U.S. debt burden and lack of foreign Treasury buyers creating unsustainable economic conditions, according to cryptocurrency payment platform executive Jack Mallers. Bitcoin is here to save the day.

What to Know:

- Federal debt has reached $36.2 trillion with annual interest costs approaching $700 billion

- Foreign nations no longer willing to fund U.S. deficits, leaving domestic banks and hedge funds as primary buyers

- Mallers predicts a global asset rotation from dollars to gold initially, then ultimately to Bitcoin

Monetary System at Breaking Point

The post-World War II monetary model has reached its limits as U.S. federal debt balloons and foreign buyers retreat from Treasury securities, according to Strike CEO Jack Mallers. The 30-year-old payment platform executive outlined his analysis during an appearance on Natalie Brunell's Coin Stories podcast, presenting Bitcoin as the inevitable beneficiary of a failing dollar-based system.

Mallers traced current economic challenges to the 1944 Bretton Woods agreement that established the dollar as the world's reserve currency. "After the world wars America was the strongest economy. We had the most gold," he explained, noting the arrangement initially allowed the U.S. to "export our strength" through currency while importing physical goods.

That relationship has since evolved into a fundamentally unbalanced system, Mallers argues. "Effectively we are printing pieces of paper and getting real stuff in return for it.

You delegate and outsource manufacturing an iPhone, the food you consume, the energy you burn, and all you're doing is importing real goods and exporting currency. That's Triffin's dilemma in action."

The numbers support his assessment. Gross federal debt currently stands at approximately $36.2 trillion and is projected to exceed $37 trillion by fiscal year-end, according to Treasury data reviewed by the Concord Coalition. Interest payments alone are running at an annualized $684 billion.

Foreign nations that once recycled their export earnings into U.S. government securities have largely withdrawn from that role, Mallers noted. "If your buddy was $36 trillion in debt, would you lend him more money? Probably not," he said.

The funding gap is now being filled primarily by "our own banking system and hedge funds levered up in the Cayman Islands," according to Mallers. This observation aligns with recent market commentary from JPMorgan Chase CEO Jamie Dimon, who warned that current capital regulations discourage banks from holding Treasuries. Dimon urged regulators last month to exclude these securities from the supplementary leverage ratio to enable dealers to absorb supply spikes without exceeding capital limits.

Market Vulnerability and Bitcoin's Role

The heavy reliance on leveraged buyers creates inherent market fragility, Mallers explained. "Leverage doesn't do well with volatility, so as soon as markets start to move, they print the money." This dynamic makes the United States "structurally short volatility," in his assessment.

Recent market events support this analysis. President Trump's April threat to impose new tariffs on Chinese goods caused bond market turbulence, with 10-year Treasury yields briefly exceeding 4.6 percent before settling at 4.46 percent. Mallers characterized this episode as testing "how far can I push before I cascade the deck of cards."

Since that market disruption, monetary authorities have reverted to accommodative policies. Broad money supply (M2) has resumed its upward trajectory as policymakers "are providing the liquidity," according to Mallers.

This monetary expansion directly benefits Bitcoin, in Mallers' view. "Bitcoin equals technology plus fiat liquidity," he stated, arguing that increasing dollar creation chasing a finite supply of coins represents the asset's strongest tailwind.

When questioned about gold's recent price strength, particularly among central bank buyers, Mallers remained emphatic about Bitcoin's superior position. "Gold is the temporary parking lot. Bitcoin carries every monetary property the market demands—fixed supply, scarcity, divisibility, portability, and the ability to self-custody."

Mallers estimated the global investment universe at approximately $900 trillion, with half serving as savings vehicles. "The dollar will increasingly not be used for that; sovereign debt won't either," he predicted, forecasting an initial rotation toward gold before a decisive movement into Bitcoin as technological familiarity increases.

The cryptocurrency executive referenced President Trump's Strategic Bitcoin Reserve initiative and outlined a potential path where the United States maintains dollar pricing for everyday transactions while anchoring value in Bitcoin. "If they come out, devalue the debt enough and build a Bitcoin position that's $50 trillion over the next ten years—problem solved. All your dollars are backed by Bitcoin. Your hot dog on the corner is still priced in dollars, but the real capital storage, the real wealth, sits in Bitcoin."

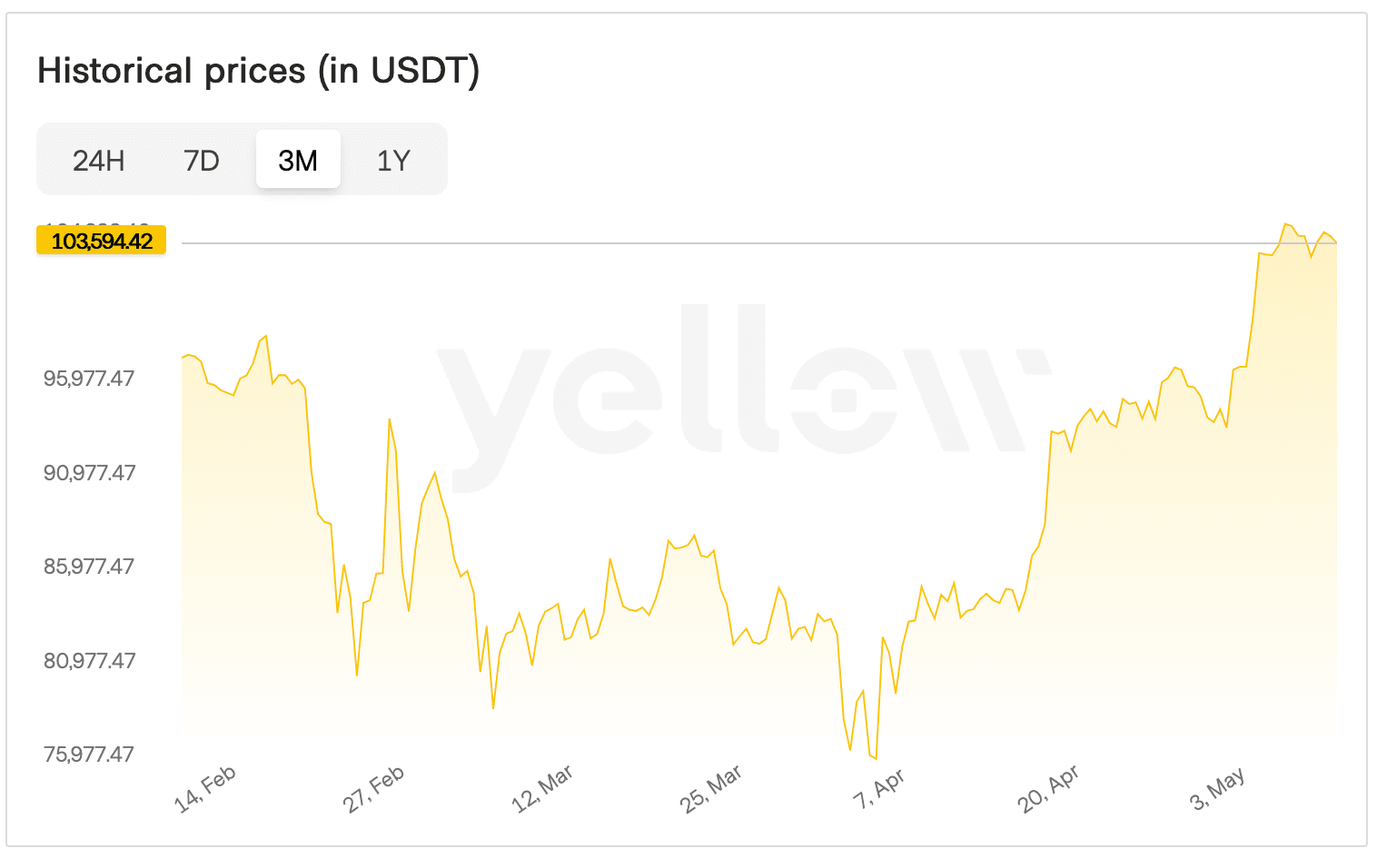

Bitcoin recently surpassed $100,000 after consolidating in the high-$70,000 range throughout spring. Mallers attributed the earlier price pause to market misinterpretation of Trump's initial "liquidity-negative" position. Current conditions resemble late 2023, he suggested, when expanding money supply coincided with Bitcoin's rise through successive price levels from $40,000 to $70,000. "We're on the other side of liquidity negative," he said.

The primary risk to his outlook would be disorderly volatility in Treasury markets. Dimon recently cautioned about a potential "kerfuffle" that might force Federal Reserve intervention in secondary markets. Should such a scenario materialize, Mallers expects policymakers to "print the money"—an action he believes would accelerate Bitcoin adoption rather than hinder it.

Closing Thoughts

While Mallers' fundamental thesis isn't new, his latest presentation sharpened key points. The United States can no longer rely on foreign surplus nations to finance its deficits, he argued. Domestic financial institutions can only fill this gap if regulators provide leverage flexibility and the Federal Reserve supplies dollars.

This financial cycle, already struggling under $36 trillion of debt, inherently generates inflation, according to Mallers. "The game is rigged—and Bitcoin wins, because math doesn't lie," he concluded.