. customers might simultaneously operate under MiCA in Europe, FCA regulation in the UK, and MAS oversight in Singapore.

Cross-border coordination would address issues like information sharing between regulators, recognition of foreign regulatory approvals, and prevention of regulatory arbitrage. The legislation explicitly contemplates international harmonization efforts, though the specific mechanisms remain to be developed through agency rulemaking and bilateral or multilateral agreements.

The dollar-dominated nature of crypto markets gives the U.S. outsized influence. Stablecoins like USDC and USDT, which are pegged to the U.S. dollar and widely used in crypto trading, fall partly under U.S. regulatory jurisdiction regardless of where the issuing platform is located. This creates natural leverage for U.S. regulators to shape global standards through their domestic framework.

Why It Matters: Implications for Industry, Innovation & Markets

For the Crypto Industry: The End of Regulatory Uncertainty?

The industry has long argued that regulatory clarity would unlock innovation and investment. Without clear rules, many traditional financial institutions have stayed on the sidelines, unwilling to risk enforcement actions for entering gray-zone markets. Banks hesitated to custody crypto assets or offer crypto services to customers. Institutional investors limited their exposure. Payment processors avoided facilitating crypto transactions.

A clear CFTC framework could change this calculus. Banks could confidently offer custody services for digital commodities without fearing SEC enforcement for handling unregistered securities. Traditional exchanges could list digital commodity products alongside stocks and bonds. Pension funds and endowments could allocate to crypto assets as part of diversified portfolios. Payment networks could integrate digital commodities into their rails.

The explicit protection for self-custody matters enormously to the crypto community's philosophical foundations. Decentralization advocates view the ability to hold one's own keys — to control digital assets without relying on intermediaries — as fundamental to cryptocurrency's purpose. By codifying self-custody rights in federal law, the legislation signals that government regulation need not eliminate the peer-to-peer, trustless properties that make crypto distinctive.

Developer protections could spur open-source innovation. Currently, software developers face uncertainty about whether building DeFi protocols or other crypto infrastructure could subject them to money transmitter regulations or other legal liability. Clear safe harbors for pure development work — as opposed to operating platforms or services — would allow programmers to contribute to blockchain ecosystems without fear of inadvertent legal exposure.

However, the new regime would also impose substantial compliance costs. Registration with the CFTC requires building compliance departments, implementing surveillance systems, hiring legal and risk management staff, and submitting to regular examinations. Smaller platforms might struggle to afford these expenses, potentially leading to market consolidation as only well-funded exchanges can meet regulatory standards.

For Token Classification: Commodity vs. Security

The shift from security to commodity classification would transform token economics and market structure. Securities offerings require extensive disclosure, registration with the SEC, ongoing reporting obligations, and restrictions on trading. These requirements are expensive and time-consuming, which is why many token projects avoided the U.S. market entirely or limited token sales to accredited investors and offshore buyers.

Commodity classification would dramatically reduce these barriers. Digital commodities could be offered to U.S. retail investors without securities registration, though platforms would still need CFTC registration and customer protection rules would apply. Token issuers could list on multiple platforms simultaneously without navigating exchange-specific listing requirements. Secondary trading could occur more freely, increasing liquidity and price discovery.

Venture capital investment patterns would likely shift. VCs have been cautious about funding token projects given the risk that the SEC might later deem the tokens to be securities, subjecting investors to rescission liability. With clearer commodity classification, VC money could flow more freely to projects building on decentralized networks, potentially accelerating innovation in DeFi, Web3 applications, and blockchain infrastructure.

The classification framework would also affect how projects structure token distributions. Rather than conducting initial coin offerings that look like securities offerings, projects could launch tokens on functioning blockchains that meet decentralization criteria from day one, qualifying immediately as digital commodities. This could spur more responsible launch practices, as projects would need to demonstrate genuine decentralization rather than concentrating control in founding teams.

For Investor Protections: A Mixed Picture

Consumer advocates worry that shifting oversight to the CFTC could weaken investor protections. The agency has historically focused on institutional derivatives markets where participants are sophisticated and well-resourced. Retail investors in crypto spot markets may face different vulnerabilities, including less ability to assess platform risks, greater susceptibility to fraud, and fewer resources to pursue legal remedies.

The disclosure and custody requirements in the draft bill address some concerns. Mandatory fund segregation would prevent platforms from gambling with customer assets. Regular audits would verify that customer funds are fully reserved. Clear disclosures would inform investors about risks, fees, and terms. These protections mirror some aspects of securities regulation, though they are less comprehensive than the full investor protection regime the SEC applies.

Enforcement powers present another consideration. The SEC can bring fraud cases under securities laws that provide for treble damages and other strong remedies for investors. The CFTC's commodity fraud authority is robust but structured differently. Class action mechanisms, private rights of action, and the standard of proof required may differ depending on whether conduct is challenged as securities fraud or commodity fraud.

The CFTC's resource constraints raise concerns about examination frequency and enforcement capacity. With 700 employees overseeing all commodity derivatives markets plus the new spot crypto mandate, the agency may struggle to conduct regular examinations of every registered platform. Less frequent examinations mean problems could fester longer before detection, potentially allowing fraud or misconduct to cause substantial harm before regulators intervene.

For Market Structure: Exchanges, DeFi, and Tokenization

Cryptocurrency exchanges would face the most immediate operational changes. Major platforms like Coinbase, Kraken, and Gemini already operate with substantial compliance infrastructure, so CFTC registration may not fundamentally alter their business models. But the formal regulatory framework would provide legitimacy and legal certainty that could expand their services and customer base.

Offshore exchanges face a more difficult calculus. Platforms like Binance, which have limited or withdrawn U.S. operations due to regulatory uncertainty, would need to decide whether CFTC registration makes U.S. market re-entry worthwhile. The appeal of the massive U.S. market would be balanced against the costs of compliance, the risk of enforcement for past conduct, and the potential for other jurisdictions to offer more favorable terms.

DeFi protocols present the hardest question. The draft's silence on DeFi oversight leaves fundamental uncertainties unresolved. Automated market makers that facilitate peer-to-peer token swaps, lending protocols that enable borrowing against crypto collateral, and derivatives protocols that offer synthetic exposure to commodities all provide services similar to regulated exchanges and brokers. Should they be regulated similarly? How would enforcement work against protocols with no central operator?

The tension between innovation and regulation is most acute in DeFi. Heavy-handed regulation could make it impossible to offer decentralized services from the U.S., pushing development offshore and undermining American leadership in blockchain technology. But leaving DeFi entirely unregulated could create systemic risks, enable massive fraud or market manipulation, and undermine the protections established for centralized platforms.

Tokenization of traditional assets — stocks, bonds, real estate, commodities — would likely accelerate under the new framework. If the regulatory treatment of tokenized securities becomes clear (SEC oversight) while the infrastructure for trading digital assets becomes more robust (CFTC-regulated platforms), financial institutions might move more aggressively to issue tokenized products. This could eventually transform how securities are issued, transferred, and settled.

For Innovation: Unleashing Potential or Regulatory Burden?

Proponents argue that regulatory clarity itself is the most important innovation catalyst. Developers can build without fear of enforcement actions. Startups can raise capital from U.S. investors. Large financial institutions can enter the market without legal risk. This combination could drive the next wave of crypto adoption, much as clear internet regulations in the 1990s and 2000s enabled web-based services to flourish.

The U.S. has historically led in financial and technological innovation through its combination of liquid capital markets, entrepreneurial culture, strong rule of law, and clear property rights. Extending that framework to digital assets could cement American dominance in blockchain technology, cryptocurrency infrastructure, and crypto-financial services. The alternative — regulatory hostility or prolonged uncertainty — risks allowing other countries to capture leadership in what many see as a transformative technology.

Critics counter that excessive regulation could stifle experimentation. Registration requirements, compliance costs, and prescriptive rules about market structure might freeze the industry in its current form, preventing the type of rapid iteration that has characterized crypto's first decade. The most innovative projects might simply launch offshore, beyond U.S. regulatory reach, depriving American investors and developers of participation.

The impact on token design could cut both ways. Clear rules about what qualifies as a digital commodity versus a security would shape how projects structure governance, distribute tokens, and implement economic incentives. Some designs might become more common because they fit regulatory requirements. Others might be abandoned as noncompliant. Whether this channeling effect helps or hinders innovation depends on whether the regulatory categories align well with productive uses of the technology.

Risks & Challenges

Institutional and Political Hurdles

The CFTC's resource constraints represent the most frequently cited concern. Senator Booker explicitly flagged this issue in his statement accompanying the draft release. With approximately 700 employees, the agency currently oversees derivatives markets for agricultural commodities, metals, energy products, interest rates, equities, and foreign exchange. Adding oversight of the entire spot cryptocurrency market — potentially valued in the trillions of dollars with millions of retail participants — would multiply the agency's responsibilities.

The funding mechanism in the bill — registration fees capped at $40 million annually — may not suffice. The SEC spends hundreds of millions of dollars annually on examinations and enforcement related to broker-dealers, exchanges, and trading platforms. The CFTC would need to build similar capacity for crypto markets, including hiring specialized staff who understand blockchain technology, developing surveillance systems to detect market manipulation, and conducting examinations of dozens of registered platforms.

Political obstacles loom. Senator Elizabeth Warren and some progressive Democrats have voiced strong opposition to shifting oversight to the CFTC, arguing it would weaken investor protection. Warren has described crypto as rife with fraud, money laundering, and abuse, and she prefers maintaining SEC authority with its stronger enforcement tools and investor protections.

President Trump's personal crypto investments create political complications. Critics argue his family's holdings in crypto ventures represent conflicts of interest that could bias his administration's regulatory preferences. Democrats may demand strong conflict-of-interest provisions, independent oversight of rulemaking, or other safeguards as a condition for supporting the legislation.

Classification Risks and Residual Ambiguity

Despite the effort to establish clear definitions, classification disputes would inevitably continue. The line between digital commodities and securities depends on factors like decentralization, control, and the expectation of profits from others' efforts. These factors can be ambiguous and may change over time as projects evolve.

A token might be issued initially through a centralized offering that constitutes a security, but later transition to commodity status as the network decentralizes. The legislation contemplates this possibility but leaves critical details to agency rulemaking. When exactly does the transition occur? Who determines whether sufficient decentralization has been achieved? What happens if the agencies disagree?

The decentralization test itself presents challenges. How many validators or nodes are required? What if control is theoretically distributed but effectively concentrated through voting coalitions or economic incentives? What about Layer 2 protocols built on top of decentralized base layers? These questions lack obvious answers and will require agencies to develop detailed, technically sophisticated guidance.

Projects might structure themselves specifically to qualify as digital commodities, potentially gaming the rules. A project could distribute tokens widely and implement decentralized governance on paper while maintaining de facto control through other mechanisms. Detecting and addressing such arrangements would require regulatory judgment calls that could themselves become sources of litigation and uncertainty.

Compliance Costs and Market Fragmentation

Registration and compliance requirements would impose substantial costs, particularly on smaller platforms. Building anti-fraud surveillance systems, maintaining detailed transaction records, implementing fund segregation, conducting regular audits, and staffing compliance departments all require significant capital investment. Platforms might need to spend millions of dollars annually to maintain regulatory compliance.

These costs could lead to market consolidation. Large, well-funded exchanges like Coinbase could absorb compliance expenses as a cost of doing business, potentially strengthening their competitive position. Smaller platforms with lower trading volumes might find the costs prohibitive, forcing them to exit the market, merge with larger competitors, or move operations offshore.

State-federal conflicts could create additional complexity. Some states have enacted their own cryptocurrency regulations through money transmitter laws, consumer protection statutes, and state securities rules. A platform registered with the CFTC for digital commodity trading might still need to comply with varying state requirements, creating a patchwork of overlapping obligations. The draft bill does not preempt state law, leaving this tension unresolved.

Cross-border issues compound the challenges. A U.S.-based platform with CFTC registration might face different requirements in Europe under MiCA, in the UK under FCA rules, and in Asia under various regional frameworks. Maintaining compliance with multiple regulatory regimes simultaneously requires sophisticated legal infrastructure and could force platforms to fragment their operations geographically.

Innovation and Offshore Migration Risks

Restrictive regulations could push innovation beyond U.S. borders. If compliance costs are too high or rules too restrictive, developers and startups might simply locate in more favorable jurisdictions. Countries like Singapore, Switzerland, and the UAE have actively courted crypto businesses with clear rules, tax incentives, and streamlined approval processes.

The DeFi problem is particularly acute. If DeFi protocols face the same registration and compliance requirements as centralized platforms, developers may conclude that building decentralized systems from the U.S. is impractical. They could relocate to jurisdictions with DeFi-friendly approaches or design their protocols to be truly decentralized and ungovernable, operating beyond the reach of any regulatory system.

Token issuers might launch offshore to avoid classification disputes and compliance burdens. Rather than navigating the complexities of commodity versus security classification in the U.S., projects could conduct token sales exclusively to non-U.S. investors, establish operations in crypto-friendly jurisdictions, and build global user bases that happen to exclude Americans. This would deprive U.S. investors and developers of participation in potentially valuable innovations.

The risk of regulatory overreach extends to traditional financial innovation as well. If banks find crypto custody too complicated or risky under the new framework, they might avoid offering such services despite customer demand. If payment networks decide CFTC compliance is too burdensome, they might refuse to facilitate crypto transactions. The result could be a regulatory regime that theoretically allows crypto innovation but practically makes it too difficult to pursue.

Enforcement Gaps and Systemic Risks

Former CFTC Chair Timothy Massad warned that the new regime could create enforcement gaps, particularly around consumer protection. The CFTC's enforcement focus has historically centered on market manipulation, fraud in derivatives trading, and registration violations. Its consumer protection authority in spot commodity markets is less developed than the SEC's securities investor protection framework.

The agency would need to build out new enforcement capabilities focused on retail investors. This includes systems for receiving and investigating customer complaints, examining platforms for compliance with disclosure and custody requirements, detecting Ponzi schemes and other fraud, and pursuing cases that often involve small individual losses but large aggregate harm.

Systemic risk concerns persist. Crypto markets have experienced spectacular failures, from the Mt. Gox hack to the FTX collapse. The new framework addresses some vulnerabilities through fund segregation and custody requirements. But interconnections between platforms, opacity in DeFi protocols, and the potential for rapid contagion when confidence erodes all pose ongoing systemic risks that commodity regulation may not fully address.

The global nature of crypto markets complicates enforcement. Bad actors can operate from jurisdictions beyond U.S. reach, serve American customers through VPNs and proxy services, and move assets across chains and through mixers to evade detection. The CFTC's international coordination capabilities would need substantial enhancement to effectively police global crypto markets that touch U.S. investors.

Global Perspective: How U.S. Fits With the World

The EU's MiCA: A Comprehensive Model

The European Union's Markets in Crypto-Assets Regulation represents the most comprehensive crypto regulatory framework globally. MiCA became fully applicable across all 27 EU member states on December 30, 2024, establishing harmonized rules for crypto-asset issuers and service providers. The regulation covers authorization requirements, operating conditions, consumer protection measures, and market abuse prevention.

MiCA classifies digital assets into three categories: asset-referenced tokens (stablecoins backed by baskets of assets), e-money tokens (stablecoins pegged to single fiat currencies), and other crypto-assets (including utility tokens and unclassified digital assets). Each category faces tailored requirements. Stablecoin issuers must maintain liquid reserves, publish regular disclosure, meet capital requirements, and undergo supervision by the European Banking Authority if they reach certain size thresholds.

Crypto-asset service providers (CASPs) must obtain licenses from national regulators to operate in the EU. Licensed CASPs benefit from passporting rights, allowing them to operate across all member states without separate authorizations in each country. Services covered include exchange operation, custody, portfolio management, investment advice, and order execution. Requirements include governance standards, operational resilience, customer protection, and market abuse prevention.

MiCA's implementation included transitional periods allowing existing providers time to adapt. Member states could adopt grandfathering provisions permitting service providers already operating under national law to continue for up to 18 months while seeking MiCA authorization. This gradual approach aims to prevent market disruption while ensuring compliance.

Early impacts have been significant. Several non-compliant stablecoins have been delisted from European exchanges as CASPs move to restrict access to tokens issued by entities without proper EU authorization. The European Securities and Markets Authority (ESMA) has stated that restrictions on non-MiCA compliant stablecoins should be complete, with full compliance expected by the end of Q1 2025.

UK, Singapore, and Asian Approaches

The United Kingdom's Financial Conduct Authority has developed a "same risk, same regulation" model for crypto assets. Crypto firms must meet standards similar to traditional financial institutions, including capital requirements, governance standards, and consumer protection measures. The approach seeks to integrate crypto into the existing financial regulatory framework rather than creating an entirely new regime.

The UK is developing specific rules for stablecoins, following the success of the GENIUS Act in the U.S. and MiCA in the EU. The FCA has also launched sandboxes for innovative crypto products, allowing firms to test new services under regulatory supervision before full market launch. This balanced approach aims to foster innovation while maintaining oversight and protecting consumers.

Singapore's Monetary Authority (MAS) has established a sophisticated framework emphasizing reserve requirements, regular audits, and institutional-grade custody for crypto service providers. The Payment Services Act regulates crypto payment services, while the Securities and Futures Act covers security tokens. MAS has finalized stablecoin frameworks with particular focus on systemic stablecoins that could impact financial stability.

Singapore actively courts crypto businesses through clear rules, reasonable licensing timelines, and business-friendly tax treatment. Major exchanges and projects have established operations in Singapore, attracted by regulatory certainty and government support for financial technology innovation. The approach balances openness to innovation with robust anti-money laundering standards and consumer protection.

Hong Kong has launched regulatory sandboxes for digital assets, allowing new products to be tested under supervision. The Securities and Futures Commission licenses crypto exchanges and requires them to meet standards for custody, cybersecurity, and investor protection. Hong Kong's approach reflects its position as a major financial center seeking to maintain relevance in the digital asset era.

Japan, one of the earliest countries to regulate cryptocurrency exchanges, has mature frameworks covering exchange licensing, stablecoin issuance, and custody requirements. The Financial Services Agency oversees crypto businesses, requiring registration, regular audits, and compliance with anti-money laundering rules. Japan's experience — including lessons from the Mt. Gox collapse — has informed its cautious but sophisticated regulatory approach.

The United Arab Emirates: Aggressive Competition

The UAE, particularly Dubai, has positioned itself as a global crypto hub through aggressive regulatory innovation and business incentives. The Dubai Virtual Assets Regulatory Authority (VARA) has established clear rules for crypto businesses while offering favorable tax treatment and streamlined approval processes.

VARA's framework aligns with many MiCA principles while maintaining flexibility to attract businesses. Licensed entities can offer a full range of crypto services including exchange operation, custody, advisory services, and lending. Dubai's approach combines clear regulation with business-friendly policies, creating an environment attractive to both crypto startups and established firms seeking operational flexibility.

The UAE's success in attracting crypto businesses highlights the competitive dynamics of global regulation. Countries that establish clear, balanced frameworks early can capture significant market share as businesses relocate to favorable jurisdictions. The UAE's gains have come partly at the expense of regions with uncertain or hostile regulatory environments.

Implications for International Harmonization

The diversity of global approaches creates both challenges and opportunities. Crypto markets are inherently global — tokens trade 24/7 across borders, users access platforms from anywhere with internet, and capital flows freely across jurisdictions. Divergent regulations create compliance complexity but also allow for regulatory arbitrage and experimentation.

If the U.S. establishes a CFTC-led framework while the EU maintains MiCA and Asia pursues various approaches, platforms will need to navigate multiple regimes simultaneously. This could be manageable for large, well-resourced firms but prohibitive for smaller startups. The result might be a crypto market dominated by a few global platforms that can afford comprehensive compliance while smaller, regional players serve local markets.

International coordination efforts would benefit from U.S. leadership. The Financial Stability Board, International Organization of Securities Commissions, and other international bodies have been developing high-level principles for crypto regulation. The U.S. adopting a clear framework would allow American regulators to actively shape global standards rather than reacting to frameworks developed elsewhere.

Conversely, if the U.S. lags in establishing clear rules, other jurisdictions may set the template. MiCA is already influencing discussions in Latin America, Africa, and other regions considering crypto regulation. The standard-setting role could shift to Europe, diminishing U.S. influence over the evolution of global digital asset markets.

What to Watch: Indicators & Timeline

Legislative Milestones and Timeline

The Boozman-Booker draft represents the first step in a lengthy legislative process. The Senate Agriculture Committee will solicit feedback from stakeholders, hold hearings to examine provisions and receive testimony, conduct markup sessions where committee members can propose amendments, and eventually vote on whether to advance the bill to the full Senate.

Parallel action in the Senate Banking Committee remains essential. While the Agriculture Committee draft addresses CFTC oversight, a companion bill from the Banking Committee must address SEC jurisdiction over securities-classified tokens, issuer requirements, and coordination between agencies. The Banking Committee released a discussion draft of the Responsible Financial Innovation Act (RFIA) in July 2025, but substantial work remains before the two committees' bills can be merged.

The timeline for Senate passage has repeatedly slipped. President Trump initially sought legislation by August 2025, but that deadline passed with only the GENIUS Act (stablecoin legislation) enacted. Subsequent targets of September and November also came and went. Current predictions suggest possible action by year-end 2025 or early 2026.

If the Senate eventually passes its version, differences with the House CLARITY Act would need reconciliation. This could occur through a formal conference committee that negotiates a compromise bill, or through one chamber accepting the other's version with modifications. Given the technical complexity and political sensitivities involved, reconciliation could take months.

Industry Indicators to Monitor

Registration patterns would reveal market responses to the new framework. If enacted, observers should track how many exchanges register with the CFTC during the transition period, which platforms choose to focus solely on digital commodities versus maintaining both commodity and security offerings, and whether new entrants launch platforms specifically designed for the CFTC regime.

Token classification decisions would provide crucial data on how the commodity versus security framework functions in practice. Key questions include which tokens the CFTC and SEC accept as digital commodities, how projects structure token launches to qualify for commodity treatment, and whether classification disputes lead to litigation that clarifies or muddies the legal standards.

Enforcement actions would demonstrate regulatory priorities and capacity. Early enforcement would indicate whether the CFTC focuses primarily on fraud prevention, market manipulation, registration compliance, or other priorities. The frequency and scale of enforcement also would reveal whether the agency has adequate resources or is overwhelmed by its new mandate.

Market metrics including digital asset prices, trading volumes, and capital flows would reflect industry confidence. If regulatory clarity drives institutional adoption, we might see increased trading volumes on regulated platforms, growth in crypto-related financial products, and capital flows from institutional investors into digital assets. Conversely, declining volumes or capital outflows could signal that compliance costs exceed expected benefits.

VC investment trends would indicate whether the framework encourages innovation. A surge in U.S.-based crypto startup funding would suggest that regulatory clarity is unlocking investment. Continued preference for offshore projects or declining crypto VC activity might indicate that regulations remain too uncertain or burdensome.

Market Signals and Global Positioning

International developments would shape U.S. competitiveness. Key questions include whether major platforms expand operations in the U.S. or shift to other jurisdictions, whether token issuers choose to launch in the U.S. or avoid American markets, and whether U.S. leadership in blockchain technology strengthens or erodes.

Global listings of tokens and crypto products would demonstrate market integration or fragmentation. Do tokens launched under U.S. rules also list on European platforms under MiCA? Do Asian exchanges accept CFTC-regulated assets? The answers would reveal whether regulatory frameworks are compatible or create silos that fragment global markets.

Stablecoin adoption would indicate the practical impact of the GENIUS Act and potential crypto commodity regulations. Growth in U.S. dollar-denominated stablecoins issued by GENIUS-compliant entities would validate the regulatory approach. Migration to non-U.S. stablecoins or declining stablecoin usage could suggest regulatory overreach.

Developer activity metrics like GitHub commits to U.S.-based blockchain projects, attendance at American crypto conferences and hackathons, and location of blockchain startup headquarters would reveal whether the U.S. maintains its position as a center of crypto innovation. Brain drain to more favorable jurisdictions would be a troubling signal.

Failure Scenarios and Alternatives

If the legislation fails to advance, the status quo of regulatory uncertainty would persist. The SEC would continue asserting broad jurisdiction over most tokens as securities. The CFTC would maintain limited authority over derivatives but lack explicit spot market powers. Enforcement actions would continue defining boundaries through litigation rather than legislation.

Failure could also lead to regulatory fragmentation at the state level. Some states might pass their own comprehensive crypto frameworks, creating a patchwork of varying requirements similar to state-level data privacy regulations. This outcome would be costly for firms operating nationally and could disadvantage U.S. competitiveness globally.

Partial legislative success remains possible. Congress could pass only certain provisions, such as CFTC funding enhancements or stablecoin regulations, while leaving broader market structure questions unresolved. This incremental approach might build momentum for future action while addressing the most urgent issues.

Agency rulemaking could partly fill the gap if legislation stalls. The CFTC and SEC could issue joint guidance clarifying their respective jurisdictions, establishing coordination procedures, and providing greater regulatory certainty through administrative action rather than legislation. While less comprehensive than statutory reform, improved agency cooperation could reduce uncertainty.

Conclusion: A Defining Moment for Digital Asset Markets

The proposed shift of cryptocurrency oversight from the SEC to the CFTC represents one of the most consequential regulatory changes in the brief history of digital assets. If enacted, the Boozman-Booker framework would establish the first comprehensive federal structure for spot digital commodity markets, resolve years of jurisdictional uncertainty, and position the United States to compete globally in blockchain technology and crypto-financial services.

The implications extend far beyond regulatory bureaucracy. Token classification as commodities rather than securities would transform how projects raise capital, design governance structures, and interact with investors. Exchange registration would legitimize crypto trading platforms while imposing meaningful oversight and consumer protection. Clear rules for custody, disclosure, and operations would enable traditional financial institutions to enter crypto markets with confidence.

Yet significant uncertainties remain. The CFTC's resource constraints raise legitimate questions about whether the agency can effectively oversee the massive crypto market with its current staffing and budget. DeFi regulation remains largely unaddressed, leaving billions of dollars in decentralized transactions in legal limbo. Classification disputes would inevitably continue as projects test the boundaries between commodities and securities.

The global context adds urgency. The EU's MiCA framework has created regulatory clarity for European crypto markets, attracting businesses and establishing Europe as a potential standard-setter. Singapore, the UAE, and other jurisdictions have developed sophisticated approaches that balance innovation with oversight. The U.S. risks losing its historical leadership in financial innovation if it continues to lag in establishing clear rules.

For participants in crypto markets — whether developers building blockchain protocols, entrepreneurs launching token projects, investors allocating to digital assets, or traditional financial institutions considering crypto services — the next several months will be pivotal. The rules established now will define how digital asset markets evolve over the coming decade. They will determine whether crypto reaches mainstream adoption or remains a niche asset class, whether innovation flourishes or moves offshore, and whether the U.S. maintains its position as the center of global finance or cedes ground to international competitors.

The draft legislation is precisely that — a draft. Substantial negotiations, amendments, and refinements lie ahead before any bill reaches the president's desk. Industry stakeholders will lobby for favorable provisions. Consumer advocates will push for stronger protections. Congressional members will seek to address constituent concerns and political considerations. The final product, if one emerges, may differ significantly from the current proposal.

What seems certain is that the era of regulatory ambiguity is ending. Whether through the Boozman-Booker framework, an alternative legislative approach, or a combination of statute and agency rulemaking, the U.S. will establish clearer rules for crypto markets. The question is not whether to regulate, but how — and whether the chosen approach will foster the innovation, competition, and investor protection that have historically characterized American financial markets.

For readers in the crypto ecosystem, this is a moment demanding attention, engagement, and preparedness. Follow legislative developments closely. Participate in comment processes. Prepare compliance infrastructure for likely requirements. Consider how different regulatory outcomes would affect business models and strategies. The decisions being made in Washington this year will shape the industry for years to come.

The cryptocurrency revolution has always been about more than technology. It has been about reimagining how value is stored, transferred, and governed. The regulatory framework emerging now will determine whether that revolution unfolds on American soil, under American rules, with American participation — or whether it takes shape elsewhere, with the U.S. relegated to the sidelines of one of the most transformative financial innovations of the digital age.