Crypto exchange Gemini launched something that would have seemed impossible just a few years ago: a credit card that automatically converts your everyday purchases into staked cryptocurrency, generating passive yields while you sleep.

The Gemini Solana Credit Card offers cardholders up to 4% back in SOL on purchases, with an innovative twist that sets it apart from traditional crypto rewards cards. For the first time, those SOL rewards can be automatically staked to earn up to 6.77% annual yield, effectively transforming routine spending into a compounding crypto investment vehicle.

This product represents more than just another rewards card in an increasingly crowded market. It signals the convergence of three previously separate domains: consumer payments, cryptocurrency rewards programs, and decentralized network staking mechanisms. When you buy gas with the Gemini Solana card, you are not simply earning cashback.

You are participating in a complex economic system where merchant fees subsidize token rewards, which are then automatically delegated to blockchain validators who secure the Solana network and share their earnings with you.

The implications extend far beyond the card itself. As Mizuho analysts noted, Gemini's credit card sign-ups ballooned from 8,000 in 2024 to nearly 31,000 by August 2025, demonstrating strong demand for products that bridge traditional finance and crypto-native yield generation.

According to Gemini's own data, users who held their Solana rewards for at least one year saw those holdings grow by 299.1% as of July 2025, though this reflects both staking rewards and significant SOL price appreciation during a bull market period.

Below we analyze the mechanics, benefits, risks, and future trajectory of crypto credit cards that integrate staking functionality.

In particular: how do these products actually work beneath the surface? What incentives drive exchanges to offer them, and what economic trade-offs do users accept when they adopt these cards? As regulatory frameworks evolve and technology advances, could everyday spending become a standard entry point into on-chain yield generation? And what happens when the inevitable crypto winter arrives, turning paper gains into real losses while users continue accumulating volatile assets with every purchase?

The State of Crypto Credit Cards Today: A Market Coming of Age

Before diving into the staking innovation, it is worth understanding the broader landscape of crypto credit cards and how they have evolved from niche products into mainstream offerings backed by major payment networks.

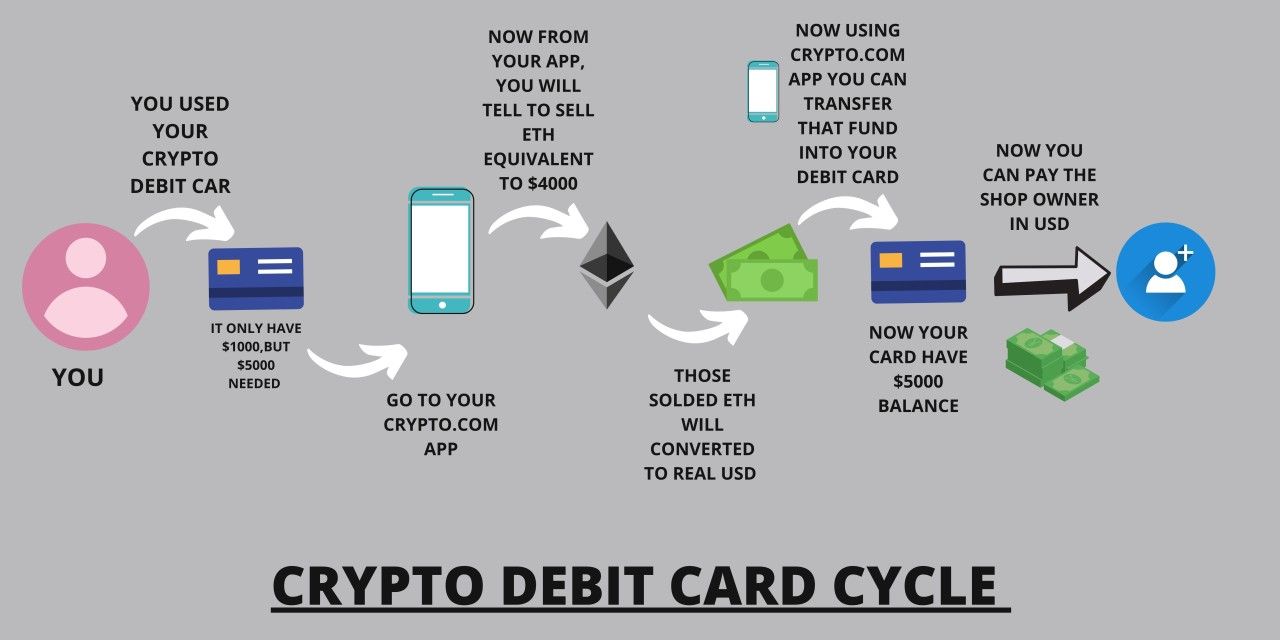

Crypto credit cards, in their current form, are conventional credit products issued by regulated banks that offer cryptocurrency as a reward mechanism instead of traditional cashback or points. Unlike debit cards that spend from crypto balances, these are true credit instruments with monthly billing cycles, interest charges on carried balances, and credit underwriting requirements. The cryptocurrency reward is typically calculated as a percentage of purchase amounts and deposited into the cardholder's account at the issuing exchange or custodian, usually within hours or days of the transaction.

The market has grown substantially in recent years, driven by several factors. First, cryptocurrency exchanges sought new user acquisition and retention strategies as trading volumes became increasingly competitive and regulatory pressures mounted. Credit cards offered a way to deepen customer relationships and increase lifetime value by encouraging daily engagement rather than sporadic trading activity.

Second, the rise of crypto-native infrastructure made it technically feasible to distribute token rewards in real time, calculate rewards in volatile assets, and manage the custody complications that would have been prohibitive just a few years earlier. Third, payment networks like Visa and Mastercard, along with partner banks, became comfortable with crypto-denominated rewards after years of experimentation with prepaid crypto cards.

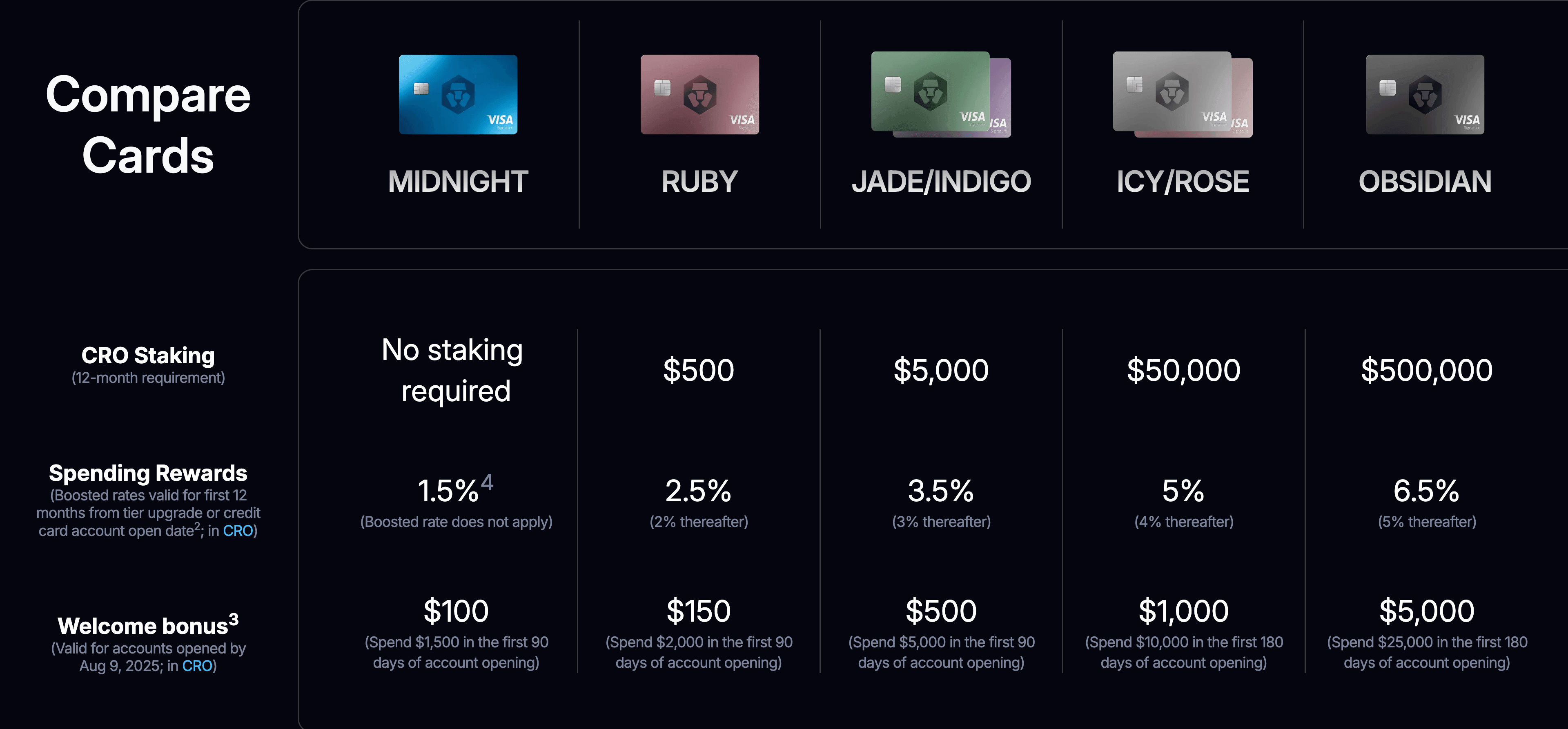

Among existing products, Crypto.com's card program stands as one of the most established examples. The platform offers multiple tiers of cards, with rewards structures tied to the amount of CRO tokens users stake on the platform. The highest tier cards historically offered up to 8% cashback, though these rates were reduced substantially in 2022 following market conditions, with current rates ranging from 1.5% to 6% depending on the tier.

The Crypto.com model requires users to lock up significant amounts of the native CRO token for six months to access premium benefits, ranging from $400 for the Ruby Steel tier to $400,000 for the Obsidian tier. This staking requirement serves multiple purposes: it creates financial commitment from users, reduces token circulating supply, and aligns user incentives with the platform's token economics.

Coinbase announced in June 2025 that it would launch the Coinbase One Card in partnership with American Express, offering up to 4% back in Bitcoin. The card, expected to launch in fall 2025, is exclusively available to Coinbase One subscription members and features tiered rewards based on the total value of assets held on the platform.

This approach represents a different strategy from Gemini's blockchain-specific cards, focusing instead on Bitcoin as a universal store of value while using subscription membership as the gating mechanism. Cardholders can repay their balances using crypto held on Coinbase, and Bitcoin rewards are not included on 1099 tax forms, though selling those rewards later would trigger taxable events.

Gemini itself has built a broader card program beyond Solana, having previously launched Bitcoin and XRP editions of its credit card. The core structure remains consistent: up to 4% back on gas, electric vehicle charging, and rideshare; 3% on dining; 2% on groceries; and 1% on other purchases. The cards carry no annual fees and no foreign transaction fees. What differentiates the Solana edition is the automatic staking feature, which Gemini introduced for the first time with this product, allowing users to earn an additional yield of up to 6.77% on their rewards.

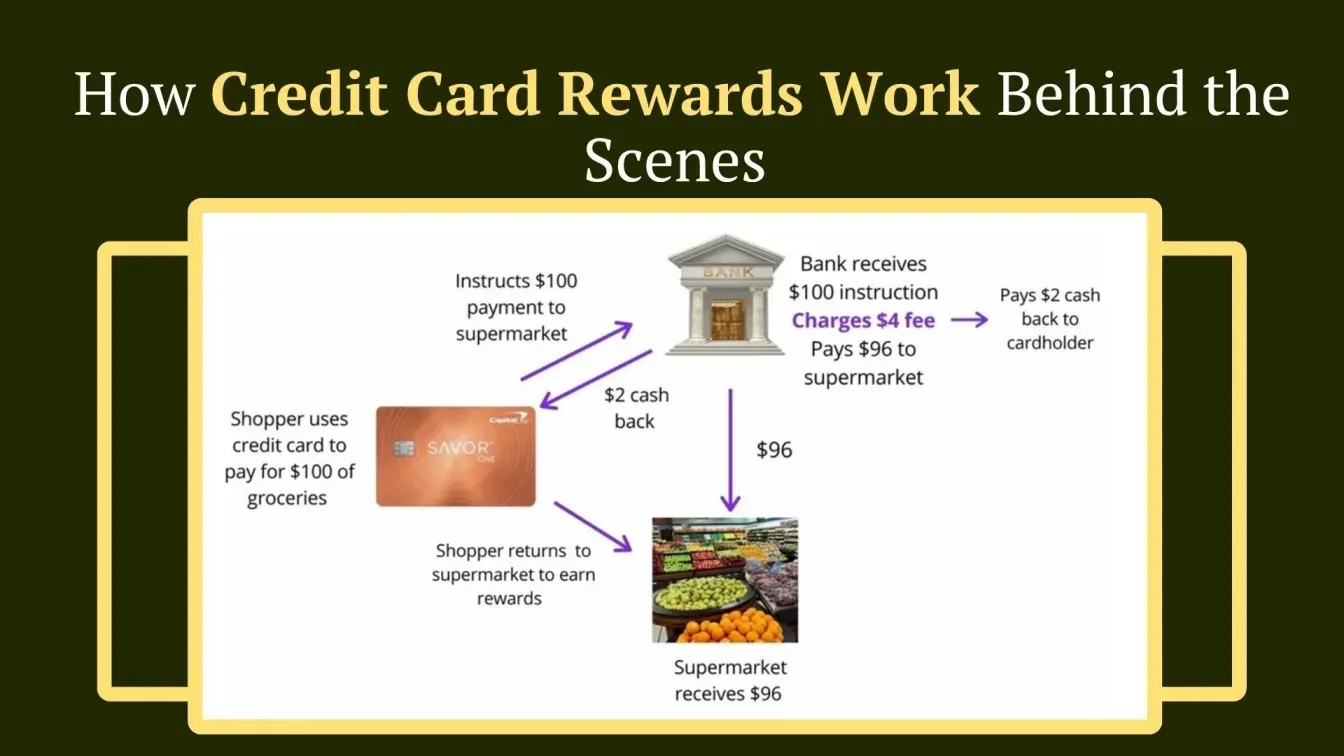

The market dynamics are shaped by several factors. Card issuers absorb the cost of rewards through a combination of interchange fees collected from merchants, interest charges on carried balances, and in some cases, strategic subsidies designed to drive user acquisition and ecosystem growth. Unlike traditional cashback cards where the issuer pays rewards in fiat currency, crypto card issuers often benefit from holding reserve positions in the reward tokens, which can appreciate in value. This creates an unusual alignment where rising token prices make rewards programs more sustainable even as the nominal percentage paid to users remains constant.

User adoption patterns reveal interesting insights. According to industry data, roughly half of Gemini credit cardholders also become monthly exchange traders, creating what analysts call a "flywheel effect" where the card serves as an entry point into broader platform engagement. This helps explain why exchanges are willing to offer competitive rewards rates even during periods of compressed margins. The cards function as customer acquisition tools with lifetime value calculations that extend far beyond the interchange revenue from payment processing.

The competitive landscape has intensified throughout 2025, with multiple platforms racing to differentiate their offerings through exclusive partnerships with blockchain networks, higher reward rates, unique staking integrations, and premium perks. This competition has generally benefited consumers through improved terms and expanded options, though it has also increased complexity as users must navigate different token ecosystems, reward structures, staking requirements, and tax implications.

Inside the Gemini Solana Credit Card Case Study: Mechanics and Motivations

To understand how spending and staking converge in practice, examining the Gemini Solana Credit Card in detail reveals both the technical implementation and the strategic motivations driving this product innovation.

The card itself is a Mastercard World Elite product issued by WebBank, a Utah-based industrial bank that partners with fintech companies to offer credit products. This partnership structure is common in the crypto card space, where the cryptocurrency platform handles customer relationships and rewards distribution while a licensed bank manages the actual credit underwriting, risk management, and regulatory compliance requirements. Users apply through the Gemini app, undergo standard credit checks, and upon approval receive a physical card featuring Solana-themed branding that reflects the network's visual identity.

The rewards structure follows Gemini's standard tiered model, with the highest rewards concentrated in categories that represent frequent, predictable spending. The 4% rate on gas, electric vehicle charging, and rideshare applies to up to $300 in monthly spend in these categories, after which the rate drops to 1%. This cap prevents gaming of the system while still delivering substantial rewards for typical users. The dining category earns 3% with no cap, recognizing that restaurant spending represents a sizable portion of discretionary budgets for many cardholders. Groceries earn 2%, and all other purchases earn 1%. Additionally, Gemini's Vault Rewards program offers up to 10% back at select merchants, subject to monthly limits and merchant-specific terms.

Rewards are distributed in real time, a significant advantage over traditional rewards programs that require waiting for statement cycles. When a transaction posts, the corresponding SOL reward appears in the user's Gemini account almost immediately. This immediacy serves several purposes: it creates instant gratification, encourages users to check their account balance frequently, and exposes users to real-time token price movements that can amplify the psychological impact of rewards as prices fluctuate.

The automatic staking feature represents the core innovation. Users can opt into auto-staking either during card signup or by selecting Solana as their preferred reward currency in their account settings. Once enabled, SOL rewards are automatically delegated to Gemini's staking infrastructure, where they begin earning additional yield through participation in Solana network validation. Gemini advertises a staking rate of up to 6.77%, though this rate varies based on network conditions, validator performance, and Gemini's commission structure.

The staking mechanism operates through Gemini's institutional-grade custody and staking infrastructure. Rather than requiring users to manage their own wallet addresses, validator selections, and epoch timing, Gemini handles these technical complexities behind the scenes. SOL rewards are pooled with other user stakes and delegated to validators that Gemini has vetted for performance, reliability, and security. This abstraction makes staking accessible to users who lack the technical knowledge or desire to manage these details themselves, though it also creates a centralized point of control and counterparty risk.

Users can unstake their rewards at any time through the Gemini app, though withdrawal times may vary from several hours to a few days due to Solana's epoch-based activation and deactivation mechanisms. This liquidity feature distinguishes the product from traditional staking arrangements that often impose longer lock-up periods, though users must still plan ahead if they need immediate access to their staked SOL.

From Gemini's strategic perspective, the Solana card serves multiple objectives. First, it deepens the exchange's relationship with the Solana ecosystem following earlier initiatives including support for USDC and USDT transfers on Solana, institutional staking services for Solana, and partnerships with Solana ecosystem projects. By aligning with one of crypto's fastest-growing networks, Gemini positions itself to benefit from Solana's momentum in decentralized finance, payments, and developer activity.

Second, the card creates a natural on-ramp for users to accumulate SOL through regular spending rather than explicit purchases. This approach can be psychologically powerful, as users may view rewards as "free money" even though they are effectively converting spending into SOL accumulation. According to Gemini's data, cardholders who held Solana rewards for at least one year saw gains of nearly 300%, though this figure reflects SOL's price performance during a bull market period and should not be interpreted as guaranteed future returns.

Third, the automatic staking feature increases the stickiness of the product by creating a yield-generating position that users may be reluctant to abandon. The compounding nature of staking rewards means that users who maintain their card and allow rewards to accumulate over time can build substantial positions without the friction of regular purchases or deposits. This reduces churn and increases the likelihood that users remain engaged with the Gemini platform over the long term.

Fourth, the card generates valuable data about user spending patterns, category preferences, and price sensitivity that can inform Gemini's product development, marketing strategies, and partnership opportunities. This data advantage is particularly valuable as the crypto industry matures and platforms seek to build more personalized, targeted user experiences.

The Solana network also benefits from the card's existence. Each card user who opts into staking contributes additional stake to the network, increasing its security and decentralization. While individual card rewards represent relatively small stakes, at scale across thousands of users the aggregate impact can be meaningful. Additionally, the card serves as marketing for Solana, exposing mainstream consumers to the network's capabilities and ecosystem. The alignment between Gemini's commercial interests and Solana's network growth creates a symbiotic relationship that both parties are motivated to nurture.

The Mechanics of Rewards and Staking: How Value Flows Through the System

Understanding how crypto credit cards with staking actually work requires tracing value flows from the point of purchase through reward distribution to staking yield and eventual liquidity. The mechanics involve multiple parties, several technical systems, and economic relationships that differ fundamentally from traditional rewards programs.

When a cardholder makes a purchase, the transaction follows the standard credit card payment flow. The merchant's payment processor communicates with the card network, which routes the transaction to the issuing bank for authorization. The bank checks the available credit, applies fraud detection algorithms, and either approves or declines the transaction. If approved, the merchant receives payment minus the interchange fee, a percentage that varies by merchant category and transaction type but typically ranges from 1.5% to 3.5% for credit card transactions. This interchange fee is what ultimately funds most credit card rewards programs.

For crypto rewards cards, the reward calculation happens in parallel with or immediately after transaction posting. The card issuer's system determines the reward rate based on the transaction category and multiplies it by the transaction amount. For example, a $100 restaurant charge on the Gemini Solana card would trigger a 3% reward calculation, resulting in $3 worth of SOL being allocated to the cardholder's account. The actual number of SOL tokens distributed depends on the prevailing market price at the moment of calculation, introducing the first point of cryptocurrency price volatility into the equation.

The reward tokens must come from somewhere. In most cases, the card issuer maintains an inventory of the reward cryptocurrency, purchasing it either on the open market or through partnerships with the token's foundation or ecosystem development funds. The issuer may buy tokens in advance to lock in predictable costs, purchase them in real time as rewards are distributed, or use a combination of both strategies. In some cases, particularly with native tokens like CRO for Crypto.com or when working directly with blockchain foundations, issuers may receive tokens at subsidized rates or through ecosystem development agreements that provide marketing value in exchange for discounted token prices.

Once the reward tokens are allocated to a user's account, the staking mechanism can engage if the user has opted in. For the Gemini Solana card, this happens automatically. The SOL tokens are transferred from the user's main account balance to a staking account, where they are delegated to validators on the Solana network.

Solana staking operates through a delegated proof-of-stake mechanism. Token holders delegate their SOL to validators, who use this stake to participate in network consensus. Validators propose blocks, vote on which blocks should be added to the blockchain, and collectively secure the network against attacks. The more stake a validator controls through delegation, the more voting weight they have in consensus and the more frequently they are selected to propose blocks.

Validators earn rewards for their participation through two primary mechanisms. First, they receive a portion of newly minted SOL tokens that are created through the network's inflation schedule. Solana's inflation rate started at 8% and decreases by 15% annually, targeting a long-term rate of 1.5%. As of 2024, inflation had reached approximately 4.8%.

These newly minted tokens are distributed to validators and their delegators in proportion to their stake. Second, validators earn a portion of transaction fees paid by users who interact with the network. While currently small compared to inflation rewards, transaction fees will become increasingly important as inflation declines over time.

Validators charge commission fees for their services, typically ranging from 0% to 10% but commonly around 5-8%. This commission is deducted from rewards before they are distributed to delegators. Gemini's advertised staking rate of up to 6.77% represents the net yield after validator commissions are applied. The actual rate can fluctuate based on changes in network inflation, total staked SOL, validator performance, and Gemini's commission structure.

The timing of rewards distribution follows Solana's epoch structure. An epoch lasts approximately two to three days, during which validators process transactions and maintain network operations. At the end of each epoch, rewards are calculated based on each validator's performance, including factors like uptime, vote accuracy, and the number of blocks proposed. These rewards are then distributed to delegators proportionally based on their staked amounts.

When a user decides to unstake their SOL, they initiate a deactivation process that also follows epoch boundaries. Newly unstaked tokens enter a "deactivating" state and become fully liquid at the start of the next epoch. This typically results in a waiting period of several hours to a few days. Additionally, Solana implements a rate limit where only 25% of the network's total staked SOL can be deactivated in a single epoch, designed to prevent sudden destabilizing changes in network security.

The compounding nature of staking rewards means that yields accumulate on top of both the initial stake and previously earned rewards. This creates exponential growth over time, assuming the staked amount remains constant and rewards continue to be automatically restaked. The difference between simple and compound returns becomes substantial over longer time periods, which is why products like the Gemini Solana card emphasize the automatic restaking feature.

Comparing this setup to alternative reward structures illuminates the trade-offs involved. Traditional crypto cashback cards like Coinbase Card offer rewards without staking integration, giving users immediate liquidity and the ability to sell, convert, or transfer tokens freely. This approach prioritizes flexibility and avoids the complexity of staking mechanics, but it foregoes the additional yield that staking can provide. Cards that offer native token rewards with staking requirements, like Crypto.com's model, create stronger lock-in effects by requiring users to stake the platform's token in order to unlock higher reward rates, effectively tying users' financial interests to the platform's token performance.

The Gemini Solana approach represents a middle ground: users receive rewards in a liquid asset that is not native to Gemini's platform, but those rewards can automatically participate in yield-generating staking without requiring additional steps or financial commitments. This design reduces friction while adding a yield component that may encourage longer holding periods and deeper engagement with both Gemini and the Solana ecosystem.

Benefits for Users, Issuers, and Networks: A Three-Sided Value Proposition

The integration of spending, rewards, and staking creates distinct benefits for each participant in the ecosystem, though these benefits come with corresponding risks and trade-offs that will be examined in the next section.

For users, the most obvious benefit is the ability to earn cryptocurrency rewards on everyday spending without making explicit investment decisions. Unlike purchasing crypto through an exchange, which requires deliberate action, budgeting, and often emotional fortitude during market volatility, reward-based accumulation happens passively as users conduct normal spending activities. This psychological advantage can make it easier for users to maintain long-term crypto positions, as the rewards feel like bonus value rather than capital at risk.

The automatic staking functionality adds a second layer of passive income without requiring technical knowledge about validator selection, wallet management, or epoch timing. For many users, the complexity of direct staking represents a significant barrier to entry. The Gemini Solana card removes this friction entirely, making it possible to earn staking yields without ever learning the difference between an epoch and a validator or understanding how proof-of-stake consensus works. This accessibility could significantly expand the population of users who participate in network staking, democratizing access to yields that were previously limited to more technically sophisticated crypto natives.

The potential for compounding returns creates attractive long-term economics for users who maintain their positions. Consider a user who spends $3,000 monthly on their card with an average reward rate of 2%, accumulating $60 in SOL rewards per month. If those rewards are automatically staked at 6.77% annual yield, after one year the user would have accumulated approximately $741 in SOL from spending rewards alone, plus an additional $25 from staking yields on those rewards.

Over five years, assuming consistent spending and no change in rates, the user could accumulate more than $3,800 in SOL, with nearly $200 coming from staking yields. These calculations exclude any appreciation in SOL's price, which could dramatically amplify returns in a bull market or diminish them in a bear market.

Diversification represents another potential benefit for users who hold predominantly fiat currency or traditional investments. By automatically converting a portion of spending into crypto rewards, users gain exposure to an asset class that historically has exhibited low correlation with traditional markets. This exposure happens in small increments, reducing the psychological stress of making large allocation decisions while still building meaningful positions over time. For users who believe in crypto's long-term trajectory but struggle with timing their entries, reward-based accumulation offers a form of dollar-cost averaging where the "cost" is spending that would have occurred anyway.

For issuers like Gemini, the benefits center on user acquisition, engagement, and lifetime value. Credit cards generate interchange revenue from every transaction, providing a steady stream of income that scales with user spending. More importantly, cards serve as powerful customer acquisition tools. Mizuho analysts noted that card sign-ups create a "flywheel effect," with roughly half of cardholders also becoming monthly exchange traders. This conversion rate means that the card effectively serves as a marketing channel with built-in qualification, attracting users who are already spending money and likely to engage with trading services.

The data generated by card usage provides valuable insights into user behavior, category preferences, and spending patterns that can inform product development, marketing strategies, and partnership negotiations. Unlike trading data, which reveals episodic behavior during market volatility, spending data offers a window into users' daily financial lives and long-term habits. This information can be used to create more targeted user experiences, personalized offers, and predictive models for user lifetime value.

The staking integration specifically increases user retention by creating yield-generating positions that users may be reluctant to abandon. The longer rewards remain staked, the more value accumulates, creating an opportunity cost to churning to a competitor. This reduced churn translates directly into higher lifetime value calculations, making it economically viable to offer competitive rewards rates even when margins are compressed.

Strategic positioning within blockchain ecosystems represents another key benefit for issuers. By launching ecosystem-specific cards for Bitcoin, XRP, and Solana, Gemini establishes itself as a partner to these networks rather than a competitor or mere service provider. These partnerships can lead to ecosystem development funding, marketing support, integration with network-native applications, and first-mover advantages as new products and features emerge. As blockchain networks increasingly recognize the importance of retail user engagement, issuers who have built bridges between traditional payments and crypto-native infrastructure will hold valuable positions.

For networks like Solana, the benefits primarily revolve around increased staking participation, user acquisition, and ecosystem awareness. Every card user who opts into automatic staking contributes additional stake to the network, increasing its security, decentralization, and resistance to attacks. While individual stakes from card rewards may be small, the aggregate effect across thousands of users can be meaningful. More importantly, this form of staking represents highly distributed stake from retail users rather than concentrated holdings from institutions or whales, contributing to more robust decentralization.

The card serves as a marketing vehicle for Solana, exposing mainstream consumers to the network's brand and capabilities. Many card users may have limited prior exposure to Solana or blockchain technology in general. By creating a smooth, frictionless experience around earning and staking SOL, the card helps normalize the network in users' minds and may serve as a gateway to deeper ecosystem engagement. Users who accumulate significant SOL through rewards may become curious about what they can do with those tokens beyond staking, potentially leading them to explore Solana-based decentralized applications, NFT marketplaces, or DeFi protocols.

The alignment of incentives between user spending, issuer revenue, and network growth creates a positive feedback loop where all parties benefit from increased card usage. This three-sided value proposition explains why ecosystem-specific cards have proliferated throughout 2025, with multiple exchanges racing to launch partnerships with major blockchain networks.

Key Risks and Trade-Offs: The Hidden Costs of Turning Spending Into Yield

While the benefits of crypto credit cards with staking integration are substantial, the risks and trade-offs are equally important to understand. Users entering these arrangements should recognize what they are accepting in exchange for rewards and yields.

Cryptocurrency price volatility represents the most significant risk for cardholders. Unlike traditional cashback that delivers stable dollar values, crypto rewards fluctuate in value continuously. A user who earns $100 worth of SOL in rewards during one month might find those rewards worth $80 or $120 the following week depending on market movements. Over longer periods, this volatility can be extreme. Users who accumulated rewards during bull market conditions may experience substantial paper losses during subsequent corrections or bear markets.

The Gemini data point about 299% gains for users who held SOL rewards for one year illustrates the upside of this volatility but also obscures the downside risks. During crypto's periodic bear markets, SOL has experienced drawdowns exceeding 90% from peak to trough. A user who accumulated rewards during euphoric highs might have watched those holdings decline by similar magnitudes during subsequent downturns. While staking yields continue to accrue during these periods, they are typically insufficient to offset major price declines. A 6.77% staking yield provides little consolation when the underlying asset loses 50% of its value.

The interaction between reward accumulation and price volatility can create perverse incentives around spending behavior. Users who focus excessively on maximizing rewards during bull markets may over-spend relative to their means, effectively gambling that price appreciation will continue. Conversely, users who experience significant losses may develop negative associations with the card and reduce usage, defeating the engagement objectives that drove the product's creation in the first place.

Liquidity risk stems from the staking mechanism itself. While Gemini allows users to unstake at any time, the process requires waiting through epoch boundaries, resulting in delays of several hours to a few days before staked tokens become fully liquid. For users who need immediate access to the value of their rewards, this delay can be problematic, particularly during periods of rapid price movement when the difference between initiating an unstake and being able to sell could represent significant value loss.

The rate limit on network-wide unstaking adds another layer of liquidity risk during stress scenarios. If a large percentage of the network attempts to unstake simultaneously during a crisis, only 25% of total staked SOL can deactivate per epoch, creating a queue and potentially extending waiting times substantially. While this scenario is unlikely to affect individual card users under normal conditions, it represents tail risk during extreme market dislocations or network incidents.

Counterparty risk exists at multiple levels in the system. Users who opt into automatic staking through Gemini are trusting the exchange to maintain custody of their staked tokens, select appropriate validators, distribute rewards accurately, and honor withdrawal requests. While Gemini is a regulated U.S. exchange with strong security practices, the history of crypto includes numerous examples of exchanges failing, being hacked, or mismanaging customer funds. Users essentially accept counterparty risk to Gemini in exchange for the convenience of automatic staking and custodial management.

Validator risk represents another dimension of counterparty exposure. While Solana does not implement traditional slashing for most validator misbehavior, validators can still experience performance issues that reduce rewards. Low uptime, missed votes, or technical problems can diminish the yields distributed to delegators. Validator selection based on performance metrics is crucial for optimizing returns, but Gemini's opaque validator selection process means users have limited visibility into how their stake is being deployed and whether optimal validators are being used.

Network-level risks include potential protocol bugs, consensus failures, or security vulnerabilities that could impact the Solana blockchain. While Solana has demonstrated robust performance and security since launch, it has also experienced several network outages and performance degradations that temporarily halted transaction processing. During these incidents, staking may continue to function, but the broader ecosystem disruption can impact confidence and token prices. Users whose wealth is concentrated in staked SOL through card rewards bear exposure to these network-level risks.

Regulatory and tax considerations add significant complexity. In the United States, cryptocurrency rewards are generally treated as ordinary income and must be reported at fair market value when received. This means users owe income tax on the dollar value of their rewards in the year they are earned, regardless of whether they sell those rewards. For users accumulating substantial rewards over time, this can create tax liabilities that require selling a portion of rewards to satisfy tax obligations, reducing the compounding effect of staking.

Staking yields face additional tax complexity. The IRS has not issued definitive guidance on the tax treatment of staking rewards, creating uncertainty about whether they should be treated as ordinary income when received, capital gains when sold, or some other category. Different tax professionals may provide different advice, and users who stake substantial amounts may face unexpected tax bills based on evolving interpretations or new IRS guidance. The lack of clarity creates compliance risks and potentially significant unforeseen costs.

The interaction between credit card debt and crypto accumulation represents a less obvious but potentially serious risk. Users who carry balances on their crypto rewards cards and pay interest are effectively borrowing money to accumulate cryptocurrency. If a user carries a $5,000 balance at 20% APR while accumulating SOL rewards, they are paying $1,000 annually in interest to earn perhaps $100-200 in rewards and yields. This obviously destructive trade-off can be masked by rising crypto prices during bull markets, but the mathematics are unforgiving once prices stabilize or decline. Users must maintain financial discipline and pay balances in full to avoid turning reward accumulation into an expensive form of leveraged crypto speculation.

Behavioral risks emerge from the gamification of spending through crypto rewards. The psychological framing of rewards as "free money" can encourage overconsumption and irrational spending decisions. Users may justify unnecessary purchases by pointing to the rewards they will earn, ignoring the fact that not spending money at all would leave them in a better financial position than spending money to earn 3% back. The compounding effect of staking can amplify these justifications, as users may view rewards as investments that will grow over time, further rationalizing spending beyond their means.

Comparing these risks to traditional rewards programs highlights the unique characteristics of crypto rewards with staking. Traditional cashback cards carry minimal risk beyond the obvious danger of accumulating credit card debt. The value of cashback does not fluctuate, there are no liquidity delays, and there are no tax complications beyond simple income reporting. Users trade this simplicity and stability for the potential upside of crypto price appreciation and staking yields, accepting volatility, complexity, and additional risks in exchange for potentially higher returns.

The Competitive Landscape and Future Innovations: Where This Trend Is Heading

The rapid proliferation of crypto credit cards throughout 2024 and 2025 reflects broader trends in the convergence of traditional finance and crypto-native infrastructure. Understanding the competitive dynamics and likely future directions helps contextualize the Gemini Solana card within a rapidly evolving market.

Crypto.com remains one of the most established players in the space, having launched its prepaid card program years before credit products emerged. The platform recently introduced a U.S. credit card in partnership with Bread Financial, offering tiered rewards in CRO tokens with rates reaching 5-6% depending on the user's Level Up subscription tier. This approach differs from Gemini's model by requiring users to stake the platform's native token to unlock higher rewards, creating stronger lock-in but also exposing users to the performance of CRO specifically rather than diversified crypto assets. The program has faced challenges, including significant rewards reductions in 2022 that sparked user backlash, but it remains a major competitor with global reach and brand recognition.

Coinbase's announced partnership with American Express for the Coinbase One Card represents another significant competitive development. Expected to launch in fall 2025, the card offers up to 4% back in Bitcoin with tiered rates based on total assets held on the platform. By focusing on Bitcoin rather than alternative tokens, Coinbase is targeting a different segment of users who view Bitcoin as the primary or only cryptocurrency worth holding.

The subscription requirement ties the card to broader platform engagement, and the American Express partnership brings premium perks and strong merchant acceptance. The ability to repay balances with crypto held on Coinbase adds another dimension of integration between credit products and platform assets.

Beyond these major players, several smaller platforms and specialized products are testing alternative approaches. Some cards offer multi-token rewards where users can select from rotating options, allowing for diversification or speculation on specific assets. Others provide higher rates in exchange for annual fees or required platform activity thresholds. Still others focus on specific niches like international travelers, gamers, or DeFi power users, creating differentiated value propositions for targeted segments.

The next frontier of innovation likely involves several directions. Programmable debit and credit cards could allow users to set custom rules for reward allocation, automatically splitting rewards across multiple tokens, adjusting exposure based on portfolio targets, or routing rewards to different yield strategies based on market conditions. Smart contract integration could enable rewards to flow directly to DeFi protocols, where they could participate in lending, liquidity provision, or more complex yield strategies without ever touching a centralized exchange. This would create truly decentralized spending-to-yield pipelines where every purchase triggers on-chain financial activity.

Tokenized credit lines represent another potential evolution. Rather than traditional bank-issued credit backed by fiat reserves and user creditworthiness, future products might offer credit lines collateralized by on-chain assets or governed by decentralized protocols. Users could borrow against their crypto holdings to fund spending, with rewards flowing back to reduce debt or increase collateral positions. This would blur the lines between credit cards, DeFi lending, and asset management in ways that could unlock new forms of financial utility.

Spending-collateralized staking could enable users to earn even higher yields by allowing their staked positions to serve as collateral for credit lines. A user might stake SOL earned through card rewards, use those staked tokens as collateral to obtain additional credit, spend using that credit to earn more rewards, and repeat the process in a leveraged cycle. While potentially powerful for sophisticated users, this approach would significantly amplify risks and likely require robust safeguards to prevent excessive leverage and liquidation cascades.

Co-branded ecosystem cards could deepen partnerships between issuers and blockchain networks. Rather than generic cards that offer rewards in a network's token, future products might be developed in direct partnership with network foundations, featuring exclusive benefits like priority access to new token launches, governance voting rights, or special yields on ecosystem-specific staking mechanisms. These partnerships could include revenue sharing arrangements where network foundations subsidize rewards in exchange for user acquisition and ecosystem growth.

The Gemini Solana card can be viewed as a lead indicator of these trends. Its automatic staking feature represents the first step toward deeper integration between spending and on-chain yield generation. The ecosystem-specific branding demonstrates the strategic value of network partnerships. The custodial simplicity makes advanced crypto mechanics accessible to mainstream users. Future iterations will likely build on this foundation, adding programmability, expanding integration points, and creating more sophisticated ways to turn everyday spending into portfolio construction.

Competition will likely intensify around several dimensions. Reward rates will continue to be a primary battlefield, with platforms racing to offer higher percentages even as underlying economics become challenging. Staking yields and integration depth will differentiate products as users become more sophisticated and demand access to more advanced yield strategies. Network ecosystem partnerships will create exclusive moats as blockchain foundations recognize the user acquisition value of co-branded cards. User experience and simplicity will remain crucial as mainstream adoption depends on making complex crypto mechanics feel effortless and secure.

The long-term trajectory points toward a future where the boundary between spending, saving, and investing becomes increasingly blurred. Crypto credit cards with staking represent an early example of products that make this blurring tangible, allowing users to simultaneously consume, accumulate, and earn yields through a single instrument. As the technology matures, regulatory frameworks stabilize, and user sophistication increases, these integrated financial products may become the norm rather than the exception.

Regulatory, Compliance, and Consumer Protection Considerations: Navigating a Complex Landscape

The intersection of credit cards, cryptocurrency rewards, and staking mechanisms creates a regulatory environment of unusual complexity, involving multiple agencies, overlapping jurisdictions, and evolving interpretations of existing law.

Credit cards themselves are heavily regulated financial products subject to consumer protection laws, disclosure requirements, and oversight by banking regulators. In the United States, the issuing bank – WebBank in the case of Gemini's cards – must comply with banking regulations administered by the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, and state banking authorities. The Truth in Lending Act requires clear disclosure of interest rates, fees, and terms. The Credit Card Accountability Responsibility and Disclosure Act imposes additional restrictions on rate increases, overlimit fees, and billing practices.

Cryptocurrency exchanges face their own regulatory requirements, including anti-money laundering programs, know-your-customer verification, suspicious activity reporting, and in some jurisdictions, money transmitter licensing or securities registration. The SEC and CFTC have increasingly asserted jurisdiction over crypto markets, with ongoing debates about whether specific tokens should be classified as securities subject to SEC oversight or commodities under CFTC authority. The regulatory landscape shifted substantially in 2025 with the Trump administration's more crypto-friendly approach, including the creation of a crypto task force and efforts to provide clearer regulatory frameworks.

Staking introduces additional regulatory questions. Are staking rewards investment income, ordinary income, or something else? Do staking arrangements constitute investment contracts subject to securities laws? Can staking services be offered without registration under various financial services regulations? The Consumer Financial Protection Bureau has proposed extending consumer protections to digital payment mechanisms, potentially capturing certain cryptocurrency transactions.

For crypto credit card issuers, navigating this regulatory maze requires coordination between the issuing bank, the exchange platform, and legal counsel specialized in both traditional banking and digital assets. Products must be structured to comply with payment card regulations while also satisfying crypto-specific requirements. Rewards programs must be disclosed clearly, including explanations of how token values fluctuate, what risks users face, and what happens to rewards during market volatility or platform issues.

Consumer protection implications are substantial. Traditional credit card rewards programs are straightforward: users earn a fixed percentage back, receive that value in stable currency or points with known redemption rates, and face minimal complexity. Crypto rewards introduce volatility, counterparty risk, tax complexity, and technical barriers that many users may not fully understand when signing up. Regulators are increasingly focused on ensuring that platforms provide adequate disclosures and do not mislead users about the risks they are accepting.

The automatic staking feature raises specific regulatory questions. Does automatically staking user rewards constitute investment advice requiring registration with the SEC? Are users providing informed consent to have their rewards staked, or are they accepting this feature without understanding its implications? What happens if staking yields decline or turn negative after accounting for validator fees and opportunity costs? Platforms must carefully structure these features to avoid crossing lines that would trigger additional regulatory requirements or create liability.

Tax reporting obligations add another layer of complexity. Exchanges must issue Form 1099 to users who receive cryptocurrency rewards exceeding certain thresholds, reporting the fair market value of rewards as income. Coinbase has stated that Bitcoin rewards from its upcoming credit card will not appear on 1099 forms, though the legal basis for this treatment remains unclear and may be subject to change. Users remain responsible for accurately reporting income and capital gains regardless of whether they receive tax forms from platforms.

International regulatory variations create additional complications for platforms operating globally. The European Union's Markets in Crypto-Assets Regulation establishes comprehensive requirements for crypto service providers, including licensing, disclosure, and operational standards. United Kingdom regulators have taken a more cautious approach, requiring crypto platforms to register and comply with anti-money laundering rules while considering whether additional regulations are needed. Asian jurisdictions vary widely, with some embracing crypto innovation and others imposing strict limitations or outright bans.

For users evaluating crypto credit cards with staking, several regulatory and compliance considerations should inform their decisions. First, verify that the issuing bank is properly licensed and that the card product itself complies with applicable credit card regulations. Look for clear disclosures about fees, interest rates, and terms in the cardholder agreement. Second, understand the exchange's regulatory status and whether it is licensed or registered in your jurisdiction. Platforms operating without proper licensing may face enforcement actions that could disrupt service or access to funds.

Third, review the terms governing cryptocurrency rewards and staking carefully. Understand who maintains custody of staked tokens, what rights you have to unstake and withdraw, what happens if the platform experiences technical issues or security breaches, and how disputes are resolved. Fourth, consider the tax implications and ensure you can comply with reporting requirements. If you are likely to accumulate substantial rewards, consult a tax professional familiar with cryptocurrency taxation to avoid surprises. Fifth, evaluate the distinction between credit and debit products. Credit cards involve borrowing with interest charges on carried balances, while debit cards spend existing funds. Make sure you understand which type of product you are using and manage spending accordingly.

The regulatory landscape will continue evolving as crypto becomes more mainstream and regulators develop more sophisticated frameworks. Users should stay informed about changes that might affect their card products, tax obligations, or access to features. Platforms that prioritize compliance, provide clear disclosures, and work cooperatively with regulators are more likely to offer sustainable products that can weather regulatory scrutiny.

Strategic Implications for Users: Evaluating Crypto Credit Cards in Your Financial Life

For users considering whether to adopt a crypto credit card with staking functionality, several strategic questions can help frame the decision and ensure the product aligns with their broader financial goals and risk tolerance.

The first consideration is net yield versus risk. Calculate the expected rewards rate based on your spending patterns and categories. If you spend $2,000 monthly with an average reward rate of 2%, you would earn $40 in monthly rewards or $480 annually. Add the staking yield – at 6.77%, those accumulated rewards would generate approximately $32 in additional yield during the first year assuming linear accumulation and immediate staking. This produces a total benefit of roughly $512, or 2.13% of annual spending, before accounting for any token price appreciation or depreciation.

Compare this to your best alternative. A strong cashback card might offer 2% back in stable dollars with no volatility or complexity. A premium travel card might offer points worth 2-3% toward travel if used strategically. The crypto card only makes sense if the potential upside from token price appreciation and staking yields exceeds the downside from price risk and the costs of managing volatility. For users who already want crypto exposure and planned to purchase tokens anyway, the card may be attractive as a form of automated dollar-cost averaging with a bonus yield component. For users who are indifferent to crypto or risk-averse, simpler alternatives likely offer better risk-adjusted returns.

Reward token selection matters significantly. Cards offering rewards in Bitcoin provide exposure to the most established and liquid cryptocurrency with the longest track record. Cards offering rewards in platform-specific tokens like CRO create alignment with the platform's success but also concentration risk if the platform faces challenges. Cards offering rewards in ecosystem tokens like SOL provide exposure to specific blockchain networks with higher growth potential but also higher volatility and technology risk. Users should choose reward tokens that match their investment thesis and risk appetite, or diversify across multiple cards if they want broader crypto exposure.

Unstaking flexibility deserves careful evaluation. Products that require long lock-up periods or impose significant penalties for early withdrawal reduce liquidity and limit your ability to respond to market movements or personal financial needs. The Gemini Solana card's ability to unstake at any time with only epoch-boundary delays offers reasonable flexibility, though users should understand the timing and plan accordingly if they anticipate needing access to funds quickly. Products with more restrictive terms should offer correspondingly higher yields to compensate for reduced liquidity.

Fee structures can significantly impact net returns. Cards with no annual fees, no foreign transaction fees, and no fees for receiving crypto rewards provide the cleanest economics. Cards that charge annual fees only make sense if the additional rewards or benefits exceed the fee cost. Be especially cautious about hidden costs like unfavorable foreign exchange spreads, reward redemption fees, or high validator commissions that reduce staking yields.

Credit versus debit has important implications for how you use the card and what risks you accept. Credit cards allow you to carry balances and pay interest, which can be financially destructive if you accumulate debt while earning crypto rewards. Credit cards also typically offer stronger fraud protection and dispute resolution mechanisms. Debit cards spend from existing balances, preventing debt accumulation but also eliminating the interest-free float period that credit cards provide. Choose the structure that matches your spending discipline and financial habits.

The card's impact on your spending behavior warrants honest self-assessment. If earning crypto rewards will motivate you to make unnecessary purchases, the card will likely harm your financial position regardless of the rewards earned. The mathematics are unforgiving: spending $100 to earn $3 in rewards leaves you $97 worse off than not spending at all. Only use crypto rewards cards for spending you would do anyway, and maintain the same budgetary discipline you would apply to any credit card.

Tax planning implications should be considered upfront. If you earn substantial rewards, you will owe income tax on their fair market value when received. This could create quarterly estimated tax payment obligations or a surprise tax bill at year-end. Factor these tax costs into your evaluation of the card's net benefit, and consider whether you need to sell a portion of rewards to cover tax liabilities or can cover them from other income sources.

The role of crypto in your broader financial plan provides important context. If you have a well-defined asset allocation strategy that includes a target percentage for crypto exposure, the card can be a convenient way to maintain that allocation through regular small purchases. If you have no coherent investment strategy and are simply accumulating crypto because it seems exciting, the card may contribute to an unfocused financial plan that lacks clear goals or risk management. Integrate the card into your existing financial framework rather than treating it as a standalone activity.

Wallet and ecosystem integration may become increasingly important as these products mature. Future iterations could allow automatic routing of rewards to self-custody wallets, direct participation in DeFi protocols, or conversion to multiple tokens based on preset rules. Users who anticipate wanting this kind of flexibility should favor platforms with strong APIs, broad integration support, and commitment to interoperability. Users who prefer custodial simplicity should favor platforms with polished user interfaces and comprehensive support.

The behavioral dimension of reward accumulation deserves attention. For many users, watching crypto rewards accumulate and compound through staking creates positive reinforcement that encourages card usage and long-term holding. This can be beneficial if it leads to disciplined investing and wealth accumulation. It can be harmful if it encourages excessive spending, unrealistic expectations about future returns, or emotional attachment to positions that should be rebalanced or liquidated. Maintain awareness of how the product affects your psychology and decision-making, and be prepared to adjust your approach if you notice concerning patterns.

Final thoughts

The Gemini Solana Credit Card represents a genuine innovation in how consumer payments, cryptocurrency accumulation, and on-chain yield generation can intersect. By automatically converting everyday purchases into staked cryptocurrency earning additional yields, the product eliminates multiple layers of friction that previously separated spending from investing. The result is an integrated financial experience where grocery shopping and restaurant meals become inputs to a compounding yield-generating machine.

This convergence of previously separate financial activities signals broader trends in how the boundaries between banking, payments, and investment management are dissolving. Traditional distinctions – credit versus debit, spending versus saving, consumption versus investment – become less meaningful when a single card transaction simultaneously provides convenience, rewards, and yield. The psychological and practical implications are profound: users can participate in sophisticated financial strategies through the simple act of paying for parking or buying coffee.

Yet the trade-offs are substantial and should not be minimized. Users accept cryptocurrency price volatility, counterparty risk, tax complexity, and liquidity constraints in exchange for rewards and yields that may or may not compensate for these costs. The advertised potential of staking yields and token appreciation can obscure the very real possibility of principal loss during crypto bear markets, when declining token prices overwhelm modest staking returns.

Historical performance, including Gemini's data about 299% gains for long-term SOL holders, reflects specific market conditions that may not repeat.

The regulatory environment remains in flux, with agencies working to define how existing laws apply to these hybrid products and whether new regulations are needed. Users should expect continued evolution in how rewards are treated for tax purposes, what disclosures platforms must provide, and what consumer protections apply. Platforms that operate with regulatory cooperation and provide transparent disclosures will likely fare better than those that push legal boundaries or minimize risks in their marketing.

For users evaluating whether to adopt these products, several indicators warrant ongoing monitoring. First, compare advertised reward rates to actual yields received in your account, accounting for all fees, commissions, and price movements. Platforms may highlight theoretical maximum rewards while delivering substantially less in practice due to category restrictions, spending caps, validator fees, and token price volatility. Second, track staking unlock periods and liquidity terms.

Platforms facing financial stress may impose additional restrictions on withdrawals or extend processing times, turning notionally liquid positions into locked funds. Third, watch merchant adoption and payment network relationships. Cards that lose support from major merchants or face processing restrictions become less useful regardless of reward rates.

Fourth, monitor reward token performance relative to alternatives. If the token you are accumulating consistently underperforms other cryptocurrencies or traditional investments, the opportunity cost of holding those rewards may exceed the nominal yield you are earning. Fifth, observe regulatory enforcement and guidance. New rules, enforcement actions against similar platforms, or unfavorable tax guidance can dramatically change the economics and risk profile of these products. Platforms that receive regulatory approval or work cooperatively with authorities signal lower tail risk than those facing enforcement or operating in gray areas.

Looking forward, the question is not whether everyday spending will become part of users' investment portfolios – that integration is already happening through multiple products in market – but rather how sophisticated and nuanced that integration will become. Will users eventually set custom reward allocation rules, automatically routing different spending categories to different yield strategies? Will rewards flow directly to DeFi protocols without touching centralized exchanges? Will credit lines become collateralized by on-chain staked positions in ways that blur the distinction between borrowing and investing?

The infrastructure enabling these possibilities is being built now. Smart contract capabilities, interoperability standards, regulatory frameworks, and user interfaces are all evolving to support more complex integration between spending and yield. The Gemini Solana card's automatic staking feature can be viewed as an early step in a longer journey toward fully integrated financial experiences where every transaction serves multiple purposes simultaneously.

For the crypto-curious consumer standing in the grocery store checkout line, swiping a Gemini Solana card to earn 2% back in SOL that automatically stakes for 6.77% additional yield, the question has already been answered: everyday spending has become part of a staking portfolio. Whether that represents prudent financial innovation or speculative excess will only become clear in hindsight, after we have seen how these products perform across full market cycles encompassing both euphoria and despair.

The era of spending-as-staking has begun. The eventual destination remains to be written.